Berman Capital Q2 Financial Reports

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

S://Rockco.Sharepoint.Com/Sites/Rockcocommunicationshttp S://Rockco.Sharepoint.Com/Sites/Rockcocommunications

2020 s://rockco.sharepoint.com/sites/RockcoCommunicationshttp s://rockco.sharepoint.com/sites/RockcoCommunications ROCKEFELLER PRIVATE WEALTH ADVISORY PLATFORM WRAP FEE BROCHURE ROCKEFELLER FINANCIAL LLC FORM ADV PART 2A Rockefeller Financial LLC 45 Rockefeller Plaza, Fifth Floor New York, NY 10111 212-549-5100 http://www.rockco.com As of April 28, 2021 This wrap fee brochure provides information about the qualifications and business practices of Rockefeller Financial LLC (“Rockefeller Financial” or the “Firm”), also doing business as Rockefeller Capital Management relating to the Rockefeller Private Wealth Advisory Platform (the “Platform”). If you have any questions about the contents of this brochure, please contact the Rockefeller Financial team at [email protected]. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission (“SEC”) or by any state securities authority. Registration with the SEC does not imply a certain level of skill or training. Additional information about Rockefeller Financial dba Rockefeller Capital Management is available at the SEC’s website at www.adviserinfo.sec.gov. registered broker-dealer and a member of the Financial Industry Item 2: Material Changes Regulatory Authority, Inc. (“FINRA”). This Item identifies and discusses material changes to the Platform Rockefeller Financial is an indirect, wholly-owned subsidiary of since the most recent annual Wrap Fee Brochure update (the Rockefeller Capital Management, L.P., a leading independent “Brochure”) on March 30, 2020. The Brochure contains material financial services firm offering global family office, wealth updates to Items 4, 6 and to reflect changes to certain offerings management, asset management and strategic advisory services provided to investors, including the following: to ultra-high and high net-worth individuals, families, institutions and corporations. -

Bloomberg Briefs: Hedge Funds

Tuesday March 7, 2017 March 7, 2017 Alaska's Wealth Fund Seeks 11 Funds for Investments Number of the Week By Hema Parmar Alaska’s $55.4 billion wealth fund is seeking up to 11 hedge funds for allocations, following its decision in May to redeem from its funds of hedge funds and invest in $1.06 Billion managers directly. The Alaska Permanent Fund Corp. prefers experienced managers that have a track Net inflows into macro hedge funds in record of producing returns of at least inflation plus 5 percent, according to public January, according to eVestment. documents from its quarterly board of trustees meeting. Alaska is seeking funds with low correlation to equity markets, "appropriate" risk controls as measured by historical drawdowns and volatility and that can show they have protected capital during down Inside markets, the documents from the Feb. 22-23 board meeting show. Equity-focused Viking Global saw a Marcus Frampton, Alaska’s director of private markets, declined to comment. slight loss in February, while Alaska currently has nine managers in its program that invests directly in hedge funds. Renaissance's equities fund gained It plans to invest a total 5 percent of the firm’s assets, or about $2.8 billion, in managers in the month: Returns in Brief via that program, the documents said. As of Dec. 31, Alaska had a 4.5 percent exposure to commingled funds, either directly Macro funds run by Prologue and or via the funds of hedge funds from which it is redeeming. The move to allocate to State Street are closing: Closures managers directly will save Alaska $15 million a year, according to the documents, as it allows the wealth fund to cut the layer of fees paid to funds of funds for making Ray Dalio jolts Bridgewater as Jon investments. -

Top 100 Hedge Funds

P2BW14403B-0-P01100-1--------XA P22 BARRON'S May24,2010 May24,2010 BARRON'S P11 BLACK Top 100 Hedge Funds The market’s horrors of 2008 gave way to the pleasures of 2009. John Paulson’s Paulson Credit Opportunities fund has gained a phenomenal 123% annually over the past three years. The worst-performing member of Barron’s Top 100 has returned roughly five times what the average hedge fund has risen. Currencies (USD, GBP and Euro) refer to specific currency classes of a fund. Fund 3-Year RANKING Assets Compound 2009 Total Firm 05/24/2010 2009 ’08 Name (mil) Fund Strategy Annual Return Return Company Name / Location Assets (mil) 1. nr Paulson Credit Opportunities a $4,000 Credit 122.92% 35.02% Paulson / New York $32,000 2. 2. Balestra Capital Partners 1,050 Global Macro 65.63 4.22 Balestra Capital / New York 1,225 3. nr Medallion 9,000 Quantitative Trading 62.80 38.00 Renaissance Tech / East Setauket, NY 15,000 4. 13. Element Capital 1,214 Macro/Relative Value 45.02 78.82 Element Capital / New York 1,214 IF THERE WERE EE,EU,MW,NL,SW,WE 5. nr Providence MBS Offshore 333 Mortgage-Backed Securities 44.29 85.67 Providence Investment Mgmt / Providence, RI 400 6. nr OEI Mac (USD) 355 Equity Long/Short 41.78 18.56 Odey Asset Mgmt / London 2,834 7. 1. Paulson Advantage b 4,750 Event Arbitrage 41.31 13.60 Paulson / New York 32,000 EVERATIMETOASK 8. nr SPM Structured Servicing 1,049 Mortgage-Backed Securities 39.80 134.60 Structured Portfolio Mgmt / Stamford, CT 2,725 9. -

Confidential Recommendation on Phase II of Hedge Fund Implementation Plan

Confidential Recommendation on Phase II of Hedge Fund Implementation Plan To: RISIC Prepared: October 17, 2011 From: Thomas Lynch, CFA, Managing Director The purpose of this memo is to provide RISIC with a summary of Cliffwater’s recommendation for Phase II of the Hedge Fund Implementation Plan. Cliffwater has presented to the RISIC an investment plan for hedge funds. The goal of the plan is to reduce volatility in the ERSRI portfolio (or the “Fund”) as well as individual long-only asset classes and to improve the Sharpe Ratio of the Fund. The overall investment plan calls for an allocation of 15% of the Fund to hedge funds. The hedge fund allocation will consist of three components, grouping hedge funds strategies by associated market beta. As shown in Table 1 below, 8% of the 15% hedge fund allocation will be made to equity related strategies (i.e. equity long/short and event driven strategies) and they will be allocated to the Fund’s global equity allocation. Similarly, 5% of the 15% hedge fund allocation will be made to absolute return strategies (i.e. global macro and multi-strategy) and they will be allocated to the Fund’s real return allocation; 2% of the 15% hedge fund allocation will be made to fixed income strategies (i.e. credit and relative value strategies) and they will be allocated to the Fund’s fixed income allocation. Table 1. Recommended Hedge Recommended RISIC Policy Fund Allocations Structure % Target $ Target % Target $ Target # Funds $/Fund Cash 3% $210 Fixed Income 20% $1,400 2% $140 3 $47 Real Estate 8% $560 Real Return 11% $770 5% $350 7 $50 Global Equity 51% $3,570 8% $560 10 $56 Private Equity 7% $490 100% $7,000 15% $1,050 20 $53 Recommendations on individual hedge funds will be subject to the following: 1. -

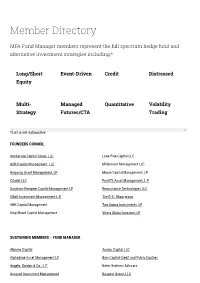

Member Directory

Member Directory MFA Fund Manager members represent the full spectrum hedge fund and alternative investment strategies including:* Long/Short Event-Driven Credit Distressed Equity Multi- Managed Quantitative Volatility Strategy Futures/CTA Trading *List is not exhaustive FOUNDERS COUNCIL Anchorage Capital Group, LLC Lone Pine Capital LLC AQR Capital Management, LLC Millennium Management LLC Balyasny Asset Management, LP Moore Capital Management, LP Citadel LLC Point72 Asset Management, L.P. Davidson Kempner Capital Management LP Renaissance Technologies LLC Elliott Investment Management L.P. The D. E. Shaw group HBK Capital Management Two Sigma Investments, LP King Street Capital Management Viking Global Investors LP SUSTAINING MEMBERS – FUND MANAGER Abrams Capital Axonic Capital LLC Alphadyne Asset Management LP Bain Capital Credit and Public Equities Angelo, Gordon & Co., L.P. Baker Brothers Advisors Assured Investment Management Baupost Group, LLC BlackRock Alternative Investors IONIC Capital Management LLC Bracebridge Capital, LLC Junto Capital Management LP Bridgewater Associates, LP. Kensico Capital Management Brigade Capital Management, LP Kepos Capital LP Cadian Capital Management Kingdon Capital Management, LLC Campbell & Company, LP Laurion Capital Management LP Capula Investment Management LLP Magnetar Capital LLC CarVal Investors Man Group Casdin Capital Marathon Asset Management, L.P. Castle Hook Partners LP Marshall Wace North America LP Centerbridge Partners, L.P. Melvin Capital CIFC Asset Management Meritage Group LP Coatue Management LLC Millburn Ridgeeld Corporation D1 Capital Partners MKP Capital Management Diameter Capital Partners LP Monarch Alternative Capital LP EJF Capital, LLC Napier Park Global Capital Element Capital Management LLC One William Street Capital Management LP Eminence Capital, LP P. Schoenfeld Asset Management LP Empyrean Capital Partners, LP Palestra Capital Management LLC Emso Asset Management Limited Paloma Partners Management Company ExodusPoint Capital Management, LP PAR Capital Management, Inc. -

36 Bloomberg Markets February 2015

36 BLOOMBERG MARKETS FEBRUARY 2015 FEBRUARY 2015 BLOOMBERG MARKETS 37 Mortgage funds did well in 2014 in part because fewer debtors missed payments on home loans—including the subprime borrowers whose debt hedge funds love. The collateral backing mortgage bonds performed well, and the owners of the bonds did, too. At the end of the third quarter, 18.75 percent of subprime home loans were delinquent, down from 27.2 Stamford, Connecticut–based Hildene Harvard University, the University of percent in March 2010, according to the Capital Management, vacuums up com- Pennsylvania’s Wharton School, the Uni- Mortgage Bankers Association. plex securities when others are shunning versity of Oxford, the University of Cali- Bonds backed by home loans have ral- them as toxic junk. fornia at Berkeley and the Massachusetts lied for five years, making analysts wonder So does Michael Craig-Scheckman’s Deer Institute of Technology. They trade ev- how long the good times will last. “Every- Park Road Corp. “We make money because erything—stocks, bonds, currencies, one thought mortgages were over,” says people on Wall Street make mistakes,” says commodities and insurance-linked secu- Chris Acito, chief executive officer of Gap- Craig-Scheckman, 62, whose firm is based rities such as catastrophe bonds, where stow Capital Partners in New York, which in Steamboat Springs, Colorado. their actuarial skills come in handy. Yet has $1.1 billion invested in hedge funds Six years after the 2008 debt crisis ex- it was fixed income that drove gains in that trade credit. Yet the party goes on. posed how clueless the smart people on 2014, a Quantedge Capital spokeswoman “If people haven’t defaulted on these yet, Wall Street can be, both men are profiting said in an e-mailed response to questions. -

Best 100 Hedge Funds - Barron's Page 1 of 2

Best 100 Hedge Funds - Barron's Page 1 of 2 BARRON'S News, Quotes, Companies, Videos SEARCH Log In Subscribe HOME MAGAZINE DAILY INVESTING IDEAS TOP ADVISORS MARKET DATA PAID ADVISOR DIRECTORY Best 100 Hedge Funds Our ranking of the top-performing funds Email Print 0 Comments Order Reprints May 17, 2014 BARRON'S TOP HEDGE FUNDS reflected a number of marketplace shifts last year. As we predicted in early 2013, investors in asset-backeds and mortgage-backeds have seen a slowing of returns over the past year, ending a remarkable run. Our 100 best funds, many of them equity-related, returned an annualized 17.01%, net of fees, over three years, beating the BarclayHedge Index Average by a comfortable 13 percentage points and the Standard & Poor's 500 by a point. Leading the way was Glenview Offshore Opportunity, up 32.61% per year over three years, and distressed investor Hildene Opportunities, up 30.64%. 2013 2012 Fund Name Fund Assets Fund Strategy 3yr Compound Annual Return 2013 Firm Name / Location Total Firm Assets Ranking Ranking (Ending Dec 2013) Return 175Glenview Offshore Opportunity 2,026 Opportunistic, Concentrated 32.61 101.74 Glenview Capital Mgmt / New York 7,706 Equity L/S 2 6 Hildene Opportunities Fund, LP 1,004 Distressed Securities 30.64 35.33 Hildene Capital Mgmt / Stamford, CT 1,809 3 3 Chenavari - Toro Capital IA Class A 383 Asset Backed Securities 29.96 32.93 Chenavari Investment Managers / 4,429 EUR London 454Children's Investment Fund Ltd 7,830 Equity / Activist 27.00 47.22 TCIF Mgmt / London 12,100 5 Tiger Global 6,000 Equity Long/Short 26.68 14.00 Tiger Global Mgmt. -

IN the COURT of CHANCERY of the STATE of DELAWARE BRIAN T. OLSON, ) ) Plaintiff, ) ) V. ) C.A. No. 1884-VCL ) O. ANDREAS HALVORS

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE BRIAN T. OLSON, ) ) Plaintiff, ) ) v. ) C.A. No. 1884-VCL ) O. ANDREAS HALVORSEN, DAVID C. ) OTT, VIKING GLOBAL INVESTORS LP, ) VIKING GLOBAL PARTNERS LLC, ) VIKING GLOBAL PERFORMANCE LLC, ) and VIKING GLOBAL FOUNDERS LLC, ) ) Defendants. ) ____________________________________) ) VIKING GLOBAL PERFORMANCE LLC, ) DANIEL CAHILL and THOMAS ) PURCELL, ) ) Defendant-Counterclaim ) Plaintiff and Third-Party ) Plaintiffs, ) ) v. ) ) BRIAN T. OLSON, ) ) Plaintiff-Counterclaim ) Defendant and Third- ) Party Defendant- ) Counterclaimant. ) MEMORANDUM OPINION AND ORDER Submitted: February 17, 2009 Decided: May 13, 2009 Collins J. Seitz, Jr., Esquire, Bradley R. Aronstam, Esquire, CONNOLLY BOVE LODGE & HUTZ, LLP, Wilmington, Delaware; R. Scott Garley, Esquire, Jeffrey L. Nagel, Esquire, Mark W. Stoutenberg, Esquire, GIBBONS P.C., New York, New York, Attorneys for Brian T. Olson. Martin P. Tully, Esquire, Jon E. Abramczyk, Esquire, MORRIS NICHOLS ARSHT & TUNNELL LLP, Wilmington, Delaware; Bruce Birenboim, Esquire, Susanna Buergel, Esquire, PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP, New York, New York, Attorneys for the Defendants and Counterclaim Plaintiffs. LAMB, Vice Chancellor. A founder of a successful hedge fund brings this action against his two co- founders and entities created to run the fund, claiming that they failed to pay him for his equity interest in the enterprise after he was let go. At trial, the co-founders proved that there was an oral agreement reached, before any operations began, that all earnings would be paid out annually, with no deferral of compensation, and that a departing member would receive only his accrued compensation and the balance of his capital account. Following trial, the court concludes that agreement was never superceded by any other agreement relating to deferred compensation or post-termination rights. -

Searching for Alpha, More Hedge Fund Managers Invest in Private Opportunities July 10, 2019

Peltz International White Paper Series: Searching for Alpha, More Hedge Fund Managers Invest in Private Opportunities July 10, 2019 © Copyright 2019. Peltz International. All Rights Reserved. 1 Table of Contents Page I. Introduction 3 II. Rationale Behind Hedge Fund Managers Investing In Private Opportunities 4 Investing at Different Stages III. Separate Funds vs Integrated Funds 6 IV. Not For Every Manager 7 V. Liquidity and Other Concerns 8 VI. Type Of Hedge Fund Managers Investing in Privates 10 Tiger Cubs Others VII. Outlook 21 VIII. Footnotes 22 IX. About Peltz International 24 IMPORTANT DISCLAIMER Any information or written materials provided to you by Peltz International Inc concerning a manager or a hedge fund is solely the responsibility of the manager and the fund. All information included in these materials has been provided by the participating managers. Peltz International Inc has merely compiled them in these materials for your convenience. The information and written materials contained in these materials have not been reviewed or approved by Peltz International Inc. The distribution by Peltz International Inc of these materials and the information contained therein is not and should not be constructed as an endorsement or recommendation by Peltz International Inc of any fund or manager or of any information provided by the fund or manager or advice given by Peltz International Inc about the merits of investing in the fund, of the legal regulatory, tax or financial consequences of doing so, or as an offer or solicitation to acquire or dispose of any interest in the fund. Peltz International Inc has not taken any steps to verify the adequacy or completeness of any such information contained in the Material. -

Finding Top Hedge Funds Fundana, a Swiss Fund of Funds, Uses LRSK to Help Identify New Managers Who Are Best Able to Respond to Changing Market Conditions

STRATEGIES PORTFOLIOS Finding Top Hedge Funds Fundana, a Swiss fund of funds, uses LRSK to help identify new managers who are best able to respond to changing market conditions. BY JON ASMUNDSSON FINDING THE NEXT JULIAN ROBERTSON IS three funds of funds, instead focuses on identify- no easy task. For one thing, there are very few of ing up-and-coming hedge-fund managers who them out there, says Dariush Aryeh, a founding share a skill with Robertson, the legendary inves- partner at Fundana SA. tor who ran Tiger Management LLC: the ability to So the Geneva-based firm, which advises clients curb losses in market downturns. That talent, on hedge funds and oversees about $900 million in Aryeh says, is the key to outperforming over time. If you look at successful hedge-fund managers, he says, they typically don’t make much more than others in rising markets. “It’s on the crash, on ev- ery correction, that they limit the loss,” he says. “We try to identify these people.” MANY NEW HEDGE FUNDS RACK UP IMPRES- sive returns for a couple of years, Aryeh says. Of- ten that’s because their strategy jibes with the prevailing market environment. “You can suc- ceed because you are a bull during a bull period,” he says. “You can succeed because you are short during a crash period,” he adds, referring to the practice of selling borrowed shares in the expec- tation that prices will drop. It often takes a change in market conditions to differentiate the skilled from the merely lucky, he says. -

World's Richest Hedge Funds

DAVOS: LOVE, BETRAYAL SWISS BANK THE SEARCH AND INSIDER GIANTS FALL FOR GROWTH TRADING TO EArth FEBRUARY 2013 Bloomberg Markets Bloomberg WINNING STRATEGIES BEST RETURNS THE WORLD’S 100 RICHEST HEDGE FUNDS FEBRUARYHEDGE RICHEST 100 2013 WORLD’S THE THE STEVE COHEN’S SAC RAKES IN PROFITS WORLD’S BLUEMOUNTAIN HARPOONS THE BLOOMBERGMARKETS.COM RICHEST LONDON WHALE METACAPITAL SCORES HEDGE WITH MORTGAGES FUNDS 02_COVER [PT].indd 4 12/20/12 3:46 PM 20 BLOOMBERG MARKETS February 2013 Pine River has three funds in the top 20. Portfolio manager Aaron Yeary runs the No. 19 fund. Fannie Mae and Freddie Mac have a friend on West 57th Street. That’s the New York address of Metacapital Man- agement LP, the hedge fund founded by Deepak Narula. The much-maligned mortgage aggre- gators were taken over by the federal government in 2008 and have since absorbed $140 billion in taxpayer bailout money. The head of the House Financial Services Committee wants to abolish them. Yet they still own or guarantee more than half of all U.S. housing loans—and for that reason, the administration of President Barack Obama isn’t about to let them go belly up. Narula, 50, has used Fannie and fund started trading in July 2008. first 10 months of 2012 was Steve Co- Freddie to build the world’s most-suc- Three of the top five funds in the hen’s SAC Capital International, cessful hedge fund. His Metacapital BLOOMBERG MARKETS list invested in which earned $789.5 million for its Mortgage Opportunities Fund, which mortgage securities, and two of them managers. -

Norwegian Hedge Fund Billionaire Halvorsen Remains Committed to FANG Stocks

Norwegian Hedge Fund Billionaire Halvorsen Remains Committed to FANG stocks Stockholm (HedgeNordic) – Ole Andreas Halvorsen (pictured) is the CEO of and co-founder of Viking Global Investors, a hedge fund management firm based in Connecticut US. The firm is managing the Viking Global Fund which oversees 16.3 billion USD in assets under management. According to wealth-x, a website tracking wealthy individuals, 57-year old Halvorsen, who rarely speeks to media, has throughout his hedge fund career built a personal fortune of 3.3 billion USD, hence likely to be the most successful Nordic hedge fund manager of all times, at least in terms of building his private wealth. From Norway to Wall Street Halvorsen was born in Norway where he attended the Norwegian Naval Academy, after which he attended Williams College and Stanford Business School. One of his professors at Stanford described him as one of his “brightest students ever”. His investment career began at Morgan Stanley where he worked on Mergers and Acquisitions. In 1992, he joined Julian Robertsson´s renowned hedge fund, Tiger Management Corporation. In 1999, Halvorsen alongside two other fund managers at Tiger Management, David Ott and Brian Olson, left to start Viking Global Investors. Viking manages long/short global equity funds, a long only fund and a fund that invests in illiquid stocks and private companies. Total assets under management for Viking Global Investors amounted to 24 billion USD as of 2017. Bottom-up stock picking Andreas Halvorsen has a bottom-up stock picking approach when selecting companies to invest in. He looks for catalysts and fundamental factors and encourages his analysts to become industry specialists and to get to understand the companies they cover intimately.