Draft 2023 ACTION PLAN

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The National Union

Nena's statement at the Conference on Human Rights VIENNA, Austria (FSM INFOR- MATION SERVICE) - The following is the full text of Vice President Jacob Nena's statement at the World Confer- ence on Human Right held at Vienna, Austria on June 21,1993. "MR. PRESIDENT, DISTIN- GUISHED DELEGATES, LADIES AND GENTLEMEN, I am honored to speak to this historic Conference today, particularly because in doing so, I am making for my country its first public statements relating our position in re- gard to the international human rights system and the fundamental rights and freedoms addressed in the Universal Declaration of Human Rights. The Federated States of Micronesia NANCY LEFT FSM - From left to right are Vice President Jacob Nena, Nancy Murray, is a relatively new Nation, but having Secretary of Education Catalino Cantero, and Attorney General Camilo Noket, during had a long association with the United a farewell get together for Murray held at the Department of Education. Murray was Nations as a Trust Territory we made at Asssistant Attorney General for the Division of Law. (See HUMAN RIGHTS, Page 3) THE NATIONAL UNION PEACE' UNITY • LIBERTY AN OFFICIAL PUBLICATION OF THE PEOPLE OF FEDERATED STATES OF MICRONESIA Volume 14 Palikir, Pohnpei, Augustl993 Number 8 Banking Board released information on FSM banking system PALIKIR, Pohnepi (FSM INFOR- million as of June 30, 1993. decreased by $9.8 million and $9.3 mil- MATION SERVICE) - The Banking Although the growth rate for the last lion, respectively. Board releases the following informa- six-month period appears to be very Somehow this development could be tion on the FSM banking system based moderate, individual analysis of each indicative of an increasing patronage on a review conducted on the financial bank's financial condition and perfor- and support for the locally chartered condition and performance of the three mance disclosed a major shift of bank- commercial bank which may have been commercial banks as of June 30, 1993. -

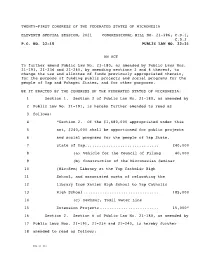

Twenty-First Congress of the Federated States of Micronesia

TWENTY-FIRST CONGRESS OF THE FEDERATED STATES OF MICRONESIA ELEVENTH SPECIAL SESSION, 2021 CONGRESSIONAL BILL NO. 21-396, C.D.1, C.D.2 P.C. NO. 22-15 PUBLIC LAW NO. 22-21 AN ACT To further amend Public Law No. 21-180, as amended by Public Laws Nos. 21-191, 21-234 and 21-240, by amending sections 2 and 6 thereof, to change the use and allottee of funds previously appropriated therein, for the purpose of funding public projects and social programs for the people of Yap and Pohnpei States, and for other purposes. BE IT ENACTED BY THE CONGRESS OF THE FEDERATED STATES OF MICRONESIA: 1 Section 1. Section 2 of Public Law No. 21-180, as amended by 2 Public Law No. 21-191, is hereby further amended to read as 3 follows: 4 “Section 2. Of the $1,680,000 appropriated under this 5 act, $240,000 shall be apportioned for public projects 6 and social programs for the people of Yap State. 7 state of Yap.......................... ..... 240,000 8 (a) Vehicle for the Council of Pilung 40,000 9 (b) Construction of the Micronesian Seminar 10 (Mic-Sem) Library at the Yap Catholic High 11 School, and associated costs of relocating the 12 library from Xavier High School to Yap Catholic 13 High School ................................ 185,000 14 (c) Dechmur, Tomil Water Line 15 Extension Projects ......................... 15,000” 16 Section 2. Section 6 of Public Law No. 21-180, as amended by 17 Public Laws Nos. 21-191, 21-234 and 21-240, is hereby further 18 amended to read as follows: CBL 21-412 CONGRESSIONAL BILL NO. -

PUBLIC POLICY: by Submitted in Partial Fulfillment of the Requirements for the Degree of in Dr. Jungho Baek, Committee Chair

Tourism development and public policy: perceptions of the Chuukese community Item Type Thesis Authors Perez, Gerald San Agustin Download date 05/10/2021 09:13:24 Link to Item http://hdl.handle.net/11122/10527 TOURISM DEVELOPMENT AND PUBLIC POLICY: PERCEPTIONS OF THE CHUUKESE COMMUNITY By Gerald San Agustin Perez A Dissertation Submitted in Partial Fulfillment of the Requirements For the Degree of Doctor of Philosophy in Rural Tourism Development: Interdisciplinary Program University of Alaska Fairbanks May 2019 APPROVED: Dr. Jungho Baek, Committee Chair Dr. Fred Schumann, Committee Co-Chair Dr. Jennifer Caroll, Committee Member Dr. Ansito Walter, Committee Member Dr. Mark Herrmann, Dean School of Management Dr. Michael Castellini, Dean of the Graduate School Abstract Tourism is a widely used tool for economic development in small insular communities. This mixed methods study examines factors that influence residents' perceptions toward tourism development in Chuuk and the relevance of “complexity theory” in describing the island's stage of development. Empirical evidence and data triangulation corroborate general support for tourism development and sensitivity to cultural impacts, economic impacts, social impacts, environmental impacts, local control and sustainability. Economic and cultural impacts were the strongest factors influencing perceptions and are most significant to sustainable development and destination development. This reflects residents' beliefs that the island will benefit from tourism because of perceived improvements in the economy, infrastructure, tourist facilities and expanded social amenities. It also reflects residents' expectations for long term planning, managed growth, and laws to protect the environment. Some differences and similarities are noted between sampled residents living in Chuuk and Guam. -

Micrdnlms International 300 N

INFORMATION TO USERS This was produced from a copy of a document sent to us for microfilming. While the most advanced technological means to photograph and reproduce this document have been used, the quality is heavily dependent upon the quality of the material submitted. The following explanation of techniques is provided to help you understand markings or notations which may appear on this reproduction. 1. The sign or “target” for pages apparently lacking from the document photographed is “Missing Page(s)”. If it was possible to obtain the missing page(s) or section, they are spliced into the film along with adjacent pages. This may have necessitated cutting through an image and duplicating adjacent pages to assure you of complete continuity. 2. When an image on the film is obliterated with a round black mark it is an indication that the film inspector noticed either blurred copy because of movement during exposure, or duplicate copy. Unless we meant to delete copyrighted materials that should not have been filmed, you will find a good image of the page in the adjacent frame. 3. When a map, drawing or chart, etc., is part of the material being photo graphed the photographer has followed a definite method in “sectioning” the material. It is customary to begin filming at the upper left hand comer of a large sheet and to continue from left to right in equal sections with small overlaps. If necessary, sectioning is continued again—beginning below the first row and continuing on until complete. 4. For any illustrations that cannot be reproduced satisfactorily by xerography, photographic prints can be purchased at additional cost and tipped into your xerographic copy. -

ETG-YAP Strategic Framework

The following is a brief analysis of a “Strategic Framework of Cooperation,” signed between ETG (Deng Hong) and Yap State Government (as represented by Governor Sebastian Anefal) in Chengdu, PRC, on 2011-04-21 (just under two years ago!). That date is of some importance, as both ETG and Governor Anefal have repeatedly stated that “ETG learned about Yap in March of 2011”… One (1) month earlier! According to the ETG “Yap Paradise Islands” project sales presentation, the first hotel complex, convention center, casino, and entertainment center were planned to be completed by 2013… (listen to audio here) Yes, that’s right: 2013! According to this “framework,” one of ETG’s major aims with the “project” is to “raise living standards of local residents of Yap”… Today (2013-03-12), according to a report published by FSM President Emanuel Mori, ETG has agreed to “scale back” their original ideas—4,000-10,000 hotel rooms, 8-15 golf courses, casinos, convention centers, water park, a China Town, a “Native Neighborhood” (not clear what this means), Condominiums, Timeshares, Luxury Villas, and much more—to “only” construct 1,500 hotel rooms—no casinos, no golf courses, no nothing... So far, so good? In Addition to Many Eyebrows, the Following Questions May Be Raised: Question 1: How can that presentation have been made after March of 2011? The presentation, as well as all that ETG has published (so far) about their plans, has a huge amount of detail of what ETG plans for Yap State! Even on a “fast track,” ETG must originally have planned to start the -

Hon. Yosiwo P. George Eighth Vice President of the Federated States of Micronesia

Hon. Yosiwo P. George Eighth Vice President of the Federated States of Micronesia George was born in Kosrae on July 24th, 1941. His rich and varied public and political life started during the Trust Territory of the Pacific Islands (TTPI) and has continued through today. His public service experiences began as an Engineer Trainee at the Pohnpei Transportation Authority, later as a classroom teacher in Kolonia Elementary School, and then as the TTPI Social Security manager in Saipan. George later served as Kosrae's Lieutenant Governor for a partial term, when he was appointed by the 1st President of the FSM, Tosiwo Nakayama, as the Director of Department of Social Services with foci on health, education, and community services. After many accomplishments in the Department of Social Services, George was reminded again of his home in Kosrae, and ran for Governor of Kosrae State, where he served two full and consecutive terms. George was then appointed by President Bailey Olter to serve as the Ambassador of the FSM to the United Nations, where he served with distinction for three years. International service on behalf of the FSM inspired George to run for a seat in the Congress of the FSM, and in the 10th Congress he began his service as a Senator for four years. George was later appointed by Governor Rensley Sigrah to serve as the Chief Justice for Kosrae State Court, where he served until 2006 when he was then called upon by President Manny Mori to serve as the Administrator for MiCare. After several years of dedicated service, President Mori appointed George to be the Ambassador of the FSM to the United States, which additional accreditation to the State of Israel. -

Final Yap Report2

The Integration of Traditional and Modern Systems of Environmental Management and the Use of Public-Private Partnerships in Natural Resource Management and Tourism Development in the State of Yap, Federated States of Micronesia A Field Study with Observations and Recommendations Asian Development Bank TA No. 6039 – REG Formulating a Pacific Region Environmental Strategy (PRES) Contract No. COCS/03-139 Richard S. Stevenson Mantaray Management LLC 15 April 2003 The views expressed in this book are those of the authors and do not necessarily reflect the views and policies of the Asian development Bank, or its Board of Governors or the governments they represent. The Asian Development Bank does not guarantee the accuracy of the data included in this publication and accepts no responsibility for any consequences of their use. Use of the term “country” does not imply any judgment by the authors or the Asian Development Bank as to the legal or other status of any territorial entity. Acknowledgements Many gracious and knowledgeable people of Yap contributed generously of their time and their thoughts to the research for this paper. They welcomed enquiry into sometimes-difficult subjects and were patient and candid in their responses to endless questions. Busy leaders from the state and FSM government, the traditional leadership system, the private sector and the non- governmental organizations were always able and willing to find time to talk. Without them the study would not have been possible. Their names are listed in Appendix 1 of the paper. Special thanks are offered to John Wayaan, owner and manager of the Pathways Hotel who provided critical assistance in suggesting whom to interview and in making the needed introductions. -

17Th MICRONESIAN CHIEF EXECUTIVES' SUMMIT OPENING

17th MICRONESIAN CHIEF EXECUTIVES’ SUMMIT OPENING DAY WEDNESDAY, MARCH 14, 2012 7:45 a.m. - 8:15 a.m Registration 8:30 a.m. Convene Call to Order Introduction of Chief Executives and First Ladies Presentation of Colors by Guam National Guard USA National Anthem Guam Hymn Posting of Colors by Guam National Guard Opening Prayer Change of Chairmanship The Honorable Lyndon Jackson, Governor of Kosrae Chairman, 16th Micronesian Chief Executives’ Summit turns over Chairmanship of the 17th Micronesian Chief Executives’ Summit to the Honorable Eddie Baza Calvo, Governor of Guam Traditional Chant 9:30 a.m. Welcoming Remarks The Honorable Eddie Baza Calvo, Governor of Guam Chairman, 17th Micronesian Chief Executives’ Summit Adoption of Agenda Opening Remarks by Chief Executives: • His Excellency Emanuel Mori, President of the Federated States of Micronesia • His Excellency Johnson Toribiong, President, Republic of Palau • His Excellency Christopher Loeak, President, Republic of the Marshall Islands • The Honorable Benigno R. Fitial, Governor, CNMI • The Honorable Sebastian L. Anefal, Goveror of Yap State • The Honorable John Ehsa, Governor of Pohnpei State • The Honorable Johnson S. Elimo, Governor of Chuuk State • The Honorable Lyndon H. Jackson, Governor of Kosrae State 10:30 -10:45 a.m. Break – Photo Session, Chief Executives 10:45-11:00 a.m. Region IX, Federal Regional Council (FRC) Presenter: Mr. Herb Schultz, Chairman (15 minute-video conference) 11:00-11:30 a.m. Towards a Strategic Framework: The MCSF as a Regional Planning Council 11:30-11:45 p.m. Chinese Visa Waiver for the Region 11:45-12:00 p.m. U. -

Country Economic Review

Federated States of Micronesia Proceedings March 28 to April 2, 2004 Palikir, Pohnpei, Federated States of Micronesia FOREWORD To all participants of the 3rd FSM Economic Summit, I wish to thank you for your contributions to a successful Summit. I fully agree with the Floor Leader of the Pohnpei State Legislature, Fernando Scaliem, who said in his closing remarks, “I am confident that the results of this Summit will provide us with a realistic and viable road map for the future growth of our Nation.” I am pleased to see that broad participation was achieved during the Summit, including key contribu- tions from our traditional leaders, church groups, non-governmental and international donor organiza- tions. The spirited discussions during plenary sessions are a clear indication of the level importance our Nation’s representatives brought to this meeting. I wish to thank all of the Summit’s participants for their dedication and hard work. The goals of our Summit were to (a) increase awareness of the Compact, as amended; (b) achieve consensus on an overall economic strategy; and (c) improve the monitoring mechanisms to support economic growth. I’d like to take a moment to address these. As our nation continues on its journey toward economic self-reliance, we clearly face many chal- lenges, not least including the structure of the amended Compact with the annual decrement and par- tial inflation adjustment. The Select Committee formed during the Summit has chosen a high-growth scenario, and the Summit has endorsed this choice as well. This decision for economic growth will require an initial investment in reforms but will ultimately lead to a sustainable economy. -

Chunga 25, Particularly Your Con Report

From the rills and chasms of a distant peak issues Chunga, descending in musical cascades through deserts of indifference and canyons of criticism to water the green, green hills of Trufandom. Come dangle your feet for a while and perhaps you too will receive a complimentary pedicure. Edited by Andy ([email protected]), Randy, and carl ([email protected]). COA: Please address all postal correspondence to 11032 30th Ave NE, Seattle WA 98125. Editors: please send two copies of any zine for trade. Available by editorial whim or wistfulness, or, grudgingly, for $5 for a single issue; full–color PDFs of every issue may be found at eFanzines.com. Issue 26, November 2019 Tanglewood Artists this issue 1 an editorial Patrick Ijima–Washburn You Only Fail If You Stop Writing Front & back covers 2 by Steven Bieler Ulrika O’Brien 3, 4, 6, 50, 55, 58, 61 Fear and Loathing on the O’Bama Trail 4 by James Bacon Dan Steffan 10, 12, 13 Hal O’Brien 15 (top photo) Thumbs Up for Mr. Sardonicus 7 by John Hertz Randy Byers et al 17–31, 61 (photos) My Life as a Hack Steve Stiles 41, 52 8 by Graham Charnock Ray Nelson 46 Antecedents carl juarez design, other art 10 by Gordon Eklund ❦ On Distance and Expanding the World 14 by Pete Young Home is Like No Place There 17 by Randy Byers Contributors’ addresses have been removed Biographical Directory of the 1939 Worldcon (II) from this edition. 32 by Andy Hooper The Iron Pig 48 a letter column by divers hands Tanglewood Tangledown hen last we met in Chunga #25, it was February of respondent Luke McGuff volunteered to edit such an anthology, 2017. -

First Special Session Twentieth Congress

JOURNAL FIRST SPECIAL SESSION TWENTIETH CONGRESS of the Federated States of Micronesia MAY 11, 2017 to MAY 10 2019 PALIKIR, POHNPEI Convened on Tuesday, the 6th of July 2017 Adjourned on Saturday, the 15th of July 2017 Twentieth Congress of the Federated States of Micronesia FIRST SPECIAL SESSION May 11, 2017 and May 10, 2019 TABLE OF CONTENTS SECTION Page No. CERTIFICATION................................................................................................. iii ORGANIZATION ............................................................. ............................. iv-vi Leadership and Membership ............................................................. iv Standing Committees ......................................................................... v Congressional Offices ....................................................................... vi SUMMARY OF LEGISTRATION ................................................................ viii-x DAILY JOURNAL INDEX .................................................................................. xii DAILY JOURNAL .......................................................................................... 2-184 STANDING COMMITTEE REPORTS ..................................................... 185-208 Presidential Communications ............................................................. 209-213 FSM Supreme Court Communications ............................................... 214-215 Member Communications .................................................................. 216-217 -

Telling Pacific Lives

TELLING PACIFIC LIVES PRISMS OF PROCESS TELLING PACIFIC LIVES PRISMS OF PROCESS Brij V. Lal & Vicki Luker Editors Published by ANU E Press The Australian National University Canberra ACT 0200, Australia Email: [email protected] This title is also available online at: http://epress.anu.edu.au/tpl_citation.html National Library of Australia Cataloguing-in-Publication entry Title: Telling Pacific lives : prisms of process / editors, Vicki Luker ; Brij V. Lal. ISBN: 9781921313813 (pbk.) 9781921313820 (pdf) Notes: Includes index. Subjects: Islands of the Pacific--Biography. Islands of the Pacific--Anecdotes. Islands of the Pacific--Civilization. Islands of the Pacific--Social life and customs. Other Authors/Contributors: Luker, Vicki. Lal, Brij. Dewey Number: 990.0099 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior permission of the publisher. Cover design by Teresa Prowse Cover image: Choris, Louis, 1795-1828. Iles Radak [picture] [Paris : s.n., [1827] 1 print : lithograph, hand col.; 20.5 x 26 cm. nla.pic-an10412525 National Library of Australia Printed by University Printing Services, ANU This edition © 2008 ANU E Press Table of Contents Preface vii 1. Telling Pacic Lives: From Archetype to Icon, Niel Gunson 1 2. The Kila Wari Stories: Framing a Life and Preserving a Cosmology, Deborah Van Heekeren 15 3. From ‘My Story’ to ‘The Story of Myself’—Colonial Transformations of Personal Narratives among the Motu-Koita of Papua New Guinea, Michael Goddard 35 4. Mobility, Modernisation and Agency: The Life Story of John Kikang from Papua New Guinea, Wolfgang Kempf 51 5.