NXC Corporation and Subsidiaries Consolidated Financial Statements December 31, 2014 and 2013 NXC Corporation and Subsidiaries Index December 31, 2014 and 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UNO Template

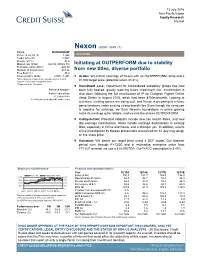

13 July 2016 Asia Pacific/Japan Equity Research Internet Nexon (3659 / 3659 JT) Rating OUTPERFORM* Price (12 Jul 16, ¥) 1,444 INITIATION Target price (¥) 1,900¹ Chg to TP (%) 31.6 Market cap. (¥ bn) 629.93 (US$ 6.10) Initiating at OUTPERFORM due to stability Enterprise value (¥ bn) 440.12 Number of shares (mn) 436.24 from new titles, diverse portfolio Free float (%) 35.0 52-week price range 2,065 - 1,401 ■ Action: We initiate coverage of Nexon with an OUTPERFORM rating and a *Stock ratings are relative to the coverage universe in each ¥1,900 target price (potential return 31.6%). analyst's or each team's respective sector. ¹Target price is for 12 months. ■ Investment case: Impairment for consolidated subsidiary gloops has now Research Analysts been fully booked, greatly reducing future impairment risk. Amortization is Keiichi Yoneshima also down following the full amortization of IP for Dungeon Fighter Online 81 3 4550 9740 (Arad Senki) in August 2015, which had been ¥700mn/month. Looking at [email protected] revenues, existing games are doing well, and Nexon is preparing to release game iterations under existing strong brand titles. Even though the rising yen is negative for earnings, we think Nexon’s foundations in online gaming make its earnings quite reliable, and we rate the shares OUTPERFORM. ■ Catalysts/risk: Potential catalysts include new title launch dates, and new title earnings contributions. Risks include earnings deterioration in existing titles, especially in China and Korea, and a stronger yen. In addition, results of the investigation by Korean prosecutors announced on 12 July may weigh on the share price. -

16Th Annual Securities Report

[These documents are based on the Company's Annual Securities Report (Japanese only) prepared following the Financial Instruments and Exchange Act for the purpose of providing accurate financial information and other information in a manner that is easy to understand. In the event of any discrepancy between these translated documents and the Japanese originals, the originals shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translations.] Annual Securities Report (The 16th Fiscal Year) From January 1, 2017 to December 31, 2017 NEXON Co., Ltd Table of Contents Page Annual Securities Report for the 16th Fiscal Year 【Cover】 ··················································································································· 1 Part I 【Information on the Company】 ················································································ 2 I. 【Overview of the Company】 ···················································································· 2 1 【Changes in Key Management Indicators】 ································································ 2 2 【History】 ······································································································· 5 3 【Description of Business】 ··················································································· 9 4 【Group Companies】 ·························································································· 17 5 【Employees】 ··································································································· -

Notice of Annual General Meeting of Shareholders

Securities code: 3659 March 11, 2013 To Shareholders with Voting Rights 2-3-1 Shinkawa, Chuo-ku, Tokyo NEXON Co., Ltd. Representative Director/President Seungwoo Choi Notice of the 11th Ordinary General Meeting of Shareholders Dear Shareholders: You are cordially invited to attend the 11th Ordinary General Meeting of Shareholders. The meeting details and agenda are as outlined below. If you are unable to attend the meeting, you may exercise your voting rights in writing. Please review the General Shareholders Meeting agenda described below and return the Voting Rights Exercise Form with your vote by 7pm on Monday, March 25, 2013. Notice 1. Date &Time: 10:00 a.m., Tuesday, March 26, 2013 2. Location: Tokyo Sankei Building At Otemachi Sankei Plaza on 4th Floor 1-7-2, Otemachi, Chiyoda-ku, Tokyo (Please be aware that this is a different location from the last year and refer to the location map on the last page of this document) 3. Agenda: Matters to be reported: 1) Business Report and Consolidated Financial Statements for the 11th fiscal year (from January 1, 2012 to December 31, 2012), and audit results on the Consolidated financial statements by the Independent Auditors and the Board of Statutory Auditors. 2) Non-consolidated Financial Statements for the 11th fiscal year (from January 1, 2012 to December 31, 2012). Proposals to be voted on: Proposal No. 1: Selection and appointment of six (6) directors Proposal No. 2: Issuance of subscription rights to shares as stock options to the Company’s directors and employees Proposal No. 3: Amount of directors’ remuneration in the form of equity-based compensation stock options and the decision on the contents ········································································································································· If attending the meeting in person, please submit the enclosed Voting Rights Exercise Form to the receptionist. -

Annual Securities Report

[These documents are based on the Company's Annual Securities Report (Japanese only) prepared following the Financial Instruments and Exchange Act for the purpose of providing accurate financial information and other information in a manner that is easy to understand. In the event of any discrepancy between these translated documents and the Japanese originals, the originals shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translations.] Annual Securities Report (The 17th Fiscal Year) From January 1, 2018 to December 31, 2018 NEXON Co., Ltd Table of Contents Page Annual Securities Report for the 17th Fiscal Year 【Cover】 ··················································································································· 1 Part I 【Information on the Company】 ················································································ 2 I. 【Overview of the Company】 ···················································································· 2 1 【Changes in Key Management Indicators】 ································································ 2 2 【History】 ······································································································· 6 3 【Description of Business】 ··················································································· 10 4 【Group Companies】 ·························································································· 18 5 【Employees】 ··································································································· -

NXC Corporation and Subsidiaries Consolidated Financial Statements December 31, 2015 and 2014 NXC Corporation and Subsidiaries Index December 31, 2015 and 2014

NXC Corporation and Subsidiaries Consolidated Financial Statements December 31, 2015 and 2014 NXC Corporation and Subsidiaries Index December 31, 2015 and 2014 Page(s) Independent Auditor’s Report ·········································································· 1 – 2 Consolidated Financial Statements Consolidated Statements of Financial Position ······················································ 3 – 4 Consolidated Statements of Comprehensive Income ·············································· 5 Consolidated Statements of Changes in Equity ···················································· 6 Consolidated Statements of Cash Flows ······························································ 7 Notes to the Consolidated Financial Statements······················································ 8 – 67 Independent Auditor’s Report (English Translation of a Report Originally Issued in Korean) To the Shareholder and Board of Directors of NXC Corporation We have audited the accompanying consolidated financial statements of NXC Corporation and its subsidiaries (collectively “the Group”), which comprise the consolidated statements of financial position as of December 31, 2015 and 2014, and the consolidated statements of comprehensive income, changes in equity and cash flows for the years then ended, and notes, comprising a summary of significant accounting policies and other explanatory information. Management’s responsibility for the financial statements Management is responsible for the preparation and fair presentation of these -

NXC Corporation and Subsidiaries Consolidated Financial Statements December 31, 2016 and 2015 NXC Corporation and Subsidiaries Index December 31, 2016 and 2015

NXC Corporation and Subsidiaries Consolidated Financial Statements December 31, 2016 and 2015 NXC Corporation and Subsidiaries Index December 31, 2016 and 2015 Page(s) Independent Auditor’s Report ·········································································· 1 - 2 Consolidated Financial Statements Consolidated Statements of Financial Position ······················································ 3 - 4 Consolidated Statements of Comprehensive Income ·············································· 5 Consolidated Statements of Changes in Equity ···················································· 6 Consolidated Statements of Cash Flows ······························································ 7 Notes to the Consolidated Financial Statements······················································ 8 - 74 Independent Auditor’s Report (English Translation of a Report Originally Issued in Korean) To the Board of Directors and Shareholders of NXC Corporation We have audited the accompanying consolidated financial statements of NXC Corporation and its subsidiaries (collectively referred to as the “Group"), which comprise the consolidated statements of financial position as at December 31, 2016 and 2015, and the consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for the years then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies and other explanatory information. Management’s Responsibilities -

Securities Code: 3659 March 12, 2012 to Shareholders with Voting Rights 2-3-1 Shinkawa 2-Chome, Chuo-Ku, Tokyo NEXON Co., Ltd

Securities code: 3659 March 12, 2012 To Shareholders with Voting Rights 2-3-1 Shinkawa 2-chome, Chuo-ku, Tokyo NEXON Co., Ltd. Representative Director/President Seungwoo Choi Notice of the 10th Ordinary General Meeting of Shareholders Dear Shareholders: You are cordially invited to attend the 10th Ordinary General Meeting of Shareholders. The meeting details and agenda are as outlined below. If you are unable to attend the meeting, you may exercise your voting rights in writing. Please review the General Shareholders Meeting agenda described below and return the Voting Rights Exercise Form with your vote by 7pm on Monday, March 26, 2012. Notice 1. Date &Time: 10:00 a.m., Tuesday, March 27, 2012 2. Location: ANA InterContinental Hotel Tokyo At Prominence Room on B1 Floor 1-12-33, Akasaka, Minato-ku, Tokyo (Please refer to the location map on the last page of this document) 3. Agenda: Matters to be reported: 1) Business Report and Consolidated Financial Statements for the 10th fiscal year (from January 1, 2011 to December 31, 2011), and audit results on the Consolidated financial statements for the 10th fiscal year (from January 1, 2011 to December 31, 2011) by the Independent Auditors and the Board of Statutory Auditors. 2) Non-consolidated Financial Statements for the 10th fiscal year (from January 1, 2011 to December 31, 2011). Proposals to be voted on: Proposal No. 1: Election of six (6) directors Proposal No. 2: Reduction of Capital reserve Proposal No. 3: Issuance of subscription rights to shares as stock options to the Company’s directors and employees ··········································································································· If attending the meeting in person, please submit the enclosed Voting Rights Exercise Form to the receptionist.