Zbwleibniz-Informationszentrum

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Solomon Islands

SOLOMON ISLANDS STAFF REPORT FOR THE 2016 ARTICLE IV CONSULTATION AND FIFTH AND SIXTH REVIEWS UNDER THE EXTENDED CREDIT FACILITY ARRANGEMENT—INFORMATIONAL ANNEX March 8, 2016 Prepared By Asia and Pacific Department (In consultation with other departments) CONTENTS FUND RELATIONS ________________________________________________________________________ 2 SUPPORT FROM THE PACIFIC FINANCIAL TECHNICAL ASSISTANCE CENTRE ________ 6 RELATIONS WITH THE WORLD BANK GROUP __________________________________________ 8 RELATIONS WITH THE ASIAN DEVELOPMENT BANK ________________________________ 10 STATISTICAL ISSUES ____________________________________________________________________ 12 MAIN WEBSITES OF DATA _____________________________________________________________ 14 ©International Monetary Fund. Not for Redistribution SOLOMON ISLANDS FUND RELATIONS (As of January 31, 2016) Membership Status: Joined September 22, 1978; Article VIII General Resources Account: SDR Percent of Million Quota Quota 10.40 100.00 Fund holdings of currency 9.85 94.73 Reserve position in the 0.55 5.29 Fund SDR Department: SDR Million Percent of Allocation Net cumulative allocation 9.91 100.00 Holdings 8.23 83.07 Outstanding Purchases and Loans: SDR Million Percent Quota SDR Million Percent of Quota ECF Arrangements 0.74 7.14 SCF Arrangements 10.40 100.00 Latest Financial Arrangements: Type Approval Expiration Amount Approved Amount Drawn Date Date (SDR Mission) (SDR Million) ECF 12/7/2012 3/31/2016 1.04 0.74 SCF 12/6/2011 12/5/2012 5.20 0.00 SCF 6/2/2010 12/1/2011 12.48 12.48 Projected Payments to Fund1: (SDR Million; based on existing use of resources and present holdings of SDRs): …..Forthcoming 2016 2017 2018 2019 2020 Principal 2.77 2.77 2.46 1.46 0.13 Charges/Interest 0.00 0.01 0.01 0.01 0.00 Total 277 2.79 2.46 1.47 0.14 1 When a member has overdue financial obligations outstanding for more than three months, the amount of such arrears will be shown in this section. -

World Bank Document

Document of The World Bank FOR OMCIAL USE ONLY Public Disclosure Authorized R1uutNo. P-3687-Snr- RERPO- AND REWOIUIKNDkON OF TME PRSIEn OF THEl Public Disclosure Authorized I,FNTONL D EL, ASSOCIATION TO TME EXECUTIVE DIRECTORS m A PROPSED XD& C3REDIT 3N AN AMONT EBUIV TO SDR 3.3 MILLION Public Disclosure Authorized TO SOL9ON ISLANDS FOR A RURAL SERVICES PROJECT November 14, 1983 Public Disclosure Authorized bsbcmmet Ihas iatdc dEggbetI ma hbe m..i by retip -a ely in Oh pefama of IIeoftial dum kg =my ne ethewise be dbdched W &_WM Bk mberdz.do CURRENCYEQUIVALENTS Calendar 1982 July 1983 Solomon Islands Solomon Islands Currency Unit dollar (SI$) dollar (SI$) $1.00 SI$1.03 ST$1.20 SI$1.00 US$0.971 US$0.830 The Solomon Islands Dollar was introduced in 1977. The exchange rate is determined on the basis of a weighted basket of currencies of the major trading partners of the Solomon Tslands. ABBREVIATIONS ADB - Asian Development Bank ADAB - Australian Development Assistance Bureau AIU - Agriculture Information Unit DBSI - Development Bank of Solomon Islands FTC - Farmer Training Center IFAD - International Fund for Agricultural Development HHAND - Ministry of Home Affairs and National Development KATI - National Agricultural Training Institute rIU - Project Implementation Unit RDC - Rural Development Center UNDP - United Nations Development Program FISCAL YEAR January 1 - December 31 FOR OFFICIAL USE ONLY SOLOMONISLANDS RURALSERVICES PROJECT Credit and Project Summary Borrower: The Solomon Islands Amount: SDR 3.3 million (US$3.5million) Terms: Standard IDA terms. Project Description: The project would expand and improve the country's agricul- tural support services in the areas of research,education, training and extensionservices, and foster developmentof rural enterprises. -

Country Scheme Alpha 3 Alpha 2 Currency Albania MC / VI ALB AL

Country Scheme Alpha 3 Alpha 2 Currency Albania MC / VI ALB AL Lek Algeria MC / VI DZA DZ Algerian dinar Argentina MC / VI ARG AR Argentine peso Australia MC / VI AUS AU Australian dollar -Christmas Is. -Cocos (Keeling) Is. -Heard and McDonald Is. -Kiribati -Nauru -Norfolk Is. -Tuvalu Christmas Island MC CXR CX Australian dollar Cocos (Keeling) Islands MC CCK CC Australian dollar Heard and McDonald Islands MC HMD HM Australian dollar Kiribati MC KIR KI Australian dollar Nauru MC NRU NR Australian dollar Norfolk Island MC NFK NF Australian dollar Tuvalu MC TUV TV Australian dollar Bahamas MC / VI BHS BS Bahamian dollar Bahrain MC / VI BHR BH Bahraini dinar Bangladesh MC / VI BGD BD Taka Armenia VI ARM AM Armenian Dram Barbados MC / VI BRB BB Barbados dollar Bermuda MC / VI BMU BM Bermudian dollar Bolivia, MC / VI BOL BO Boliviano Plurinational State of Botswana MC / VI BWA BW Pula Belize MC / VI BLZ BZ Belize dollar Solomon Islands MC / VI SLB SB Solomon Islands dollar Brunei Darussalam MC / VI BRN BN Brunei dollar Myanmar MC / VI MMR MM Myanmar kyat (effective 1 November 2012) Burundi MC / VI BDI BI Burundi franc Cambodia MC / VI KHM KH Riel Canada MC / VI CAN CA Canadian dollar Cape Verde MC / VI CPV CV Cape Verde escudo Cayman Islands MC / VI CYM KY Cayman Islands dollar Sri Lanka MC / VI LKA LK Sri Lanka rupee Chile MC / VI CHL CL Chilean peso China VI CHN CN Colombia MC / VI COL CO Colombian peso Comoros MC / VI COM KM Comoro franc Costa Rica MC / VI CRI CR Costa Rican colony Croatia MC / VI HRV HR Kuna Cuba VI Czech Republic MC / VI CZE CZ Koruna Denmark MC / VI DNK DK Danish krone Faeroe Is. -

Currency Exchange Rates

Pacific Data Hub .Stat metadata Currency exchange rates Data description Title Currency exchange rates Description Number of U.S. Dollars per of domestic currency unit for currencies used in Pacific Island Countries and Territories. Monthly and yearly values for end-of-period and period-average exchange rates since 1950 are based on data from IMF International Financial Statistics. Data identification Identifier SPC:DF_CURRENCIES(2.0) URL https://stats.pacificdata.org/vis?locale=en&facet=6nQpoAP&constraints[0]=6nQpoAP%2C0%7CEconomy%23ECO%23&start=0 &dataflow[datasourceId]=SPC2&dataflow[dataflowId]=DF_CURRENCIES&dataflow[agencyId]=SPC&dataflow[version]=2.0 Data source Monthly and yearly currency exchange rates are collected from IMF International Financial Statistics, using the SDMX API. Exchange rates are domestic currency per U.S. Dollar for currencies used by Pacific Island Countries and Territories : Australian Dollar, CFP Franc, Fiji Dollar, Kina, New Zealand Dollar, Pa’anga, Solomon Islands Dollar, Tala and Vatu. End of period rates and period average rates are collected. The call to IMF API used to collect the data is : http://dataservices.imf.org/REST/SDMX_XML.svc/CompactData/IFS/A+M.FJ+NC+PG+SB+TO+VU+WS+AU+NZ.ENDA_XDC_USD_RATE+ENDE_XD C_USD_RATE?startPeriod=1950&endPeriod=2050 Data processing Data values are rounded to 4 decimal places. Quarterly values are calculated from monthly values: end of perdiod value of the last month of the quarter is used for end of period rate, average of average monthly rates is used for period average rate. Reference area ISO3166-1 alpha 2 codes are recoded to ISO 4217 currency codes this way : Temporal coverage First period 1950 Last period Current month-1 Data scheduling Frequency Monthly and yearly Timeliness Data is refreshed at the beginning of each month, timeliness of data for individual currencies has not been assessed. -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

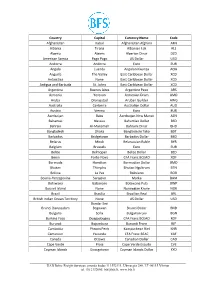

International Currency Codes

Country Capital Currency Name Code Afghanistan Kabul Afghanistan Afghani AFN Albania Tirana Albanian Lek ALL Algeria Algiers Algerian Dinar DZD American Samoa Pago Pago US Dollar USD Andorra Andorra Euro EUR Angola Luanda Angolan Kwanza AOA Anguilla The Valley East Caribbean Dollar XCD Antarctica None East Caribbean Dollar XCD Antigua and Barbuda St. Johns East Caribbean Dollar XCD Argentina Buenos Aires Argentine Peso ARS Armenia Yerevan Armenian Dram AMD Aruba Oranjestad Aruban Guilder AWG Australia Canberra Australian Dollar AUD Austria Vienna Euro EUR Azerbaijan Baku Azerbaijan New Manat AZN Bahamas Nassau Bahamian Dollar BSD Bahrain Al-Manamah Bahraini Dinar BHD Bangladesh Dhaka Bangladeshi Taka BDT Barbados Bridgetown Barbados Dollar BBD Belarus Minsk Belarussian Ruble BYR Belgium Brussels Euro EUR Belize Belmopan Belize Dollar BZD Benin Porto-Novo CFA Franc BCEAO XOF Bermuda Hamilton Bermudian Dollar BMD Bhutan Thimphu Bhutan Ngultrum BTN Bolivia La Paz Boliviano BOB Bosnia-Herzegovina Sarajevo Marka BAM Botswana Gaborone Botswana Pula BWP Bouvet Island None Norwegian Krone NOK Brazil Brasilia Brazilian Real BRL British Indian Ocean Territory None US Dollar USD Bandar Seri Brunei Darussalam Begawan Brunei Dollar BND Bulgaria Sofia Bulgarian Lev BGN Burkina Faso Ouagadougou CFA Franc BCEAO XOF Burundi Bujumbura Burundi Franc BIF Cambodia Phnom Penh Kampuchean Riel KHR Cameroon Yaounde CFA Franc BEAC XAF Canada Ottawa Canadian Dollar CAD Cape Verde Praia Cape Verde Escudo CVE Cayman Islands Georgetown Cayman Islands Dollar KYD _____________________________________________________________________________________________ -

Currency Rates 2014-2015 – Rolling 12 Month Average

Currency rates 2014-2015 – Rolling 12 Month Average Currency Code 15/04/14 15/05/14 15/06/14 15/07/14 15/08/14 15/09/14 15/10/14 15/11/14 15/12/14 15/01/15 15/02/15 15/03/15 Australia Dollar AUD 0.8931 0.9007 0.9074 0.9139 0.9162 0.9184 0.9205 0.9217 0.9234 0.9248 0.9276 0.9289 Bahrain Dinar BHD 0.3116 0.3129 0.3148 0.3178 0.3191 0.3193 0.3180 0.3167 0.3150 0.3134 0.3106 0.3068 Britain Pound GBH 0.5154 0.5132 0.5131 0.5126 0.5120 0.5113 0.5092 0.5081 0.5072 0.5077 0.5064 0.5051 Canada Dollar CAD 0.8736 0.8823 0.8924 0.9032 0.9109 0.9161 0.9185 0.9204 0.9230 0.9251 0.9259 0.9251 China Yuan CNY 5.0553 5.0819 5.1194 5.1736 5.1976 5.2015 5.1827 5.1631 5.1439 5.1272 5.0932 5.0389 Denmark Kroner DKK 4.5741 4.5692 4.5928 4.6228 4.6404 4.6523 4.6534 4.6612 4.6733 4.7088 4.7348 4.7878 European Community Euro EUR 0.6132 0.6124 0.6155 0.6196 0.6219 0.6236 0.6239 0.6250 0.6268 0.6318 0.6355 0.6426 Fiji Dollar FJ D 1.5339 1.5416 1.5518 1.5622 1.5661 1.5692 1.5693 1.5699 1.5688 1.5673 1.5639 1.5583 French Polynesia Franc XPF 73.1675 73.0734 73.4489 73.9347 74.2226 74.4277 74.4707 74.6081 74.8172 75.4201 75.8505 76.7147 Hong Kong Dollar HKD 6.4103 6.4356 6.4751 6.5365 6.5629 6.5656 6.5401 6.5128 6.4795 6.4461 6.3873 6.3096 India Rupee INR 50.1763 50.7103 51.1397 51.6807 51.8547 51.7080 51.3998 51.0851 50.9015 50.6313 50.1609 49.6534 Indonesia Rupiah IDR 9,142.9017 9,304.7083 9,493.6458 9,698.4908 9,822.5217 9,873.8358 9,909.4217 9,906.6033 9,895.5325 9,864.7367 9,832.0200 9,833.5850 Japan Yen JPY 82.9540 83.2486 84.2967 85.2286 85.9152 86.4854 86.6823 -

Exchange Rate Statistics

Exchange rate statistics Updated issue Statistical Series Deutsche Bundesbank Exchange rate statistics 2 This Statistical Series is released once a month and pub- Deutsche Bundesbank lished on the basis of Section 18 of the Bundesbank Act Wilhelm-Epstein-Straße 14 (Gesetz über die Deutsche Bundesbank). 60431 Frankfurt am Main Germany To be informed when new issues of this Statistical Series are published, subscribe to the newsletter at: Postfach 10 06 02 www.bundesbank.de/statistik-newsletter_en 60006 Frankfurt am Main Germany Compared with the regular issue, which you may subscribe to as a newsletter, this issue contains data, which have Tel.: +49 (0)69 9566 3512 been updated in the meantime. Email: www.bundesbank.de/contact Up-to-date information and time series are also available Information pursuant to Section 5 of the German Tele- online at: media Act (Telemediengesetz) can be found at: www.bundesbank.de/content/821976 www.bundesbank.de/imprint www.bundesbank.de/timeseries Reproduction permitted only if source is stated. Further statistics compiled by the Deutsche Bundesbank can also be accessed at the Bundesbank web pages. ISSN 2699–9188 A publication schedule for selected statistics can be viewed Please consult the relevant table for the date of the last on the following page: update. www.bundesbank.de/statisticalcalender Deutsche Bundesbank Exchange rate statistics 3 Contents I. Euro area and exchange rate stability convergence criterion 1. Euro area countries and irrevoc able euro conversion rates in the third stage of Economic and Monetary Union .................................................................. 7 2. Central rates and intervention rates in Exchange Rate Mechanism II ............................... 7 II. -

Forecasting Tala/USD and Tala/AUD of Samoa Using AR (1), and AR (4): a Comparative Study

Mathematics and Computers in Contemporary Science Forecasting Tala/USD and Tala/AUD of Samoa using AR (1), and AR (4): A Comparative Study Shamsuddin Ahmed Graduate School of Business MGM Khan School of Computing, Information and Mathematical Science Biman Prasad School of Economics The University of the South Pacific, Suva, Fiji [email protected] Abstract: - The paper studies the Autoregressive (AR) Models to forecast exchange rate of Samoan Tala/USD and Tala/AUD during the period of January 3 2008 to September 28 2012. We used daily exchange rate data to do our study. The performance of AR (1), and AR (4) model forecasting was measured by using varies error functions such as RSME Error, MAE, MAD, MAPE, Bias error, Variance error, and Co-variance error. The empirical findings suggest that AR (1) model is an effective tool to forecast the Tala/USD and Tala/AUD.. Key-Words: - AR (1), and AR (4) model, Exchange rate, RSME, MAE, MAD, MAPE, Bias error, Variance error, and Co-variance error 1 Introduction source of remittances, followed by Australia and the Samoa is located half way between Hawaii and United States. The tourism sector has also been New Zealand with the geographic coordinates of 13 growing steadily over the past few years, although 35 south and 172 20 west. The total area of the 2009 tsunami caused extensive damage to landmass is 2831 square kilometers. Samoa has got several hotels and resorts. Foreign development a tropical climate. It has got two main islands assistance in the form of loans, grants and direct aid (Savaii, Upolu) several smaller islands and is an important component of the economy. -

Samoa: 2019 Article IV Consultation-Press Release

IMF Country Report No. 19/138 SAMOA 2019 ARTICLE IV CONSULTATION—PRESS RELEASE; May 2019 STAFF REPORT; STAFF STATEMENT; AND STATEMENT BY THE EXECUTIVE DIRECTOR FOR SAMOA Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. In the context of the 2019 Article IV consultation with Samoa, the following documents have been released and are included in this package: • A Press Release summarizing the views of the Executive Board as expressed during its May 8, 2019 consideration of the staff report that concluded the Article IV consultation with Samoa. • The Staff Report prepared by a staff team of the IMF for the Executive Board’s consideration on May 8, 2019, following discussions that ended on March 5, 2019, with the officials of Samoa on economic developments and policies. Based on information available at the time of these discussions, the staff report was completed on March 27, 2019. • An Informational Annex prepared by the IMF staff. • A Debt Sustainability Analysis prepared by the staffs of the IMF and the World Bank. • A Staff Statement updating information on recent developments. • A Statement by the Executive Director for Samoa. The IMF’s transparency policy allows for the deletion of market-sensitive information and premature disclosure of the authorities’ policy intentions in published staff reports and other documents. Copies of this report are available to the public from International Monetary Fund • Publication Services PO Box 92780 • Washington, D.C. 20090 Telephone: (202) 623-7430 • Fax: (202) 623-7201 E-mail: [email protected] Web: http://www.imf.org Price: $18.00 per printed copy International Monetary Fund Washington, D.C. -

Opportunities to Improve Vanilla Value Chains for Small Pacific Island Countries

Opportunities to Improve Vanilla Value Chains for Small Pacific Island Countries Sisikula Palutea Sisifa, Betty Ofe-Grant and Christina Stringer About NZIPR The New Zealand Institute for Pacific Research (NZIPR) was launched in March 2016. Its primary role is to promote and support excellence in Pacific research. The NZIPR incorporates a wide network of researchers, research institutions and other sources of expertise in the Pacific Islands. Published by Opportunities to Improve Vanilla Value Chains for Small Pacific Island Countries Sisikula Palutea Sisifa, Betty Ofe-Grant and Christina Stringer ISBN: 978-0-473-48280-0 1 Acknowledgements We would like to thank our participants in the Cook Islands, Niue and Samoa who gave of their time to meet and talanoa with us. Each of them shared their passion for vanilla with us. They each have the desire to see the vanilla sector in their respective countries grow. They are keen to develop opportunities whereby the vanilla sector can be incorporated into commercial value chains and, importantly, for each country to be recognised for the quality of vanilla produced there. We learned a lot from each of those we met with. We hope our recommendations do justice to their vision for the industry. We also thank our New Zealand participants who provided key insights into possibilities in New Zealand for vanilla from the three Pacific Island countries. Our reviewers provided valuable comments, critique and suggestions towards improving the report. Thank you. Finally, we would like to express our appreciation to Alfred Hazelman, who worked tirelessly on this research project with us as our research assistant. -

The Parables of a Samoan Divine

THE PARABLES OF A SAMOAN DIVINE An Analysis of Samoan Texts of the 1860’s By Leulu F. Va’a A thesis submitted for the degTee of Master of Arts at the Australian National University. February 1987 1 Table of Contents Declaration iii Acknowledgements iv Abstract v 1. INTRODUCTION 1 1.1. The Nature of Hermeneutics 2 1.2. Historical Distance and Interpretation 3 1.3. Explanation and Understanding 4 1.4. Application of Hermeneutics 6 1.5. The Problem of Meaning 8 1.6. The Hymn Book 10 1.7. The Penisimani Manuscripts 12 1.8. The Thesis 17 2. Traditional Samoan Society 18 2.1. Political Organisation 26 2.2. Economic Organisation 29 2.3. Religious Organisation 31 3. The Coming of the Missionaries 39 3.1. Formation of the LMS 40 3.2. The Society’s Missionaries 41 3.3. Early Christian Influences 43 3.4. John Williams 45 3.5. Missionaries in Samoa 47 3.6. The Native Teachers 48 3.7. Reasons for Evangelical Success 51 3.8. Aftermath 54 4. The Folktales of Penisimani 57 4.1. Tala As Myths 57 4.2. Pemsimani’s Writings 59 4.3. Summary 71 5. The Parables of Penisimani 72 5.1. Leenhardt and Myth 73 5.2. Summary 86 6. The Words of Penisimani 87 6.1. The Power of the Word 88 6.2. Summary IOC 7. Myth, Parable and Signification 101 7.1. The Components of the Parable 102 7.1.1. The Cultural Element 103 7.1.2. The Christian Message 104 7.2.