Section C. Borrower Credit Analysis Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Down Payment and Closing Cost Assistance

STATE HOUSING FINANCE AGENCIES Down Payment and Closing Cost Assistance OVERVIEW STRUCTURE For many low- and moderate-income people, the The structure of down payment assistance programs most significant barrier to homeownership is the down varies by state with some programs offering fully payment and closing costs associated with getting a amortizing, repayable second mortgages, while other mortgage loan. For that reason, most HFAs offer some programs offer deferred payment and/or forgivable form of down payment and closing cost assistance second mortgages, and still other programs offer grant (DPA) to eligible low- and moderate-income home- funds with no repayment requirement. buyers in their states. The vast majority of HFA down payment assistance programs must be used in combi DPA SECOND MORTGAGES (AMORTIZING) nation with a first-lien mortgage product offered by the A second mortgage loan is subordinate to the first HFA. A few states offer stand-alone down payment and mortgage and is used to cover down payment and closing cost assistance that borrowers can combine closing costs. It is repayable over a given term. The with any non-HFA eligible mortgage product. Some interest rates and terms of the loans vary by state. DPA programs are targeted toward specific popula In some programs, the interest rate on the second tions, such as first-time homebuyers, active military mortgage matches that of the first mortgage. Other personnel and veterans, or teachers. Others offer programs offer more deeply subsidized rates on their assistance for any homebuyer who meets the income second mortgage down payment assistance. Some and purchase price limitations of their programs. -

Commercial Mortgage Loans

STRATEGY INSIGHTS MAY 2014 Commercial Mortgage Loans: A Mature Asset Offering Yield Potential and IG Credit Quality by Jack Maher, Managing Director, Head of Private Real Estate Mark Hopkins, CFA, Vice President, Senior Research Analyst Commercial mortgage loans (CMLs) have emerged as a desirable option within a well-diversified fixed income portfolio for their ability to provide incremental yield while maintaining the portfolio’s credit quality. CMLs are privately negotiated debt instruments and do not carry risk ratings commonly associated with public bonds. However, our paper attempts to document that CMLs generally available to institutional investors have a credit profile similar to that of an A-rated corporate bond, while also historically providing an additional 100 bps in yield over A-rated industrials. CMLs differ from public securities such as corporate bonds in the types of protections they offer investors, most notably the mortgage itself, a benefit that affords lenders significant leverage in the relationship with borrowers. The mortgage is backed by a hard, tangible asset – a property – that helps lenders see very clearly the collateral behind their investment. The mortgage, along with other protections, has helped generate historical recovery from defaulted CMLs that is significantly higher than recovery from defaulted corporate bonds. The private CML market also provides greater flexibility for lenders and borrowers to structure mortgages that meet specific needs such as maturity, loan amount, interest terms and amortization. Real estate as an asset class has become more popular among institutional investors such as pension funds, insurance companies, open-end funds and foreign investors. These investors, along with public real estate investment trusts (REITs), generally invest in higher quality properties with lower leverage. -

Know Your Credit History: How to Interpret a Credit Report

A Financial Empowerment Toolkit for Youth and Young Adults in Foster Care Know Your Credit History: How to Interpret a Credit Report You may have recently seen your credit report for the first time or have been asked about your credit by a prospective employer, landlord, or lender. Credit has become a critical part of daily life in our economy. Because credit is so important, there’s a law to protect consumers called the Fair Credit Report- ing Act (FCRA), which ensures that consumers are treated fairly by all play- ers in the credit system. Read on to learn more about your rights under the FCRA and how to assert them. Tip Sheet Series for Youth in Foster Care Key FCRA Terms: Before you start interpreting your credit report you need to know Know Your Credit History: some FCRA lingo. There are three main players in the FCRA universe: consumers (that’s How to Interpret a Credit you), credit reporting agencies (CRAs), and furnishers. CRAs collect information about Report consumers’ credit activity, compile the information, and provide the information on credit Creating a Credit Profile: reports. Furnishers are banks, other types of lenders, government entities, collection agen- How to Build Your Credit cies, and others that provide credit activity information to the CRAs. Identity Theft: How to Resolve Errors on Your Your Right To Get the “Big Three” and More: The most important CRAs are known Credit Report as the “Big Three.” They are Equifax, Experian, and TransUnion. There are also hundreds Protect Yourself and Your of other CRAs that generate specialty reports. -

Your Step-By-Step Mortgage Guide

Your Step-by-Step Mortgage Guide From Application to Closing Table of Contents In this Guide, you will learn about one of the most important steps in the homebuying process — obtaining a mortgage. The materials in this Guide will take you from application to closing and they’ll even address the first months of homeownership to show you the kinds of things you need to do to keep your home. Knowing what to expect will give you the confidence you need to make the best decisions about your home purchase. 1. Overview of the Mortgage Process ...................................................................Page 1 2. Understanding the People and Their Services ...................................................Page 3 3. What You Should Know About Your Mortgage Loan Application .......................Page 5 4. Understanding Your Costs Through Estimates, Disclosures and More ...............Page 8 5. What You Should Know About Your Closing .....................................................Page 11 6. Owning and Keeping Your Home ......................................................................Page 13 7. Glossary of Mortgage Terms .............................................................................Page 15 Your Step-by-Step Mortgage Guide your financial readiness. Or you can contact a Freddie Mac 1. Overview of the Borrower Help Center or Network which are trusted non- profit intermediaries with HUD-certified counselors on staff Mortgage Process that offer prepurchase homebuyer education as well as financial literacy using tools such as the Freddie Mac CreditSmart® curriculum to help achieve successful and Taking the Right Steps sustainable homeownership. Visit http://myhome.fred- diemac.com/resources/borrowerhelpcenters.html for a to Buy Your New Home directory and more information on their services. Next, Buying a home is an exciting experience, but it can be talk to a loan officer to review your income and expenses, one of the most challenging if you don’t understand which can be used to determine the type and amount of the mortgage process. -

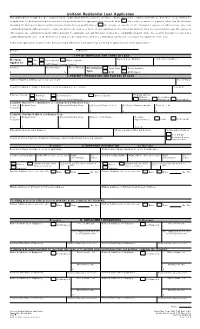

Sample Mortgage Application (PDF)

Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as "Borrower" or "Co-Borrower," as applicable. Co-Borrower information must also be provided (and the appropriate box checked) when the income or assets of a person other than the Borrower (including the Borrower's spouse) will be used as a basis for loan qualification or the income or assets of the Borrower's spouse or other person who has community property rights pursuant to state law will not be used as a basis for loan qualification, but his or her liabilities must be considered because the spouse or other person has community property rights pursuant to applicable law and Borrower resides in a community property state, the security property is located in a community property state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan. If this is an application for joint credit, Borrower and Co-Borrower each agree that we intend to apply for joint credit (sign below): Borrower Co-Borrower I. TYPE OF MORTGAGE AND TERMS OF LOAN Agency Case Number Lender Case Number Mortgage VA Conventional Other (explain): Applied for: FHA USDA/Rural Housing Service Amount Interest Rate No. of Months Amortization Fixed Rate Other (explain): $%Type: GPM ARM (type): II. PROPERTY INFORMATION AND PURPOSE OF LOAN Subject Property Address (street, city, state & ZIP) No. of Units Legal Description of Subject Property (attach description if necessary) Year Built Purpose of Loan Purchase Construction Other (explain): Property will be: Primary Secondary Refinance Construction-Permanent Residence Residence Investment Complete this line if construction or construction-permanent loan. -

FICO Mortgage Credit Risk Managers Handbook

FICO Mortgage Credit Risk Manager’s Best Practices Handbook Craig Focardi Senior Research Director Consumer Lending, TowerGroup September 2009 Executive Summary The mortgage credit and liquidity crisis has triggered a downward spiral of job losses, declining home prices, and rising mortgage delinquencies and foreclosures. The residential mortgage lending industry faces intense pressures. Mortgage servicers must better manage the rising tide of defaults and return financial institutions to profitability while responding quickly to increased internal, regulatory, and investor reporting requirements. These circumstances have moved management of mortgage credit risk from backstage to center stage. The risk management function cuts across the loan origination, collections, and portfolio risk management departments and is now a focus in mortgage servicers’ strategic planning, financial management, and lending operations. The imperative for strategic focus on credit risk management as well as information technology (IT) resource allocation to this function may seem obvious today. However, as recently as June 2007, mortgage lenders continued to originate subprime and other risky mortgages while investing little in new mortgage collections and infrastructure, technology, and training for mortgage portfolio management. Moreover, survey results presented in this Handbook reveal that although many mortgage servicers have increased mortgage collections and loss mitigation staffing, few servicers have invested sufficiently in data management, predictive analytics, scoring and reporting technology to identify the borrowers most at risk, implement appropriate treatments for different customer segments, and reduce mortgage re-defaults and foreclosures. The content of this Handbook is based on a survey that FICO, a leader in decision management, analytics, and scoring, commissioned from TowerGroup, a leading research and advisory firm focusing on the strategic application of technology in financial services. -

1 I. Introduction Interest Rates, Financial Leverage, and Asset Values Are

I. Introduction Interest rates, financial leverage, and asset values are among the most important variables in the economy. Many economists, policy makers, and investors believe that these variables may affect each other; therefore, manipulation of some variables may cause desired changes in the others. While interest rates are traditionally the variable that the Federal Reserve monitors and tries to influence, research on the recent financial crisis highlights the importance of financial leverage in the economy (see, e.g. Geanakoplos (2009), Acharya and Viswanathan (2011), among others). Recognizing this, Federal Reserve researchers are investigating whether changing requirements for mortgages’ loan-to-value ratios based on the economic environment could improve financial stability.1 The effectiveness of such policies would depend on how the loan to value ratios and property values exactly interact with each other, as well as whether and how they are endogenously determined. For example, if the two variables are only endogenously correlated and do not affect each other, policies that tries to manipulate the loan to value ratios to affect property values would have little effect. A natural starting point to understand the interactions between the loan to value ratios and property values is to understand their long-run equilibrium relationship. However, the existing literature is virtually silent on this very important issue. 1 See the speech by Ben S. Bernanke at the Annual Meeting of the American Economic Association at Philadelphia: http://www.federalreserve.gov/newsevents/speech/bernanke20140103a.htm. 1 This paper develops a very simple theoretical model in which commercial real estate mortgage interest rates, leverage, and property values are jointly determined. -

Nber Working Paper Series Covered Farm Mortgage

NBER WORKING PAPER SERIES COVERED FARM MORTGAGE BONDS IN THE LATE NINETEENTH CENTURY U.S. Kenneth A. Snowden Working Paper 16242 http://www.nber.org/papers/w16242 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 July 2010 This paper has benefited from the comments of Walid BuSaba, Charles Courtemanche, John Neufeld, Dan Rosenbaum, Chris Ruhm, Chris Swann, Insan Tunali, two anonymous referees and participants of seminars at UNC Greensboro, Rutgers and the University of Western Ontario. Nidal Abu Saba assembled the Watkins loan sample while Debra Ritch and Michael Cofer provided invaluable research assistance in coding Watkins’s mortgage ledgers. The material is based upon work supported by the National Science Foundation Grant No. SES-9122566. The views expressed herein are those of the author and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2010 by Kenneth A. Snowden. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Covered Farm Mortgage Bonds in the Late Nineteenth Century U.S. Kenneth A. Snowden NBER Working Paper No. 16242 July 2010 JEL No. G28,G29,N1,N11,N2,N21,N5,N51,R51 ABSTRACT Covered mortgage bonds have been used successfully in Europe for two centuries, but failed in the U.S. -

Model Insurance Requirements for a Commercial Mortgage Loan

Model Insurance Requirements For A Commercial Mortgage Loan James E. Branigan and Joshua Stein Commercial buildings make good collateral for a lender.They make even better collateral when properly insured against damage and destruction. ⅥⅥⅥ REAL ESTATE LOANS START FROM the A fire or other loss affecting the borrower’s fundamental assumption that the borrower’s building can undercut this very fundamental assumption and throw the loan into default building will continue to exist. As long as the rather quickly—unless the borrower has main- building exists, it can produce rental income so tained an appropriate package of insurance cov- the borrower can pay debt service. erage for the mortgaged property. James E. Branigan, President and Chief Executive Officer of Omega Risk Management LLC, has spoken extensively on insurance and risk management for bar associations and major law firms. His firm is a consultancy, which does not sell insurance. He can be reached at (631) 692-9866 or [email protected]. Joshua Stein, a partner in the New York office of Latham & Watkins LLP, is a member of the American College of Real Estate Lawyers, First Vice Chair of the New York State Bar Association Real Property Law Section, and author of New York Commercial Mortgage Transactions (Aspen 2002), A Practical Guide to Real Estate Practice (ALI-ABA 2001), and over 100 articles about commercial real estate law and prac- tice. He can be reached at (212) 906-1342 or [email protected]. An earlier version of this article appeared in The Real Estate Finance Journal 10 (Winter 2004) , and in Joshua Stein’s recent Mortgage Bankers Association book, Lender’s Guide to Structuring and Closing Commercial Mortgage Loans. -

The Subprime Mortgage Crisis: Underwriting Standards, Loan Modifications and Securitization∗

The Subprime Mortgage Crisis: Underwriting Standards, Loan Modifications and Securitization∗ Laurence Wilse-Samsony February 2010 Abstract This is a survey of some literature on things that have been going on in housing mainly. Because it’s interesting. I highlight some aspects of the bubble, then some causes of the crash. I add some notes on the mortgage finance industry, and a little bit about the role of securitization in the crisis, and in posing hurdles for resolving the crisis. Those familiar with this area will be familiar with what I write about. Those not might find better surveys elsewhere. So you’ve been warned. Keywords: housing; securitization; subprime. ∗Notes on institutional detail written for personal edification. Thanks to Patrick Bolton for helpful and kind comments. [email protected] 2 1. Introduction This paper is a survey of some of the literature on the subprime mortgage crisis. I focus on two aspects of the debate around securitization. First, I consider securitization as a possible mechanism for a decline in underwriting standards. Second, I review some evidence about its role in inhibiting the restructuring of loans through modification. These aspects are related, since creating a more rigid debt structure can facilitate bet- ter risk management and permit the greater extension of credit. However, it can also result in inefficiencies, through externalities on non-contracting parties. This might justify intervention ex post (Bolton and Rosenthal, 2002 [7]). I then consider some of the recent government modification programs and their problems. A concluding sec- tion tentatively suggests topics for research. We begin by outlining the shape of the non-prime mortgage market by way of back- ground, tracing its rapid expansion from the mid-1990s, but in particular its rapid de- velopment since the turn of the century. -

Mortgages for Borrowers Without Credit Scores

Mortgages for Borrowers Without Credit Scores Assessment of Mortgages for Borrowers Without Credit Scores We have updated Freddie Mac Loan Product Advisor® to allow you to assess mortgages for borrowers without credit scores. Currently, you may deliver Loan Product Advisor Accept mortgages to Freddie Mac where not all borrowers on the mortgage have a usable credit score. Caution mortgages must be manually underwritten in accordance with the Seller’s purchase documents. For more information, refer to Freddie Mac’s Seller Servicer Guide (Section 5201.1(c)(ii)). Getting Started To take advantage of this offering, simply submit your loan to Loan Product Advisor. Loan Product Advisor’s Feedback Certificate will include messages advising you of any additional requirements for delivery of the loan to Freddie Mac, including specific credit history requirements when either not all borrowers have a credit score or no borrower has a credit score. Eligibility Requirements To be eligible when no borrower has a credit score, the To be eligible when not all borrowers have a credit mortgage: score, the mortgage: Must be a purchase or a "no cash-out" refinance Must be a purchase or a "no cash-out" refinance mortgage mortgage Must be secured by a 1-unit property and all Must be secured by a 1-unit property and all borrowers must occupy the property as their primary borrowers must occupy the property as their residence primary residence Loan-to-value (LTV), total LTV (TLTV) and Home Equity Line of Credit (HELOC) TLTV (HTLTV) ratios must not exceed 95% Must be a fixed-rate mortgage Must not be: • A mortgage secured by a manufactured home • A super-conforming mortgage If a transaction does not meet the above requirements, Loan Product Advisor will return Data Quality and System Messages. -

Mainstream Vs Alternative Financial Services

Mainstream vs Alternative Financial Services POWERPOINT PRESENTATION Today, you will create a 4‐slide PowerPoint presentation summarizing the differences between Mainstream Financial Services (offered by banks) and Alternative Financial Services (check cashing outlets, payday loans, rent‐to‐ own). Use the information shown below to help you in preparing your PowerPoint. Be sure to make your PowerPoint interesting by using fonts, colors, backgrounds, clipart, wordart, animations, etc. You will have the option of presenting your PowerPoints in class! MAINSTREAM FINANCIAL SERVICES Mainstream financial institutions include commercial banks, savings and loan associations, credit unions, consumer credit companies, and so forth. For many families, it is advantageous to use such institutions. For example, banks offer many advantages over the check‐cashing outlets and providers of payday loans. Most importantly, banks offer a safe place to keep money. The federal government insures deposits in banks. In contrast, holding cash savings at home is very risky. Cash can be easily lost or stolen. Banks and similar institutions offer several other advantages as well. They enable bank customers to accumulate savings, develop a credit history, keep records, and use various financial services at comparatively low rates. In the past, each type of financial institution offered specific services. Banks took in deposits for savings accounts, checking accounts, and certificates of deposit. Banks then made loans to individuals and businesses. Savings and loan associations offered savings accounts and home mortgages. Credit unions were member‐owned cooperatives that made low‐interest loans to members. Brokerage firms were businesses that bought and sold stocks and bonds. Today the lines between all these institutions are blurred.