Hold DMCI Holdings 3 April 2013 Recommendation Asia Philippines Change Price at 2 Apr 2013 (PHP) 54.80 Conglomerates Price Target - 12Mth (PHP) 57.20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Diversification Strategies of Large Business Groups in the Philippines

Philippine Management Review 2013, Vol. 20, 65‐82. Diversification Strategies of Large Business Groups in the Philippines Ben Paul B. Gutierrez and Rafael A. Rodriguez* University of the Philippines, College of Business Administration, Diliman, Quezon City 1101, Philippines This paper describes the diversification strategies of 11 major Philippine business groups. First, it reviews the benefits and drawbacks of related and unrelated diversification from the literature. Then, it describes the forms of diversification being pursued by some of the large Philippine business groups. The paper ends with possible explanations for the patterns of diversification observed in these Philippine business groups and identifies directions for future research. Keywords: related diversification, unrelated diversification, Philippine business groups 1 Introduction This paper will describe the recent diversification strategies of 11 business groups in the Philippines. There are various definitions of business groups but in this paper, these are clusters of legally distinct firms with a managerial relationship, usually by virtue of common ownership. The focus on business groups rather than on individual firms has to do with the way that business firms in the Philippines are organized and managed. Businesses that are controlled and managed by essentially the same set of principal owners are often organized as separate corporations, not as separate divisions within the same firm, as is often the case in American corporations like General Electric, Procter and Gamble, or General Motors (Echanis, 2009). Moreover, studies on emerging markets have pointed out that business groups often occupy dominant positions in the business landscape in markets like India, Korea, Indonesia, Thailand, and the Philippines (Khanna & Palepu, 1997; Khanna & Yafeh, 2007). -

Sec 17-A Fy 2018

12. Check whether the issuer: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of The Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports); Yes [ X ] No [ ] (b) has been subject to such filing requirements for the past ninety (90) days. Yes [ X ] No [ ] 13. State the aggregate market value of the voting stock held by non-affiliates of the registrant. P1,931,103,029 as of December 31, 2018 APPLICABLE ONLY TO ISSUERS INVOLVED IN INSOLVENCY/SUSPENSION OF PAYMENTS PROCEEDINGS DURING THE PRECEDING FIVE YEARS: 14. Check whether the issuer has filed all documents and reports required to be filed by Section 17 of the Code subsequent to the distribution of securities under a plan confirmed by a court or the Commission. Yes [ ] No [X] DOCUMENTS INCORPORATED BY REFERENCE 15. If any of the following documents are incorporated by reference, briefly describe them and identify the part of SEC Form 17-A into which the document is incorporated: Consolidated Financial Statements as of and for year ended December 31, 2018 (Incorporated as reference for Item 7 to 12 of SEC Form 17-A) ________________________________________________________________________ CENTURY PROPERTIES GROUP INC. Page 2 of 84 SEC Form 17-A TABLE OF CONTENTS PART I. BUSINESS AND GENERAL INFORMATION 4 Item 1 Business……………………………………………………………………………………………... 4 Item 1.1 Overview…………………………………………………………………………. -

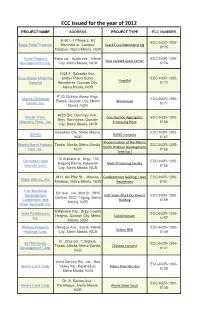

ECC Issued for the Year of 2012

ECC Issued for the year of 2012 PROJECT NAME ADDRESS PROJECT TYPE ECC NUMBER B-50 L-1 Phase 3. E2 ECC-NCR-1205- Eagle Food Products Martiniko st., Longos, Snack Food Manufacturing 0175 Malabon, Metro Manila, NCR Ayala Property Edsa cor., Ayala ave., Makati ECC-NCR-1205- Edsa Carpark Ayala Center Management Corp. City, Metro Manila, NCR 0174 1025 F. Salvador Ave., Cruz-Dalida Maternity Jordan Plains Subd., ECC-NCR-1205- Hospital Hospital Novaliches, Quezon City, 0172 Metro Manila, NCR #125 Quirino Hiway, Brgy. Manila Chemical ECC-NCR-1205- Baesa, Quezon City, Metro Warehouse Center, Inc. 0171 Manila, NCR #220 Sto. Domingo Ave., Pacific Paint Construction Aggregates ECC-NCR-1205- Brgy. Baringasa, Quezon (Boysen) Phils., Inc. Processing Plant 0168 City, Metro Manila, NCR Kalookan City, Metro Manila, ECC-NCR-1205- DSWD DSWD Complex NCR 0167 Modernization of the Manila Manila North Harbour Tondo, Manila, Metro Manila, ECC-NCR-1205- North Harbour Development Port, Inc. NCR 0166 Terminal I 116 Arellano st., Brgy. 135, Bernabest food ECC-NCR-1205- Bagong Barrio, Kalookan Meat Processing Facility Housse Corp. 0165 City, Metro Manila, NCR M.H. del Pilar St. , Maysilo, Condominium Building / Juez ECC-NCR-1205- Major Homes, Inc, Malabon, Metro Manila, NCR Residences 0161 Fort Bonifacio 5th Ave., cor. 30th St., BHS Development East Super Block Northwest ECC-NCR-1205- Central, BGC, Taguig, Metro Corporation and Building 0159 Manila, NCR Store Specialist Inc. Katipunan Ave., Brgy. Loyola Vista Residences, ECC-NCR-1205- Heights, Quezon City, Metro Condominium Inc. 0157 Manila, NCR Phinma Property Villongco Ave., Sucat, Makati ECC-NCR-1205- Solano Hills Holdings Corp. -

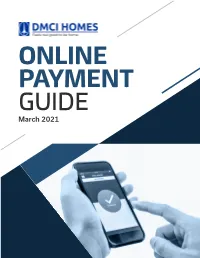

ONLINE PAYMENT GUIDE March 2021 Online Transactions Reference 3

ONLINE PAYMENT GUIDE March 2021 Online Transactions Reference 3 BDO 4 BPI 6 Eastwest Bank 8 Metrobank 12 UnionBank 14 Robinsons Bank 15 For concerns and clarifications, you may contact Customer Care through the following channels: Phone: Manila (02) 8555.7700 • (0918) 918.3465 • (0917) 811.5268 Davao (082) 297.0447 • (0998) 592.4529 Chat: dmcihomes.com or facebook.com/dmcihomesofficial Email: [email protected] • [email protected] Disclaimer: The details in this manual are subject to change without prior notice. DMCI Homes Online Payment Guide | March 2021 Online Transactions Reference Enjoy convenient and secured ways to pay your amortization, property tax, and other fees via Systems Information Desk (SID) or bills payment thru online banking using your debit or credit card. Available Payment Gateway via Online Banking Systems Information Desk (SID) Bills Payment Bills and Dues (DMCI Project eghl Global Payments Developers, Inc.) Reservation Fee ✔ ✔ ✔ Closing Fee ✔ - ✔ Down Payment ✔ - ✔ Full Payment ✔ - ✔ Loan Difference ✔ - ✔ Monthly Amortization ✔ - ✔ Storage Fee ✔ - ✔ Transfer of Ownership ✔ - ✔ Transfer of Unit Fee ✔ - ✔ Real Property Tax* for Unit ✔ - ✔ Other Admin Fees ✔ - ✔ Notes: *RPT in common areas is paid directly to Condo Corp. Only billings that are ✔ Available - Not Available payable under DMCI Project Developers, Inc. are applicable for online payment transactions. A convenience fee will be charged by your chosen payment gateway for every transaction. Your payment is debited from your account in real-time. However, depending on the merchant’s policy, your payment will be reflected on the merchant’s record within 1-5 banking days from your transaction date. Online Banking and Online Payment Partners Note: Contact Customer Care to get your Remitter’s Code. -

November 4, 2019

November 4, 2019 Global equities advanced over the week amid strong corporate earnings from the US and reduced risk over a no-deal Brexit. Meanwhile, US Treasury yields, German bund yields, and Japanese bond yields fell on the back of uncertainties surrounding the US-China trade talks. Global oil prices decreased due to the rise in oil production from the US and OPEC. Global Equities US equities advanced week-on-week on the back of strong third quarter US corporate earnings and the policy rate cut by the Federal 2.0% Reserve last Wednesday. Among the companies whose reported earnings exceeded expectations include Apple, Starbucks, and 1.50% 1.44% 1.47% Facebook. The DJIA closed at 27,347.36 (+1.44% WoW), while the 1.32% S&P closed at 3,066.91 (+1.47% WoW). Asian equities went up despite resurfacing doubts regarding the US-China trade negotiations. The APEC Summit in Chile where 1.0% President Trump and President Xi were scheduled to meet for trade talks was cancelled due to transport protests. During the latter part of the week, optimism surrounded the market amid the anticipated rate 0.30% cut by the Fed and the creation of a potential bloc between ASEAN countries, Australia, Japan, New Zealand and South Korea. The 0.0% MSCI APxJ closed at 524.97 (+1.50% WoW). MSCI MSCI MSCI Asia DJIA S&P 500 European equities rose over the week as strong corporate earnings World Europe ex-Japan led by the automative sector and reduced risk of a no-deal Brexit lifted investors' sentiment. -

7 Trends Shaping Philippine Real Estate in 2020

Report 7 Trends Shaping Philippine Real Estate santosknightfrank.com/research in 2020 he beginning of 2020 has been marked by a series of unexpected events that continue to affect the global economy. Despite the impact of COVID-19 and downturn in international stock markets, the Philippine real estate industry continues to have reasons to be optimistic, according to leading real estate service company, Santos Knight Frank. This is due to various drivers, including the roll out of REITs, continuous expansion of BPO companies, and strong consumer demand. (Since 1985, household consumption has accounted for 70-75% of Philippine GDP). Santos Knight Frank identifies the seven key trends that will be shaping the real estate industry this 2020. Media inquiries — Paolo Abellanosa Santos Knight Frank Research Reports are available [email protected] at santosknightfrank.com/market-reports 1. The year for REITs More property companies have expressed interest in Real Estate Investment Trusts (REITs) after regulators unveiled the revised rules in January. Property giant Ayala Land recently filed its application for its own REIT subsidiary, AREIT, while DoubleDragon Properties Corp is looking at raising PHP 11 billion annually over a six- year period via REITs. Companies such as Megaworld, SM Prime Holdings Inc., Robinsons Land, and Ortigas & Co. have also expressed interests on REITs. Asia-Pacific REIT markets Australia, Japan, and Singapore have all performed well in 2019, producing higher dividend yields than listed property companies, according to Santos Knight Frank. In addition to the impressive performance of dividend yields in the three markets, REITs in Hong Kong and Japan have delivered higher total returns versus listed property companies during the year. -

University of the Philippines Diliman Student Research Robinsons Land

University of the Philippines Diliman Student Research This report is published for educational purposes only by Philippine Real Estate Industry students competing in the CFA Institute Research Challenge. Robinsons Land Corporation Date: 2 Dec 2011 Ticker: ●RLC (PSE Ticker) Recommendation: ●BUY Price: ●Php 11.70 Price Target: ●Php 15.32 Highlights We initiate a BUY rating for Robinsons Land Corporation (RLC) with a one-year target price per share of Php 15.32, offering a 30.9% upside potential from its closing price on December 2, 2011. We ground our recommendation on RLC’s timely expansion in its Build-and-Keep segments to effectively capitalize on growth opportunities in the Philippine real estate industry. Stable Growth in Earnings from Build-and-Keep Component: Aggressive expansion in the Commercial Centers, Office Buildings and Hotels segments will increase Build-and-Keep core revenue contribution from 72.6% in 2011 to 87.9% by 2016. Capitalizing on the stable growth of the economy, the company focuses on developing these rental-based segments, which are expected to fuel most of RLC’s revenues in the next five years. This results in a Compounded Annual Growth Rate (CAGR) of 8.1% for total revenues over a five-year period. Together with this increasing revenue, EBIT will have a CAGR of 7.0% over the same period. Strong Operating Cash Flows: The strengthened position in RLC’s Build-and-Keep segments will translate to even stronger operating cash flows, reaching an estimated Php 8.8B in 2016 from Php 5.2B in 2010. The nature of its Build-and-Keep businesses, where most of the expenses are in the form of depreciation, explains why operating cash flows are high. -

FER~ALES Director Company Registration and Monitoring Department COVER SHEET COMPANY REGISTRATION and MONITORING DEPARTMENT

REPUBLIC OF THE PHILIPPINES SECURITIES AND EXCHANGE COMMISSION SEC Building, EDSA, Greenhills City of Mandaluyong, Metro Manila COMPANY REG. NO. AS095-004137 CERTIFICATE OF FILING OF AMENDED ARTICLES OF INCORPORATION KNOW ALL PERSONS BY THESE PRESENTS: This is to certify that the amended articles of incorporation of the DMCI PROJECT DEVELOPERS, INC. [Amending Article III thereof.] copy annexed, adopted on November 17, 2014 by majority vote of the Board of Directors and by the vote of the stockholders owning or representing at least two thirds of the outstanding capital stock, and c.ertified under oath by the Corporate Secretary and a majority of the Board of Directors of the corporation was approved by the Commission on this date pursuant to the provision of Section 16 of the Corporation Code of the Philippines, Batas Pambansa Big. 68, approved on May 1, 1980 and copies thereof are filed with the Commission. Unless this corporation obtains or already has obtained the appropriate Secondary License from this Commission, this Certificate does not authorize it to undertake business activities requiring a Secondary License from this Commission such as, but not limited to acting as: broker or dealer in securities, government securities eligible dealer (GSED), investment adviser of an investment company, close-end or open-end investment company, investment house, transfer agent, commodity/financial futures exchange/broker/merchant, financing company and time shares/club shares/membership certificates issuers or selling agents thereof. Neither does this Certificate constitute as permit to undertake activities for which other government agencies require a license or permit. IN WITNESS WHEREOF, I have set my hand and caused the seal of this Commission to be ~fiJced to this Certificate at Mandaluyong City, Metro Manila, Philippines, this //'f'4' day of December, Twenty Fourteen. -

Resume 201512

COMPLETED CONSULTING PROJECTS Type of Project Project Name Client Airports Caticlan Airport San Miguel Corporation NAIA IPT 3 Review TCGI Engineers Embassies British Embassy British Embassy Qatar Embassy Astec US Embassy Manila Ayala Land Inc./MDC Excavation Protection 6786 Nova Century Properties 81 Newport IPM Alveo Highpark Ayala Land Inc./MDC Annapolis Building We Enterprises Ascott BGC Winsome Development Corp. Avida 34th Street Mega Philippines Avida Capital House Ayala Land Inc./MDC Bridgetowne (Exxa and Zeta) We Enterprises Bristle Ridge DMCI Homes Cebu Marco Polo Residences Federal Land, Inc. Century BGC Century Properties Century Spire We Enterprises Citynet Central We Enterprises Corinthian Hills Mansion Parade Megaworld Corp. Ecoprime Ecoprime Estancia Mall Hong Drill Estancia Mall We Enteprises Every Nation BGC Hong Drill Finance Centre Daiichi Properties Fortune Hills IPM Garden Towers Ayala Land Inc./MDC Globe Telecoms Building Ayala Land Inc./MDC Grand Hyatt Federal Land, Inc. Hamilton Tower 2 IPM Horizon 101 Taft Property HSS Tower 2 Mega Philippines Imperium Project We Enterprises Jabba Ayala Land Inc./MDC Lopez Tower We Enterprises Magnolia Residences IPM Makati North Gateway 1 Ayala Land Inc./MDC Marriott We Enterprises Marriott Tunnel We Enterprises Mayflower BPO IPM MDC HQ Ayala Land Inc./MDC Net Park We Enterprises Newport PP3 IPM Northwest Superblock Hong Drill One Meridien Ayala Land Inc./MDC One World Place Daiichi Properties Oxford Parksuites Anchor Land Holdings Inc. Park Triangle Ayala Land Inc./MDC Paseo de Roxas - Villar Underpass Ayala Land Inc./MDC Philamlife Cebu We Enterprises Project Jade We Enterprises Robinsons Galleria Cebu Monolith Construction Royalton We Enterprises Type of Project Project Name Client Senta Building Ayala Land Inc./MDC SM Keppel IPM Somerset Alabang We Enterprises Sotogrande We Enterprises Sun Residences SM Development Corp. -

SEC Form 17-A Annual Report

COVER SHEET SEC Registration Number 6 2 8 9 3 Company Name R O C K W E L L L A N D C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) 2 F , 8 R O C K W E L L , H I D A L G O D R I V E R O C K W E L L C E N T E R , M A K A T I C I T Y Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A N / A COMPANY INFORMATION Company’s Email Address Company’s Telephone Number/s Mobile Number [email protected] 7-793-0088 N/A Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 46,263 (as of 31 MAY 2020) August 28, 2020 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Ms. Ellen V. Almodiel [email protected] 7-793-0088 N/A Contact Person’s Address Ground Floor, East Podium, Joya Lofts & Towers, 28 Plaza Drive, Rockwell Center, Makati City 1200 Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

Project Technical Orientation

Project Technical Orientation “The best sales questions have your expertise wrapped into them.” – Jill Konrath Structural Considerations • Buildings are compliant with the National Structural Code of the Philippines (NSCP) • Designs use available state of the art computer-aided software to find out any weak points in the structural design • Buildings designed to resist up to magnitude 7.2 earthquakes • Buildings have deflection (allowable movement) • Buildings are made of reinforced concrete Soil Composition, Zoning, CAAP • Soil composition varies from project to project • Soil investigation is always done to find out the type of soil which is used as the basis for designing the right type of foundation • Project developments also depend on the zoning classification, and clearance would still be obtained from the Civil Aviation Authority of the Philippines Roads • 8 – 10 meters wide (enough for two-way traffic) • Driveways (parking) – 6 meters min. ave. • Length of roads may vary depending on the project Open Spaces/Amenities Open spaces shall be provided within the project site pursuant to the NBC rules & regulations • Courts • Access roads • Yards • Parking spaces • Setbacks • Buffer strips • Light wells • Parks & Playgrounds • Uncovered driveways DMCI Homes Open Spaces/Amenities • Follow guidelines set by the Building Code as to how much of the land can be converted into open spaces • Typically, 60 % is of land area is allotted for open spaces in our projects NBC Parking Slots • The minimum size of a parking lot accdg. to NBC is 2.4m -

Dmci Holdings I N C O R P O R a T E D

DMCI HOLDINGS I N C O R P O R A T E D Corporate Profile May 2007 DMCI HOLDINGS, INC. DMCI Holdings, Inc. (DMCI HI) was incorporated on March 8, 1995 as a holding company to consolidate all construction business, construction component companies and related interests of the Consunji Family. It was listed on the Philippine Stock Exchange on December 18, 1995. The Company has three major operating subsidiaries, namely: D.M. Consunji, Inc . (DMCI), DMCI Project Developers, Inc . (PDI), and Semirara Mining Corporation [Semirara ( formerly Semirara Coal Corporation )]. DMCI , a wholly owned subsidiary, is engaged in general construction services – the Company’s core business. It is also engaged in various construction component businesses such as production and trading of concrete products, and electrical and foundation works. Founded in 1954, DMCI is acknowledged as one of the leaders in the Philippine construction industry, noted for quality projects delivered on time and its pioneering application of advanced engineering methodology. PDI , another wholly owned subsidiary, is engaged in construction business-generating investments primarily through its significant minority interests in various project and infrastructure development activities. These ventures generate not only investment income but also construction business for DMCI. PDI also seeks strategic partners who will add value and expertise to the various aspects of its project development and implementation. Semirara , a 58%-owned subsidiary, is a publicly listed company engaged in the exploration, mining and development of coal resources on Semirara Island in Caluya, Antique. It is currenly the Philippines’ largest coal-producing company with a guaranteed long-term market by virtue of its supply contract with the state-run National Power Corporation.