Suspended Unilever Palm Oil Suppliers and Growers (With Mill List)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Request for Consideration of the Situation of Indigenous Peoples In

Request for Consideration of the Situation of Indigenous Peoples in Kalimantan, Indonesia, under the United Nations Committee on the Elimination of Racial Discrimination’s Urgent Action and Early Warning Procedures Committee on the Elimination of Racial Discrimination Seventy-First Session 30 July – 18 August 2007 Submitted by Perkumpulan Sawit Watch Aliansi Masyarakat Adat Nusantara/AMAN (Indigenous People Alliance of the Archipelago) Aliansi Masyarakat Adat Kalimantan Barat (Indigenous People Alliance of West Kalimantan) Lembaga Studi dan Advokasi Masyarakat/ELSAM (Center for Community Study and Advocacy) Wahana Lingkungan Hidup Indonesia/WALHI (Friends of the Earth Indonesia) Perkumpulan Untuk Pembaharuan Hukum Berbasis Masyarakat dan Ekologis/HuMA (Association for Community- and Ecologically-based Legal Reform) Yayasan Padi Indonesia Lembaga Bela Banua Talino Lembaga Gemawan (Lembaga Pengembangan Masyarakat Swandiri/The Institution of Swandiri Society Empowerment) Institut Dayakologi Forest Peoples Programme 6 July 2007 Contents Page Executive Summary 1 Submitting Organizations 4 I. INTRODUCTION 6 II. INDIGENOUS PEOPLES IN INDONESIA 8 III. OIL PALM PLANTATIONS AND INDIGENOUS PEOPLES’ 10 RIGHTS IV. PERSISTENT VIOLATION OF INDIGENOUS PEOPLES' 11 RIGHTS IN KALIMANTAN V. INDONESIA IS IN THE ADVANCED STAGES OF ESTABLISHING MASSIVE PALM OIL PLANTATIONS IN INDIGENOUS PEOPLES’ TRADITIONAL TERRITORIES IN 13 KALIMANTAN VI. INDONESIAN LAW DISCRIMINATES AGAINST INDIGENOUS 17 PEOPLES A. The Constitution 17 B. The Basic Agrarian Law 18 C. The 1999 Forestry Act 19 D. The 2004 Plantation Act 20 VII. REQUEST 22 VIII. ANNEXES 23 A. ‘President Admits Indigenous People Mistreated’, Jakarta Post, 10 August 24 2006 B. Oil Palm and Other Commercial Tree Plantations, Mono-cropping: 25 Impacts on Indigenous Peoples’ Land Tenure and Resource Management Systems and Livelihoods, UN Permanent Forum on Indigenous Issues Working Paper, E/C.19/2007/CRP.6 C. -

Oil Palm Plantations and Transboundary Haze: Patronage Networks and Land

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by UM Digital Repository HELENA VARKKEY POST-PRINT WETLANDS 1 Oil Palm Plantations and Transboundary Haze: Patronage Networks and Land 2 Licensing in Indonesia’s Peatlands 3 Helena Varkkey 4 5 Department of International and Strategic Studies, University of Malaya, 50603, Kuala 6 Lumpur, Malaysia 7 Email: [email protected] 8 Tel: +60123162146 9 Fax: +60323008318 10 1 HELENA VARKKEY POST-PRINT WETLANDS 11 Oil Palm Plantations and Transboundary Haze: Patronage Networks and Land 12 Licensing in Indonesia’s Peatlands 13 By HELENA VARKKEY 14 15 Peatlands in Indonesia are protected by regulations that forbid the conversion of these lands 16 into plantations. However, peat fires here have been found to be a major source of smoke that 17 travels across national boundaries creating regional haze. Despite these regulations, more 18 than a quarter of all Indonesian oil palm plantations are on peat. This paper argues that 19 patronage networks within the Indonesian oil palm sector have been a major factor in the 20 unsustainable use of peatlands there. Rampant patronage politics have made it easy for well- 21 connected companies to skirt regulations to obtain licenses for these lands. Decentralization 22 has further encouraged this practice at the regional level, as regional elites are eager to reap 23 the benefits of local investments. In addition, clients are able to exert their influence over 24 state decision-making to ensure that any changes to the licensing process does not jeopardize 25 their access to these lands. -

Parent Mill Mill Name Latitude Longitude Country Aa Sawit Siang

PepsiCo Palm Oil Mill List 2018 The following list is of mills that were in our supply chain in 2018 and does not necessarily reflect mills that are supplying or will supply PepsiCo in 2019. Some of these mills are associated with ongoing complaints that have been registered in our Grievance Mechanism and are being managed through our grievance process. The following palm oil mill list is based on information that has been self-reported to us by suppliers and has only been partially independently verified (see our Palm Oil Progress Report for more information). Though we have made considerable effort to validate the data, we cannot guarantee its full accuracy or completeness. Parent Mill Mill Name Latitude Longitude Country Aa Sawit Siang 1.545386 104.209347 Malaysia Aathi Bagawathi Manufacturing Abdi Budi Mulia 2.051269 100.252339 Indonesia Aathi Bagawathi Manufacturing Abdi Budi Mulia 2 2.11272 100.27311 Indonesia Ace Oil Mill Ace Oil Mill 2.91192 102.77981 Malaysia Aceites Aceites Cimarrones 3.035593889 -73.11146556 Colombia Aceites De Palma Aceites De Palma 18.0470389 -94.91766389 Mexico Aceites Manuelita Yaguarito 3.883139 -73.339917 Colombia Aceites Manuelita Manavire 3.937706 -73.36539 Colombia Aceites Sustentables De Palma Aceites Sustentables De Palma 16.360506 -90.467794 Mexico Achi Jaya Plantations Johor Labis 2.251472222 103.0513056 Malaysia Adimulia Agrolestari Singingi -0.205611 101.318944 Indonesia Adimulia Agrolestari Segati -0.108983 101.386783 Indonesia Adimulia Palmo Lestari Adimulia Palmo Lestari -1.705469 102.867739 -

Key Sustainability Issues in the Palm Oil Sector

Key Sustainability Issues in the Palm Oil Sector A Discussion Paper for Multi-Stakeholders Consultations (commissioned by the World Bank Group) By Cheng Hai Teoh THE WORLD BANK Disclaimer The opinions expressed in this discussion draft do not necessarily represent the views of the World Bank Group or its member governments. The World Bank Group does not guarantee the accuracy of the data included in this draft and accepts no responsibility whatsoever for any consequence of their use. The boundaries, colors, denominations, and other information shown on any map in this draft do not imply on the part of the World Bank Group any judgment on the legal status of any territory or the endorsement or acceptance of such boundaries. Table of Contents A. Introduction ................................................................................................... 2 Background ............................................................................................................ 2 Objectives .............................................................................................................. 2 Approach ............................................................................................................... 3 B. Overview of the Palm Oil Sector ..................................................................... 4 Introduction ........................................................................................................... 4 Development of the palm oil sector .......................................................................... -

Embedding Sustainable Values

EMBEDDING SUSTAINABLE VALUES ANNUAL REPORT 2017 Who we are TH Plantations Berhad (“THP”), the Our Core Business plantation arm of Lembaga Tabung Haji (“TH”), is engaged in the business of oil palm and rubber plantations in Malaysia. Developing and cultivating oil 6 Palm Oil Mills with It was first incorporated in 1972 as palm Total Milling Capacity of Perbadanan Ladang-Ladang Tabung Haji 240 Metric Tonnes Per Hour Sendirian Berhad with its first estate being Marketing of Processing Ladang Sungai Mengah, measuring 4,054 CPO, PK and FFB into Management Agent FFB CPO and PK hectares. Over the years, THP gradually expanded its land bank and to date, THP’s land bank stands close to 101,000 hectares. With the acquisitions made in recent years, 5% 6% 5% THP believes there is vast potential for 22% 10% significantly higher FFB and CPO production 25% in the coming years. Group Semenanjung 28% Average Age: Average Age: 17% LEGENDS 10 Years 10 Years 25> (Old Mature) 4 – 9 (Young Mature) 20 – 25 (Mature) <4 (Immature) 10 – 19 (Prime Mature) 40% 42% Who we are 6 Palm Oil Mills with 32 Oil Palm Estates 7 Forestry Plantations 101,000ha Total Milling Capacity of in Malaysia & Indonesia in Sabah of land bank 240 Metric Tonnes Per Hour 0% 3% 0% 0% 0% 0% 18% 16% 25% 34% Sabah Sarawak Indonesia Average Age: Average Age: Average Age: 4% 100% 14 Years 9 Years 1 Year 24% 47% 29% INSIDE THIS REPORT Cover Rationale About This Report 2 Corporate Information 3 Corporate Structure 5 Strategic Report Management Discussion & Analysis 9 Business Model and Strategy 11 Financial Review 15 Managing Our Risks 16 Sustainability Statement Linking Sustainability to Our Strategy 23 Our Governance Framework Our Board Leadership 55 An Experienced Management 67 Corporate Governance Overview 71 Embedding Sustainable Values reflects THP’s Statement of Risk Management & Internal Control 95 determination towards realising its goal of Additional Compliance Information 100 becoming a regionally- and globally-recognised Performance Statistics sustainable palm oil producer. -

Of TDM BERHAD’S Annual Report 2019 Is Also Available on Our Website

STRENGTHENING FOCUS, ACHIEVING TRUE POTENTIAL ANNUAL REPORT 2019 STRENGTHENING FOCUS, TH ACHIEVING TRUE POTENTIAL 55 TDM's sustainability effort is derived from the ability to strengthen our focus during challenging ANNUAL times. It is about making critical decisions and improving decision-making for better outcomes GENERAL through the use of robust strategic frameworks. To us, the ever changing macroeconomic challenges MEETING are an opportunity for TDM to make organisational improvements - in our people, our processes, the (AGM) OF technology that we leverage on and the branding of TDM. TDM BERHAD We recognise our ability as a leading player in Broadcast Venue the oil palm plantation industry and demonstrate Tricor Leadership Room continuous growth in our healthcare business. We believe the unrelenting efforts in optimising our Unit 32-01, Level 32, Tower A strength will lead TDM to the path of achieving its Vertical Business Suite, Avenue 3 true potential. Bangsar South No. 8 Jalan Kerinchi 59200 Kuala Lumpur. VISION CORE VALUES Date & Time To be the iconic corporation Monday, 27 July 2020 of the East Coast that creates GOOD 11.00 a.m. GOVERNANCE sustainable values for our stakeholders. TEAM WORK MISSION To be a model corporate citizen in PEOPLE TDM BERHAD ANNUAL REPORT CENTRIC 2019 DIGITAL VERSION Terengganu; • To create sustainable value for our Follow the steps below to scan the shareholders. QR Code reader in 3 easy steps INNOVATIVE • To improve the well being of our Download the “QR CodeReader” on App Store or stakeholders while protecting the Google Play. environment. • To deliver quality products & ENVIRONMENTAL Run the QR Code Reader app FRIENDLY and point your camera to the services above expectation for QR Code. -

The Case of Malaysian Palm Oil

Agro-Commodity Global Value Chains and Upgrading: The Case of Malaysian Palm Oil Yee Siong Tong Queens’ College University of Cambridge This dissertation is submitted for the degree of Doctor of Philosophy August 2018 Agro-Commodity Global Value Chains and Upgrading: The Case of Malaysian Palm Oil Yee Siong Tong Summary This dissertation consists of three closely related essays on upgrading in agro-commodity value chains, which is an important issue for many developing countries that produce and export commodities in mostly unprocessed form. The essays are based on fieldwork in Malaysia and focus on its palm oil, which is the world’s largest oils and fats product by production and export volumes. The first essay examines the suitability of vertical specialisation for participation and upgrading in agro-commodity value chains based on the case of Malaysian palm oil. It uses data from interviews, site visits, and industry and economic statistics to analyse upgrading at the sector and firm levels. The essay suggests that upgrading is prone to sectoral linkage development and vertical integration at local lead firms. The development is driven by production characteristics, sectoral dynamics, eco-historical settings that are unique to agro-commodity value chains, as well as firm motives seeking resources, markets, efficiency gains, and strategic assets. The second essay studies Malaysia’s industrial policy for its palm oil sector through three distinct stages of development. The findings show that resource-based industrialisation (RBI) requires selective state intervention targeting macroeconomic conditions, infrastructure, business climate, and human capital. The Malaysian experience also highlights the importance of local firms in driving RBI investments, contrary to the emphasis in the literature which either overplays the importance of foreign linkages or dismisses nationality of firms as a non-factor for industrialisation. -

How a Leading RSPO Palm Oil Producer Is Clearing Peatland Tiger

How a leading RSPO palm oil producer is clearing peatland tiger habitat covered by Indonesia’s moratorium on deforestation This crime file reveals the ongoing rogue activities of one of Indonesia’s largest palm oil producers, the Darmex Agro group – generally known as ‘Duta Palma’ – whose illegal and destructive operations were first exposed by Greenpeace International in 2007. While some companies in the sector are seizing the initiative and setting an example of zero deforestation development, the activities of rogue operators such as Duta Palma serve as an example of practices that the palm oil industry must put behind it. Other stakeholders, from government to end users, must show that they will no longer tolerate flagrant legal abuse and environmental destruction. A DIRTYA BUSINESS b Contents Introduction 2 Duta Palma: a pedigree of illegality 4 Background 4 Duta Palma’s operations in Riau 4 Recent investigations: Duta Palma still flouting the law 10 Failures of governance 12 The Indonesian government 14 The Roundtable on Sustainable Palm Oil 16 Other efforts to ensure responsible palm oil production 18 Time for action Producers 20 Traders 20 Corporate consumers 20 Financial sector 20 Indonesian government 21 Cover: PT Palma Satu, Indragiri Hulu, RSPO 21 Riau, September 2011: An excavator clearing peatland forest; 0°34’06.6”S 102°38’40.8”E. Endnotes 22 ©Ifansasti/Greenpeace Here: Duta Palma concessions, Indragiri Bibliography 24 Hulu, Riau, October 2007: Drainage canal a nd recent peatland rainforest clearance in a palm oil concession in Riau owned by the Duta Palma group. ©Budhi/Greenpeace A DIRTYA BUSINESS 1 Introduction Indonesia’s rainforests are under threat from some of the users such as Nestlé have committed themselves to most destructive companies within one of the world’s zero deforestation in their supply chains, working with fastest growing industries. -

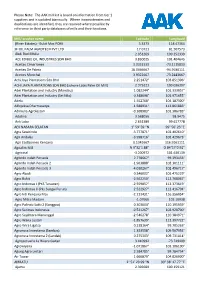

The AAK Mill List Is Based on Information from Tier 1 Suppliers and Is Updated Biannually

Please Note: The AAK mill list is based on information from tier 1 suppliers and is updated biannually. Where inconsistencies and duplications are identified, they are resolved where possible by reference to third party databases of mills and their locations. Mill/ crusher name Latitude Longitude (River Estates) - Bukit Mas POM 5.3373 118.47364 3F OIL PALM AGROTECH PVT LTD 17.0721 81.507573 Abdi Budi Mulia 2.051269 100.252339 ACE EDIBLE OIL INDUSTRIES SDN BHD 3.830025 101.404645 Aceites Cimarrones 3.0352333 -73.1115833 Aceites De Palma 18.0466667 -94.9186111 Aceites Morichal 3.9322667 -73.2443667 Achi Jaya Plantations Sdn Bhd 2.251472° 103.051306° ACHI JAYA PLANTATIONS SDN BHD (Johore Labis Palm Oil Mill) 2.375221 103.036397 Adei Plantation and Industry (Mandau) 1.082244° 101.333057° Adei Plantation and Industry (Sei Nilo) 0.348098° 101.971655° Adela 1.552768° 104.187300° Adhyaksa Dharmasatya -1.588931° 112.861883° Adimulia Agrolestari -0.108983° 101.386783° Adolina 3.568056 98.9475 Aek Loba 2.651389 99.617778 AEK NABARA SELATAN 1° 59' 59 "N 99° 56' 23 "E Agra Sawitindo -3.777871° 102.402610° Agri Andalas -3.998716° 102.429673° Agri Eastborneo Kencana 0.1341667 116.9161111 Agrialim Mill N 9°32´1.88" O 84°17´0.92" Agricinal -3.200972 101.630139 Agrindo Indah Persada 2.778667° 99.393433° Agrindo Indah Persada 2 -1.963888° 102.301111° Agrindo Indah Persada 3 -4.010267° 102.496717° Agro Abadi 0.346002° 101.475229° Agro Bukit -2.562250° 112.768067° Agro Indomas I (PKS Terawan) -2.559857° 112.373619° Agro Indomas II (Pks Sungai Purun) -2.522927° -

RM New Entries 2016 Mar.Pdf

International Plant Nutrition Institute Regional Office • Southeast Asia Date: March 31, 2016 Page: 1 of 88 New Entries to IPNI Library as References Roberts T. L. 2008. Improving Nutrient Use Efficiency. Turkish Journal of Agriculture and Forestry, 32:177-182. Reference ID: 21904 Notes: #21904e Abstract: Public interest and awareness of the need for improving nutrient use efficiency is great, but nutrient use efficiency is easily misunderstood. Four indices of nutrient use efficiency are reviewed and an example of different applications of the terminology show that the same data set might be used to calculate a fertilizer N efficiency of 21% or 100%. Fertilizer N recovery efficiencies from researcher managed experiments for major grain crops range from 46% to 65%, compared to on-farm N recovery efficiencies of 20% to 40%. Fertilizer use efficiency can be optimized by fertilizer best management practices that apply nutrients at the right rate, time, and place. The highest nutrient use efficiency always occurs at the lower parts of the yield response curve, where fertilizer inputs are lowest, but effectiveness of fertilizers in increasing crop yields and optimizing farmer profitability should not be sacrificed for the sake of efficiency alone. There must be a balance between optimal nutrient use efficiency and optimal crop productivity. Souza L. F. D.and D. H. Reinhardt. 2015. Pineapple. Pages 179-201 IPO. Reference ID: 21905 Notes: #21905e Abstract: Pineapple is one of the tropical fruits in greatest demand on the international market, with world production in 2004 of 16.1 million mt. Of this total, Asia produces 51% (8.2 million mt), with Thailand (12%) and the Philippines (11%) the two most productive countries. -

Mill List - 2020

General Mills - Mill List - 2020 General Mills July 2020 - December 2020 Parent Mill Name Latitude Longitude RSPO Country State or Province District UML ID 3F Oil Palm Agrotech 3F Oil Palm Agrotech 17.00352 81.46973 No India Andhra Pradesh West Godavari PO1000008590 Aathi Bagawathi Manufacturing Abdi Budi Mulia 2.051269 100.252339 No Indonesia Sumatera Utara Labuhanbatu Selatan PO1000004269 Aathi Bagawathi Manufacturing Abdi Budi Mulia 2 2.11272 100.27311 No Indonesia Sumatera Utara Labuhanbatu Selatan PO1000008154 Abago Extractora Braganza 4.286556 -72.134083 No Colombia Meta Puerto Gaitán PO1000008347 Ace Oil Mill Ace Oil Mill 2.91192 102.77981 No Malaysia Pahang Rompin PO1000003712 Aceites De Palma Aceites De Palma 18.0470389 -94.91766389 No Mexico Veracruz Hueyapan de Ocampo PO1000004765 Aceites Morichal Aceites Morichal 3.92985 -73.242775 No Colombia Meta San Carlos de Guaroa PO1000003988 Aceites Sustentables De Palma Aceites Sustentables De Palma 16.360506 -90.467794 No Mexico Chiapas Ocosingo PO1000008341 Achi Jaya Plantations Johor Labis 2.251472222 103.0513056 No Malaysia Johor Segamat PO1000003713 Adimulia Agrolestari Segati -0.108983 101.386783 No Indonesia Riau Kampar PO1000004351 Adimulia Agrolestari Surya Agrolika Reksa (Sei Basau) -0.136967 101.3908 No Indonesia Riau Kuantan Singingi PO1000004358 Adimulia Agrolestari Surya Agrolika Reksa (Singingi) -0.205611 101.318944 No Indonesia Riau Kuantan Singingi PO1000007629 ADIMULIA AGROLESTARI SEI TESO 0.11065 101.38678 NO INDONESIA Adimulia Palmo Lestari Adimulia Palmo Lestari -

How the Palm Oil Industry Is Cooking the Climate

HOW THE PALM OIL INDUSTRY IS COOKING THE CLIMATE www.greenpeace.org ii ‘Climatechangeismarket failureonthegreatest scaletheworldhasseen. Itresultsfromthefactthat thecostsofgreenhouse gasemissionsarenot paidforbythosewho createtheemissions.’ 2007 King Review for the UK Government Treasury iii CONTENTS EXECUTIVE SUMMARY 1 TICK TICK TICK … 8 FORESTS AS TICKING CLIMATE BOMBS 8 PEAT: A VOLATILE MATERIAL 16 RIAU: A LIT FUSE 22 DUTA PALMA: THE OIL PALM INDUSTRY’S RECIPE FOR CLIMATE DISASTER 38 WHO CONTROLS THE TRADE? 38 UNILEVER – RSPO PRESIDENT 38 UNILEVER’S SUPPLIERS – CARGILL, ADM-KUOK-WILMAR, GOLDEN HOPE AND SINAR MAS 38 WHAT THE COMMODITY TRADERS ARE AddING TO THE MIX 40 MAJOR NAMES IN THE FOOD INDUSTRY ARE USING TAINTED PALM OIL 46 PROCTER & GAMBLE USES NEARLY 1% OF GLOBAL PALM OIL PRODUCTION 46 NESTLÉ TRADING WITH CARGILL 46 KRAFT AND A LOAD OF OTHER WORLD LEADERS IN THE 47 FOOD INDUSTRY HAVE THEIR FINGERS IN THE PALM OIL PIE BIOFUELING RAINFOREST DESTRUCTION 50 CLIMATE CHANGE – A BRAND NEW MARKETING OPPORTUNITY FOR PALM OIL 52 LAYING THE FOUNDATIONS FOR FOREST DESTRUCTION 53 TODAY’S EMPIRE BUILDING, TOMORROW’S DOWNFALL 55 EMISSIONS EXPLOSION – DUTA PALMA’S SMOKING GUN 56 DEFUSE OR DETONATE? 58 TIME FOR ACTION 59 STOP THE PROBLEM: ZERO DEFORESTATION 61 START THE SOLUTION: CLIMATE PROTECTION START THE SOLUTION: CUT ONGOING EMISSIONS ENDNOTES 64 reFerenCes 73 ACronYMS, teCHNICAL terMS, etC 79 CREDITS 81 iv 1997: HAZE OVER INDONESIA Uncontrollable fires in forests and peatlands during 1997 released up to 2.57Gt of carbon, a volume equivalent to up to 40% of the mean annual global carbon emissions from fossil fuels during the period.