Canadian Business Expansion to the U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TN Professionals from Canada and Mexico

5000 Forbes Ave, Posner Hall 1st Floor, Pittsburgh, PA 15213 Phone: (412) 268-5231 ▪ Email: [email protected] ▪ Web: www.cmu.edu/oie TN Professionals from Canada and Mexico I. Explanation and terms The TN (Trade NAFTA) category resulted from the North American Free Trade Agreement (NAFTA) to facilitate the entry of Canadian and Mexican citizens to work in the US in certain professions on a temporary basis. For a list of the TN occupations, visit: https://travel.state.gov/content/travel/en/us-visas/employment/visas-canadian-mexican-nafta-professional- workers.html II. Conditions and limitations An advantage of TN status is that there is no upper limit on the length of time that an individual may remain working in TN status, and as of January 1, 2004, there is no numerical limit on the number of new Canadian or Mexican TN applications. For Canadians, TN status is quick to obtain at the border or port of entry. Disadvantages of the TN include (1) it is only valid for a limited number of occupations, (2) TN status is only available to citizens of Canada or Mexico, and (3) since it is meant to be temporary, tenure-track or tenured professors may have difficulty in obtaining TN status. Canadians do not require a visa stamp, but must renew every three years. For Mexicans, a TN worker must have a TN visa from a US consulate to enter the US. TN’s are admitted to the US for three year increments, and must renew every three years. TN status is “employer specific.” A person in TN status who wants to change employers must make a new application – at the border or via the US Immigration and Citizenship Services (USCIS) for Mexicans – before starting new employment in order to obtain a new, properly notated I-94 card. -

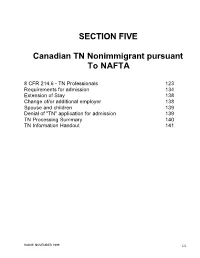

SECTION FIVE Canadian TN Nonimmigrant Pursuant to NAFTA

SECTION FIVE Canadian TN Nonimmigrant pursuant To NAFTA 8 CFR 214.6 - TN Professionals 123 Requirements for admission 134 Extension of Stay 138 Change of/or additional employer 138 Spouse and children 139 Denial of "TN" application for admission 139 TN Processing Summary 140 TN Information Handout 141 HQINS: NOVEMBER 1999 122 8 CFR Sec. 214.6 Canadian and Mexican citizens seeking temporary entry to engage in business activities at a professional level. (Sec. 214.6 revised 1/1/94; 58 FR 69212) (a) General. Under Section 214(e) of the Act, a citizen of Canada or Mexico who seeks temporary entry as a business person to engage in business activities at a professional level may be admitted to the United States in accordance with the North American Free Trade Agreement (NAFTA). (b) Definitions. As used in this section, the terms: Business activities at a professional level means those undertakings which require that, for successful completion, the individual has a least a baccalaureate degree or appropriate credentials demonstrating status as a professional in a profession set forth in Appendix 1603.D.1 of the NAFTA. Business person, as defined in the NAFTA, means a citizen of Canada or Mexico who is engaged in the trade of goods, the provision of services, or the conduct of investment activities. Engage in business activities at a professional level means the performance of prearranged business activities for a United States entity, including an individual. It does not authorize the establishment of a business or practice in the United States in which the professional will be, in substance, self-employed. -

Temporary Foreign Workers by the Numbers New Estimates by Visa Classification

Temporary foreign workers by the numbers New estimates by visa classification Report • By Daniel Costa and Jennifer Rosenbaum • March 7, 2017 Summary: Basic information published by the U.S. government shows that hundreds of thousands of new nonimmigrant visas authorizing employment are issued each year; it also shows the average aggregate size of the population of persons who hold nonimmigrant visas in the United States. However, the U.S. government does not have an adequate, reliable estimate for the total number of temporary foreign workers who are authorized to be employed in the U.S. labor market in the main nonimmigrant visa classifications that authorize employment. This report seeks to add to the limited existing literature on the size and makeup of temporary foreign worker programs in the United States by reviewing and assessing the available data in the main nonimmigrant visa classifications that authorize employment. It estimates that 1.42 million temporary foreign workers were employed in the United States with nonimmigrant visas in fiscal 2013. This number is approximately equal to 1 percent of the U.S. labor force. • Washington, DC View this report at epi.org/120773 SECTIONS Executive Summary 1. Executive Summary • 1 2. Introduction: Many Americans are aware of the often-cited estimate that Nonimmigrant visas approximately 11 million unauthorized immigrants reside in and temporary foreign the United States. However, the U.S. government does not workers • 3 have an adequate, reliable estimate for the total number of 3. Nonimmigrant visa temporary foreign workers who are authorized to be classifications employed in the U.S. -

Immigration Spotlight October 30, 2012 | Issue 126

IMMIGRATION SPOTLIGHT OCTOBER 30, 2012 | ISSUE 126 INSIDE SPOTLIGHT USCIS NEWS U.S. CITIZENSHIP AND IMMIGRATION SERVICES NEW OPTION FOR FILING TN New option for filing TN .................................................. 126.1 On October 1, 2012, USCIS began accepting Form I-129 on be- half of Canadian citizens who are outside the U.S. and seeking DEPARTMENT OF STATE TN (Treaty National) classification. Prior to this change, USCIS Visa Reissuance Program (VRP) ...................................... 126.2 would only accept Form I-129 for a petition to extend TN status November Visa Bulletin ................................................... 126.2 or change to TN status for individuals who are already in the United States. DEPARTMENT OF HOMELAND SECURITY The TN classification was created pursuant to the North Ameri- Taiwan added to Visa Waiver Program .......................... 126.3 can Free Trade Agreement (NAFTA). The TN is a nonimmigrant OTHER NEWS visa which allows citizens of Canada to work in the United J&H webinars ................................................................... 126.3 States in a professional position listed on the NAFTA job series list. For a list of positions eligible for TN classification, please see Immigration Trivia............................................................ 126.3 http://www.jackson-hertogs.com//?page_id=4848 . Canadian citizens continue to have the option of applying for TN classification directly with U.S. Customs and Border Protection at the border. However, the option to file for initial TN classifi- cation with USCIS allows petitioners to retain more control over the filing. The benefits of such a filing including obtaining a “preclearance” for a potential new hire in advance of the travel date. This may allow employers to better plan for new TN em- ployees to come to the United States if the TN processing is done in advance of the entry date. -

CHANGE of NONIMMIGRANT STATUS Updated by Matthew I

CHANGE OF NONIMMIGRANT STATUS updated by Matthew I. Hirsch and Shino Komine Milby* INTRODUCTION status, and may require the alien to pursue consular When a person present in the United States in processing to obtain a new nonimmigrant visa. one nonimmigrant (temporary) status wishes to en- gage in a primary activity permitted only under a AUTHORITIES different nonimmigrant status—for example, a B-2 1 tourist decides to attend school—that person has two Immigration and Nationality Act (INA) options: visa processing at a U.S. consulate abroad INA §248 is the primary statutory authority for or change of status in the United States. change of nonimmigrant classification. Other rele- Under the first option, the person leaves the vant authorities are portions of INA §§101(a)(15), United States, applies for the appropriate visa at a 212, and 214. U.S. consulate abroad (which may require an ap- Code of Federal Regulations (CFR) proved nonimmigrant petition depending on the visa 8 CFR §248 is the primary regulatory reference. category), and then re-enters the United States in the Also relevant are portions of 8 CFR §§212.1, 214, correct nonimmigrant classification. This option, and 217. often referred to as “consular processing,” is dis- cussed in depth in another article in this volume. GENERAL ELIGIBILITY The second option entails an application to U.S. Citizenship and Immigration Services (USCIS) to In most cases, USCIS may authorize an alien to request a change of status (COS) to a different non- change his or her status from one nonimmigrant immigrant classification. This article discusses the classification to another, provided that he or she was considerations involved when choosing this option. -

Temporary Migration to the United States

TEMPORARY MIGRATION TO THE UNITED STATES NONIMMIGRANT ADMISSIONS UNDER U.S. IMMIGRATION LAW Temporary Migration to the United States: Nonimmigrant Admissions Under U.S. Immigration Law U.S. Immigration Report Series, Volume 2 About this Edition This document discusses nonimmigrants and the laws and regulations concerning their admission to the United States. The purpose of this report is to describe the various nonimmigrant categories and discuss the policy concerns surrounding these categories. Topics covered include: adjustment of status, temporary workers, work authorization, and visa overstays. The United States welcomes visitors to our country for a variety of purposes, such as tourism, education, cultural exchange, and temporary work. Admittance to the United States as a nonimmigrant is intended to be for temporary visits only. However, some nonimmigrants are permitted to change to a different nonimmigrant status or, in some cases, to permanent resident status. This report provides an overview of the reasons for visiting the United States on a temporary basis and the nexus between temporary visitor and permanent resident. Nonimmigrants – v. 06.a TEMPORARY MIGRATION TO THE UNITED STATES: NONIMMIGRANT ADMISSIONS UNDER U.S. IMMIGRATION LAW Research and Evaluation Division U.S. Citizenship and Immigration Services Office of Policy and Strategy January 2006 ACKNOWLEDGEMENTS This report was prepared by staff in the Research and Evaluation Division of the Office of Policy and Strategy, U.S. Citizenship and Immigration Services, under the direction of David R. Howell, Deputy Chief, and Lisa S. Roney, Director of Evaluation and Research. The report was written by Rebecca S. Kraus. The following staff made significant contributions in the research for and review of this report: Lisa S. -

Visa Immigration Document

Page 1 of 9 Last updated: 07/30/2010 Foreign nationals receiving appointments to Cold Spring Harbor Laboratory (CSHL) require a valid U.S. working visa to work at the Laboratory. It is important for a foreign national to arrive in U.S. on the appropriate visa. Below is the list of visa categories, which are sponsored by the Laboratory. We also sponsor our WSBS foreign students for their F-1 visas. Visa Classifications 1. J-1 visa (exchange visitor) 2. H1B visa (temporary workers for specialty occupation) 3. TN visa (Canadians and Mexicans) 4. O1 visa (aliens with extraordinary ability) 5. F1 visa (student visa) 6. B1/B2 visa (visitors for business and tourism) 7. Visa Waiver Program (VWP) J-1 visa (exchange visitor’s visa) Cold Spring Harbor Laboratory is a designated exchange visitor program sponsor authorized to carry the exchange visitor program for short-term scholars and research scholars. J1 is a non-immigrant visa. The visa holder may not apply for a green card or a permanent residence status in the United States. The applicant will be required to provide proof of nonimmigrant intent to the US consulate, at the time of the visa application. Research Scholar The maximum duration of stay allowed on a J1 research scholar visa is 5 years, therefore it is considered as a long-term J1 program. We sponsor a research scholar visa for our research scientists and post doctoral fellows. Student visitors who are approved by the Laboratory to stay longer than 6 months may also qualify for J1 research scholar visa. -

Instructions for I-129

Instructions for completing Form I-129 The I-129 is used for many non-immigrant petitions. The University uses the I-129 for H-1B petitions, O-1 petitions, TN and E-3 extensions (inside the U.S.), and TN and E-3 change of status petitions (inside the U.S.). The instructions for Parts 1-9 apply to all the petitions the University files. Parts 1-9 are located on pages 1-8 of the I-129. In addition, please complete the following for the appropriate type of petition you are filing: • E Classification Supplement must be completed in addition to Parts 1-9 when filing an E-3 application with the appropriate changes being made to Parts 1-9. The E Classification Supplement can be found on pages 9-10. E-3 status is for Australian nationals only. • Trade Agreement Supplement must be completed in addition to Parts 1-9 when filing a TN application with the appropriate changes being made to Parts 1-9. The Trade Agreement Supplement can be found on pages 11-12. TN status is for Canadian and Mexican citizens only (not landed immigrants or permanent residents). • H Classification Supplement must be completed in addition to Parts 1-9 when filing an H-1B application with appropriate changes being made to Parts 1-9. The H Classification Supplement can be found on pages 13-14. You only need to complete Questions 1-7.b. and all of Section 1. Sections 2-3 do not apply. H-1B status is for foreign nationals who will perform services (work) in a specialty occupation. -

Rules and Regulations Federal Register Vol

11287 Rules and Regulations Federal Register Vol. 69, No. 47 Wednesday, March 10, 2004 This section of the FEDERAL REGISTER DC 20536. To ensure proper handling, visitor is a businessperson from another contains regulatory documents having general please reference CIS No. 2266–03 on NAFTA party who seeks to engage in an applicability and legal effect, most of which your correspondence. Comments may occupation or profession with one of the are keyed to and codified in the Code of also be submitted electronically to the seven categories of business activities Federal Regulations, which is published under Department at [email protected]. When listed in Appendix 1603.A.1. The seven 50 titles pursuant to 44 U.S.C. 1510. submitting comments electronically, categories of business activities listed in The Code of Federal Regulations is sold by you must include CIS No. 2266–03 in Appendix 1603.A.1 represent a the Superintendent of Documents. Prices of the subject box so that the comments complete business cycle and include: (1) new books are listed in the first FEDERAL can be electronically routed to the Research and Design; (2) Growth, REGISTER issue of each week. appropriate office for review. Comments Manufacture and Production; (3) may be inspected at the above address Marketing; (4) Sales; (5) Distribution; (6) by calling (202) 514–3291 to arrange for After-Sales Service; and (7) General DEPARTMENT OF HOMELAND an appointment. Service. SECURITY FOR FURTHER INFORMATION CONTACT: Traders and investors are admitted to the United States under the E–1 and E– 8 CFR Part 214 Craig Howie, Staff Officer, Business and Trade Services Branch, Program and 2 nonimmigrant categories, respectively, [CIS No. -

Long Brochure.Pdf

ILW.COM’S Immigration Law Library THE I-140 BOOK - Editor: Herbert A. Weiss THE IMMIGRATION COMPLIANCE BOOK - Editors: Angelo A. Paparelli, L. Batya Schwartz Ehrens, and Dan Siciliano THE CONSULAR POSTS BOOK - Editor: Rami Fakhoury US Tax Compliance For Immigrants And Employers: The Lawyer's Complete Guide Editor: Paula N. Singer, Esq. The Employer's Immigration Compliance Desk Reference - By: Gregory H. Siskind THE PERM BOOK - Editor: Joel Stewart THE H-1B BOOK - Editor: Karen Weinstock THE NURSE IMMIGRATION BOOK - Editors: Joseph P. Curran and Dan H. Berger THE REMOVAL BOOK - By Scott Bratton The Immigrant's Way - By Margaret W. Wong Immigration Practice 2009-2010 - Editors: Robert C. Divine and R. Blake Chisam Business Immigration Law: Strategies For Employing Foreign Nationals Editors: Rodney A. Malpert and Amanda Petersen Business Immigration Law: Forms and Filings - Authors: Rodney A. Malpert and Amanda Petersen The Whole ACT—INA by P. J. Patel 8 CFR Plus by P. J. Patel 20/22/28 CFR Plus by P. J. Patel Patel's Citations of Administrative Decisions under Immigration and Nationality Laws by P. J. Patel Publication Catalog THE I-140 BOOK Editor: Herbert A. Weiss Contributors: Brian S. Weiss, Kristen Quan Hammill, Prakash Khatri, Faye M. Kolly, Howard L. Kushner, Dorothee B. Mitchell, and Sherry Neal EDITOR Herbert A. Weiss is a partner at Garganigo, Goldsmith & Weiss, based in New York and has been serving the immigrant community for thirty five years. He has practiced immigration law since his admission to the bar. He has been a member of the firm since 1979. -

8 CFR Ch. I (1–1–12 Edition) § 214.6

§ 214.6 8 CFR Ch. I (1–1–12 Edition) (3) Employment authorization or order to establish that the alien’s practical training. entry will be temporary, the alien (4) Request for reinstatement of stu- must demonstrate to the satisfaction dent status. of the inspecting immigration officer (5) Application for change of non- that his or her work assignment in the immigrant status. United States will end at a predictable (Secs. 103, 212, 214, 248; 8 U.S.C. 1103, 1182, time and that he or she will depart 1184, 1258) upon completion of the assignment. [48 FR 10297, Mar. 3, 1983] (c) Appendix 1603.D.1 to Annex 1603 of the NAFTA. Pursuant to the NAFTA, § 214.6 Citizens of Canada or Mexico an applicant seeking admission under seeking temporary entry under this section shall demonstrate business NAFTA to engage in business activi- ties at a professional level. activity at a professional level in one of the professions set forth in Appendix (a) General. Under section 214(e) of 1603.D.1 to Annex 1603. The professions the Act, a citizen of Canada or Mexico in Appendix 1603.D.1 and the minimum who seeks temporary entry as a busi- requirements for qualification for each ness person to engage in business ac- 1 tivities at a professional level may be are as follows: admitted to the United States in ac- APPENDIX 1603.D.1 (ANNOTATED) cordance with the North American Free Trade Agreement (NAFTA). —Accountant—Baccalaureate or (b) Definitions. As used in this sec- Licenciatura Degree; or C.P.A., C.A., tion, the terms: C.G.A., or C.M.A. -

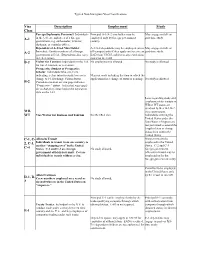

Visa Classification Chart

Typical Non-Immigrant Visa Classifications Visa Description Employment Study Class Foreign Diplomatic Personnel: Individuals Principal A-1/A-2 visa holder may be May engage in full- or A-1 in the U.S. as employees of a foreign employed only by foreign government part-time study. government, e.g. ambassador, minister, country. diplomat, or consular officer. Dependent of A-1/A-2 Visa Holder: A-1/A-2 dependents may be employed (on or May engage in full- or A-2 Immediate family members of a foreign off-campus) only if they apply and receive an part-time study. government official. (Dependents also carry EAD from USCIS, subject to any restrictions A-1/A-2 status) stated on the EAD. B-2 Visitor for Tourism: Individuals in the U.S. No employment is allowed. No study is allowed. for travel, tourism, or recreation. Prospective Student or Prospective Scholar: Individuals who enter U.S. indicating a clear intent to study here or to May not work including the time in which the change to J-1 Exchange Visitor Status. application for a change of status is pending. No study is allowed. B-2 Consulate notation on visa page indicates “Prospective” status. Individual must apply for a change of status before the expiration date on the I-94. Laws regarding study and employment for visitors in WB or WT status are identical to their B-1/B-2 WB, visa counterparts. WT Visa Waiver for business and Tourism See B-1/B-2 visa. Individuals entering the United States under the Visa Waiver Program are not permitted to extend the length of stay or change status from within the United States.