PIPELINES and LAND FACILITIES 145 Pipelines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oil and Gas Fields in Norway

This book is a work of reference which provides an easily understandable Oil and gas fields in n survey of all the areas, fields and installations on the Norwegian continental shelf. It also describes developments in these waters since the 1960s, Oil and gas fields including why Norway was able to become an oil nation, the role of government and the rapid technological progress made. In addition, the book serves as an industrial heritage plan for the oil in nOrway and gas industry. This provides the basis for prioritising offshore installations worth designating as national monuments and which should be documented. industrial heritage plan The book will help to raise awareness of the oil industry as industrial heritage and the management of these assets. Harald Tønnesen (b 1947) is curator of the O Norwegian Petroleum Museum. rway rway With an engineering degree from the University of Newcastle-upon- Tyne, he has broad experience in the petroleum industry. He began his career at Robertson Radio i Elektro before moving to ndustrial Rogaland Research, and was head of research at Esso Norge AS before joining the museum. h eritage plan Gunleiv Hadland (b 1971) is a researcher at the Norwegian Petroleum Museum. He has an MA, majoring in history, from the University of Bergen and wrote his thesis on hydropower ????????? development and nature conser- Photo: Øyvind Hagen/Statoil vation. He has earlier worked on projects for the Norwegian Museum of Science and Technology, the ????????? Norwegian Water Resources and Photo: Øyvind Hagen/Statoil Energy Directorate (NVE) and others. 55 tHe ekoFIsk AReA The Ekofisk area lies in 70-75 metres of water at the southern end of Norway’s North Sea sector, about 280 kilometres south-west of Stavanger. -

New Document

ANNUAL STATEMENT OF RESERVES 2016 AKER BP ASA Annual Statement of Reserves 2016 Annual Statement of Reserves 2016 Table of Contents 1 Classification of Reserves and Contingent Resources 1 2 Reserves, Developed and Non-Developed 2 3 Description of Reserves 5 3.1 Producing Assets 5 3.1.1 Alvheim and Viper/Kobra (PL036, Pl088BS, PL203) 5 3.1.2 Vilje (PL036D) 7 3.1.3 Volund (PL150) 8 3.1.4 Bøyla (PL340) 9 3.1.5 Atla (PL102C) 11 3.1.6 Jette (PL027D), PL169C, PL504) 11 3.1.7 Jotun (PL027B, PL203B) 12 3.1.8 Varg (PL038) 12 3.1.9 Ivar Aasen Unit and Hanz (Pl001B, PL028B, PL242, PL338BS, PL457) 13 3.1.10 Valhall (PL006B, PL033B) 15 3.1.11 Hod (PL033) 16 3.1.12 Ula (PL019) 17 3.1.13 Tambar (PL065) 19 3.1.14 Tambar East (PL065, PL300, PL019B) 20 3.1.15 Skarv/Snadd (PL262, PL159, PL212B, PL212) 21 3.2 Development Projects 22 3.2.1 Johan Sverdrup (PL265, PL501, PL502; Pl501B) 22 3.2.2 Gina Krog (PL029B) 25 3.2.3 Oda (PL405) 26 4 Contingent Resources 28 5 Management’s Discussion and Analysis 34 Annual Statement of Reserves 2016 List of Figures 1.1 SPE reserves and recourses classification systen .................................................................... 1 3.1 Alvheim and Viper/Kobra Location Map.................................................................................... 5 3.2 Vilje location map ...................................................................................................................... 7 3.3 Volund location map.................................................................................................................. 8 3.4 Bøyla location map.................................................................................................................. 10 3.5 Ivar Aasen Unit and Hanz location map.................................................................................. 13 3.6 Valhall and Hod location map................................................................................................. -

Oil and Gas Fields in Norway

This book is a work of reference which provides an easily understandable Oil and gas fields in n survey of all the areas, fields and installations on the Norwegian continental shelf. It also describes developments in these waters since the 1960s, Oil and gas fields including why Norway was able to become an oil nation, the role of government and the rapid technological progress made. In addition, the book serves as an industrial heritage plan for the oil in nOrway and gas industry. This provides the basis for prioritising offshore installations worth designating as national monuments and which should be documented. industrial heritage plan The book will help to raise awareness of the oil industry as industrial heritage and the management of these assets. Harald Tønnesen (b 1947) is curator of the O Norwegian Petroleum Museum. rway rway With an engineering degree from the University of Newcastle-upon- Tyne, he has broad experience in the petroleum industry. He began his career at Robertson Radio i Elektro before moving to ndustrial Rogaland Research, and was head of research at Esso Norge AS before joining the museum. h eritage plan Gunleiv Hadland (b 1971) is a researcher at the Norwegian Petroleum Museum. He has an MA, majoring in history, from the University of Bergen and wrote his thesis on hydropower ????????? development and nature conser- Photo: Øyvind Hagen/Statoil vation. He has earlier worked on projects for the Norwegian Museum of Science and Technology, the ????????? Norwegian Water Resources and Photo: Øyvind Hagen/Statoil Energy Directorate (NVE) and others. 47 tHe VAlHAll AReA The Valhall area lies right at the southernmost end of the NCS in the North Sea, just south of Ekofisk, Eldfisk and Embla. -

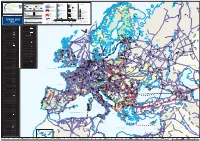

TYNDP 2017 FID Status (Final Investment Decision) White Sea PCI Status (Project of Common Interest) Submission

SHTOKMAN SNØHVIT Pechora Sea ASKELADD MELKØYA KEYS ALBATROSS Hammerfest Salekhard Cross-border points / intra-country or intra balancing zone points Transport by pipeline LNG Import Terminals Storage facilities Compressor stations Barents KILDIN N Acquifer Sea 1ACross-border interconnection point Cross-border interconnection point Pipeline diameters : LNG Terminals’ entry point within Europe within Europe Diameter < 600 mm intro transmission system Salt cavity - cavern or export point to non-EU country or export point to non-EU country Operational Under construction or Planned Diameter 600 - 900 mm Depleted (Gas) eld on shore / oshore MURMAN Diameter > 900mm Other type Unknown Cross-border interconnection point Cross-border third country (import) with third country (import) Under construction or Planned Pomorskiy Project categories : Project categories : Project categories : Project categories : Strait Intra-country or Murmansk Third country cross-border FID projects FID projects FID projects intra balancing zone points interconnection point FID projects Non-FID, advanced projects Non-FID, advanced projects Non-FID, advanced projects REYKJAVIK Non-FID, advanced projects Non-FID, non-advanced projects Non-FID, non-advanced projects Non-FID, non-advanced projects Gas Reserve areas Countries Non-FID, non-advanced projects ENTSOG Member Countries ICELAND Project is part of 2nd PCI list : Project is part of 2nd PCI list : Project is part of 2nd PCI list : Project is part of 2nd PCI list : Drilling platform ENTSOG Associated Partner P ENTSOG -

10Fields in Production

eng_fakta_2005_kap10 12-04-05 15:26 Side 66 10 Fields in production eng_fakta_2005_kap10 12-04-05 15:26 Side 67 Keys to tables in chapters 10–12 Interests in fields do not necessarily correspond with interests in the individual production licences (unitised fields or ones for which the sliding scale has been exercised have a different composition of interests than the production licence). Because interests are shown up to two decimal places, licensee holdings in a field may add up to less than 100 percent. Interests are shown at 1 January 2005. “Recoverable reserves originally present” refers to reserves in resource categories 0, 1, 2 and 3 in the NPD’s classification system (see the definitions below). “Recoverable reserves remaining” refers to reserves in resource categories 1, 2 and 3 in the NPD’s classification system (see the definitions below). Resource category 0: Petroleum sold and delivered Resource category 1: Reserves in production Resource category 2: Reserves with an approved plan for development and operation Resource category 3: Reserves which the licensees have decided to develop FACTS 2005 67 eng_fakta_2005_kap10 12-04-05 15:26 Side 68 Southern North Sea The southern part of the North Sea sector became important for the country at an early stage, with Ekofisk as the first Norwegian offshore field to come on stream, more than 30 years ago. Ekofisk serves as a hub for petroleum operations in this area, with surrounding developments utilising the infrastructure which ties it to continental Europe and Britain. Norwegian oil and gas is exported from Ekofisk to Teesside in the UK and Emden in Germany respectively. -

Fields in Production

12 Fields in production Southern North Sea sector Ekofisk area (Ekofisk, Eldfisk, Embla and Tor) . 71 Glitne . 74 Gungne . 75 Gyda (incl Gyda South) . 76 Hod . 77 Sigyn . 78 Sleipner West . 79 Sleipner East . 80 Tambar . 81 Ula . 82 Valhall ( incl Valhall flanks and Valhall water injection) . 83 Varg . 84 Northern North Sea sector Balder (incl Ringhorne) . 86 Brage . 87 Frigg . 88 Gullfaks (incl Gullfaks Vest) . 90 Gullfaks South (incl Rimfaks and Gullveig) . 92 Heimdal . 94 Huldra . 95 Jotun . 96 Murchison . 97 Oseberg (Oseberg, Oseberg West, Oseberg East, Oseberg South) . 98 Snorre (incl Snorre B) . 101 Statfjord . 103 Statfjord North . 105 Statfjord East . 106 Sygna . 107 Tordis (incl Tordis East and Borg) . 108 Troll phase I . 110 Troll phase II . 112 Tune . 114 Vale . 115 Veslefrikk . 116 Vigdis . 117 Visund . 118 Norwegian Sea Draugen . 120 Heidrun . 121 Njord . 122 Norne . 123 Åsgard . 124 Fields which have ceased production . 126 12 Explanation of the tables in chapters 12–14 Interests in fields do not necessarily correspond with interests in the individual production licences (unitised fields or ones for which the sliding scale has been exercised have a different composition of interests than the production licence). Because interests are shown up to two deci- mal places, licensee holdings in a field may add up to less than 100 per cent. Interests are shown at 1 January 2003. Recoverable reserves originally present refers to reserves in resource categories 0, 1, 2 and 3 in the NPD’s classification system (see the definitions below). Recoverable reserves remaining refers to reserves in resource categories 1, 2 and 3 in the NPD’s classification system (see the definitions below). -

Last Ned Brosjyre Om Prosessanlegget På Kollsnes

FAKTA Kollsnes prosessanlegg Som en oase lyser prosessanlegget opp kystlandskapet en sensommerkveld Kollsnesanlegget spiller en nøkkelrolle når det gjelder transport av gass i store mengder fra felt i norsk del av Nordsjøen til kunder i Europa. Gass fra Kollsnes utgjør nærmere 40 prosent av totale norske gass- leveranser. De enorme gassmengdene i Troll-feltet var starten på det hele. Kollsnes prosessanlegg er i dag et Selve prosessanlegget består i hovedsak Troll er selve hjørne- senter for behandling av gass fra feltene av tre duggpunktsanlegg for behand- steinen i norsk gass- Troll, Fram, Visund og Kvitebjørn. På ling av henholdsvis gass, kondensat og Kollsnes blir gassen renset, tørket og monoetylenglykol (MEG). I tillegg finnes produksjon. Da feltet komprimert før den sendes som tørrgass et eget anlegg for utvinning av flytende gjennom eksportrør til Europa. I tillegg våtgass (Natural Gas Liquids -NGL). ble erklært drivverdig i transporteres noe gass i eget rør til I anlegget blir våtgass (NGL) først Naturgassparken, vest i Øygarden, der skilt ut. Deretter blir tørrgass trykket 1983, kom spørsmålet Gasnor behandler og distribuerer gass opp ved hjelp av de seks eksport- om hvilken vei de til innenlands forbruk. Kondensat, eller kompressorene og sendt ut i transport- våtgass, som er tyngre komponenter i systemet via eksportrør-ledningene enorme gassmengdene gassen, føres via Stureterminalen i rør Zeepipe IIA og IIB. til Mongstad (Vestprosess). Her videre- skulle ta for å komme behandles produktet og fraksjoneres til trygt fram til brukerne. propan, butan og nafta. Løsningen ble et mottaksanlegg på Kollsnes i Øygarden kommune nordvest 40% Gass fra Kollsnes utgjør nærmere for Bergen. -

Oil and Gas Delivery to Europe

Oil and gas delivery to Europe An Overview of Existing and Planned Infrastructures GOUVERNANCE EUROPÉENNE ET GÉOPOLITIQUE DE L’ÉNERGIE 4 bis Susanne NIES l es é tud es The French Institute for International Relations (Ifri) is France’s premier centre for independent research, information, and debates on today’s most important international issues. Founded in 1979 by Thierry de Montbrial, Ifri is an officially recognized organization (1901 law). It is not beholden to any administrative authority, independently chooses its projects, and regularly publishes its works. Ifri brings together, through studies and debates and in an interdisciplinary manner, political and economic decision-makers, researchers and experts from the global level. With its Brussels branch (Ifri Brussels), Ifri is one of the rare French think-tanks that is at the heart of European debates. * Site Int 1 © Ifri Contents ABSTRACT ......................................................................................... 4 INTRODUCTION ................................................................................... 5 I. THE CONSTRUCTION OF GAS AND OIL INFRASTRUCTURES IN EUROPE11 Summary.................................................................................................11 1. From the Discovery of Resources to the Construction of Separate East-West Networks .......................12 2. Developing Infrastructures in the Soviet Block, and their Extension to Western Europe .............................................16 3. Conclusion: Continuity and Ruptures.............................................19 -

Statoil Gas Seminar

Creating value in times of low commodity prices Statoil gas seminar, 18 February 2016, London Jens Økland, EVP, Marketing, Midstream & Processing (MMP) Classification: Internal 2012-10-24 Our industry is in a challenging situation • Low oil and gas prices Commodity prices 140 120 Climate 100 80 • High costs 60 USD/boe 40 20 0 • Oil and gas in a 2013 2014 2015 2016 Oil Gas (NBP) decarbonising world Costs 2 Sources: Platts, Heren, IHS Statoil’s mid- and downstream business is adding value • With low commodity prices, the relative MMP1) - adjusted earnings2) importance of our mid- and downstream activity increases 25 20 • Through Asset Backed Trading, the value of our products can be increased 15 10 Billion NOK • MMP earnings in 2015 exceeds NOK 20 5 billion and accounts for nearly 30% of Statoil’s adjusted earnings 0 2012 2013 2014 2015 MMP 1) Marketing, Midstream & Processing (MMP). Before 2015: Marketing, Processing and Renewables (MPR) 2) Before tax 3 Source: Statoil Asset Backed Trading – an extensive toolbox for value creation • Our most successful trading activities imply Adjusted earnings 1) MMP - 2015 use of physical infrastructure or contractual assets − Storages − Refineries − Terminals − Shipping − Rail − Capacity bookings • Active use of assets add flexibility and optionality to our portfolio and increase our Natural gas Europe Natural gas US competitiveness Liquids Other 1) Before tax 4 Source: Statoil Resetting costs in MMP Continue efforts to become more competitive A sustained culture of continuous improvement Respond to -

Processing Plant Like an Oasis, the Processing Plant Lights up the Coastal Landscape in Late Summer Evenings

FACTS Kollsnes Processing Plant Like an oasis, the processing plant lights up the coastal landscape in late summer evenings. The Kollsnes processing plant plays a key role in the transport of large quanti- ties of gas from fields in the Norwegian sector of the North Sea to customers in Europe. Gas from Kollsnes accounts for around 40 per cent of all Norwegian gas deliveries. The enormous quantities of gas in the Troll field started it all. Today, Kollsnes processing plant acts as goes further treatment and is fractioned Troll is the very corner- a centre for processing of gas from the into propane, butane and naphtha. stone of Norwegian Troll, Fram, Visund and Kvitebjørn fields. At Kollsnes, the gas is cleaned, dried and The processing plant itself consists gas production. When compressed before being transported as primarily of three dew point plants for dry gas through export pipes to Europe. treating gas, condensate and mono- the field was declared In addition, some gas is transported ethylene glycol (MEG) respectively. in separate pipes to Naturgassparken There is also a separate plant for the commercially viable in western Øygarden, where Gassnor production of Natural Gas Liquids in 1983, the question treats and distributes gas for domestic (NGL). In the plant, the wet gas (NGL) use. Condensate, or wet gas, which is is separated out first, and then the dry arose of what route made up of heavier components in the gas is pressurised using the six export gas, is transported via the Sture ter- compressors and sent into the transport the enormous quanti- minal through a pipeline to Mongstad system via the export pipelines Zeepipe ties of gas should take (Vestprosess). -

Technical Report Challenge 6

2011 Technical Report Challenge 6 Ahmed Awol Tebarek, Brigite Caleca Cabenguela, Farid Abadli, Håkon Eidem Christiansen and Øystein Texmo Prytz NTNU 13.04.2011 Table of content 1 Abstract............................................................................................................................... 3 2 Introduction ........................................................................................................................ 4 2.1 Gullfaks Main Field......................................................................................................... 5 2.2 Gulltopp ........................................................................................................................... 8 2.2.1 Source: ................................................................................................................ 12 3 Plot the inflow along the wellbore.................................................................................... 13 3.1 Segments........................................................................................................................ 13 3.2 Base Case....................................................................................................................... 16 3.2.1 Oil Production .................................................................................................... 16 3.2.2 Segment flow rate ............................................................................................... 17 3.2.3 Sands.................................................................................................................. -

Total E&P Norge AS

TOTAL E&P NORGE AS ANNUAL REPORT 20 16 CONTENTS 04 KEY FIGURES 05 BOARD OF DIRECTORS’ REPORT 12 INCOME STATEMENT 13 CASH FLOW STATEMENT 14 BALANCE SHEET 16 ACCOUNTING POLICIES 17 NOTES 27 AUDITORS' REPORT 29 OUR INTERESTS ON THE NCS 30 MANAGEMENT STRUCTURE 2 2016 TOTAL REVENUES MILLION NOK 24 762 OPERATING PROFIT MILLION NOK 4 164 PRODUCTION (NET AVERAGE DAILY PRODUCTION) THOUSAND BOE 235 RESERVES OF OIL AND GAS (PROVED DEVELOPED AND UNDEVELOPED RESERVES AT 31.12) MILLION BOE 816 EMPLOYEES (AVERAGE NUMBER) 438 3 ANNUAL REPORT 2016 | TOTAL E&P NORGE AS | KEY FIGURES KEY FIGURES MILLION NOK 2016 2015 2014 INCOME STATEMENT Total revenues 24 762 30 423 42 624 Operating profit 4 164 10 864 22 323 Financial income / (expenses) - net (204) (1 020) (364) Net income before taxes 3 960 9 844 21 959 Taxes on income 1 663 6 014 14 529 Net income 2 297 3 830 7 431 Cash flow from operations 13 351 15 644 17 038 BALANCE SHEET Intangible assets 1 763 2 090 2 326 Investments, property, plant and equipment 85 103 84 056 76 002 Current assets 9 385 7 106 7 814 Total equity 17 154 18 880 15 032 Long-term provisions 37 922 36 139 31 884 Long-term liabilities 32 856 33 504 26 774 Current liabilities 8 319 4 730 12 452 OTHER KEY FIGURES Acquisition of property, plant and equipment IN (MNOK) 13 583 15 476 16 902 Exploration activity, costs and investments IN (MNOK) 1 512 1 270 1 237 Rate of return on capital employed *) 4,8 % 8,8 % 20,1 % Production cost USD/BBL 5,5 6,9 9,2 Transport cost USD/BBL 3,6 3,6 5,3 PRODUCTION IN THOUSAND BOE Net average daily production 235 239 242 RESERVES OF OIL AND GAS IN MILLION BOE Proved developed and undeveloped reserves at 31.12 816 869 958 EMPLOYEES Average number of employees 438 447 424 *) Net income plus financial expense after tax as a percentage of capital employed at 1 January.