Feasibility Study for a New Visitor Experience at Prestonpans, East Lothian

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fentoun Green

FENTOUN GREEN GULLANE CALA HOMES FENTOUN GREEN OFF MAIN STREET GULLANE EAST LOTHIAN EH31 2EE CALA.CO.UK Local photography of Gullane Beach is courtesy of Richard Elliott FENTOUN GREEN ESCAPE TO CALMER SURROUNDINGS Situated to the eastern edge of the idyllic seaside haven of Gullane, this select development of light and spacious family homes enjoys a tranquil semi-rural feel, with picturesque views of the mature tree-lined setting and stunning countryside beyond. Part of CALA’s beautiful East Lothian Range, Fentoun Green features an exclusive collection of 3, 4 and 5 bedroom detached and semi-detached homes. Boasting plentiful open green spaces, you can appreciate a superior quality of life in relaxed surroundings, with the convenience of everyday amenities, top performing schools and commuter links still in close reach. Local photography is courtesy of Chris Robson Photography 3 GULLANE A LIFE OF COASTAL BLISS You can relax or be as active as you like with Gullane’s many outdoor pursuits, including mile after mile of nature walks, award-winning beaches and world-famous golf courses. The scenic John Muir Way passes by Fentoun Green, while the golden sands of Gullane Bents and Aberlady Bay are the perfect settings for taking in the beautiful coastline. Or discover the trails, café and bar at Archerfield Walled Garden, where you can sample the famous Archerfield Craft Ales. Every year, golf enthusiasts from around the globe flock to the championship links courses of Gullane and world-famous Muirfield, as well as the highly regarded clubs of Archerfield and Renaissance nearby. Gullane’s quaint main street has a selection of shops, top eateries, cafés and other amenities, while the desirable town of North Berwick is only a few miles away, as are plentiful family attractions including Dirleton Castle, the Scottish Seabird Centre, National Museum of Flight and Seacliff Stables. -

Brückenschlag in Der Krise Finden Investoren Und Immobilienmanager Zueinander Inhalt Zur Sache

Ausgabe 1 | 2010 RAUM mehr Das Immobilienmagazin von Union Investment Zuversicht US-Markt steht vor der Wende Lichtblick Nachhaltige Energiekonzepte Brückenschlag In der Krise finden Investoren und Immobilienmanager zueinander INHALT ZUR SACHE TITEL Wer seinen Immobi- Plädoyer für eine weltweite ökosoziale Marktwirtschaft lienbestand in 4 Ein hartes Stück Arbeit Die Branche besinnt sich wieder von Franz Josef Radermacher Schuss hält, punktet auf die bewährten Instrumente des Immobiliengeschäfts auch in schwierigen Zeiten. Seite 4 7 Interview Hanspeter Gondring, Studienleiter an der Dualen Hochschule Baden-Württemberg, Stuttgart 9 Studie Immobilien-Investitionsklimaindex von Union Investment steigt erneut ie Welt befindet sich in einer extrem schwierigen Situation. Als Allerdings reicht technischer Fortschritt alleine nicht. Parallel müssen Folge der wirtschaftlichen Globalisierung sieht sich das welt- gesellschaftliche Innovationen durchgesetzt werden, um die Nutzung MÄRKTE Dökonomische System in einem Prozess zunehmender Entfesse- von Ressourcen sinnvoll zu begrenzen. Dies ist heute ein Thema der 10 US-Markt Investoren beurteilen die Märkte New York, lung und Entgrenzung. Vor allem das rasche Bevölkerungswachstum Global Governance. Das bedeutet, es müssen gleichzeitig zwei For- Chicago, Seattle und Washington weiterhin unterschiedlich hin zu zehn Milliarden Menschen und das wirtschaftliche Aufholen men von Innovationen verfolgt werden: diejenige im Bereich Technik, 14 Budgethotels Preiswerte Anbieter profitieren von der Krise großer Schwellenländer wie China, Indien und Brasilien stellen unter Design und neue Materialien und diejenige im Bereich Governance, Umwelt- und Ressourcenaspekten eine gigantische Herausforderung also der Gestaltung politisch-gesellschaftlicher Strukturen. Gelingt PORTFOLIO dar. Angesichts hoher CO2-Emissionen droht womöglich schon bald es, beide in einer klugen Zukunftsstrategie zu verknüpfen, gibt es 18 Institutionelle Investoren Versicherungen und Versorgungs- die Klimakatastrophe. -

'The Neo-Avant-Garde in Modern Scottish Art, And

‘THE NEO-AVANT-GARDE IN MODERN SCOTTISH ART, AND WHY IT MATTERS.’ CRAIG RICHARDSON DOCTOR OF PHILOSOPHY (BY PUBLISHED WORK) THE SCHOOL OF FINE ART, THE GLASGOW SCHOOL OF ART 2017 1 ‘THE NEO-AVANT-GARDE IN MODERN SCOTTISH ART, AND WHY IT MATTERS.’ Abstract. The submitted publications are concerned with the historicisation of late-modern Scottish visual art. The underpinning research draws upon archives and site visits, the development of Scottish art chronologies in extant publications and exhibitions, and builds on research which bridges academic and professional fields, including Oliver 1979, Hartley 1989, Patrizio 1999, and Lowndes 2003. However, the methodology recognises the limits of available knowledge of this period in this national field. Some of the submitted publications are centred on major works and exhibitions excised from earlier work in Gage 1977, and Macmillan 1994. This new research is discussed in a new iteration, Scottish art since 1960, and in eight other publications. The primary objective is the critical recovery of little-known artworks which were formed in Scotland or by Scottish artists and which formed a significant period in Scottish art’s development, with legacies and implications for contemporary Scottish art and artists. This further serves as an analysis of critical practices and discourses in late-modern Scottish art and culture. The central contention is that a Scottish neo-avant-garde, particularly from the 1970s, is missing from the literature of post-war Scottish art. This was due to a lack of advocacy, which continues, and a dispersal of knowledge. Therefore, while the publications share with extant publications a consideration of important themes such as landscape, it reprioritises these through a problematisation of the art object. -

Written Guide

The tale of a tail A self-guided walk along Edinburgh’s Royal Mile ww.discoverin w gbrita in.o the stories of our rg lands discovered th cape rough w s alks 2 Contents Introduction 4 Route map 5 Practical information 6 Commentary 8 Credits © The Royal Geographical Society with the Institute of British Geographers, London, 2015 Discovering Britain is a project of the Royal Geographical Society (with IBG) The digital and print maps used for Discovering Britain are licensed to the RGS-IBG from Ordnance Survey Cover image: Detail from the Scottish Parliament Building © Rory Walsh RGS-IBG Discovering Britain 3 The tale of a tail Discover the stories along Edinburgh’s Royal Mile A 1647 map of The Royal Mile. Edinburgh Castle is on the left Courtesy of www.royal-mile.com Lined with cobbles and layered with history, Edinburgh’s ‘Royal Mile’ is one of Britain’s best-known streets. This famous stretch of Scotland’s capital also attracts visitors from around the world. This walk follows the Mile from historic Edinburgh Castle to the modern Scottish Parliament. The varied sights along the way reveal Edinburgh’s development from a dormant volcano into a modern city. Also uncover tales of kidnap and murder, a dramatic love story, and the dramatic deeds of kings, knights and spies. The walk was originally created in 2012. It was part of a series that explored how our towns and cities have been shaped for many centuries by some of the 206 participating nations in the 2012 Olympic and Paralympic Games. -

0-208 Artwork

The North*s Original Free Arts Newspaper + www.artwork.co.uk Number 208 Pick up your own FREE copy and find out what’s really happening in the arts May - June 2019 Shedding Old Coats – one of the haunting works by Karólína Lárusdóttir from a recent exhibition of her work at the Castle Gallery, Inverness. In- side: Denise Wilson tells the story of this Anglo-Icelandic artist. INSIDE: Cultivating Patrick Geddes :: Tapestry Now Victoria Crowe at City Arts :: A northern take on Turner artWORK 208 May/June 2019 Page 2 artWORK 208 May/June 2019 Page 3 CASTLE GALLERY KELSO POTTERY 100 metresmetres behind behind the Kelso Kelso Abbey in the Knowes Car Park. Abbey in The Knowes Car Park. Mugs, jugs, bowls and “TimePorridge Tablets” and Soup fired Bowls, in Piggy theBanks Kelso and Goblets,Pit Kiln. Ovenproof OpenGratin DishesTuesday & Pit-fi to Saturday red Pieces. Open Mon, 10 Braemar Road, 10am-1pm and 2pm-5pm Ballater Thurs, Fri and TelephoneOpen Tues -(01573) Sat 10 to224027 1 - 2 to 5 Sat 10.00 -5.00 AB35 5RL NEWTelephone: SHOP, (01573) DISABLED 224027 ACCESS larksgallery.com facebook/Larks Gallery 013397 55888 CHECK OUT OUR ROBERT GREENHALF OTHER TITLES opening 17th may Jane B. Gibson RMS Wild Wings Over Lonely Shores Scotland’s Premier artWORK kirsty lorenz richard bracken 7th - 29th June www.artwork.co.uk Miniture Portrait Oils and woodcuts inspired by the birds of our jim wright kirstie cohen Painter coast and wetlands by Robert Greenhalf SWLA with hand-carved birds by Michael Lythgoe. West Highland www.resipolestudios.co.uk Open Studio/Gallery Castle Gallery, 43 Castle St, Inverness, IV2 3DU 01463 729512 Wayfarer loch sunart | acharacle | argyll | scotland | ph36 4hx EVERY FRIDAY [email protected] www.westhighlandwayfarer.co.uk or by appointment any www.castlegallery.co.uk THE other time. -

Sons of Crispin

Sons of Crispin Sons of Crispin: The St Crispin Lodges of Edinburgh and Scotland By Sandra M. Marwick Sons of Crispin: The St Crispin Lodges of Edinburgh and Scotland, by Sandra M. Marwick This book first published 2014 Cambridge Scholars Publishing 12 Back Chapman Street, Newcastle upon Tyne, NE6 2XX, UK British Library Cataloguing in Publication Data A catalogue record for this book is available from the British Library Copyright © 2014 by Sandra M. Marwick All rights for this book reserved. No part of this book may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. ISBN (10): 1-4438-6361-0, ISBN (13): 978-1-4438-6361-2 TABLE OF CONTENTS List of Illustrations .................................................................................... vii Acknowledgements .................................................................................... ix Abbreviations .............................................................................................. x Chapter One ................................................................................................. 1 Introduction: Why Crispin? Chapter Two .............................................................................................. 17 St Crispin as Patron Saint Chapter Three ............................................................................................ 52 The Memorable Crispin Chapter Four ............................................................................................. -

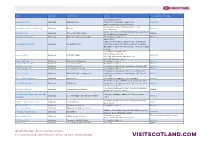

Information Correct at Time of Issue See

NAME LOCATION DESCRIPTION NOTES PLAN YOUR VISIT / BOOK Pre-booking required Craigmillar Castle Edinburgh Medieval castle Till 31st Oct: open daily, 10am to 4pm Book here Winter opening times to be confirmed. Pre-booking required. Some glasshouses closed. Royal Botanic Garden Edinburgh Edinburgh Gardens Book here Free admission Castle closed. Free entry to the grounds (open daily 08.00- Lauriston Castle Edinburgh 16th-century tower house Walk-in 19.00) and Mimi's Cafe on site. Royal Yacht Britannia Edinburgh Attraction - former royal yacht Pre-booking recommended. Book here Shop is open Tours have been put on hold for the time being due to Edinburgh Gin Distillery Edinburgh Gin distillery tours restrictions in force from 9th Oct, and can't be booked - until further notice. Wee Wonders Online Tasting available instead. Pre-booking recommended. Currently open Thu-Mon Georgian House Edinburgh New Town House Book here 1st - 29th Nov: open Sat-Sun, 10am-4pm 30th Nov- 28th Feb: closed Edinburgh Castle Edinburgh Main castle in Edinburgh Pre-booking required. Book here Real Mary King's Close Edinburgh Underground tour Pre-booking required. Book here Our Dynamic Earth Edinburgh Earth Science Centre Pre-booking required. Open weekends in October only. Book here Edinburgh Dungeon Edinburgh Underground attraction Pre-booking required. Book here Pre-booking recommended. The camera show is not Camera Obscura Edinburgh World of Illusions - rooftop view running at the moment - admission price 10% lower to Book here reflect this. Palace of Holyroodhouse Edinburgh Royal Palace Pre-booking recommended. Open Thu-Mon. Book here Pre-booking required. Whisky is not consumed within Scotch Whisky Experience Edinburgh Whisky tours the premises for now, instead it's given at the end of Book here the tours to take away. -

Regno Unito Regno Unito

REGNO UNITO PROFILO DEL MERCATO TURISTICO 2007 REGNO UNITO Profilo del mercato turistico 2007 1. PROFILO DI SINTESI PROFILO ECONOMICO UK • Popolazione: (Stima a metà 2006): 60.6 milioni • Popolazione con maggiore capacita’ di spesa (Sud Est/Londra) • Tasso di crescita del PIL: 2,7% (2006) • Tasso di disoccupazione: 5,5% (marzo 2007) • Tasso di inflazione: 1,8% (Settembre 2007) – Target 2%. • Salario medio annuale: £24,301 VIE DI ACCESSO • Per l’Italia non e’ richiesto alcun visto • 22 Aeroporti britannici sono collegati con l’Italia • Nel 2006 3.073.000 visitatori britannici si sono recati in Italia in aereo • Incrementano coloro che vanno in Italia via mare da 163.000 a 251.000 (+54%). IL MERCATO TURISTICO IN GENERALE 2006 • Outbound 2006: 69.5 milioni di visitatori britannici all’estero (+4,6%) di cui 55.2 mil. in Europa (79,4%) • La spesa totale per turismo e’ stata di £34.411.000 (+7%) di cui £21.344 mil. in Europa. • La spesa media per vacanza e’ stata di £495. DINAMICHE DEL MERCATO TURISTICO • Nel 2006 45.287.000 sono stati i viaggi per vacanza di cui 18.951 mil. i pacchetti tutto compreso e 26.336 mil. i viaggi indipendenti. I viaggi per affari sono stati pari a 9.102 mil. e le visite a parenti e amici 11.963 mil. I restanti 3.184 mil costituiscono il mercato di nicchia. • L’affluenza maggiore in Italia (2006) si e’ registrata nel trimestre Luglio- Settembre. I FLUSSI VERSO L’ITALIA E LA CONCORRENZA • Dati Ufficio Statistica UK : nel 2006 l’Italia e’ la quinta destinazione preferita con una quota di mercato pari al 4,8% con 3.380.000 mil. -

Janice Mcnab — Curriculum Vitae

Janice McNab — Curriculum vitae Born in Aberfeldy, Scotland. Lives and works in The Hague. EDUCATION 2019 PhD, Amsterdam School for Cultural Analysis, University of Amsterdam 1997 MFA, Glasgow School of Art. Exchange to Hunter College of the Arts, New York 1986 BA, Edinburgh College of Art EMPLOYMENT 2020–2022 Post-doc researcher, ACPA, University of the Arts, The Hague and Leiden University 2015–ongoing Head, MA Artistic Research, The Royal Academy of Art, The Hague Previous teaching experience includes: 2013–2015 Thesis supervisor, Piet Zwart Masters Institute, Rotterdam 2011–2015 Thesis supervisor, Gerrit Rietveld Academy, Amsterdam 2009–2015 Studio tutor, The Royal Academy of Art, The Hague 2006–2008 Thesis supervisor, Piet Zwart Masters Institute, Rotterdam 1997–1999 Studio tutor, Glasgow School of Art External examiner, visiting artist and guest lecturer at various art schools across Britain and Europe, including, in 2020, lectures for DutchCulture.nl Brexit debates and ASCA, University of Amsterdam 30th anniversary conference. OTHER PROFESSIONAL EXPERIENCE 2018–ongoing Chair, Board of 1646 Experimental Art Space, The Hague 2009–2015 Co-editor, If I Can’t Dance Publications, Amsterdam 2008–2009 Mentor, My Miyagi Young Curator programme, Stichting Mama, Rotterdam 2006–2009 Co-curator, Artis Den Bosch, Art Space, ‘s Hertogenbosch 1/4 SELECTED EXHIBITIONS AND PROJECTS 2020 Slits and a Skull, Bradwolff Projects, Amsterdam A New World, Stroom, The Hague 2016 Hollandaise, The Dutch Embassy and New Art Projects, London 2015 Undone, Bradwolff -

Histoire Des Collections Numismatiques Et Des Institutions Vouées À La Numismatique

HISTOIRE DES COLLECTIONS NUMISMATIQUES ET DES INSTITUTIONS VOUÉES À LA NUMISMATIQUE Numismatic Collections in Scotland Scotland is fortunate in possessing two major cabinets of international signifi- cance. In addition over 120 other institutions, from large civic museums to smaller provincial ones, hold collections of coins and medals of varying size and impor- tance. 1 The two main collections, the Hunterian held at the University of Glasgow, and the national collection, housed at the National Museums of Scotland in Edinburgh, nicely complement each other. The former, based on the renowned late 18th centu- ry cabinet of Dr. William Hunter, contains an outstanding collection of Greek and Roman coins as well as important groups of Anglo-Saxon, medieval and later English, and Scottish issues along with a superb holding of medals. The National Museums of Scotland house the largest and most comprehensive group of Scottish coins and medals extant. Each collection now numbers approximately 70,000 speci- mens. The public numismatic collections from the rest of Scotland, though perhaps not so well known, are now recorded to some extent due to a National Audit of the coun- try’s cultural heritage held by museums and galleries carried out by the Scottish Museums Council in 2001 on behalf of the Scottish Government. 2 Coins and Medals was one of 20 collections types included in the questionnaire, asking for location, size and breakdown into badges, banknotes, coins, medals, tokens, and other. Over 12 million objects made up what was termed the Distributed National Collection, of which 3.3% consisted of approximately 68,000 coins and medals in the National Museums concentrated in Edinburgh and 345,000 in the non-nationals throughout the rest of the country. -

Asva Visitor Trend Report - September 2009/2010

ASVA VISITOR TREND REPORT - SEPTEMBER 2009/2010 OVERVIEW Visitor numbers for September 2009/2010 were received from 218 sites. 9 sites requested confidentiality, and although their numbers have been included in the calculations, they do not appear in the tables below. There are 14 sites for which there is no directly comparable data for 2009. The 2010 figures do appear in the table below for information but were not included in the calculations. Thus, directly comparable data has been used from 204 sites. From the usable data from 204 sites, the total number of visits recorded in September 2010 was 1,551,800 this compares with 1,513,324 in 2009 and indicates an increase of 2.5% for the month. Weatherwise, September was a changeable month with rain and strong winds, with average rainfall up to 150% higher than average Some areas experienced localised flooding and there was some disruption to ferry and rail services. The last weekend of the month saw clear skies in a northerly wind which brought local air frosts to some areas and a few places saw their lowest temperatures in September in 20 to30 years. http://news.bbc.co.uk/weather/hi/uk_reviews/default.stm September 2009 September 2010 % change SE AREA (156) 1,319,250 1,356,219 2.8% HIE AREA (48) 194,074 195,581 0.8% SCOTLAND TOTAL (204) 1,513,324 1,551,800 2.5% Table 1 – Scotland September 2009/2010 SE AREA In September 2010 there were 1,356,219 visits recorded, compared to 1,319,250 during the same period in 2009, an increase of 2.8%. -

Asva Visitor Trend Report - January 2011/2012

ASVA VISITOR TREND REPORT - JANUARY 2011/2012 OVERVIEW Visitor figures for January 2011/2012 were received from 215 sites. 10 sites requested confidentiality, and although their numbers have been included in the calculations, they do not appear in the tables below. 75 sites noted that they were closed for the season. The Riverside Museum in Glasgow was not open in 2010 so their figures for 2011 are shown in the table below for reference but have not been included in the calculation. And following discussion with colleagues, we have published the 2010 and 2011 figures for the National Museum of Scotland but these have not been included in the calculations. The reason for this decision is that the site was only partially open in 2010 whilst it was undergoing major refurbishment and upgrade, prior to the re-opening of the whole site in the summer of 2011. As can be seen, the total increase in visitor numbers is just under 300%, and to include these considerable numbers in the calculations would skew the national figure (see below). In addition, there are 6 sites for which there was no comparable data Comparable data was therefore received from 134 sites. The total number of visits recorded in January 2011 was 788,707 this compares with 733,699 in 2010 and indicates an increase of 7.5%. January 2012 had much better overall weather conditions than 2011 which saw widespread disruption because of low temperatures, sleet and snow. It was a relatively mild month, although the start of the month carried over some stormy conditions from December.