Important Notice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2009

NWS HOLDINGS LIMITED NWS Holdings Limited (incorporated in Bermuda with limited liability) ANNUAL REPORT 2009 ANNUAL REPORT 28/F New World Tower 18 Queen’s Road Central Hong Kong Tel: (852) 2131 0600 Fax: (852) 2131 0611 E-mail: [email protected] Sustaining Growth www.nws.com.hk Striving for Excellence NWS Holdings Limited takes every practicable measure to conserve resources and minimize waste. NWS HOLDINGS LIMITED This annual report is printed on FSC certified paper using vegetable oil-based inks. Pulps used are elemental chlorine-free. ANNUAL REPORT 2009 The FSC logo identifies product group from well-managed forests and other controlled sources in accordance with the rules of the Forest Stewardship Council. STOCK CODE: 659 VISION To build a dynamic and premier group of infrastructure and service management companies driven by a shared passion for customer value and care MISSION Synergize and develop business units that: • Nurture total integrity • Attain total customer satisfaction • Foster learning culture and employee pride • Build a world-class service provider brand • Maximize financial returns CORE VALUES • Reputable customer care • Pride and teamwork • Innovation • Community contributions and environmental awareness • Stakeholders’ interest CONTENTS 2 CORPORATE PROFILE 4 MILESTONES 6 FINANCIAL HIGHLIGHTS 8 CHAIRMAN’S STATEMENT 10 BOARD OF DIRECTORS 14 CORPORATE GOVERNANCE REPORT 26 KEY INFORMATION FOR SHAREHOLDERS 30 HUMAN CAPITAL 32 COMMUNITY CARE 34 ENVIRONMENTAL FRIENDLINESS 36 MANAGEMENT DISCUSSION AND ANALYSIS 48 REPORTS AND FINANCIAL STATEMENTS 150 FIVE-YEAR FINANCIAL SUMMARY 152 PROJECT KEY FACTS AND FIGURES 164 GLOSSARY OF TERMS 166 CORPORATE INFORMATION CORPORATE PROFILE About NWS Holdings NWS Holdings Limited (“NWS Holdings” or the “Group”, Hong Kong stock code: 659) is the infrastructure and service flagship of New World Development Company Limited (Hong Kong stock code: 17). -

Placing 400 Million New Shares at HKD 25.25, Underlying Profit

Company Report: CR Land (01109 HK) Van Liu 刘斐凡 公司报告:华润置地 (01109 HK) +86 755 23976672 [email protected] 国泰君安研究 25 May 2015 Placing 400 million New Shares at HKD 25.25, Underlying Profit Revised up, Maintain fiBuyfl Research GTJA 以25.25港元配售4亿股,调高核心净利,维持“买入” Rating: Buy Maintained z CR Land (fithe Companyfl) plans to raise approximately HK$ 10.1 billion 评级: 买入 维持 by placing 400 million new shares at a price of HK$ 25.25 per placing ( ) share. The management intends to use the raised capital for further land acquisition, development costs and general working capital purposes. 6-18m TP 目标价: HK$29.40 Revised from 原目标价: HK$28.70 z Limited diluted effects with stronger balance sheet. As per our estimates, after the share placing completion, the underlying EPS will increase 0.3% due Share price 股价: HK$25.300 to the underlying profit being revised up and net gearing ratio will decrease 13.0 ppts in 2015E. Stock performance z Raised capital from share placing will help the Company’s land 股价表现 replenishment and new house set up plan acceleration, which is able to translate into earnings growth under the rebounding sales environment. 100.0 % of return z Maintain ‘Buy’. Raised capital from share pricing will help sales increase. 80.0 Expectations of loosening policies and southbound capital inflow with housing 60.0 sales rebound in April 2015 are likely to drive property companies’ valuation upside potential. We revise up the target price to HK$29.40, which represents 40.0 an 15% discount to revised 2015E NAV per share, 12.3x 2015 underlying 20.0 PER and 1.6x 2015 PBR. -

FTSE Asia Pacific Ex Japan Australia and NZ Net 20 May 2014

FTSE PUBLICATIONS FTSE Asia Pacific ex Japan Australia 20 May 2014 and NZ Net Indicative Index Weight Data as at Closing on 31 March 2014 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) AAC Technologies Holdings 0.12 HONG Beijing Capital International Airport (H) 0.03 CHINA China Development Financial Holdings 0.13 TAIWAN KONG Beijing Enterprises Holdings (Red Chip) 0.15 CHINA China Dongxiang Group (P Chip) 0.02 CHINA ABB India 0.02 INDIA Beijing Enterprises Water Group (Red Chip) 0.09 CHINA China Eastern Airlines (H) 0.02 CHINA Aboitiz Equity Ventures 0.09 PHILIPPINES Beijing Jingneng Clean Energy (H) 0.02 CHINA China Everbright (RED CHIP) 0.04 CHINA Aboitiz Power 0.04 PHILIPPINES Beijing North Star (H) 0.01 CHINA China Everbright International (Red Chip) 0.12 CHINA ACC 0.03 INDIA Belle International (P Chip) 0.17 CHINA China Foods (Red Chip) 0.01 CHINA Acer 0.05 TAIWAN Bengang Steel Plates (B) <0.005 CHINA China Galaxy Securities (H) 0.02 CHINA Adani Enterprises 0.05 INDIA Berjaya Sports Toto 0.03 MALAYSIA China Gas Holdings (P Chip) 0.08 CHINA Adani Ports and Special Economic Zone 0.05 INDIA Berli Jucker 0.02 THAILAND China Hongqiao Group (P Chip) 0.02 CHINA Adani Power 0.01 INDIA Bharat Electronics 0.01 INDIA China Huishan Dairy Holdings (P Chip) 0.03 CHINA Adaro Energy PT 0.04 INDONESIA Bharat Forge-A 0.02 INDIA China International Marine Containers (H) 0.04 CHINA Aditya Birla Nuvo 0.02 INDIA Bharat Heavy Elect .LS 0.06 INDIA China Life Insurance (H) 0.67 CHINA Advanced Info Serv 0.27 THAILAND Bharat Petroleum Corp 0.04 INDIA China Longyuan Power Group (H) 0.11 CHINA Advanced Semiconductor Engineering 0.22 TAIWAN Bharti Airtel 0.22 INDIA China Machinery Engineering (H) 0.01 CHINA Advantech 0.06 TAIWAN Bharti Infratel 0.02 INDIA China Mengniu Dairy 0.22 HONG Agile Property Holdings (P Chip) 0.03 CHINA Big C Supercenter 0.04 THAILAND KONG Agricultural Bank of China (H) 0.32 CHINA Biostime International Holdings (P Chip) 0.03 CHINA China Merchant Holdings (Red Chip) 0.13 CHINA AIA Group Ltd. -

Annual Report 2003 3

.33802 /15467 ,++- .33802 /15467 ,++- @^bYcedceWg[Z ^b g][ MWkaWb Pf`WbZf i^g] `^a^g[Z `^WX^`^gkA Kg] N`cceB R[i Vce`Z Uci[e EB EJ Sh[[b?f TcWZ M[bgeW`B Ocb\ Qcb\ U[`L @JHFA FEGE DFDE NWj L @JHFA FEGE DFEI iiiCbiY`CYcaC]_ a new way of living and working The New World Group has been active in the Mainland China property market since the early 1980s. New World China Land is helping to transform the nation and its people by offering a wide variety of property projects, encompassing residential communities, hotels, offices, shopping malls and resorts. We have always dedicated ourselves to delivering the highest quality developments. The Company is bringing new definitions of style and comfort, unprecedented levels of service and convenience. Together, these are creating distinctive environments for families or business. We stand for a whole new way of living and working. A truly national developer Global expertise Serving the community Our property portfolio spans Our professional management As we invest in a region, we the nation. By maintaining this team from Mainland China and recognise we have a broad geographic presence in from overseas brings together responsibility as a good Mainland China, we seek to diverse skills and expertise. We corporate citizen. We are play a key role in fulfilling the blend best international practice dedicated to improving the nation’s property needs. with home-grown vision and lives of the local communities talent to deliver unrivalled results. in which we operate. 30-year blue-chip heritage Best in class Turning dreams into reality Through our parent New World Quality is at the heart of We do more than build Development, a reputable and everything we do. -

Annual Report 2013

NWD_AR13_CoverBack_E new.ai 2013/10/9 12:01:28 AM Annual Report 2013 Contents 2 Corporate Profile Design Concept 4 Corporate Structure This design scheme revolves around the 5 Financial Highlights concept enshrined under Luban Lock, which 6 Chairman’s Statement represents ancient wisdom and sophisticated 8 Joint General Managers’ Report craftsmanship. This sophisticated structure depicted in the cover page represents the 8 Property focal point to converge the core businesses of 18 Hotel Operations 24 Infrastructure and Service New World Development. 30 Department Stores 34 Telecommunications 35 Outlook 40 Management Discussion and Analysis 46 Principal Projects Summary 68 Corporate Governance Report 78 Investor Relations 82 Directors’ Profile 89 Senior Management Profile 90 Corporate Sustainability 100 Corporate Information 101 Financial Section Contents Disclaimer The photographs, images, drawings or sketches shown in this annual report represent an artist’s impression of the development concerned only. They are not drawn to scale and/or may have been edited and processed with computerised imaging techniques. Prospective purchasers should make reference to the sales brochure for details of the development. The vendor also advises prospective purchasers to conduct an on-site visit for a better understanding of the development site, its surrounding environment and the public facilities nearby. All parties engaged in the production of this annual report have made their best efforts to ensure the highest accuracy of all information, photographs, images, drawings or sketches herein contained as to the printing of this annual report and to minimise the existence of clerical errors. Readers are invited to make enquires to sales personnel or consult relevant professionals for verification of doubts or particulars of specific items. -

Board of Directors

Board of Directors from left to right: Mr Dominic Lai; Mr Wilfried Ernst Kaffenberger; Mr Cheung Chin Cheung; Mr Wong Kwok Kin, Andrew; Mr Chan Kam Ling; Dr Cheng Kar Shun, Henry; Mr Doo Wai Hoi, William BOARD OF DIRECTORS had served with the Hong Kong Police Force for 38 years and retired from the Force as its Commissioner in December 2003. He has extensive experience in corporate leadership and public administration. Mr Tsang was awarded the Gold Bauhinia Dr Cheng Kar Shun, Henry GBS Star, the OBE, the Queen’s Police Medal, the Colonial Police Medal for Meritorious Chairman Service, the Commissioner’s Commendation, and the HKSAR Police Long Service Dr Cheng (60) was appointed as Executive Director in March 2000 and became Medal. the Chairman in March 2001. Dr Cheng is the Managing Director of NWD, a substantial shareholder of the Company, the Chairman and Managing Director of New World China Land Limited and the Chairman of New World Department Store Mr Wong Kwok Kin, Andrew China Limited, Taifook Securities Group Limited and International Entertainment Executive Director Corporation. He is also a director of Chow Tai Fook Enterprises Limited, Centennial Mr Wong (61) was appointed as Executive Director in January 2003. Mr Wong is an Success Limited and Cheng Yu Tung Family (Holdings) Limited, all of them are executive director of Sky Connection Limited and several subsidiary companies and substantial shareholders of the Company. Dr Cheng is also the Managing Director affiliates of New World Group providing duty-free liquor and tobacco concessions, of New World Hotels (Holdings) Limited, an independent non-executive director communication services, cleaning and laundry services, and estate management of HKR International Limited and a non-executive director of Lifestyle International in both Hong Kong and Mainland China. -

FTSE EPRA/NAREIT Global Real Estate Index Series Asia Quarterly

FTSE EPRA/NAREIT Global Real Estate Index Series Asia Qty Review Page 1 of 3 FTSE EPRA / NAREIT Global Real Estate Index Series Asia Quarterly Review 5 June 2014 FTSE, EPRA and NAREIT announce the results of the quarterly review of the Asian region of the FTSE EPRA/NAREIT Global Real Estate Index as at 5 June 2014. All changes are effective as of Monday, 23 June 2014. FTSE EPRA/NAREIT Global Developed Index Additions (from Developed Asia Region) Company Name SEDOL Country Japan Hotel REIT Investment B1530B1 Japan Deletions (from Developed Asia Region) No Changes FTSE EPRA/NAREIT Global Developed Index Focus Reclassifications No Changes FTSE EPRA/NAREIT Global Developed Index Sector Reclassifications Company Name SEDOL Country Old Sector New Sector Champion REIT B14WZ47 Hong Kong Office Diversified Orix J-REIT Inc 6527774 Japan Office Diversified FTSE EPRA/NAREIT Global Emerging Index Additions (from Emerging Asia Region) Company Name SEDOL Country Redco Properties Group (P Chip) BJ6L322 China Deletions (from Emerging Asia Region) http://ftse.com/tech_notices/2014/Q2/87447_20140605_EPRA_Asia_Jun14.jsp 05/06/2014 FTSE EPRA/NAREIT Global Real Estate Index Series Asia Qty Review Page 2 of 3 Company Name SEDOL Country Shanghai Lujiazui Finance & Trade Zone Development Co. Ltd. B 6798666 China Tebrau Teguh BhD 6381356 Malaysia Sentul City B19HL05 Indonesia UEM Sunrise B3FKMY3 Malaysia FTSE EPRA/NAREIT Global Emerging Index Sector Reclassifications Company Name SEDOL Country Old Sector New Sector Minmetals Land (Red Chip) 6508478 China Residential -

2015 Annual Report New Business Opportunities and Spaces Which Rede Ne Aesthetic Standards Breathe New Life Into Throbbing and a New Way of Living

MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have been undertaken to rejuvenate the that nurture family living and old city into vibrant communities character- promote a healthy cultural ised by eclectic urban housing, ample and social life. public space, shopping, entertain- ment and leisure facilities. SPURRING BUSINESS REFINING LIVING OPPORTUNITIES We have developed large-scale multi- LIFESTYLE purpose commercial complexes, all Our residential communities are fully equipped well-recognised city landmarks that generate with high quality facilities and multi-purpose Annual Report 2015 new business opportunities and spaces which redene aesthetic standards breathe new life into throbbing and a new way of living. We enable owners hearts of Chinese and residents to experience the exquisite metropolitans. and sensual lifestyle enjoyed by home buyers around the world. Annual Report 2015 MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have -

Shui on Land Limited 瑞安房地產有限公司* (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 272)

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult a stockbroker or other registered dealer 14A.58(3)(b) in securities, bank manager, solicitor, professional accountant or other professional adviser for independent advice. If you have sold or transferred all your shares in Shui On Land Limited (the “Company”), you should at once hand this circular, together with the enclosed proxy form, to the purchaser or the transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this 14A.59(1) circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. A1B1 13.51A Shui On Land Limited 瑞安房地產有限公司* (Incorporated in the Cayman Islands with limited liability) (Stock code: 272) DISCLOSEABLE AND CONNECTED TRANSACTION IN RELATION TO THE ACQUISITION OF THE ISSUED SHARE CAPITAL IN RIMMER AND MAGIC GARDEN AND CONNECTED TRANSACTION IN RELATION TO THE FINANCIAL ASSISTANCE TO MEMBERS OF THE SELLERS’ GROUP AND CONTINUING CONNECTED TRANSACTIONS IN RELATION TO LANGHAM XINTIANDI HOTEL RELATED TRANSACTIONS AND NOTICE OF EXTRAORDINARY GENERAL MEETING Financial Adviser to Shui On Land Limited Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders A letter from the board of the directors of the Company is set out on pages 8 to 30 of this circular. -

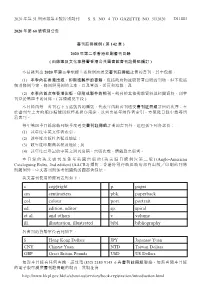

2020 年第51 期憲報第4 號特別副刊ss No. 4 to Gazette No. 51/2020

2020 年第 51 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 51/2020 D11883 2020 年第 60 號特別公告 書刊註冊條例 ( 第 142 章 ) 2020 年第二季香港印刷書刊目錄 ( 由康樂及文化事務署香港公共圖書館書刊註冊組編訂 ) 本目錄列出 2020 年第二季根據上述條例而送交書刊註冊組註冊的書刊。其中包括: (1) 本季內在香港出版、印刷或製作的書籍,包括政府物流服務署出版的刊物,但不包括 個別條例草案、條例與規例的文本,以及單張、活頁和海報;及 (2) 本季內首次在香港出版、印刷或製作的期刊。期刊的其他期數資料及相關資料,則會 刊登於第四季的目錄。( 詳情請見下段 ) 本目錄內每一書刊右下方括號內的編號,代表年內該書刊送交書刊註冊組註冊的次序;至 於書刊左上方的順序編號則純粹是排序用途,以列出是年的作者索引,方便從目錄中搜尋所 需書刊。 每年第四季目錄除載列該季度送交書刊註冊組註冊的書刊外,還包括下列各部份: (1) 該年度中英文作者索引; (2) 該年度出版社名稱及地址; (3) 該年度印刷商名稱及地址 ; 及 (4) 該年度已登記的中英文期刊名稱、出版次數、價錢及出版者。 本目錄的英文書刊是參考英國出版的《英美編目條例》( 第二版) (Anglo-American Cataloguing Rules, 2nd edition) (AACR2) 編訂;香港特別行政區政府部門出版╱印刷的刊物 則屬例外。中文書刊則參考劉國鈞的圖書著錄法。 英文書刊使用的簡寫表列如下: c copyright p. pages cm centimeters pbk. paperback col. colour port. portrait ed. edition, editor sp. spiral et al. and others v volume ill. illustration, illustrated bibl. bibliography 各書刊的貨幣單位表列如下: $ Hong Kong Dollars JPY Japanese Yuan CNY Chinese Yuan NTD Taiwan Dollars GBP Great Britain Pounds USD US Dollars 如對本目錄有任何查詢,請致電 (852) 2180 9145–6 與書刊註冊組聯絡。如需查閱本目錄 的電子版可瀏覽書刊註冊組的網頁,其網址為 http://www.hkpl.gov.hk/tc/about-us/services/book-registration/introduction.html 2020 年第 51 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 51/2020 D11885 ENGLISH BOOKS AND PERIODICALS 2529 25TH ifva : festival = 第二十五屆ifva : 獨立短片 2525 及影像媒體節 / edited by Charlotte Wat. — Hong Kong : Hong Kong Arts Centre, 2020. — 128 p. : 1957 & CO. (HOSPITALITY) LIMITED col. ill., col. port ; 30 cm. 1957 & Co. (Hospitality) Limited first For sale quarterly report 2020 = 1957 & Co. Arts (Hospitality) Limited第一季度業績報告2020. Text in Chinese and English — Hong Kong : 1957 & Co. (Hospitality) Limited, ISBN 978-988-14114-5-7 (pbk.) : $50.00 2020. — 18, 18 p. ; 29 cm. (2020-02540) Not for sale Publications of Listed Companies Text in Chinese and English 2530 (2020-06203) 3000+ words and phrase for writing. -

Briefing Residential Sales January 2015

Savills World Research Beijing Briefing Residential sales January 2015 Image: Glory Chateau, Daxing district SUMMARY Given recent incentive policies, high-end residences with high asking prices accelerated their completion to enter the market in Q4/2014, rather than waiting until 2015. Beijing’s first-hand residential This led to transaction prices transaction volumes surged by 94.5% appreciating by 5.0% QoQ and 11.8% “The high-end residential QoQ to 3.8 million sq m, in reaction YoY to an average of RMB68,390 per to several incentive policies launched sq m. market is expected to enter an in H2/2014. However, the end of November still saw the first-hand The high-end villa market era of “RMB100,000 per sq residential price index down by 2% continued to show a positive m plus apartments” as several and 2.5% from that of this September performance, with transaction and December 2013, respectively. volumes up 39.7% QoQ and 22.6% luxury residences priced YoY to 320 units. Prices increased by Five Grade A apartments were 2.3% QoQ to RMB52,700 per sq m, above this landmark price are granted pre-sale certifications in up 13.6% YoY. Q4/2014, adding 724 units to the anticipated in 2015.” market. Meanwhile, transaction New high-end residence supply Joan Wang, Savills Research volumes surged to 764 units, almost will be more limited, with only 13 high- doubling that of the previous quarter, end residences scheduled to enter the and the highest level since Q1/2013. market between 2015 and 2017. -

Evergrande Real Estate Group Ltd SW 3 July 2014

Evergrande Real Estate Group Ltd SW 3 July 2014 Evergrande – House of cards Company Name: Evergrande Rating: SELL (-23%) Last close: HKD 3.08 Target Price: HKD 2.50 Real Estate Group Ltd Bbg Ticker: 3333 HK Evergrande is among China’s largest property developers – ranking first by saleable area as it has historically relied on volume and low prices to expand aggressively. We note that short-seller Citron Research alleged Evergrande of fraud in 2012, but the claims were vigorously refuted and Evergrande went to record over 40% bottomline growth in FY13. However, as the China residential property market starts to slow down alongside the Last close: HKD 3.08 economy, exacerbated by tight credit and home ownership restrictions, we think Target Price: HKD 2.50 (-23%) Evergrande, as the largest and most indebted, will be most at risk. Additionally, questionable management decisions raise more red flags than a Communist parade: Rating: Sell (1-year period) Stunning cash outflows on negative FCF guidance. An 18% HKD3bn dividend comprising 71% of earnings while guiding negative free cash flow for FY14; share repurchases totaling HKD3bn and purchase of a stake in Huaxia Bank for ~HKD1bn. Market Cap (USDm): 5,814 Veteran management selling shares and leaving the company. CEO Xie Haijun Avg 3M daily value traded sold 68m shares, his first sale since joining the Board in 2007; Li Gang, the vice- Chairman, resigned effective May 1 and sold 33m shares in April after a 8-year (USDm/day): 16.8 tenure; Lai Lixin resigned as Executive Director in February. In contrast, according to Evergrande’s annual reports, there were no management changes in 2010-2013 Shares outstanding (m): 14,630 during the previous property downcycle.