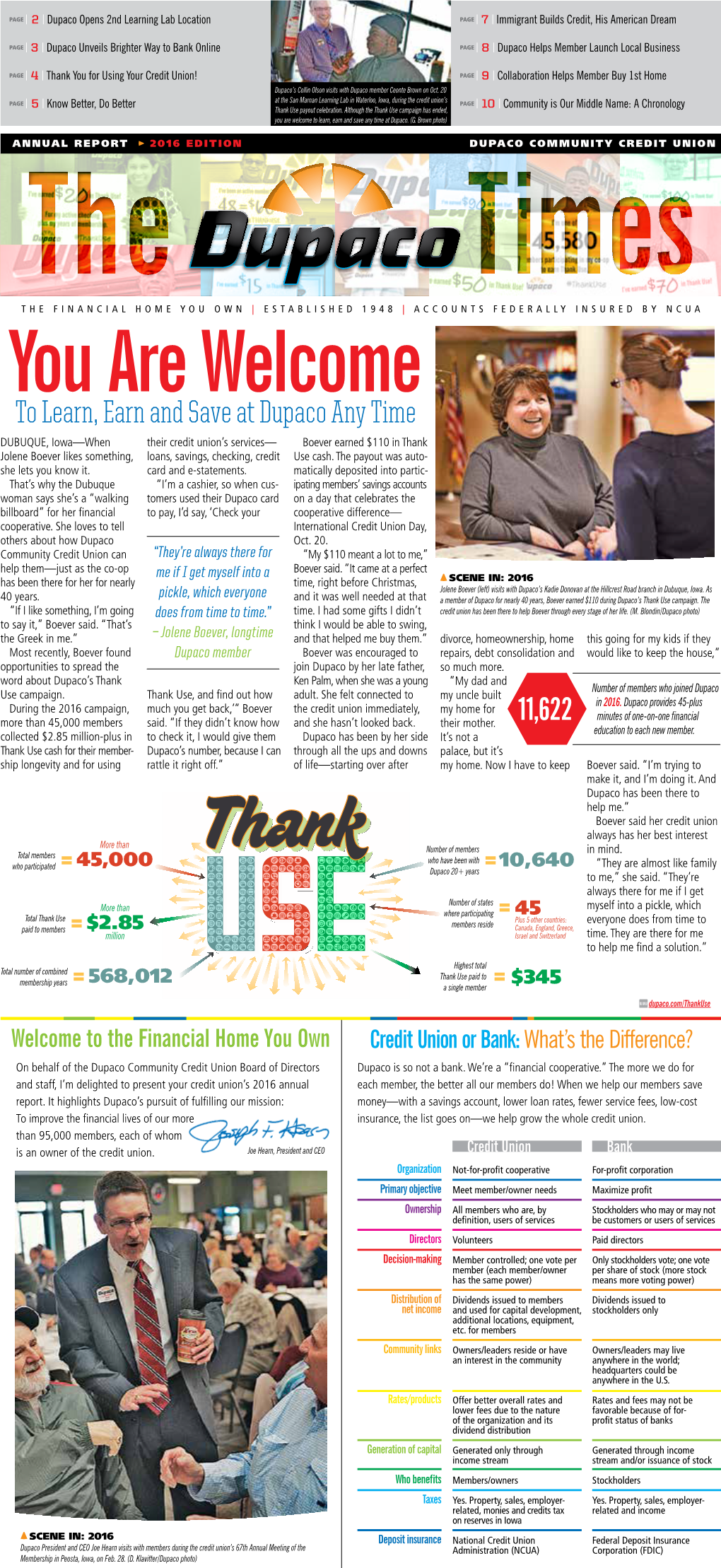

To Learn, Earn and Save at Dupaco Any Time

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Postgame Notes – April 3, 2021 at Dubuque Fighting Saints Game 47, Road Game 25

Chicago Steel Postgame Notes – April 3, 2021 at Dubuque Fighting Saints Game 47, Road Game 25 Final Score 1 2 3 OT F STEEL 2 3 2 - 7 Dubuque 1 0 1 - 2 (Mystique Community Ice Center – Dubuque, IA) Chicago Steel Postgame Central Records: STEEL: 31-11-3-2 (Road: 15-6-3-1); 67 pts. Dubuque: 19-20-3-1 (Home: 9-11-1-1); 42 pts. Game Sheet Quick Stats: Shots PP PK PIM STEEL 30 1-1 0-0 16 Dubuque 18 0-0 0-1 20 Notes: • The Steel became the first team in the USHL to clinch a berth in the 2021 Clark Cup Playoffs with aa 7-2 victory over the Dubuque Fighting Saints at Mystique Community Ice Center in Iowa Saturday night … Despite being outshot 30-18, Chicago netted at least two goals in each period including two goals on three shots in the first … The Steel reached the back of the net on the only power play of the game, going 1-for-1 (100%) on the man advantage … Chicago recorded a 5-2-0-1 record in eight games played against Dubuque during the regular season. • Sean Farrell extended his USHL lead in points with two goals and a helper in the win. The Montreal Canadiens prospect now has 87 points (28G, 59A) in 46 games played this season. • The league leader in goals, Matt Coronato, became just the seventh player in USHL Tier I history to reach the 40-goal plateau in a single season with a pair of markers. -

Tucson Roadrunners Pronunciation Guide

Tucson Roadrunners Pronunciation Guide 3 Jordan Gross D 5-10 190 Grow-ss 4 Cam Dineen D 5-11 185 5 Robbie Russo D 6-0 190 Roo-so 7 Kevin Ekman-Larsson D 5-11 180 Ek-men Lar-sen 8 Conor Garland F 5-10 165 Garr-lend 9 Domenic Alberga F 6-1 210 Al-burr-guh 12 Darik Angeli F 6-3 203 Ann-jelly 15 Laurent Dauphin F 6-1 180 Daww-fan 16 Trevor Murphy D 5-10 180 17 Tyler Steenbergen F 5-10 190 Steen-burr-gen 18 Lane Pederson F 6-0 190 Pee-ter-son 20 Mario Kempe F 6-0 185 Kem-pay 21 Matteo Gennaro F 6-2 190 Genn-air-oh 23 Kyle Capobianco D 6-1 195 Cap-oh-bee-ann-co 24 Hudson Fasching F 6-3 205 27 Michael Bunting F 5-11 195 28 Adam Helewka F 6-2 205 Hell-oo-kuh 29 David Ullstrom F 6-4 195 Ull-strum 31 Merrick Madsen G 6-5 175 33 Adin Hill G 6-6 206 Aiden 35 Hunter Miska G 6-1 175 Miss-kuh 37 Dysin Mayo D 6-2 195 39 Trevor Cheek F 6-2 205 41 Brayden Burke F 5-10 165 43 Dakota Mermis D 6-0 195 Murr-miss 81 Jens Looke F 6-1 180 Yenz Loo-kay 2018-19 TUCSON ROADRUNNERS SCORES BY GAME Date Opp Result Record Pts SF SA PP PK Goalie Scorers GWG Att 10/6 SD 6-4 W 1-0-0-0 2 44 20 2/11 1/2 Hill 81, 81, 28, 28, 21, 15 21 21 6,327 10/12 @ SD 3-2 W 2-0-0-0 4 32 44 0/2 2/2 Miska 27, 39, 16 16 12,467 10/13 @ BAK 2-1 W 3-0-0-0 6 21 26 0/7 2/3 Hill 24, 28 28 4,033 10/15 @ SJ 2-3 SOL 3-0-0-1 7 33 37 0/3 4/5 Miska 43, 28 N/A 2,095 10/19 RFD 4-3 OTW 4-0-0-1 9 19 19 2/7 4/6 Hill 27, 28, 39, 8 8 4,397 10/20 RFD 3-5 L 4-1-0-1 9 38 26 1/6 3/6 Miska 81, 18, 16 N/A 4,411 10/26 @ ONT 8-5 W 5-1-0-1 11 39 27 0/7 3/4 Hill/Miska 29, 21, 8, 24, 27, 8, 21, 21 8 7,203 10/27 @ SD 4-3 -

USA Hockey's National Team Development Program

USA Hockey’s National Team Development Program U.S. National Under-17 Team · 2013-14 Schedule Date Opponent Location Site Time Fri., Sept. 13 Janesville Jets# Ann Arbor, Mich. Ann Arbor Ice Cube 7:00 p.m. Sat., Sept. 14 Janesville Jets# Ann Arbor, Mich. Ann Arbor Ice Cube 7:00 p.m. Sat., Sept. 21 Youngstown Phantoms* Ann Arbor, Mich. Ann Arbor Ice Cube 3:30 p.m. Fri., Sept. 27 Muskegon Lumberjacks* Ann Arbor, Mich. Ann Arbor Ice Cube 7:00 p.m. Sat., Sept. 28 Chicago Steel* Ann Arbor, Mich. Ann Arbor Ice Cube 7:00 p.m. Thurs., Oct. 3 Indiana Ice* Ann Arbor, Mich. Ann Arbor Ice Cube 7:00 p.m. Fri., Oct. 4 Indiana Ice* Ann Arbor, Mich. Ann Arbor Ice Cube 7:00 p.m. Sat., Oct. 12 Minnesota Elite League TBD TBD TBD Sun., Oct. 13 Minnesota Elite League TBD TBD TBD Fri., Oct. 18 Dubuque Fighting Saints Dubuque, Iowa Mystique Ice Center 7:35 p.m. Sat., Oct. 19 Des Moines Buccaneers* Urbandale, Iowa Buccaneer Arena 7:05 p.m. Sat., Oct. 26 Des Moines Buccaneers* Ann Arbor, Mich. Ann Arbor Ice Cube 7:00 p.m. Sun., Oct. 27 Youngstown Phantoms* Ann Arbor, Mich. Ann Arbor Ice Cube 3:30 p.m. Nov. 6-10 Four Nations Tournament Slovakia TBD TBD Sat., Nov. 23 Tri-City Storm* Ann Arbor, Mich. Ann Arbor Ice Cube 7:00 p.m. Sun., Nov. 24 Tri-City Storm* Ann Arbor, Mich. Ann Arbor Ice Cube 3:30 p.m. Wed., Nov. 27 Fargo Force* Fargo, N.D. -

Men's Division I

MEN’S DIVISION I ATLANTIC NAME HOMETOWN INSTITUTION PREVIOUS TEAM Trevor Stone Pleasant Plains Air Force Springfield Jr. Blues (NAHL) Evan Giesler Naperville Air Force Bismarck Bobcats (NAHL) Joe Tyran Wadsworth Air Force Bismarck Bobcats (NAHL) Nicolas Luka Bartlett American International Coulee Region Chill (NAHL) Brennan Kapcheck Mt. Prospect American International Aston Rebels (NAHL) Ryan Papa Prospect Heights American International Waterloo Black Hawks (UHSL) Chris Dodero West Chicago American International Janesville Jets (NAHL) Tucker DeYoung Lake Bluff Army West Point New Jersey Hitmen (USPHL) Sam Kauppila Gurnee Bentley Lincoln Stars (USHL) Michael Zuffante Bloomingdale Bentley MN Wilderness (NAHL) Jake Kauppila Gurnee Bentley Trail Smoke Eaters (BCHL) Matt Long Orland Park Canisius Springfield Jr. Blues (NAHL) Blake Wareham Park Ridge Canisius Janesville Jets (NAHL) Matt Barry Naperville Holy Cross Youngstown Phantoms (USHL) Kip Hoffmann Huntley Robert Morris Janesville Jets (NAHL) BIG TEN NAME HOMETOWN INSTITUTION PREVIOUS TEAM Jack Randl Carpentersville Michigan University Omaha Lancers (USHL) Sam Saliba Lincolnshire Michigan State Green Bay Gamblers (USHL) Tory Dello Crystal Lake Notre Dame Tri-City Storm (USHL) Pierce Crawford Park Ridge Notre Dame Youngstown Phantoms (USHL) Jake Pivonka Naperville Notre Dame USNTDP Bobby Nardella Rosemont Notre Dame Tri-City Storm (USHL) Jack Jenkins Lake Bluff Notre Dame Fargo Force (USHL) Charlie Raith Winnetka Notre Dame Central Ill. Flying Aces (USHL) Tanner Laczynski Shorewood Ohio -

Media Kit Ontario Reign Vs Iowa Wild Game #27: Friday, October 13

Media Kit Ontario Reign vs Iowa Wild Game #27: Friday, October 13, 2017 theahl.com Ontario Reign (0-1-0-0) vs. Iowa Wild (0-2-0-0) Oct 13, 2017 -- Wells Fargo Arena AHL Game #27 GOALIES GOALIES # Name Ht Wt GP W L OT SO GAA SV% # Name Ht Wt GP W L OT SO GAA SV% 1 Jack Campbell 6-3 195 1 0 1 0 0 2.04 0.938 30 Adam Vay 6-5 215 0 0 0 0 0 0.00 0.000 37 Jeff Zatkoff 6-2 179 0 0 0 0 0 0.00 0.000 34 Steve Michalek 6-2 203 0 0 0 0 0 0.00 0.000 40 Cal Petersen 6-1 182 0 0 0 0 0 0.00 0.000 35 Niklas Svedberg 6-1 165 2 0 2 0 0 4.17 0.830 SKATERS SKATERS # Name Pos Ht Wt GP G A Pts. PIM +/- # Name Pos Ht Wt GP G A Pts. PIM +/- 3 Matt Roy D 6-1 200 1 0 0 0 0 0 2 Alex Grant D 6-3 209 2 0 0 0 4 2 4 Kevin Gravel D 6-4 200 1 0 0 0 0 -1 3 Nick Seeler D 6-2 201 2 0 1 1 0 -1 7 Brett Sutter C 6-0 192 1 0 0 0 0 0 4 Hunter Warner D 6-3 220 2 0 0 0 0 0 8 Zach Leslie D 6-0 175 1 0 0 0 0 0 5 Zach Palmquist D 5-11 185 0 0 0 0 0 0 9 Matt Luff RW 6-3 196 1 0 0 0 0 1 7 Sam Anas RW 5-8 160 0 0 0 0 0 0 10 Alex Lintuniemi D 6-2 214 1 0 0 0 0 -1 8 Matt Caito D 5-11 190 0 0 0 0 0 0 11 Matt Schmalz RW 6-6 209 0 0 0 0 0 0 9 Cal O'Reilly C 6-0 188 2 1 0 1 0 -1 12 Spencer Watson RW 5-11 170 1 0 0 0 0 0 11 Chase Lang RW 6-1 190 0 0 0 0 0 0 13 Keegan Iverson C 6-2 220 0 0 0 0 0 0 12 Pat Cannone C 5-10 190 2 2 0 2 0 -1 16 Philippe Maillet C 5-9 167 1 0 0 0 0 0 19 Luke Kunin C 6-0 195 2 1 1 2 4 1 17 T.J. -

Dubuque Youth Hockey Association

Dubuque Youth Hockey Association Travel Team Policy 2017 – 2018 Table of Contents Topic Page Number A. Mission Statement 2 B. About Travel Hockey 3 - 4 C. Travel Team Committee 5 D. Evaluation Process 5 - 9 1. Evaluations 2. Evaluation Fee 3. Team Selection 4. Number of Teams and Players Per Team 5. Player Evaluation Process 6. Travel Team Registration E. Skating at a Higher Age Category 9 F. Coaching 9 - 10 1. Travel Coaches Selection 2. Coaching Overview 3. Criteria for Selecting Head Coaches 4. Monitoring of Coaches G. Travel Team Management Policies 11 - 12 1. Team Manager H. Team Finances 12 1. Estimated Budget 2. Payment Obligations I. Conduct 12 J. Travel Team Grievances/Discipline 12 - 13 K. Miscellaneous 13 - 14 1. Medical Kits 2. Jersey Policy 3. Equipment 4. Ice Time L. USA Hockey Locker Room Supervision Policy 15 Page 1 A. Mission Statement The Dubuque Youth Hockey Association (DYHA) strives to create and sustain an environment where participants exhibit pride and a desire to remain involved in hockey. DYHA will be successful by aligning solid leadership principles with positive coaching, strong member relationships and fiscal responsibility. DYHA will cultivate mutually supportive relationships connecting parents, players, coaches and staff while providing the opportunity for hockey players to develop life skills that will serve them well beyond the ice rink. USA Hockey Core Values The following core values of USA Hockey are adopted to guide the association’s members in their planning, programming and play, both now and in the future. DYHA honors these core values SPORTSMANSHIP - Foremost of all values is to learn a sense of fair play. -

2013-14 Hockey Hall of Fame Donor List

2013-14 Hockey Hall of Fame Donor List The Hockey Hall of Fame would like to express its sincere appreciation to the following donors: Leagues/Associations: American Hockey League, Canada West Universities Athletic Association, Canadian Deaf Ice Hockey Federation, Canadian Hockey League, Central Hockey League, College Hockey Inc., ECHL, National Hockey League, Ontario Hockey League, Quebec Major Junior Hockey League, United States Hockey League, Western Hockey League Companies/Organizations: Canadian Baseball Hall of Fame, CloutsnChara, Colin Barrow Toronto Valuations Inc., Ilitch Holdings, Inc., Maiquay Company Ltd., Nike Canada, Reebok CCM Hockey, The MeiGray Group, The Upper Deck Company IIHF Members: International Ice Hockey Federation, Austrian Ice Hockey Association, Hockey Canada, Finnish Ice Hockey Association, Hong Kong Ice Hockey Association Ltd., Hungarian Ice Hockey Federation, New Zealand Ice Hockey Federation, Ice Hockey Federation of Russia, Ice Hockey Federation of Slovenia, Ice Hockey UK Hockey Clubs: Alaska Aces, Anaheim Ducks, Brampton Beast, Chicago Blackhawks, Chicago Wolves, Clarkson University Golden Knights, Cornwall Colts, Dallas Stars, Dubuque Fighting Saints, Edmonton Oilers, Edmonton Oil Kings, Elrose Aces, Erie Otters, Färjestad BK, Guelph Storm, Indiana Ice, Iowa Wild, London Knights, Los Angeles Kings, Mettalurg Magnitogorsk, New Jersey Devils, North Bay Battalion, Nottingham Panthers, Peterborough Petes, Portland Winterhawks, Prince Albert Mintos, Rosetown Red Wings, St. Louis Blues, Texas Stars, Toronto Maple Leafs, Union College Dutchmen, Université de Montréal Carabins, University of Alberta Golden Bears, University of Saskatchewan Huskies, Utica Comets, Val d'Or Foreurs, Weyburn Gold Wings, Yale University Bulldogs, Yorkton Terriers Individuals: Jim Agnew, Michael Anscombe, Bill Armstrong, Camille Baccanale, Randy Baran, Charles "Rusty" Barton, Gerald Bayza, Annabel Begg, Barbara Benjamin, Aki Petteri Berg, Jonathan Bernier, Taylor Best, Kevin Bonish, Tyler Bozak, Claude R. -

2017-18 AHL Regular Season

TORONTO MARLIES VS STOCKTON HEAT Wednesday, February 24, 2021 Scotiabank Saddledome — Calgary, AB 6:00 p.m. (MST) — AHL Game #406 RECORD: 4-2-0-0 RECORD: 0-2-0-0 TEAM GAME: 7 HOME RECORD: 0-0-0-0 TEAM GAME: 3 HOME RECORD: 0-2-0-0 AWAY GAME: 7 AWAY RECORD: 4-2-0-0 HOME GAME: 3 AWAY RECORD: 0-0-0-0 # GOALTENDER GP W L OT GAA SV% # GOALTENDER GP W L OT GAA SV% 1 Ian Scott 0 0 0 0 0.00 0.000 1 Louis Domingue 0 0 0 0 0.00 0.000 29 Andrew D'Agostini 6 4 2 0 1.86 0.933 30 Hayden Lavigne 0 0 0 0 0.00 0.000 31 Jeremy Link 0 0 0 0 0.00 0.000 31 Max Paddock 0 0 0 0 0.00 0.000 45 Kai Edmonds 0 0 0 0 0.00 0.000 32 Dustin Wolf 1 0 1 0 10.65 0.545 40 Garret Sparks 2 0 1 0 4.57 0.841 # P PLAYER GP G A P SOG PIM # P PLAYER GP G A P SOG PIM 6 D Teemu Kivihalme 6 1 2 3 12 6 2 D Connor Mackey 2 0 0 0 1 0 7 D Timothy Liljegren 6 0 5 5 14 4 3 D Greg Moro 0 0 0 0 0 0 10 LW Zack Trott 2 0 0 0 0 0 5 D Colton Poolman 2 0 0 0 4 0 11 C Kalle Kossila 0 0 0 0 0 0 6 D Alex Petrovic 2 0 0 0 3 2 12 RW Jeremy McKenna 2 0 2 2 2 0 7 D Noah King 0 0 0 0 0 0 14 C Adam Brooks 6 2 5 7 14 4 8 D Zach Leslie 2 0 0 0 2 2 15 C Rourke Chartier 6 0 3 3 9 0 11 RW Matthew Phillips 2 0 0 0 1 0 17 LW Rich Clune 6 2 0 2 6 12 14 D CJ Lerby 2 0 0 0 1 0 18 LW Kenny Agostino 6 2 5 7 18 2 16 C Mark Simpson 1 0 1 1 1 0 19 RW Gordie Green 0 0 0 0 0 0 17 RW Dmitry Zavgorodniy 2 0 0 0 3 0 21 D Joseph Duszak 6 1 3 4 10 0 20 LW Alex Gallant 2 1 0 1 3 7 24 RW Cole MacKay 0 0 0 0 0 0 22 RW Giorgio Estephan 0 0 0 0 0 0 25 D Dakota Krebs 0 0 0 0 0 0 23 LW Justin Kirkland 2 0 0 0 6 0 27 D Riley McCourt -

Sport-Scan Daily Brief

SPORT-SCAN DAILY BRIEF NHL 6/18/2021 Boston Bruins Florida Panthers 1215913 Bruins re-sign Anton Blidh 1215938 Despite leading Panthers’ massive turnaround, 1215914 NHL Players Show Massive Bergeron RespeCt In NHLPA Quenneville misses out on JaCk Adams Award Poll 1215939 Panthers’ Bill Zito named finalist for general manager of 1215915 Can Jake DeBrusk’s relationship with Bruce Cassidy be the year fixed? What it could mean for the Bruins 1215940 Rod Brind’Amour beats Florida Panthers Joel Quenneville for JaCk Adams Buffalo Sabres 1215941 Florida Panthers Bill Zito named GM of the Year Finalist 1215916 Kyle Williams, John Beilein among 12 new members of 1215942 Panthers 2020-21 Report Card: Jonathan Huberdeau Buffalo Sports Hall of Fame 1215917 Sabres goalie prospeCt Erik Portillo preparing to take over Los Angeles Kings starting job at Michigan 1215943 2021 NHLPA Players Poll – Doughty, Kopitar, Reverse Retro Jerseys mentioned Calgary Flames 1215918 Foreurs Captain Pelletier finalist for QMJHL's MVP award Minnesota Wild 1215919 NHL award-winner Hodgson part of Calgary hero 1215944 Wild sign new affiliate deal with Iowa Heartlanders of community helping kids in sports ECHL Carolina Hurricanes Montreal Canadiens 1215920 Division Championship earns Canes’ Brind’Amour NHL 1215945 Canadiens defenCeman Jeff Petry is the latest in a saga of coach of the year award NHL postseason toughness 1215921 Brind’Amour, Waddell talk Hamilton, SveChnikov and the 1215946 Fleury, PriCe take the spotlight as Knights to face the rest of the Canes’ to-do list -

Hphl Players Drafted to Ushl

HPHL PLAYERS DRAFTED TO USHL USHL 2014 Draft - PHASE I USHL 2014 Draft - PHASE II Round Pick Player USHL Team Round Pick Player Current Team USHL Team 1 4 MITCH LEWANDOWSKI • LW •Detroit Honeybaked Des Moines Buccaneers 1 2 Lukas Craggs Team Illinois Youngstown Phantoms 1 5 DOMINICK MERSCH • F •Chicago Mission Minor Lincoln Stars 1 10 David Keefer Detroit Honeybaked Muskegon Lumberjacks 1 7 *MITCH ELIOT • D •Detroit Honeybaked Minor Muskegon Lumberjacks 1 17 Ryan Blankemeier Chicago Young Americans Chicago Steel 1 11 KEEGHAN HOWDESHELL • C •Detroit Compuware Muskegon Lumberjacks 2 27 Maskim Dzhioshvili Detroit Little Caesars Bloomington Thunder 1 12 *HUGH MCGING • F •Chicago Mission Cedar Rapids RoughRiders 2 30 Tyler Parsons Detroit Little Caesars Cedar Rapids RoughRiders 2 1 COLE GALLANT • RW •Detroit Honeybaked Minor Fargo Force 3 43 Chris Allemon Detroit Little Caesars Des Moines Buccaneers 2 4 NICHOLAS MCKEEBY • RD •Detroit Honeybaked Des Moines Buccaneers 4 71 Kenny Shemanske Chicago Young Americans Waterloo Black Hawks 2 11 *WILLIE KNIERIM • F •Chicago Mission Dubuque Fighting Saints 8 123 Walker Deuhr Chicago Young Americans Sioux City Musketeers 2 14 SEMANDEL, ALEC • LD •Chicago Mission Minor Cedar Rapids RoughRiders 8 130 Andrew Madej Chicago Mission Green Bay Gamblers 3 2 ALEC MAHALAK • RD •Detroit Compuware Minor Youngstown Phantoms 9 141 Kevin Fitzgerald Chicago Mission Chicago Steel 3 4 NOAH LALONDE • C •Detroit Honeybaked Minor Des Moines Buccaneers 11 174 Garrett Hallford Detroit Honeybaked Muskegon Lumberjacks 3 5 RYAN -

Four Time Clark Cup Champions - 23 NHL Alumni

Four Time Clark Cup Champions - 23 NHL Alumni G A M E I N F O R M A T I O N Broadcast: bucshockey.com Contact Scott Montesano office: 515-278-2827 ext 7027 // cell: 315-292-0064 // [email protected] // @scottmontesano Des Moines Buccaneers Friday January 23, 2015 Dubuque Fighting Saints 16-11-6; 38 PTS 7:35pm 20-9-3; 43 PTS Mystique Community Ice Center Dubuque, IA AT A GLANCE Longest Point Streak The Bucs are on a seven- Power Play Clicks in Wins Des Moines has been game point streak (4-0-3), matching a seven-game near the top in power play stats most of the season streak to open the season. so its no surprise that when the team wins the Place in Western Conference: 4 The team’s longest point streak in recent power play is key. Points Back/Ahead: -5 seasons was a 10-game streak in 2005-2006. In their 17 victories, the Bucs power play is hit- Most Points Ahead for First: +1 Getting to 40 With their victory on Saturday, the ting at 28.9% (21/74) Bucs will reach 40pts in 34 games. Halfway Home With their game on Jan. 4th the Most Points Behind for First: -7 It took the team 45 games last season. Buccaneers reached the statistical midway point of High Water Mark: 9-3-1 (+5) (2) Road Power Play Goal Drought The Bucs have the season. Since 2009-2010, the Buccaneers had Low Water Mark: 13-11-4 (-2) had a solid power play all season. -

Chicago Steel Postgame Notes – January 3, 2021 at Dubuque Fighting Saints Game 15, Road Game 6

Chicago Steel Postgame Notes – January 3, 2021 at Dubuque Fighting Saints Game 15, Road Game 6 Final Score 1 2 3 OT F STEEL 0 0 1 0 1 Dubuque 1 0 0 1 2 (Mystique Community Ice Arena – Dubuque, IA) Chicago Steel Postgame Central Records: STEEL: 11-2-2-0 (Road: 3-1-2-0); 24 pts. Dubuque: 5-11-0-0 (Home: 3-7-0-0); 10 pts. Game Sheet Quick Stats: Shots PP PK PIM STEEL 24 0-4 0-0 2 Dubuque 24 0-0 4-4 23 Notes: • The Steel fell 2-1 in overtime against the Dubuque Fighting Saints on Sunday afternoon at Mystique Community Ice Center in Iowa … The Steel could not capitalize on the power play for just the second time this season, going 0-for-4 (0.0%) with the man advantage … Chicago did not face any shorthanded time for the first time this year … Both teams registered 24 shots on goal in the game. • Chicago extended its point streak to 11 games in a row earning a point in the standings. • Matt Coronato extended his USHL leading total to 32 points (14G, 18A) with a goal in the overtime loss. The Harvard-bound forward has reached the scoresheet in all 15 games for Chicago this season. • Erik Middendorf extended his point streak to 15 games with his 13th helper of the season. The Chicago captain shares second in the USHL with 24 points (11G, 13A) this season. • Forward Sean Farrell picked up a helper, pushing his current point streak to 11 games (6G, 13A).