I.L.R. (2011) III (JUNE) DELHI.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Murdering Journalists

A JOURNAL OF THE PRESS INSTITUTE OF INDIA ISSN 0042-5303 October-December 2017 Volume 9 Issue 4 Rs 60 Murdering journalists: CONTENTS • When the media ignored its own principles / Bharat the much larger attack Dogra • GST – a good and simple tax? / Shreejay Sinha When writer-activist Gauri Lankesh was shot dead in Bengaluru • Do Indian cinema and on September 5, it was not just one journalist or one fearless television mimic life, or vice- female activist who was murdered. It was a manifestation of versa? / Pushpa Achanta • Dhananjoy and the death something far, far larger – the maiming of a big chunk of the sentence / Shoma A. lives and futures of 1.2-odd billion Indians, no less, a big chunk Chatterji of the fundamental rights of each citizen, and a big chunk of the • Can’t we make room for Constitution that we gave to ourselves with such pride 70 years people with disabilities? / ago, says Sakuntala Narasimhan Aditi Panda • Fostering change-makers, making the world a ut aside the political imputations for a moment. As of this writing (end- better place / Sakuntala September*), the case is still being investigated, the guilty are yet to be Narasimhan Pidentified. Just collate the facts on a wider canvas, and what you have, as • Creativity: the missing the larger picture, is a collection of events that spell murder of a basic concept ingredient in Chinese of democracy, something more than an attack on an individual, a woman, an thinking? / Asma Masood activist, or journalist. • Another scribe falls victim to If I cannot eat what my family -

![DV R ]``\D E` Arhrc W`C Hrj](https://docslib.b-cdn.net/cover/7227/dv-r-d-e-arhrc-w-c-hrj-2397227.webp)

DV R ]``\D E` Arhrc W`C Hrj

3' (#&(4! &(4! 4 RNI Regn. No. CHHENG/2012/42718, Postal Reg. No. - RYP DN/34/2013-2015 %()#%'*+,- : ?*@.,-**.0-11 *-:-/-2,-:..,=- ;*2.,?*--/ -12,1*/;0 +2;1+2*+/-0. :;.,/,A;B'.-',- ./2,.,*. 2/,.2 ,/+*1;/6''.,';: ;:-/1/ -2.*/ 2<-.+=,><0 51 "#$6%%%&' 78 5(- !!( . ! //./0/*1 */2 P$ % " R P ,,-- " * +, Pawar said, “Singh has made serious allegations against ith the “letter bomb” Deshmukh. But he has not Wdropped by Mumbai’s given substantial proof to back * +, SUV planting case. former Police Commissioner his allegation. I have to talk to Shinde is a dismissed Param Bir Singh having tuned our Home Minister to listen to he mystery shrouding the policeman, who has been con- into the first-ever major polit- his side of the story. I would Talleged murder of Thane- victed in the case involving the ical crisis for the 16-month-old like Chief Minister Thackeray based businessman Mansukh fake encounter of Ramnarayan MVA Government in to order a thorough probe into Hiran, whose Scorpio laden Gupta, alias Lakhan Bhaiya. Maharashtra, the ruling Shiv the former Police ! "# ! with gelatin sticks was recov- Bhaiya was killed in a fake Sena on Sunday appeared to be Commissioner’s allegations $ $ ered from near the residence of encounter on November 11, depending heavily on NCP against the Home Minister. # % industrialist Mukesh Ambani 2006. In 2013, a Mumbai ses- .,*. president Sharad Pawar to “Prior to this Press con- % # !'( on February 25, turned murki- sions court had awarded life resolve the explosive situation ference, I spoke to the Chief er on Sunday as Maharashtra sentences to 21 people, includ- ongress leader Rahul arising out of Singh’s allegation Minister. -

Editorial.Qxd (Page 2)

SUNDAY, AUGUST 9, 2020 DAILY EXCELSIOR, JAMMU daily Excelsior Established 1965 A story of a lockdown marriage Founder Editor S.D. Rohmetra Anita Kanwal Slathia from my well wisher and my support system, my more methodical with the essential skill of priori- ness as the auspicious time mentioned by my priest dear MOM. Whenever she called me, I was ever tizing. was that all these rituals were supposed to be per- Reservation of professional ockdown marriage, ever heard of this term ready with a pen and a diary. This became my daily Next came the listing part which kept changing formed before twelve at noon.The ceremonies before? Wow, what a name I have coined to planner, a special Gift from my dear sister proved many a times. Here again the mobile assisted me to went smooth and Almighty in the form of my well- Lthis marriage, a unique and entirely a new to be blessing. search for the phone numbers whom to contact and wishers were a great support. seats for Ladakh paradigm for all of us. At this juncture of time I had no other alterna- finally a lady for preparation of the food was One of the most important part of a marriage Do you know when and how this came into tive on which I had my future planned day to day. arranged. As she came as a God's messenger, she are the guests. It was a again a challenge. We t may be recalled that following the doing away existence? A very interesting and a unique experi- It was a brand new one, a pen nicely placed in one was as perfect in preparing meals we could never wished all our near and dears to be present in the with the 'special status' of the erstwhile state ence. -

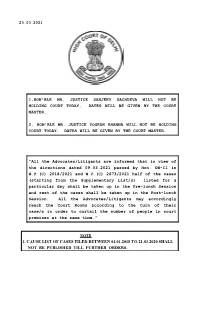

1. Cause List of Cases Filed Between 01.01.2018 to 21.03.2020 Shall Not Be Published Till Further Orders

23.03.2021 1.HON'BLE MR. JUSTICE SANJEEV SACHDEVA WILL NOT BE HOLDING COURT TODAY. DATES WILL BE GIVEN BY THE COURT MASTER. 2. HON'BLE MR. JUSTICE YOGESH KHANNA WILL NOT BE HOLDING COURT TODAY. DATES WILL BE GIVEN BY THE COURT MASTER. “All the Advocates/Litigants are informed that in view of the directions dated 09.03.2021 passed by Hon. DB-II in W.P.(C) 2018/2021 and W.P.(C) 2673/2021 half of the cases (starting from the Supplementary List/s) listed for a particular day shall be taken up in the Pre-lunch Session and rest of the cases shall be taken up in the Post-lunch Session. All the Advocates/Litigants may accordingly reach the Court Rooms according to the turn of their case/s in order to curtail the number of people in court premises at the same time.” NOTE 1. CAUSE LIST OF CASES FILED BETWEEN 01.01.2018 TO 21.03.2020 SHALL NOT BE PUBLISHED TILL FURTHER ORDERS. HIGH COURT OF DELHI: NEW DELHI No. 384/RG/DHC/2020 DATED: 19.3.2021 OFFICE ORDER HON'BLE ADMINISTRATIVE AND GENERAL SUPERVISION COMMITTEE IN ITS MEETING HELD ON 19.03.2021 HAS BEEN PLEASED TO RESOLVE THAT HENCEFORTH THIS COURT SHALL PERMIT HYBRID/VIDEO CONFERENCE HEARING WHERE A REQUEST TO THIS EFFECT IS MADE BY ANY OF THE PARTIES AND/OR THEIR COUNSEL. Sd/- (MANOJ JAIN) REGISTRAR GENERAL DELETION NOTE 1. W.P.(C) 2670/2020 LISTED BEFORE HON'BLE DB-I AT ITEM NO.9 IS DELETED AS THE SAME IS FIXED FOR 30.04.2021. -

Project Management Consultancy Services for Re-Routing of Mumbai-Manmad Pipeline

Project Management Consultancy Services for re-routing of Mumbai-Manmad Pipeline TENDER DOCUMENT (Document No : A731-TENDER_DOC-A731-000-83-41-MK-T-9503) Page 1 of 1266 Click on the Document Title to go to that section of the document Table of Contents Document Number Rev. Document Title Page Number A731- A TENDER DOCUMENT 4 TENDER_DOC- A731-000-83-41-MK- T-9503 A731-000-83-41-MK- A INSTALLN OF PIPELINE ACROSSMAJOR CROSSINGS BY HDD 547 T-9503 A731-000-83-41- A SCOPE OF WORK & SUPPLY 548 SOW-0007 A731-000-83-41-LL- A LIST OF ATTACHMENTS 563 0007 A731-000-83-41-AD- 2 Addendum Standard Specification no. 6-71-0054 567 0054 6-71-0044 5 Standard specification for field joint coating (onshore pipelines). 570 6-71-0048 1 Standard specification for repair of polyethylene coating 585 6-71-0051 4 Standard specification for pipeline construction (onshore). 591 6-71-0054 4 Standard specification for major river / water crossings using 629 directional drilling method 6-71-0055 3 Standard specification for hydrostatic testing of onshore pipelines. 644 6-71-0059 5 Standard specification for documentation for pipeline construction. 664 6-71-0071 3 Standard specification for pipeline surveys (onshore). 673 A731-000-02-42- 1 WELDING SPECIFICATION CHART 697 WSC-0002 A731-000-02-42- 0 WELDING SPECIFICATION 701 WSP-0002 A731-000-02-42- 2 ELECTRONIC GEOMETRY PIGGING 743 EGP-0004 A731-000-2-42-MDX- A MISCELLANEOUS DOCUMENTS 757 1003 A731-00-83-41-SP- 2 SPECIFICATION FOR GEOTECHNICAL INVESTIGATIONS FOR 774 51 HDD WORKS 7-71-0001 4 Typical right of use for pipelines. -

No Land's People

For my parents, Anita and Amrit, and my sister, Anwesha Somebody must have made a false accusation against Josef K., for he was arrested one morning without having done anything wrong. ‘You’re under arrest, after all.’ ‘But how can I be under arrest? And above all in this way?’ ‘Now you’re beginning again,’ said the warder and he dipped his bread and butter in the honey jar. ‘We don’t answer such questions.’ ‘You’ll have to answer them,’ said K. —The Trial, Franz Kafka 1 It is hotter than Prague. It does not have the Czech capital’s cobbled squares or narrow streets but instead tin-roofed houses and paddies hemmed with palms and mango trees. Yet Franz Kafka would have felt quite at home in Assam. —‘India is declaring millions of its citizens to be foreigners’, The Economist 2 Contents Author’s note Introduction PART I Finding the ‘foreigners’ 1. A numbers game 2. Vaghaiwalla’s NRC 3. ‘Write down you are a Bangladeshi’ 4. The search for a cut-off year 5. Everyone wants a correct NRC PART II Chronicles of statelessness 6. My grandmother is a doubtful voter 7. Kangaroo courts 8. Declared foreigner in absentia 9. A soldier in a detention camp 10. Ten long years 11. ‘This bideshi case’ Part III Preparing the NRC 12. The beginnings 13. Who is an original inhabitant? 14. Shifting goalposts 15. In and out 16. Chaos and deaths 17. The ‘much-misunderstood coordinator’ 18. The legal snarl PART IV Political gamesmanship 19. Between policy and ground reality 20. -

Claiming Dignity Profit, Non-Governmental, Human Rights Organisation, HRLN Recognizes Rights

The Human Rights Law Network (HRLN) is a collective of lawyers and social activists dedicated to using the legal system to advance human rights in India and to ensure access to justice for victims of human rights violations. A not-for CLAIMING DIGNITY profit, non-governmental, human rights organisation, HRLN recognizes rights broadly to include civil and political as well as economic, social, and cultural DIGNITY CLAIMING USING LAW TO ADVANCE REPRODUCTIVE AND SEXUAL rights. Recognising law as an area of struggle, HRLN views the legal system as HEALTH RIGHTS a limited but crucial weapon for realising human rights. We believe that large scale struggles against human rights violations have to be waged by social and political movements and that the legal system can play a significant supportive role in these. Starting in 1989 as an ad hoc group of lawyers and social activists, HRLN has since evolved into a human rights organisation with dedicated activists, lawyers, and social workers in all Indian states. In addition to pro-bono legal services and public interest litigation, HRLN engages in legal advocacy both inside and outside of the courts including conducting legal workshops and investigations, publishing “Know Your Rights” material, and participating in campaigns. In collaboration with social movements and human rights and development organisations, HRLN works on behalf of the rights of women, prisoners, Dalits, workers, children, farmers, indigenous people, refugees, HIV positive people, people with disabilities, religious minorities, sexual minorities, and the homeless among others. 2019 3rd EDITION 2019 European Union CLAIMING DIGNITY USING LAW TO ADVANCE REPRODUCTIVE AND SEXUAL HEALTH RIGHTS 3RD EDITION 2019 HUMAN RIGHTS LAW NETWORK: OUR VISION • To protect fundamental human rights, increase access to basic resources for marginalised communities, and eliminate discrimination. -

Annual Report-2004-2005

122 Board of Trustees Shri Soli J. Sorabjee, President Dr Kapila Vatsyayan Prof. M.G.K. Menon Smt. Justice (Retd.) Leila Seth Dr L.M. Singhvi Dr R.K. Pachauri Dr Karan Singh Shri P.C. Sen, Director Director Shri P. C. Sen Executive Committee Shri P.C. Sen, Chairman Shri M.P. Wadhawan, Hon. Treasurer Smt. Rajni Kumar Shri Inder Malhotra Cmdre C. Uday Bhaskar Dr Arvind Pandalai Shri Vipin Malik Cmdre K.N. Venugopal, Secretary Dr S.M. Dewan Finance Committee Dr L.M. Singhvi Shri M.P. Wadhawan Shri Inder Malhotra Cmdre (Retd.) K.N. Venugopal Dr E.A.S. Sarma Shri P.R. Sivasubramanian Shri P.C. Sen Medical Consultants Dr K. P. Mathur Dr (Mrs.) Rita Mohan Dr K. A. Ramachandran Dr B. Chakravorty Dr Mohammad Qasim Senior Staff Cmdre (Retd.) K. N. Venugopal Secretary Shri L. K. Joshi Chief General Manager Shri P. R. Sivasubramanian Chief Finance Officer Dr H. K. Kaul Chief Librarian Dr Geeti Sen Chief Editor Dr A. C. Katoch Administration Officer Ms Premola Ghose Chief, Programme Division Shri Arun Potdar Chief, Maintenance Division Shri W. R. Sehgal Accounts Officer 120 2005-2006 THIS IS THE 45th Annual Report of the India International Centre for the year commencing the 1st of February 2005 to the 31st of January 2006. It will be placed before the 50th Annual General Body Meeting of the Centre, to be held on the 31st of March 2006. Elections to the Executive Committee and the Board of Trustees of the Centre for the two year period 2005-07 were initiated in the latter half of 2004. -

September 2018

Volume 5, Issue 3 (V) ISSN 2394 - 7780 July - September 2018 UGC University Grants Commission Journal No.: 63571 International Journal of Advance and Innovative Research (Conference Special) Indian Academicians and Researchers Association www.iaraedu.com NATIONAL CONFERENCE ON CHARTING NATIONAL GROWTH: SOCIO – ECONOMIC CHALLENGES IN MANUFACTURING & SERVICE SECTOR Thakur Institute of Management Studies & Research Mumbai Publication Partner Indian Academicians and Researcher’s Association Approved by AICTE Affiliated to University of Mumbai ISO 2001 : 2015 Certified INTERNATIONAL PARTNERS ABOUT TIMSR Thakur Institute of Management Studies & Research (TIMSR) managed by Zagdu Singh Charitable Trust(ZCT), was established in the year 2002. TIMSR today is deemed as one of the best business schools in Maharastra. With marvelous infrastructure, experienced and innovative teaching faculty, and modern pedagogical techniques, the Institute is acquiring a true global setup. TIMSR offers post graduate programs in management education including 2 years full time MMS Program and for working executives like MMM,MFM,MIM and MHRDM approved by AICTE,DTE,Government of Maharastra and affiliated to University of Mumbai. Besides TIMSR also offers its flagship PGDM Program in close collaboration with industry, and approved by AICTE and DTE,Govt. of Maharastra. TIMSR has a proven track record of excellence and is an ISO 9001:2008 certified organization, committed towards providing quality education. ABOUT THE CONFERENCE TIMSR has always endevoured for helping the corporate world by identifying their current problems & issues. The theme of this conference is based on the problems of the industrial world which are identified through the discussion of TIMSR staff with Tarapur Management Association(TMA). The research contributions in this conference will address the problems of the industry & will lead towards strengthening the ‘Make in India’ initiative of the GOI. -

Charkha Annual Report 2019-2020

Annual Report 2019 – 2020 2 Table of Contents About the Organization & its Founder ........................................................................... 3 LIST OF GOVERNING BODY MEMBERS ............................................................................. 4 Project 1 .................................................................................................................................... 5 Writing Skill Development Workshop, Ladakh .........................................................................................6 Writing Skill Development Workshop, Poonch, J&K ............................................................................... 11 Writing Skills Development Workshop, Kupwara, J&K ............................................................................ 17 Writing Skill Development Workshop, Nainital, Uttarakhand ................................................................. 20 Writing Skill Development Workshop, Dehradun, Uttarakhand .............................................................. 25 The Sanjoy Ghose Media Awards .................................................................................... 30 Project 2 .................................................................................................................................. 32 Writing Skill Development Workshop, Jaipur, Rajasthan ........................................................................ 33 Project 3 ................................................................................................................................. -

Defending Human Rights in India

Amnesty International On-line. http://www.amnesty.org ai-index ASA 20/008/2000 26/04/2000 PART I: Defending human rights in India 1. The human rights movement in India "No one is going to give them their rights to live with dignity on a silver platter. They have to be extracted with force... We will have to strengthen ourselves to stop those who find it profitable to misuse authority and public funds. Perhaps the courts and the NGOs are the only solution." Chair of the National Human Rights Commission at a workshop on "Human Rights of Marginalised and Tribal Communities -- the role of non-governmental organizations and the NHRC in promoting a human rights culture for a just and equitable society", Dehra Dun, 1 October 1999. As reported in The Times of India, 2 October 1999, "People should fight for their rights: NHRC chief", by Man Mohan, Justice Venkatachaliah, former Chair, National Human Rights Commission The global trend towards rights awareness has led to a proliferation of NGOs and movements for human rights worldwide. In independent India post-1949, a civil liberties movement which had been active in opposing human rights abuses under the colonial rule of the British including the preventive detention of political prisoners, re-emerged to raise concerns about state atrocities against left-wing political activists particularly in West Bengal and Andhra Pradesh. The 1975 Emergency again galvanised the human rights movement to oppose the oppressive actions of the state. Many politicians who are active today were imprisoned by the state and were the subject of campaigns by the human rights movement in India and abroad. -

May, 2013) P.S.D

I.L.R. (2013) III DELHI Part-I (May, 2013) P.S.D. 25.5.2013 (Pages 1641-2084) 600 Annual Subscription rate of I.L.R.(D.S.) 2013 INDIAN LAW REPORTS (for 6 volumes each volume consisting of 2 Parts) DELHI SERIES In Indian Rupees : 2500/- 2013 Single Part : 250/- (Containing cases determined by the High Court of Delhi) VOLUME-3, PART-I (CONTAINS GENERAL INDEX) EDITOR MS. R. KIRAN NATH for Subscription Please Contact : REGISTRAR VIGILANCE CO-EDITOR Controller of Publications MS. NEENA BANSAL KRISHNA Department of Publication, Govt. of India, (ADDITIONAL DISTRICT & SESSIONS JUDGE) Civil Lines, Delhi-110054. REPORTERS Website: www.deptpub.nic.in Email:[email protected], [email protected] MR. CHANDER SHEKHAR MS. ANU BAGAI Tel.: 23817823/9689/3761/3762/3764/3765 (DISTRICT & SESSIONS JUDGE) MR. SANJOY GHOSE Fax.: 23817876 MR. GIRISH KATHPALIA MR. ASHISH MAKHIJA MR. VINAY KUMAR GUPTA (ADVOCATES) MS. SHALINDER KAUR MR. LORREN BAMNIYAL MR. GURDEEP SINGH MR. KESHAV K. BHATI MS. ADITI CHAUDHARY JOINT REGISTRARS MR. ARUN BHARDWAJ MS. ANU GROVER BALIGA MR. DIG VINAY SINGH (ADDITIONAL DISTRICT PRINTED BY : J.R. COMPUTERS, 477/7, MOONGA NAGAR, & SESSIONS JUDGES) KARAWAL NAGAR ROAD DELHI-110094. AND PUBLISHED UNDER THE AUTHORITY OF HIGH COURT OF DELHI, PUBLISHED UNDER THE AUTHORITY OF HIGH COURT OF DELHI, BY THE CONTROLLER OF PUBLICATIONS, DELHI-110054—2013. BY THE CONTROLLER OF PUBLICATIONS, DELHI-110054. (i) (ii) NOMINAL-INDEX Noor Salam v. The State (Govt. NCT of Delhi) ................................ 1732 VOLUME-3, PART-I Pancham Singh v. Union of India & Ors. .......................................... 1897 MAY, 2013 Punjab Motor Workshop v.