Hong Kong & South East Asia Report 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

09 Board of Directors

Board of Directors Simon Israel Chua Sock Koong • Non-executive and non-independent Director • Executive and non-independent Director • Chairman, Singtel Board • Member, Optus Advisory Committee • Chairman, Finance and Investment Committee • Date of appointment: Director on 12 October 2006 and Group Chief • Member, Corporate Governance and Nominations Committee Executive Offi cer (CEO) on 1 April 2007 • Member, Executive Resource and Compensation Committee • Last re-elected: 28 July 2017 • Member, Optus Advisory Committee • Number of directorships in listed companies (including Singtel): 2 • Date of appointment: Director on 4 July 2003 and Chairman on 29 July 2011 • Last re-elected: 29 July 2016 Ms Chua Sock Koong, 61, was appointed Group CEO • Number of directorships in listed companies (including Singtel): 3 on 1 April 2007. She has overall responsibility for the Group’s businesses. Mr Simon Israel, 66, is the Chairman of Singapore Sock Koong joined Singtel in June 1989 as Treasurer Post Limited and a Director of Fonterra Co- before becoming CFO in April 1999. She held the operative Group Limited and Stewardship Asia positions of Group CFO and CEO, International Centre CLG Limited. He is also a member of the from February 2006 to 12 October 2006, when she Governing Board of Lee Kuan Yew School of Public was appointed Deputy Group CEO. Policy and Westpac’s Asia Advisory Board. Simon is a former Director of CapitaLand Limited and Sock Koong sits on the boards of Bharti Airtel Stewardship Asia Centre Pte. Ltd. Limited, Bharti Telecom Limited, the Defence Science and Technology Agency, Cap Vista Pte Ltd Simon was an Executive Director and President of and key subsidiaries of the Singtel Group. -

News Release

News Release To: Editor For immediate release Hongkong Land unveils BaseHall, its new premium food hall concept at Jardine House, set to revolutionise the F&B experience in the heart of Central BaseHall is a dynamic, digital-centric culinary destination designed to be the ultimate hangout with its diverse gourmet offerings, unparalleled energy and urban style HONG KONG, 15th June 2020 – Hongkong Land today celebrated the official opening of BaseHall, a first-of-its-kind food hall concept on the basement level of Jardine House. This latest development underscores Hongkong Land’s continuous commitment to enhance the value of its portfolio, and also champions the LANDMARK EATO ethos – the contemporary culinary concept bringing together the best of Hong Kong’s vibrant, world-class F&B scene, all at LANDMARK. “As the leading landlord in Hong Kong’s Central District, we constantly seek the next opportunity to elevate the Central community experience and ensure it continues to thrive as Asia’s most prestigious and dynamic city centre,” said Mr Robert Wong, Chief Executive of Hongkong Land. “The launch of BaseHall, together with CENTRICITY and BESPOKE salon, our tailor-made offerings for both corporate tenants and retail shoppers, is the latest example of Hongkong Land reinvesting into its portfolio to create innovative offerings crafted to meet the needs of today’s tenants and customers. These initiatives will strengthen the attractiveness of our high-quality office and retail space, and ensure Central continues to flourish as a vibrant community that our tenants and customers aspire to be part of.” Mr Raymond Chow, Executive Director of Hongkong Land, added: “BaseHall is core to our strategy for attracting younger customers while still catering to our existing loyal customer base. -

Stoxx® Singapore 75 Index

STOXX® SINGAPORE 75 INDEX Components1 Company Supersector Country Weight (%) Oversea-Chinese Banking Corp. Banks SG 10.52 DBS Group Holdings Ltd. Banks SG 8.74 Singapore Telecommunications L Telecommunications SG 8.24 United Overseas Bank Ltd. Banks SG 7.60 Jardine Matheson Holdings Ltd. Industrial Goods & Services SG 5.93 Wilmar International Ltd. Food & Beverage SG 3.38 Hongkong Land Holdings Ltd. Real Estate SG 3.04 Keppel Corp. Ltd. Oil & Gas SG 2.72 CapitaLand Ltd. Real Estate SG 2.47 Jardine Strategic Holdings Ltd Industrial Goods & Services SG 2.38 Thai Beverage PCL Food & Beverage SG 2.12 Singapore Exchange Ltd. Financial Services SG 2.00 Singapore Press Holdings Ltd. Media SG 1.99 ComfortDelGro Corp. Ltd. Travel & Leisure SG 1.97 Singapore Airlines Ltd. Travel & Leisure SG 1.92 GLOBAL LOGISTIC PROPS Real Estate SG 1.82 Jardine Cycle & Carriage Ltd. Retail SG 1.63 Ascendas Real Estate Investmen Real Estate SG 1.62 Singapore Technologies Enginee Industrial Goods & Services SG 1.52 CAPITALAND MALL TRUST MGMT Real Estate SG 1.51 Genting Singapore PLC Travel & Leisure SG 1.45 Suntec Real Estate Investment Real Estate SG 1.32 City Developments Ltd. Real Estate SG 1.13 UOL Group Ltd. Real Estate SG 0.99 CapitaLand Commercial Trust Real Estate SG 0.96 Golden Agri-Resources Ltd. Food & Beverage SG 0.91 SembCorp Industries Ltd. Oil & Gas SG 0.88 SINGAPORE POST Industrial Goods & Services SG 0.84 MAPLETREE CHINA COMMERCIAL TRU Real Estate SG 0.82 SATS Industrial Goods & Services SG 0.78 Dairy Farm International Holdi Retail SG 0.75 Noble Group Ltd. -

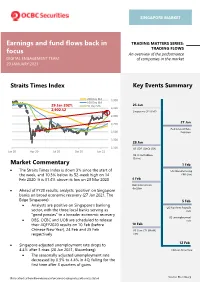

Earnings and Fund Flows Back in Focus

SINGAPORE MARKET Earnings and fund flows back in TRADING MATTERS SERIES: TRADING FLOWS focus An overview of the performance DIGITAL ENGAGEMENT TEAM of companies in the market 29 JANUARY 2021 Straits Times Index Key Events Summary 200 Day MA 3,300 100 Day MA 29 Jan 2021: 50 Day MA 25 Jan 3,100 2,902.52 Singapore CPI (YoY) 2,900 27 Jan 2,700 Fed Interest Rate 2,500 Decision 2,300 28 Jan 2,100 US GDP (QoQ) (Q4) Jan 20 Apr 20 Jul 20 Oct 20 Jan 21 US Initial Jobless Claims Market Commentary 1 Feb • The Straits Times Index is down 3% since the start of US Manufacturing the week, and 10.3% below its 52-week high on 14 PMI (Jan) Feb 2020. It is 31.4% above its low on 23 Mar 2020 4 Feb BoE interest rate decision • Ahead of FY20 results, analysts 'positive' on Singapore banks on broad economic recovery (27 Jan 2021, The Edge Singapore) 5 Feb • Analysts are positive on Singapore’s banking US Nonfarm Payrolls sector, with the three local banks serving as (Jan) “good proxies” to a broader economic recovery US unemployment • DBS, OCBC and UOB are scheduled to release rate their 4QFY2020 results on 10 Feb (before 10 Feb Chinese New Year), 24 Feb and 25 Feb US Core CPI (MoM) respectively (Jan) 12 Feb • Singapore adjusted unemployment rate drops to 4.4% after 3 rises (28 Jan 2021, Bloomberg) Chinese New Year • The seasonally adjusted unemployment rate decreased by 0.3% to 4.4% in 4Q, falling for the first time after 3 quarters of gains Source: Bloomberg Data extractedfromBloomberg asof previous closing unlessotherwisestated Straits Times Index Components: -

Jardine Matheson Holdings Limited As Deputy Managing Director on 1St August 2016

News Release To: Business Editor For immediate release Hongkong Land Senior Management Changes 26th November 2015 – Hongkong Land Holdings Limited today announced that Y.K. Pang will step down as Chief Executive on 31st July 2016 to be succeeded by Robert Wong. In addition, John Witt will step down as Chief Financial Officer on 31st March 2016 to be replaced by Simon Dixon. Y.K. Pang is stepping down as Chief Executive to move to Jardine Matheson Holdings Limited as deputy managing director on 1st August 2016. He will remain as a non- executive Director of the Company. He will be replaced as Chief Executive of Hongkong Land by Robert Wong. Robert Wong has been an executive director of Hongkong Land’s management company since 1996, having first joined the Group in 1985. In his current role, Robert has been instrumental in the creation of Hongkong Land’s successful residential development business. John Witt will step down as Chief Financial Officer of Hongkong Land on 31st March 2016, when he will take up the position of group finance director of Jardine Matheson Holdings Limited. He will remain a director of management company Hongkong Land Limited. Succeeding John Witt will be Simon Dixon, who is currently finance director of Astra International. Simon Dixon, a chartered accountant, joined the Jardine Matheson Group in 2006 from PwC and first served as group treasurer. He moved to the group’s listed Indonesian affiliate, Astra International, in 2010. He will take up his new role in Hongkong Land at the end of April, following Astra’s annual general meeting. -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Asia Pacific ex 19 August 2021 Japan ex Controversies ex CW Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.1 NEW CJ Cheiljedang 0.1 KOREA GPT Group 0.22 AUSTRALIA ZEALAND CJ CheilJedang Pfd. 0.01 KOREA Green Cross 0.05 KOREA AAC Technologies Holdings 0.16 HONG KONG CJ Corp 0.04 KOREA GS Engineering & Construction 0.07 KOREA ADBRI 0.04 AUSTRALIA CJ ENM 0.05 KOREA GS Holdings 0.06 KOREA Afterpay Touch Group 0.61 AUSTRALIA CJ Logistics 0.04 KOREA GS Retail 0.04 KOREA AGL Energy 0.12 AUSTRALIA CK Asset Holdings 0.5 HONG KONG Guotai Junan International Holdings 0.01 HONG KONG AIA Group Ltd. 4.6 HONG KONG CK Hutchison Holdings 0.64 HONG KONG Haitong International Securities Group 0.02 HONG KONG Air New Zealand 0.02 NEW CK Infrastructure Holdings 0.11 HONG KONG Hana Financial Group 0.36 KOREA ZEALAND Cleanaway Waste Management 0.08 AUSTRALIA Hang Lung Group 0.07 HONG KONG ALS 0.14 AUSTRALIA CLP Holdings 0.5 HONG KONG Hang Lung Properties 0.15 HONG KONG Alteogen 0.06 KOREA Cochlear 0.37 AUSTRALIA Hang Seng Bank 0.44 HONG KONG Altium 0.09 AUSTRALIA Coles Group 0.5 AUSTRALIA Hanjin KAL 0.04 KOREA Alumina 0.1 AUSTRALIA ComfortDelGro 0.08 SINGAPORE Hankook Technology Group 0.1 KOREA Amcor CDI 0.54 AUSTRALIA Commonwealth Bank of Australia 4.07 AUSTRALIA Hanmi Pharmaceutical 0.06 KOREA AmoreG 0.05 KOREA Computershare 0.21 AUSTRALIA Hanmi Science 0.03 KOREA Amorepacific Corp 0.21 KOREA Contact Energy 0.14 NEW Hanon Systems 0.07 KOREA Amorepacific Pfd. -

2019 Annual Report

Annual Report 2019 Hongkong Land Holdings Limited Hongkong Land’s Central Portfolio provides a haven for business and lifestyle experiences, this year launching the world-class CENTRICITY and newly designed BESPOKE Salon (front cover). Contents Corporate Overview 1 Corporate Information 2 Highlights 3 Chairman’s Statement 4 Chief Executive’s Review 6 Financial Review 13 Directors’ Profiles 20 Financial Statements 22 Independent Auditors’ Report 74 Five Year Summary 78 Responsibility Statement 79 Corporate Governance 80 Principal Risks and Uncertainties 85 Shareholder Information 86 Offices 87 Report of the Valuers 89 Major Property Portfolio 90 is a major listed property investment, management and development group. Founded in 1889, Hongkong Land’s business is built on excellence, integrity and partnership. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally in Hong Kong, Singapore, Beijing and Jakarta. Its properties attract the world’s foremost companies and luxury brands. The Group’s Central Hong Kong portfolio represents some 450,000 sq. m. of prime property. It has a further 165,000 sq. m. of prestigious office space in Singapore mainly held through joint ventures, a luxury retail centre at Wangfujing in Beijing, and a 50% interest in a leading office complex in Central Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across Greater China and Southeast Asia. In Singapore, its subsidiary, MCL Land, is a well-established residential developer. Hongkong Land Holdings Limited is incorporated in Bermuda and has a standard listing on the London Stock Exchange, with secondary listings in Bermuda and Singapore. -

175 Years of Looking to the Future

175 Years of Looking to The Future of Looking 175 Years C M Y K Merchant Adventurers 5 Great Foresight and Market Knowledge 9 Independent Spirit 13 Courageous and Determined 17 Further Transformation and Innovation... 23 Calculated Risk Takers 27 Looking Ahead 31 A Market Leader Today 33 Timeline 38 Contents An Enterprising Spirit 175 years ago, William Jardine and James Matheson formed a trading partnership that was to become one of the most successful, long lasting, diversified enterprises in Asia. The success of Jardine Matheson has been due in no small part to its unique character, which to this day clearly reflects many of the personal traits of the founders. Not only did the two founding Scotsmen, one highlander and one lowlander, instil an enterprising spirit into their newly created trading venture in 1832, but also qualities such as a strong work ethic, an independent spirit, financial prudence, business foresight, determination and the understanding of the need to build strong relationships in business. Over the years, these qualities have helped those working for Jardines overcome many challenges and consolidate its position in Asia. There has been a constant evolution in the nature of the business interests of Jardine Matheson, or ‘the Firm’ as it has been affectionately known for most of its existence. Its business activities have kept pace with the times during its long history as new opportunities were sought when the profitability of older ventures waned. Today, Jardines’ businesses are at the forefront of their chosen markets. They include property investment and development, luxury hotels, retail, motor vehicles, financial services and insurance, engineering and construction, agribusiness, mining, restaurants and IT services. -

General Announcement__CDL & MCL Land Jo... Two

ÿ !"ÿ#ÿ$ "ÿ" %ÿ&' (ÿ) ÿ ÿ" )ÿ' 0ÿ1234$ÿ5 ÿ6ÿ7' 0ÿ )'% 'ÿ%87 ) z{|{}~ÿ~|||{{| ÿÿÿ~|ÿ| ÿ{}{ÿz}{{|ÿ~|ÿ ~|zÿ }ÿ ÿ |zÿ}{{| ~ÿ{{{| VWWXY`ÿbÿcYdX`efeYW VWWXY`gÿhipiqY` rVstÿuvwvxyhvscÿxVhVsvu cYdX`efeYW rVstÿuvwvxyhvscÿxVhVsvuÿÿc ÿÿr cfiYÿcYdX`ef ppXpdYYpfÿuYfieW ppXpdYYpfÿsefY YpY`iÿppXpdYYpf uifYÿbseYÿÿ`idiWf dXqÿefed cfifXW Yg ppXpdYYpfÿcXhÿsefY ruxÿbÿhrxÿxipÿiepfÿWYdX`Yÿ`YYpÿxipWÿffiepqÿcjklhÿ`ÿfgÿXdepqÿ`YWeYpfeiÿYmYYpfW ppXpdYYpfÿ YY`YpdY cdysn wcxV cXheffYÿÿorpgÿVppÿiYq vpeÿxepqÿYYrÿspq uYWeqpifep ripÿcYd`Yfi` uYWd`efepÿoYiWYÿ`meYÿiÿYfieYÿYWd`efepÿÿftYÿYmYpfÿepÿftYÿhuÿhYgq YiWYÿ`YY`ÿfÿftYÿiffidtYÿYgWÿ YYiWYÿfefYÿvruxÿipÿhrxÿxipÿiepfÿWYdX`Yÿ`YYpÿxipWÿffiepq cjklÿheepÿ`ÿfgÿXdepqÿ`YWeYpfeiÿYmYYpfWvÿeWWXYÿhÿrefÿuYmYYpfWÿxeefYÿipÿhrx xipÿpÿdÿXqXWfÿp ffidtYpfW depfYgW YYiWYruxiphrxxipWYdX`Yq`YYpipW`w`iYdfWp sfiÿWewYÿxfyÿh 97)' @)A)0BAAA 7 C )DEF EGHIP1EQ55544%R5R5%SR55%RTTSS43%3543R4S4U News Release 31 August 2021 CDL AND MCL LAND JOINTLY SECURE GREEN LOANS TOTALLING S$847 MILLION FOR TWO UPCOMING RESIDENTIAL DEVELOPMENTS − Green loans will be used to finance the development of two newly-acquired GLS sites at Northumberland Road and Tengah Garden Walk, with over 1,000 residential units − Both developments will obtain the BCA Green Mark GoldPLUS rating, with Tengah Garden Walk EC set to be one of Singapore’s first new Super Low Energy private residential developments − MCL Land breaks new ground with its first green loan in Singapore – keeping pace with its parent company, Hongkong Land, which has secured US$1.9 billion in sustainability-linked loans to date and recently issued its US$500 million inaugural green bond and a HK$375 million green bond City Developments Limited (CDL) and MCL Land are pleased to announce the successful securing of green loans amounting to S$847 million for the financing of two upcoming developments in Singapore, under a 50:50 joint venture (JV). -

Hongkong Land – Expanding Its Commercial Property Portfolio Across Asia Past, Present and Future

2012 vol.1 Thistle The Magazine of Jardine Matheson Group Chairman Celebrates 50 years with Jardines > page 3 Group Managing Director Attends Asia-Pacific Summit in Hawaii > page 6 Gala Celebrates Mandarin Oriental’s Paris Debut > page 9 Hongkong Land – Expanding its Commercial Property Portfolio Across Asia Past, Present and Future As we enter the new Year of the Dragon, it is a good time to reflect on the past, make the most of the present and look to the future. At a special dinner held at Mandarin Oriental, Tokyo on 8th December, directors of our main listed companies and country heads came together to celebrate Group Chairman, Sir Henry Keswick’s 50 years with Jardine Matheson. A presentation described the Group’s colourful history during the past half century and the Chairman’s great contribution in building the business to where we are today. In our feature on pages 14 to 19, we see how Hongkong Land, one of Asia’s leading property investment, management and development groups, is making the most of the present by extending its brand across Asia and positioning itself for further expansion. As to the future, I shall be stepping down as Group Managing Director at the end of March after six challenging but very enjoyable years in this position, and so this is the last time I shall address you in this column. Since I joined Jardines in 1969, there have been many changes. At that time, we were primarily an agency house with the majority of our business in Hong Kong and despite our long history we were a much smaller group than we are now. -

STOXX Asia/Pacific 600 Last Updated: 01.11.2017

STOXX Asia/Pacific 600 Last Updated: 01.11.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Large 146.3 1 1 AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Large 88.4 2 2 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Large 81.6 3 3 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Large 77.9 4 4 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Large 73.7 5 5 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Large 65.3 6 6 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Large 58.6 7 10 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Large 57.8 8 7 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Large 57.7 9 8 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Large 56.1 10 9 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Large 48.3 11 11 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Large 48.2 12 12 JP3236200006 6490995 6861.T 649099 Keyence Corp. JP JPY Large 43.0 13 13 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Large 42.1 14 16 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Large 41.5 15 14 JP3496400007 6248990 9433.T 624899 KDDI Corp.