Charter Market Report 2018 SPECIAL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aircraft Noise and Operations Report 2014 Bi-Annual Summary January – June

Aircraft Noise and Operations Report 2014 Bi-Annual Summary January – June Cincinnati/Northern Kentucky International Airport AIRCRAFT NOISE AND OPERATIONS REPORT 2014 BI-ANNUAL SUMMARY JANUARY - JUNE Table of Contents and Summary of Reports Aircraft Noise Report Page 1 This report details the locations of all complaints for the reporting period. Comparisons include state, county and areas within each county. Quarterly & Annual Comparison of Complaints Page 2 This report shows the trends of total complaints comparing the previous five years by quarter to the current year. Complaints by Category Page 3 Complaints received for the reporting period are further detailed by fourteen types of complaints, concerns or questions. A complainant may have more than one complaint, concern or question per occurrence. Complaint Locations and Frequent Complainants Page 4 This report shows the locations of the complainants on a map and the number of complaints made by the most frequent/repeat complainants for the reporting period. Total Runway Usage - All Aircraft Page 5 This report graphically shows the total number and percentage of departures and arrivals on each runway for the reporting period. Nighttime Usage by Large Jets Page 6 This report graphically shows the total number and percentage of large jet departures and arrivals on each runway during the nighttime hours of 10:00 p.m. to 7:00 a.m. for the reporting period. Nighttime Usage by Small Jets and Props Page 7 This report graphically shows the total number and percentage of small jet and prop departures and arrivals on each runway during the nighttime hours of 10:00 p.m. -

Delta Air Lines Ecosystem Atlanta, GA 30320 Phone: (404) 715-2600 Delta.Com

Delta Air Lines 1030 Delta Blvd, Delta Air Lines Ecosystem Atlanta, GA 30320 Phone: (404) 715-2600 delta.com Outside Relationships Working Capital; Term Outside Relationships Loan Financing; Fuel, Delta Air Lines, Inc. (A Delaware Corporation) Regulators Capital Suppliers Customers Interest Rate and Securities Regulation Customers Suppliers Capital Regulators Foreign Currencies Debt Structure Equity Structure and Stock Exchange Hedging Programs US and Foreign Commercial Debt ($27.974 B @ 12/31/20) Credit Ratings: S&P – BB; Fitch – BB+; Moody’s – Baa3 Equity Listing Rules Securities Regulators Regulators Banks Secured by Slots, Secured by SkyMiles Assets Common Stock Unsecured 2022 – 2045 NYTDC Special Facilities 2021-2023 3.75% Revolving Secured by Aircraft Equity Capital Significant US Securities U.S. & Other Public Debt Bond Financing Gates and/or Routes 2023-2028 4.5% - 4.75% SkyMiles Notes $6.0B Authorized: 1,500,000,000 Shareholders 2021 – 2029 2.90% - 7.38% Revenue Bonds 4.00% - 5.00% $2.89B Credit Facility $2.65B (Undrawn) 2021-2032 0.81% - 5.75% Notes $1.28B Dividends and Exchange Environmental Holders Issued: 647,352,203 Unsecured Notes $5.35B 2030 1.00% Unsecured CARES Act 2021-2023 5.75% Term Loan 2025 7.00% Senior Secured (Currently Suspended) The Vanguard Commission Protection 2021-2028 2.00% - 8.02% Certificates $2.63B 2023-2027 4.75% SkyMiles Term Loan $3.0B Outstanding: 638,146,665 (SEC) JFK Airport Terminal #4 Payroll Support Program Loan $1.65B $1.49B Notes $3.5B Group Agencies (Air, New York Construction Financing (Financial Water, Soil, and Recordholders: 2,300 Professional Transportation (10.1%) Reporting, GHG Emissions Services Disclosure Development BlackRock Regulation and Governance Finance and Accounting Sales Marketing and Network and Revenue Firms Requirements; Permits) Corporation Communications Management Corporate Matters Fund Advisors Board of Directors Financial Planning Worldwide Customer King & Anti-Corruption U.S. -

(VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers February 1, 2020 In order to facilitate the arrival of Visa Waiver Program (VWP) passengers, carriers need to be signatory to a current agreement with U.S. Customs and Border Protection (CBP). A carrier is required to be signatory to an agreement in order to transport aliens seeking admission as nonimmigrant visitors under the VWP (Title 8, U.S.C. § 1187(a)(5). The carriers listed below are currently signatory to the VWP and can transport passengers under the program. The date indicates the expiration of the current signed agreement. Agreements are valid for 7 years. If you transport VWP passengers and are not a signatory carrier, fines will be levied. Use the following link to apply to CBP to become a Signatory Carrier: https://www.cbp.gov/travel/international-visitors/business-pleasure/vwp/signatory-status # 21st Century Fox America, Inc. (04/07/2022) 245 Pilot Services Company, Inc. (01/14/2022) 258131 Aviation LLC (09/18/2020) 4770RR, LLC (12/06/2023) 51 CL Corp. (06/23/2024) 51 LJ Corporation (02/01/2023) 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2024) 711 CODY, Inc. (02/09/2025) A A&M Global Solutions, Inc. (09/03/2021) A.J. Walter Aviation, Inc. (01/17/2021) A.R. Aviation, Corp. (12/30/2022) Abbott Laboratories Inc. (08/26/2026) AbbVie US LLC (10/15/2026) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2026) ABS Jets A.S. (05/07/2025) ACASS Canada Ltd. (02/27/2026) Accent Airways LLC (01/12/2022) Ace Flight Center Inc. -

Charter Report - 2019 Prospectuses

CHARTER REPORT - 2019 PROSPECTUSES Beginning Number of Type of Aircraft Charter Operator Carrier Origin Destination Date Ending Date Remarks/Indirect Carrier Flights & No. of Seats Embraer 135 19-001 Resort Air Services RVR Aviation (air taxi) DAL-89TE LAJ-DAL-89TE 2/22/2019 12/15/2019 94 w/30 sts New England Air Transport Inc. PILATUS PC-12 19-002 JetSmarter Inc. (air taxi) FLL MYN 2/8/2019 2/8/2019 1 w/6 guests Hawker 800 w/8 19-003 JetSmarter Inc. Jet-Air, LLC (air taxi) FLL HPN 3/3/2019 3/3/2019 1 guests Gulfstream G200 w/10 19-004 JetSmarter Inc. Chartright Air Inc. (air taxi) FLL YYZ 3/7/2019 3/7/2019 1 guests Domier 328 Jet Ultimate Jetcharters, LLC dba w/30sts/ Ultimate Jet Shuttle Public Ultimate JETCHARTERS, LLC Embraer 135 Jet 19-005 Charters Inc.(co-charterer) dba Ultimate Air Shuttle CLT PDK 2/25/2019 2/24/2020 401 w/30 sts Citation C J2 19-006 JetSmarter Inc. Flyexclusive, Inc. (air taxi) ORL TEB 3/30/2019 3/30/2019 1 w/6 guests Phenom 300 19-007 JetSmarter Inc. GrandView Aviation (air taxi) JAX MTN 3/24/2019 3/24/2019 1 w/7 guests Aviation Advantage/E-Vacations Corp Boeing 737-400 19-008 (co-charterer) Swift Air SJU-PUJ-POP-etc PUJ-SJU-CUN-etc 6/3/2019 8/3/2019 50 w/150 sts Boeing 737-400 19-009 PrimeSport Southwest Airlines BOS ATL 2/1/2019 2/4/2019 50 w/150 sts CHARTER REPORT - 2019 PROSPECTUSES Delux Public Charter, LLC EMB-135 w/30 19-010 JetBlue Airways Corporation dba JetSuite X (commuter) KBUR-KLAS-KCCR-etc KLAS-KBUR-KCCR-etc 4/1/2019 7/1/2019 34,220 sts Glulfstream IV- 19-011 MemberJets, LLC Prine Jet, LLC (air taxi) OPF-TEB-MDW--etc TEB-OPF-PBI-etc 2/14/2019 12/7/2019 62.5 SP w/10 sts Phenom 300 19-012 JetSmarter Inc. -

(VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers March 1, 2020 In order to facilitate the arrival of Visa Waiver Program (VWP) passengers, carriers need to be signatory to a current agreement with U.S. Customs and Border Protection (CBP). A carrier is required to be signatory to an agreement in order to transport aliens seeking admission as nonimmigrant visitors under the VWP (Title 8, U.S.C. § 1187(a)(5). The carriers listed below are currently signatory to the VWP and can transport passengers under the program. The date indicates the expiration of the current signed agreement. Agreements are valid for 7 years. If you transport VWP passengers and are not a signatory carrier, fines will be levied. Use the following link to apply to CBP to become a Signatory Carrier: https://www.cbp.gov/travel/international-visitors/business-pleasure/vwp/signatory-status # 21st Century Fox America, Inc. (04/07/2022) 245 Pilot Services Company, Inc. (01/14/2022) 258131 Aviation LLC (09/18/2020) 4770RR, LLC (12/06/2023) 51 CL Corp. (06/23/2024) 51 LJ Corporation (02/01/2023) 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2024) 711 CODY, Inc. (02/09/2025) A A&M Global Solutions, Inc. (09/03/2021) A.J. Walter Aviation, Inc. (01/17/2021) A.R. Aviation, Corp. (12/30/2022) Abbott Laboratories Inc. (08/26/2026) AbbVie US LLC (10/15/2026) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2026) ABS Jets A.S. (05/07/2025) ACASS Canada Ltd. (02/27/2026) Accent Airways LLC (01/12/2022) Ace Flight Center Inc. -

Permiso-Empresas 2007

CONCESIONES, PERMISOS O AUTORIZACIONES OTORGADOS POR LA SECRETARIA DE COMUNICACIONES Y TRANSPORTES Identificador de la Tipo Unidad Administrativa Nombre de la persona física, denominación o Objeto de la concesión, autorización Vigencia de la Procedimiento para su concesión, concesionaria, autorizada o razón social de la persona moral o permiso concesión, otorgamiento autorización o permiso permisionaria concesionaria, autorizada o permisionaria autorización o permiso 35710 PERMISO DIRECCIÓN GENERAL DE ABSA - AEROLINHAS BRASILEIRAS S.A. FLETAMENTO INTERNACIONAL INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL DE CARGA 28161 PERMISO DIRECCIÓN GENERAL DE ABX AIR INC./AIRBORNE EXPRESS INC. FLETAMENTO INTERNACIONAL INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL DE CARGA 24579 PERMISO DIRECCIÓN GENERAL DE ADMINISTRACIÓN AÉREA INTEGRAL S.A. FLETAMENTO NACIONAL DE INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL CARGA 24578 PERMISO DIRECCIÓN GENERAL DE ADMINISTRACIÓN AÉREA INTEGRAL S.A. FLETAMENTO NACIONAL DE INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL PASAJEROS 31979 PERMISO DIRECCIÓN GENERAL DE AERIS S.A. FLETAMENTO INTERNACIONAL INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL DE PASAJEROS 9858 PERMISO DIRECCIÓN GENERAL DE AERO CUAHONTE, S.A. DE C.V. FLETAMENTO NACIONAL DE INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL PASAJEROS 16572 PERMISO DIRECCIÓN GENERAL DE AERO JBR S.A. DE C.V. FLETAMENTO NACIONAL DE INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL CARGA 18088 PERMISO DIRECCIÓN GENERAL DE AERO JBR S.A. DE C.V. FLETAMENTO INTERNACIONAL INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL DE CARGA 26738 PERMISO DIRECCIÓN GENERAL DE AEROCARIBBEAN FLETAMENTO INTERNACIONAL INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL DE CARGA 26739 PERMISO DIRECCIÓN GENERAL DE AEROCARIBBEAN FLETAMENTO INTERNACIONAL INDEFINIDO A SOLICITUD DE PARTE AERONÁUTICA CIVIL DE PASAJEROS 32144 PERMISO DIRECCIÓN GENERAL DE AERODAN S.A. -

The Evolution of U.S. Commercial Domestic Aircraft Operations from 1991 to 2010

THE EVOLUTION OF U.S. COMMERCIAL DOMESTIC AIRCRAFT OPERATIONS FROM 1991 TO 2010 by MASSACHUSETTS INSTME OF TECHNOLOGY ALEXANDER ANDREW WULZ UL02 1 B.S., Aerospace Engineering University of Notre Dame (2008) Submitted to the Department of Aeronautics and Astronautics in PartialFulfillment of the Requirementsfor the Degree of MASTER OF SCIENCE at the MASSACHUSETTS INSTITUTE OF TECHNOLOGY June 2012 0 2012 Alexander Andrew Wulz. All rights reserved. .The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature of Author ..................................................................... .. ...................... Department of Aeronautr and Astronautics n n May 11, 2012 Certified by ............................................................................ Peter P. Belobaba Principle Research Scientist of Aeronautics and Astronautics / Thesis Supervisor A ccepted by ................................................................... Eytan H. Modiano Professor of Aeronautics and Astronautics Chair, Graduate Program Committee 1 PAGE INTENTIONALLY LEFT BLANK 2 THE EVOLUTION OF U.S. COMMERCIAL DOMESTIC AIRCRAFT OPERATIONS FROM 1991 TO 2010 by ALEXANDER ANDREW WULZ Submitted to the Department of Aeronautics and Astronautics on May 11, 2012 in PartialFulfillment of the Requirementsfor the Degree of MASTER OF SCIENCE IN AERONAUTICS AND ASTRONAUTICS ABSTRACT The main objective of this thesis is to explore the evolution of U.S. commercial domestic aircraft operations from 1991 to 2010 and describe the implications for future U.S. commercial domestic fleets. Using data collected from the U.S. Bureau of Transportation Statistics, we analyze 110 different aircraft types from 145 airlines operating U.S. commercial domestic service between 1991 and 2010. We classify the aircraft analyzed into four categories: turboprop, regional jet, narrow-body, and wide-body. -

Case 2:17-Bk-21386-SK Doc 574 Filed 01/22/18 Entered 01/22/18 20:44:04 Desc Main Document Page 1 of 69

Case 2:17-bk-21386-SK Doc 574 Filed 01/22/18 Entered 01/22/18 20:44:04 Desc Main Document Page 1 of 69 Attorney or Party Name, Address, Telephone & FAX Nos., State FOR COURT USE ONLY Bar No. & Email Address ROBBIN L. ITKIN (SBN 117105) [email protected] DLA PIPER LLP (US) 2000 Avenue of the Stars Suite 400 North Tower Los Angeles, California 90067-4704 Tel: (310) 595-3000 Fax: (310) 595-3300 JOHN K. LYONS (Pro Hac Vice) [email protected] KATIE ALLISON (Pro Hac Vice) [email protected] DLA PIPER LLP (US) 444 West Lake Street, Suite 900 Chicago, Illinois 60606-0089 Tel: (312) 368-4000 Fax: (312) 236-7516 Individual appearing without an attorney Attorneys for: Jonathan D. King as Chapter 7 Trustee UNITED STATES BANKRUPTCY COURT CENTRAL DISTRICT OF CALIFORNIA - LOS ANGELES DIVISION In re: Lead Case No.: 2:17-bk-21386-SK ZETTA JET USA, INC., a California corporation, CHAPTER: 7 Jointly Administered with ZETTA JET PTE, LTD., a Singaporean company, Case No.: 2:17-bk-21387-SK DECLARATION THAT NO PARTY REQUESTED A HEARING ON MOTION LBR 9013-1(o)(3) Debtors. [No Hearing Required] 1. I am the attorney for Movant(s). 2. On (date): December 20, 2017, Movant(s) filed a motion or application entitled: Notice of Motion and Chapter 7 Trustee's Omnibus Motion for Entry of an Order Authorizing the Rejection of Executory Contracts and Unexpired Leases Nunc Pro Tunc to November 30, 2017 [Docket No. 498] (the “Motion”). 3. A copy of the Motion and notice of motion is attached to this declaration. -

2020 Special Conference Program

The 31st Annual International Women in Aviation Conference Empowering women around the globe. United is proud to support Women in Aviation International. ©2020 United Airlines, Inc. All rights reserved. WELCOME TO WAI2020 WEDNESDAY, MARCH 4 Contents 7:45 a.m.-5 p.m. TOUR: Kennedy Space Center Tour Convention Center Porte Cochere Conference Schedule (ticket required, lunch not included) 23 Registration Open Sponsored by American Airlines 24 Seminars and Workshops 3-6 p.m. Veracruz C Yoga, Mindfulness, Zumba 6:30-7:30 p.m. WAI Chapter Reception Sponsored by Envoy Air Fiesta 6 24 (ticket required/by invitation only) 26 Education Sessions Friday, March 6 THURSDAY, MARCH 5 30 Education Sessions Saturday, March 7 Yoga Class 7-8 a.m. Fiesta 9 Conference Sponsors 8-11 a.m. WAI Chapter Leadership Workshop Sponsored by ConocoPhillips Durango 1 32 Registration Open Sponsored by American Airlines 32 Student Conference 8 a.m.-4:30 p.m. Veracruz C Sponsors 7:45-11:30 a.m. TOUR: Disney’s Business Behind the Magic Convention Center Porte Cochere (ticket required, lunch not included) 34 WAI Board 8:30-10:30 a.m. Professional Development Seminar Sponsored by XOJET Fiesta 5 34 New Members Connect Seen! Increasing Your Visibility and Influence (ticket required) 34 Meet and Greet With 9:15 a.m.-3:45 p.m. TOUR: Embraer Facility (ticket required, includes lunch) Convention Center Porte Cochere the WAI Board Minute Mentoring® Sponsored by Walmart Aviation 9-10:30 a.m. Coronado C 34 Annual Membership (preregistration required) Meeting and Board of 9-noon Aerospace Educators Workshop Sponsored by Walmart Aviation Coronado F Directors Elections (preregistration required) 36 WAI Corporate Members 10:15 a.m.-5:30 p.m. -

Delta Air Lines Announces June Quarter 2021 Financial Results

CONTACT: Investor Relations Corporate Communications 404-715-2170 404-715-2554 [email protected] [email protected] Delta Air Lines Announces June Quarter 2021 Financial Results June quarter 2021 GAAP pre-tax income of $776 million and earnings per share of $1.02 on total revenue of $7.1 billion June quarter 2021 adjusted pre-tax loss of $881 million and adjusted loss per share of $1.07 on adjusted operating revenue of $6.3 billion With an improving demand environment, achieved a solid pre-tax profit in the month of June and recently announced the opportunistic addition of seven A350s and 29 737-900ERs to our fleet ATLANTA, Jul. 14, 2021 – Delta Air Lines (NYSE:DAL) today reported financial results for the June quarter 2021 and provided its outlook for the September quarter 2021. Highlights of the June quarter 2021 results, including both GAAP and adjusted metrics, are on page six and are incorporated here. “With the best employees and operation in the industry and an accelerating demand environment, we achieved significant milestones in the quarter including a solid pre-tax profit in the month of June, positive free cash flow for the June quarter, and our people and our brand being recognized with the top spot in the J.D. Power 2021 Airline Study,” said Ed Bastian, Delta’s chief executive officer. “Looking forward, we are harnessing the power of our differentiated brand and resilient competitive advantages to drive towards sustainable profitability in the second half of 2021 and enable long-term value creation.” “Domestic leisure travel is fully recovered to 2019 levels and there are encouraging signs of improvement in business and international travel. -

January 2018 Monthly Data (Pdf)

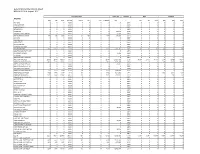

General Mitchell International Airport MONTHLY DATA: January 2018 PASSENGERS LNDG WT SHARE MAIL FREIGHT AIRLINES ENP DEP TOTAL MKT SHR LANDGS INT'L OLTS SCREENED LBS % ENP DEP TOTAL ENP DEP TOTAL ACP JETS - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AERO CHARTER - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AERODYNAMICS - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AEROMEXICO - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AERONAVES - - - 0.00% 1 - - - 15,550 0.00% 0 0 0 0 0 0 AIR BERLIN - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AIRCRAFT MGMT GROUP - - - 0.00% 1 - - - 15,700 0.00% 0 0 0 0 0 0 AIR GEORGIAN/CANADA 1,237 1,244 2,481 0.47% 49 2,481 - 1,237 2,303,000 0.59% 0 0 0 0 0 0 AIR INDIA - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AIR NUNAVUT - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AIR PARTNER - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AIRSTAR - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AIR TRANSPORT - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AITHERAS AVIATION - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 ALASKA AIRLINES 2,116 2,166 4,282 0.80% 31 - - 2,116 2,323,667 0.59% 2,849 604 3,453 17 1,141 1,158 ALBATROS AIRCRAFT CORP - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 ALGONQUIN AIRLINK - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 ALLEGIANT 5,491 5,420 10,911 2.05% 44 - - 5,491 6,167,877 1.57% 0 0 0 0 0 0 AMERICAN AIR CHARTERS - - - 0.00% - - - - 0 0.00% 0 0 0 0 0 0 AMERICAN AIRLINES 15,208 14,765 29,973 5.62% 135 - - 15,208 17,745,696 4.52% 31,059 44,571 75,630 2,669 4,369 7,038 AMERICAN EAGLE/AIR WIS 3,277 3,070 6,347 1.19% 92 - - 3,277 4,324,000 1.10% 0 0 0 124 951 1,075 AMERICAN EAGLE/ENVOY -

2017 Monthly Data.Xlsx

General Mitchell International Airport MONTHLY DATA: August 2017 PASSENGERS LNDG WT SHARE MAIL FREIGHT AIRLINES ENP DEP TOTAL MKT SHR LANDGS INT'L OLTS SCREENED LBS % ENP DEP TOTAL ENP DEP TOTAL ACP JETS 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AERO CHARTER 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AERODYNAMICS 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AEROMEXICO 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AIR BERLIN 0 0 00.00% 1 0 0 0 396,832 0.10% 0 0 0 0 0 0 AIRCRAFT MGMT GROUP 0 0 0 0.00% 2 0 0 0 31,400 0.01% 0 0 0 0 0 0 AIR GEORGIAN/CANADA 1970 2090 4,060 0.64% 53 4060 0 1970 2,491,000 0.61% 0 0 0 0 0 0 AIR INDIA 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AIR NUNAVUT 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AIR PARTNER 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AIR TRANSPORT 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AITHERAS AVIATION 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 ALASKA AIRLINES 3845 3857 7,702 1.22% 56 0 0 3845 4,197,592 1.03% 389 471 860 510 90 600 ALBATROS AIRCRAFT CORP 0 0 0 0.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 ALGONQUIN AIRLINK 0 0 0 0.00% 1 0 0 0 15,200 0.00% 0 0 0 0 0 0 ALLEGIANT 0 0 00.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AMERICAN AIR CHARTERS 0 0 0 0.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AMERICAN AIRLINES 20189 20144 40,333 6.41% 178 0 0 20189 23,265,700 5.72% 18,354 23,519 41,873 3,774 10,800 14,574 AMERICAN EAGLE/AIR WIS 7014 7161 14,175 2.25% 174 0 0 7014 8,178,000 2.01% 0 43 43 172 2,647 2,819 AMERICAN EAGLE/ENVOY 0 0 0 0.00% 1 0 0 0 43,651 0.01% 0 0 0 0 0 0 AMERICAN EAGLE/EXP JET 0 0 0 0.00% 0 0 0 0 0 0.00% 0 0 0 0 0 0 AMERICAN EAGLE/MESA 0 0 0 0.00%