We Link People to a Brighter Future

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coin Cart Schedule (From 2014 to 2020) Service Hours: 10 A.M

Coin Cart Schedule (From 2014 to 2020) Service hours: 10 a.m. to 7 p.m. (* denotes LCSD mobile library service locations) Date Coin Cart No. 1 Coin Cart No. 2 2014 6 Oct (Mon) to Kwun Tong District Kwun Tong District 12 Oct (Sun) Upper Ngau Tau Kok Estate Piazza Upper Ngau Tau Kok Estate Piazza 13 Oct (Mon) to Yuen Long District Tuen Mun District 19 Oct (Sun) Ching Yuet House, Tin Ching Estate, Tin Yin Tai House, Fu Tai Estate Shui Wai * 20 Oct (Mon) to North District Tai Po District 26 Oct (Sun) Wah Min House, Wah Sum Estate, Kwong Yau House, Kwong Fuk Estate * Fanling * (Service suspended on Tuesday 21 October) 27 Oct (Mon) to Wong Tai Sin District Sham Shui Po District 2 Nov (Sun) Ngan Fung House, Fung Tak Estate, Fu Wong House, Fu Cheong Estate * Diamond Hill * (Service suspended on Friday 31 October) (Service suspended on Saturday 1 November) 3 Nov (Mon) to Eastern District Wan Chai District 9 Nov (Sun) Oi Yuk House, Oi Tung Estate, Shau Kei Lay-by outside Causeway Centre, Harbour Wan * Drive (Service suspended on Thursday 6 (opposite to Sun Hung Kai Centre) November) 10 Nov (Mon) to Kwai Tsing District Islands District 16 Nov (Sun) Ching Wai House, Cheung Ching Estate, Ying Yat House, Yat Tung Estate, Tung Tsing Yi * Chung * (Service suspended on Monday 10 November and Wednesday 12 November) 17 Nov (Mon) to Kwun Tong District Sai Kung District 23 Nov (Sun) Tsui Ying House, Tak Chak House, Tsui Ping (South) Estate * Hau Tak Estate, Tseung Kwan O * (Service suspended on Tuesday 18 November) 24 Nov (Mon) to Sha Tin District Tsuen Wan -

Annex C Information on Re-Tendering Exercises on the Relevant Service Contracts Conducted/To Be Conducted by FEHD, LCSD and HD in 2018 and 2019

- 1 - Annex C Information on re-tendering exercises on the relevant service contracts conducted/to be conducted by FEHD, LCSD and HD in 2018 and 2019 Procuring department: FEHD Start date of Name of existing/previous new service Service districts involved Name of new contractor contractor contract 1. 1.1.2018 Depots of Transport Section Law's Cleaning Services Limited Integrity Service Limited 2. 1.1.2018 Po On Road Municipal Services Building in Sham Shui Po Johnson Cleaning Services Company Baguio Cleaning Services Company District and Hung Hom Municipal Services Building in Limited Limited Kowloon City District 3. 1.1.2018 Markets in Kwun Tong District Johnson Cleaning Services Company World Environmental Services Limited Limited 4. 1.1.2018 Markets in Tsuen Wan District Johnson Cleaning Services Company Johnson Cleaning Services Company Limited Limited 5. 1.1.2018 Markets in Tuen Mun District Lapco Service Limited Baguio Pest Management Limited 6. 1.1.2018 Public place in Wan Chai District (East) Lapco Service Limited Johnson Cleaning Services Company Limited 7. 1.1.2018 Public place in Wan Chai District (East) Lapco Service Limited Lapco Service Limited 8. 1.2.2018 Markets in Sha Tin District Johnson Cleaning Services Company Lapco Service Limited Limited 9. 1.2.2018 Markets in Islands District Johnson Cleaning Services Company Lapco Service Limited Limited 10. 1.3.2018 Public place in the Territory ISS Environmental Services (HK) ISS Environmental Services (HK) - 2 - Start date of Name of existing/previous new service Service districts involved Name of new contractor contractor contract Limited Limited 11. 1.3.2018 Public place in Wan Chai District (East) Lapco Service Limited Baguio Cleaning Services Company Limited 12. -

29 July 2020 Notice on BOCHK Branch Services Bank of China

29 July 2020 Notice on BOCHK Branch Services Bank of China (Hong Kong) Limited (“BOCHK”) would like to notify its customers and the general public that in view of the current novel coronavirus outbreak, we will review current measures from time to time, and adjust branch services as appropriate. Except for certain branches listed below, 180 BOCHK branches across the city will continue to provide services. Customers may also access banking services via our 24-hour Self-service Banking Centres, ATMs, or electronic means such as Mobile Banking, Internet Banking and Phone Banking. Details of BOCHK outlets are available at our website (www.bochk.com/en/branch.html). For enquiries, please call BOCHK Customer Service Hotline at (852) 3988 2388. From 29 July 2020 (Wednesday) onwards, the services of the following branch will be suspended until further notice: Branch Name Branch Address Hong Kong Shop 4, G/F, Causeway Centre, 28 Harbour Road, Wan Harbour Road Branch# Chai The services of the following branches will remain suspended until further notice: Branch Name Branch Address Kowloon Yuk Wah Street Branch 46-48 Yuk Wah Street, Tsz Wan Shan Shop Nos. A317 and A318, 3/F, Choi Wan Shopping Choi Wan Estate Branch# Centre Phase II, 45 Clear Water Bay Road, Ngau Chi Wan Choi Hung Branch 19 Clear Water Bay Road, Ngau Chi Wan Diamond Hill Branch# G107 Plaza Hollywood, Diamond Hill Ma Tau Kok Road Branch# 39-45 Ma Tau Kok Road, To Kwa Wan Shop 206A, Dragon Centre, 37K Yen Chow Street, Dragon Centre Branch Sham Shui Po Shop 108, Lei Cheng Uk Commercial -

The Globalization of Chinese Food ANTHROPOLOGY of ASIA SERIES Series Editor: Grant Evans, University Ofhong Kong

The Globalization of Chinese Food ANTHROPOLOGY OF ASIA SERIES Series Editor: Grant Evans, University ofHong Kong Asia today is one ofthe most dynamic regions ofthe world. The previously predominant image of 'timeless peasants' has given way to the image of fast-paced business people, mass consumerism and high-rise urban conglomerations. Yet much discourse remains entrenched in the polarities of 'East vs. West', 'Tradition vs. Change'. This series hopes to provide a forum for anthropological studies which break with such polarities. It will publish titles dealing with cosmopolitanism, cultural identity, representa tions, arts and performance. The complexities of urban Asia, its elites, its political rituals, and its families will also be explored. Dangerous Blood, Refined Souls Death Rituals among the Chinese in Singapore Tong Chee Kiong Folk Art Potters ofJapan Beyond an Anthropology of Aesthetics Brian Moeran Hong Kong The Anthropology of a Chinese Metropolis Edited by Grant Evans and Maria Tam Anthropology and Colonialism in Asia and Oceania Jan van Bremen and Akitoshi Shimizu Japanese Bosses, Chinese Workers Power and Control in a Hong Kong Megastore WOng Heung wah The Legend ofthe Golden Boat Regulation, Trade and Traders in the Borderlands of Laos, Thailand, China and Burma Andrew walker Cultural Crisis and Social Memory Politics of the Past in the Thai World Edited by Shigeharu Tanabe and Charles R Keyes The Globalization of Chinese Food Edited by David Y. H. Wu and Sidney C. H. Cheung The Globalization of Chinese Food Edited by David Y. H. Wu and Sidney C. H. Cheung UNIVERSITY OF HAWAI'I PRESS HONOLULU Editorial Matter © 2002 David Y. -

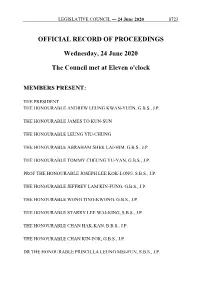

Official Record of Proceedings

LEGISLATIVE COUNCIL ― 24 June 2020 8723 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 24 June 2020 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, G.B.S., J.P. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, G.B.S., J.P. THE HONOURABLE STARRY LEE WAI-KING, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, B.B.S., J.P. THE HONOURABLE CHAN KIN-POR, G.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. 8724 LEGISLATIVE COUNCIL ― 24 June 2020 THE HONOURABLE WONG KWOK-KIN, S.B.S., J.P. THE HONOURABLE MRS REGINA IP LAU SUK-YEE, G.B.S., J.P. THE HONOURABLE PAUL TSE WAI-CHUN, J.P. THE HONOURABLE CLAUDIA MO THE HONOURABLE MICHAEL TIEN PUK-SUN, B.B.S., J.P. THE HONOURABLE STEVEN HO CHUN-YIN, B.B.S. THE HONOURABLE FRANKIE YICK CHI-MING, S.B.S., J.P. THE HONOURABLE WU CHI-WAI, M.H. THE HONOURABLE YIU SI-WING, B.B.S. THE HONOURABLE MA FUNG-KWOK, S.B.S., J.P. THE HONOURABLE CHARLES PETER MOK, J.P. THE HONOURABLE CHAN CHI-CHUEN THE HONOURABLE CHAN HAN-PAN, B.B.S., J.P. -

Wong Tai Sin District(Open in New Window)

District : Wong Tai Sin Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,194) H01 Lung Tsui 15,391 -10.49% N Lung Cheung Road 1. LOWER WONG TAI SIN (II) ESTATE (PART) : NE Po Kong Village Road Lung Chi House E Po Kong Village Road Lung Fai House SE Choi Hung Road Lung Gut House Lung Hing House S Shatin Pass Road, Tung Tau Tsuen Road Lung Kwong House SW Ching Tak Street Lung Lok House Lung On House W Ching Tak Street Lung Shing House NW Ching Tak Street, Lung Cheung Road Lung Wai House 2. WONG TAI SIN DISCIPLINED SERVICES QUARTERS H02 Lung Kai 18,003 +4.71% N Tung Tau Tsuen Road 1. KAI TAK GARDEN 2. LOWER WONG TAI SIN (I) ESTATE NE Shatin Pass Road E Choi Hung Road, Shatin Pass Road SE Choi Hung Road S Choi Hung Road, Tai Shing Street SW Tai Shing Street W Tung Tau Tsuen Road NW Tung Tau Tsuen Road H1 District : Wong Tai Sin Recommended District Council Constituency Areas +/- % of Population Estimated Quota Code Recommended Name Boundary Description Major Estates/Areas Population (17,194) H03 Lung Sheung 20,918 +21.66% N Ngan Chuk Lane 1. LOWER WONG TAI SIN (II) ESTATE (PART) : NE Nga Chuk Street, Wong Tai Sin Road Lung Cheung House E Shatin Pass Road, Ying Fung Lane Lung Fook House SE Ching Tak Street, Lung Cheung Road Lung Hei House Lung Moon House S Fung Mo Street, Tung Tau Tsuen Road Lung Tai House SW Fung Mo Street Lung Wo House 2. -

Annex Compulsory Testing Notices Issued by the Secretary for Food

Annex Compulsory Testing Notices issued by the Secretary for Food and Health on December 30, 2020 Amended List of Specified Premises 1. Hibiscus House, Ma Tau Wai Estate, 9 Shing Tak Street, Kowloon City, Kowloon, Hong Kong 2. David Mansion, 93-103 Woosung Street, Yau Ma Tei, Kowloon, Hong Kong 3. Tung Hoi House, Tai Hang Tung Estate, 88 Tai Hang Tung Road, Shek Kip Mei, Kowloon, Hong Kong 4. Un Mun House, Un Chau Estate, 303 Un Chau Street, Sham Shui Po, Kowloon, Hong Kong 5. Fu Wen House, Fu Cheong Estate, 19 Sai Chuen Road, Sham Shui Po, Kowloon, Hong Kong 6. Cherry House, So Uk Estate, 380 Po On Road, Sham Shui Po, Kowloon, Hong Kong 7. Tao Tak House, Lei Cheng Uk Estate, 10 Fat Tseung Street, Sham Shui Po, Kowloon, Hong Kong 8. Scenic Court, 451-461 Shun Ning Road, Sham Shui Po, Kowloon, Hong Kong 9. Block 11, Rhythm Garden, 242 Choi Hung Road, Wong Tai Sin, Kowloon, Hong Kong 10. Chi Siu House, Choi Wan (I) Estate, 45 Clear Water Bay Road, Wong Tai Sin, Kowloon, Hong Kong 11. Sau Man House, Choi Wan (I) Estate, 45 Clear Water Bay Road, Wong Tai Sin, Kowloon, Hong Kong 12. Kai Fai House, Choi Wan (II) Estate, 55 Clear Water Bay Road, Wong Tai Sin, Kowloon, Hong Kong 13. Ching Yuk House, Tsz Ching Estate, 80 Tsz Wan Shan Road, Wong Tai Sin, Kowloon, Hong Kong 14. Ching Tai House, Tsz Ching Estate, 80 Tsz Wan Shan Road, Wong Tai Sin, Kowloon, Hong Kong 15. -

Saint Honore Cake Shop

Saint Honore Cake Shop Address Telephone G/F, 11 Tung Sing Road, Aberdeen 2873 5881 Shop 402A, Chi Fu Landmark, Pok Fu Lam. 2538 0870 Shop E, G/F, Top View Mansion, 10 Canal Road West, Hong Kong 2575 5161 Ground Floor and Mezzanine Floor, No. 21 Sing Woo Road, Hong Kong 2572 3255 No. 15 Lan Fong Road, Ground Floor, Hong Kong 2752 7706 Shop No. 113b on Level 1 of New Jade Shopping Arcade, Chai Wan Inland Lot No. 120 2625 4831 Shop No. 22 on Ground Floor, Coronet Court, Nos. 321-333 King’s Road & Nos. 1, 3, 5, 7, 7A, 9 & 9A North 2505 7318 Point Road, Hong Kong Shop 113, 1/F, Oi Tung Shopping Ctr., Oi Tung Estate, Shaukeiwan 3156 1438 Shop D, G/F, Pier 3, 11 Man Kwong Street, Central, H.K. 2234 9744 Shop Unit 129, Paradise Mall, Hong Kong 2976 5261 Shop No.4 on Ground Floor and Air-Conditioning Plant Room on 1st Floor of Perfect Mount Gardens, No.1 2543 0138 Po Man Street, Hong Kong Shop No. 1, Ground Floor, V Heun Building, 138 Queen's Road Central, H.K. 2544 0544 Shop No. 2, G/F., East Commercial Block of South Horizons, No. 18A South Horizon Drive, Apleichau, Hong 2871 9155 Kong Shop No. 10, G/F., Fairview Height, 1 Seymour Road, Mid-Levels, Hong Kong 2546 8031 Shop No. 8, Shek Pai Wan Shopping Centre, Shek Pai Wan Estate, Southern, Hong Kong 2425 8979 Shop G3B, G/F, Amoy Plaza, Phase I, 77 Ngau Tau Kok Road, Ngau Tau Kok. -

Open Space at Hing Wah Street West, Sham Shui Po

For discussion PWSC(2015-16)38 (Date to be confirmed) ITEM FOR PUBLIC WORKS SUBCOMMITTEE OF FINANCE COMMITTEE HEAD 703 – BUILDINGS Recreation, Culture and Amenities – Open spaces 434RO – Open space at Hing Wah Street West, Sham Shui Po Members are invited to recommend to the Finance Committee the upgrading of 434RO to Category A at an estimated cost of $122 million in money-of-the-day prices. PROBLEM There are insufficient sports and recreation facilities in the vicinity of Hing Wah Street West, Sham Shui Po to meet the needs of the local community. PROPOSAL 2. The Director of Architectural Services, with the support of the Secretary for Home Affairs, proposes to upgrade 434RO to Category A at an estimated cost of $122 million in money-of-the-day (MOD) prices for the development of open space at Hing Wah Street West, Sham Shui Po. / PROJECT ….. PWSC(2015-16)38 Page 2 PROJECT SCOPE AND NATURE 3. The project site occupies an area of around 8 392 square metres (m2) at the junction of Hing Wah Street West and Tung Chau Street in Sham Shui Po. The proposed scope of works under the project comprises- (a) a garden with soft landscaping and seating areas; (b) an area with fitness stations for the elderly; (c) a children’s play area with a designated area for tri-cycling; (d) a pet garden; (e) a 7-a-side artificial turf football pitch; and (f) a service block with ancillary facilities including toilets, changing rooms, a babycare room, a management office and a store room. -

Register of Public Payphone

Register of Public Payphone Operator Kiosk ID Street Locality District Region HGC HCL-0007 Chater Road Outside Statue Square Central and HK Western HGC HCL-0010 Chater Road Outside Statue Square Central and HK Western HGC HCL-0024 Des Voeux Road Central Outside Wheelock House Central and HK Western HKT HKT-2338 Caine Road Outside Albron Court Central and HK Western HKT HKT-1488 Caine Road Outside Ho Shing House, near Central - Mid-Levels Central and HK Escalators Western HKT HKT-1052 Caine Road Outside Long Mansion Central and HK Western HKT HKT-1090 Charter Garden Near Court of Final Appeal Central and HK Western HKT HKT-1042 Chater Road Outside St George's Building, near Exit F, MTR's Central Central and HK Station Western HKT HKT-1031 Chater Road Outside Statue Square Central and HK Western HKT HKT-1076 Chater Road Outside Statue Square Central and HK Western HKT HKT-1050 Chater Road Outside Statue Square, near Bus Stop Central and HK Western HKT HKT-1062 Chater Road Outside Statue Square, near Court of Final Appeal Central and HK Western HKT HKT-1072 Chater Road Outside Statue Square, near Court of Final Appeal Central and HK Western HKT HKT-2321 Chater Road Outside Statue Square, near Prince's Building Central and HK Western HKT HKT-2322 Chater Road Outside Statue Square, near Prince's Building Central and HK Western HKT HKT-2323 Chater Road Outside Statue Square, near Prince's Building Central and HK Western HKT HKT-2337 Conduit Road Outside Elegant Garden Central and HK Western HKT HKT-1914 Connaught Road Central Outside Shun Tak -

Annex Table 1 Estates with PRH Tenants Permitted to Keep Dogs

Annex Table 1 Estates with PRH tenants permitted to keep dogs under the TPR ESTATE ESTATE 1 AP LEI CHAU ESTATE 29 FU TUNG ESTATE 2 BUTTERFLY ESTATE 30 FUK LOI ESTATE 3 CHAI WAN ESTATE 31 GRANDEUR TERRACE 4 CHAK ON ESTATE 32 HAU TAK ESTATE 5 CHEUNG CHING ESTATE 33 HING MAN ESTATE 6 CHEUNG FAT ESTATE 34 HING TUNG ESTATE 7 CHEUNG HANG ESTATE 35 HING WAH (I) ESTATE 8 CHEUNG HONG ESTATE 36 HING WAH (II) ESTATE 9 CHEUNG KWAI ESTATE 37 HO MAN TIN ESTATE 10 CHEUNG SHAN ESTATE 38 HOI LAI ESTATE 11 CHEUNG WAH ESTATE 39 HONG TUNG ESTATE 12 CHEUNG WANG ESTATE 40 HUNG HOM ESTATE 13 CHING HO ESTATE 41 KA FUK ESTATE 14 CHOI FAI ESTATE 42 KAI TIN ESTATE 15 CHOI FOOK ESTATE 43 KAI YIP ESTATE 16 CHOI HUNG ESTATE 44 KAM PENG ESTATE 17 CHOI WAN (I) ESTATE 45 KIN MING ESTATE 18 CHOI WAN (II) ESTATE 46 KO YEE ESTATE 19 CHOI YING ESTATE 47 KWAI CHUNG ESTATE 20 CHOI YUEN ESTATE 48 KWAI FONG ESTATE 21 CHUK YUEN (SOUTH) ESTATE 49 KWAI SHING EAST ESTATE 22 CHUN SHEK ESTATE 50 KWAI SHING WEST ESTATE 23 CHUNG ON ESTATE 51 KWONG FUK ESTATE 24 FORTUNE ESTATE 52 KWONG TIN ESTATE 25 FU CHEONG ESTATE 53 LAI KING ESTATE 26 FU SHAN ESTATE 54 LAI KOK ESTATE 27 FU SHIN ESTATE 55 LAI ON ESTATE 28 FU TAI ESTATE 56 LAI YIU ESTATE - 2 - ESTATE ESTATE 57 LEE ON ESTATE 85 ON TING ESTATE 58 LEI MUK SHUE (I) ESTATE 86 ON YAM ESTATE 59 LEI MUK SHUE (II) ESTATE 87 PAK TIN ESTATE 60 LEI MUK SHUE ESTATE 88 PING SHEK ESTATE 61 LEI TUNG ESTATE 89 PING TIN ESTATE 62 LEI YUE MUN ESTATE 90 PO LAM ESTATE 63 LEK YUEN ESTATE 91 PO TAT ESTATE 64 LOK FU ESTATE 92 PO TIN ESTATE 65 LOK WAH (NORTH) -

Hong Kong Housing Authority Redevelopment of So Uk Estate Air Ventilation Assessment – Initial Study Report

Hong Kong Housing Authority Redevelopment of So Uk Estate Air Ventilation Assessment – Initial Study Report Issue 1 | 17 Feb 2015 This report takes into account the particular instructions and requirements of our client. It is not intended for and should not be relied upon by any third party and no responsibility is undertaken to any third party. Job number 25236-03 Ove Arup & Partners Hong Kong Ltd Level 5 Festival Walk 80 Tat Chee Avenue Kowloon Tong Kowloon Hong Kong www.arup.com Hong Kong Housing Authority Redevelopment of So Uk Estate Air Ventilation Assessment – Initial Study Report Contents Page Executive Summary 1 1. Introduction 4 1.1 Project Background 4 1.2 Objective 4 1.3 Study Tasks 4 2. Background Information 5 2.1 Site Characteristics 5 2.2 Study Scenarios 6 3. Methodology of AVA Study 13 3.1 Wind Availability 13 3.2 Study Area 16 3.3 Test Point for Local and Site Ventilation Assessment 18 3.4 Assessment Tools 19 4. Results and Discussion 22 4.1 Overall Pattern of Ventilation Performance 22 4.2 Directional Analysis 24 4.3 SVR and LVR 40 4.4 Focus Areas 41 5. Wind Enhancement Features 43 5.1 Stepping Profile of Building Height 43 5.2 Local Air Paths 45 5.3 Empty Bays 48 6. Conclusion 51 Appendices Appendix A VR Result Tables Appendix B Directional VR Contour Plots Appendix C Directional VR Vector Plot | Issue 1 | 17 Feb 2015 \\HKGAET092\PROJECT\JAVIER\SOUKESTATE\AVA_PROPOSED_JUL14\REPORT\AVA_STUDY_SOUKV07_ISSUE1.DOCX Hong Kong Housing Authority Redevelopment of So Uk Estate Air Ventilation Assessment – Initial Study Report Executive Summary Ove Arup and Partners Hong Kong Limited (Arup) is commissioned by Hong Kong Housing Authority (HKHA) to conduct Air Ventilation Assessment (AVA) study for the Redevelopment of So Uk Estate Phases 1 and 2 (the Development).