View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Troisième Partie Du Livre De Quatre : 3 / 4

Troisième partie du livre de quatre : 3 / 4. Russel Bouchard Charles Côté Charles-Julien Gauvin Richard Harvey Daniel Larouche Mario Tremblay La Société du 14 Juillet Saguenay-Lac-Saint-Jean, juin 2001 Un document produit en version numérique par Jean-Marie Tremblay, professeur de sociologie au Cégep de Chicoutimi Courriel: [email protected] Site web: http://pages.infinit.net/sociojmt Dans le cadre de la collection: "Les classiques des sciences sociales" Site web: http://www.uqac.uquebec.ca/zone30/Classiques_des_sciences_sociales/index.html Une collection développée en collaboration avec la Bibliothèque Paul-Émile-Boulet de l'Université du Québec à Chicoutimi Site web: http://bibliotheque.uqac.uquebec.ca/index.htm La Société du 14 Juillet (2001), Le Pays trahi (fichier 3 de 4) 2 Cette édition électronique a été réalisée par Jean-Marie Tremblay, professeur de sociologie au Cégep de Chicoutimi à partir de : Le Pays trahi Russel Bouchard Charles Côté Charles-Julien Gauvin Richard Harvey Daniel Larouche Mario Tremblay Une édition électronique réalisée à partir du livre de Russel Bouchard, Charles Côté, Charles-Julien Gauvin, Richard Harvey, Daniel Larouche, Mario Tremblay (2001), Le pays trahi. Chicoutimi : La Société du 14 Juillet, juin 2001, 276 pages. Polices de caractères utilisée : Pour le texte: Times, 12 points. Pour les citations : Times 10 points. Pour les notes de bas de page : Times, 10 points. Édition électronique réalisée avec le traitement de textes Microsoft Word 2001 pour Macintosh. Mise en page sur papier format LETTRE (US letter), 8.5’’ x 11’’) Édition complétée le 2 février 2002 à Chicoutimi, Québec. La Société du 14 Juillet (2001), Le Pays trahi (fichier 3 de 4) 3 http://www3.sympatico.ca/caspalcio/ Nous sommes infiniment reconnaissant à La Société du 14 Juillet de nous accorder son autorisation afin que nous puissions rendre disponible sur Internet, en format numérique, à l’intérieur de la bibliothèque virtuelle Les Classiques des sciences sociales, cette importante étude critique de M. -

L'ascension De Lucien Francoeur Dans Le Champ Littéraire Québécois

UNIVERSITÉ DU Q UÉBEC À MONTRÉAL L'ASCENSION DE LUCIEN FRANCOEUR DANS LE CHAMP LITTÉRAIRE QUÉBÉCOIS MÉMOIRE PRÉSENTÉ COMME EX IG ENCE PARTIELLE DE LA MAÎTRISE EN ÉTUDES LITTÉRAIRES PAR CHARLES MESSIER AOÛT2007 UNIVERSITÉ DU QUÉBEC À MONTRÉAL Service des bibliothèques Avertissement La diffusion de ce mémoire se fait dans leqrespect des droits de son auteur, qui a signé le formulaire Autorisation de reproduire et de diffuser un travail de recherche de cycles supérieurs (SDU-522- Rév.01-2006). Cette autorisation stipule que «conformément ·à l'article 11 du Règlement no 8 des études de cycles supérieurs, [l'auteur] concède à l'Université du Québec à Montréal une licence non exclusive d'utilisation et de . publication oe la totalité ou d'une partie importante de [son] travail de recherche pour des fins pédagogiques et non commerciales. Plus précisément, [l'auteur] autorise l'Université du Québec à Montréal à reproduire, diffuser, prêter, distribuer ou vendre des . copies de. [son] travail de recherche à des fins non commerciales sur quelque support que ce soit, y compris l'Internet. Cette licence et cette autorisation n'entraînent pas une renonciation de [la] part [de l'auteur] à [ses] droits moraux ni à [ses] droits de propriété intellectuelle. Sauf entente contraire, [l'auteur] conserve la liberté de diffuser et de commercialiser ou non ce travail dont [il] possède un exemplaire.» REMERCIEMENTS Merci à mon directeur, Daniel Chartier, pour sa confiance, pour avoir su être présent et discret aux bons moments, pour m'avoir donné la chance de travailler à ses côtés et pour m'avoir permis d'apprendre en me lançant des défis à ma mesure. -

Avis De Convocation À L'assemblée Annuelle Et Circulaire De Sollicitation

Circulaire de sollicitation de procurations de la direction Avis de convocation à l’assemblée annuelle et extraordinaire des actionnaires de 2021 Table des matières Lettre aux actionnaires ......................... 1 Régimes d’unités d’actions différées ............ 24 Circulaire de sollicitation de procurations de la Tableau de la rémunération des administrateurs . 25 direction .................................... 3 Rémunération des hauts dirigeants ............... 26 Remise des documents relatifs à l’assemblée ........ 3 Analyse de la rémunération ................... 26 Procédure de notification et d’accès ............ 3 Gouvernance de la rémunération ............... 27 Comment consulter les documents par voie Gestion des risques liés à la rémunération ........ 27 électronique ............................... 4 Actionnariat requis .......................... 33 Aperçu des résultats de la Société .............. 34 Comment obtenir un exemplaire imprimé ........ 4 Décisions relatives au régime incitatif annuel du Demandes de renseignements ................. 4 chef de la direction .......................... 35 Ordre du jour de l’assemblée annuelle ............ 4 Tableau récapitulatif de la rémunération ......... 36 1. Recevoir les états financiers ................. 4 Attributions aux termes des régimes incitatifs ..... 38 2. Approuver les modifications de nos statuts ..... 4 Prestations de retraite ....................... 40 3. Élire les administrateurs .................... 5 Prestations en cas de cessation d’emploi et de 4. Nommer les auditeurs -

Andra Bolotin's Biography

BIOGRAPHY Andra Bolotin Chief Financial Officer, Putnam Investments Executive Vice President, Chief Financial Officer, Great West-Lifeco U.S. Chief Financial Officer, Great-West Financial Ms. Bolotin is Chief Financial Officer of Putnam Investments and Great-West Financial, reporting directly to Robert L. Reynolds, President and CEO of Putnam Investments and Great-West Financial. She is also a member of Putnam's Operating Committee. Ms. Bolotin was appointed Chief Financial Officer of Great- West Financial in 2015, Executive Vice President, Chief Financial Officer, of Great-West Lifeco U.S. in 2016, and Chief Financial Officer of Putnam Investments in 2017. In her role as Chief Financial Officer, she is responsible for the financial oversight, accounting, reporting, analysis, and planning across Putnam's lines of business and brands operating under Great-West Financial, including Empower Retirement. She joined Putnam in 2008 and has been in the investment industry since 2004. Previously at Putnam, Ms. Bolotin served as Head of Corporate Finance and Controller. Prior to joining Putnam, she was a Senior Vice President and Chief Financial Officer of a business group at Fidelity Investments and earlier served as Senior Vice President of Corporate Finance. Prior to Fidelity, Ms. Bolotin held several roles of increasing responsibility at Polaroid Corporation, including Vice President and Treasurer, Vice President of Strategy, and Senior Controller. Earlier in her career, Ms. Bolotin was an Engagement Manager at McKinsey & Company and served as a Financial Consultant at IBM Corporation. Ms. Bolotin earned an M.B.A. and an M.S. in Chemical Engineering from the Massachusetts Institute of Technology and a B.S. -

Carbon Disclosure Project 2014 TABLE of CONTENTS

Carbon Disclosure Project 2014 TABLE OF CONTENTS Introduction 3 MANAGEMENT 6 1 › Governance 7 2 › Strategy 9 3 › Targets and Initiatives 17 4 › Communication 21 RISKS AND OPPORTUNITIES 22 5 › Climate Change Risks 23 6 › Climate Change Opportunities 26 EMISSIONS 29 7 › Emissions Methodology 30 8 › Emissions Data (1 Jan 2013–31 Dec 2013) 32 9 › Scope 1 Emissions Breakdown (1 Jan 2013–31 Dec 2013) 33 10 › Scope 2 Emissions Breakdown (1 Jan 2013–31 Dec 2013) 33 11 › Energy 33 12 › Emissions Performance 34 13 › Emissions Trading 36 Carbon 14 › Scope 3 Emissions 37Disclosure SIGN OFF 41 Project 15 › Sign Off 42 2014 INTRODUCTION CC0.1 Please give a general description and introduction to your organization. Incorporated in 1925, Power Corporation of Canada (hereinafter “Power Corporation” or the “Corporation”) is a diversified international management and holding company with interests in companies in the financial services, communications and other business sectors. Financial Services (over 98% of assets) Power Corporation’s principal asset, Power Financial Corporation, holds substantial interests in the financial services industry through its controlling interest in each of Great-West Lifeco Inc. and IGM Financial Inc. (our major publicly traded subsidiaries). Great-West Lifeco is an international financial services holding company with interests in life insurance, health insurance, retirement and investment services, asset management and reinsurance businesses. The company has operations in Canada, the United States, Europe and Asia through The Great-West Life Assurance Company, London Life Insurance Company, The Canada Life Assurance Company, Irish Life Group Limited, Great-West Life & Annuity Insurance Company (Great-West Financial) and Putnam Investments, LLC. -

Directors' Report to Shareholders

DIRECTORS’ REPORT TO SHAREHOLDERS The Power Corporation group of companies, our investment funds and investments performed well in 2013, with increased returns from the financial services businesses and a meaningful contribution from investing activities. Equity markets in North America increased significantly, while European markets improved more modestly as economies continued to recover. As well, interest rates moved upward, reflecting the improving global economic conditions. Our results indicate that we have the strategies, risk management culture, capital and liquidity to navigate these economic conditions successfully and that investment gains represent an attractive upside to our business. Power Corporation’s financial services companies are management culture, our credit skills and the resilience of focused on providing protection, asset management, and our distribution channels. We believe that this approach retirement savings products and services. We continue to has produced industry-leading results at Great-West Lifeco believe that the demographic trends affecting retirement and IGM Financial, as well as a resilient portfolio of high- savings, coupled with strong evidence that advice from quality companies in the Pargesa group. a qualified financial advisor creates added value for our Our investment activities continued to demonstrate their clients, reinforce the soundness of our strategy of building return potential in 2013. In applying the Power Corporation an advice-based multi-channel distribution platform in investment -

U Ottawa L'universiw Canadienne Canada's University ITTTT FACULTE DES ETUDES SUPERIEURES T=L FACULTY of GRADUATE and ET POSTOCTORALES U Ottawa POSDOCTORAL STUDIES

u Ottawa L'UniversiW canadienne Canada's university ITTTT FACULTE DES ETUDES SUPERIEURES t=l FACULTY OF GRADUATE AND ET POSTOCTORALES U Ottawa POSDOCTORAL STUDIES L'University canadienne Canada's university Drew Justin Swanson M.A. (Political Science) _____„___.„ School of Political Science -FACULTOCOI^ The End of Medicare or Did Anything Even Change? Examining Discourses in the Wake of Chaoulli v. Quebec TITRE DE LA THESE / TITLE OF THESIS Michael Orsini Nathalie Burlone Jonathan Paquette .Gari.w„-.?Me.L Le Doyen de la Faculte des etudes superieures et postdoctorales / Dean of the Faculty of Graduate and Postdoctoral Studies The End of Medicare or Did Anything Even Change? Examining Discourses in the wake of Chaoulli v. Quebec By Drew J. Swanson Thesis submitted in partial fulfillment of the requirements for the Degree of Master of Arts in Public Administration University of Ottawa October, 2010 © Drew Justin Swanson, Ottawa, Canada, Library and Archives Bibliotheque et 1*1 Canada Archives Canada Published Heritage Direction du Branch Patrimoine de I'edition 395 Wellington Street 395, rue Wellington Ottawa ON K1A 0N4 Ottawa ON K1A 0N4 Canada Canada Your file Votre reference ISBN: 978-0-494-73869-6 Our Me Notre reference ISBN: 978-0-494-73869-6 NOTICE: AVIS: The author has granted a non L'auteur a accorde une licence non exclusive exclusive license allowing Library and permettant a la Bibliotheque et Archives Archives Canada to reproduce, Canada de reproduire, publier, archiver, publish, archive, preserve, conserve, sauvegarder, conserver, transmettre au public communicate to the public by par telecommunication ou par I'lnternet, preter, telecommunication or on the Internet, distribuer et vendre des theses partout dans le loan, distribute and sell theses monde, a des fins commerciales ou autres, sur worldwide, for commercial or non support microforme, papier, electronique et/ou commercial purposes, in microform, autres formats. -

Carbon Disclosure Project 2020

Carbon Disclosure Project 2020 Carbon Disclosure Project 2020 TABLE OF CONTENTS INTRODUCTION 3 EMISSIONS BREAKDOWN 65 Emissions performance 66 GOVERNANCE 6 Board oversight ENERGY 7 68 Management responsibility Energy 9 spend 69 Employee incentives Energy-related 10 activities 69 RISKS AND OPPORTUNITIESADDITIONAL 14 METRICS 70 Management processes Other 15 climate-related metrics 71 Risk disclosure 34 Opportunity disclosure VERIFICATION 35 74 Other verified data 76 BUSINESS STRATEGY 36 Business strategy: Financial CARBONservices 43 PRICING 77 Project-based carbon credits 78 TARGETS AND PERFORMANCEInternal 46 price on carbon 79 Emissions targets 47 Emissions reduction initiativesENGAGEMENT 50 85 Low-carbon products Value 53 chain engagement 86 Public policy engagement 93 EMISSIONS METHODOLOGY 56 Communications 99 Base year Industry emissions collaboration 57 101 Emissions methodology 57 PORTFOLIO IMPACT 102 EMISSIONS DATA Portfolio 58 alignment 106 Scope 1 59 emissions data Scope 2 emissionsSIGNOFF reporting 108 59 Scope 2 emissions data 60 Exclusions 60 Scope 3 emissions data 61 Emissions intensities 64 C0 Introduction Introduction (C0.1) Give a general description and introduction to your organization. Incorporated in 1925, Power Corporation of Canada (Power Corporation or the Corporation) is an international management and holding company that focuses on financial services in North America, Europe and Asia. Its core holdings are leading insurance, retirement, wealth management and investment businesses, including a portfolio of alternative asset investment platforms. Financial Services (approx. 98% of assets) Power Corporation holds substantial interests in the financial services industry through its controlling interest in each of Great-West Lifeco Inc. (Lifeco) and IGM Financial Inc. (IGM) (our major publicly traded subsidiaries). -

Brief Regarding the Future of Regional News Submitted to The

Brief Regarding the Future of Regional News Submitted to the Standing Committee on Canadian Heritage By The Fédération nationale des communications – CSN April 18, 2016 Contents Contents ............................................................................................................................................................................ 3 Foreword .......................................................................................................................................................................... 5 Introduction .................................................................................................................................................................... 5 The role of the media in our society ..................................................................................................................... 7 The informative role of the media ......................................................................................................................... 7 The cultural role of the media ................................................................................................................................. 7 The news: a public asset ............................................................................................................................................ 8 Recent changes to Quebec’s media landscape .................................................................................................. 9 Print newspapers .................................................................................................................................................... -

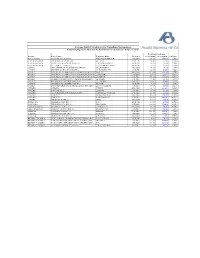

Average Daily Circulation for Canadian Newspapers Preliminary Figures As Filed with the Audit Bureau of Circulations -- Subject to Audit

Average Daily Circulation for Canadian Newspapers Preliminary Figures as Filed with the Audit Bureau of Circulations -- Subject to Audit Total Paid Circulation Province City (County) Newspaper Name Frequency As of 9/30/09 As of 9/30/08 % Change NOVA SCOTIA HALIFAX (HALIFAX CO.) CHRONICLE-HERALD AVG (M-F) 108 182 110 875 -2,43% NEW BRUNSWICK FREDERICTON (YORK CO.) GLEANER MON-FRI 20 863 21 553 -3,20% NEW BRUNSWICK MONCTON (WESTMORLAND CO.) TIMES-TRANSCRIPT MON-FRI 36 115 36 656 -1,48% NEW BRUNSWICK ST. JOHN (ST. JOHN CO.) TELEGRAPH-JOURNAL MON-FRI 32 574 32 946 -1,13% QUEBEC CHICOUTIMI (LE FJORD-DU-SAGUENAY) LE QUOTIDIEN AVG (M-F) 26 635 26 996 -1,34% QUEBEC GRANBY (LA HAUTE-YAMASKA) LA VOIX DE L'EST MON-FRI 14 951 15 483 -3,44% QUEBEC MONTREAL (COMMUNAUTE-URBAINE -DE-MONTREAL)GAZETTE AVG (M-F) 147 668 143 782 2,70% QUEBEC MONTREAL (COMMUNAUTE-URBAINE- DE-MONTREAL)LE DEVOIR AVG (M-F) 26 099 26 181 -0,31% QUEBEC MONTREAL (COMMUNAUTE-URBAINE- DE-MONTREAL)LA PRESSE AVG (M-F) 198 306 200 049 -0,87% QUEBEC QUEBEC (COMMUNAUTE- URBAINE-DE-QUEBEC) LE SOLEIL AVG (M-F) 77 032 81 724 -5,74% QUEBEC SHERBROOKE (SHERBROOKE CO.) LA TRIBUNE AVG (M-F) 31 617 32 006 -1,22% QUEBEC SHERBROOKE (SHERBROOKE CO.) RECORD MON-FRI 4 367 4 539 -3,79% QUEBEC TROIS-RIVIERES (FRANCHEVILLE CEN. DIV. (MRC) LE NOUVELLISTE AVG (M-F) 41 976 41 886 0,21% ONTARIO OTTAWA CITIZEN AVG (M-F) 118 373 124 654 -5,04% ONTARIO OTTAWA-HULL LE DROIT AVG (M-F) 35 146 34 538 1,76% ONTARIO THUNDER BAY (THUNDER BAY DIST.) CHRONICLE-JOURNAL AVG (M-F) 25 495 26 112 -2,36% ONTARIO TORONTO GLOBE AND MAIL AVG (M-F) 301 820 329 504 -8,40% ONTARIO TORONTO NATIONAL POST AVG (M-F) 150 884 190 187 -20,67% ONTARIO WINDSOR (ESSEX CO.) STAR AVG (M-F) 61 028 66 080 -7,65% MANITOBA BRANDON (CEN. -

Putnam VT Small Cap Value Fund

Putnam Variable Trust Putnam VT Small Cap Value Fund Annual report 12 | 31 | 20 Message from the Trustees February 12, 2021 Dear Shareholder: The world welcomed 2021 with high hopes for improvement in the global economy and public health. Although COVID-19 infections have reached new levels, distribution of vaccines is underway, boosting optimism about a return to normal in the not-too-distant future. In the United States, new proposals to rebuild the economy are anticipated from the Biden administration. The stock and bond markets started the year in good shape, indicating that investors are willing to look beyond current challenges and see the potential for renewed economic growth. Putnam continues to employ active strategies that seek superior investment performance for you and your fellow shareholders. Putnam’s portfolio managers and analysts take a research-intensive approach that includes risk management strategies designed to serve you through changing conditions. As always, thank you for investing with Putnam. Respectfully yours, Robert L. Reynolds President and Chief Executive Officer Putnam Investments Kenneth R. Leibler Chair, Board of Trustees Performance summary (as of 12/31/20) Investment objective Portfolio composition Capital appreciation Financials 26.1% Net asset value December 31, 2020 Industrials 20.2% Class IA: $10.18 Class IB: $10.01 Consumer discretionary 14.1% Materials 11.2% Total return at net asset value Real estate 7.0% Russell 2000 Information technology 5.1% (as of 12/31/20) Class IA shares* Class IB shares* Value Index Energy 4.3% 1 year 4.12% 3.96% 4.63% Health care 4.1% 5 years 43.81 42.24 58.53 Communication services 4.0% Annualized 7.54 7.30 9.65 Utilities 2.8% 10 years 125.50 120.16 129.43 Consumer staples 1.3% Annualized 8.47 8.21 8.66 Cash and net other assets –0.2% Life 498.57 468.63 532.11 Annualized 8.61 8.35 8.88 For a portion of the periods, the fund had expense limitations, without which Allocations are shown as a percentage of the fund’s net assets. -

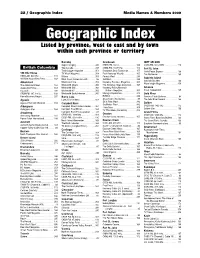

Geographic Index Media Names & Numbers 2009 Geographic Index Listed by Province, West to East and by Town Within Each Province Or Territory

22 / Geographic Index Media Names & Numbers 2009 Geographic Index Listed by province, west to east and by town within each province or territory Burnaby Cranbrook fORT nELSON Super Camping . 345 CHDR-FM, 102.9 . 109 CKRX-FM, 102.3 MHz. 113 British Columbia Tow Canada. 349 CHBZ-FM, 104.7mHz. 112 Fort St. John Truck Logger magazine . 351 Cranbrook Daily Townsman. 155 North Peace Express . 168 100 Mile House TV Week Magazine . 354 East Kootenay Weekly . 165 The Northerner . 169 CKBX-AM, 840 kHz . 111 Waters . 358 Forests West. 289 Gabriola Island 100 Mile House Free Press . 169 West Coast Cablevision Ltd.. 86 GolfWest . 293 Gabriola Sounder . 166 WestCoast Line . 359 Kootenay Business Magazine . 305 Abbotsford WaveLength Magazine . 359 The Abbotsford News. 164 Westworld Alberta . 360 The Kootenay News Advertiser. 167 Abbotsford Times . 164 Westworld (BC) . 360 Kootenay Rocky Mountain Gibsons Cascade . 235 Westworld BC . 360 Visitor’s Magazine . 305 Coast Independent . 165 CFSR-FM, 107.1 mHz . 108 Westworld Saskatchewan. 360 Mining & Exploration . 313 Gold River Home Business Report . 297 Burns Lake RVWest . 338 Conuma Cable Systems . 84 Agassiz Lakes District News. 167 Shaw Cable (Cranbrook) . 85 The Gold River Record . 166 Agassiz/Harrison Observer . 164 Ski & Ride West . 342 Golden Campbell River SnoRiders West . 342 Aldergrove Campbell River Courier-Islander . 164 CKGR-AM, 1400 kHz . 112 Transitions . 350 Golden Star . 166 Aldergrove Star. 164 Campbell River Mirror . 164 TV This Week (Cranbrook) . 352 Armstrong Campbell River TV Association . 83 Grand Forks CFWB-AM, 1490 kHz . 109 Creston CKGF-AM, 1340 kHz. 112 Armstrong Advertiser . 164 Creston Valley Advance.