Significantly Regulated Organizations Added ‐ May 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Scanned Image

3130 W 57th St, Suite 105 Sioux Falls, SD 57108 Voice: 605-373-0201 Fax: 605-271-5721 [email protected] www.greatplainsfa.com Securities offered through First Heartland Capital, Inc. Member FINRA & SIPC. Advisory Services offered through First Heartland Consultants, Inc. Great Plains Financial Advisors, LLC is not affiliated with First Heartland Capital, Inc. In this month’s recap: the Federal Reserve eases, stocks reach historic peaks, and face-to-face U.S.-China trade talks formally resume. Monthly Economic Update Presented by Craig Heien with Great Plains Financial Advisors, August 2019 THE MONTH IN BRIEF July was a positive month for stocks and a notable month for news impacting the financial markets. The S&P 500 topped the 3,000 level for the first time. The Federal Reserve cut the country’s benchmark interest rate. Consumer confidence remained strong. Trade representatives from China and the U.S. once again sat down at the negotiating table, as new data showed China’s economy lagging. In Europe, Brexit advocate Boris Johnson was elected as the new Prime Minister of the United Kingdom, and the European Central Bank indicated that it was open to using various options to stimulate economic activity.1 DOMESTIC ECONOMIC HEALTH On July 31, the Federal Reserve cut interest rates for the first time in more than a decade. The Federal Open Market Committee approved a quarter-point reduction to the federal funds rate by a vote of 8-2. Typically, the central bank eases borrowing costs when it senses the business cycle is slowing. As the country has gone ten years without a recession, some analysts viewed this rate cut as a preventative measure. -

New Years Trading Schedule 2021

New Years Trading Schedule 2021 Product Thurs Dec 31st Fri Jan 1st Mon Jan 4th Tues Jan 5th Australian Securities Exchange | ASX 9:30pm Wednesday Night All Products Early Close Closed Normal Hours Normal Hours Chicago Mercantile Exchange | CME Currency & Eurodollar Normal Hours Closed Normal Hours Normal Hours Equity Index Normal Hours Closed Normal Hours Normal Hours Livestock 8:30am Livestock & Lumber Normal Hours Closed Open/Lumber 9am Open Normal Hours Dairy 1:55pm Early Close Closed Normal Hours Normal Hours Globex Bitcoin Normal Hours Closed Normal Hours Normal Hours Globex Currency & Eurodollar Normal Hours Closed Normal Hours Normal Hours Globex Equity Index Normal Hours Closed Normal Hours Normal Hours Pre-Open 8am - Livestock 8:30am Open/Pre-Open Globex Livestock & Lumber Normal Hours Closed 6am - Lumber 9am Open Normal Hours Globex Dairy 1:55pm Early Close Closed Normal Hours Normal Hours Chicago Board of Options Exchange | CBOE CBOE/CFE 12:15pm Early Close Closed Normal Hours Normal Hours Chicago Board of Trade | CBOT Treasuries Normal Hours Closed Normal Hours Normal Hours Grains Normal Hours Closed 8:30am Open Normal Hours Globex Treasuries Normal Hours Closed Normal Hours Normal Hours MGEX Wheat Pre-Open 7:45am/Pre-Open 8:00am - Globex Grains Normal Hours Closed 8:30am Open Normal Hours Montreal Exchange | MX Interest Rates 12:30pm Early Close Closed Normal Hours Normal Hours Stock Indices Normal Hours Closed Normal Hours Normal Hours ICE Futures Canada | ICE All Products Normal Hours Closed Normal Hours Normal Hours European -

Norway – United States

NORWAY – UNITED STATES Overview of requirements for listing shares on Oslo Børs vs NYSE Euronext / NASDAQ April 2014 Overview ∙ This presentation has been prepared with respect to listing of shares on the regulated markets operated by the Oslo Stock Exchange and NYSE Euronext and NASDAQ − In Norway: Oslo Børs and Oslo Axess − In the United States (US): New York Stock Exchange Euronext (NYSE) and NASDAQ Stock Market (NASDAQ) ∙ This presentation has been prepared by Advokatfirmaet Selmer DA for matters pertaining to Norwegian law and by Akin Gump Straus Hauer & Feld LLP for matters pertaining to US law, based on their experience for Norway and US transactions respectively, to provide an overview with respect to certain listing requirements and obligations in relation to listing on Oslo Børs / Oslo Axess vs NYSE / Nasdaq ∙ This presentation comprises only general information on certain Norwegian and US regulations related to listing, and registration of securities, and the continuing obligations of companies listed on Oslo Børs / Oslo Axess and NYSE / Nasdaq, and is not a complete nor exhaustive description of such obligations or other matters that could impact the regulations or application of such regulations. This presentation is prepared for information purposes only as of the date hereof, and shall not be considered nor construed as legal advice in any respect. No liability or responsibility are accepted as a result of this presentation 2 Main features for listing in Norway and the US 03 Listing in Norway 05 Listing in the US 10 Listing comparisons - fees and continuing obligations 16 Prospectus and registration requirements 20 American Depository Receipts, FPIs and EGCs 24 Contact persons 31 Main features for listing in Norway vs US Norway United States Time listing process Formal listing process takes minimum 8 weeks (fast Varies. -

Base Prospectus Dated 21 November 2019

BASE PROSPECTUS DATED 21 NOVEMBER 2019 Heimstaden Bostad AB (publ) (incorporated with limited liability in Sweden) €4,000,000,000 Euro Medium Term Note Programme Under this €4,000,000,000 Euro Medium Term Note Programme (the "Programme"), Heimstaden Bostad AB (publ) (the "Issuer") may from time to time issue notes (the "Notes") denominated in any currency agreed between the Issuer and the relevant Dealers (as defined below). Notes may be issued in bearer or registered form (respectively "Bearer Notes" and "Registered Notes") or in uncertificated book entry form ("VPS Notes") settled through the Norwegian Central Securities Depositary, Verdipapirsentralen ASA (the "VPS"). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €4,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement described herein), subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under "Overview of the Programme" and any additional Dealer appointed under the Programme from time to time by the Issuer (each a "Dealer" and together the "Dealers"), which appointment may be for a specific issue or on an ongoing basis. References in this Base Prospectus to the "relevant Dealer" shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see "Risk Factors". -

Additional Provisions Applicable When Trading Asian Markets Using Electronic Connectivity

ADDITIONAL PROVISIONS APPLICABLE WHEN TRADING ASIAN MARKETS USING ELECTRONIC CONNECTIVITY A. Rules for Trading on Asian markets 1. Applicable Law You acknowledge and agree that you must comply in all respects with Applicable Law, including in relation to short sales of securities when using the Trading System. 2. Asian Exchange “Asian Exchange” means exchanges, markets or associations of dealers to which the Relevant JPMorgan Entity (either directly or through its agents) from time to time provides DMA to Client for the purchase and sale of securities, including, without limitation, exchanges in Australia, Hong Kong, Japan, Korea, Singapore, Taiwan, India, Indonesia, Malaysia, Thailand and/or such other countries as may be determined from time to time. 3. Relevant JPMorgan Entity “Relevant JPMorgan Entity” means any one or more of the JPMorgan brokers with whom you have a contractual relationship to trade securities electronically, and for the avoidance of doubt may include, without limitation, any one or more of the following: J.P. Morgan Securities Australia Limited, J.P. Morgan Securities Singapore Private Limited, JPMorgan Securities Japan Co. Ltd., J.P. Morgan Securities (Asia Pacific) Limited, J.P. Morgan Broking (Hong Kong) Limited, J.P. Morgan Securities (Far East) Ltd., Seoul Branch, J.P. Morgan Securities (Taiwan) Limited, J.P. Morgan India Private Limited, PT J.P. Morgan Securities Indonesia, JPMorgan Securities (Malaysia) Sdn. Bhd., JPMorgan Securities (Thailand) Limited and any of their successors or assigns. B. Rules for Trading on Australian Markets 1. Prohibited conduct 1.1 You must not, and must procure that your Representatives do not, take any action or omit to take any action so that you breach any Applicable Law and in particular you must advise Relevant JPMorgan Entity immediately if you believe that you or any of your Representatives have breached, or may breach, any provision of this Clause 1.1. -

Msci Index Calculation Methodology

INDEX METHODOLOGY MSCI INDEX CALCULATION METHODOLOGY Index Calculation Methodology for the MSCI Equity Indexes Esquivel, Carlos July 2018 JULY 2018 MSCI INDEX CALCULATION METHODOLOGY | JULY 2018 CONTENTS Introduction ....................................................................................... 4 MSCI Equity Indexes........................................................................... 5 1 MSCI Price Index Methodology ................................................... 6 1.1 Price Index Level ....................................................................................... 6 1.2 Price Index Level (Alternative Calculation Formula – Contribution Method) ............................................................................................................ 10 1.3 Next Day Initial Security Weight ............................................................ 15 1.4 Closing Index Market Capitalization Today USD (Unadjusted Market Cap Today USD) ........................................................................................................ 16 1.5 Security Index Of Price In Local .............................................................. 17 1.6 Note on Index Calculation In Local Currency ......................................... 19 1.7 Conversion of Indexes Into Another Currency ....................................... 19 2 MSCI Daily Total Return (DTR) Index Methodology ................... 21 2.1 Calculation Methodology ....................................................................... 21 2.2 Reinvestment -

Bermuda to Oslo (And Beyond?): Still an Attractive Route to Growth by Guy Cooper, Conyers Dill & Pearman

Bermuda to Oslo (and beyond?): still an attractive route to growth By Guy Cooper, Conyers Dill & Pearman T he last five years have seen Shipping industry participants Potential investors are more incorporated – second only to several shipping and ship- choose to incorporate in likely to show interest in an Norwegian companies. The ping-related companies incor- Bermuda because investors are equity offering where there is most recent examples of porate in Bermuda and go on to comfortable with the island’s some immediate liquidity for Bermuda companies listing on list on the Oslo Stock reputation as one of the world’s their investment. Norway, the N-OTC are GoodBulk in Exchange. A key step along the premier offshore jurisdictions where shipping is in the April 2017 and 2020 Bulkers in route for a number of them has and an established international country’s DNA, is the obvious December 2017. been the use of the Norwegian finance centre. Bermuda offers place to turn to raise funds over-the-counter market as a a tax-neutral, business-friendly quickly. One option is a private Oslo listing fast-track way to access fresh environment, with a robust placement of shares to Many companies have used the capital. Avance Gas, Flex LNG, regulatory framework that investors, whilst simultaneously N-OTC as a stepping stone to a and Borr Drilling all took this full listing on the Oslo Stock route prior to an Oslo listing, Shipping industry participants choose Exchange or elsewhere. Over whilst GoodBulk and 2020 the past five years, several Bulkers listed on Norway’s to incorporate in Bermuda because Bermuda companies have OTC just last year, highlighting investors are comfortable with the island’s followed this route, including the enduring appeal of the reputation as one of the world’s premier Avance Gas in 2014, Flex LNG O c Bermuda-Oslo nexus. -

List of Execution Venues Made Available by Societe Generale

List of Execution Venues made available by Societe Generale January 2018 Note that this list of Execution Venues is not exhaustive and will be kept under review and updated in accordance with Societe Generale’s execution practices. Societe Generale reserves the right to use other Execution Venues in addition to those listed below where it deems it appropriate in accordance with execution practices. Where Societe Generale acts as the Execution Venue, it will consider all sources of reasonably available information to obtain the best possible outcome. Fixed Income . The main Execution Venue is Societe Generale SA (and its affiliates) . When the trading obligation for derivatives applies, execution will take place on MiFID trading venues (Regulated Markets, or MTF or OTF or all equivalent venues as SEF) Alternative Venues include: BGC Bloomberg Bloomberg FIET Brokertec GFI Marketaxess MTP MTS TP ICAP Tradeweb Tradition Forex . The main Execution Venue is Societe Generale SA (and its affiliates) Alternative Venues include: 360T Alpha BGC Bloomberg Currenex EBS Equilend FX Connect FX Spotstream FXall Hotpspot ICAP Integral FX inside Reuters Tradertools Cash Equities Abu Dhabi Securities Exchange EDGEA Exchange NYSE Amex Alpha EDGEX Exchange NYSE Arca AlphaY EDGX NYSE Stock Exchange Aquis Equilend Omega ARCA Stocks Euronext Amsterdam OMX Copenhagen ASX Centre Point Euronext Block OMX Helsinki Athens Stock Exchange Euronext Brussels OMX Stockholm ATHEX Euronext Cash Amsterdam OneChicago Australia Securities Exchange Euronext Cash Brussels Oslo -

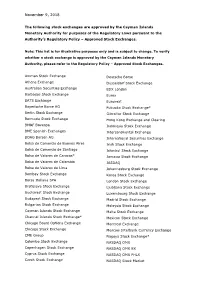

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Voluntary Delisting in Korea: Causes and Impact on Company Performance Sun Min Kang, Ph.D., Chung-Ang University, South Korea

The Journal of Applied Business Research – March/April 2017 Volume 33, Number 2 Voluntary Delisting In Korea: Causes And Impact On Company Performance Sun Min Kang, Ph.D., Chung-Ang University, South Korea ABSTRACT This research investigates the attributes of firms that choose to voluntarily delist in Korea, including the evolution of firms after delisting, using performance indicators such as total assets, revenue, and net income. Empirical evidence suggests that the higher the shareholding ratio of the largest shareholder and the higher the growth prospects and liquidity, the greater the incentive for voluntary delisting. In addition, firms in non-high-tech industries choose to delist more often than those in high-tech industries. Further, firms that have delisted show lower total assets, revenues, and net incomes than listed firms, and these gaps increase over time. Keywords: Voluntary Delisting; The Largest Shareholder Ratio; Growth Prospect; Performance INTRODUCTION elisting refers to the loss of the trading eligibility of a listed company’s marketable securities and the cancellation of a qualified listing. Generally, delisting happens under the authority of a stock exchange. When a serious management problem occurs (e.g., bankruptcy) and investors incur losses, Dor when there is a risk of undermining the order of the stock market, the stock exchange will delist a company that meets the delisting criteria in order to protect investors, unless the reason for delisting is resolved during a certain grace period. Alternatively, a company may voluntarily delist itself through the public purchase of treasury stock. Many unlisted companies undertake an initial public offering (IPO) to obtain funding without debt by issuing shares, despite the complicated conditions and procedures of IPOs. -

World Markets 5

MARKET5 final 2019_Layout 1 2/15/19 5:19 PM Page 25 Lisette WORLD Van Doorn Ruchir “Sentiment is more negative on cities fac- Sharma's ing geopolitical risks” Markets Top 10 Economic Financial Markets Insights Trends To Watch p.02 Out For in 2019 Distributed Freely Monthly Edition ⎥ Volume II ⎥ Issue 05 ⎥ January 2019 P. 07 John Bogle East & SE Europe Equities The life and legacy of Vanguard’s Monthly performance reports and Analysts give their 2019 outlook on FUNDS founder p.06 statistics from the region p.02 world markets p.03 SEE STOCK EXCHANGES FORECAST GREAT TRADERS David Alan Tepper A specialist in distressed debt investing David A.Tepper was born on 11 Sep- Bond Funds. He also worked in the treasury tember 1957 in Pittsburgh, Pennsylva- department of Republic Steel. In 1985 Tepper nia, USA. He is the founder and was recruited by Goldman Sachs as a Credit D president of the wildly successful hedge Analyst. His primary focus was bankruptcies “The point is, fund Appaloosa Management which is based and special situations at the firm. Within six in Miami Beach, Florida and now manages months he became its head trader, remaining markets adapt, $15 billion. Tepper earned a Bachelor of Arts at Goldman till December 1992. He founded people adapt. with honors in economics from the University Appaloosa Management in early 1993. A 2010 Don’t listen to of Pittsburgh in 1978 and an M.B.A. from profile in New York Magazine described him Carnegie Mellon University in 1982. During as the object of “a certain amount of hero wor- all the crap college, he began small scale investing in var- ship inside the industry.” Forbes listed him as out there.” ious markets.