Hampton Creek (/Organization/Hampton-Creek-Foods)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Comments October 30 to November 12, 2013

Public Comments October 30 to November 12, 2013 From: Ron Conway Sent: Thursday, November 07, 2013 3:03 PM To: Nancy Bechtle Subject: Join me in supporting the Lucas Cultural Arts Museum in the Presidio in SF To the Board of the Presidio Trust: As you know, I have a passion for making and keeping San Francisco at the forefront of innovation. Through sf.citi, the nonprofit organization I founded to help promote San Francisco as the country’s 21st century capital of technology and forward thinking, I watch every day the work of countless artists, technicians and talented people that keep this city at the top of its game. I believe that the Lucas Cultural Arts Museum is the perfect addition to San Francisco’s cityscape: not only an attraction that will generate interest in and support for the Presidio (not to mention millions of dollars each year in revenue for the Presidio through land rents) but specifically as a beacon that says to the world that San Francisco is, and will remain, this country’s capital of innovation. Certainly, there is no greater innovator around than George Lucas. His films and his vision have transformed cinema. His businesses have transformed the tech sector, specifically digital technology. And, his passion for education has resulted in a world-class collection of art (still growing) that is second to none. San Francisco deserves this museum. It demands it. I, along with those listed below, are supporting this museum not because of George Lucas, but rather because of the promise it represents. -

PETER THIEL Palantir Technologies; Thiel Foundation; Founders Fund; Paypal Co-Founder

Program on SCIENCE & DEMOCRACY Science, Technology & Society LECTURE SERIES 2015 HARVARD KENNEDY SCHOOL HARVARD UNIVERSITY PETER THIEL Palantir Technologies; Thiel Foundation; Founders Fund; PayPal co-founder BACK TO THE FUTURE Will we create enough new technology to sustain our society? WITH PANELISTS WEDNESDAY Antoine Picon Travelstead Professor, Harvard Graduate School of Design March 25, 2015 Margo Seltzer Harvard College Professor, School of Engineering and 5:00-7:00pm Applied Sciences Science Center Samuel Moyn Professor of Law and History, Harvard Law School Lecture Hall C 1 Oxford Street MODERATED BY Sheila Jasanoff Harvard University Pforzheimer Professor of Science and Technology Studies CO-SPONSORED BY Program on Harvard University Harvard School of Harvard University Center for the Engineering and Graduate School Science, Technology & Society Environment Applied Sciences of Design HARVARD KENNEDY SCHOOL HARVARD UNIVERSITY http://sts.hks.harvard.edu/ Program on SCIENCE & DEMOCRACY Science, Technology & Society LECTURE SERIES 2015 HARVARD KENNEDY SCHOOL HARVARD UNIVERSITY Peter Thiel is an entrepreneur and investor. He started PayPal in 1998, led it as CEO, and took it public in 2002, defining a new era of fast and secure online commerce. In 2004 he made the first outside investment in Facebook, where he serves as a director. The same year he launched Palantir Technologies, a software company that harnesses computers to empower human analysts in fields like national security and global finance. He has provided early funding for LinkedIn, Yelp, and dozens of successful technology startups, many run by former colleagues who have been dubbed the “PayPal Mafia.” He is a partner at Founders Fund, a Silicon Valley venture capital firm that has funded companies like SpaceX and Airbnb. -

NVCA 2021 YEARBOOK Data Provided by Dear Readers

YEARBOOK Data provided by Credits & Contact National Venture Capital Association NVCA Board of Directors 2020-2021 (NVCA) EXECUTIVE COMMITTEE Washington, DC | San Francisco, CA nvca.org | [email protected] | 202-864-5920 BARRY EGGERS Lightspeed Venture Partners, Venture Forward Chair Washington, DC | San Francisco, CA MICHAEL BROWN Battery Ventures, Chair-Elect ventureforward.org | [email protected] JILL JARRETT Benchmark, Treasurer ANDY SCHWAB 5AM Ventures, Secretary BOBBY FRANKLIN President and CEO PATRICIA NAKACHE Trinity Ventures, At-Large JEFF FARRAH General Counsel EMILY MELTON Threshold Ventures, At-Large JUSTIN FIELD Senior Vice President of Government MOHAMAD MAKHZOUMI NEA, At-Large Affairs MARYAM HAQUE Executive Director, Venture AT-LARGE Forward MICHAEL CHOW Research Director, NVCA and PETER CHUNG Summit Partner Venture Forward DIANE DAYCH Granite Growth Health Partners STEPHANIE VOLK Vice President of Development BYRON DEETER Bessemer Venture Partners RHIANON ANDERSON Programs Director, Venture SCOTT DORSEY High Alpha Forward RYAN DRANT Questa Capital CHARLOTTE SAVERCOOL Senior Director of PATRICK ENRIGHT Longitude Capital Government Affairs STEVE FREDRICK Grotech Ventures MICHELE SOLOMON Director of Administration CHRIS GIRGENTI Pritzker Group Venture Capital DEVIN MILLER Manager of Communications and JOE HOROWITZ Icon Ventures Digital Strategy GEORGE HOYEM In-Q-Tel JASON VITA, Director of Programming and CHARLES HUDSON Precursor Ventures Industry Relations JILL JARRETT Benchmark JONAS MURPHY Manager of Government Affairs -

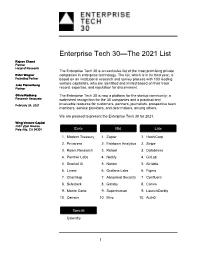

Enterprise Tech 30—The 2021 List

Enterprise Tech 30—The 2021 List Rajeev Chand Partner Head of Research The Enterprise Tech 30 is an exclusive list of the most promising private Peter Wagner companies in enterprise technology. The list, which is in its third year, is Founding Partner based on an institutional research and survey process with 103 leading venture capitalists, who are identified and invited based on their track Jake Flomenberg Partner record, expertise, and reputation for discernment. Olivia Rodberg The Enterprise Tech 30 is now a platform for the startup community: a Research Associate watershed recognition for the 30 companies and a practical and February 24, 2021 invaluable resource for customers, partners, journalists, prospective team members, service providers, and deal makers, among others. We are pleased to present the Enterprise Tech 30 for 2021. Wing Venture Capital 480 Lytton Avenue Palo Alto, CA 94301 Early Mid Late 1. Modern Treasury 1. Zapier 1. HashiCorp 2. Privacera 2. Fishtown Analytics 2. Stripe 3. Roam Research 3. Retool 3. Databricks 4. Panther Labs 4. Netlify 4. GitLab 5. Snorkel AI 5. Notion 5. Airtable 6. Linear 6. Grafana Labs 6. Figma 7. ChartHop 7. Abnormal Security 7. Confluent 8. Substack 8. Gatsby 8. Canva 9. Monte Carlo 9. Superhuman 9. LaunchDarkly 10. Census 10. Miro 10. Auth0 Special Calendly 1 2021 The Curious Case of Calendly This year’s Enterprise Tech 30 has 31 companies rather than 30 due to the “curious case” of Calendly. Calendly, a meeting scheduling company, was categorized as Early-Stage when the ET30 voting process started on January 11 as the company had raised $550,000. -

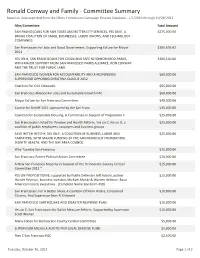

Ronald Conway and Family - Committee Summary Based on Data Exported from the Ethics Commission Campaign Finance Database - 1/1/2010 Through 10/28/2012

Ronald Conway and Family - Committee Summary Based on data exported from the Ethics Commission Campaign Finance Database - 1/1/2010 through 10/28/2012 Filer/Committee Total Amount SAN FRANCISCANS FOR FAIR TAXES AND BETTER CITY SERVICES, YES ON E, A $275,000.00 BROAD COALITION OF SMALL BUSINESSES, LABOR UNIONS, AND TECHNOLOGY COMPANIES San Franciscans for Jobs and Good Government, Supporting Ed Lee for Mayor $105,693.62 2011 YES ON B, SAN FRANCISCANS FOR CLEAN AND SAFE NEIGHBORHOOD PARKS, $100,100.00 WITH MAJOR SUPPORT FROM SAN FRANCISCO PARKS ALLIANCE, RON CONWAY AND THE TRUST FOR PUBLIC LAND SAN FRANCISCO WOMEN FOR ACCOUNTABILITY AND A RESPONSIBLE $69,000.00 SUPERVISOR OPPOSING CHRISTINA OLAGUE 2012 Coalition For Civil Sidewalks $65,000.00 San Francisco Alliance For Jobs and Sustainable Growth PAC $60,000.00 Mayor Ed Lee for San Francisco Committee $49,000.00 Cunnie for Sheriff 2011 sponsored by the San Franc $35,000.00 Coalition for Sustainable Housing, A Committee in Support of Proposition C $25,000.00 San Franciscans United for Pension and Health Reform, Yes on C, No on D, a $25,000.00 coalition of public employees, taxpayers and business groups SAVE HETCH HETCHY, NO ON F, A COALITION OF BUSINESS, LABOR AND $25,000.00 TAXPAYERS, WITH MAJOR FUNDING BY THE SAN FRANCISCO FOUNDATION, DIGNITY HEALTH, AND THE BAY AREA COUNCIL Why Tuesday San Francisco $25,000.00 San Francisco Parent Political Action Committee $20,000.00 A New San Francisco Majority in Support of the Democratic County Central $15,000.00 Committee 2012 * YES ON PROPOSITION B, supported by Public Defender Jeff Adachi, author $15,000.00 Harriet Heyman, business investors Michael Moritz & Warren Hellman, Basic American Goods executives…(Complete Name See Form 410) San Franciscans For A Better Muni, A Coalition Of Muni Riders, Concerned $10,000.00 Citizens, And Supervisor Sean R. -

Paypal Co-Founder Peter Thiel Revealed As Buyer of Miami Beach Mansions

2/18/2021 PayPal’s Peter Thiel Buys Miami Beach mansions PayPal Co-founder Peter Thiel revealed as Buyer of Miami BeaCh mansions Billionaire co-founder of Founders Fund also incorporated a company in Florida Miami Jan. 22, 2021 03:30 PM By Katherine Kallergis Peter Thiel with 445 to 441 East Rivo Alto Drive (Getty) PayPal co-founder Peter Thiel was revealed as the buyer of two waterfront adjacent Miami Beach mansions that sold in September for $18 million (https://therealdeal.com/miami/2020/09/21/longtime-ford-motor-exec-sells-venetian- islands-estate-for-18m) . https://therealdeal.com/miami/2021/01/22/paypal-co-founder-peter-thiel-revealed-as-buyer-of-miami-beach-mansions/ 1/2 2/18/2021 PayPal’s Peter Thiel Buys Miami Beach mansions Thiel, the German-American billionaire entrepreneur and venture capitalist, acquired Jacques Nasser’s double-home at 445 to 441 East Rivo Alto Drive on the Venetian Islands (https://therealdeal.com/miami/tag/venetian-islands) . Business Insider rst reported the buyer’s identity, which a source conrmed to The Real Deal. Thiel is a co-founder of San Francisco-based venture capital rm Founders Fund, which has a presence in the Miami area. Thiel incorporated Founders Fund Miami in December, according to state records. He also invested in Facebook and co-founded Palantir Technologies. Forbes pegs his net worth at about $5.9 billion. Nasser, a Lebanese-American business executive and philanthropist who led Ford Motor Company as president and CEO, put the Miami Beach property up for sale asking nearly $20 million in July. -

1Q 2019 Relationship Management Purpose-Built for Finance Learn More at Affinity.Co

Co-sponsored by Global League Tables 1Q 2019 Relationship Management Purpose-Built for Finance Learn more at affinity.co IMPROVE ELIMINATE SUPPORT DISCOVER PROPIERTARY CROSSING YOUR NEW EXECUTIVE DEAL FLOW WIRES PORTFOLIO CONNECTIONS Learn why 500+ firms use Affinity's patented technology to leverage their network and increase deal flow “Within weeks of moving “The biggest problems Affinity “Let’s be honest, no one wants to Affinity, we were able to helps me solve are how to to use Salesforce reporting. easily discover and manage track all of my activity and how Affinity isn’t just better for most the 1,000s of entrepreneur to prioritize my time. It makes teams, it’ll make the difference and venture community me a better investor. All of the between managing your relationships already latent things I need to do on a day-to- pipeline to success, versus not within our team." day basis I now do in Affinity.” tracking it at all.” ERIC EMMONS KYLE LUI KEVIN ZHANG Managing Director Partner Principal MassMutual Ventures DCM Ventures Bain Capital Ventures [email protected]@affinity.co AffinityAffinity is a relationship is a relationship intelligence intelligence platform platform built to builtexpand to expandand evolve and theevolve traditional the traditional CRM. AffinityCRM. Affinityinstantly instantly surfaces surfaces all all www.affinity.cowww.affinity.co of yourof team’s your team’sdata to data show to you show who you is bestwho issuited best tosuited make to the make crucial the crucialintroductions introductions you need you to need close to your close next your big next deal. big deal. -

Open Internet Investors Letter the Honorable Tom Wheeler, Chairman Federal Communications Commission 445 12Th Street

7/2/2014 Open Internet Investors Letter Open Internet Investors Letter The Honorable Tom Wheeler, Chairman Federal Communications Commission 445 12th Street, SW Washington D.C. 20554 May 8, 2014 Dear Chairman Wheeler: We write to express our support for a free and open Internet. We invest in entrepreneurs, investing our own funds and those of our investors (who are individuals, pension funds, endowments, and financial institutions). We often invest at the earliest stages, when companies include just a handful of founders with largely unproven ideas. But, without lawyers, large teams or major revenues, these small startups have had the opportunity to experiment, adapt, and grow, thanks to equal access to the global market. As a result, some of the startups we have invested in have managed to become among the most admired, successful, and influential companies in the world. We have made our investment decisions based on the certainty of a level playing field and of assurances against discrimination and access fees from Internet access providers. Indeed, our investment decisions in Internet companies are dependent upon the certainty of an equal opportunity marketplace. Based on news reports and your own statements, we are worried that your proposed rules will not provide the necessary certainty that we need to make investment decisions and that these rules will stifle innovation in the Internet sector. If established companies are able to pay for better access speeds or lower latency, the Internet will no longer be a level playing field. Startups with applications that are advantaged by speed (such as games, video, or payment systems) will be unlikely to overcome that deficit no matter how innovative their service. -

Digital Garage Invests in SV Angel to Strengthen Its Silicon Valley Investment Portfolio

30 June 2011 Digital Garage, Inc. Digital Garage Invests in SV Angel To Strengthen Its Silicon Valley Investment Portfolio Digital Garage, Inc. (JASDAQ: 4819, Head Office: Shibuya-ku, Tokyo, Japan, President & Group CEO: Kaoru Hayashi, henceforth DG), through its investments and new business development subsidiary DG Incubation, Inc. (Head Office: Shibuya-ku, Tokyo, Japan, President: Yasuyuki Rokuyata, henceforth DGI) made an investment in ‘SV Angel III’, a venture fund with a prominent Silicon Valley investor Ron Conway as its primary strategic advisor. SV Angel, founded by Ron Conway and David Lee, is a fund focusing mainly on providing mentoring to the early-stage startup companies. With recognized for the early-backing of Google, PayPal and Twitter, hugely successful Silicon Valley investor and entrepreneur Ron Conway, it puts priority on funding and business development of social media and mobile technology services. The fund’s investments portfolio companies include: about.me (http://about.me/, acquired by AOL), Bump Technologies (http://bu.mp/, acquired), Flipboard (http://flipboard.com/), Milo (http://milo.com/, acquired by eBay) and Path (http://www.path.com/) among others. Furthermore, there are a number of common items on Ron Conway’s and DGI’s portfolio, such as Twitter, Path, Three SF (acquired by Electric Arts), Fotonauts (http://fotopedia.com/) and Context Logic (http://contextlogic.com). Partnership with SV Angel provides DGI with ample opportunities for indirect investments in the Silicon Valley and San Francisco based promising startup ventures. This newly-earned access to the talented young entrepreneurs is expected to introduce considerable stabilization of DGI’s investments portfolio. This is especially because through strengthening of ties with the fund’s network of angel investors and entrepreneurs, DGI gains first-hand information on the industry’s newest trends. -

Vcs Aim to Out-Angel the Angels

NEWS ANALYSIS April 2, 2007, 12:00AM EST VCs Aim to Out-Angel the Angels Responding to the emergence of a new breed of wealthy investor, venture capitalists are boosting their early-stage investments in startups by Aaron Ricadela In October, as startup Jaxtr hit up venture capital firms for its first round of funding, it landed an unusual arrangement. Instead of taking a few million in cash from a firm that would hope to one day book a fat return, Jaxtr took a loan—just $1.5 million, from no less than four VC firms and three angel investors. None got the usual perk of a seat on Jaxtr's board. The result is plenty of independence for Jaxtr, a maker of software that routes calls from blogs and MySpace profiles to cell phones. "You're still basically on your own," says Jaxtr Chief Executive Konstantin Guericke, one of the co-founders of networking site LinkedIn. Jaxtr's tale illustrates the new calculus governing high-tech venture capital. For years, angel investors and traditional venture firms existed in a sort of symbiosis. Wealthy tech-industry veterans willing to open their checkbooks for $100,000 or so—the angels, as they're known—could bootstrap promising young companies before serious money, to the tune of six or more figures, from venture firms arrived. Angling for a slice of Jaxtr, however, were both groups: Mayfield Fund, Draper Fisher Jurvetson, Draper Richards, and the Founders Fund on one hand; angel investors Ron Conway, Reid Hoffman, and Rajeev Motwani on the other. "The company was a bit in the driver's seat," one investor says. -

Lessons from Silicon Valley

Lessons From Silicon Valley Cathy Anterasian Spencer Stuart, Silicon Valley Jeff Hauswirth Spencer Stuart, Toronto Today’s Discussion > Silicon Valley overview > Key factors that make it unique > Opportunities for Canada Silicon Valley Overview > Where? Southern part of the San Francisco > Boasts 10 of the most inventive towns in the Bay Area in Northern California U.S. (Wall Street Journal) > Diverse Population of 2.5 million > Has “World Class” Universities • White: 41% (Stanford, Berkeley) • Asian: 28% • Hispanic: 25% > One in five has a graduate or post graduate • African American: 3% degree; one in four is a university grad • Native American: 1% • Other 3% > Very high concentration of Fortune 1000 tech firms (Adobe, Apple, Business Objects, eBay, > Average Wages: $73,300 Google, HP, Intel, Sun MicroSystems) > Amongst the highest real estate and cost of > “HQ” of thousands of others living > About 30% of all venture capital in the U.S. is spent in Silicon Valley Counter Great Culture Universities Innovative Critical Mass Financing History Military Venture Catalysts Complex Capitalists Risk Pioneers Takers Silicon Great Start-up Climate Valley Scene Relaxed Tolerance Atmosphere of Failure Lack of Tolerance Hierarchy of “Crazy Ideas” Information Highly Freeflow Creative Dense Fiercely Social Competitive Networks Culture & Lifestyle The Pioneers Fred Terman Bill Hewlett William Shockley David Packard “The Fairchild Eight” The Lure and Contributions of Great Universities In Silicon Valley Big Companies…Seed Many New Stars Formed Among the Estimated 70 Companies that Fairchild Semiconductor Spawned… Critical Mass of Venture Capital Infrastructure and Specialized Services > Office space > Lawyers > Accountants > Investment Bankers > Executive Recruiters > Marketing Consultants > Etc. Risk Taking Dream Big… …It’s OK to fail… …As long as you learn Think Big “From the beginning at Intel, we planned on being big. -

Largest Venture Capital Deals and Exits; Deals by Value and Stage

The Preqin Quarterly: Private Equity, Q3 2012 This report is an excerpt from: Preqin Quarterly: Private Equity, Q3 2012. To download the full report please visit: https://www.preqin.com/docs/quarterly/PE/Private_Equity_Quarterly_Q3_2012.pdf Largest Venture Capital Deals and Exits; Deals by Value and Stage Fig. 42: Average Value of Venture Capital Deals by Stage, Fig. 43: Proportion of Number and Aggregate Value of Venture 2010 - 2012 YTD Capital Deals by Industry, Q3 2012 45 30% 28% 40 25% 35 21% 22% 30 20% 18% 25 17% 16% 15% 20 12% 15 10% 8% 8% 7% 6% 10 5% Average Deal Size ($mn) Average 5% 4% 4% 5% 4% 3% 5 2% 3% 3% 2% 2% 0 0% Other Seed Debt Angel/ Angel/ Disc. Venture Other IT Internet Business Series B/ Series Round 2 Services Round 1 Round 3 Series A/ Series Series C/ Series Growth Round 4 Round Series D/ Series Capital/ Related Telecoms and Later Industrials Semic. & & Semic. Expansion Consumer Electronics Cleantech Software & Healthcare Unspecified 2009 2010 2011 2012 YTD No. of Deals Aggregate Value of Deals Source: Preqin Venture Deals Analyst Source: Preqin Venture Deals Analyst Fig. 44: 10 Largest Venture Capital Deals, Q3 2012 Deal Size Name Date Stage Investors Primary Industry Location (mn) Square Sep-12 Series D/Round 4 200 USD Citi Ventures, Rizvi Traverse Management, Starbucks Mobile Payments US Flipkart Aug-12 Series D/Round 4 150 USD Accel Partners, Iconiq Capital, Naspers, Tiger Global Management Internet India Bessemer Venture Partners, Draper Fisher Jurvetson, General Growth Capital/ Box.net, Inc. Jul-12 125 USD Atlantic, New Enterprise Associates, SAP Ventures, Scale Venture Cloud Computing US Expansion Partners, The Social+Capital Partnership Andreessen Horowitz, Atomico, Baroda Ventures, DOCOMO Fab.com Jul-12 Series C/Round 3 105 USD Capital, First Round Capital, Mayfi eld Fund, Menlo Ventures, Internet US Pinnacle Ventures, ru-Net Ltd.