Smartphone Firms See Clear Shift on Pentup Demand

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Prohibited Agreements with Huawei, ZTE Corp, Hytera, Hangzhou Hikvision, Dahua and Their Subsidiaries and Affiliates

Prohibited Agreements with Huawei, ZTE Corp, Hytera, Hangzhou Hikvision, Dahua and their Subsidiaries and Affiliates. Code of Federal Regulations (CFR), 2 CFR 200.216, prohibits agreements for certain telecommunications and video surveillance services or equipment from the following companies as a substantial or essential component of any system or as critical technology as part of any system. • Huawei Technologies Company; • ZTE Corporation; • Hytera Communications Corporation; • Hangzhou Hikvision Digital Technology Company; • Dahua Technology company; or • their subsidiaries or affiliates, Entering into agreements with these companies, their subsidiaries or affiliates (listed below) for telecommunications equipment and/or services is prohibited, as doing so could place the university at risk of losing federal grants and contracts. Identified subsidiaries/affiliates of Huawei Technologies Company Source: Business databases, Huawei Investment & Holding Co., Ltd., 2017 Annual Report • Amartus, SDN Software Technology and Team • Beijing Huawei Digital Technologies, Co. Ltd. • Caliopa NV • Centre for Integrated Photonics Ltd. • Chinasoft International Technology Services Ltd. • FutureWei Technologies, Inc. • HexaTier Ltd. • HiSilicon Optoelectronics Co., Ltd. • Huawei Device Co., Ltd. • Huawei Device (Dongguan) Co., Ltd. • Huawei Device (Hong Kong) Co., Ltd. • Huawei Enterprise USA, Inc. • Huawei Global Finance (UK) Ltd. • Huawei International Co. Ltd. • Huawei Machine Co., Ltd. • Huawei Marine • Huawei North America • Huawei Software Technologies, Co., Ltd. • Huawei Symantec Technologies Co., Ltd. • Huawei Tech Investment Co., Ltd. • Huawei Technical Service Co. Ltd. • Huawei Technologies Cooperative U.A. • Huawei Technologies Germany GmbH • Huawei Technologies Japan K.K. • Huawei Technologies South Africa Pty Ltd. • Huawei Technologies (Thailand) Co. • iSoftStone Technology Service Co., Ltd. • JV “Broadband Solutions” LLC • M4S N.V. • Proven Honor Capital Limited • PT Huawei Tech Investment • Shanghai Huawei Technologies Co., Ltd. -

TCL 科技集团股份有限公司 TCL Technology Group Corporation

TCL Technology Group Corporation Annual Report 2019 TCL 科技集团股份有限公司 TCL Technology Group Corporation ANNUAL REPORT 2019 31 March 2020 1 TCL Technology Group Corporation Annual Report 2019 Table of Contents Part I Important Notes, Table of Contents and Definitions .................................................. 8 Part II Corporate Information and Key Financial Information ........................................... 11 Part III Business Summary .........................................................................................................17 Part IV Directors’ Report .............................................................................................................22 Part V Significant Events ............................................................................................................51 Part VI Share Changes and Shareholder Information .........................................................84 Part VII Directors, Supervisors, Senior Management and Staff .......................................93 Part VIII Corporate Governance ..............................................................................................113 Part IX Corporate Bonds .......................................................................................................... 129 Part X Financial Report............................................................................................................. 138 2 TCL Technology Group Corporation Annual Report 2019 Achieve Global Leadership by Innovation and Efficiency Chairman’s -

TIMWE – Born Global Firm Case Study

CATÓLICA-LISBON, SCHOOL OF BUSINESS & ECONOMICS TIMWE – Born Global Firm Case Study Frederico José Castro Reis Marques December 2012 A Dissertation submitted in partial fulfillment of the requirements for the degree of MSc in Business Administration, at CLSBE – Católica-Lisbon, School of Business & Economics. ABSTRACT Title: TIMWE – Born Global Firm Author: Frederico José Castro Reis Marques TIMWE is the Portuguese based company chosen to illustrate and serve as background to support the creation of a teaching case in Strategy, exploring the internationalization of a real company and the challenges undertaken by the process of being a born global firm, followed by a Teaching Note that can be used as a tool to help solving the case. TIMWE is a Portuguese owned company, founded in 2002, that offers mobile monetization solutions and services (entertainment, marketing and money) to its global clients (brands, end-consumers, media groups, mobile carriers and governments), by leveraging its in- house developed intellectual proprietary technology, wide network of connections, mobile expertise and local presence. The main focus of the business strategy always has been B2O (business-to-operators), and since the beginning of its foundation the company aimed to build a global reach. In 2011, it had 26 offices, employing more than 300 people, operating in 75 countries across the 5 continents, as well as partnerships with over 280 mobile carriers spread all over the world giving access to 3 billion mobile subscribers. The case was prepared with the intent of providing useful insights about an IT services Portuguese company that managed to internationalize and operate in several countries, on top of giving a generic overview of the industry where it acts and is doing business. -

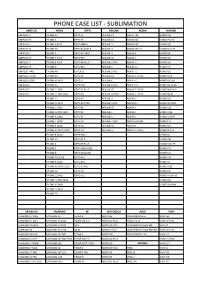

Qikink Product & Price List

PHONE CASE LIST - SUBLIMATION ONEPLUS APPLE OPPO REALME NOKIA HUAWEI ONEPLUS 3 IPHONE SE OPPO F3 REALME C1 NOKIA 730 HONOR 6X ONEPLUS 3T IPHONE 6 OPPO F5 REALME C2 NOKIA 640 HONOR 9 LITE ONEPLUS 5 IPHONE 6 PLUS OPPO FIND X REALME 3 NOKIA 540 HONOR Y9 ONEPLUS 5T IPHONE 6S OPPO REALME X REALME 3i NOKIA 7 PLUS HONOR 10 LITE ONEPLUS 6 IPHONE 7 OPPO F11 PRO REALME 5i NOKIA 8 HONOR 8C ONEPLUS 6T IPHONE 7 PLUS OPPO F15 REALME 5S NOKIA 6 HONOR 8X ONEPLUS 7 IPHONE 8 PLUS OPPO RENO 2F REALME 2 PRO NOKIA 3.1 HONOR 10 ONEPLUS 7T IPHONE X OPPO F11 REALME 3 NOKIA 2.1 HONOR 7C ONEPLUS 7PRO IPHONE XR OPPOF13 REALME 3 PRO NOKIA 7.1 HONOR 5C ONEPLUS 7T PRO IPHONE XS OPPO F1 REALME C3 NOKIA 3.1 PLUS HONOR P20 ONEPLUS NORD IPHONE XS MAX OPPO F7 REALME 6 NOKIA 5.1 HONOR 6PLUS ONEPLUS X IPHONE 11 OPPO A57 REALME 6 PRO NOKIA 7.2 HONOR PLAY 8A ONEPLUS 2 IPHONE 11 PRO OPPO F1 PLUS REALME X2 NOKIA 7.1 PLUS HONOR NOVA 3i ONEPLUS 1 IPHONE 11 PRO MAX OPPO F9 REALME X2 PRO NOKIA 6.1 PLUS HONOR PLAY IPHONE 12 OPPO A7 REALME 5 NOKIA 6.1 HONOR 8X IPHONE 12 MINI OPPO R17 PRO REALME 5 PRO NOKIA 8.1 HONOR 8X MAX IPHONE 12 PRO OPPO K1 REALME XT NOKIA 2 HONOR 20i IPHONE 12 PRO MAX OPPO F9 REALME 1 NOKIA 3 HONOR V20 IPHONE X LOGO OPPO F3 REALME X NOKIA 5 HONOR 6 PLAY IPHONE 7 LOGO OPPO A3 REALME 7 PRO NOKIA 6 (2018) HONOR 7X IPHONE 6 LOGO OPPO A5 REALME 5S NOKIA 8 HONOR 5X IPHONE XS MAX LOGO OPPO A9 REALME 5i NOKIA 2.1 PLUS HONOR 8 LITE IPHONE 8 LOGO OPPO R98 HONOR 8 IPHONE 5S OPPO F1 S HONOR 9N IPHONE 4 OPPO F3 PLUS HONOR 10 LITE IPHONE 5 OPPO A83 (2018) HONOR 7S IPHONE 8 -

Tamil Nadu Consumer Products Distributors Association No. 2/3, 4Th St

COMPETITION COMMISSION OF INDIA Case No. 15 of 2018 In Re: Tamil Nadu Consumer Products Distributors Association Informant No. 2/3, 4th Street, Judge Colony, Tambaram Sanatorium, Chennai- 600 047 Tamil Nadu. And 1. Fangs Technology Private Limited Opposite Party No. 1 Old Door No. 68, New Door No. 156 & 157, Valluvarkottam High Road, Nungambakkam, Chennai – 600 034 Tamil Nadu. 2. Vivo Communication Technology Company Opposite Party No. 2 Plot No. 54, Third Floor, Delta Tower, Sector 44, Gurugram – 122 003 Haryana. CORAM Mr. Sudhir Mital Chairperson Mr. Augustine Peter Member Mr. U. C. Nahta Member Case No. 15 of 2018 1 Appearance: For Informant – Mr. G. Balaji, Advocate; Mr. P. M. Ganeshram, President, TNCPDA and Mr. Babu, Vice-President, TNCPDA. For OP-1 – Mr. Vaibhav Gaggar, Advocate; Ms. Neha Mishra, Advocate; Ms. Aayushi Sharma, Advocate and Mr. Gopalakrishnan, Sales Head. For OP-2 – None. Order under Section 26(2) of the Competition Act, 2002 1. The present information has been filed by Tamil Nadu Consumer Products Distributors Association (‘Informant’) under Section 19(1) (a) of the Competition Act, 2002 (the ‘Act’) alleging contravention of the provisions of Sections 3 and 4 of the Act by Fangs Technology Private Limited (‘OP- 1’) and Vivo Communication Technology Company (‘OP-2’) (collectively referred to as the ‘OPs’). 2. The Informant is an association registered under the Tamil Nadu Society Registration Act, 1975. Its stated objective is to protect the interest of the distributors from unfair trade practices and stringent conditions imposed by the manufacturers of consumer products. 3. OP-1 is engaged in the business of trading and distribution of mobile handsets under the brand name ‘VIVO’ and also provide marketing support to promote its products. -

Gadget-Inn.Com June-List

www.Gadget-inn.com Customer Support Always Available Before and After you buy OEM, WholeSale, Export and Agents Contact us for Corporation More than 200 Laptops and Phones in Stock Every week, Lets chat any time www.Gadget-INN.com Trusted and Popular Source for best deals among students and professionals across major cities in China Yuan USD Currency Rate 6.36 1.00 Customized Phone Covers Available on all phones, iphones, samsung, etc Yuan USD Plastic transparent cover with your custom picture/text 50 8 Black Plastic cover with your custom picture/text 65 10 Black rubber cover with your custom picture/text 80 13 Customized cover for ipads with your custom picture/text 149 23 Phones iPhones Yuan USD iphone 4S with 16 gig 450 71 iphone 4S with 32gig 599 94 iPhone 5 with 16 gig 699 110 iphone 5 with 32 gig 749 118 iphone 5S with 16 gig 949 149 iphone 5S with 32gig 1049 165 iphone 5S with 64gig 1199 189 iphone 5C with 16gig 799 126 iPhone 5C with 32gig 899 141 Yuan USD iPhone SE with 32gig performs like 6S 2199 346 iphone SE with 64gig performs like 6S 2399 377 iphone 6 with 16gig 1450 228 IPhone 6 with 64gig 1599 251 iphone 6 with 128gig 1799 283 iphone 6 plus with 16gig. 1799 283 iPhone 6 Plus with 64gig 2099 330 iphone 6 Plus with 128gig 2299 361 iphone 6S with 16gig 1999 314 Iphone 6S with 64gig 2099 330 iphone 6S with 128gig 2399 377 iPhone 6S Plus 16gig 2299 361 iPhone 6S Plus 64gig 2599 409 iphone 6S plus 128gig 2899 456 Yuans USD Iphone 7 with 32gig 3099 487 Iphone 7 with 128gig 3399 534 iphone 7 with 256gig 3699 582 iphone 7 Plus -

Handset ODM Industry White Paper

Publication date: April 2020 Authors: Robin Li Lingling Peng Handset ODM Industry White Paper Smartphone ODM market continues to grow, duopoly Wingtech and Huaqin accelerate diversified layout Brought to you by Informa Tech Handset ODM Industry White Paper 01 Contents Handset ODM market review and outlook 2 Global smartphone market continued to decline in 2019 4 In the initial stage of 5G, China will continue to decline 6 Outsourcing strategies of the top 10 OEMs 9 ODM market structure and business model analysis 12 The top five mobile phone ODMs 16 Analysis of the top five ODMs 18 Appendix 29 © 2020 Omdia. All rights reserved. Unauthorized reproduction prohibited. Handset ODM Industry White Paper 02 Handset ODM market review and outlook In 2019, the global smartphone market shipped 1.38 billion units, down 2.2% year-over- year (YoY). The mature markets such as North America, South America, Western Europe, and China all declined. China’s market though is going through a transition period from 4G to 5G, and the shipments of mid- to high-end 4G smartphone models fell sharply in 2H19. China’s market shipped 361 million smartphones in 2019, a YoY decline of 7.6%. In the early stage of 5G switching, the operator's network coverage was insufficient. Consequently, 5G chipset restrictions led to excessive costs, and expectations of 5G led to short-term consumption suppression. The proportion of 5G smartphone shipments was relatively small while shipments of mid- to high-end 4G models declined sharply. The overall shipment of smartphones from Chinese mobile phone manufacturers reached 733 million units, an increase of 4.2% YoY. -

Copy of Google VR Compatible Phones

Google VR Compatible Phones Apple Huawei LG Nokia Sony iPhone 6s Ascend D2 G Flex 2 7 Xperia X iPhone 6s Plus Ascend P6 G2 7 Plus** Xperia X Performance iPhone 7 Honor 10 ** G3 8 Xperia XZ Premium iPhone 7 Plus Honor 3 G3 LTE-A 8 Sirocco Xperia XZ1 iPhone 8 Honor 3X G750 G4 Lumia 930 Xperia XZ2 Compact iPhone 8 Plus Honor 6 G5 3 Xperia XZ2 Premium iPhone X** Honor 6 Plus GX F310L 5 Xperia XZs Honor 7 Nexus 4 Xperia Z Honor 8 Nexus 5 Xperia Z1 Asus Honor 9 Nexus 5X OnePlus Xperia Z1 S Padfone 2 Honor View 10 ** Optimus G N3 Xperia Z2 Padfone Infinity Mate 10 Porsche Design Optimus G E970 OnePlus Xperia Z2a Padfone Infinity 2 Mate 10 Pro ** Optimus GJ E975W X Xperia Z3 Zenfone 2 Mate 10 ** Optimus LTE2 2 Xperia Z3 + Zenfone 2 Deluxe Mate 10 ** Q6 3 Zperia Z3 + Dual Zenfone 2 Laser Mate 9 Pro V30** 3T Xperia Z3 Dual Zenfone 3 Mate RS Porsche Desing ** V30S ThinQ** 5 Xperia Z5 Zenfone 3 Max Mate S VU 3 F300L 5T** Zperia Z5 Dual Zenfone 3 Zoom Nova 2 X Venture Xperia Z5 Premium Zenfone 4 Max Nova 2 Plus Xperia ZL Zenfone 4 Max Pro Nova 2s ** Samsung Zenfone 5** P10 Microsoft Galaxy A3 P10 Lite Lumia 950 Galaxy A5 Xiaomi P10 Plus Galaxy A8 Black Shark Blackberry P20 ** Galaxy A8+ Mi 3 Motion P20 Lite ** Motorola Galaxy Alpha Mi 4 Priv P20 Pro ** DROID Maxx Galaxy C5 Pro Mi 4 LTE Z30 P8 DROID Turbo Galaxy C7 Mi 4c P9 DROID Turbo 2 Galaxy J5 Mi 4i Y7 DROID Ultra Galaxy J7 Mi 5 Google Y9 (2018) ** Mot X Force Galaxy J7 Pro Mi 5c PIxel Moto G4 Galaxy J7 V Mi 5s Pixel 2 Moto G4 Plus Galaxy K Zoom Mi 6 Pixel 2 XL ** Lenovo Moto G5 Galaxy Note 3 Neo -

China's BBK Giving Jitters to Other Android Brands Through Impactful

Journal of Xi'an University of Architecture & Technology Issn No : 1006-7930 China’s BBK Giving Jitters to Other Android Brands through Impactful Marketing Strategies: A Study of the Indian Market Dr. Shikha Singh Assistant Professor Symbiosis Centre for Management Studies, Symbiosis International (Deemed University), Noida, Uttar Pradesh. India. Email: [email protected],[email protected] Prof. (Dr.) Tarun Kumar Singhal Professor Symbiosis Centre for Management Studies, Symbiosis International (Deemed University), Noida, Uttar Pradesh. India. Email: [email protected] Rupashi Sehgal BBA Student Symbiosis Centre for Management Studies, Symbiosis International (Deemed University), Noida, Uttar Pradesh. India. Email: [email protected] Tuhina Shukla BBA Student Symbiosis Centre for Management Studies, Symbiosis International (Deemed University), Noida, Uttar Pradesh. India. Email: [email protected] Abstract- Technology has flourished enormously over the last few decades, which has bought a revolution to the IT and Telecom sector. Cellphones which were primarily developed to make phone calls, have now turned out to be a necessity and are just not limited to calling. They have taken over many gadgets that are useful in day to day lives. Everyday people encounter a significant number of better and improved features being embedded into them. The end-users face a dilemma in selecting smartphones because of the cut-throat prices and a wide range of features being offered. Seeking the business opportunity, BBK Electronics Corporation (a Chinese company) tapped the Indian market with a different approach to capture the Indian market. BBK Electronics launched three different smartphone companies - VIVO, OPPO, ONE PLUS with different owners, USPs, marketing tactics as well as different features. -

Coloros 7.1 User Guide

ColorOS 7.1 User Guide Here is everything you need to know about ColorOS 7.1 The demonstrated contents (including but not limited to UI, wallpapers) are only references. The features may vary by different models and regions. Please refer to the actual product. Contents Communication and Network ........................................................................................ 19 SIM Card Settings ................................................................................................................. 19 Wi-Fi ............................................................................................................................................. 19 Wi-Fi Connection .................................................................................................. 20 Enhance Internet Experience ......................................................................... 21 Dual-Wi-Fi Speed-Up .......................................................................................... 21 Apps Using Wi-Fi and Mobile Data ............................................................. 22 Other Wireless Connections ........................................................................................... 23 VPN .............................................................................................................................. 23 Tethering .................................................................................................................. 23 NFC ............................................................................................................................. -

Maintaining Us Leadership in Semiconductors and Countering

MAINTAINING U.S. LEADERSHIP IN SEMICONDUCTORS AND COUNTERING CHINA’S THREATS JEFF FERRY, CHIEF ECONOMIST, COALITION FOR A PROSPEROUS AMERICA ROSLYN LAYTON, PH.D., CO-FOUNDER, CHINA TECH THREAT MARCH 2021 TABLE OF CONTENTS Executive Summary . 1 Introduction . .2 . Part I: Maintaining U S. Leadership in Semiconductors . 4 Part II: Combatting China . 8 Conclusion . 10 Endnotes . 11 JEFF FERRY is Chief Economist at the Coalition for a Prosperous America (CPA) . CPA is the only national, bipartisan organization representing exclusively a coalition of domestic manufacturers, labor unions, and family farm groups dedicated to rebuilding U .S . manufacturing and broadly restoring American prosperity . Ferry is an economist, author, and former technology executive . From 2005 to 2011, he served as a marketing executive at Infinera, a U .S . manufacturer of optical networking systems that designs and manufactures photonic integrated circuits in Sunnyvale, California . In 2019, the CPA economics team won the Mennis Award from the National Association for Business Economics for a paper, Decoupling from China: an economic analysis of the impact on the U.S. economy of a permanent tariff on Chinese imports. He can be contacted at [email protected] . ROSLYN LAYTON, PhD co-founded China Tech Threat to improve U .S . policy to protect Americans from technological threats from the People’s Republic of China (PRC) . She is a Visiting Researcher at the Department of Electronic Systems at Aalborg University and Senior Vice President at Strand Consult . She is a Senior Contributor to Forbes . She holds a Ph .D . in business economics from Aalborg University, an M .B .A . from the Rotterdam School of Management, and a B .A . -

GSM Arena Nokia Lumia 1020 Camera in a Class of Its Own No Other High End Smartphone Camera Com

GSM Arena: Nokia Lumia 1020 Camera In A Class Of Its Own, No Other High End Smartphone Camera Comes Close 1 / 5 2 / 5 GSM Arena: Nokia Lumia 1020 Camera In A Class Of Its Own, No Other High End Smartphone Camera Comes Close 3 / 5 The Nokia Lumia 1320 is, it has to be said, pretty good value - positioned in the ... The device is competitively priced compared to other 6 inch Android phablets in India ... Capture amazing images and videos with Lumia Camera and expand your ... Android from any The Nokia Lumia 1520 won the GSM Arena's Smartphone .... Microsoft Lumia is a discontinued line of mobile devices that was originally designed and ... On 3 September 2013, Microsoft announced its purchase of Nokia's mobile ... These new low-end devices were intended to improve Windows Phone ... the Lumia 1020, which features a 41-megapixel camera based on technology .... Huawei; Honor; iPhone; Infinix; Nokia; Oppo; Samsung; Other Brands. ... using the latest Windows Phone operating system, to the high quality, low price Asha series. ... Check prices, specs, and shop direct at the Nokia Phones store UK. ... Samsung ¦ Panasonic ¦ Pioneer ¦ Sony ¦ LG ¦ Hitachi ¦ Philips ¦ Sharp ¦ Camera Shop.. Nokia Lumia 1020 Windows Mobile smartphone. Announced Jul 2013. Features 4.5″ AMOLED display, Snapdragon S4 Plus chipset, 41 MP primary camera, .... The Nokia Lumia 1020 shoots 38MP stills and there's only one phone in our database that manages that, the Nokia 808 PureView. The Sony Xperia Z1 is the only non-Nokia that comes close at 20.7MP. You might want to use the tool's downscaling feature to compare the 1020 against other phones more easily.