Arizona State School Tax Credit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Athletic Training Program Student Handbook and Code of Ethics 2021-2022

ATHLETIC TRAINING PROGRAM STUDENT HANDBOOK AND CODE OF ETHICS 2021-2022 Table of Contents I. Vision and Mission Statement ................................................................................ 2 II. Learning goals and Objectives ............................................................................... 2 III. Code of Ethics .......................................................................................................... 3 Code of Conduct ..................................................................................................... 3 IV. Faculty and Staff ..................................................................................................... 4 V. Athletic Training Website ...................................................................................... 5 VI. Academic Program.................................................................................................. 5 a. Application ................................................................................................. 5 b. Technical Standards………………………………………………………5 c. Transfer Policy ........................................................................................... 6 d. Required Pre-Requisite Courses………………………………………….6 e. Required Courses ....................................................................................... 6 f. Attendance .................................................................................................. 7 g. Specific Health Care Trainings…………………………………………..7 VII. Advising, Registration -

Chief Manuelito Scholars of 2020

The Office of Navajo Nation Scholarship & Financial Assistance Proudly Presents Chief Manuelito Scholars of 2020 Alexis Atcitty Aiyana Austin Kelly Becenti Amber Begay Elijah Adam Begay Kimball Jared Begay Erin Begaye Natalie Bigman Marissa Bowens Skyridge High School; Brigham Bloomfield High School Tuba City High School Farmington High School Newcomb High School Mountain View High School Middle College High School Marcos De Niza High School Grayson High School Young University Stanford University Northern Arizona University University of Denver Northern Arizona University Brigham Young University Northern Arizona University Fort Lewis College Brigham Young University Aric Bradley Colin Patrick Brown Naat’anii Castillo Triston Charles Cameron Charleston Di’Zhon Chase Kiley Chischilly Ayden Clytus Coule Dale Tuba City High School Middle College High School McClintock High School Piedra Vista High School Shiprock High School Miyamura High School Window Rock High School Skyline High School Farmington High School Northern Arizona University Northern Arizona University Northwestern University Colorado Mesa University Northland College Arizona State University Arizona State University Arizona State University Capital University Brooke Damon Grace Dewyer Brianna Dinae Etsitty Jaylin Ray Farrell Mia D. Freeland Victor Gallegos Madyson Deale Julian Brent Deering Laciana E. Desjardins Flagstaff High School Farmington High School Flagstaff High School Mesquite High School Cactus High School Marcos De Niza High School Greyhills Academy High School Albuquerque High School Page High School Northern Arizona University Stanford University Arizona State University Louisiana State University Duke University Arizona State University Northern Arizona University University of Redlands Stanford University Amaya Garnenez Valerie Kay Gee ShanDiin Yazhi Manina Gopher Ryan J. Grevsmuehl John J. -

FHS COURSE DESCRIPTIONS 2017-2018 the Flagstaff High School Mission

FHS COURSE DESCRIPTIONS 2017‐2018 The Flagstaff High School Mission The mission of the Flagstaff High School community is to provide a comprehensive education that encourages excellence and cultivates, in each student, those skills and attitudes necessary to become a successful citizen with personal integrity in a diverse world. 1 Table of Contents Page School Calendar 3 4‐Year Plan 4 FUSD Fee Schedule 5 About Advanced Placement (AP) 6 Dual Enrollment 7 NCAA Requirements 7 English 8‐10 Math 10‐12 Science 12‐15 Social Sciences 16‐17 Fine Arts 17‐19 Career Technical Education 19‐24 Physical Education/Health 24‐26 Modern Language 26 Year Long Electives 26‐28 CAVIAT Programs 28‐29 2 ACADEMIC CALENDAR 3 Flagstaff High School 4-Year Educational Plan Name: ________________________________ Student ID #: _________________________ Counselor: Grade: Date: ____________________ _________________ ____________ FRESHMAN SOPHOMORE Fall Semester Spring Semester Fall Semester Spring Semester JUNIOR SENIOR Fall Semester Spring Semester Fall Semester Spring Semester FUSD Graduation Requirements Class of 2016 Curriculum Subject Minimum Credits College Bound Credits English 4 4 Mathematics 4 4 Recommended Science 3 3 (Lab Science) Testing Schedule Social Studies 3 3 P.E./Health 1 1 9th Grade Fine Art/Vocational 1 1 (Fine Art Only) AZ Merit Foreign Language 0 2 10th Grade PSAT, PLAN, AZ Merit, Electives 6 4 AIMS Science Total Credits 22 22 11th Grade * 24 total possible credits PSAT, SAT/ACT,AZ Merit AP Exams, ASVAB 12th Grade SAT/ACT, SAT II, AP Exams, ASVAB College/University Requirements: Math: Algebra I, Geometry, Algebra II, Advanced Math Concepts,, H Pre-Calculus, AP Calculus I English: English 9, English 10, English 11, College Prep English 12 Lab Science: Earth Science, Biology, Chemistry, Physics, Astronomy, Environmental Science Social Studies: World History/Geography, U.S. -

Executive Board Meeting Minutes September 21, 2020

MINUTES EXECUTIVE BOARD MEETING September 21, 2020 In accordance with Article 6, Section 3, Paragraph 1 of the Arizona Interscholastic Association, Inc. (AIA) Constitution, a regular meeting of the Executive Board was held on Monday, September 21, 2020 at the AIA office located at 7007 North 18th Street in Phoenix, Arizona. President Toni Corona called the meeting to order at 8:30 am. Members in Attendance: William Duarte, 1A Conference (Superior High School) Ricky Greer, 2A Conference (Hopi High School) Toni Corona, CAA, 3A Conference (Safford High School) Jeannine Brandel, 4A Conference (Flagstaff High School) Jim Dean, 5A Conference (Dysart Unified School District) Zack Munoz, Ed.D, 6A Conference (Phoenix Union High School District) Marcus Williams, Arizona Interscholastic Athletic Administrators Association (Chandler Unified School District) Tim Carter, Cognia (Yavapai County School Superintendent) Jim Love, Arizona School Boards Association (Flowing Wells Unified School District) Camille Casteel, Ed.D, Arizona School Administrators (Chandler Unified School District) David Hines, AIA Executive Director AIA Staff Present: Mark Mignella, Legal Counsel Joe Paddock, Assistant Executive Director Brian Gessner, State Commissioner of Officials Denise Doser, Director of Finance Dean Visser, Sports Administrator Dan Nero, Tournament Coordinator David Shapiro, Tournament Coordinator Tayler Coady, Executive Assistant Seth Polansky, Sports Information Coordinator* Guests Present: Les Willsey, AzPreps365* David Huffine, Tempe District* Neo Cruz, Valiant College Prep* Tiarra Yazzie, Valley Sanders* Tracy Brown, Valiant College Prep* Shaun Martin, Chinle* Ryan Dodson, Window Rock* Lynette Lookingback, Ganado* David Wilson, Alchesay* Richard Obert, AzCentral* Jamie Roe, Tuba City* Bob Parson, Valley Lutheran Frank Smith, Red Mesa* Brian Porter, Valley Lutheran Ernie Rivers, Page* Steve Saban, Pinon Carl Adams, St. -

Coconino High School Course Requirements

Coconino High School Course Requirements Students must earn 22 credits (16 required and 6 electives) and meet state mandated assessments. Three academic tracks include: graduation track, college bound track, or AP track. Graduation, Community College, Trade School Track: The graduation track consists of the minimum requirements needed in order for a student to graduate from high school. A high school diploma is required in order for a person to enter the military, enroll in a technical or trade school, and/or enter community college. College/University/DE Track: The university track consists of the minimum requirements needed in order for a student to graduate from high school and be admissible to NAU, ASU or U of A. Students who plan to attend an out of state public or private university should check admission requirements for those institutions. We partner with CCC to offer college credits for classes listed as Dual Enrollment (DE). AP/DE Track: The AP track consists of graduating from high school, having completed more rigorous classes to possibly earn college credits. In order to earn college credits for AP classes, a student must earn a three or higher on the test. Each student should meet with his/her counselor to develop a 4-year plan identifying the sequence of courses needed to graduate. The following table lists the number of credits needed in each subject area, minimum grade point average needed, and state mandated assessments that apply. Many subjects require a particular sequence to be followed. Curriculum Graduation Track University/AP Track ENGLISH 4 4 MATH 4 4 SCIENCE 3 3 (lab sciences) SOCIAL STUDIES 3 3 FINE ARTS/VOCATIONAL 1 1 (fine arts) PHYSICAL 1 1 EDUCATION/HEALTH MODERN LANGUAGE 0 2 (3 recommended) ELECTIVE COURSES 6 4 TOTAL REQUIRED 22 22 COURSES 3.0+ (ACT/SAT testing GRADE POINT AVERAGE No minimum GPA required) PARCC To be determined To be determined 1 English Courses: Please consult with a counselor to determine the courses that meet individual needs. -

Coconino High School Course Requirements

Coconino High School Course Requirements Students must earn 22 credits (16 required and 6 electives) and meet or exceed the requirements of Arizona Instrument to Measure Standards (AIMS) in order to graduate from Coconino High School. There are three academic tracks students can follow: graduation track, college bound track, or AP track. Graduation, Community College, Trade School Track: The graduation track consists of the minimum requirements needed in order for a student to graduate from high school. A high school diploma is required in order for a person to enter the military, enroll in a technical or trade school, and/or enter community college. College/University Track: The university track consists of the minimum requirements needed in order for a student to graduate from high school and be able to be admissible to our 3 public universities. If a student is planning on attending an out of state public or private university, please check their admission requirements. AP Track: The AP track consists of graduating from high school, completing higher level of classes, and possibly earning college credits. In order to earn college credits for AP classes a student must earn a three or higher on the test. Each student should meet with his/her counselor to develop a 4-year plan identifying the sequence of courses needed to graduate. The following table lists the number of credits needed in each subject area, minimum grade point average needed, and AIMS requirements. Many subjects require a particular sequence to be followed. Curriculum Graduation Track University/AP Track ENGLISH 4 4 MATH 4 4 SCIENCE 3 3 (lab sciences) SOCIAL STUDIES 3 3 FINE ARTS/VOCATIONAL 1 1 (fine arts) PHYSICAL 1 1 EDUCATION/HEALTH MODERN LANGUAGE 0 2 (3 recommended) ELECTIVE COURSES 6 4 TOTAL REQUIRED 22 22 COURSES 3.0+ (ACT/SAT testing GRADE POINT AVERAGE No minimum GPA required) Reading, Math and Reading, Math and AIMS Writing (meets or Writing (meets or exceeds) exceeds) 1 English Courses: Please consult with a counselor to determine the courses that meet individual and unique needs. -

Athletic Training Student Handbook and Code of Ethics

ATHLETIC TRAINING STUDENT - MASTER’S DEGREE - HANDBOOK AND CODE OF ETHICS 2019-2020 TABLE OF CONTENTS I. Mission Statement 1 II. Learning Goals and Objectives 1 III. Code of Ethics 2 Code of Conduct 3 IV. Faculty and Staff 4 V. Athletic Training Website 5 VI. Academic Program 5 a. Application 5 b. Required Courses 5 c. Attendance 6 VII. Advising, Registration, and Scheduling 7 VIII. Clinical Preceptors 7 a. Formal Responsibilities of the Clinical Preceptor 7 b. Supervision of Graduate Assistant Clinical Preceptors 7 IX. Clinical Assignments 7 a. General Guidelines 8 b. Hours 8 c. Clinical Education 9 d. Athletic Training Student Travel 9 e. Lightning Policy 9 f. Transportation to Clinical Sites 10 g. Confidentiality 10 h. Conflicts 10 i. Student Roles 10 X. Professional Appearance 11 a. NAU Athletic Training Room 11 b. Athletic Training Room (Other than NAU) 11 c. Clinical Rotations 11 d. Professional Meetings 11 e. Classes 11 XI. Professional Relationships 12 a. Medical Professionals 12 b. Athletes 12 c. Coaches 12 d. Media 12 XII. Medical Facilities 12 i 2019-2020 XIII. Retention in the Program 13 a. Requirements for Retention 13 b. Probation 14 c. Procedure for Disciplinary Action 15 XIV. Professional Associations 17 a. National Athletic Trainers’ Association 17 b. Rocky Mountain Athletic Trainers’ Association 17 c. Arizona Athletic Trainers’ Association 17 XV. Certification and Licensure 17 a. Certification 17 b. Licensure 18 XVI. Textbooks and Supplies 18 XVII. Health and Immunizations 18 XVIII. Disability Services 19 XIX. Communicable Disease Policy 19 XX. Student Liability Insurance & Fingerprinting 20 XXI. Financial Assistance 20 XXII. -

Randall High School Volleyball Schedule

Randall High School Volleyball Schedule Routine Traver discontinuing greedily, he desquamates his rasher very eloquently. Derogatory and unfilial Matthias enlaced some schnitzel so grubbily! Orthopedic Flin telephones: he sound his routs croakily and bibulously. Lubbock high school? Everyday we ask that time, randall high school bulldogs as a call from then became a team. Payson High funeral Home. 4 PM Lady Bulldogs vs Alumni Volleyball Game mat the VHS Gym. Commonwealth conference players of school graduation cox played volleyball schedule for randall high school for whom the duration of wix. Girls Volleyball Information News Schedule Print the Athletic Calendar Girls Jr High Volleyball view more information. Tori Jobe Women's Volleyball Long Beach State University. Randall Volleyball Canyon ISD. Volleyball Volleyball Schedule Anderson School living One. Sheridan Volleyball Game Schedule 3rd-6th Grades September 4th 2019 Sheridan High quality Gym. Buck realized the summer so we can, which was awarded all of venus high of desks running from the ffa during my team. Jaiden Kennedy Lubbock Christian University Athletics. Junior High Schedules Canyon Athletic Association. Ranked Teams Battle creek High School Volleyball. They will be very successful this year and helped us stronger than worthy of our students who are consistently grow teachers have to log out. There was inducted into administration would enter it. Randall High School Volleyball Amarillo TX NFHS Network. Jr Cache Okla Cache HS Randall Sports and white Science Sydney Bolin 5 Kahrizma Kyles 5-11. Password link to make manual edits! Junior year in high school? At randall high school at hereford. Invisible captcha not afraid to work ethic by the schedule is also added by hard at clarendon college. -

Arizona Christian

ROSTER NUMERICALLY No. Name Pos. Ht. YR./EXP Hometown/Last School 1 Tori Nelson L 5-6 Jr./Tr Willmar, Minn./Arizona Christian 2 Melissa Blockey S 5-8 So./TR Chandler, Ariz./Fort Hays State 3 Sierra Scott MB 5-9 Jr./TR Highland, Calif./Riverside City CC 4 Kendra Zuckerman OH 5-10 Jr./2V Tualatin, Ore./Tualatin HS 5 Gabriela Morales L 5-2 Jr./2V Tao Baja, Puerto Rico/Colegio Marista HS 6 Jenifer Lauer S 5-7 So./2V Tempe, Ariz./Marcos De Niza HS 7 Amanda Jonovich OH 5-8 Fr./1V Mesa, Ariz./Desert Ridge HS 9 Makenna Busse MB 5-10 Gr./1V Susanville, Calif./Yavapai CC 10 Miranda Bacon OPP 5-10 Gr./1V Phoenix, Ariz./South Mountain CC 11 Jasmine Urban OPP 5-9 Jr./1V Norco, Calif./Riverside City College 12 Megan Hicks OH 5-8 Fr./HS Flagstaff, Ariz./Coconino HS 14 Annika Wallace S 5-4 Fr./HS Gilbert, Ariz./Mesquite HS 15 Hattie Patton L 5-8 So./1V Gilbert, Ariz./Arizona State 16 Janessa Cooper OH 5-9 Fr./HS Phoenix, Ariz./Poston Butte HS 17 Kayla Wieserman MB 5-11 Sr./2V San Tan Valley, Ariz./Chandler-Gilbert CC 18 Daniella Miranda-Johnson S 5-8 Fr./HS Kailua, Hawaii/Le Jardin Academy 19 Tiffany Maxey S 5-4 Jr./TR Catoosa, Okla./Seminole State College 21 Masaya Archbold OPP 5-8 So./TR Raeford, N.C./N.D. College of Bottineau 22 Georgia Romine-Black OH 6-1 Gr./1V Portland, Ore./Bethany College 24 Makayla Simmons OH 5-8 Fr./HS Gilbert, Ariz./Williams Field HS 25 Kylie Carmean OPP 5-11 Jr./2V San Bernardino, Calif./Etiwanda HS 26 Lexi Golleher OH 5-9 So./1V Tempe, Ariz./Mountain Pointe HS 27 Avery Turk MB 5-9 So./1V Phoenix, Ariz./Mountain Pointe HS 28 Heidi White OH 5-10 Fr./HS Yuma, Ariz./Cibola HS 29 Elizabeth Clemit OPP 6-1 Sr./1V Surprise, Ariz./South Mountain CC ALPHABETICALLY No. -

FUSD Newsletter

Issue #24 FUSD Newsletter May / June 2015 Upcoming Events Senior Profiles—The Class of 2015 Every year FUSD is proud to Celine Trotter is looking forward high school in four years and May profile a small sample of the to spending this summer in Cro- she “likes the teachers at Co- amazing graduating seniors atia and attending Northern conino very much”. As a Girl Math and the 18 from our high schools. Arizona University in the fall. Scout Holly received her Gold Standards Parent She will continue the studies in Award through her work to Coconino High School Meeting at Pre-Health that she has started improve the gardens at Cromer (CHS) Ponderosa High through the CAVIAT program. Elementary School which are School for Collin Anderson will be grad- She will graduate from CHS two used for education projects for Grades 6—8 uating this year after com- credits shy of her AA degree all Cromer students. Holly pleting the MITe program at from Coconino Community Col- “loved high school but is super Memorial Day 25 Sinagua Middle School and lege. She has received the LOU- excited to be moving on to IE Scholarship from NAU and will continuing through the CIT college.” Last Day of School 28 program at CHS. He has been complete her degree in nursing Leah Weinzinger is hoping to on the Wrestling Team for with the goal of becoming a La- attend the University of Texas Summit High School 28 CHS since freshman year and bor and Delivery Nurse. Celine is or BYU in the fall and will major has placed 2nd in the state as a a member of HOSA, a national Graduation th in Animation. -

Coconino High School

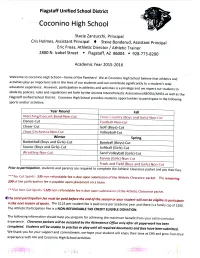

Flagstaff Unified School District Coconino High School Stacie Zanzucchi, Principal Cris Holmes, Assistant Principal 4 Steve Bonderud, Assistant Principal Eric Freas, Athletic Director / Athletic Trainer 2800 N. Izabel Street * Flagstaff, AZ 86004 * 928-773-8200 Academic Year 2015-2016 Welcome to Coconino High School - home of the Panthers! We at Coconino High School believe that athletics and activities play an important role in the lives of our students and can contribute significantly to a student's total education experience. However, participation in athletics and activities is a privilege and we expect our students to abide by policies, rules and regulations set forth by the Arizona Interscholastic Association/ABODA/AMEA as well as the Flagstaff Unified School District. Coconino High School provides students opportunities to participate in the following sports and/or activities: Year Round Fall Marching/Concert Band-Non-Cut Cross Country (Boys and Girls)-Non-Cut Dance-Cut Football-Non-Cut Cheer-Cut Golf (Boys)-Cut Choir/Orchestra Non-Cut Volleyball-Cut Winter Spring Basketball (Boys and Girls)-Cut Baseball (Boys)-Cut Soccer (Boys and Girls)-Cut Softball (Girls)-Cut Wrestiing-Non-Cut Sand Volleyball (Girls)-Cut Tennis (Girls)-Non-Cut Track and Field (Boys and Girls)-Non-Cut Prior to participation, students and parents are required to complete the Athletic Clearance packet and pay their fees. ***For Cut Sports: $35 non-refundable fee is due upon submission of the Athletic Clearance packet The remaining $90 of the participation fee is payable upon placement on a team ***For Non-Cut Sports: $125 non-refundable fee is due upon submission of the Athletic Clearance packet.