17-03 Audit of Jungle Island Facility Lease And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Snorkel Thru Science Snorkel Thru Science

Tour: Snorkel thru Science Destination: Key Largo & Miami, Florida Specialization: Marine Biology & Ecology Itinerary: 6-days / 5-nights in destination SNORKEL THRU SCIENCE - SAMPLE ITINERARY Day Morning Afternoon Evening 1 Travel to Miami; transfer to Key Largo Orientation & Swim Test Classroom: Key Habitats / Lab: Water Quality 2 Classroom & Field: Seagrass Ecology Field: Mangrove Ecology Classroom: Coral Reef Ecology / Lab: Invertebrate Diversity 3 Field: Coral Reef Ecology #1 Field: Hardbottom Shoal Ecology Classroom: Reef Fish ID / Lab: Sponge Spicule ID 4 Field: Rodriguez Key Zonation Field: Coral Reef Ecology #2 Summary / Field: Astronomy & Plankton Tow 5 Field: Coral Reef Ecology #3 Dolphins Plus Educational Program Transfer to Miami; Evening in Miami 6 Everglades Safari Park or Jungle Island Park Departure Snorkel thru Science We are pleased to partner with MarineLab to bring you an unforgettable tour to the Florida Keys in exploration of Marine Biology and Ecology! Located in Key Largo and surrounded by the protected marine environments of the Florida Keys National Marine Sanctuary, Everglades National Park, and the John Pennekamp Coral Reef State Park, MarineLab's site offers easy access to seagrass, mangroves, and the only bank coral reef off the continental United States! Through hands on investigation and snorkelling, preceded by biologist-led discussions focusing on the ecology and biology of these unique communities, students and staff alike learn while having fun and adventure. As with all sample itineraries, please be aware that this is an “example” of a schedule and that the activities included may be variable dependent upon dates, weather, special requests and other factors. Itineraries will be confirmed prior to travel. -

Front Desk Concierge Book Table of Contents

FRONT DESK CONCIERGE BOOK TABLE OF CONTENTS I II III HISTORY MUSEUMS DESTINATION 1.1 Miami Beach 2.1 Bass Museum of Art ENTERTAINMENT 1.2 Founding Fathers 2.2 The Wolfsonian 3.1 Miami Metro Zoo 1.3 The Leslie Hotels 2.3 World Erotic Art Museum (WEAM) 3.2 Miami Children’s Museum 1.4 The Nassau Suite Hotel 2.4 Pérez Art Museum Miami (PAMM) 3.3 Jungle Island 1.5 The Shepley Hotel 2.5 Miami Science Museum 3.4 Rapids Water Park 2.6 Vizcaya Museum & Gardens 3.5 Miami Sea Aquarium 2.7 Frost Art Museum 3.6 Lion Country Safari 2.8 Museum of Contemporary Art (MOCA) 3.7 Seminole Tribe of Florida 2.9 Lowe Art Museum 3.8 Monkey Jungle 2.10 Flagler Museum 3.9 Venetian Pool 3.10 Everglades Alligator Farm TABLE OF CONTENTS IV V VI VII VIII IX SHOPPING MALLS MOVIE THEATERS PERFORMING CASINO & GAMING SPORTS ACTIVITIES SPORTING EVENTS 4.1 The Shops at Fifth & Alton 5.1 Regal South Beach VENUES 7.1 Magic City Casino 8.1 Tennis 4.2 Lincoln Road Mall 5.2 Miami Beach Cinematheque (Indep.) 7.2 Seminole Hard Rock Casino 8.2 Lap/Swimming Pool 6.1 New World Symphony 9.1 Sunlife Stadium 5.3 O Cinema Miami Beach (Indep.) 7.3 Gulfstream Park Casino 8.3 Basketball 4.3 Bal Harbour Shops 9.2 American Airlines Arena 6.2 The Fillmore Miami Beach 7.4 Hialeah Park Race Track 8.4 Golf 9.3 Marlins Park 6.3 Adrienne Arscht Center 8.5 Biking 9.4 Ice Hockey 6.4 American Airlines Arena 8.6 Rowing 9.5 Crandon Park Tennis Center 6.5 Gusman Center 8.7 Sailing 6.6 Broward Center 8.8 Kayaking 6.7 Hard Rock Live 8.9 Paddleboarding 6.8 BB&T Center 8.10 Snorkeling 8.11 Scuba Diving 8.12 -

Thank You for Choosing Miami & the Keys Explorer Pass! Need Help

Thank you for choosing Miami & The Keys Explorer Pass! Welcome to sunny South Florida. In addition to white sand beaches and turquoise waters, South Florida features a unique combination of history, art, adventure, and unforgettable fun. The Miami & The Keys Explorer Pass® is your pass to all the best attractions, tours, and activities in Fort Lauderdale, Miami, and The Keys. Choose attractions as you go and take your time. Once you activate your pass by visiting your first attraction, your pass is good for 30 days. Choose from over 20 top attractions, including the Miami Seaquarium, Jungle Island, Big Bus Miami 48 Hour Pass, Duck Tours South Beach, CityView Trolley, Key West Conch Train Tour, a snorkel adventure, and more. Enjoy South Florida, and your #BestVacationEver. This packet contains your admission pass(es) Your pass is required for admission at each attraction. Please print it out, carry it with you and retain it after each visit. How to use your admission pass Every pass has a unique code. A representative at the attraction will scan the code on each traveler’s pass, granting you admission. For special offers at shops and restaurants, show your pass to your server or cashier. Be aware of admission policies Please read attraction information for hours, closings, and special admis- sion instructions. Attractions with the symbol require reservations. Attractions displaying require you to pick up tickets at a separate location. Pass expiration Visiting your first attraction activates your pass. Then, you have 30 calen- dar days to use your pass. You may only visit each attraction once. -

Loews Miami Beach Hotel

Loews Miami Beach Hotel Get Outside (outdoor activities and parks) Havana 19757 405 Espanola Way, Miami Beach, FL 33139 Calle Ocho – Little Havana 305.503.3828 SW 8th St, Miami, FL 33135 Mare Mio Coconut Grove 447 Espanola Way, Miami Beach, FL 33139 Multiple Access Points 305.397.8950 Jungle Island Mercato Delle Pescheria 1111 Parrot Jungle Trail, Miami, FL 33132 412 Espanola Way, Miami Beach, FL 33139 305.534.5822 Miami Seaquarium 4400 Rickenbacker Causeway, Miami, FL 33149 Yuca 501 Lincoln Rd, Miami Beach, FL 33139 Vizcaya Museum & Gardens 305.532.9822 3251 S Miami Ave, Miami, FL 33129 Wynwood Arts District Need Assistance? (healthcare, pharmacies, services) Multiple Access Points Mount Sinai Medical Center 4300 Alton Road, Miami Beach, FL 33140 Stay Indoors (museums and indoor attractions) 305.674.2273 SOBE Kids Club Walgreens Pharmacy Loews Miami Beach Hotel 1400 Collins Ave, Miami Beach, FL 33139 305.423.1050 Bass Museum of Art 2100 Collins Ave, Miami Beach, FL 33139 For information on bonded babysitting services, please contact our concierge team. Miami Children’s Museum 2100 Collins Ave, Miami Beach, FL 33139 Forgot Something? Leave it to Loews We offer: Perez Art Museum of Miami - PAMM Baby bathtubs 2100 Collins Ave, Miami Beach, FL 33139 Bed rails Board games Frost Museum of Science 2100 Collins Ave, Miami Beach, FL 33139 Bottle warmers Cribs and playpens The Wolfsonian – FIU Museum of Art Electric outlet guards 2100 Collins Ave, Miami Beach, FL 33139 Gaming systems with compatible games Humidifiers Grab a Bite (family-friendly restaurants) Kettles All items subject to availability. -

Jungle Island Begins Construction This Week of Gigantic Lanterns Shaped Into Animals, Plants and Iconic Miami Destinations for Upcoming Luminosa Festival of Lights

FOR IMMEDIATE RELEASE Media Contact: Rachel Pinzur, Pinzur Communications 305-725-2875 or [email protected] Jungle Island Begins Construction This Week of Gigantic Lanterns Shaped into Animals, Plants and Iconic Miami Destinations for Upcoming Luminosa Festival of Lights ~Early bird tickets now on sale for whimsical Chinese lantern festival, which debuts Oct. 5, 2019~ MIAMI (August 20, 2019) — Jungle Island, South Florida’s popular eco-adventure attraction, begins the construction and over month-long installation this week of 34 beautifully intricate lantern exhibits, including its own interpretation of an iconic Wynwood destination and a South Beach art deco scene, as part of Luminosa Festival of Lights. In partnership with Zigong Lantern Group and China Lantern International, which is the #1 industry leader in Chinese Lantern Festivals worldwide, the park will invite visitors from around the globe to marvel at a nighttime jungle filled with giant lanterns, up lit by over 1 million LED lights and hand-crafted out of colorful silk by Chinese artisans, from October 5, 2019 to January 8, 2020. Luminosa will take guests on a memorable journey through light across 13 of the park’s 18 acres. The journey tells a magical story of the jungle, which begins with an exploration of wildlife, birds, bloom and the beautiful Biscayne Bay. It then writes a chapter into the future through a story of transformation, rooted in adventure and infused with Miami’s new vibrant urban art identity. “Luminosa at Jungle Island is certain to be one of the most Instagram-worthy and talked about events of the season,” says Curtis Crider, Jungle Island’s general manager. -

The Cruise Capital of the World…

Surrounded by the gentle swells of the Atlantic Ocean, Greater Miami and the Beaches is celebrated for its turquoise Welcome to the Cruise waters, white sandy Capital of the World… beaches and picture perfect weather. Myriad attractions, recreational activities, museums, festivals and fairs add a Shan Shan Sheng, Ocean Waves I and II, 2007 Cruise Terminal D, Port of Miami spicy sense of fun. First- Miami-Dade County Public Art Collection class accommodations, world-class cuisine, sizzling nightlife, and infinite shopping opportunities are just part of the magical appeal of our city. Whether it’s your first time here or you’re a returning 701 Brickell Avenue, Suite 2700 visitor, we invite you to Miami, FL 33131 USA 305/539-3000 • 800/933-8448 experience our tropical and MiamiandBeaches.com cosmopolitan destination. MiamiDade.gov/PortOfMiami CruiseMiami.org FSC Logo Here TS 030310 THE CRUISE CAPITAL OF THE WORLD 10 mm high © Greater Miami Convention & Visitors Bureau Tantalizing Treats Attractions Galore Adventures in Shopping A Taste of the Arts Miami’s international flair, seaside locale and fresh, Few places in the world have it all. But Greater Miami and Greater Miami and the Beaches shopping offers everything This town knows how to put on a show. At our performing local produce add up to unforgettable dining experiences. the Beaches definitely does. Miami is an attraction itself. from designer creations to everyday great deals. From elegant arts centers, the playbill includes symphony concerts, New World cuisine tantalizes with dishes featuring Miami is also home to a bevy of unique and historic outdoor malls to hip neighborhood Miami shopping districts, world-class dance, theater and opera, and so much more. -

View Brochure

CONTENTS VISIONARY 4 CENTRE 10 RESIDENCES 16 PENTHOUSES 32 BRICKELL 38 TEAM 44 CONTACT 48 VISIONARY Swire Properties has been developing in South Florida for more than 35 years, and enjoys an enviable record of local business, civic, and environmental achievement. By combining well-honed local market knowledge with parent company Swire Pacific’s 200-years of global experience, we’re able to put formidable financial, design, and innovative resources behind each new project we undertake. Creative Transformation captures what we do and how we do it. It underlines the creative mindset and long-term approach that enables us to seek out new perspectives, and ties in our core values of integrity, originality, long-term focus, and quality that define us as a company. It also encapsulates our ability to unlock the potential of places and create vibrant destinations that can engender further growth and create sustainable value for our stakeholders. The benefits of this approach are evident in the industry-leading quality and forward-thinking feature throughout our Brickell development portfolio- from the 44-acre master-planned urban island sanctuary at Brickell Key to the $1.05 billion mixed-use complex, Brickell City Centre which has redefined Miami’s cosmopolitan center. Reach 04 05 Brickell Key The man-made island of Brickell Key is a 44-acre, master-planned community located at the mouth of the Miami River in downtown Miami. Brickell Key’s master developer, Swire Properties, which invested $1 billion into the property starting with its first development, Brickell Key One, controls all undeveloped land on the island. -

Brickell Key Is Located in Downtown Miami from Brickell Key

Brickell Key DESCRIPTION Brickell Key is located in Downtown Miami Large studio in the exclusive gated island of Brickell Key. All tile unit with washer and dryer inside. Many amenities, excellent location. Valet parking, 24 hour security, minuets to airport, top restaurants, the beaches, all the entratainment and hot spots in Miami. BEST PRICE IN BRICKELL. $ 168,000 Baths: 1 Sqft: 400 Type: Condo Year built: 1991 From Brickell key to: Parking: Garage - Detached, Garage - Attached • Miami Arena 4 minutes Availability: now • The Port of Miami 5 minutes Lease term: ContactForDetails • Parrot Jungle Island : 6 Cooling: Central minutes Heating: Forced air • Performing Arts Center 6 Appliances included: Washer, Refrigerator, Dishwasher, Dryer, Range / Oven minutes Cable ready: Yes • International Airport: 11 Controlled access: Yes minutes County: Miami-Dade • Coconut Grove 11 minutes Doorman: Yes • Coral Gables 11 minutes Elevator: Yes • Miami Beach 15 minutes Fitness center: Yes Floor covering: Tile Gated entry: Yes Hot tub/spa: Yes Last remodel year: 1991 Neighborhood name: Miami Pool: Yes Sauna: Yes Tennis court: Yes Brickell Key offers fabulous living on an exclusive island in the very heart of Miami. Shaped by history and progress, Brickell Key has evolved as one of the world’s finest private islands. Stunning residential and corporate towers rise like beacons on this carefully, master-planned premier island. Surrounded by the warm waters of Biscayne Bay and the beautiful sparkling skyline of Miami Brickell Key is a true and stunning gem - a sparkling diamond on Florida’s sun drenched coast. Brickell Key is a gated community with 24 hour security just east of Brickell Avenue and SW 8th Street and offers a relaxing, family oriented environment, in the heart of Miami Financial District. -

Travel Caribbean Center Miami, FL Restaurants

Kimberly Green Latin American and Travel Caribbean Center Miami, FL Restaurants Brain Freeze Latin American Jasmine Sushi Little Caesar’s Subrageous Menchie’s Nitrogen Ice Cafeteria and Thai Pizza 1553 SW 107 Ave Frozen Yogurt Cream 9796 SW 24th St 1429 SW 107 Ave 1551 SW 107 Ave (305) 220-7332 1309 SW 107th 3905 NW 107Ave (305) 226-2393 (305) 207-9700 (305) 220-0215 Ave B (786) 235-8505 (305) 223-7707 http://www.brainfreezeicecreamlab.com/Click here https://www.yelp.com/biz/latin-american-cafeteria-miami-3Click here http://www.jasminesushi.comClick here http://littlecaesars.com/Click here http://subrageousfiu.com/Click here http://www.menchies.com/ Click here 109 Burger Rey’s Pizza Pizza Rustica Chipotle Five Guys La Nonna Italian 646 SW 109 Ave 296 SW 107 Ave 1671 SW 107 Ave 10141 West Burgers & Fries (305) 228-0109 (305) 225-9393 (786) 458-8100 Flagler St 1433 SW 107 Ave Restaurant 117 SW 107th Ave (305) 554-8674 (305) 225-6228 (305) 228-4900 http://www.109burgerjoint.com/Click here https://www.zomato.com/miami/rey-pizza-2-miamiClick here https://www.yelp.com/biz/pizza-rustica-miami-5Click here http://chipotle.com/Click here http://www.fiveguys.com/Click here https://www.doordash.com/store/la-nonna-italian-restaurantClick here La Carreta Earls Kitchen & 8650 SW 40th St Bar at Dadeland (305) 553-8383 7535 N Kendall Dr Unit 2510 (305) 667-1786 http://lacarreta.com/Click here https://earls.ca/locations/dadeland/menu/kitchenClick here Kimberly Green Latin American and Travel Caribbean Center Miami, FL Sightseeing Dolphin Mall International -

Miami, Florida the Vision

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). MIAMI, FLORIDA THE VISION World-Class Shopping in South Florida. An International Destination. Dadeland Mall consistently offers customers unique-to-market aspirational and luxury retailers. Spanning more than 1.4 million square feet of retail and featuring more than 185 shops and restaurants, Dadeland Mall continues to be among the best shopping destinations in the country with world-class shopping and elegant dining options. A planned expansion and redevelopment will add a new fashion department store, specialty retail shops, residential units, and a full- service hotel. KEY PROPOSED DEPARTMENT STORES: EXISTING, FASHION PROPOSED DEPARTMENT FASHION EXPANSION & RELOCATION STORE DEPARTMENT PROPOSED STORE PROPOSED RESTAURANTS PARKING DECK PARKING DECK RETAIL PROPOSED 3 LEVEL THEATER FASHION DEPARTMENT STORE PROPOSED ROOF MACY’S PROPOSED 2 LEVELS OF NEW RETAILERS EXPANSION JCPENNEY ROOF PROPOSED PROPOSED THEATER RELOCATION PROPOSED RESIDENTIAL / OFFICES PROPOSED HOTEL NORDSTROM PROPOSED LEVEL II PROPOSED LEVEL III PARKING DECK PARKING DECK PROPOSED FASHION DEPARTMENT PROPOSED FOOD STORE PARKING DECK COURT MACY’S MACY’S CHILDREN & HOME SR 826 / PALMETTO EXPWY. PALMETTO / 826 SR JCPENNEY PROPOSED NEW LOCATION SAKS FIFTH THE PARKING DECK NORDSTROM AVENUE CHEESECAKE FACTORY SW 88TH ST. US 1 / S. DIXIE HWY. BALAN N PHASE IB LEVEL II TEXAS DE BRAZIL EARLS KITCHEN + BAR LEVEL II TERRACE DINING BOBBY’S BURGER AOKI PALACE TEPPANAKI MASTER PLAN SOUTH FLORIDA THE ULTIMATE LIFESTYLE Miami is the preeminent destination for shopping, trendsetting fashions, nightlife, and entertainment. -

Downtown Attractions & Sightseeing

Olympia Theater Downtown Attractions & Sightseeing Tours: Museums: Big Bus Tours Miami HistoryMiami * www.bigbustours.com/en/miami 101 W Flagler St, Miami, FL 33130 www.historymiami.org City Sightseeing Miami www.miamicitysightseeing.com Miami Children’s Museum 980 MacArthur Cswy, Miami, FL 33132 City Tours offered by HistoryMiami www.miamichildrensmuseum.org www.historymiami.org Patricia & Phillip Frost Museum of Science Duck Tours - Multiple Tours Museum Park, Miami, FL 33132 www.ducktourssouthbeach.com www.frostscience.org www.miamipirateducktours.com Pérez Art Museum Miami * Walking Tours offered by: 1103 Biscayne Blvd, Miami, FL 33132 Miami Center for Architecture & Design www.pamm.org www.miamicad.org *Museum offers regularly scheduled as well as group Island Queen – Sightseeing Cruises Miami gallery tours. www.islandqueencruises.com Thriller Miami Speed Boat Tours www.thrillermiami.com Miami Downtown Development Authority | 305-579-6675 | www.miamidda.com Performances Spaces: Adrienne Arsht Center for the Performing Arts* 1300 Biscayne Blvd, Miami, FL 33132 www.arshtcenter.org AmericanAirlines Arena 601 Biscayne Blvd, Miami, FL 33132 www.aaarena.com Olympia Theater* 174 E Flagler St, Miami, FL 33131 www.olympiatheater.org Bayfront Park Amphitheater 301 N Biscayne Blvd, Miami, FL 33132 www.bayfrontparkmiami.com James L. Knight Center 400 SE 2 Ave, Miami, FL 33131 www.jlkc.com Adrienne Arsht Center National YoungArts Foundation 2100 Biscayne Blvd, Miami, FL 33137 www.youngarts.org Parks: *Performance Space offers regularly scheduled -

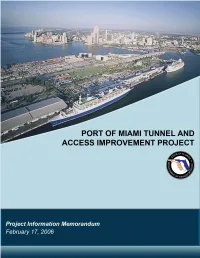

Port of Miami Tunnel Project Information Memo

Florida Department of Transportation Port of Miami Tunnel – Project Information Memorandum Table of Contents INTRODUCTION .......................................................................................................................... 4 1.1. Overview and Project Description ............................................................................. 4 1.2. Project Funding and Financing .................................................................................. 4 1.3. Authority......................................................................................................................... 5 1.4. PPP Goals and Framework ........................................................................................ 6 1.5. Procurement Overview................................................................................................ 6 1.6. Use of Information in this PIM .................................................................................... 7 DETAILED PROJECT DESCRIPTION........................................................................................ 8 2.1. Project Scope................................................................................................................ 8 2.2. Project Location............................................................................................................ 9 2.2.1. Port of Miami......................................................................................................... 9 2.2.2. Watson Island ....................................................................................................