An Empirical Analysis of the Shanghai and Shenzhen Limit Order Books

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 1: Rank of China's 338 Prefecture-Level Cities

Appendix 1: Rank of China’s 338 Prefecture-Level Cities © The Author(s) 2018 149 Y. Zheng, K. Deng, State Failure and Distorted Urbanisation in Post-Mao’s China, 1993–2012, Palgrave Studies in Economic History, https://doi.org/10.1007/978-3-319-92168-6 150 First-tier cities (4) Beijing Shanghai Guangzhou Shenzhen First-tier cities-to-be (15) Chengdu Hangzhou Wuhan Nanjing Chongqing Tianjin Suzhou苏州 Appendix Rank 1: of China’s 338 Prefecture-Level Cities Xi’an Changsha Shenyang Qingdao Zhengzhou Dalian Dongguan Ningbo Second-tier cities (30) Xiamen Fuzhou福州 Wuxi Hefei Kunming Harbin Jinan Foshan Changchun Wenzhou Shijiazhuang Nanning Changzhou Quanzhou Nanchang Guiyang Taiyuan Jinhua Zhuhai Huizhou Xuzhou Yantai Jiaxing Nantong Urumqi Shaoxing Zhongshan Taizhou Lanzhou Haikou Third-tier cities (70) Weifang Baoding Zhenjiang Yangzhou Guilin Tangshan Sanya Huhehot Langfang Luoyang Weihai Yangcheng Linyi Jiangmen Taizhou Zhangzhou Handan Jining Wuhu Zibo Yinchuan Liuzhou Mianyang Zhanjiang Anshan Huzhou Shantou Nanping Ganzhou Daqing Yichang Baotou Xianyang Qinhuangdao Lianyungang Zhuzhou Putian Jilin Huai’an Zhaoqing Ningde Hengyang Dandong Lijiang Jieyang Sanming Zhoushan Xiaogan Qiqihar Jiujiang Longyan Cangzhou Fushun Xiangyang Shangrao Yingkou Bengbu Lishui Yueyang Qingyuan Jingzhou Taian Quzhou Panjin Dongying Nanyang Ma’anshan Nanchong Xining Yanbian prefecture Fourth-tier cities (90) Leshan Xiangtan Zunyi Suqian Xinxiang Xinyang Chuzhou Jinzhou Chaozhou Huanggang Kaifeng Deyang Dezhou Meizhou Ordos Xingtai Maoming Jingdezhen Shaoguan -

Impact Stories from the People's Republic of China: Partnership For

Impact Stories from the People’s Republic of China Partnership for Prosperity Contents 2 Introduction Bridges Bring Boom 4 By Ian Gill The phenomenal 20% growth rate of Shanghai’s Pudong area is linked to new infrastructure— and plans exist to build a lot more. Road to Prosperity 8 By Ian Gill A four-lane highway makes traveling faster, cheaper, and safer—and brings new economic opportunities. On the Right Track 12 By Ian Gill A new railway and supporting roads have become a lifeline for one of the PRC’s poorest regions. Pioneering Project 16 By Ian Gill A model build–operate–transfer water project passes its crucial first test as the PRC encourages foreign-financed deals. Reviving a Historic Waterway 20 By Ian Gill Once smelly and black with pollution, a “grandmother” river is revived in Shanghai. From Waste to Energy 24 By Lei Kan Technology that can turn animal waste into gas is changing daily life for the better in rural PRC. From Pollution to Solution 28 By Lei Kan A project that captures and uses methane that would otherwise be released into the atmosphere during the mining process is set to become a model for thousands of coal mines across the PRC. Saving Sanjiang Wetlands 35 By Lei Kan A massive ecological preservation project is fighting to preserve the Sanjiang Plain wetlands, home to some of the richest biodiversity in the PRC . From Clean Water to Green Energy 38 By Lei Kan Two new hydropower plants in northwest PRC are providing clean, efficient energy to rural farming and herding families. -

EDUCATION in CHINA a Snapshot This Work Is Published Under the Responsibility of the Secretary-General of the OECD

EDUCATION IN CHINA A Snapshot This work is published under the responsibility of the Secretary-General of the OECD. The opinions expressed and arguments employed herein do not necessarily reflect the official views of OECD member countries. This document and any map included herein are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. Photo credits: Cover: © EQRoy / Shutterstock.com; © iStock.com/iPandastudio; © astudio / Shutterstock.com Inside: © iStock.com/iPandastudio; © li jianbing / Shutterstock.com; © tangxn / Shutterstock.com; © chuyuss / Shutterstock.com; © astudio / Shutterstock.com; © Frame China / Shutterstock.com © OECD 2016 You can copy, download or print OECD content for your own use, and you can include excerpts from OECD publications, databases and multimedia products in your own documents, presentations, blogs, websites and teaching materials, provided that suitable acknowledgement of OECD as source and copyright owner is given. All requests for public or commercial use and translation rights should be submitted to [email protected]. Requests for permission to photocopy portions of this material for public or commercial use shall be addressed directly to the Copyright Clearance Center (CCC) at [email protected] or the Centre français d’exploitation du droit de copie (CFC) at [email protected]. Education in China A SNAPSHOT Foreword In 2015, three economies in China participated in the OECD Programme for International Student Assessment, or PISA, for the first time: Beijing, a municipality, Jiangsu, a province on the eastern coast of the country, and Guangdong, a southern coastal province. -

Low Carbon Development Roadmap for Jilin City Jilin for Roadmap Development Carbon Low Roadmap for Jilin City

Low Carbon Development Low Carbon Development Roadmap for Jilin City Roadmap for Jilin City Chatham House, Chinese Academy of Social Sciences, Energy Research Institute, Jilin University, E3G March 2010 Chatham House, 10 St James Square, London SW1Y 4LE T: +44 (0)20 7957 5700 E: [email protected] F: +44 (0)20 7957 5710 www.chathamhouse.org.uk Charity Registration Number: 208223 Low Carbon Development Roadmap for Jilin City Chatham House, Chinese Academy of Social Sciences, Energy Research Institute, Jilin University, E3G March 2010 © Royal Institute of International Affairs, 2010 Chatham House (the Royal Institute of International Affairs) is an independent body which promotes the rigorous study of international questions and does not express opinion of its own. The opinions expressed in this publication are the responsibility of the authors. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or any information storage or retrieval system, without the prior written permission of the copyright holder. Please direct all enquiries to the publishers. Chatham House 10 St James’s Square London, SW1Y 4LE T: +44 (0) 20 7957 5700 F: +44 (0) 20 7957 5710 www.chathamhouse.org.uk Charity Registration No. 208223 ISBN 978 1 86203 230 9 A catalogue record for this title is available from the British Library. Cover image: factory on the Songhua River, Jilin. Reproduced with kind permission from original photo, © Christian Als, -

The Effect of Beijing-Shanghai High-Speed Railway on the Economic Development of Prefecture-Level Cities Along the Line Based on DID Model

E3S Web of Conferences 235, 01016 (2021) https://doi.org/10.1051/e3sconf/202123501016 NETID 2020 The Effect of Beijing-Shanghai High-Speed Railway on the Economic Development of Prefecture-Level Cities Along the Line Based on DID Model Ma Yuzhou1 1School of Economics and Management, Beijing Jiaotong University, Beijing, China Abstract. High-speed railway has an essential impact on the economic and social development of the regions along the line. Based on the Beijing-Shanghai high-speed railway, this paper constructs the DID model and analyzes the impact of Beijing-Shanghai high-speed railway on the economic development of prefecture-level cities along the route from the empirical perspective. The empirical analysis results show that the Beijing- Shanghai high-speed railway has a significant negative impact on the per capita GDP of prefecture-level cities along the line in the short term, mainly because the agglomeration effect is greater than the diffusion effect. Therefore, small cities should actively think about how to deal with the agglomeration effect caused by the construction of high-speed rail. billion yuan. The line is a project with the most massive 1 Introduction scale and highest technique since the founding of China. The BSHSR, which owns faster speed, fewer stops, and Since the opening of Beijing-Tianjin intercity high-speed more running trains, adds a vital passenger transport railway in 2008, China's high-speed railway (abbreviated channel for the eastern region. BSHSR improves the to “HSR”, for short) has stepped into a rapid expansion transportation capacity of Beijing-Shanghai line, meets stage, and the "four vertical and four horizontal" HSR the ever-growing travel demand of passengers, and network planned and constructed by the state has taken strengthens the connection between the two urban clusters shape. -

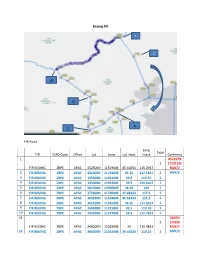

Shanghai FIR

Beijing FIR 1 2 19 15 8 11 FIR Point Long Type FIR ICAO Code Office Lat Long Lat Input Input Comment 1 452317N 1 1152115E FIR BEIJING ZBPE APAC 452500N 1151900E 45.40054 115.2947 RAN/2 2 FIR BEIJING ZBPE APAC 431500N 1173100E 43.25 117.5167 1 RAN/2 3 FIR BEIJING ZBPE APAC 395400N 1192100E 39.9 119.35 1 4 FIR BEIJING ZBPE APAC 393000N 1195200E 39.5 119.8667 1 5 FIR BEIJING ZBPE APAC 381500N 1200000E 38.25 120 1 6 FIR BEIJING ZBPE APAC 372900N 1173000E 37.48333 117.5 1 7 FIR BEIJING ZBPE APAC 363200N 1151800E 36.53333 115.3 1 8 FIR BEIJING ZBPE APAC 362100N 1145500E 36.35 114.9167 1 9 FIR BEIJING ZBPE APAC 360600N 1142100E 36.1 114.35 1 10 FIR BEIJING ZBPE APAC 345400N 1124700E 34.9 112.7833 1 11 3405N 1 11029E FIR BEIJING ZBPE APAC 340000N 1102900E 34 110.4833 RAN/2 12 FIR BEIJING ZBPE APAC 343200N 1101500E 34.53333 110.25 1 RAN/2 13 FIR BEIJING ZBPE APAC 353200N 1101800E 35.53333 110.3 1 14 FIR BEIJING ZBPE APAC 372800N 1104400E 37.46667 110.7333 1 15 FIR BEIJING ZBPE APAC 382200N 1103600E 38.36666 110.6 1 16 FIR BEIJING ZBPE APAC 384400N 1094100E 38.73333 109.6833 1 17 FIR BEIJING ZBPE APAC 402000N 1070100E 40.33333 107.0167 1 18 FIR BEIJING ZBPE APAC 404300N 1055500E 40.71667 105.9167 1 19 414451N 1 1051345E FIR BEIJING ZBPE APAC 414400N 1051300E 41.74361 105.218 RAN/2 Along political boundary to (1) Note: 1. -

Bangladesh Chittagong China Hong Kong Shenzhen

Japan Tokyo 14 Dalian Seoul 15 Yokohama 17 South 13 Tianjin 8 16 Korea 12 Osaka-wan 10 Inch'on Kobe 7 6 9 Beijing Qingdao Busan Australia Australia 34 Brisbane 34 Brisbane Australia Australia 3 Shanghai Australia Brisbane 34 34 Brisbane 34 Brisbane China Taipei Australia Brisbane 29 34 New Delhi 21 Australia Taiwan Brisbane 5 Kao-hsiung Sydney 34 Guangzhou 32 Sydney 11 Perth 32 Hong Kong 36 Adelaide 2 Perth Bangladesh 36 35 Adelaide 4 35 Shenzhen Sydney Sydney Chittagong Sydney 32 32 Nagpur 23 Perth Perth Adelaide 32 18 Perth 36 36 Adelaide Mumbai (Bombay) 20 Philippines 36 Adelaide 35 35 Manila 27 Melbourne35 India 33 Melbourne 33 Sydney 32 Perth Thailand 36 Adelaide Sydney Auckland 35 Melbourne 32 Melbourne Vietnam Perth Melbourne 33 33 37 Auckland Bangkok 30 36 Adelaide33 37 Bangalore 22 19 Chennai (Madras) 35 31 Ho Chi Minh City Auckland Auckland Auckland 37 37 Melbourne New Zealand 37 33 New Zealand Melbourne Colombo 28 Sri Lanka Main Transport Terminals Trade(import-export) value Population (million people) 33 Malaysia Connections (billion US dollars) in 2007 AucklandNew Zealand 37 New Zealand Kuala Lumpur New Zealand Road Asia Highway >1000 0 - 2 Auckland 25 Network 37 26 Port of Tanjung 1 Indonesia International Airport 500 - 1000 2 - 5 Pelepas Singapore River New Zealand Sea Harbour 100 - 500 5 - 10 New Zealand River Harbour <100 0 245 490 Miles > 10 Free Economic Zone Jakarta 24 0 245 490 KM 1. Singapore 2. Hong Kong 3. Shanghai 4. Shenzhen 5. Kaohsiung 6. Busan 7. Beijing 8. Dalian Singapore is the world’s biggest container port with yearly throughput Hong Kong is a hub port serving the South Asian Pacific region and Shanghai is the power house for the economic growth of China. -

Flying to Hangzhou and Local Transportation Info

FLYING TO HANGZHOU AND LOCAL TRANSPORTATION INFO ⚫ Transportation Between the Hangzhou Airport and Downtown Hangzhou Hangzhou has flights to and from over 130 destinations, including domestic cities and international destinations. Hangzhou Xiaoshan International Airport (HGH) is the only civil airport in the city. The airport has service to destinations throughout China. International destinations are mainly in the east and southeast Asia, and points of Africa, Europe, and South Asia. The airport is 27 kilometers (approximately 17 miles) east from the city center. There are now 2 terminal buildings to cater the domestic and international passengers. Passengers can transport between the airport and the downtown area by shuttle, bus, or taxi. It usually takes about an hour to travel by taxi from the airport to the city downtown (34 kilometers). The taxi ride is available at Gate 10, Arrival Hall, 1/F of the Domestic Terminal Building. The cost will be around CNY 150 (approximately USD 23). There are several shuttle bus lines to/from downtown Hangzhou. To arrive at the Zhejiang Hotel (the workshop venue, No. 278, Santaishan Road), the Wulinmen Line is recommended. The timetable of Wulinmen Line is listed below. The waiting hall for the shuttle bus is at Gate 8, Arrival Hall, 1/F of the Domestic Terminal Building. The Wulinmen Line originates/terminates at the Wulinmen CAAC Ticket Office. You can buy your tickets upon arrival at the ticket office. International participants will need to take a taxi (about 20 minutes for 7 kilometers) from the Wulinmen CAAC Ticket Office to arrive the hotel. Airport → Wulinmen CAAC Ticket Office Wulinmen CAAC Ticket Office → Airport 07:30; 08:30 – 22:00 every 15 minutes; 05:00 – 17:00 every 15 minutes; 22:00 – 02:00 every 30 minutes; 17:00 – 21:00 every 30 minutes; 02:00 – the last flight departs based on the flights’ schedule Ticket Fare: CNY 20 (approximately USD 3) per person Duration: 45 minutes Note: CAAC=Civil Aviation Administration of China. -

Hang Seng Shanghai-Shenzhen-Hong Kong (Selected Corporations) 300 Index

Hang Seng Shanghai-Shenzhen-Hong Kong (Selected Corporations) 300 Index This methodology document should be read in conjunction with the Index Methodology General Guide on Hang Seng Indexes Co Ltd (“HSIL”)’s website. Readers are reminded that there might be exceptions in the index handling to the below general approach in some special situations and HSIL reserves the right to determine the most appropriate handling. Objective To measure the overall performance of the 300 largest companies in terms of full market capitalisation listed in Hong Kong and/ or mainland China that operate in mainland China, Hong Kong and Macau Universe It includes securities listed on the Main Board of the HKEX and A-shares listed on SSE and SZSE; It excludes Foreign Companies and Investment Companies listed under Chapter 21 of HKEX’s Listing Rules Eligibility Criteria Geographical A-shares; or Requirements Eligible Hong Kong-listed securities with at least 50% of revenue, asset or profit derived from mainland China, Hong Kong and/ or Macau in the latest complete fiscal year Turnover Requirements 6-month Average Daily Turnover >= CNY / HKD 20 million for A-shares / HK-listed stocks respectively Constituent Selection Selection Criteria The top 300 companies with the highest Company MV Rank will be selected as constituents; If both the A-shares and H-shares listings of a dual- listed company fulfill the turnover requirement, only the A-shares will be included; Otherwise, only the class of shares that fulfill the turnover requirement will be included 1 Hang Seng -

A Study of Chinese Market Efficiency, Shanghai Versus Shenzhen

A study of Chinese market efficiency, Shanghai versus Shenzhen: Evidence based on multifractional models Pierre R. Bertrand1, Marie-Eliette Dury2, and Bing Xiao3 1 Universit´eClermont Auvergne, CNRS, LAPSCO and LMBP, F-63000 Clermont-Ferrand, France [email protected] 2 Universit´eClermont Auvergne, CNRS, CERDI, F-63000 Clermont-Ferrand, France [email protected] 3 Universit´eClermont Auvergne, IUT Aurillac, CLERMA EA 38 49, France [email protected] Abstract. The Chinese equity market is one of the emerging equity markets which offers an opportunity for international diversification, as a emerging markets, the Chinese stock markets are not mature. Since the 1990s, the reforms in regulations as well as in the attitudes of regulators have rendered the stock market more efficient. The progressive reform process of the stock market has improved the functioning of capital mar- kets and implemented market-based mechanisms. China's stocks pricing mechanism has been pushed toward a more market-oriented approach, in such cases, we expect an alteration in anomalies in the Chinese stock market. In this paper, we examine the daily data from the Shanghai A- share market, and Shenzhen A-share market over the 2006-2019 period. It would seem that in the Chinese stock market, the seasonal anomalies persist. But at the same time, by employing the Hurst exponent analysis, we find that the Chinese stock markets had a trend of becoming more and more efficient after the reform in October 2011. Keywords. Stock markets, Seasonal anomalies, Efficient market hypoth- esis, Hurst exponent, Multifractional Brownian motion. M.S.C. classification. -

浙江大学手册 Hangzhou, China Handbook University of Rhode

浙江大学手册 Zhèjiāng dàxué shǒucè Hangzhou, China Handbook University of Rhode Island Chinese International Engineering Program 1 Table of Contents Introduction 3 Overview of the city Hangzhou 4 Boost your Chinese Confidence 5 Scholarships 5 Money, Communication 8-11 Time Zone, Weather, Clothing, Packing 11 Upon Arrival 16 Transportation 16 Logistics for Living in China upon Arrival 18 Living 19 Entertainment 20 Shopping 21 Language 22 Zhejiang University Outline 23 Dormitories 23 Classes 24 University Rules 26 Useful Phrases 26 Healthcare 28 Health Vocabulary 29 2 Introduction This guide is meant to be a practical one. It is meant to help prepare you for China and to help give you an idea about how Zhejiang University differs from the University of Rhode Island. This guide will hopefully serve as a base to work from in dealing with these differences. Everyone will have a different experience in China, and as with any school year, it will have its ups and downs. Just work hard, stay healthy, and have a fun learning experience. Do your best to talk to people who have been to China before you go, and to go with an open mind. Go with patience and flexibility (you will need it)! Your time in China is meant to be a time of discovery - a time to discover a new language and culture and a time to learn more about yourself. When you arrive, go out on your own and just observe. Observe how people interact with friends, workers and family. Observe how sales transactions are made. Observe how one orders food in a restaurant. -

HD Shanghai Foreign Teachers Headline: the Right Time and The

HD Shanghai Foreign Teachers Headline: The Right Time and the Right Place International School in Shanghai looking for Licensed Teachers Positions to Fill: 22 Positions for Elementary School, Kindergarten and Jr. High Company and Job Description HD Shanghai is part of the prestigious Hurtwood House School in England. Hurtwood is consistently ranked #2 in all of the UK, right behind Eton. Hurtwood, along with its partner, EliteK12, operates 5 schools in China. The first campus was opened in 2014 in the city of Ningbo. With opulent campuses stretching over 40 acres and a brand new approach to education in China, HD School has quickly become the premier international/bi-lingual school in China. HD Shanghai. Located in historic Shanghai, one of the most cosmopolitan, fast paced financial capitals in the world, HD Shanghai lends itself to the very word: internationalization. With it's four historic districts (French, Russian, German and British,) Shanghai has been a beacon for expats and international travelers for centuries. As such, HD Shanghai's staff reflects the diversity and excellence that draws teachers, professionals and students from the world over. Our head of school is from England, our principal from Australia, our vice principal from England and our academic director from New Zealand. As a microcosm of a quickly changing world, HD Shanghai is at the epicenter of an internationalized world. In order to attract the best talent to our schools, HD Schools offer a competitive, world class salary to match any capital city in the world. Additionally, we offer an inspiring working atmosphere with small class sizes composed of foreign teacher, a Chinese teacher, and an assistant teacher in each class.