Cfds and Liquidity Risk Providers: a Comprehensive Analysis on Hedging Risk

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Saxo Bank's BEST EXECUTION POLICY

SAXO BANK’S BEST EXECUTION POLICY SAXO BANK’S BEST EXECUTION POLICY THE SPECIALIST IN TRADING AND INVESTMENT Page 1 of 6 Page 1 of 6 SAXO BANK’S BEST EXECUTION POLICY 2.2 The trading conditions for the above products 1 INTRODUCTION are available on Saxo Bank’s different web- sites. 1.1 This policy is issued pursuant to, and in com- pliance with, EU Directive 2004/39/EC of 21 3 SAXO BANK’S APPROACH TO BEST EXE- April 2004 on Markets in Financial Instruments CUTION ("MiFID") and the Danish legislation imple- menting MiFID (the "Rules") that applies to 3.1 When executing orders Saxo Bank will take all Saxo Bank. reasonable steps to obtain the best possible result under the circumstances for the client 1.2 This policy provides an overview of how Saxo taking into account price, costs, speed, likeli- Bank executes orders on behalf of clients, the hood of execution and settlement, size, nature factors that can affect the timing of execution or any other consideration relevant to the exe- and the way in which market volatility plays a cution of the order ("Best Execution"). part in handling orders when buying or selling a financial instrument. 3.2 When considering the best executing factors, Saxo Bank takes into account: 1.3 This policy applies to Saxo Bank's execution of orders on behalf of retail clients and profes- the characteristics of the client order; sional clients as defined by the Rules. the characteristics of the financial instru- ments that are subject to that order (in 1.4 Where Saxo Bank provides a quote to a client particular in relation to OTC financial in- or negotiates the terms of an Over-the-Counter struments); and ("OTC") transaction with Saxo Bank as coun- the characteristics of the execution ven- terparty, Saxo Bank will normally not be acting ues to which that order can be directed. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Institutional Investor

R +R Research + Rankings The 2015 Tech 50 repeating in the No. 1 position, brought his company from nowhere to the top of the global exchange world in part because, he says, “technology enabled us to scale quickly.” It also can fail. ICE’s three-and-a-half-hour outage on July 8 was only the latest to affect a major mar- Racers ket platform — and demonstrate the importance of two other differentiating qualities: resiliency and recovery. Catherine Bessant (No. 2), global technology and operations executive at Bank of America Corp., frets that the technology world at large is “moving at to the the speed of the consumer, not the speed of the enterprise.” The answer? “The best and brightest talent.” Bessant believes that “in conjunction with advanced- state thinking, financial services is mag- netic for tech people.” But that means competing against Apple, Google and other name brands. Edge The Tech 50 ranking was compiled The global financial technology elite sets itself apart by understanding by Institutional Investor editors and the strategic and societal implications of high-tech advances and staff, with nominations and input from industry participants and experts. Four pushing innovation at Silicon Valley–like speed. primary sets of attributes were evalu- ated: achievements and contributions over the course of a career; scope and complexity of responsibilities; influence GROUNDED AS IT IS IN INFOR- applications and system performance as and leadership inside and outside the mation and money — and components of corporate strategy. These organization; and pure technological information about money leaders think big about the global or innovation. -

J.P. Morgan's Expression of Interest to Act As Global Co-Ordinator And

CONFIDENTIAL J.P. Morgan’s expression of interest to act as Global Co-ordinator and Bookrunner in connection with the Íslandsbanki IPO J.P. Morgan is pleased to express its interest to act as Global Co-ordinator and Bookrunner in connection with the sale process of the Icelandic State Financial Investments’ holdings in Íslandsbanki. J.P. Morgan is a leading global investment bank with a market capitalisation of $427bn and total assets of $3.4trn (December 2020). J.P. Morgan’s global headquarters are in New York, while our European headquarters are in London. We have a strong presence and track record in the Nordic region and our commitment to the region is evidenced by our local offices across the region. J.P. Morgan offers ISFI a full range of investment banking services and will provide first class advice in connection with the sale process of its holdings in Íslandsbanki. We are a global leader in areas such as equity and equity linked capital markets, debt capital markets, M&A advisory, ratings advisory and equity and debt sales, research and trading. J.P. Morgan team for Íslandsbanki Senior project leadership and sponsorship Andreas Lindh, Co-Head of EMEA FIG Stefan Weiner, Head of Northern Europe ECM Kari Hallgrimsson, Senior Country Sponsorship Nordic FIG Advisory European ECM Christian Kornhoff, Executive Director Vittorio Rivaroli, Executive Director Filiph Nilsson, Analyst Emese Pavlik, Associate Kim-Jonas Pellikka, Analyst Vincent Collan, Analyst FIG DCM Ratings Advisory Kiran D. Karia, Executive Director Jens Rasmussen, Executive Director J.P. Morgan contact details Andreas Lindh Registered address: Full legal name: Taunustor 1 J.P. -

February 2019

The definitive source of news and analysis of the global fintech sector | February 2019 www.bankingtech.com SUPERSTRUCTURES Fintech reaches new heights CASE STUDY: CITIZENS BANK US heavyweight pivots for digital era FOOD FOR THOUGHT: CAREER CHOICES The Venn diagram of doom FINTECH FUTURES IN THIS ISSUE THEM US Contents NEWS 04 The latest fintech news from around the globe: the good, the bad and the ugly. 18 Banking Technology Awards The glamour, the winners and the celebrations. 23 Focus: intraday liquidity Are banks ready to meet the ECB’s latest expectations? 24 Interview: Pavel Novak, Zonky P2P lender on a “mission possible”. 26 Focus: data How DNB uses data to reconnect with customers. 30 Analysis: openfunds Admirable data standardisation efforts for the funds industry. 32 Case study: Citizens Bank US’s 13th largest bank embraces digital era. 38 Food for thought Making career choices and the Venn diagram of doom. They struggle with Fintech complexity. We see straight to your goal. We leverage proprietary knowledge and technology to solve complex regulatory challenges, create new products 40 Comment What would a recession mean for fintech? and build businesses. Our unique “one fi rm” approach brings to bear best-in-class talent from our 32 offi ces worldwide—creating teams that blend global reach and local knowledge. Looking for a fi rm that can help keep 42 Interview: Javier Santamaría, EPC your business moving in the right direction? Visit BCLPlaw.com to learn more. Happy one year anniversary, SEPA Instant Credit Transfer! REGULARS 44 -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Understanding Self-Directed Investors Research Report

March 2021 Understanding self- directed investors A summary report of research conducted for The Financial Conduct Authority britainthinks.com BritainThinks Understanding self-directed investors Contents Introduction ............................................................................................ 3 Key findings on the self-directed investor audience ............................... 4 Background & Methodology ................................................................... 6 The self-directed investment landscape ................................................. 9 Understanding self-directed investors ...................................................11 Identifying a new group of self-directed investors .................................15 Implications for the future ......................................................................20 Appendix ...............................................................................................22 BritainThinks | Private and Confidential 2 Understanding self-directed investors Introduction Many people engage with the consumer investment market every day, making sensible decisions to grow their wealth. However, there is evidence that some consumers are making or are led into making poor investment choices. In some instances, this may lead to consumers holding a lot of money in cash, missing out on potential investment returns. In others it may lead them to invest in high risk products, which may not reflect their risk tolerance or their ability to afford the losses. In particular, -

Sales Representatives Manual 2020

Sales Representatives Manual Volume 4 2020 Volume 4 Table of Contents Chapter 1 Overview of Derivatives Transactions ………… 1 Chapter 2 Products of Derivatives Transactions ……………99 Derivatives Transactions and Chapter 3 Articles of Association and ……………… 165 Various Rules of the Association Exercise (Class-1 Examination) ……………………………………… 173 Chapter 1 Overview of Derivatives Transactions Introduction ∙∙∙∙∙∙∙∙ 3 Section 1. Fundamentals of Derivatives Transactions ∙∙∙∙∙∙∙∙ 10 1.1 What Are Derivatives Transactions? ∙∙∙∙∙∙∙∙ 10 Section 2. Futures Transactions ∙∙∙∙∙∙∙∙ 10 2.1 What Are Futures Transactions? ∙∙∙∙∙∙∙∙ 10 2.2 Futures Price Formation ∙∙∙∙∙∙∙∙ 14 2.3 How to Use Futures Transactions ∙∙∙∙∙∙∙∙ 17 Section 3. Forward Transactions ∙∙∙∙∙∙∙∙ 24 3.1 What Are Forward Transactions? ∙∙∙∙∙∙∙∙ 24 Section 4. Option Transactions ∙∙∙∙∙∙∙∙ 25 4.1 What Are Options Transactions? ∙∙∙∙∙∙∙∙ 25 4.2 Options’ Price Formation ∙∙∙∙∙∙∙∙ 32 4.3 Characteristics of Options Premiums ∙∙∙∙∙∙∙∙ 36 4.4 Sensitivity of Premiums to the Respective Factors ∙∙∙∙∙∙∙∙ 38 4.5 How to Use Options ∙∙∙∙∙∙∙∙ 46 4.6 Option Pricing Theory ∙∙∙∙∙∙∙∙ 57 Section 5. Swap Transactions ∙∙∙∙∙∙∙∙ 63 5.1 What Are Swap Transactions? ∙∙∙∙∙∙∙∙ 63 Section 6. Risks in Derivatives Transactions ∙∙∙∙∙∙∙∙ 72 Conclusion ∙∙∙∙∙∙∙∙ 82 Introduction Introduction 1. History of Derivatives Transactions Chapter 1 The term “derivatives” is used for financial instruments that “derive” from financial assets, meaning those that have securities such as shares or bonds as their underlying assets or financial transactions that use a reference indicator such as interest rates or exchange rates. Today the term “derivative” is used widely throughout society and not just on the financial markets. Although there has been criticism that they amplify financial risks and have a harmful impact on the Chapter 2 economy, derivatives are an indispensable requirement in supporting finance in the present age, and have become accepted as the leading edge of financial innovation. -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

FTSE Factsheet

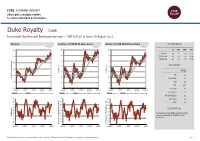

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

Morningstar Report

Report as of 25 Sep 2021 Aberdeen Standard Equity Inc Trust plc , (GB0006039597) Morningstar Rating™ Peer Group Classification Last Close Last Actual NAV (23 Sep 2021) Discount Estimated Nav QQ Morningstar IT UK Equity 345.00 379.95 -9.20 379.95 Income Investment Objective Performance The fund aims to provide shareholders with an above 169 average income while also providing real growth in 146 capital and income. It will invest in a diversified 123 portfolio consisting mainly of quoted UK equities 100 which will normally comprise between 50 and 70 77 individual equity holdings. 54 2016 2017 2018 2019 2020 2021-08 -10.88 23.83 -12.55 9.46 -19.70 19.51 Fund 16.75 13.10 -9.47 19.17 -9.82 14.66 Benchmark 8.76 10.73 -10.56 18.95 -12.56 15.52 Category Management Fee Summary Management fee of 0.65% p.a. of NA on the first GBP 175m and 0.55% thereafter. No performance fee. Contract terminable on notice period of 6 months. Portfolio 31/08/2021 Asset Allocation % Long Short Net Equity Style Box™ Mkt Cap % Fund America Europe Asia Large Size Stocks 113.11 0.00 113.11 Giant 17.55 Bonds 0.00 0.00 0.00 Mid Large 18.27 Cash 0.00 13.11 -13.11 Medium 22.91 Other 0.00 0.00 0.00 Small Small 24.92 Value Blend Growth Micro 16.35 Style Average Mkt Fund Cap (Mil) Ave Mkt Cap GBP 4,115.7 <25 25-50 50-75 >75 7 Top Holdings Stock Sector Weightings % Fund World Regions % Fund Name Sector % hCyclical 66.41 Americas 2.36 BHP Group PLC r 4.54 rBasic Materials 13.25 United States 2.36 Rio Tinto PLC r 4.30 tConsumer Cyclical 14.81 Canada 0.00 CMC Markets PLC y 3.99