Placing 400 Million New Shares at HKD 25.25, Underlying Profit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2009

NWS HOLDINGS LIMITED NWS Holdings Limited (incorporated in Bermuda with limited liability) ANNUAL REPORT 2009 ANNUAL REPORT 28/F New World Tower 18 Queen’s Road Central Hong Kong Tel: (852) 2131 0600 Fax: (852) 2131 0611 E-mail: [email protected] Sustaining Growth www.nws.com.hk Striving for Excellence NWS Holdings Limited takes every practicable measure to conserve resources and minimize waste. NWS HOLDINGS LIMITED This annual report is printed on FSC certified paper using vegetable oil-based inks. Pulps used are elemental chlorine-free. ANNUAL REPORT 2009 The FSC logo identifies product group from well-managed forests and other controlled sources in accordance with the rules of the Forest Stewardship Council. STOCK CODE: 659 VISION To build a dynamic and premier group of infrastructure and service management companies driven by a shared passion for customer value and care MISSION Synergize and develop business units that: • Nurture total integrity • Attain total customer satisfaction • Foster learning culture and employee pride • Build a world-class service provider brand • Maximize financial returns CORE VALUES • Reputable customer care • Pride and teamwork • Innovation • Community contributions and environmental awareness • Stakeholders’ interest CONTENTS 2 CORPORATE PROFILE 4 MILESTONES 6 FINANCIAL HIGHLIGHTS 8 CHAIRMAN’S STATEMENT 10 BOARD OF DIRECTORS 14 CORPORATE GOVERNANCE REPORT 26 KEY INFORMATION FOR SHAREHOLDERS 30 HUMAN CAPITAL 32 COMMUNITY CARE 34 ENVIRONMENTAL FRIENDLINESS 36 MANAGEMENT DISCUSSION AND ANALYSIS 48 REPORTS AND FINANCIAL STATEMENTS 150 FIVE-YEAR FINANCIAL SUMMARY 152 PROJECT KEY FACTS AND FIGURES 164 GLOSSARY OF TERMS 166 CORPORATE INFORMATION CORPORATE PROFILE About NWS Holdings NWS Holdings Limited (“NWS Holdings” or the “Group”, Hong Kong stock code: 659) is the infrastructure and service flagship of New World Development Company Limited (Hong Kong stock code: 17). -

STOXX Hong Kong All Shares 180 Last Updated: 01.05.2015

STOXX Hong Kong All Shares 180 Last Updated: 01.05.2015 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 97.0 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 71.8 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 69.5 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 67.4 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 59.3 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 46.7 6 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 37.7 7 10 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 32.3 8 7 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 28.9 9 9 HK0013000119 6448068 0013.HK 644806 Hutchison Whampoa Ltd. HK HKD Y 26.7 10 8 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 25.5 11 11 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 24.2 12 12 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 24.0 13 13 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 21.6 14 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 21.3 15 16 CNE100000205 B0B8Z29 3328.HK CN0054 Bank of Communications Co 'H' CN HKD Y 20.2 16 17 HK0004000045 6435576 0004.HK 643557 Wharf (Holdings) Ltd. -

FTSE Asia Pacific Ex Japan Australia and NZ Net 20 May 2014

FTSE PUBLICATIONS FTSE Asia Pacific ex Japan Australia 20 May 2014 and NZ Net Indicative Index Weight Data as at Closing on 31 March 2014 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) AAC Technologies Holdings 0.12 HONG Beijing Capital International Airport (H) 0.03 CHINA China Development Financial Holdings 0.13 TAIWAN KONG Beijing Enterprises Holdings (Red Chip) 0.15 CHINA China Dongxiang Group (P Chip) 0.02 CHINA ABB India 0.02 INDIA Beijing Enterprises Water Group (Red Chip) 0.09 CHINA China Eastern Airlines (H) 0.02 CHINA Aboitiz Equity Ventures 0.09 PHILIPPINES Beijing Jingneng Clean Energy (H) 0.02 CHINA China Everbright (RED CHIP) 0.04 CHINA Aboitiz Power 0.04 PHILIPPINES Beijing North Star (H) 0.01 CHINA China Everbright International (Red Chip) 0.12 CHINA ACC 0.03 INDIA Belle International (P Chip) 0.17 CHINA China Foods (Red Chip) 0.01 CHINA Acer 0.05 TAIWAN Bengang Steel Plates (B) <0.005 CHINA China Galaxy Securities (H) 0.02 CHINA Adani Enterprises 0.05 INDIA Berjaya Sports Toto 0.03 MALAYSIA China Gas Holdings (P Chip) 0.08 CHINA Adani Ports and Special Economic Zone 0.05 INDIA Berli Jucker 0.02 THAILAND China Hongqiao Group (P Chip) 0.02 CHINA Adani Power 0.01 INDIA Bharat Electronics 0.01 INDIA China Huishan Dairy Holdings (P Chip) 0.03 CHINA Adaro Energy PT 0.04 INDONESIA Bharat Forge-A 0.02 INDIA China International Marine Containers (H) 0.04 CHINA Aditya Birla Nuvo 0.02 INDIA Bharat Heavy Elect .LS 0.06 INDIA China Life Insurance (H) 0.67 CHINA Advanced Info Serv 0.27 THAILAND Bharat Petroleum Corp 0.04 INDIA China Longyuan Power Group (H) 0.11 CHINA Advanced Semiconductor Engineering 0.22 TAIWAN Bharti Airtel 0.22 INDIA China Machinery Engineering (H) 0.01 CHINA Advantech 0.06 TAIWAN Bharti Infratel 0.02 INDIA China Mengniu Dairy 0.22 HONG Agile Property Holdings (P Chip) 0.03 CHINA Big C Supercenter 0.04 THAILAND KONG Agricultural Bank of China (H) 0.32 CHINA Biostime International Holdings (P Chip) 0.03 CHINA China Merchant Holdings (Red Chip) 0.13 CHINA AIA Group Ltd. -

Annual Report 2003 3

.33802 /15467 ,++- .33802 /15467 ,++- @^bYcedceWg[Z ^b g][ MWkaWb Pf`WbZf i^g] `^a^g[Z `^WX^`^gkA Kg] N`cceB R[i Vce`Z Uci[e EB EJ Sh[[b?f TcWZ M[bgeW`B Ocb\ Qcb\ U[`L @JHFA FEGE DFDE NWj L @JHFA FEGE DFEI iiiCbiY`CYcaC]_ a new way of living and working The New World Group has been active in the Mainland China property market since the early 1980s. New World China Land is helping to transform the nation and its people by offering a wide variety of property projects, encompassing residential communities, hotels, offices, shopping malls and resorts. We have always dedicated ourselves to delivering the highest quality developments. The Company is bringing new definitions of style and comfort, unprecedented levels of service and convenience. Together, these are creating distinctive environments for families or business. We stand for a whole new way of living and working. A truly national developer Global expertise Serving the community Our property portfolio spans Our professional management As we invest in a region, we the nation. By maintaining this team from Mainland China and recognise we have a broad geographic presence in from overseas brings together responsibility as a good Mainland China, we seek to diverse skills and expertise. We corporate citizen. We are play a key role in fulfilling the blend best international practice dedicated to improving the nation’s property needs. with home-grown vision and lives of the local communities talent to deliver unrivalled results. in which we operate. 30-year blue-chip heritage Best in class Turning dreams into reality Through our parent New World Quality is at the heart of We do more than build Development, a reputable and everything we do. -

Istoxx® Developed and Emerging Markets Ex Usa Pk Vn Real Estate

ISTOXX® DEVELOPED AND EMERGING MARKETS EX USA PK VN REAL ESTATE Components1 Company Supersector Country Weight (%) Vonovia SE Real Estate Germany 3.58 Goodman Group Real Estate Australia 2.31 Mitsubishi Estate Co. Ltd. Real Estate Japan 2.14 Mitsui Fudosan Co. Ltd. Real Estate Japan 2.06 Sun Hung Kai Properties Ltd. Real Estate Hong Kong 2.00 Link Real Estate Investment Tr Real Estate Hong Kong 1.79 DEUTSCHE WOHNEN Real Estate Germany 1.71 Sumitomo Realty & Development Real Estate Japan 1.50 SEGRO Real Estate Great Britain 1.44 CK Asset Holdings Ltd Real Estate Hong Kong 1.33 China Resources Land Ltd. Real Estate China 1.14 SM Prime Holdings Inc Real Estate Philippines 1.11 LEG IMMOBILIEN Real Estate Germany 1.06 SCENTRE GROUP Real Estate Australia 1.04 UNIBAIL-RODAMCO-WESTFIELD Real Estate France 1.04 AROUNDTOWN (FRA) Real Estate Germany 0.85 China Overseas Land & Investme Real Estate China 0.84 WHARF REIC Real Estate Hong Kong 0.78 Mirvac Group Real Estate Australia 0.78 DEXUS Real Estate Australia 0.77 Nippon Building Fund Inc. Real Estate Japan 0.77 Stockland Real Estate Australia 0.75 Japan Real Estate Investment C Real Estate Japan 0.73 SWISS PRIME SITE Real Estate Switzerland 0.73 CAPTIALAND INT COMM TRUST Real Estate Singapore 0.71 GECINA Real Estate France 0.70 Ayala Land Inc Real Estate Philippines 0.69 Ascendas Real Estate Investmen Real Estate Singapore 0.68 New World Development Co. Ltd. Real Estate Hong Kong 0.66 CANADIAN APARTMENT PROP REIT Real Estate Canada 0.66 NIPPON PROLOGIS REIT Real Estate Japan 0.63 NOMURA REIT.MASTER FUND Real Estate Japan 0.62 CapitaLand Ltd. -

STOXX Hong Kong All Shares 180 Last Updated: 01.04.2015

STOXX Hong Kong All Shares 180 Last Updated: 01.04.2015 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 92.5 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 70.6 2 3 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 64.3 3 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 61.8 4 4 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 52.5 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 40.9 6 6 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 30.3 7 7 HK0013000119 6448068 0013.HK 644806 Hutchison Whampoa Ltd. HK HKD Y 26.2 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 25.3 9 16 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 25.2 10 10 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 25.0 11 9 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 21.7 12 11 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 20.9 13 12 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.9 14 13 HK0004000045 6435576 0004.HK 643557 Wharf (Holdings) Ltd. HK HKD Y 19.7 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 18.9 16 15 CNE100000205 B0B8Z29 3328.HK CN0054 Bank of Communications Co 'H' CN HKD Y 17.6 17 17 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Annual Report 2013

NWD_AR13_CoverBack_E new.ai 2013/10/9 12:01:28 AM Annual Report 2013 Contents 2 Corporate Profile Design Concept 4 Corporate Structure This design scheme revolves around the 5 Financial Highlights concept enshrined under Luban Lock, which 6 Chairman’s Statement represents ancient wisdom and sophisticated 8 Joint General Managers’ Report craftsmanship. This sophisticated structure depicted in the cover page represents the 8 Property focal point to converge the core businesses of 18 Hotel Operations 24 Infrastructure and Service New World Development. 30 Department Stores 34 Telecommunications 35 Outlook 40 Management Discussion and Analysis 46 Principal Projects Summary 68 Corporate Governance Report 78 Investor Relations 82 Directors’ Profile 89 Senior Management Profile 90 Corporate Sustainability 100 Corporate Information 101 Financial Section Contents Disclaimer The photographs, images, drawings or sketches shown in this annual report represent an artist’s impression of the development concerned only. They are not drawn to scale and/or may have been edited and processed with computerised imaging techniques. Prospective purchasers should make reference to the sales brochure for details of the development. The vendor also advises prospective purchasers to conduct an on-site visit for a better understanding of the development site, its surrounding environment and the public facilities nearby. All parties engaged in the production of this annual report have made their best efforts to ensure the highest accuracy of all information, photographs, images, drawings or sketches herein contained as to the printing of this annual report and to minimise the existence of clerical errors. Readers are invited to make enquires to sales personnel or consult relevant professionals for verification of doubts or particulars of specific items. -

Board of Directors

Board of Directors from left to right: Mr Dominic Lai; Mr Wilfried Ernst Kaffenberger; Mr Cheung Chin Cheung; Mr Wong Kwok Kin, Andrew; Mr Chan Kam Ling; Dr Cheng Kar Shun, Henry; Mr Doo Wai Hoi, William BOARD OF DIRECTORS had served with the Hong Kong Police Force for 38 years and retired from the Force as its Commissioner in December 2003. He has extensive experience in corporate leadership and public administration. Mr Tsang was awarded the Gold Bauhinia Dr Cheng Kar Shun, Henry GBS Star, the OBE, the Queen’s Police Medal, the Colonial Police Medal for Meritorious Chairman Service, the Commissioner’s Commendation, and the HKSAR Police Long Service Dr Cheng (60) was appointed as Executive Director in March 2000 and became Medal. the Chairman in March 2001. Dr Cheng is the Managing Director of NWD, a substantial shareholder of the Company, the Chairman and Managing Director of New World China Land Limited and the Chairman of New World Department Store Mr Wong Kwok Kin, Andrew China Limited, Taifook Securities Group Limited and International Entertainment Executive Director Corporation. He is also a director of Chow Tai Fook Enterprises Limited, Centennial Mr Wong (61) was appointed as Executive Director in January 2003. Mr Wong is an Success Limited and Cheng Yu Tung Family (Holdings) Limited, all of them are executive director of Sky Connection Limited and several subsidiary companies and substantial shareholders of the Company. Dr Cheng is also the Managing Director affiliates of New World Group providing duty-free liquor and tobacco concessions, of New World Hotels (Holdings) Limited, an independent non-executive director communication services, cleaning and laundry services, and estate management of HKR International Limited and a non-executive director of Lifestyle International in both Hong Kong and Mainland China. -

FTSE EPRA/NAREIT Global Real Estate Index Series Asia Quarterly

FTSE EPRA/NAREIT Global Real Estate Index Series Asia Qty Review Page 1 of 3 FTSE EPRA / NAREIT Global Real Estate Index Series Asia Quarterly Review 5 June 2014 FTSE, EPRA and NAREIT announce the results of the quarterly review of the Asian region of the FTSE EPRA/NAREIT Global Real Estate Index as at 5 June 2014. All changes are effective as of Monday, 23 June 2014. FTSE EPRA/NAREIT Global Developed Index Additions (from Developed Asia Region) Company Name SEDOL Country Japan Hotel REIT Investment B1530B1 Japan Deletions (from Developed Asia Region) No Changes FTSE EPRA/NAREIT Global Developed Index Focus Reclassifications No Changes FTSE EPRA/NAREIT Global Developed Index Sector Reclassifications Company Name SEDOL Country Old Sector New Sector Champion REIT B14WZ47 Hong Kong Office Diversified Orix J-REIT Inc 6527774 Japan Office Diversified FTSE EPRA/NAREIT Global Emerging Index Additions (from Emerging Asia Region) Company Name SEDOL Country Redco Properties Group (P Chip) BJ6L322 China Deletions (from Emerging Asia Region) http://ftse.com/tech_notices/2014/Q2/87447_20140605_EPRA_Asia_Jun14.jsp 05/06/2014 FTSE EPRA/NAREIT Global Real Estate Index Series Asia Qty Review Page 2 of 3 Company Name SEDOL Country Shanghai Lujiazui Finance & Trade Zone Development Co. Ltd. B 6798666 China Tebrau Teguh BhD 6381356 Malaysia Sentul City B19HL05 Indonesia UEM Sunrise B3FKMY3 Malaysia FTSE EPRA/NAREIT Global Emerging Index Sector Reclassifications Company Name SEDOL Country Old Sector New Sector Minmetals Land (Red Chip) 6508478 China Residential -

2015 Annual Report New Business Opportunities and Spaces Which Rede Ne Aesthetic Standards Breathe New Life Into Throbbing and a New Way of Living

MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have been undertaken to rejuvenate the that nurture family living and old city into vibrant communities character- promote a healthy cultural ised by eclectic urban housing, ample and social life. public space, shopping, entertain- ment and leisure facilities. SPURRING BUSINESS REFINING LIVING OPPORTUNITIES We have developed large-scale multi- LIFESTYLE purpose commercial complexes, all Our residential communities are fully equipped well-recognised city landmarks that generate with high quality facilities and multi-purpose Annual Report 2015 new business opportunities and spaces which redene aesthetic standards breathe new life into throbbing and a new way of living. We enable owners hearts of Chinese and residents to experience the exquisite metropolitans. and sensual lifestyle enjoyed by home buyers around the world. Annual Report 2015 MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have -

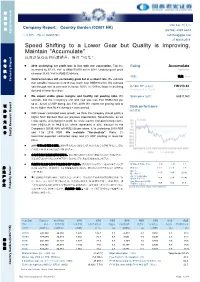

Speed Shifting to a Lower Gear but Quality Is Improving, Maintain

股 票 研 [Table_Title] Van Liu 刘斐凡 Company Report: Country Garden (02007 HK) 究 (86755) 2397 6672 Equity Research 公司报告: 碧桂园 (02007 HK) [email protected] 27 March 2019 Speed[Table_Summary Shifting] to a Lower Gear but Quality is Improving, Maintain "Accumulate" 速度换低档速但质量提升,维持“收集” 公 司 2018 underlying net profit was in line with our expectation. Top line Rating:[Table_Rank] Accumulate increased by 67.1% YoY to RMB379,079 mn in 2018. Underlying net profit Maintained 报 elevated 31.4% YoY to RMB33,864 mn. 告 评级: 收集 (维持) Contracted sales will sustainably grow but at a slower rate. We estimate Company Report that saleable resources in 2019 may reach over RMB780.2 bn. We estimate sale-through rate to decrease to below 70.0% in 2019 to factor in declining 6[Table_Price]-18m TP 目标价 : HK$13.61 demand in lower-tier cities. Revised from 原目标价: HK$12.28 We expect stable gross margins and healthy net gearing ratio. We Share price 股价: HK$11.960 estimate that the Company’s unit land cost was less than RMB2,742 per 告 sq.m., 32.6% of ASP during Jan.-Feb. 2019. We expect net gearing ratio to 证 报 be no higher than 56.4% during the same period. Stock performance 券 股价表现 究 With slower contracted sales growth, we think the Company should justify a 研 higher NAV discount than our previous expectations. Nevertheless, as we [Table_QuotePic] 研 究 revise up the underlying net profit, we revise up the Company’s target price 券 from HK$12.28 to HK$13.61, which represents a 40% discount to the 报 Company’s 2019E NAV of HK$22.68 per share, 6.1x underlying 2019 PER 告 证 and 1.5x 2019 PBR. -

China Vanke Bloomberg: 2202 HK Equity | 000002 CH Equity | Reuters: 2202.HK | 000002.SZ Refer to Important Disclosures at the End of This Report

China / Hong Kong Company Focus China Vanke Bloomberg: 2202 HK Equity | 000002 CH Equity | Reuters: 2202.HK | 000002.SZ Refer to important disclosures at the end of this report DBS Group Research . Equity 6 January 2016 H: HOLD (Downgrade from BUY) Shareholding uncertainty overshadows Last Traded Price (H): HK$20.80 (CSI300 Index : 3,540) strong fundamentals Price Target (H): HK$19.60 (6% downside) (Prev HK$23.41) Better-than-expected sales/acquisitions in Dec 2015 will likely lead to decent sales growth in 2016 A: BUY (Under review) Yet, shareholding structure is unlikely to improve in the near Last Traded Price (A): RMB24.43 (HSI : 20,981) term and potential asset restructuring is uncertain Price Target (A): RMB19.31 (21% downside) Shareholding competition will likely distract management Potential Catalyst: Better-than-expected shareholding structure efforts and affect Vanke’s long-term strategy Where we differ: Our FY15-17F EPS are below consensus Share price is under pressure after trading resumption; Analyst Downgrade Vanke-H from BUY to HOLD Ken HE CFA, +86 21 6888 3375 Uncertainty in potential asset restructuring (Details on page 3). The [email protected] difficulties are in: (i) identifying potential acquisition targets to fall in Carol WU +852 2863 8841 the definition of “material asset restructuring”, and to improve [email protected] shareholding structure (or mitigate Baoneng’s influence in Vanke’s Danielle WANG CFA, +852 2820 4915 board/strategy), as well as to strengthen Vanke’s traditional [email protected] residential and new business lines; and (ii) obtaining shareholders’ Andy YEE CFA, +852 2971 1773 approval given current shareholding structure and rich valuation.