Leadershares® Dynamic Yield ETF DYLD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Un Global Compact Communication on Progress (Cop)

Mabroc Teas (Pvt.) Ltd - 2019/2020 UN GLOBAL COMPACT COMMUNICATION ON PROGRESS (COP) 1.0 Statement of Continued Support 6th February 2020 To our stakeholders, With all the difficulties experienced in the international market place during the year 2019, Mabroc Teas continued communicating the commitment to the principles of the United Nations Global Compact reaffirming the ten principles in the areas of Human Rights, Labor, Environment and Anti-Corruption. The ethical business practices we follow on the guidelines of UNGC was further strengthened by Mabroc by integrating the Global Compact and its principles into our business strategy, culture and daily operations. We are also committed to share this information with our stakeholders using our primary channels of communication. We would like to take this opportunity to wish the United Nations Global Compact continued success in their endeavors in promoting these noble principles around the world. Yours Sincerely, MABROC TEAS (PVT.) LTD. Niran Ranatunge Managing Director 1 Mabroc Teas (Pvt.) Ltd - 2019/2020 2.0 Mabroc Teas Corporate Sustainability Programme: Tea without Tears Tea without tears (TWT) is our way of taking care of our most valuable asset, our human resources irrespective of designation of seniority; it is them who make up the Mabroc family. Each and every person engaged in the company contributes his/her might in creating the fine quality tea that Mabroc is reputed the world over. Tea without tears was started in 2008 by our own employees. During the period of 2019 we accomplished quite a few projects and we have listed some of them in this report. -

Handbook of Religious Beliefs and Practices

STATE OF WASHINGTON DEPARTMENT OF CORRECTIONS HANDBOOK OF RELIGIOUS BELIEFS AND PRACTICES 1987 FIRST REVISION 1995 SECOND REVISION 2004 THIRD REVISION 2011 FOURTH REVISION 2012 FIFTH REVISION 2013 HANDBOOK OF RELIGIOUS BELIEFS AND PRACTICES INTRODUCTION The Department of Corrections acknowledges the inherent and constitutionally protected rights of incarcerated offenders to believe, express and exercise the religion of their choice. It is our intention that religious programs will promote positive values and moral practices to foster healthy relationships, especially within the families of those under our jurisdiction and within the communities to which they are returning. As a Department, we commit to providing religious as well as cultural opportunities for offenders within available resources, while maintaining facility security, safety, health and orderly operations. The Department will not endorse any religious faith or cultural group, but we will ensure that religious programming is consistent with the provisions of federal and state statutes, and will work hard with the Religious, Cultural and Faith Communities to ensure that the needs of the incarcerated community are fairly met. This desk manual has been prepared for use by chaplains, administrators and other staff of the Washington State Department of Corrections. It is not meant to be an exhaustive study of all religions. It does provide a brief background of most religions having participants housed in Washington prisons. This manual is intended to provide general guidelines, and define practice and procedure for Washington State Department of Corrections institutions. It is intended to be used in conjunction with Department policy. While it does not confer theological expertise, it will, provide correctional workers with the information necessary to respond too many of the religious concerns commonly encountered. -

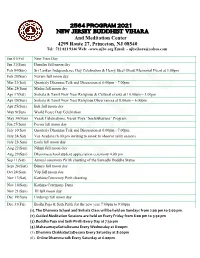

2564 PROGRAM 2021 New Jersey Buddhist Vihara and Meditation Center

2564 PROGRAM 2021 New Jersey Buddhist Vihara And Meditation Center 4299 Route 27, Princeton, NJ 08540 Tel: 732 821 9346 Web: -www.njbv.org Email: - [email protected] Jan 01(Fri) New Year Day Jan 31(Sun) Duruthu full moon day Feb 04(Sun) Sri Lankan Independence Day Celebration & Henry Steel Olcott Memorial Event at 3:00pm Feb 28(Sun) Navam full moon day Mar 21(Sat) Quarterly Dhamma Talk and Discussion at 6:00pm - 7.00pm Mar 28(Sun) Madin full moon day Apr 17(Sat) Sinhala & Tamil New Year Religious & Cultural events at 10.00am – 3.00pm Apr 18(Sun) Sinhala & Tamil New Year Religious Observances at 8.00am – 6.00pm Apr 25(Sun) Bak full moon day May 9(Sun) World Peace Day Celebration May 30(Sun) Vesak Celebrations, Vesak Poya “SeelaBhavana” Program Jun 27(Sun) Poson full moon day July 10(Sat) Quarterly Dhamma Talk and Discussion at 6:00pm - 7.00pm July 24(Sat) Vas Aradana (6.00 pm inviting to monk to observe rainy season) July 25(Sun) Esala full moon day Aug 22(Sun) Nikini full moon day Aug 29(Sun) Dhamma school student appreciation ceremony 4.00 pm Sep 11(Sat) Annual ceremony Pirith chanting of the Samadhi Buddha Statue Sept 26(Sun) Binara full moon day Oct 24(Sun) Vap full moon day Nov 13(Sat) Kathina Ceremony Prith chanting Nov 14(Sun) Kathina Ceremony Dana Nov 21(Sun) Ill full moon day Dec 19(Sun) Unduvap full moon day Dec 31(Fri) Bodhi Puja & Seth Pirith for the new year 7:00pm to 9:00pm (1). -

Document English

$QXUDGKDSXUD$$$QXUDGKDSXUDQQXXUUDDGGKKDDSSXXUUDD 88UEDQ'HYHORSPHQW3ODQ8UEDQ'HYHORSPHQW3ODQ8UUEEDDQQ''HHYYHHOORRSSPPHHQQWW33OODDQQ 9ROXPH, 8UEDQ'HYHORSPHQW$XWKRULW\8UEDQ'HYHORSPHQW$XWKRULW\ 1RUWK&HQWUDO3URYLQFLDO2IILFH1RUWK&HQWUDO3URYLQFLDO2IILFH $$QXUDGKDSXUDQXUDGKDSXUD Anuradhapura Urban Area Development Plan (2019 - 2030) Anuradhapura Urban Development Plan Volume I 2019 - 2030 Urban Development Authority North Central Provincial Office Anuradhapura i Urban Development Authority – North Central Province office Anuradhapura Urban Area Development Plan (2019 - 2030) Anuradhapura Urban Development Plan Volume I Urban Development Authority 2019 - 2030 ii Urban Development Authority – North Central Province office Anuradhapura Urban Area Development Plan (2019 - 2030) Document Information Report Title : Anuradhapura Urban Development Plan Locational Boundary : Anuradhapura Urban Area Gazette No : Stakeholders : Local Resident of Anuradhapura Urban Area, Commuters and Relevant institutions Submission Date : Document Status : Final Report Author : Urban Development Authority – North Central Province Office Document Submission Information: Version No Details Date of Submission Approval for Issue 1 Draft 2 Draft While this report is issued by the authorized parties, it has to be used only for the objectives stated in the report. It is entirely forbidden to use the content of this report by other parties and also for other objectives. The authority will not bear the responsibility for the negative effects of use of the contents of the report for other objectives or by other parties. While this report contains confidential information, it becomes an intellectual property. It is completely forgotten to provide it to other parties without the approval of the authority. i iii Urban Development Authority – North Central Province office Anuradhapura Urban Area Development Plan (2019 - 2030) Honorable Minister’s forward 41 of 1978, the Urban Development Authority by now has completed 40 years of service contributing to planned urban development in Sri Lanka. -

Landmarks Story Poson

SUNDAY JUNE 20, 2021 TIMES POSON PAGE 2 STORY PAGE 3 LANDMARKS PAGE 4 follow us on Poson lights Pic by M. A. Pushpa Kumara www.fundaytimes.lk 2 FESTIVAL TIMES Introducing Buddhism to Lanka By D. C. Ranatunga Mihintale During such a visit by eing the day that Buddhism King Devanampiyatissa, he was introduced to Sri Lanka, heard someone calling him B Poson Poya is an important day ‘Tissa Tissa’. He was taken for Buddhists in Sri Lanka. aback since no one would This year the Poson Poya day dare call him by name, is on Thursday, June 24. being the ruling king. Looking back, it was during As he looked towards the the time kings ruled Sri Lanka. side from where he heard King Pandukabhaya had his name, he saw someone ascended the throne in 437 B.C. in yellow robes appearing (Before Christ) and 70 years later on the huge rock at the city of Anuradhapura had Mihintale, a few miles been established as the ruling city. away from Anuradhapura. King Devanampiyatissa ascended The king immediately the throne in 307 B.C. threw his weapons aside Thus Buddhism was not strange to According to the Mahavamsa – and greeted Arahat Sri Lanka. the Sinhalese chronicle, the Buddha Mahinda, inviting him to come down While ruling the country, the kings had paid three visits to Sri Lanka – and select a suitable spot to stay. were used to visiting various parts of first to Sri Pada (popularly known as Once a spot was selected in the their kingdom and also to get about Adam’s Peak), next to Mahiyangana in Mahamevuna Uyana – the quiet park in merriment, along with the palace the Uva Province, and then to Kelaniya, with trees all around, the king got his assistants. -

Holy Days & Holidays Calendar July 1, 2020

HOLY DAYS & HOLIDAYS CALENDAR JULY 1, 2020 – DECEMBER 31, 2021 JULY 2020 AUGUST 2020 SEPTEMBER 2020 OCTOBER 2020 NOVEMBER 2020 DECEMBER 2020 JANUARY 2021 FEBRUARY 2021 MARCH 2021 APRIL 2021 MAY 2021 JUNE 2021 JULY 2021 AUGUST 2021 SEPTEMBER 2021 OCTOBER 2021 NOVEMBER 2021 DECEMBER 2021 S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S S M T W T F S 1 2 3 4 1 1 2 3 4 5 1 2 3 1 2 3 4 5 6 7 1 2 3 4 5 1 2 1 2 3 4 5 6 1 2 3 4 5 6 1 2 3 1 1 2 3 4 5 1 2 3 1 2 3 4 5 6 7 1 2 3 4 1 2 1 2 3 4 5 6 1 2 3 4 5 6 7 8 9 10 11 2 3 4 5 6 7 8 6 7 8 9 10 11 12 4 5 6 7 8 9 10 8 9 10 11 12 13 14 6 7 8 9 10 11 12 3 4 5 6 7 8 9 7 8 9 10 11 12 13 7 8 9 10 11 12 13 4 5 6 7 8 9 10 2 3 4 5 6 7 8 6 7 8 9 10 11 12 4 5 6 7 8 9 10 8 9 10 11 12 13 14 5 6 7 8 9 10 11 3 4 5 6 7 8 9 7 8 9 10 11 12 13 5 6 7 8 9 10 11 12 13 14 15 16 17 18 9 10 11 12 13 14 15 13 14 15 16 17 18 19 11 12 13 14 15 16 17 15 16 17 18 19 20 21 13 14 15 16 17 18 19 10 11 12 13 14 15 16 14 15 16 17 18 19 20 14 15 16 17 18 19 20 11 12 13 14 15 16 17 9 10 11 12 13 14 15 13 14 15 16 17 18 19 11 12 13 14 15 16 17 15 16 17 18 19 20 21 12 13 14 15 16 17 18 10 11 12 13 14 15 16 14 15 16 17 18 19 20 12 13 14 15 16 17 18 19 20 21 22 23 24 25 16 17 18 19 20 21 22 20 21 22 23 24 25 26 18 19 20 21 22 23 24 22 23 24 25 26 27 28 20 21 22 23 24 25 26 17 18 19 20 21 22 23 21 22 23 24 25 26 27 21 22 23 24 25 26 27 18 19 20 21 22 23 -

The Sinhalese Diaspora in the United Kingdom

The Sinhalese Buddhist Diaspora in the United Kingdom: Negotiating Sinhalese Identity By Nandasinghe Arachchige Jitendra Wijenayake A thesis submitted in partial fulfilment of the requirements of Liverpool John Moores University for the degree of Doctor of Philosophy November 2019 DECLARATION I, Nandasinghe Arachchige Jitendra Wijenayake, confirm that the work presented in this thesis is my own. Where information has been derived from other sources, I confirm this has been indicated in the thesis. Nandasinghe Arachchige Jitendra Wijenayake Total word count: 83462 words i Acknowledgements Firstly, I wish to express my sincere thanks to my first Director of Study, Prof. David Chalcraft, for giving me this opportunity in the first place and guiding me through the first three years of my PhD with his expert knowledge. I would also like to express my sincere gratitude to Dr Simone Krüger Bridge, who assumed the role of Director of Study in the last year of completing my PhD, for guiding me through the final writing up and examination stage. Sincere thanks also go to Dr Sara Parker for her continuous support of my PhD study and related research. Their guidance helped me in all the time of research and writing of this thesis. I could not have imagined of having better supervisors and mentors for my Ph.D. study. Besides my supervisors, I would also like to thank all the members of the Sinhala Buddhist community in the United Kingdom, including the participants, Gatekeepers and all the resources providers for their kindness and support. I take this opportunity to express my gratitude to everyone who supported me throughout my PhD study. -

Sri Lanka That Ancient Sinhalese Dynasties Set up Sigiriya

©Lonely Planet Publications Pty Ltd The Ancient Cities Why Go? Matale ........................... 183 Crumbling temples, lost cities and sacred sites are reason Nalanda ........................ 184 enough to head up country. It was here on the hot central Dambulla ...................... 185 plains of Sri Lanka that ancient Sinhalese dynasties set up Sigiriya.......................... 188 their capitals and supported massive artistic and architec- tural endeavours. Eventually these kingdoms fell, giving na- Polonnaruwa .................192 ture a chance to reclaim the land. Giritale .......................... 198 For more than a century archaeologists have been slowly Mandalagiri Vihara .......200 shedding the many layers of history from this overgrown Habarana ......................200 landscape. The Rock Fort at Sigiriya, the bulging dagobas Ritigala Ruins ...............202 of Polonnaruwa and the serene Buddhas scattered around Anuradhapura ..............202 Anuradhapura are but a few of the sites now considered Mihintale........................211 national treasures. Padeniya ........................214 The area covered in this chapter is commonly called the ‘Cultural Triangle’. Besides the amazing ruins, save time for Panduwasnuwara ..........215 the national parks, which teem with elephants. Plan on Ridi Vihara .....................216 spending several days here, wandering from town to town, Kurunegala ....................216 making new discoveries daily. Best Places to Eat When to Go Dambulla » A&C Restaurant (p 184 ) °C/°F Temp -

Religions and Festivals in Sri Lanka What We Will Learn

Religions and festivals in Sri Lanka What we will learn, • The four main religions in Sri Lanka • The religious places • The religious festivals There are four main religions: • Buddhism • Hinduism • Christianity • Islam Buddhism isthemostpopularreligion It About 70% of Sri Lankan opleisbuddhist pe Buddhism, we follow the In teachings of Lord Buddha ery month, on full moon, we Ev ve a religious holiday to ha orship. w uddhist people go to the temple to pray and worship. B ll temples have three main places to worship; A The 'Vehera' The bo-Tree The shelter where Lord Buddha statue is. • The three main Religious festivals are, Vesak Festival Poson Festival Asala Festival • They are three of the twelve Full-Moon days of the year. Every month, the day of full moon is called 'Poya Day' • It's a national holiday for buddhists to observe their religion. esak Poya day V is the day when we celebrate It ebirth,enlightmentand th eathofLordBuddha. d 'sabeautifulcelebration, It speciallybecauseofthe e anternsandPandolsthat L ecorateseverycityinSri d anka. L Poson Poya day It is the day when we first got • Buddhism in Sri Lanka. There is a story behind it, and • every decoration on this day is based on this story. Asala Poya day ecelebratethestartofthe W inyseasononthisdayin ra ly. Ju startsbybringingoutthe It Tooth Relic into the streets on ebackofanelephantinan th xtravagantparade. e Hinduism It is the religion of many Tamil people, especially in the north of Sri Lanka. In Hinduism, many gods are followed, and they worship and pray to the gods by serving them different food and fruit. -

Arahant Mahinda - Redactor of the Buddhapåjàva in Sinhala Buddhism

Arahant Mahinda - Redactor of the Buddhapåjàva in Sinhala Buddhism This study seeks to establish that Arahant Mahinda, who introduced the Buddhadhamma to Sri Lanka, is the Redactor of the Buddhapåjàva in Sinhala Buddhism. The Sãla Trio – Pa¤ca-, Aññhangika- and Dasa-Sãla, is also found to emerge in the same process. The launch date has been determined to be the full moon day of Kattika in the year 247 BCE, i.e., 2260 years ago (current year: Oct. 1, 2012), or even more likely, 42 days prior to that (parallel: Aug. 18, 2012). By the same Author Buddhism (selected) “‘Asoulity’ as Translation of Anattà: Absence, not Negation”, Canadian Journal of Buddhist Studies (7), 2011, 101-134. Rebirth as Empirical Basis for the Buddha’s Four Noble Truths, Sumeru, 2010. “ ‘Against Belief’: Mindfulness Meditation (satipaññàna bhàvanà) as Empirical Method”, Canadian Journal of Buddhist Studies (5), 2009, 59 - 96. “Inherited Buddhists and Acquired Buddhists”, 2006, Canadian Journal of Buddhist Studies (2), 2009, 103 - 141. Embryo as Person: Buddhism, Bioethics and Society, 2005, Toronto: Nalanda Publishing Canada. You’re What You Sense: Buddha on Mindbody, 2001; Dehiwala, Sri Lanka: Buddhist Cultural Centre. “Whole Body, not Heart, the Seat of Consciousness: the Buddha’s View,” Philosophy East and West, 45: 3 (1995): 409 - 430. Buddhist View of the Dead Body’, in Proceedings of the Transplantation Society, 22:3, 1990. ‘Buddhism in Metropolitan Toronto: a preliminary survey’, Canadian Ethnic Studies, xxi:2, 1989. Arahant Mahinda - Redactor of the Buddhapåjàva in Sinhala Buddhism with Pali Text, Translation and Analysis Suwanda H J Sugunasiri, PhD Library and Archives Canada Cataloguing in Publication Sugunasiri, Suwanda H. -

International Workers' Day the Significance of Vesak

Dæhæna - Monthly e-Newsletter May 2021 Volume 16 Issue 5 Volume 1, Issue 1 Radio 4EB Sri Lankan Group Web Address: https://4ebsrilankan.wordpress.com/ Contact: [email protected] The Significance of Vesak International Workers’ Day The Lumbini park was abundant with Sal trees in full bloom. Flowers International Workers' Day, also known as Labour Day in most coun- that have fallen from trees formed a soft carpet on the ground. On the tries and often referred to as May Day, is a celebration of labourers full moon day in the month of Vesak, Queen Maha Maya, who was and the working classes, that is promoted by the international labour pregnant, was on a journey through the Sal grove to see her parents. movement and occurs every year on 1 May. On her way, she gave birth to a prince in the Sal grove. This was about 2644 years ago. The prince was named Siddhartha Gautama. He lived While it may belong to a tradition of spring in a palace with every luxury at his command. festivals, the date was chosen in 1889 for political reasons by the Marxist Interna- At a young age, he was confronted tional Socialist Congress, which met in with the reality of life and the suf- Paris and established the Second Interna- fering of humankind. Siddhartha, tional as a successor to the earlier Interna- at the age of 29 years, gave up his tional Workingmen's Association. They wealth and position as a prince to adopted a resolution for a "great international demonstration" in sup- seek enlightenment as a spiritual port of working-class demands for the eight-hour day. -

Peel District School Board 2020-21 Days of Significance

Days of Significance July 2020 - December 2021 Peel District School Board 2020-21 Days of Significance This calendar highlights secular and creed-based days of significance. It helps to identify some of the important days of significance, however it is not designed to be a complete listing of all secular and creed-based days. Do not use this calendar to determine creed-based accommodations. Please note that every effort has been made to ensure the accuracy of dates. Some dates are determined by external organizations. If a date falls on a red dot holy day or holiday, schools are encouraged to participate on an alternate day. Changes and updates may occur throughout the year. Please check back regularly. In addition to the days of significance listed below, the Board of Trustees approved the motion to recognize the United Nations Declaration that 2015 to 2024 be declared the International Decade of Peoples of African Descent, beginning September 2020 until the end of 2024. This new Days of Significance format will be under review for the 2020-21 school year. IMPORTANT NOTES: Bahá’í, Judaism and Wicca – days of significance in these faiths begin at sunset on the evening prior to the date shown and end at sunset on the last day shown. Christianity – dates for Christianity are based on the Gregorian calendar unless specified as Julian (J). Islam – dates are tentative as some may vary based on the sighting of the moon. Sikhism – dates are based on the Original Nanakshahi calendar (O) and the Nanakshahi-Revised calendar (R). Zoroastrianism – dates are based on Fasli calendar (FC), Qadimi calendar (QC) and Shenshahi calendar (SC).