Peru Food Service

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Peru Handbook Global Health Fellowship Program Updated 3/3/2015

Peru Handbook Global Health Fellowship Program Updated 3/3/2015 11 Table of Contents NPGH CONSORTIUM IN PERU .................................................................................................3 Consortium Universities .....................................................................................................3 Partner Institutions ............................................................................................................3 Country Overview ................................................................................................................. 7 Health Statistics .................................................................................................................7 Health & Healthcare ...........................................................................................................7 PREPARING FOR YOUR TRIP ...................................................................................................9 Financial ............................................................................................................................9 Entry/Exit Requirements ....................................................................................................9 Passport & Visa ....................................................................................................................... 9 Vaccines .................................................................................................................................. 9 Other Documentation ............................................................................................................ -

Marriott Distribution Services Awarded Darden Restaurants Contract

MARRIOTT DISTRIBUTION SERVICES AWARDED DARDEN RESTAURANTS CONTRACT MARRIOTT DISTRIBUTION SERVICES AWARDED DARDEN RESTAURANTS CONTRACT WASHINGTON - Jan. 18, 2000 - Marriott Distribution Services (MDS), a division of Marriott International, Inc. (MAR / NYSE), today announced that it has been awarded a food services distribution contract for Darden Restaurants, Inc., and will provide food service distribution to Olive Garden and Red Lobster restaurants in 25 states. "We are very pleased to be named a food service distributor for Darden Restaurants' Olive Garden and Red Lobster restaurants," said Robert Pras, president of Marriott Distribution Services. "We look forward to working with both restaurant operations to ensure a smooth transition, and to provide quality products and services to their restaurants." Marriott Distribution Services, based in Washington, D.C., is one of the largest limited-line distributors in the United States. It provides food and related supplies to both external customers and Marriott facilities, and carries an average of 3,000 product items at each of its 13 distribution centers. MDS currently operates distribution centers in Los Alamitos and Milpitas, Calif.; Denver, Colo.; Groveland and Port St. Lucie, Fla.; Hanover Park, Ill.; Savage, Md.; Warren, Mich.; Westborough, Mass.; Edison, N.J.; Salem, Ore.; Fort Mill, S.C.; and Fort Worth, Texas. Darden Restaurants, Inc., based in Orlando, Fla., is the largest casual dining restaurant company in the world. It operates more than 1,120 Red Lobster, Olive Garden, Bahama Breeze and Smokey Bones restaurants in 49 states and Canada, and employs over 115,000 people. ------------------------- MARRIOTT INTERNATIONAL, INC. is a leading worldwide hospitality company with over 1,900 operating units in the United States and 56 other countries and territories. -

International Business Guide to Peru Mark Kingsmore

University of South Carolina Scholar Commons Senior Theses Honors College 5-5-2017 International Business Guide to Peru Mark Kingsmore Follow this and additional works at: https://scholarcommons.sc.edu/senior_theses Part of the International Business Commons Recommended Citation Kingsmore, Mark, "International Business Guide to Peru" (2017). Senior Theses. 180. https://scholarcommons.sc.edu/senior_theses/180 This Thesis is brought to you by the Honors College at Scholar Commons. It has been accepted for inclusion in Senior Theses by an authorized administrator of Scholar Commons. For more information, please contact [email protected]. University of South Carolina International Business Guide to Peru SCHC Senior Thesis Mark Kingsmore 5-2-2017 Table of Contents About the Author…………………………………………………………………..…3 Introduction……………………………………………………………………………..4 Being a Student in Lima……………………………………………….……………5 Pontificia Universidad Católica del Peru……………………...……5 Semester Calendar……………………………………………………………6 Compañero PUCP……………………………………………………..………8 Campus Area – Safety and Dining…………………………..…………8 Transportation to Campus……………………………………..…………9 Class Registration and Information…………………………………11 Extracurricular Activities…………………………………………………14 Living in Lima………………………………………………………………….………15 Host Family vs. Apartment……..….………………………..…………15 Neighborhoods of Lima………………………………………..…………17 Money, Money, Money………………………………………….………19 Cell Phone………………………………………………………………………20 WhatsApp………………………………………………………………………21 Food……………………………………………………………………….………21 Attractions……………………………………………………..………………23 -

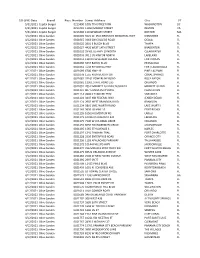

Rollout Schedule

GO-LIVE Date Brand Rest. Number Street Address City ST 5/31/2021 Capital Burger 0213400 1005 7TH STREET NW WASHINGTON DC 5/31/2021 Capital Burger 0213401 11853 MARKET STREET RESTON VA 5/31/2021 Capital Burger 0213402 159 NEWBURY STREET BOSTON MA 4/12/2021 Olive Garden 0021005 5021 W. IRLO BRONSON MEMORIAL HWY KISSIMMEE FL 4/12/2021 Olive Garden 0021015 3363 SW COLLEGE ROAD OCALA FL 4/12/2021 Olive Garden 0021025 2801 E BUSCH BLVD TAMPA FL 4/12/2021 Olive Garden 0021027 4420 WEST 14TH STREET BRADENTON FL 4/12/2021 Olive Garden 0021032 29461 US HWY 19 NORTH CLEARWATER FL 4/12/2021 Olive Garden 0021033 3911 US HWY 98 NORTH LAKELAND FL 4/12/2021 Olive Garden 0021051 12870 CLEVELAND AVENUE FORT MYERS FL 4/12/2021 Olive Garden 0021060 5037 BAYOU BLVD PENSACOLA FL 4/12/2021 Olive Garden 0021061 5550 N FEDERAL HWY FORT LAUDERDALE FL 4/12/2021 Olive Garden 0021069 6700 HWY 19 PINELLAS PARK FL 4/12/2021 Olive Garden 0021078 1555 N UNIVERSITY DR CORAL SPRINGS FL 4/12/2021 Olive Garden 0021081 22161 POWERLINE ROAD BOCA RATON FL 4/12/2021 Olive Garden 0021082 12361 STATE ROAD 535 ORLANDO FL 4/12/2021 Olive Garden 0021091 205 E MERRITT ISLAND CAUSEWAY MERRITT ISLAND FL 4/12/2021 Olive Garden 0021107 807 S UNIVERSITY DRIVE PLANTATION FL 4/12/2021 Olive Garden 0021114 4900 S TAMIAMI TRAIL SARASOTA FL 4/12/2021 Olive Garden 0021122 3447 NW FEDERAL WAY JENSEN BEACH FL 4/12/2021 Olive Garden 0021124 2602 WEST BRANDON BLVD BRANDON FL 4/12/2021 Olive Garden 0021134 5801 LAKE WORTH ROAD LAKE WORTH FL 4/12/2021 Olive Garden 0021149 9690 US HWY 19 PORT RICHEY -

Plan De Implementacion Para Una Franquicia De Comida Rapida En La Selva Peruana: Pucallpa, Una Ciudad Con Perspectivas

Plan de implementación para una franquicia de comida rápida en la Selva Peruana Pucallpa, una ciudad con perspectivas Item Type info:eu-repo/semantics/masterThesis Authors Basto Muñoz, Rosa Liliana DOI 10.13140/RG.2.1.2249.3520 Publisher Universidad Peruana de Ciencias Aplicadas (UPC) Rights info:eu-repo/semantics/openAccess Download date 28/09/2021 15:09:54 Link to Item http://hdl.handle.net/10757/324359 UNIVERSIDAD PERUANA DE CIENCIAS APLICADAS ESCUELA DE POSTGRADO MAESTRÍA EN ADMINISTRACIÓN DE EMPRESAS PLAN DE IMPLEMENTACION PARA UNA FRANQUICIA DE COMIDA RAPIDA EN LA SELVA PERUANA: PUCALLPA, UNA CIUDAD CON PERSPECTIVAS TESIS PRESENTADA POR ROSA LILIANA BASTO MUÑOZ PARA OPTAR EL GRADO ACADÉMICO DE MAGÍSTER EN ADMINISTRACIÓN DE EMPRESAS Lima, noviembre de 2012 DEDICATORIA A Dios, que por su gracia, me ha permitido llegar hasta aquí; y por su gracia, seguirá iluminando mi camino, A mi padre, Alfredo Walter Land, aunque no se encuentra físicamente a mi lado, llevo todas sus enseñanzas en el corazón, A mi madre querida, Eliana, por su amor incondicional, A mis hermanos, Alfredo y José, para que siembren en buena tierra, A todos aquellos, que buscan el desarrollo de los pueblos y que con esta humilde iniciativa, sumen las posibilidades que cualquier ciudadano nacional o extranjero considere como proyecto de inversión. AGRADECIMIENTOS A Dios por su bondad conmigo y con los míos. A mis padres, Eliana y Alfredo Walter Land, quienes supieron sembrar en mí, los valores que hoy conducen mi vida, les agradezco y agradeceré infinitamente. A mis hermanos, Alfredo y José, quienes le ponen la chispa a mis días. -

FACULTAD DE ADMINISTRACION HOTELERA, TURISMO Y GASTRONOMIA Administración Hotelera

FACULTAD DE ADMINISTRACION HOTELERA, TURISMO Y GASTRONOMIA Administración Hotelera “ALLPAPI” Trabajo de Investigación para optar el Grado Académico de Bachiller en Administración Hotelera EDDER ENRIQUE GUILLEN PAREDES Lima – Perú 2017 1 ÍNDICE RESUMEN EJECUTIVO .................................................................................................................... 7 I. INFORMACIÓN GENERAL ....................................................................................................... 7 II. ESTUDIO DE MERCADO .......................................................................................................... 8 III. INFORMACIÓN FINANCIERA ............................................................................................ 10 Capítulo II Información general .................................................................................................... 13 2.1 Datos de la empresa ................................................................................................................ 13 2.1.1. Razón Social .......................................................................................................................... 13 2.1.2. Nombre comercial ................................................................................................................ 13 2.1.3. Accionistas y Equipo ........................................................................................................... 13 2.1.4. Horizonte de Evaluación. ................................................................................................... -

Plan De Investigación

LIZ KAREM ROSALES TORRES BACHILLER EN CIENCIAS ECONÓMICAS ____________________________________________ “LA ROTACION DE PERSONAL Y SU IMPACTO EN EL SERVICIO DE ATENCION AL CLIENTE EN LA EMPRESA BEMBOS TRUJILLO 2011” TESIS PARA OPTAR EL TÍTULO DE: LICENCIADO EN ADMINISTRACIÓN ASESOR: Dr. FRANCISCO ROEDER ROSALES _______________________________________________________ UNIVERSIDAD NACIONAL DE TRUJILLO FACULTAD DE CIENCIAS ECONÓMICAS ESCUELA ACADÉMICO PROFESIONAL DE ADMINISTRACIÓN TRUJILLO – PERÚ 2012 DEDICATORIA A Dios por regalarme la vida, guiar mis pasos, brindarme su fortaleza y no dejarme caer en los momentos más difíciles de mi vida. A mis padres, Wide y Victoria por su interminable apoyo en todo momento de mi vida, por sus enseñanzas, consejos y por su eterna paciencia. i AGRADECIMIENTOS A Dios por permitirme llegar a este momento tan especial en mi vida. Por los triunfos y los momentos difíciles que me han enseñado que contigo todo es posible. A mis padres, por el apoyo recibido en mi formación profesional y por cada momento que me brindaron para seguir adelante y hacer posible este momento. A los docentes que me han acompañado durante el largo camino, brindándome siempre su orientación con profesionalismo ético en la adquisición de conocimientos y afianzando mi formación. Un agradecimiento especial al Dr. Francisco Roeder Rosales, por su tiempo y por su orientación brindada para el desarrollo de la presente investigación. ii RESUMEN El presente trabajo tiene como problema de investigación ¿Cómo la rotación de personal, impacta en el servicio de atención al cliente, en la empresa Bembos Trujillo? Teniendo como hipótesis que; La permanente rotación de personal, impacta de manera deficiente en el servicio de atención al cliente, en la empresa Bembos Trujillo. -

View Annual Report

OUR RESTAURANTS Where people of all ages gather to enjoy the abundance of great Italian food and wine and are treated like family. $3.8 billion in sales 843 units 1000 Darden Center Drive REPORT 2016 ANNUAL Orlando, FL 32837 The place for people who crave a 407-245-4000 flavorful, boldly seasoned steak in a down-to-earth setting that feels like www.darden.com a rancher’s home. $1.6 billion in sales OUR 481 units The restaurant of choice for COMMITMENT conscientious adults celebrating DARDEN REST DARDEN the goodness of life without TO YOU compromise. $254 million in sales 40 units 2016 ANNUAL REPORT AURANTS, INC. AURANTS, The destination to disconnect, lighten up and have fun. $218 million in sales 37 units The modern American gathering place where beer and food lovers unite. $507 million in sales 65 units The ultimate relationship brand, offering a welcoming and club-like dining experience. $408 million in sales 54 units The destination for a glamorous ® night out. $106 million in sales 16 units 137248_DardenAR_CVR.r2.indd 1 8/4/16 12:37 PM OUR RESTAURANTS Where people of all ages gather to enjoy the abundance of great Italian food and wine and are treated like family. $3.8 billion in sales 843 units 1000 Darden Center Drive REPORT 2016 ANNUAL Orlando, FL 32837 The place for people who crave a 407-245-4000 flavorful, boldly seasoned steak in a down-to-earth setting that feels like www.darden.com a rancher’s home. $1.6 billion in sales 481 units OUR The restaurant of choice for COMMITMENT conscientious adults celebrating DARDEN RES DARDEN the goodness of life without TO YOU compromise. -

Darden Restaurants, Inc

Darden Restaurants, Inc. (NYS:DRI) By Brittany A. Vicari www.darden.com, (DRI) “Darden is a premier full-service restaurant company featuring a portfolio of category-leading brands that include Olive Garden, LongHorn Steakhouse, Bahama Breeze, Seasons 52, The Capital Grille, Eddie V’s and Yard House.” Table of Contents Executive Summary ................................................................................................................................................................. 3 General Company Information ............................................................................................................................................... 4 Vision Statement ..................................................................................................................................................................... 4 Mission Statement .................................................................................................................................................................. 4 Exhibit 1: Organizational Chart ............................................................................................................................................... 6 Exhibit 2: EFE Matrix ............................................................................................................................................................... 8 Exhibit 3: IFE Matrix ............................................................................................................................................................. -

TRAB.SUF.PROF.MARGARITA ROSA MARCALAYA ARAUJO.Pdf

UNIVERSIDAD INCA GARCILASO DE LA VEGA FACULTAD DE PSICOLOGÍA Y TRABAJO SOCIAL Trabajo de Suficiencia Profesional Accidentes de tránsito en el servicio Delivery de la cadena de restaurante Bembos Sede Lima - periodo 2017 Para optar el Título Profesional de Licenciada en Trabajo Social Presentado por: Autor : Bachiller Margarita Rosa Marcalaya Araujo Lima – Perú 2017 Accidentes de tránsito en el servicio Delivery de la cadena de restaurante bembos sede lima -periodo 2017 ii DEDICATORIA El presente proyecto está dirigido a Dios, ya que gracias a él he logrado concluir mi trabajo de Investigación. A mi padre Armando Marcalaya R. y Doris Araujo G. ya que ellos confiaron en y a mis hermanos Nilda Marcalaya A. y Jorge Marcalaya A. por brindarme su apoyo incondicional. A mi esposo Luis Fernando Nolasco P. por su apoyo incondicional y tiempo dedicado para poder realizarme profesionalmente y sus palabras de aliento. iii AGRADECIMIENTO A todas aquellas personas que de una u otra manera me apoyaron en la culminación de la presente investigación. A mis profesores, por inculcarme sus conocimientos para poder realizarme como profesional en Trabajo Social. iv ÍNDICE DEDICATORIA .............................................................................................................. iii AGRADECIMIENTO ..................................................................................................... iv A todas aquellas personas que de una u otra manera me apoyaron en la culminación de la presente investigación. .................................................................................................... -

Índice Página (S) Inroducción 6

Índice Página (s) Inroducción 6 - 7 Capítulo 1 El Mercado de la comida rápida 1.1 Origen 8 - 9 1.2 Características 10 - 11 1.3 Línea de productos 11 - 13 1.4 El mercado latinoamericano 12 - 14 Capítulo 2 El consumidor 2.1 El consumidor con identidad 14 - 15 2.2 Consumidor del siglo XXI 15 - 16 2.3 Las tendencias de consumo globales 16 - 17 2.4 Las tendencias de consumo latinoamericanas 17 - 20 2.4.1 El consumidor argentino 20 - 21 2.4.2 El consumidor peruano 21 - 23 2.4.3 El Consumidor argentino vs. el consumidor peruano 23 - 24 1 Capitulo 3 La marca 3.1 Definición y evolución de la marca 25 3.2 La creación de la imagen de marca 25 - 28 3.3 Anatomía de la identidad 28 - 30 3.4 La identidad de la marca 30 - 32 3.5 El awareness de marca 32 - 33 3.6 Las marcas y los medios de comunicación 33 - 34 Capitulo 4 El branding 4.1 El branding 35 - 36 4.2 El poder de las marcas 36 - 37 4.3 Brand equity es igual al valor de marcas 37 - 38 4.4 Brand awareness 38 4.5 Valor agregado del branding 39 4.6 Distribución del branding 39 - 40 4.7 La web y el branding 40 - 41 Capitulo 5 El desembarco 5.1 ¿Qué es un desembarco? 42 5.2 Bembos desembarca en 43 5.2.1 Bembos India 43 - 44 5.2.2 Bembos Guatemala 44 2 5.3 Desembarco de Osaka, Ceviche y El Chalaco 44 5.3.1 Restaurante Osaka 45 5.3.2 Restaurante Ceviche 45 5.3.3 Restaurante El Chalaco sandwiches & jugos peruanos 45 - 46 Capitulo 6 La franquicia 6.1 ¿Qué es una franquicia? 47 6.2 Elementos clave de las franquicias 47 6.2.1 Franquiciador 48 6.2.2 Franquiciado 48 6.2.3 Marca comercial 48 6.2.4 Imagen 49 -

Olive Garden Alcoa, Tennessee

Olive Garden Alcoa, Tennessee Absolute NNN Corporate Lease with 10+ Years Remaining $2,377,069 Actual Location Investment Highlights •Original 15 year lease with 10+ years remaining •Strong store sales, very low rent to sales ratio •Absolute NNN lease – no landlord responsibilities •Corporate lease - tenant is GMRI, Inc., wholly owned by Darden Restaurants, Inc. with BBB credit rating (S&P) •Stable rent growth with annual 1.0% rent increases Jared Meyers •Frontage on Highway 115 with AADT of 37,899 Sage Capital Partners •Busy shopping center surrounded by national tenants and big box o: 801-438-0018 retailers, including: Walmart, Lowe’s, Dick’s Sporting Goods, Petsmart, c: 801-787-3981 Michaels, Ross, Old Navy, Aldi, Office Depot, Dollar Tree, Shoe [email protected] Carnival, and more Adam Slutzky •72,955 residents and $69,791 ave household income within 5 miles License: TN 301797 •Positive population and income growth trends Sage Capital Partners | 2265 East Murray Holladay Road | Salt Lake City, Utah This information has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to the accuracy of the information. References to square footage or age are approximate. It is the Buyer’s responsibility to verify the information and the Buyer will bear all risks of any inaccuracies. This offering is subject to change of conditions or terms, prior sale or withdrawal from the market without notice. Property Photos - Strong Store Sales Jared Meyers 801-438-0018 [email protected] Investment Summary Property Address: 244 Hamilton Crossing Drive, Alcoa, Tennessee Price: $2,377,069 Cap Rate: 5.00% Land Size: 2.10 Acres Building Size: 7,561 Square Feet Year Built: 2009 Lease Term: 15 Years (10+ Years Remaining) Primary Lease Start and End Dates: July 1, 2015 – June 30, 2030 Current Rent: $118,853.47 (July 2020) Lease Type: Absolute NNN – No Landlord Responsibilities Rent Increases: 1.0% Annually Lease Options: Five 5 Year Option Periods Lease Guarantor: GMRI, Inc., wholly owned by Darden Restaurants, Inc.