View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

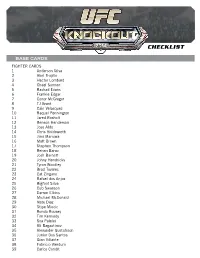

2014 Topps UFC Knockout Checklist

CHECKLIST BASE CARDS FIGHTER CARDS 1 Anderson Silva 2 Abel Trujillo 3 Hector Lombard 4 Chael Sonnen 5 Rashad Evans 6 Frankie Edgar 7 Conor McGregor 8 TJ Grant 9 Cain Velasquez 10 Raquel Pennington 11 Jared Rosholt 12 Benson Henderson 13 Jose Aldo 14 Chris Holdsworth 15 Jimi Manuwa 16 Matt Brown 17 Stephen Thompson 18 Renan Barao 19 Josh Barnett 20 Johny Hendricks 21 Tyron Woodley 22 Brad Tavares 23 Cat Zingano 24 Rafael dos Anjos 25 Bigfoot Silva 26 Cub Swanson 27 Darren Elkins 28 Michael McDonald 29 Nate Diaz 30 Stipe Miocic 31 Ronda Rousey 32 Tim Kennedy 33 Soa Palelei 34 Ali Bagautinov 35 Alexander Gustafsson 36 Junior Dos Santos 37 Gian Villante 38 Fabricio Werdum 39 Carlos Condit CHECKLIST 40 Brandon Thatch 41 Eddie Wineland 42 Pat Healy 43 Roy Nelson 44 Myles Jury 45 Chad Mendes 46 Nik Lentz 47 Dustin Poirier 48 Travis Browne 49 Glover Teixeira 50 James Te Huna 51 Jon Jones 52 Scott Jorgensen 53 Santiago Ponzinibbio 54 Ian McCall 55 George Roop 56 Ricardo Lamas 57 Josh Thomson 58 Rory MacDonald 59 Edson Barboza 60 Matt Mitrione 61 Ronaldo Souza 62 Yoel Romero 63 Alexis Davis 64 Demetrious Johnson 65 Vitor Belfort 66 Liz Carmouche 67 Julianna Pena 68 Phil Davis 69 TJ Dillashaw 70 Sarah Kaufman 71 Mark Munoz 72 Miesha Tate 73 Jessica Eye 74 Steven Siler 75 Ovince Saint Preux 76 Jake Shields 77 Chris Weidman 78 Robbie Lawler 79 Khabib Nurmagomedov 80 Frank Mir 81 Jake Ellenberger CHECKLIST 82 Anthony Pettis 83 Erik Perez 84 Dan Henderson 85 Shogun Rua 86 John Makdessi 87 Sergio Pettis 88 Urijah Faber 89 Lyoto Machida 90 Demian Maia -

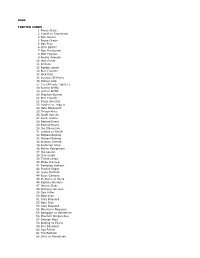

2015 Topps UFC Chronicles Checklist

BASE FIGHTER CARDS 1 Royce Gracie 2 Gracie vs Jimmerson 3 Dan Severn 4 Royce Gracie 5 Don Frye 6 Vitor Belfort 7 Dan Henderson 8 Matt Hughes 9 Andrei Arlovski 10 Jens Pulver 11 BJ Penn 12 Robbie Lawler 13 Rich Franklin 14 Nick Diaz 15 Georges St-Pierre 16 Patrick Côté 17 The Ultimate Fighter 1 18 Forrest Griffin 19 Forrest Griffin 20 Stephan Bonnar 21 Rich Franklin 22 Diego Sanchez 23 Hughes vs Trigg II 24 Nate Marquardt 25 Thiago Alves 26 Chael Sonnen 27 Keith Jardine 28 Rashad Evans 29 Rashad Evans 30 Joe Stevenson 31 Ludwig vs Goulet 32 Michael Bisping 33 Michael Bisping 34 Arianny Celeste 35 Anderson Silva 36 Martin Kampmann 37 Joe Lauzon 38 Clay Guida 39 Thales Leites 40 Mirko Cro Cop 41 Rampage Jackson 42 Frankie Edgar 43 Lyoto Machida 44 Roan Carneiro 45 St-Pierre vs Serra 46 Fabricio Werdum 47 Dennis Siver 48 Anthony Johnson 49 Cole Miller 50 Nate Diaz 51 Gray Maynard 52 Nate Diaz 53 Gray Maynard 54 Minotauro Nogueira 55 Rampage vs Henderson 56 Maurício Shogun Rua 57 Demian Maia 58 Bisping vs Evans 59 Ben Saunders 60 Soa Palelei 61 Tim Boetsch 62 Silva vs Henderson 63 Cain Velasquez 64 Shane Carwin 65 Matt Brown 66 CB Dollaway 67 Amir Sadollah 68 CB Dollaway 69 Dan Miller 70 Fitch vs Larson 71 Jim Miller 72 Baron vs Miller 73 Junior Dos Santos 74 Rafael dos Anjos 75 Ryan Bader 76 Tom Lawlor 77 Efrain Escudero 78 Ryan Bader 79 Mark Muñoz 80 Carlos Condit 81 Brian Stann 82 TJ Grant 83 Ross Pearson 84 Ross Pearson 85 Johny Hendricks 86 Todd Duffee 87 Jake Ellenberger 88 John Howard 89 Nik Lentz 90 Ben Rothwell 91 Alexander Gustafsson -

Indian Gold Book:Indian Gold Book

AN INTRODUCTION TO THE INDIAN GOLD MARKET MAJOR SPONSOR WORLD GOLD COUNCIL CORPORATE SPONSOR RAND REFINERY LIMITED Published by Virtual Metals Research & Consulting Ltd and Grendon International Research Pty Ltd AN INTRODUCTION TO THE INDIAN GOLD MARKET INDUSTRY COMMENTS Comments in letters, faxes and emails include: Reserve Bank of India (“an excellent work”), State Bank of India (“excellent coverage”) and The Gem & Jewellery Export Promotion Council (“a wonderful, educative, informative book”). “This volume is an absolute boon … The resulting accumulation of facts and data is of fantastic value to anyone who wants to understand the history and nature of the world’s most important market for gold.” London Bullion Market Association “It has provided an excellent basis for the Council and its members to learn about the complex dynamics of the market, and also is a strong foundation for us to review our operational business plans and strategies for the Indian market … it has added significant value to our operations there.” World Gold Council “It is necessary to understand the intricacy of market structures and the historical sequence of events (of the Indian gold market). The book by Nigel Desebrock … provides a veritable gold mine of authentic information”. S.S. Tarapore (former Deputy Governor, Reserve Bank of India), Financial Express (India) PHONE AND FAX NUMBERS IN INDIA In October 2002, Mumbai telephone exchanges either prefixed a “2” to the local number, or replaced the first digit with “56”. Since then, exchanges in other cities have also made changes. In this publication, while the listed Mumbai numbers take the changes into account, numbers for other parts of the country do not. -

- - Programming Alert - -

FOR IMMEDIATE RELEASE Monday, June 13, 2016 - - - PROGRAMMING ALERT - - - FS1 AND FOX DEPORTES SET BROADCASTERS FOR SATURDAY’S UFC FIGHT NIGHT: MACDONALD VS. THOMPSON Evans and Stann Serve as FS1 Analysts, While Werdum Joins on FOX Deportes LOS ANGELES – Former light heavyweight champion and current No. 8 contender Rashad Evans (@SugaRashadEvans) and former middleweight Brian Stann (@BrianStann) serve as analysts in the FS1 studio for UFC FIGHT NIGHT: MACDONALD VS. THOMPSON live on FS1 on Saturday, June 18 (10:30 PM ET). FS1 UFC FIGHT NIGHT: MACDONALD VS. THOMPSON features a pivotal welterweight contender fight between No. 1-ranked Rory MacDonald (18-3) and No. 2-ranked Stephen Thompson (12-1). A perennial contender in the 170-pound division, MacDonald has won eight of his last 10 outings. At UFC 189 in July, he came up short in 2015’s Fight of the Year against welterweight champion Robbie Lawler. Thompson is one of the most dynamic strikers in mixed martial arts and is currently riding a six-fight win streak, earning stunning knockout victories over Jake Ellenberger, Robert Whittaker and Chris Clements. In his last bout, he was the first fighter to ever finish former champion Johny Hendricks with strikes in the first round. FOX UFC analyst Tyron Woodley, who challenges Lawler for the title at UFC 201, has his eye on the main event featuring two fighters with opposing styles: “This is a classic matchup of a space invader in Stephen “Wonderboy” Thompson, who blitzes in quickly and gets in and out, and a space gauger in Rory MacDonald. -

The LBMA Bullion Market Forum 2015 in Association with the Shanghai Gold Exchange

A local Forum for a global market The LBMA Bullion Market Forum 2015 In association with the Shanghai Gold Exchange 24 - 25 June 2015 Mandarin Oriental Shanghai Why You Should Attend This Forum Given Shanghai’s importance in the Global Bullion Markets, the LBMA is holding a Bullion Market Forum in partnership with the Shanghai Gold Exchange (SGE). The Forum will take place over two days with a one-day seminar focusing on issues of relevance to market participants, both in Shanghai and in countries that trade with China. Attend the Forum to meet Bullion Market contacts, both new and old. Senior representatives of the London, Shanghai and other international Bullion Markets will be in attendance. The Forum begins with a Welcome Dinner on Wednesday, 24 June sponsored by the SGE. The formal proceedings start on Thursday, 25 June with a full day of Forum sessions. Central Bankers… Dealers… Producers… Fabricators… Refiners… Brokers… Analysts… Marketers. There’s a place for all market players at the LBMA Bullion Forum. Make sure to reserve yours now. To register for the Forum click here Registration Fee: The registration fee is £595 per delegate. This includes but we can assist you by providing a letter to accompany your application. the pre-Forum Welcome Dinner on the evening of Wednesday, 24 June, as Please indicate when registering whether or not you require a visa letter. well as attendance at all the Forum sessions on Thursday, 25 June, including all refreshments, coffee breaks and lunch. (Please note our letter will only cover the date of the Forum and allow for reasonable time to travel to and from Shanghai.) Marketing Opportunities: Shanghai provides a unique opportunity for exhibitors to promote themselves, their companies and their products to Do you need assistance with a visa application? If you need assistance with senior representatives of the London, Shanghai and International Bullion a visa application, the LBMA suggests contacting Trans World Visa Services. -

Cariboo Notes Vol 28-1

Volume 28 No. 1 Spring 2011 British Columbia Genealogical Society, Quesnel Branch Cornish Water Wheel at Quesnel, B.C. An Original Drawing by B. Patenaude VOL. 28(1) CONTENTS: The Archibald Rory McDonald Family..................................................... 3 Web Bytes.................................................................................................. 8 Twigs – Female blogging; wordle.net; Canada in 1900 ............................ 9 Dear Auntie Gen – BC Wills ..................................................................... 10 Blog Log – Jewish records in Poland ........................................................ 11 Russian keyboard site ................................................................................ 11 Member Lookups....................................................................................... 12 Member Spotlight – Leanne Broughton .................................................... 13 Books for Sale............................................................................................ 14 How to Contact Us..................................................................................... 15 Club Information........................................................................................ 17 Check out our website at http://www.rootsweb.ancestry.com/~bcqgs/ We’re on facebook! See http://www.facebook.com/pages/Quesnel-Genealogical- Society/152467561474792 where there are links to helpful sites. Thanks to Lynda for setting this up. Auntie Gen’s Tip If you find yourself -

Ufc Tonight Quotes

FOX Sports 1 UFC TONIGHT Show Quotes – 5/27/15 CONDIT ON BEATING ALVES: “I NEED TO PUSH THE PACE, GRIND HIM AND GET HIM TIRED.” Cormier On How Alves Beats Condit: “His leg kicks are the key. He has to throw leg kicks.” UFC FIGHT NIGHT Preview, Plus Condit and Rutten Interviews on UFC TONIGHT LOS ANGELES, CA – UFC TONIGHT hosts Daniel Cormier and Kenny Florian are joined by guest host Michael Bisping and preview UFC FIGHT NIGHT: CONDIT VS. ALVES. Florian and Cormier interview Carlos Condit, while Cormier and Bisping interview Bas Rutten. Karyn Bryant and Ariel Helwani add reports. UFC TONIGHT Host Daniel Cormier on being the new champ: “It’s the most amazing thing I’ve ever experienced, outside of my kids. It’s something you dream about, but you never know if you’re going to accomplish it.” Cormier on his game plan against Anthony Johnson: “The game plan was to try to implement wrestling, make him go hard and make him go long. You can wear out guys with a lot muscle. The grind can wear out the arms. But he hit me hard. That wasn’t a right hand that hit me, that was a missile shot out of a rocket launcher. He’s a stud. He’s confident and hits hard.” Cormier on Johnson putting the belt around him: “I just want to say thank you Anthony Johnson. You see many guys win and then the belt is put around the waist by Dana White. Johnson did that and made my time special. -

Bank Primer - 2018

I NSTITUTIONAL E Q U I T Y R ESEARCH Robert Sedran, CFA Marco Giurleo, CFA Christopher Bailey Financials I N D U S T R Y P RIMER February 20, 2018 Bank Primer - 2018 Canadian Banking 101 All figures in Canadian dollars, unless otherwise stated. 18-152284 © 2018 CIBC World Markets Corp., the U.S. broker-dealer, and CIBC World Markets Inc., the Canadian broker-dealer (collectively, CIBC World Markets Corp./Inc.) do and seek to do business with companies covered in its research reports. As a result, investors should be aware that CIBC World Markets Corp./Inc. may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For required regulatory disclosures please refer to "Important Disclosures" beginning on page 144. Find CIBC research on Bloomberg, Thomson Reuters, CIBC World Markets Inc., P.O. Box 500, 161 Bay Street, Brookfield Place, Toronto, Canada M5J 2S8 (416) 594-7000 FactSet, Capital IQ and ResearchCentral.cibcwm.com CIBC World Markets Corp., 425 Lexington Avenue, New York, NY 10017 (212)-856-4000 Bank Primer - 2018 - February 20, 2018 Table of Contents Canadian Banks Snapshot .................................................................... 4 Summary Income Statements ............................................................... 5 Common-Sized Income Statements ........................................................ 6 Summary Balance Sheets .................................................................... -

Isadore Sharp - Founder and Chairman “The Reason for Our Success Is No Secret

Isadore Sharp - Founder and Chairman “The reason for our success is no secret. It comes down to one single principle that transcends time and geography, religion and culture. It’s the Golden Rule – the simple idea that if you treat people well, the way you would like to be treated, they will do the same.” “There was no vision, there was no grand dream,” says Issy, reflecting on the nearly 50 years since the first Four Seasons – a modest motor hotel – opened in downtown Toronto. “But there has always been a consistent thread and it propels us forward today, as we continue to grow globally, and that’s service.” It may seem obvious that in the hotel business, service is a primary objective, but it is how that service is delivered that sets Four Seasons apart. “One way to characterise Four Seasons service would be to call it an exchange of mutual respect performed with an attitude of kindness.” Defining and enforcing the company culture was one of four key strategic decisions made in the formative years of Four Seasons history. “I sat down with our communications experts and wrote down the fundamentals of our culture, which is based on the Golden Rule – to treat others as you wish to be treated,” says Issy. “A lot of companies talk about having a culture, but we knew we had to walk the talk if we expected it to thrive in our hotels.” The other key decisions include a focus on managing only medium-sized hotels of exceptional quality; to manage, rather than own, those hotels; and to make service the brand’s distinguishing edge. -

Paperny Films Fonds

Paperny Films fonds Compiled by Melanie Hardbattle and Christopher Hives (2007) Revised by Emma Wendel (2009) Last revised May 2011 University of British Columbia Archives Table of Contents Fonds Description o Title / Dates of Creation / Physical Description o Administrative History o Scope and Content o Notes Series Descriptions o Paperny Film Inc. series o David Paperny series o A Canadian in Korea: A Memoir series o A Flag for Canada series o B.C. Times series o Call Me Average series o Celluloid Dreams series o Chasing the Cure series o Crash Test Mommy (Season I) series o Every Body series o Fallen Hero: The Tommy Prince Story series o Forced March to Freedom series o Indie Truth series o Mordecai: The Life and Times of Mordecai Richler series o Murder in Normandy series o On the Edge: The Life and Times of Nancy Greene series o On Wings and Dreams series o Prairie Fire: The Winnipeg General Strike of 1919 series o Singles series o Spring series o Star Spangled Canadians series o The Boys of Buchenwald series o The Dealmaker: The Life and Times of Jimmy Pattison series o The Life and Times of Henry Morgentaler series o Titans series o To Love, Honour and Obey series o To Russia with Fries series o Transplant Tourism series o Victory 1945 series o Brewery Creek series o Burn Baby Burn series o Crash Test Mommy, Season II-III series o Glutton for Punishment, Season I series o Kink, Season I-V series o Life and Times: The Making of Ivan Reitman series o My Fabulous Gay Wedding (First Comes Love), Season I series o New Classics, Season II-V series o Prisoner 88 series o Road Hockey Rumble, Season I series o The Blonde Mystique series o The Broadcast Tapes of Dr. -

Ufc® Welterweight Champion Robbie Lawler Defends Title Against Carlos Condit to Kick Off the New Year in Las Vegas

UFC® WELTERWEIGHT CHAMPION ROBBIE LAWLER DEFENDS TITLE AGAINST CARLOS CONDIT TO KICK OFF THE NEW YEAR IN LAS VEGAS Las Vegas – Two of the most electrifying strikers in the sport will ring in the New Year as welterweight champion Robbie Lawler looks to make a second successful title defense against fourth-ranked Carlos Condit on Saturday, Jan. 2 at the MGM Grand Garden Arena. In a division that has become known for its epic title fights in recent years, we have seen all out battles between the likes of Georges St-Pierre and Johny Hendricks, Hendricks and Lawler (twice) and most recently, an all-time great between Lawler and Rory MacDonald. With more than 30 knockout victories between the two, Lawler and Condit are primed to put on another welterweight title fight for the history books. Lawler (26-10, 1 NC, fighting out of Coconut Creek, Fla.) is coming off one of the greatest fights in mixed martial arts history, a knockout victory over top-ranked MacDonald at UFC® 189, and looks to keep the momentum going when he clashes with Condit. Since returning to the Octagon® in 2013, “Ruthless” has amassed a 7-1 record that includes knockout victories over MacDonald, Jake Ellenberger and Josh Koscheck. Currently the sixth-ranked pound-for-pound fighter in the world, a win over Condit could place Lawler amongst the all-time greats at 170 pounds. Condit (30-8, fighting out of Albuquerque, N.M.), the former UFC® interim welterweight champion and the last WEC welterweight champion, is no stranger to high profile fights, having gone to the championship rounds with the likes of St- Pierre and Nick Diaz, and successfully defending the WEC belt three times. -

UFC Tonight Quotes

FOX Sports 1 UFC TONIGHT Show Quotes – 7/8/15 MCGREGOR: “MAKE NO MISTAKE ABOUT IT. I’M THE REAL WORLD CHAMPION.” Florian on how McGregor wins: “McGregor has to use his variety of strikes, use his creativity and confuse Mendes.” Lawler: “I'm the best fighter in the world at 170 and I'm going to show why on Saturday.” LOS ANGELES – Kenny Florian, Daniel Cormier and Karyn Bryant preview the upcoming two title fights at UFC 189. They interview welterweight champ Robbie Lawler and Rory MacDonald before their title bout, as well as Chad Mendes and Conor McGregor before their featherweight interim title fight. UFC president Dana White joined the show to talk about the exciting double-header weekend of fights. Insider Ariel Helwani add reports. UFC TONIGHT host Daniel Cormier on what Chad Mendes needs to do to beat McGregor: “For Chad Mendes, he has to set up the takedowns, control the foot space, step in and grab the high crotch. He needs to throw the overhand to set up the high crotch grab. But he shouldn’t shoot the straight double leg. In the end, he has to take him down in the fight.” UFC TONIGHT host Kenny Florian on what McGregor needs to do against Mendes: “Conor has a long stance. That long stance will give Chad hard time to get inside. He uses his long range weapons very effectively. He’ll give up the single leg grab on purpose because it’s lot easier to get rid of a single grab. He has to use his variety of strikes, use his creativity and confuse Mendes.” Conor McGregor on having Jose Aldo pull out of the fight: “It is what it is.