Rated Developers' Profit Margins Will Contract in 2021-22

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bossini International Holdings Limited Invests HK$40M in New Brand “SPARKLE”

PRESS RELEASE August 28, 2002 Bossini International Holdings Limited Invests HK$40m in new brand “SPARKLE” New label expected to generate huge interest in PRC casual wear market and record sales of HK$120m in first seven months Bossini International Holdings Limited (592), the Hong Kong-based fashion chain store, today announced the September launch of SPARKLE, targeting the casual wear sector on the Mainland. During the next seven months, Bossini plans to build an extensive sales network for the new brand by establishing SPARKLE fashion chains in seven major cities including Shanghai, Beijing, Tianjin, Wuhan, Nanjing, Guangzhou, and Shenzhen. An anticipated 50 directly managed stores will open in the first phase of the launch, most located in high traffic areas and within department stores. Store sizes range from an average of 1,000 square feet to a maximum of 3,000 square feet. Mr. Edgar To, Executive Director of Bossini International Holdings Limited said, “Our capital expenditure for the first stage launch of the SPARKLE brand is HK$17m. In return, we expect to record sales of HK$120m in the first seven months of operations to the end of March 2003. We also anticipate rapid growth in sales over the next three years, with retail gross margin of 45%.” Mr. To said the time is right to implement a multi-brand strategy and grow Bossini’s share of the Mainland market. “There is rapid economic growth in many cities in the PRC and it is expected that this will be sustained at least up to 2008,” he said. -

CHAPTER 3 Hong Kong Music Ecosphere

Abstract The people of Hong Kong experienced their deepest sense of insecurity and anxiety after the handover of sovereignty to Beijing. Time and again, the incapacity and lack of credibility of the SAR government has been manifested in various new policies or incidents. Hong Kong people’s anger and discontent with the government have reached to the peak. On July 1, 2003, the sixth anniversary of the hand-over of Hong Kong to China, 500,000 demonstrators poured through the streets of Hong Kong to voice their concerns over the proposed legislation of Article 23 and their dissatisfaction to the SAR government. And the studies of politics and social movement are still dominated by accounts of open confrontations in the form of large scale and organized rebellions and protests. If we shift our focus on the terrain of everyday life, we can find that the youth voice out their discontents by different ways, such as various kinds of media. This research aims to fill the gap and explore the relationship between popular culture and politics of the youth in Hong Kong after 1997 by using one of the local bands KingLyChee as a case study. Politically, it aims at discovering the hidden voices of the youth and argues that the youth are not seen as passive victims of structural factors such as education system, market and family. Rather they are active and strategic actors who are capable of negotiating with and responding to the social change of Hong Kong society via employing popular culture like music by which the youth obtain their pleasure of producing their own meanings of social experience and the pleasure of avoiding the social discipline of the power-bloc. -

Three Red Lines” Policy

Real Estate Developers with High Leverage to See Inventory Quality Tested Under Broader “Three Red Lines” Policy October 28, 2020 In our view, the widening of regulations aimed at controlling real estate developers’ interest- ANALYSTS bearing debt would further reduce the industry’s overall credit risk in the long term. However, the nearer term may see less headroom for highly leveraged developers to finance in the capital Xiaoliang Liu, CFA market, pushing them to sell off inventory to ease liquidity pressure. Beijing +86-10-6516-6040 The People’s Bank of China said in September that measures aimed at monitoring the funding [email protected] and financial management of key real estate developers will steadily be expanded. Media reports suggest that the new regulations would see a cap of 15% on annual growth of interest-bearing Jin Wang debt for all property developers. Developers will be assessed against three indicators, which are Beijing called “red lines”: whether asset liability ratios (excluding advance) exceeded 70%; whether net +86-10-6516-6034 gearing ratio exceeded 100%; whether cash to short-term debt ratios went below 1.0. Developers [email protected] which breached all three red lines won’t be allowed to increase their debt. If only one or two of the red lines are breached, such developers would have their interest-bearing debt growth capped at 5% and 10% respectively. The first half of the year saw debt grow rapidly among developers. In a sample of 87 real estate developers that we are monitoring, more than 40% saw their interest-bearing debt grow at a faster rate than 15% year over year as of the end of June (see the chart below). -

Contracted Sales Growth Will Slow in 2021 on Tightened Credit

CORPORATES SECTOR IN-DEPTH Property – China 28 January 2021 China Property Focus: Contracted sales growth will slow in 2021 on tightened credit TABLE OF CONTENTS » We expect national contracted sales growth in 2021 to slow amid tighter onshore Mild national contracted sales growth credit conditions. National contracted sales value grew 10.8% year-on-year in 2020 likely in 2021 2 (compared with 10.3% growth in 2019), largely driven by an increase in average selling Rated developers' offshore bond issuance remained robust in January price. Contracted sales volume (gross floor area), increased by 3.2% in 2020, higher than amid signs of tightening onshore the 1.5% growth in 2019, reflecting solid housing demand and the gradual economic credit to the sector 4 recovery in China despite the disruption caused by the coronavirus outbreak in early Liquidity stress indicator remained flat in December 2020 5 2020. Eight rating actions from 27 November to 26 January 6 » Rated developers' offshore bond issuance remained robust in January amid signs Appendix I 8 of tightening onshore credit to the sector. Rated developers issued $11.5 billion of Appendix II 9 offshore bonds in January 2021 (to 26 January), mainly for refinancing. The amount Appendix III 13 dropped 30% from $16.5 billion in January 2020 but remained robust compared to the Moody's related publications 14 $4.4 billion average monthly issuance in 2020. The active issuance at the beginning of the year also reflects developers' efforts to replenish liquidity amid signs of tightening onshore credit to the sector. On 31 December 2020, the Chinese regulators announced Contacts new guidelines to limit Chinese banks' property loan exposure. -

DISPLAY CHINA 2018 2018.6.27-29 Shanghai New International Exhibition Center

DISPLAY CHINA 2018 2018.6.27-29 Shanghai New International Exhibition Center In conjunction with Organiser China Optics and Optoelectronics Manufactures Association LCB (CODA) Message from Organiser Reed Exhibitions Kuozhan (Shanghai) Co.,Ltd. The electronic and information industry is playing an ever more important role in the global economy. Having made consistent progress for a decade, the revenue of China's display industry grew 7.5 and 3 times respectively during the 11th Five-Year and 12th Five-Year Plan periods, and became the most important growth pole in the global display industry. According to forecast, the China will rank first in production output of display panel by 2019. China's new display industry has developed sophisticated technologies and mature markets, and meanwhile it is steadily progressing in technology research and innovation. Technology, market, product and competition of the display industry will change a lot in the coming years. The consistent innovation in materials and production techniques has been continuallly pushing new display and touch panel products toward larger sizes, faster response time and precise control. In order to exhibit the latest new display technologies, lead and accelerate integration of new display technologies and applications, China Optics and Optoelectronics Manufactures Association LCB (CODA) and Reed Exhibitions Kuozhan will jointly organize the DISPLAY CHINA exhibition. This exhibition will attract more than 22,000 high-end participants from display panel production, associated -

U.S. Investors Are Funding Malign PRC Companies on Major Indices

U.S. DEPARTMENT OF STATE Office of the Spokesperson For Immediate Release FACT SHEET December 8, 2020 U.S. Investors Are Funding Malign PRC Companies on Major Indices “Under Xi Jinping, the CCP has prioritized something called ‘military-civil fusion.’ … Chinese companies and researchers must… under penalty of law – share technology with the Chinese military. The goal is to ensure that the People’s Liberation Army has military dominance. And the PLA’s core mission is to sustain the Chinese Communist Party’s grip on power.” – Secretary of State Michael R. Pompeo, January 13, 2020 The Chinese Communist Party’s (CCP) threat to American national security extends into our financial markets and impacts American investors. Many major stock and bond indices developed by index providers like MSCI and FTSE include malign People’s Republic of China (PRC) companies that are listed on the Department of Commerce’s Entity List and/or the Department of Defense’s List of “Communist Chinese military companies” (CCMCs). The money flowing into these index funds – often passively, from U.S. retail investors – supports Chinese companies involved in both civilian and military production. Some of these companies produce technologies for the surveillance of civilians and repression of human rights, as is the case with Uyghurs and other Muslim minority groups in Xinjiang, China, as well as in other repressive regimes, such as Iran and Venezuela. As of December 2020, at least 24 of the 35 parent-level CCMCs had affiliates’ securities included on a major securities index. This includes at least 71 distinct affiliate-level securities issuers. -

California Tower Celebrated Its Grand Opening in Lan Kwai Fong with the Theme ‘Dance to the Beat of Your Own Drum’

California Tower Celebrated its Grand Opening in Lan Kwai Fong With the theme ‘Dance to the Beat of Your Own Drum’ (Hong Kong, 30 November 2015) The highly anticipated grand opening of the California Tower took place on 30th November 2015, drawing in Hong Kong’s creme de la creme to witness the unveiling of the brand new, one-stop lifestyle and entertainment destination in the heart of Central. With the theme colour purple, the event centred around the expression ‘Dance to the Beat of Your Own Drum’ - a motto that sums up spirit of the California Tower, where it’s all about having fun, enjoying the spaces that it has to offer - and finding your own rhythm. At the Grand Opening, Chairman of the Lan Kwai Fong Group and the “Father of Lan Kwai Fong” Dr Allan Zeman said, “With the return of California Tower, it pumps in a lot of new energy and will bring Lan Kwai Fong to a whole new level! The premium dining, entertainment and lifestyle concepts in the new building will provide endless entertainment to people in Hong Kong and beyond!” The Grand Opening saw seminal Cantopop singer and actress, the Kelly Chen take to the stage. While Lan Kwai Fong went from humble beginnings 30 years ago to the world-famous dining and nightlife destination it is today, the legendary performer has been in showbiz for almost 20 years, with millions of records sold. What’s more, with her energetic live performance that got the crowd moving on their feet, the “Diva of Asia” was the embodiment of “Dance to the Beat of Your Own Drum”. -

Report Template

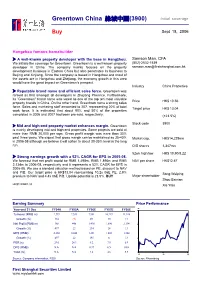

Greentown China 綠城中國(3900) Initial coverage Buy Sept 18, 2006 Hangzhou famous homebuilder ¾ A well-known property developer with the base in Hangzhou. Samson Man, CFA We initiate the coverage for Greentown. Greentown is a well-known property (852)-2532-1539 developer in China. The company mainly focuses on the property [email protected] development business in Eastern China but also penetrates its business to Beijing and Xinjiang. Since the company is based in Hangzhou and most of the assets are in Hangzhou and Zhejiang, the economy growth in this area would have the great impact on Greentown’s prospect. Industry China Properties ¾ Reputable brand name and efficient sales force. Greentown was ranked as first amongst all developers in Zhejiang Province. Furthermore, its ”Greentown” brand name was voted as one of the top ten most valuable Price HK$ 10.56 property brands in China. On the other hand, Greentown owns a strong sales force. Sales and marketing staff amounted to 207, representing 20% of total Target price HK$ 13.04 work force. It is estimated that about 90% and 50% of the properties completed in 2006 and 2007 had been pre-sold, respectively. (+23.5%) Stock code 3900 ¾ Mid and high-end property market enhances margin. Greentown is mainly developing mid and high-end properties. Some projects are sold at more than RMB 20,000 per sqm. Gross profit margin was more than 30% past three years. We expect that gross margin can be maintained as 35-40% Market cap. HK$14,229mn in 2006-08 although we believe it will soften to about 30-35% level in the long run. -

Annual Report 2007 3 Live Demonstration of Beijing Majestic Mansion Ultimate Grace of Living Corporate Profile

The homes built by Greentown lead lifestyle. Our premier class of architecture fully demonstrates dynamic blend of taste and culture. The architecture characteristics embrace the culture of city and show respect to natural landscape. Join us to live elegantly and delicately. Since its establishment, Greentown is determined to create beauty for the city with an idealistic human-oriented spirit adopted through the course of development and after-sales services for its property products, and bring ideal life for its customers with quality properties. Contents Corporate Information 3 Corporate Profile 6 Portfolio 8 Year in Review 44 Chairman’s Statement 48 CEO’s Review 49 Management Discussion and Analysis 58 Directors and Senior Management 74 Corporate Governance Report 84 Report of the Directors 90 Report of the Auditors 99 Consolidated Income Statement 101 Consolidated Balance Sheet 102 Consolidated Statement of Changes in Equity 104 Consolidated Cash Flow Statement 105 Notes to the Consolidated Financial Statements 107 Five Year Financial Summary 201 Valuation Report and Analysis 202 Corporate Information Directors Remuneration Committee Legal Advisors to Our Company Executive Directors Mr. JIA Shenghua as to Hong Kong law and U.S. law: Mr. SONG Weiping (Chairman) Mr. SZE Tsai Ping, Michael Herbert Smith Mr. SHOU Bainian Mr. CHEN Shunhua (Executive Vice-Chairman) as to PRC law: Mr. CHEN Shunhua Nomination Committee Zhejiang T&C Law Firm Mr. GUO Jiafeng Mr. SZE Tsai Ping, Michael Mr. TSUI Yiu Wa, Alec as to Cayman Islands law and Independent Non-Executive Directors Mr. SHOU Bainian British Virgin Islands law: Maples and Calder Mr. JIA Shenghua Mr. -

INFERNAL AFFAIRS (2002, 101 Min.) Online Versions of the Goldenrod Handouts Have Color Images & Hot Links

November 13 2018 (XXXVII:12) Wai-Keung Lau and Alan Mak: INFERNAL AFFAIRS (2002, 101 min.) Online versions of The Goldenrod Handouts have color images & hot links: http://csac.buffalo.edu/goldenrodhandouts.html DIRECTED BY Wai-Keung Lau (as Andrew Lau) and Alan Mak WRITING Alan Mak and Felix Chong PRODUCED BY Wai-Keung Lau producer (as Andrew Lau), line producers: Ellen Chang and Lorraine Ho, and Elos Gallo (consulting producer) MUSIC Kwong Wing Chan (as Chan Kwong Wing) and Ronald Ng (composer) CINEMATOGRAPHY Yiu-Fai Lai (director of photography, as Lai Yiu Fai), Wai-Keung Lau (director of photography, as Andrew Lau) FILM EDITING Curran Pang (as Pang Ching Hei) and Danny Pang Art Direction Sung Pong Choo and Ching-Ching Wong WAI-KEUNG LAU (b. April 4, 1960 in Hong Kong), in a Costume Design Pik Kwan Lee 2018 interview with The Hollywood Reporter, said “I see every film as a challenge. But the main thing is I don't want CAST to repeat myself. Some people like to make films in the Andy Lau...Inspector Lau Kin Ming same mood. But because Hong Kong filmmakers are so Tony Chiu-Wai Leung...Chen Wing Yan (as Tony Leung) lucky in that we can be quite prolific, we can make a Anthony Chau-Sang Wong...SP Wong Chi Shing (as diverse range of films.” Lau began his career in the 1980s Anthony Wong) and 1990s, serving as a cinematographer to filmmakers Eric Tsang...Hon Sam such as Ringo Lam, Wong Jing and Wong Kar-wai. His Kelly Chen...Dr. -

Music from the 1990S to the Present

j:,/ � • .. ….......:._. ‘. • '1- ;V . jn/w Tnn • ft ¾( ! \ ..' � •'. I . I .广, I n . .....Vv'Z …'.J I O > 3 . • • I •• . ^ • jr ,' ‘:'. ; , ''Jr ... Hong Kong Film Music from the 1990s to the Present CHENG LingYan A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Philosophy in Ethnomusicology © The Chinese University of Hong Kong June 2004 The Chinese University of Hong Kong holds the copyright of this thesis. Any person(s) intending to use a part or whole of the materials in the thesis in a proposed publication must seek copyright release from the Dean of the Graduate School. ^ST university~7^// ^XLIBRARy SYSTEM^W Abstract i Hong Kong Film Music from the 1990s to the Present Submitted by LingYan CHENG for the degree of Master of Philosophy in Ethnomusicology at The Chinese University of Hong Kong in June 2004 Abstract This thesis focuses on Hong Kong film music from the 1990s to the 2000s. In recent years, there has been much research and theory on western film music, especially the Hollywood film industry, by musicologists and scholars in film studies, popular music studies, and other fields. However, there has been little research on Hong Kong Film music, the system of which is different from that of western film music, and therefore I will apply basic film music concepts, but using the real situation of Hong Kong film music to formulate my own argument. The methodology used in this thesis will include the application of basic concepts used by scholars of film music, such as the functions of music in film, combined with fieldwork and analysis of films. -

China Property Sector

China / Hong Kong Industry Focus China Property Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 19 Apr 2021 Spotlight on future land supply • Solid sales growth momentum sustained with strong HSI: 28,970 potential to ink another year of record-high sales • Developers poised to meet their 2021 targets ANALYST Jason LAM +852 3668 4179 [email protected] • Future land supply and new starts as keys to watch for Danielle WANG CFA, +852 3668 4176 [email protected] • Sector top picks: Vanke, COLI, CIFI and Logan Ken HE CFA, +86 21 3896 8221 [email protected] Solid performance in 1Q21; strong potential for another year of Ben Wong [email protected] record-high residential sales. Residential sales in Mar rose 63% y-o-y (or 44% vs Mar-19) on the back of a 38% (or 19% vs Mar- Recommendation & valuation 19) increment in residential GFA sold and 19% (or 21% vs Mar- 19) rise in residential ASP, marking another solid month of FY22F physical market performance. We believe the market is well- Target Price Price Rec Mkt Cap PE poised to post another record-high sales value this year – as it HK$ HK$ US$bn x will likely attain 2020’s level even if the market records a 12.5% y- o-y decline for the remaining nine months. China Overseas Developers well on track to achieve their 2021 targets. Presales 20.15 25.70 BUY 28.4 4.0 (688 HK) growth of 30 listed developers we track on a weighted-average China Vanke 'H' 28.25 45.56 BUY 49.9 5.3 basis remained strong at 47% y-o-y (or +33% vs Mar 2019) in (2202 HK) Mar (Feb-21: 144%), as compared to their c.10% weighted Logan Property 12.50 16.44 BUY 8.9 3.5 average presales target for 2021.