Anglogold A/R Front (P1-40)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Arend J Hoogervorst1 B.Sc.(Hons), Mphil., Pr.Sci

Audits & Training Eagle Environmental Arend J Hoogervorst1 B.Sc.(Hons), MPhil., Pr.Sci. Nat., MIEnvSci., C.Env., MIWM Environmental Audits Undertaken, Lectures given, and Training Courses Presented2 A) AUDITS UNDERTAKEN (1991 – Present) (Summary statistics at end of section.) Key ECA - Environmental Compliance Audit EMA - Environmental Management Audit EDDA -Environmental Due Diligence Audit EA- External or Supplier Audit or Verification Audit HSEC – Health, Safety, Environment & Community Audit (SHE) – denotes safety and occupational health issues also dealt with * denotes AJH was lead environmental auditor # denotes AJH was contracted specialist local environmental auditor for overseas environmental consultancy, auditing firm or client + denotes work undertaken as an ICMI-accredited Lead Auditor (Cyanide Code) No of days shown indicates number of actual days on site for audit. [number] denotes number of days involved in audit preparation and report write up. 1991 *2 day [4] ECA - AECI Chlor-Alkali Plastics, Umbogintwini, KwaZulu-Natal, South Africa. November 1991. *2 day [4] ECA - AECI Chlor-Alkali Plastics- Environmental Services, Umbogintwini, KwaZulu-Natal, South Africa. November 1991. *2 Day [4] ECA - Soda Ash Botswana, Sua Pan, Botswana. November 1991. 1992 *2 Day [4] EA - Waste-tech Margolis, hazardous landfill site, Gauteng, South Africa. February 1992. *2 Day [4] EA - Thor Chemicals Mercury Reprocessing Plant, Cato Ridge, KwaZulu-Natal, South Africa. March 1992. 2 Day [4] EMA - AECI Explosives Plant, Modderfontein, Gauteng, South Africa. March 1992. *2 Day [4] EMA - Anikem Water Treatment Chemicals, Umbogintwini, KwaZulu-Natal, South Africa. March 1992. *2 Day [4] EMA - AECI Chlor-Alkali Plastics Operations Services Group, Midland Factory, Sasolburg. March 1992. *2 Day [4] EMA - SA Tioxide factory, Umbogintwini, KwaZulu-Natal, South Africa. -

Integrated Report 2016 Contents

INTEGRATED REPORT 2016 CONTENTS To create value for our shareholders, our employees and our business and social partners through safely and responsibly exploring, mining and marketing our products. Our primary focus is gold, but we will pursue value creating opportunities in other minerals OUR where we can leverage our OUR existing assets, skills and MISSION experience to enhance the VALUES delivery of value. HOW TO USE THIS REPORT This is an interactive PDF. Navigation tools at the top left of each page and within the report are indicated as follows. Interactive indicator Contents page Print Previous page Next page Undo Search Website Email Download Page reference Video INTEGRATED REPORT 2016 1 SECTION 1 OVERVIEW About our reports / 3 Directors’ statement of responsibility / 4 Corporate profile / 5 Chairman’s letter / 7 Highlights of the year / 10 CEO’s review / 11 An overarching view of our reports, the Chairman’s message to our stakeholders, the profile of the company and the year’s highlights, as well as the CEO’s account of delivery on the last year’s commitments and an outlook for the year ahead. INTEGRATED REPORT 2016 2 Picture: Kibali, DRC ABOUT OUR REPORTS AngloGold Ashanti Limited’s Notice of Annual General Meeting and SCOPE AND BOUNDARY investors. Stakeholders are also referred to (AngloGold Ashanti’s) 2016 suite Summarised Financial Information (Notice OF REPORTS the supplementary reports in this suite and the of Meeting) <NOM> is produced and posted <SDR>, in particular, for additional information. The 2016 suite of reports covers the year from of reports is made up as follows: to shareholders in line with the JSE Listings 1 January to 31 December 2016. -

Universidade Federal De Minas Gerais Escola De Arquitetura Artur

Universidade Federal de Minas Gerais Escola de Arquitetura Artur Magnani Figueiredo O resgate da centralidade da Mina Grande em Nova Lima: história, memória e desenvolvimento Belo Horizonte 2017 Artur Magnani Figueiredo O resgate da centralidade da Mina Grande em Nova Lima: história, memória e desenvolvimento Dissertação apresentada ao Programa de Pós- -Graduação em Ambiente Construído e Patrimônio Sustentável da Escola de Arquitetura da Universidade Federal de Minas Gerais, como requisito parcial à obtenção do título de Mestre. Área de Concentração: Ambiente Construído e Patrimônio Sustentável Área Básica: Interdisciplinar Linha de pesquisa: Paisagem e Ambiente Orientadora: Prof.ª Dra. Stael de Alvarenga Pereira Costa Belo Horizonte 2017 FICHA CATALOGRÁFICA F476r Figueiredo, Artur Magnani. O resgate da centralidade da Mina Grande em Nova Lima [manuscrito] : história, memória e desenvolvimento / Artur Magnani Figueiredo. - 2017. 152 f. : il. Orientadora: Stael de Alvarenga Pereira Costa. Dissertação (mestrado) – Universidade Federal de Minas Gerais, Escola de Arquitetura. 1. Nova Lima (MG) - História - Teses. 2. Mina Grande (MG) - Teses. 3. Ouro - Minas e mineração - Teses. 4. Ouro - Aspectos sociais - Teses. 5. Patrimônio histórico - Teses. 6. Patrimônio cultural - Teses. I. Costa, Stael de Alvarenga Pereira. II. Universidade Federal de Minas Gerais. Escola de Arquitetura. III. Título. CDD 622 Ficha catalográfica: Biblioteca Raffaello Berti, Escola de Arquitetura/UFMG AGRADECIMENTOS À professora e orientadora Stael, que se dedicou na construção deste trabalho, com contribuições que viabilizaram o seu caráter interdisciplinar. À CAPES, pela bolsa concedida nestes dois anos de estudo e que propiciaram a realização deste trabalho. Aos professores Yacy-Ara Froner Gonçalves e Fabiano Lopes de Paula, pelas contribuições valiosas na banca de qualificação. -

Report for the Quarter Ended 31 March 2014

Report for the quarter ended 31 March 2014 Production 1.06Moz improving 17% yeara -on-year and well ahead of 950Koz–1Moz guidance Total cash costs decrease 14% year-on-year to $770/ooz, beating guidance of $800/oz-$850/oz All-in-sustaining cost (AISC) decreased by 22% year-on-year to $993/oz on lower capex, cash costs and overhead costs Adjusted headline earnings $119m, or 29 US cents per share International operations see 34% rise in output to 765,000oz year-on-year, and 22% drop in AISC to $972/oz South Africa production down 11% to 290,0000z year-on-year, while AISC improves to $975/oz or 14% Tropicana contributes 84,000oz at total cash cost of $4495/oz; AISC of $694/oz Kibali contributes 51,000oz at total cash cost of $538/ozz; AISC of $572/oz Net debt stable at $3.105bn Cash flow from operating activities stable year-on-year at $350m, despite 21% lower gold price Quarter Year ended ended ended ended Mar Dec Mar Dec 2014 2013 2013 2013 US dollar / Imperial Operating review Gold Produced - oz (0000) 1,055 1,229 899 4,105 Price received 1 - $/oz 1,290 1,271 1,636 1,401 All-in sustaining cost 2 - $/oz 993 1,015 1,275 1,174 All-in cost 2 - $/oz 1,114 1,233 1,622 1,466 Total cash costs 3 - $/oz 770 748 894 830 Financial review Adjusted gross profit 4 - $m 312 376 434 1,351 Gross profit - $m 296 404 434 1,445 Profit (loss) attributable to equity shareholders - $m 39 (305) 239 (2,230) - cents/share 10 (75) 62 (568) Headline earnings (loss) - $m 38 (276) 259 78 - cents/share 9 (68) 67 20 Adjusted headliine earnings 5 - $m 119 45 113 599 - cents/share 29 11 29 153 Dividends per ordinary share - cents/share - - 5 5 Cash flow from operating activities - $m 350 431 356 1,246 Capital expenditure - $m 274 477 512 1,993 Notes: 1. -

Reef Adjacent to Structures at Tautona Mine, Anglogold Ashanti South African Operations

Reef Adjacent To Structures at TauTona Mine, AngloGold Ashanti South African Operations DE DAVIES Section Manager TauTona Mine, AngloGold Ashanti South African Operations SYNOPSIS The paper describes the extraction of reef adjacent to geological structures in the Carbon Leader Reef Section at TauTona Mine. Traditionally long wall mining has left feasible and economical blocks of ground adjacent to structures when negotiating major geological features. This meant that mining through an up- throw fault, rolling to the reef elevation on the displaced side of the fault left reef in the long wall. High grade areas were abandoned and gold was sterilized. In these tight economic times and with the need to continuously improve safety standards the need arose to develop a technique to extract these blocks economically and safely. It was believed that the structures in these abandoned areas were de-stressed and could now be mined in small volumes at a high grade. The term RATS is an acronym derived from “reef adjacent to structures” and aptly describes the process of identifying and extracting these blocks. The viability of this method was addressed in terms of the mine design, underground investigations and financial risks. The paper concludes with an analysis of the successes achieved to date. 1 INTRODUCTION TauTona Mine is one of the AngloGold Ashanti Southern Africa operations. It is close to the town of Carletonville in the province of Gauteng and about 70km south-west of Johannesburg. TauTona is 46 years old and employs ± 4 000 people. Mining operations are conducted at depths ranging from 1,800m to 3,500m at which the world’s deepest stoping sections are found. -

May 2020 Presentation

Investor Presentation May 2020 Cautionary and Forward Looking Statement This document has been prepared by Patagonia Gold Corp. (“Patagonia Gold” or, the “Company”) for evaluation of the Company by the recipient. The information contained in this presentation is derived from estimates made by the Company, information that has been provided to the Company by other parties, and otherwise publicly available information concerning the Company and does not purport to be all-inclusive or to contain all the information that an investor may desire to have in evaluating whether or not to make an investment in the Company. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. No person has been authorized to give any information or make any representations other than those contained in this presentation and, if given and/or made, such information or representations must not be relied upon as having been so authorized. In furnishing this presentation, the Company does not undertake or agree to any obligation to provide the attendees with access to any additional information or to update this presentation or to correct any inaccuracies in, or omissions from, this presentation that may become apparent. The contents of this presentation are not to be construed as legal, financial or tax advice. Each prospective investor should contact his, her or its own legal adviser, independent financial adviser or tax adviser for legal, financial or tax advice. No securities commission or regulatory authority has reviewed the accuracy or adequacy of the information presented. -

The Yatela Gold Deposit: 2 Billion Years in the Making

Journal of African Earth Sciences 112 (2015) 548e569 Contents lists available at ScienceDirect Journal of African Earth Sciences journal homepage: www.elsevier.com/locate/jafrearsci The Yatela gold deposit: 2 billion years in the making * K.A.A. Hein a, , I.R. Matsheka a, O. Bruguier b, Q. Masurel c, D. Bosch b, R. Caby b, P. Monie b a School of Geosciences, University of the Witwatersrand, Johannesburg, South Africa b Geosciences Montpellier, UMR 5243 e CC 60, Universite Montpellier 2, Place E. Bataillon, 34095 Montpellier Cedex 5, France c Centre for Exploration Targeting, The University of Western Australia, 35 Stirling Highway, Crawley, Western Australia, Australia article info abstract Article history: Gold mineralisation in the Yatela Main gold mine is hosted in a saprolitic residuum situated above Received 13 February 2015 Birimian supracrustal rocks, and at depth. The supracrustal rocks comprise metamorphosed calcitic and Received in revised form dolomitic marbles that were intruded by diorite (2106 ± 10 Ma, 207Pb/206Pb), and sandstone-siltstone- 1 July 2015 shale sequences (youngest detrital zircon population dated at 2139 ± 6 Ma). In-situ gold-sulphide Accepted 15 July 2015 mineralisation is associated with hydrothermal activity synchronous to emplacement of the diorite and Available online 5 August 2015 forms a sub-economic resource; however, the overlying saprolitic residuum hosts economic gold min- eralisation in friable lateritized palaeosols and aeolian sands (loess). Keywords: West African craton Samples of saprolitic residuum were studied to investigate the morphology and composition of gold Mali grains as a proxy for distance from source (and possible exploration vector) because the deposit hosts Kedougou-K eni eba Inlier both angular and detrital gold suggesting both proximal and distal sources. -

Technical Report Gold –Silver Resource Estimate of the La Josefina Project Santa Cruz, Argentina

Technical Report Gold –Silver Resource Estimate of the La Josefina Project Santa Cruz, Argentina C. Gustavo Fernandez, P. Geo. UAKO Consultora Geológica September 29th, 2010. Prepared for Hunt Mining Corp. Gold - Silver Resource Estimate for the La Josefina Project Page 1 Contents 1.0 Summary ................................................................................................................................. 8 2.0 Introduction .......................................................................................................................... 13 2.1. Project Scope and Terms of Reference ................................................................................ 14 2.2. Frequently used acronyms, abbreviations, definitions and units of measure ................... 14 3.0 Reliance on other experts .................................................................................................... 15 4.0 Property description and location ....................................................................................... 15 4.1. General ................................................................................................................................. 15 4.2. Mineral tenure...................................................................................................................... 17 4.3. Cerro Cazador – Fomicruz agreement................................................................................. 20 4.4. Royalties .............................................................................................................................. -

Access Ways in Ultra High Stress – the Next Step SANIRE 2004 – the Miner’S Guide Through the Earth’S Crust, South African National Institute of Rock Engineering

Scheepers, L.J, Stability of access ways in ultra high stress – The next step SANIRE 2004 – The Miner’s Guide through the Earth’s Crust, South African National Institute of Rock Engineering Stability of access ways in ultra high stress – The next step L.J. Scheepers TauTona Mine ABSTRACT Stability of access tunnels through high stressed abutments remains a problem associated with deep level mining. The problem is compounded by the presence of faults or dykes in these abutments or pillars as large seismic events can occur on such features. This paper describes a novel way of ensuring the long-term stability of access tunnels through high stressed areas by mining an off reef de-stressing slot 7m above the tunnel simultaneous with and leading the development of the tunnel. 1 Introduction Republic of South Africa. Figure 1 shows the location of TauTona Mine in the West Rand Area. With all mining operations the stability of the access ways to the ore bodies are crucial for sustained safe Two economically viable gold-bearing orebodies are production. In deep level operations, quasi-static exploited within the TauTona Mine boundary area, stress related instabilities must be catered for with namely the younger and shallower Ventersdorp layout and support design of the access ways. In Contact Reef (VCR), and the older, deeper Carbon addition possible seismic loading on the access ways Leader Reef (CLR). must also be catered for. This is certainly true for TauTona Mine. At TauTona the CLR has been accessed and mined from depths between 2500 and 3600 metres below surface for an area of approximately 5000m on strike by 3500m on dip within the lease area. -

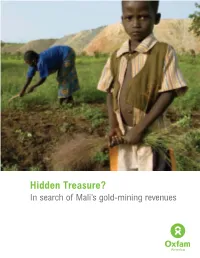

Hidden Treasure? in Search of Mali’S Gold-Mining Revenues a C I R E M a M a F X O / F F O L E T T E R B

Hidden Treasure? In search of Mali’s gold-mining revenues A C I R E M A M A F X O / F F O L E T T E R B Authors Rani Parker (Ph.D., George Washington University) is founder of Business-Community Synergies, a development economist, and a leading authority on corporate-community engagement. Parker has 20 years' experience in international development, including consultancies with organizations such as CARE, the UN Children’s Fund (UNICEF), the UN Development Program (UNDP), and multi- national companies in the energy and extractive industries. Fred Wood (Ph.D., University of London) is an internationally recognized expert on early childhood and youth development. For 12 years, Dr. Wood served as director of education for Save the Children. His consulting projects have included Save the Children, UNICEF, and the World Bank. FRONT COVER: Niama Makalu, 22, and her nephew, Amidou Dembelle, working in a field of groundnuts against the backdrop of a waste dump area for the Sadiola Hill Gold Mine in Mali. Their families were among the many people displaced when mining began in the area in the mid-1990s. Makalu, who is married to the chief of Sadiola, is now—like many others—forced to cultivate food for her family on land in close proximity to mine waste. What’s more, since the Sadiola Hill Mine now occupies much of the area’s former agricultural land, local people have no viable alternatives to farming on these few remaining sites. Above: Sign and fence on the border of the Sadiola Hill Mine, barring trespassers from land that has been conceded to the mining company. -

2010 Minerals Yearbook

2010 Minerals Yearbook GOLD U.S. Department of the Interior October 2012 U.S. Geological Survey GOLD By Micheal W. George Domestic survey data and tables were prepared by Wanda G. Wooten, statistical assistant, and the world production table was prepared by Lisa D. Miller, international data coordinator. In 2010, domestic mine production of gold increased to end use of gold were jewelry and arts, 54%; dental and medical, 231,000 kilograms (kg), 4% more than that in 2009 (tables 1–2). 10%; electrical and electronics, 7%; and other, 29%. This marks the fi rst increase in 10 years, although production Refi ned bullion comprised 33% of U.S. gold imports and 77% was 37% lower than the historical high of 366,000 kg in of exports; the United States was a net exporter of 95,700 kg of 1998. In 2010, the value of domestic production increased to bullion in 2010 (tables 4, 6). The imports and exports of gold $9.13 billion, up 30% compared with that in 2009 because of bullion increased by 57% and 5%, respectively, from those in 2009. the increase in the price of gold and the increase in domestic The increases in imports mainly were from Canada and Mexico, production. It was the ninth straight year that the value had which provided almost 51% and 25%, respectively, of the refi ned increased. Gold recovery from the major mines in Nevada bullion imported. Imports of ores and concentrates increased by decreased because mining lower grade ore was more profi table 450% because of a substantial increase in imports from Mexico for with high gold price. -

Fermor 2011 Ore Deposits in an Evolving Earth 7 - 9 September 2011

Fermor 2011 Ore Deposits in an Evolving Earth 7 - 9 September 2011 Abstract Book CONVENORS Gawen Jenkin (University of Leicester) Adrian Boyce (SUERC, Glasgow) Richard Herrington (Natural History Museum) Paul Lusty (British Geological Survey) Iain McDonald (Cardiff University) Martin Smith (University of Brighton) Jamie Wilkinson (Imperial College London)ster) Fermor 2011: Ore Deposits in an Evolving Earth CONTENTS Sponsor acknowledgement Page 2 Programme Pages 3-7 Oral abstracts Pages 8-38 (In programme order) Poster abstracts Pages 39-65 (In programme order) Sponsor information Pages 66-68 Fire safety information Pages 69-70 Map to the Royal Society Page 71 Note pages Pages 72-74 07-09 September 2011 Page 1 #fermor11 Fermor 2011: Ore Deposits in an Evolving Earth We gratefully acknowledge the support of the sponsors for making this meeting possible. 07-09 September 2011 Page 2 #fermor11 Fermor 2011: Ore Deposits in an Evolving Earth Programme Wednesday 7 September 2011 12.30 Arrival & registration & lunch Student session - sponsored by Gnomic Resources, Goldfields & the SEG 13.40 Opening comments Gawen Jenkin, University of Leicester 13.45 Modern mineral exploration – more than just geology Barry Stoffell, Rio Tinto 14.30 CPD and Chartership in the mining and exploration industry Bill Gaskarth, Geological Society & Jim Coppard, Anglo American 15.00 Tea & coffee & student posters 16.15 Keynote: Introduction to exploration and mining finance Philip Crowson, University of Dundee 17.15 Discussion & closing remarks 17.30 Icebreaker reception