Summary of Disability-Related Complaint Data All Carriers Total Number of Complaints Submitted: 13766

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

January 2002 Airport Statistics

DENVER INTERNATIONAL AIRPORT DOMESTIC MARKET SHARES OCTOBER 1997 VS. PREVIOUS MONTH AND PREVIOUS YEAR OCTOBER 1997 SEPTEMBER 1997 OCTOBER 1996 (1) REVENUE REVENUE REVENUE PASS. MARKET PASS. MARKET PASS. MARKET AIRLINE IN AND OUT SHARE MONTH AGO SHARE YEAR AGO SHARE AIR WISCONSIN/UAX 63,074 2.32% 71,152 2.60% 56,334 2.25% AMERICAN 106,579 3.91% 107,924 3.94% 96,044 3.84% AMERICAN TRANS AIR 1,092 0.04% 183 0.01% 0 0.00% AMERICA WEST 31,665 1.16% 33,864 1.24% 38,585 1.54% ASPEN MTN AIR 638 0.02% 1,843 0.07% 0 0.00% AV ATLANTIC 0 0.00% 0 0.00% 266 0.01% CARNIVAL AIRLINES 0 0.00% 0 0.00% 96 0.00% CASINO 302 0.01% 826 0.03% 0 0.00% CHAMPION AIR 595 0.02% 380 0.01% 389 0.02% CONTINENTAL 67,076 2.46% 71,538 2.61% 53,690 2.15% DELTA 118,999 4.37% 123,013 4.49% 116,024 4.64% FRONTIER AIRLINES 94,716 3.48% 93,135 3.40% 80,905 3.23% GREAT AMERICAN 0 0.00% 0 0.00% 207 0.01% GREAT LAKES/UAX 9,834 0.36% 12,839 0.47% 17,541 0.70% MESA/UAX 114,728 4.21% 98,407 3.59% 83,879 3.35% MIAMI AIRLINES 131 0.00% 913 0.03% 1,439 0.06% MOUNTAIN AIR EXPRESS 21,134 0.78% 18,074 0.66% 0 0.00% MIDWEST EXPRESS 4,963 0.18% 4,899 0.18% 4,547 0.18% NORTHWEST 57,515 2.11% 59,146 2.16% 50,675 2.03% RENO AIR 9,449 0.35% 10,562 0.39% 11,116 0.44% SUN COUNTRY 7,869 0.29% 4,323 0.16% 5,106 0.20% TWA 30,134 1.11% 32,424 1.18% 33,652 1.35% UNITED 1,794,759 65.91% 1,781,015 65.02% 1,795,290 71.78% US AIRWAYS 33,231 1.22% 38,101 1.39% 32,599 1.30% VANGUARD AIRLINES 12,099 0.44% 10,412 0.38% 22,586 0.90% WESTERN PACIFIC 142,388 5.23% 164,206 5.99% 0 0.00% TOTALS 2,722,970 100.00% 2,739,179 100.00% 2,500,970 100.00% (1) October 1996 revised. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

CTA Carriers US DOT Carriers

CTA Carriers The Canadian Transportation Agency (CTA) has defined the application and disclosure of interline baggage rules for travel to or from Canada for tickets issued on or after 1 April 2015. The CTA website offers a list of carriers filing tariffs with the CTA at https://www.otc-cta.gc.ca/eng/carriers-who-file-tariffs-agency. US DOT Carriers The following is a list of carriers that currently file general rule tariffs applicable for travel to/from the United States. This list should be used by subscribers of ATPCO’s Baggage product for determining baggage selection rules for travel to/from the United States. For international journeys to/from the United States, the first marketing carrier’s rules apply. The marketing carrier selected must file general rules tariffs to/from the United States. Systems and data providers should maintain a list based on the carriers listed below to determine whether the first marketing carrier on the journey files tariffs (US DOT carrier). Effective Date: 14AUG17 Code Carrier Code Carrier 2K Aerolineas Galapagos (AeroGal) AA American Airlines 3P Tiara Air Aruba AB Air Berlin 3U Sichuan Airlines AC Air Canada 4C LAN Colombia AD Azul Linhas Aereas Brasileiras 4M LAN Argentina AF Air France 4O ABC Aerolineas S.A. de C.V. AG Aruba Airlines 4V BVI Airways AI Air India 5J Cebu Pacific Air AM Aeromexico 7I Insel Air AR Aerolineas Argentinas 7N Pan American World Airways Dominicana AS Alaska Airlines 7Q Elite Airways LLC AT Royal Air Maroc 8I Inselair Aruba AV Avianca 9V Avoir Airlines AY Finnair 9W Jet Airways AZ Alitalia A3 Aegean Airlines B0 Dreamjet SAS d/b/a La Compagnie Page 1 Revised 31 July 2017 Code Carrier Code Carrier B6 JetBlue Airways GL Air Greenland BA British Airways HA Hawaiian Airlines BE Flybe Group HM Air Seychelles Ltd BG Biman Bangladesh Airlines HU Hainan Airlines BR Eva Airways HX Hong Kong Airlines Limited BT Air Baltic HY Uzbekistan Airways BW Caribbean Airlines IB Iberia CA Air China IG Meridiana CI China Airlines J2 Azerbaijan Airways CM Copa Airlines JD Beijing Capital Airlines Co., Ltd. -

G410020002/A N/A Client Ref

Solicitation No. - N° de l'invitation Amd. No. - N° de la modif. Buyer ID - Id de l'acheteur G410020002/A N/A Client Ref. No. - N° de réf. du client File No. - N° du dossier CCC No./N° CCC - FMS No./N° VME G410020002 G410020002 RETURN BIDS TO: Title – Sujet: RETOURNER LES SOUMISSIONS À: PURCHASE OF AIR CARRIER FLIGHT MOVEMENT DATA AND AIR COMPANY PROFILE DATA Bids are to be submitted electronically Solicitation No. – N° de l’invitation Date by e-mail to the following addresses: G410020002 July 8, 2019 Client Reference No. – N° référence du client Attn : [email protected] GETS Reference No. – N° de reference de SEAG Bids will not be accepted by any File No. – N° de dossier CCC No. / N° CCC - FMS No. / N° VME other methods of delivery. G410020002 N/A Time Zone REQUEST FOR PROPOSAL Sollicitation Closes – L’invitation prend fin Fuseau horaire DEMANDE DE PROPOSITION at – à 02 :00 PM Eastern Standard on – le August 19, 2019 Time EST F.O.B. - F.A.B. Proposal To: Plant-Usine: Destination: Other-Autre: Canadian Transportation Agency Address Inquiries to : - Adresser toutes questions à: Email: We hereby offer to sell to Her Majesty the Queen in right [email protected] of Canada, in accordance with the terms and conditions set out herein, referred to herein or attached hereto, the Telephone No. –de téléphone : FAX No. – N° de FAX goods, services, and construction listed herein and on any Destination – of Goods, Services, and Construction: attached sheets at the price(s) set out thereof. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Airline Business & Law: Aircraft Acquisition, Finance & Leasing

Airline Business & Law: Aircraft Acquisition, Finance & Leasing Airline Business & Law (ASPL 614) McGill Institute of Air & Space Law Mark Lessard Pillsbury Winthrop Shaw Pittman LLP Table of Contents 1. Introduction: Aircraft as Investments 2. The Principal Players a. Aircraft Operators b. The Metal-Heads c. Sources of Finance 3. Aircraft Acquisition Process a. Selecting Equipment b. OEM Aircraft Purchase Agreements c. Pre-Delivery Payments and Financing d. Secondary Market 4. The Aircraft Leasing Industry a. Operating Leasing vs. Finance Leasing b. Asset Risk Arbitrage vs. Credit Arbitrage c. Depreciation Table of Contents 5. Aircraft Financing Methods a. Airline Credit vs. Asset Values b. Commercial Bank Lending c. Export Credit Agencies d. Capital Markets 6. Legal and Contractual Protections a. Perfecting Security in Aircraft b. Operation, Maintenance and Return Conditions c. Insurance 7. Default and Remedies a. Lease and Loan Defaults b. Airline Bankruptcies c. Foreclosure and Repossession d. Transition and Deficiency 8. Conclusion: Risk and Reward Introduction: Aircraft as Investments Q: What is the surest way to become a millionaire? A: Become a billionaire and start an airline… - Richard Branson Introduction: 10 Reasons for Investor Caution 1. Danger and liability = highly regulated industry (SAFETY!) 2. Variable operating costs, mainly driven by fuel and personnel 3. Highly mobile, crossing national borders and subject to expropriation 4. Expensive to maintain even when not in use 5. Value dependent on maintenance status, variant, upgrades, engine type, operating conditions, line number etc… 6. Highl y cycli cal i nd ust ry (GDP growth necessary b u t not suffi c ien t) 7. Long-dated asset (30 + years) 8. -

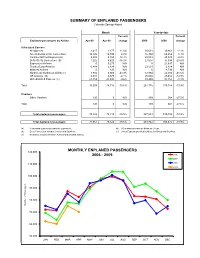

APR 2009 Stats Rpts

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Grand Cayman, Cayman Islands

BIRD TOURISM REPORTS 7/2016 Petri Hottola GRAND CAYMAN, CAYMAN ISLANDS Fig. 1. An Antillean Nighthawk, one of the birds seen during the short Grand Cayman visit. In 2016, June 18th to 20th, I made a brief visit to the island of Grand Cayman, Cayman Islands. The visit was not without its problems, notably those with American Airlines delays and cancellations. Moreover, my need to save money on this exceedingly expensive (accommodation) island resulted in a program not everybody would consider their piece of cake. Nevertheless, some of the mistakes and successes of this trip might be informative or inspiring to other birders who intend to visit Grand Cayman. The target birds were seen, after all. I therefore decided to write a few lines in the form of the following report. This was actually my second visit in Grand Cayman. In 2013, on my way to Cuba, I was in transit in George Town, with Cayman Airways flights. The plan was to look for the near-endemic Vitelline Warbler in a promising spot next to the airport. Unfortunately, nobody was able to confirm our departure time. It could be delayed or early, and I therefore had to check in at once, not being able to leave the building, as planned. Cayman Airways, Bahamasair and various other regional airlines operate in their own cultural realm, in which timetables are not followed the way the rest of the world follows them. It is the so called ‘Caribbean Time Zone’. As a result, I needed to return to Grand Cayman in 2016, and overnight there. -

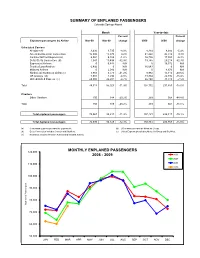

MAR 2009 Stats Rpts

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Mar-09 Mar-08 change 2009 2008 change Scheduled Carriers Allegiant Air 3,436 3,735 -8.0% 8,214 8,684 -5.4% American/American Connection 15,900 15,873 0.2% 41,268 45,510 -9.3% Continental/Cont Express (a) 6,084 6,159 -1.2% 16,736 17,884 -6.4% Delta /Delta Connection (b) 7,041 10,498 -32.9% 19,785 29,218 -32.3% ExpressJet Airlines 0 6,444 N/A 0 16,372 N/A Frontier/Lynx Aviation 6,492 0 N/A 16,643 0 N/A Midwest Airlines 0 2,046 N/A 0 4,673 N/A Northwest/ Northwest Airlink (c) 3,983 6,773 -41.2% 8,982 15,110 -40.6% US Airways (d) 7,001 7,294 -4.0% 19,364 22,892 -15.4% United/United Express (e) 24,980 26,201 -4.7% 66,140 71,510 -7.5% Total 74,917 85,023 -11.9% 197,132 231,853 -15.0% Charters Other Charters 150 188 -20.2% 289 564 -48.8% Total 150 188 -20.2% 289 564 -48.8% Total enplaned passengers 75,067 85,211 -11.9% 197,421 232,417 -15.1% Total deplaned passengers 72,030 82,129 -12.3% 192,861 226,953 -15.0% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Years Years Service Or 20,000 Hours of Flying

VOL. 9 NO. 1 OCTOBER 2001 MAGAZINE OF THE ASSOCIATION OF ASIA PACIFIC AIRLINES 50 50YEARSYEARS Japan Airlines celebrating a golden anniversary AnsettAnsett R.I.PR.I.P.?.? Asia-PacificAsia-Pacific FleetFleet CensusCensus UPDAUPDATETE U.S.U.S. terrterroror attacks:attacks: heavyheavy economiceconomic fall-outfall-out forfor Asia’Asia’ss airlinesairlines VOL. 9 NO. 1 OCTOBER 2001 COVER STORY N E W S Politics still rules at Thai Airways International 8 50 China Airlines clinches historic cross strait deal 8 Court rules 1998 PAL pilots’ strike illegal 8 YEARS Page 24 Singapore Airlines pulls out of Air India bid 10 Air NZ suffers largest corporate loss in New Zealand history 12 Japan Airlines’ Ansett R.I.P.? Is there any way back? 22 golden anniversary Real-time IFE race hots up 32 M A I N S T O R Y VOL. 9 NO. 1 OCTOBER 2001 Heavy economic fall-out for Asian carriers after U.S. terror attacks 16 MAGAZINE OF THE ASSOCIATION OF ASIA PACIFIC AIRLINES HELICOPTERS 50 Flying in the face of bureaucracy 34 50YEARS Japan Airlines celebrating a FEATURE golden anniversary Training Cathay Pacific Airways’ captains of tomorrow 36 Ansett R.I.P.?.? Asia-Pacific Fleet Census UPDATE S P E C I A L R E P O R T Asia-Pacific Fleet Census UPDATE 40 U.S. terror attacks: heavy economic fall-out for Asia’s airlines Photo: Mark Wagner/aviation-images.com C O M M E N T Turbulence by Tom Ballantyne 58 R E G U L A R F E A T U R E S Publisher’s Letter 5 Perspective 6 Business Digest 51 PUBLISHER Wilson Press Ltd Photographers South East Asia Association of Asia Pacific Airlines GPO Box 11435 Hong Kong Andrew Hunt (chief photographer), Tankayhui Media Secretariat Tel: Editorial (852) 2893 3676 Rob Finlayson, Hiro Murai Tan Kay Hui Suite 9.01, 9/F, Tel: (65) 9790 6090 Kompleks Antarabangsa, Fax: Editorial (852) 2892 2846 Design & Production Fax: (65) 299 2262 Jalan Sultan Ismail, E-mail: [email protected] Ü Design + Production Web Site: www.orientaviation.com E-mail: [email protected] 50250 Kuala Lumpur, Malaysia. -

Buttimer Travel Information FINAL

Buttimer Dates • Arrival and check-in: Sunday, June 24, 2018 between 1:00 – 5:00 p.m. • Departure and check-out: Saturday, July 7, 2018 by 1:00 p.m. Getting to Manhattan College • Air Transportation o For those traveling from other countries, many services from maJor non-US airlines may be handled by U.S. carriers through alliances. In the U.S., maJor alliance carriers are: § Oneworld – American Airlines § SkyTeam – Delta Air Lines § Star Alliance – United Airlines o New York City is served by two maJor international airports as well as an “in-town” airport that handles primarily domestic flights. § Newark Liberty International Airport (EWR) • EWR is the most convenient airport to access rail transportation to Manhattan College and is a major operational center for United Airlines. • Passengers arriving at Newark Liberty may take New Jersey Transit (or Amtrak, though that is more expensive) trains to New York Penn Station where they may connect to the Metropolitan Transportation Authority (MTA) #1 Train (Uptown) – the last stop on the #1 Train (Van Cortlandt Park-242 Street) is a short walk to our dormitory and registration. One possible route is as follows: o From your arrival terminal take the Newark AirTrain to the AirTrain/EWR Railroad Station (US $5.50). o At the EWR Railroad Station take the New Jersey Transit Train to Penn Station (US $7.50). Check schedules and fares at the NJ Transit Trip Planner. o At Penn Station purchase a MetroCard (usable on all NYC subways and buses). The NYC Metro Trip Planner can be accessed by clicking here. -

Financial Statements for the Years Ended June 30, 2003 and 2002, Supplemental Schedules for the Year Ended June 30, 2003 and Independent Auditors' Report

State of Hawaii Department of Transportation - Airports Division (An Enterprise Fund of the State of Hawaii) Financial Statements for the Years Ended June 30, 2003 and 2002, Supplemental Schedules for the Year Ended June 30, 2003 and Independent Auditors' Report STATE OF HAWAII DEPARTMENT OF TRANSPORTATION - AIRPORTS DIVISION (An Enterprise Fund of the State Of Hawaii) TABLE OF CONTENTS JUNE 30, 2003 AND 2002 Page Independent Auditors' Report 1-2 Management's Discussion and Analysis 3-14 Financial Statements as of and for the Years Ended June 30, 2003 and 2002: Statements of Net Assets 15-17 Statements of Revenues, Expenses and Changes in Net Assets 18-19 Statements of Cash Flows 20-22 Notes to Financial Statements 23-44 Supplementary Information - Schedules as of and for the Year Ended June 30, 2003: 1 - Operating Revenues and Operating Expenses Other Than Depreciation 45 2 - Calculations of Net Revenues and Taxes and Debt Service Requirement 46-47 3 - Summary of Debt Service Requirements to Maturity 48 4 - Debt Service Requirements to Maturity - Airports System Revenue Bonds 49 5 - Debt Service Requirements to Maturity - General Obligation Bonds 50 6 - Airports System Charges - Fiscal Year 1995-97 Lease Extension 51-53 7 - Approved Maximum Revenue Landing Weights and Airport Landing Fees - Signatory Airlines 54 8 - Approved Maximum Revenue Landing Weights and Airport Landing Fees - Nonsignatory Airlines 55 Deloitte & Touche LLP Suite 1200 1132 Bishop Street Honolulu, Hawaii 96813· 2870 Tel: (808) 543-0700 Fax: (808) 526-0225 www.us.deloitte.com Deloitte &Touche INDEPENDENT AUDITORS' REPORT The Director Department of Transportation State of Hawaii: We have audited the statements of net assets of the Airports Division, Department ofTransportation, State of Hawaii (an enterprise fund of the State of Hawaii) (Airports Division) as of June 30, 2003 and 2002, and the related statements of revenues, expenses and changes in net assets, and of cash flows for the years then ended.