A Good Start in the New Year, More Advances Is Expected

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2017 Passenger Vehicles Actual and Reported Fuel Consumption: a Gap Analysis

2017 Passenger Vehicles Actual and Reported Fuel Consumption: A Gap Analysis Innovation Center for Energy and Transportation December 2017 1 Acknowledgements We wish to thank the Energy Foundation for providing us with the financial support required for the execution of this report and subsequent research work. We would also like to express our sincere thanks for the valuable advice and recommendations provided by distinguished industry experts and colleagues—Jin Yuefu, Li Mengliang, Guo Qianli,. Meng Qingkuo, Ma Dong, Yang Zifei, Xin Yan and Gong Huiming. Authors Lanzhi Qin, Maya Ben Dror, Hongbo Sun, Liping Kang, Feng An Disclosure The report does not represent the views of its funders nor supporters. The Innovation Center for Energy and Transportation (iCET) Beijing Fortune Plaza Tower A Suite 27H No.7 DongSanHuan Middle Rd., Chaoyang District, Beijing 10020 Phone: 0086.10.6585.7324 Email: [email protected] Website: www.icet.org.cn 2 Glossary of Terms LDV Light Duty Vehicles; Vehicles of M1, M2 and N1 category not exceeding 3,500kg curb-weight. Category M1 Vehicles designed and constructed for the carriage of passengers comprising no more than eight seats in addition to the driver's seat. Category M2 Vehicles designed and constructed for the carriage of passengers, comprising more than eight seats in addition to the driver's seat, and having a maximum mass not exceeding 5 tons. Category N1 Vehicles designed and constructed for the carriage of goods and having a maximum mass not exceeding 3.5 tons. Real-world FC FC values calculated based on BearOil app user data input. -

2333 a Share Stock Code: 601633

(a joint stock company incorporated in the People's Republic of China with limited liability) H Share Stock Code: 2333 A Share Stock Code: 601633 * For identification purpose only IMPORTANT NOTICE I. The Board, the Supervisory Committee and the directors, supervisors and senior management of the Company warrant that the contents of this annual report are true, accurate and complete and do not contain any false representations, misleading statements or material omissions, and jointly and severally take legal liability for its contents. II. All the directors of the Company attended the Board meeting. III. Deloitte Touche Tohmatsu Certified Public Accountants LLP has issued the standard audited report for the Company without qualified opinion. The financial information in the annual report was prepared in accordance with China Accounting Standards for Business Enterprises and the relevant laws and regulations. IV. Wei Jian Jun, person-in-charge of the Company, Li Hong Shuan, person-in-charge of the accounting affairs and Lu Cai Juan, person-in-charge of the accounting department (head of the accounting department), declare that they warrant the truthfulness, accuracy and completeness of the financial report in this annual report. V. Proposal of profit distribution or capitalization of capital reserve during the Reporting Period reviewed by the Board As audited by Deloitte Touche Tohmatsu Certified Public Accountants LLP, the net profit of the Group and net profit attributable to shareholders of the Company in 2020 amounted to RMB5,362,490,194.32 and RMB5,362,490,194.32 respectively. The Company has implemented the profit plan for the first three quarters of 2020, pursuant to which it distributed a cash dividend of RMB0.28 (tax inclusive) per share to all shareholders, with a total cash dividend of RMB2,569,266,924.00 (tax inclusive) distributed. -

Gscan Software Release Highlights

cs~~rr- · rw ---- ------- -------- GScan SoŌware Release Highlights G-scan Software Release January 2019 Update TOYOTA/LEXUS ................................................................. 2 OPEL / GM BRAZIL ............................................................ 2 NISSAN/INFINITI ................................................................. 2 HOLDEN ......................................................................... 2 HONDA /ACURA ................................................................. 2 CHERY ..................................................................................... 2 MITSUBISHI .......................................................................... 2 DAEHAN .................................................................................. 2 MAZDA .................................................................................... 2 SSANGYONG........................................................................ 2 SUZUKI/MARUTI ................................................................. 2 MVM .......................................................................................... 2 SUBARU ................................................................................. 2 LIFAN ........................................................................................ 2 ISUZU ....................................................................................... 2 LDV ............................................................................................ 2 FUSO ....................................................................................... -

Automotive Industry Weekly Digest

Automotive Industry Weekly Digest 25-29 January 2021 IHS Markit Automotive Industry Weekly Digest - Jan 2021 WeChat Auto VIP Contents [OEM Highlights] Great Wall to reshape brand image with new models 3 [OEM Highlights] VW begins sales of ID.4 CROZZ in China 4 [Sales Highlights] Chinese new vehicle sales contract 2% during 2020; demand rebound expected in 2021 6 [Sales Highlights] VW Group reports sales decline of 9.1% in China during 2020 8 [Technology and Mobility Highlights] Huawei develops smart roads in Wuxi that communicate with driverless vehicles 10 [Technology and Mobility Highlights] Geely teams up with Tencent to develop smart car technologies 10 [Supplier Trends and Highlights] DENSO collaborate with AEVA to develop next-generation FMCW lidar system 12 [Supplier Trends and Highlights] Freudenberg Sealing Technologies develops new DIAvent valves for safer lithium-ion batteries 12 [GSP] India/Pakistan Sales and Production Commentary -2020.12 14 [VIP ASSET] Stellantis: Scale Creates Opportunity 16 [VIP ASSET] Stellantis expects scale to support strong brand stable, investment into new tech 17 Confidential. ©2021 IHS Markit. All rights reserved. 2 IHS Markit Automotive Industry Weekly Digest - Jan 2021 WeChat Auto VIP [OEM Highlights] Great Wall to reshape brand image with new models IHS Markit perspective Implications Great Wall has delivered satisfactory sales results during 2020 despite the disruption from the coronavirus disease 2019 (COVID-19) pandemic. The automaker's sales rose by 5% to more than 1.11 million vehicles during 2020 on the back of strong demand for its new models, including the Haval H6 and the Pao pickup. The sales volumes of 1.11 million units exceeded the company’s target set for the year, which was 1.02 million units. -

Haval-H6-2019-AU.Pdf

Who is HAVAL Built for the world by the world Powerful 145kW turbo-charged 2.0-litre direct injection engine Although new in Australia and New Zealand, HAVAL is one of the world’s largest specialist SUV companies. With over 5 million owners, HAVAL is the No.1 SUV brand in the world’s largest auto market – China, and has been for the last 16 years. HAVAL research and development centre Our philosophy is simple – employ the best people, use the best technology and suppliers in the world and utilise high precision robots for consistent quality. No wonder HAVAL SUVs are recognised for their style, features, build quality and deep lustrous paintwork. Getrag 6DCT (Dual clutch transmission) When you invest in a HAVAL, you can be confident that it’s been designed with care, built with pride and engineered to last. We look forward to welcoming you to the HAVAL family. HAVAL concept vehicle Sport mode Power to excite The HAVAL H6 matches the performance of a powerful turbo-charged 2.0-litre direct injection engine with a Getrag six-speed dual clutch transmission (DCT). The DCT combines all the advantages of manual and automatic transmissions to deliver fast, smooth gear changes with maximum efficiency. When the mood takes you, select Paddle shifters Compact SUV Sporty mid-sized SUV Ultimate 7-seater family adventure 4WD sport mode and use the paddle shifters to give you even more control and fun. European-inspired driving dynamics With European engineering inspiration it’s no surprise the HAVAL H6 drives and handles so well. -

Great Wall Motors Showed up at Saudi International Motor Show with Several Star Models

NEWS Great Wall Motors Showed up at Saudi International Motor Show with Several Star Models On December 10, 2019, the 41st Saudi International Motor Show(SIMS) kicked off at Jeddah Center for Forums & Events in Jeddah, Saudi Arabia. As a new force in auto market of the Kingdom, Great Wall Motors (GWM) exhibited at the Motor Showed three of its brands HAVAL, Great Wall Pickup and ORA with 6 models in total. At the presence of Mr. Faisal, the chairman of ADMC-GWM’s distributor in KSA and Mr. Li Zhixiong, representative of GWM and Senior Manager of the Middle East and Africa as well as other main members of both sides, New HAVAL H2 and WINGLE 7 Pickup, the two models were officially launched on the Motor Show. With the launch of new models and product upgrades, it would do GWM great favor in completing its product line-up and layout in Saudi Arabia. SIMS is the largest and most influential motor show in Saudi Arabia, attracting well-known auto brands from the United States, Japan, South Korea and China. HAVAL, amid total 14 auto brands like Toyota, Hyundai and KIA, was one of the shining brands at this motor show, which lasted 5 days and was expected to attract more than 100,000 visitors, providing an auto visual feast for Saudi consumers. 1 NEWS At SIMS 2019, GWM set up both indoor and outdoor booths, and HAVAL booth was located in the center of the indoor exhibition, adjacent to Toyota and Hyundai. HAVAL family inclusive of new HAVAL H2, ALL New H6, HAVAL H9 and the fully electric car ORA IQ were all on display as expected, attracting the eyes of people touring the show. -

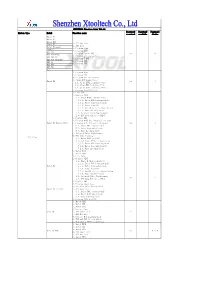

GWM SPECIAL(Reprogram) V10.44Diagnostics List(Note:For Reference Only)

GWM SPECIAL(reprogram) V10.44Diagnostics List(Note:For reference only) Functions Car CONNE Vehicle System Name Sub-System Name CTOR Read Clear Data Sys. Special Others code code Stream Info. Functions Red 4G15_ME788(Fomer M4) DBSCar √ 1.reprogram ECM Blue 4G15_ME788 DBSCar √ 1.reprogram HAVAL H1 Xiamen tongzhi DBSCar √ 1.reprogram BCM UAES BCM DBSCar √ 1.reprogram EPS DBSCar √ 1.reprogram ECM 4G15B-ME788 DBSCar √ 1.reprogram HAVAL H2 TCU HPT 6AT DBSCar √ 1.reprogram BCM Delphi BCM DBSCar √ 1.reprogram 4D20Delphi DBSCar √ 1.reprogram ECM 4D20 Bosch DBSCar 1.reprogram 4G63T-MT80 DBSCar √ 1.reprogram HAVAL H5 Delphi BCM DBSCar √ 1.reprogram BCM Tongzhi BCM DBSCar 1.reprogram TPMS Classic Type DBSCar √ 1.reprogram 4D20 Delphi DBSCar √ 1.reprogram 4D20 Bosch DBSCar 1.reprogram GWM SPECIAL(reprogram) V10.44Diagnostics List(Note:For reference only) Functions Car CONNE Vehicle System Name Sub-System Name CTOR Read Clear Data Sys. Special Others code code Stream Info. Functions ECM 4G15B_ME788 DBSCar √ 1.reprogram 4G15B_ME1788 DBSCar √ 1.reprogram HAVAL H6 4G15E_ME17810 DBSCar √ 1.reprogram H6 Upgrade Type Delphi DBSCar 1.reprogram BCM H6 Sports UAES DBSCar 1.reprogram TCU HPT 6AT DBSCar 1.reprogram PEPS Kostal DBSCar √ 1.reprogram ECM GW4C20-MT92 DBSCar √ 1.reprogram BCM DBSCar √ 1.reprogram HAVAL H6 Getrag 6DCT DBSCar √ 1.reprogram Coupe TCU HPT-6AT TCU DBSCar √ 1.reprogram Trailer Module DBSCar 1.reprogram ECM GW4C20A- UAES DBSCar √ 1.reprogram IFV DBSCar √ 1.reprogram 4 Channels RPA DBSCar √ 1.reprogram PAS 8 Channels UPA DBSCar √ 1.reprogram GWM SPECIAL(reprogram) V10.44Diagnostics List(Note:For reference only) Functions Car CONNE Vehicle System Name Sub-System Name CTOR Read Clear Data Sys. -

GREATWALL Function List V29.94 System Type Model

GREATWALL Function List V29.94 Password Password Password System type Model Function menu required readable digits Haval F5 Haval F7 Haval H2S 1、All key lost Haval H4 2、Add keys Haval H9(2020) 3、Program peps CHB025A 4、Program ESCL WEY VV7 5、Program engine ECU yes 8 WEY VV7(PHEV) 6、Program all new system WEY VV7 GT 7、Program T-BOX WEY VV7 GT(PHEV) 8、Program HCU WEY P8 9、Program TCU WEY VV5 WEY VV6 Pao 1、Program keys 2、Prpgram ECU 3、Program all new system 4、Clear ECU Learn State Haval H2 yes 6 4.1、Clear ESCL learning state 4.2、Clear EMS learning state 4.3、Clear CAPE learning state 5、Program keys(offline) 1、Live data 2、Replace PEPS 2.1、Erase K-SK, relearn keys 2.1.1、Enter EOL learning mode 2.1.2、Enter keys match mode 2.1.3、Erase Keys-SK 2.1.4、Key-SK write to Base System 2.1.5、Base matching keys 2.2、Solenoid Valve Replacement 2.3、ECU data Writes to PEPS 3、Replace EMS 4、Program with the original car keys Haval H6 Button PEPS 5、Program keys the all lost model yes 4 5.1、Enter EOL learning mode 5.2、Enter keys match mode 5.3、Base matching keys 6、Solenoid Valve Replacement 7、EOL mode learning Smart Key 7.1、Match PEPS and EMS 7.2、Not Erase K-SK, relearn keys 7.2.1、Enter EOL learning mode 7.2.2、Enter keys match mode 7.2.3、Base matching keys 8、Match ESCL 9、Match TBOX 1、Live data 2、Replace PEPS 2.1、Erase K-SK,relearn keys 2.1.1、Enter EOL learning mode Haval H8 2.1.2、Enter keys match mode 2.1.3、Erase Keys-SK 2.1.4、Key-SK write to Base System 2.1.5、Base matching keys 2.2、Solenoid Valve Replacement yes 4 2.3、ECU data Writes to PEPS 3、Replace EMS 4、Program -

Download H6 Brochure

Who is HAVAL Whilst new in Australia and New Zealand, HAVAL is one of the world’s largest specialist SUV companies. With over 4 million owners, HAVAL is the No.1 SUV brand in the world’s largest auto market – China, and has been for the last 15 years. Powerful 145kW turbo-charged 2.0-litre direct injection engine Our goal is to become one of the world’s leading SUV brands. We are well on our way with Brand Finance concluding that the HAVAL brand is already worth more than many other established auto brands.* HAVAL research and development centre Our philosophy is simple – employ the best people, use the best technology and suppliers in the world and utilise high precision robots for consistent quality. No wonder HAVAL’s are recognised for their style, Getrag 6DCT (Dual clutch transmission) features, build quality and deep lustrous paintwork. When you invest in a HAVAL, you can be confident that it’s been designed with care, built with pride and engineered to last. We look forward to welcoming you to the HAVAL family. Concept vehicle Sport mode Power to excite The HAVAL H6 matches the performance of a powerful turbo-charged 2.0-litre direct injection engine with a Getrag six-speed dual clutch transmission (DCT). The DCT combines all the advantages of manual and automatic transmissions to deliver fast, smooth gear changes with maximum efficiency. When the mood Compact SUV Sporty mid-sized SUV Ultimate 7-seater family adventure SUV takes you, select sport mode and use the paddle shifters to give you even more control and fun. -

Automotive Industry Weekly Digest

Automotive Industry Weekly Digest 17 May – 21 May 2021 IHS Markit Automotive Industry Weekly Digest - May 2021 WeChat Auto VIP Contents [Domestic Sales Highlights] Great Wall reports 13.5% y/y growth in sales during April 3 [Domestic Sales Highlights] Chery Holding reports 91.6% y/y growth in sales during April 3 [OEM Highlights] Arrival partners with Uber to build electric car for ride-hailing services 5 [OEM Highlights] EV startup NIO reveals strategy in Norway 6 [Technology Highlights] Huawei looks to acquire EV unit of domestic automaker 8 [Technology Highlights] Luminar to supply LiDAR sensors to autonomous vehicle startup Pony.ai 8 [GSP] North America Sales and Production Commentary -2021.04 10 [Supplier Trends and Highlights] Green Hills Software partners with MathWorks to develop toolbox for embedded automotive processors 12 [Supplier Trends and Highlights] Arbe Robotics announces availability of 4D imaging radar solution on NVIDIA DRIVE Platform 12 Confidential. ©2021 IHS Markit. All rights reserved. 2 IHS Markit Automotive Industry Weekly Digest - May 2021 WeChat Auto VIP [Domestic Sales Highlights] Great Wall reports 13.5% y/y growth in sales during April Great Wall Motor Co has reported 13.5% year-on-year (y/y) growth in sales to 91,784 units in April, with sales up 86.27% y/y to 430,582 units in the year to date (YTD). In April, the total deliveries of the Haval brand were down by 3.64% y/y to 55,018 units, while sales of the WEY brand decreased 40.9% y/y to 3,590 units. Sales of the automaker's pick-up trucks, including the Wingle and Pao, totalled 20,200 units last month, up 28.4% y/y. -

Diagnostic List HAVAL V9.80

Diagnostic List HAVAL_v9.80 Remark: 1.√ : means that the system has this function 2. - : means that the system does not have this function 3.compared with the last version, the new added function is marked in red color Function Model Menu System Version Info. Read DTC Erase DTC Read Data Stream Actuation Test Read Freeze Frame Remarks(Other functions) read historical fault code;Oxygen sensor feedback rationality General Type Haval H3 Delphi MT20U2_EOBD electronic control system √ √ √ √ √ √ diagnosis; idle catalytic converter diagnosis; tooth learning; fault code diagnosis test General Type Haval H3 Bosch V50engine system √ √ √ √ √ √ engine test,read frozen frame General Type Haval H3 Great Wall bosch-edc16 diesel engine - √ √ √ √ - engine test,matching function General Type Haval H3 Delphi MT20U engine - √ √ √ √ - system state General Type Haval H3 Liaoning Xinfeng electronic control system √ √ √ √ - √ read frozen frame General Type Haval H3 Bosch ABS system √ √ √ √ √ - exhaust mode General Type Haval H3 Jinzhou Jinheng safety airbag √ √ √ √ - - - General Type Haval H3 BOSCH safety airbag √ √ √ √ - - - General Type Haval H3 Continental safety airbag √ √ √ - - - - network configuration; function configuration; system General Type Haval H3 Tongzhi Body control module √ √ √ √ √ - configuration network configuration; function configuration; system General Type Haval H3 Delphi Body control module √ √ √ √ √ - configuration Read network configuration information; write network configuration General Type Haval H3 safety airbag(ABM) TRW safety -

2016 Real-World Passenger Vehicle Fuel Consumption Analysis

2016 Real-world Passenger Vehicle Fuel Consumption Analysis Innovation Center for Energy and Transportation September 2016 0 Acknowledgements We wish to thank the Energy Foundation for providing us with the financial support required for the execution of this report and subsequent research work. We would also like to express our sincere thanks for the valuable advice and recommendations provided by distinguished industry experts and colleagues. Authors Lanzhi Qin, Maya Ben Dror, Hongbo Sun, Liping Kang, Feng An Disclosure The report does not represent the views of its funders nor supporters. The Innovation Center for Energy and Transportation (iCET) Beijing Fortune Plaza Tower A Suite 27H No.7 DongSanHuan Middle Rd., Chaoyang District, Beijing 10020 Phone: 0086.10.6585.7324 Email: [email protected] Website: www.icet.org.cn 1 Glossary of Terms LDV Light Duty Vehicles; Vehicles of M1, M2 and N1 category not exceeding 3,500kg curb-weight. Category M1 Vehicles designed and constructed for the carriage of passengers comprising no more than eight seats in addition to the driver's seat. Category M2 Vehicles designed and constructed for the carriage of passengers, comprising more than eight seats in addition to the driver's seat, and having a maximum mass not exceeding 5 tons. Category N1 Vehicles designed and constructed for the carriage of goods and having a maximum mass not exceeding 3.5 tons Real-world FC FC values calculated based on BearOil App users’ data inputs. Certified FC Prior to sale in China (either domestic produced or imported cars), the vehicle is certified according to the “light duty vehicle FC testing method” standard (GB/T19233).