CBL & Associates Properties, Inc. 2014 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

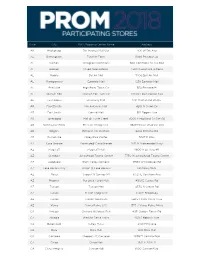

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Laurence Paskowitz, Et Al. V. CBL & Associates Properties, Inc., Et Al. 19

UNITED STATES DISTRICT COURT EASTERN DISTRICT OF TENNESEE CHATTANOOGA DIVISION LAURENCE PASKOWITZ, O n B ehalf O f H imself A nd A ll O thers S imilarly S ituated, Plaintiff, v. C ivil .A ction No. ____________ CBL & ASSOCIATES PROPERTIES, INC., STEPHEN CLASS ACTION D. LEBOVITZ, CHARLES B. LEBOVITZ, A. LARRY CHAPMAN and FARZANA KHALEEL, JURY DEMAND Defendants. Plaintiff Laurence Paskowitz (“Plaintiff”), by his attorneys, alleges for his Class Action Complaint against D efendants (defined below) upon personal knowledge as to himself and his own acts, and as to all other matters upon information and belief based upon, inter alia , the investigation made by and through his attorneys (including review of SEC filings, press releases and court proceedings), as follows: SUMMARY OF THE ACTION 1. This is a securities fraud class action brought o n behalf of all persons who purchased the publicly traded securities of defendant CBL & Associates Properties, Inc. (“CBL” or “the Company”) from November 8, 2017 through March 26, 2019 (the “Class Period”). In addition to the Company, D efendants named herein are CBL’s founder and Board Chairman Charles B. Lebovitz, Chief Executive Officer Stephen D. Lebovitz, Chief Financial Officer Farzana Khaleel , and Audit Committee Chairman A. Larry Chapman (collectively, “ the Individual Defend a nts”). Case 1:19-cv-00149-JRG-CHS Document 1 Filed 05/17/19 Page 1 of 23 PageID #: 1 2. CBL, th rough its two operating subsidiaries, is organized as a real estate investment trust (“REIT”). The C ompany’s business is described as follows: “We own, develop, acquire, lease, manage, and operate regional shopping malls, open - air and mixed - use centers, o utlet centers, associated centers, community centers, office and other properties. -

SH 288 Toll Lanes

Houston Pearland Shadow Creek Ranch Pomona Sedona Lakes 2,000 Lots 900 Lots COUNTY ROAD 58 New Hope Church Rodeo Palms 1,750 Lots PROPOSED MANVEL PARKWAY 800 Acres 288 CONNECTOR 1 . 5 M I L E S SITE O F 267.7 Acres F R Allied Commercial O 111.7 Acres N T A G E S E N A SITE L L L 13.8 Acres O T on Highway 6 E R U T U F +/- 267.7 AND +/-13.8 ACRES ON S.H. 288 HOUSTON, TEXAS OFFER PROCESS Exclusive Representation ARA has been exclusively retained to represent the seller in the disposition of 267.73 acres on State Highway 288 and 13.8182 acres on Highway 6. All inquiries about the properties should be directed to ARA. Offer Requirements Offers should be presented in the form of a non-binding Letter of Intent, and must include: Pricing Due Diligence and Closing Timeframe Earnest Money Deposit Description of Debt/Equity Structure Qualifications to Close Development Plans Purchase terms shall require cash to be paid at closing. Offers should be delivered to the attention of Tim Dosch, David Marshall, Tom Dosch, or Clark Dalton via fax or email. Due Diligence Information To access the due diligence information please visit the property website at: arausa.listinglab.com/TX288Hwy6LandSites Contacts Tim Dosch David Marshall Tom Dosch Clark Dalton Principal Principal Principal Associate [email protected] [email protected] [email protected] [email protected] O 713-955-3127 O 713-955-3126 O 713-955-3125 O 713-955-3122 M 713-459-8123 M 713-206-1574 M 713-557-4455 M 832-449-2223 CONTENTS PROPERTY INFORMATION 4 Property Summary 4 Assemblage Opportunity 6 Houston Market Overview 8 Drive Times to Central Houston 9 Drive Times to Employment Centers 10 Nearby Residential Development 11 Property Access (267.7 Acres) 12 267.7 Acres Conceptual Land Plan 14 13.8 Acres Conceptual Land Plan 15 AREA HIGHLIGHTS 16 S.H. -

Pearland Town Plaza

PEARLAND TOWN PLAZA New Retail Available For Lease SEC of FM 518 and Kirby Road | Pearland, Texas Bob Conwell | Austen Baldridge | 281.477.4300 Leasing | Tenant Representation | Development | Land Brokerage | Acquisition | Property Management Pearland Town Plaza SEC of FM 518 and Kirby Road | Pearland, Texas KINGSLEY DR Pearland Town Center, a 1.2 million square foot mixed-use development, is anchored by Dillard’s, Macy’s, Dick’s Sporting Goods, and Barnes & Noble. This open-air lifestyle center is the first of its kind in the Pearland area. Located on the southeast corner of Highway 288 and FM 518 in Pearland, Texas. The W. BROADWAY ST 105 subject pad building has unparalleled visibility. TEXAS 105 Location Conroe TEXAS 336 ±7,000 Homes Todd Mission Pearland Town Center is positionedTEXAS at the gateway to Shadow59 Creek Ranch, Pearland’s premier master-planned community. Encompassing 3,500 acres and 12,723 residential242 lots, Shadow 249 TEXAS SITE CreekTEXAS Ranch combines homes from $220,000 to $800,000s, The Woodlands ±1,400 Homes along with recreational parks, award-winning schools, and an “all-inclusive” lifestyle community. 99 45 TOLL Tomball 146 FARM TEXAS 2920 Pearland Highlights ROAD • Convenient accessSpring to Texas Medical Center, Rice K I R B Y D R University, University of Houston, and Downtown Houston Southgate FARM 442 Homes • New Memorial Hermann1960 medical campus Cypress ROAD • HCA Gulf Coast Division’s Pearland Medical Center 90 99 HCTRA TOLL 290 59 TOLLWAY 45 COUNTY RD 59 / SOUTHFORK DR HCTRA TOLLWAY COUNTY RD 48 -

FAYETTE MALL Lexington, KY CBL PROPERTIES

MALL FAYETTE Lexington, KY CBL PROPERTIES HIGHLIGHTS NUMBER OF STORES 150 TRADE AREA 824,980 (2017 est.) SIZE 1,203,002 square feet CENTER EMPLOYMENT 2,750 (est.) FEATURED STORES Macy’s, Dillard’s, DICK’S Sporting Goods, JCPenney, Altar’d State, Apple, The Cheesecake Factory, Cinemark (16 1971 screens), Coach, Disney, H&M, Michael Kors, and Sephora YEAR OPENED WEBSITE ShopFayette-Mall.com CORPORATE OFFICE: FOR LEASING: CBL Center, Suite 500 MALL OFFICE: CBL PROPERTIES Laura Farren 3401 Nicholasville Road, Suite 303 cblproperties.com 2030 Hamilton Place Boulevard p. 423.490.8620 c. 423.463.4589 Lexington, KY 40503 NYSE: CBL Chattanooga, TN 37421-6000 [email protected] 859.272.3493 423.855.0001 DEMOGRAPHICS TRADE AREA FACTS PRIMARY SECONDARY TOTAL • Known as the “Horse Capital of the World,” Lexington, Kentucky POPULATION TRENDS TRADE AREA TRADE AREA TRADE AREA contributes over $5 billion a year to the state’s horse industry. 2022 Projection 420,298 448,220 868,518 • Lexington is the financial, retail, healthcare and cultural core of the 2017 Estimate 396,214 428,766 824,980 entire Bluegrass region. 2010 Census 369,850 412,671 782,521 • High household income of almost $80,000 is fueled by some of the 2017-2022 % Change 6.08% 4.54% 5.28% largest corporations in the U.S., including Toyota’s primary Camry/ Avalon/Lexus ES350 manufacturing facility, Ashland Oil, Lexmark, 2017 Daytime Population Estimate 251,368 189,885 441,253 IBM, Square D, The Trane Company, and Tempur-Pedic. • 27 companies, including Toyota, Florida Tile, EnerBlu Inc. and AVERAGE HOUSEHOLD INCOME Xooker invested $1.5 billion in the Lexington area for business 2022 Projection $92,586 $76,397 $84,384 expansion in 2017. -

AFFIDAVIT of MICHAEL NOEL (Affirmed September 21, 2020)

Court File No. CV-20-00642970-00CL ONTARIO SUPERIOR COURT OF JUSTICE COMMERCIAL LIST IN THE MATTER OF THE COMPANIES’ CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED AND IN THE MATTER OF A PLAN OF COMPROMISE OR ARRANGEMENT OF GNC HOLDINGS, INC., GENERAL NUTRITION CENTRES COMPANY, GNC PARENT LLC, GNC CORPORATION, GENERAL NUTRITION CENTERS, INC., GENERAL NUTRITION CORPORATION, GENERAL NUTRITION INVESTMENT COMPANY, LUCKY OLDCO CORPORATION, GNC FUNDING INC., GNC INTERNATIONAL HOLDINGS INC., GNC CHINA HOLDCO, LLC, GNC HEADQUARTERS LLC, GUSTINE SIXTH AVENUE ASSOCIATES, LTD., GNC CANADA HOLDINGS, INC., GNC GOVERNMENT SERVICES, LLC, GNC PUERTO RICO HOLDINGS, INC. AND GNC PUERTO RICO, LLC APPLICATION OF GNC HOLDINGS, INC., UNDER SECTION 46 OF THE COMPANIES’ CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED Applicant AFFIDAVIT OF MICHAEL NOEL (affirmed September 21, 2020) I, Michael Noel, of the City of Toronto, in the Province of Ontario, MAKE OATH AND SAY: 1. I am an associate at Torys LLP, Canadian counsel to GNC Holdings, Inc. (the “Foreign Representative”) in its capacity as foreign representative of itself as well as General Nutrition Centres Company (“GNC Canada”), GNC Parent LLC, GNC Corporation, General Nutrition Centers, Inc., General Nutrition Corporation, General Nutrition Investment Company, Lucky 30552746 - 2 - Oldco Corporation, GNC Funding Inc., GNC International Holdings Inc., GNC China Holdco, LLC, GNC Headquarters LLC, Gustine Sixth Avenue Associates, Ltd., GNC Canada Holdings, Inc., GNC Government Services, LLC, GNC Puerto Rico Holdings, Inc., and GNC Puerto Rico, LLC (collectively, the “Debtors”), and, as such, have knowledge of the matters contained in this Affidavit. -

THE IRON HORSE Offering Memorandum

Offering Memorandum THE IRON HORSE 6541 US-51 • Horn Lake, MS 38637 1 NON-ENDORSEMENT AND DISCLAIMER NOTICE Confidentiality and Disclaimer The information contained in the following Marketing Brochure is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Marcus & Millichap R E Inv, Svcs of Nevada Inc. (hereafter referred to as “Marcus & Millichap”) and should not be made available to any other person or entity without the written consent of Marcus & Millichap. This Marketing Brochure has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. Marcus & Millichap has not made any investigation, and makes no warranty or representation, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the property and improvements, the presence or absence of contaminating substances, PCB's or asbestos, the compliance with State and Federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant's plans or intentions to continue its occupancy of the subject property. The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable; however, Marcus & Millichap has not verified, and will not verify, any of the information contained herein, nor has Marcus & Millichap conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. -

Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20

Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 1 of 54 Fill in this information to identify the case: United States Bankruptcy Court for the Southern District of Texas Case number (if known): Chapter 11 Check if this is an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor’s name Laredo Outlet Shoppes, LLC 2. All other names debtor used N/A in the last 8 years Include any assumed names, trade names, and doing business as names 3. Debtor’s federal Employer Identification Number (EIN) 81-1563566 4. Debtor’s address Principal place of business Mailing address, if different from principal place of business 2030 Hamilton Place Blvd. Number Street Number Street CBL Center, Suite 500 P.O. Box Chattanooga Tennessee 37421 City State ZIP Code City State ZIP Code Location of principal assets, if different from principal place of business Hamilton County County 1600 Water Street Number Street Laredo Texas 78040 City State ZIP Code 5. Debtor’s website (URL) www.cblproperties.com 6. Type of debtor ☒ Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) ☐ Partnership (excluding LLP) ☐ Other. Specify: Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy Page 1 WEIL:\97969900\8\32626.0004 Case 21-31717 Document 1 Filed in TXSB on 05/26/21 Page 2 of 54 Debtor Laredo Outlet Shoppes, LLC Case number (if known) 21-_____ ( ) Name A. -

Chapter 11 ) CHRISTOPHER & BANKS CORPORATION, Et Al

Case 21-10269-ABA Doc 125 Filed 01/27/21 Entered 01/27/21 15:45:17 Desc Main Document Page 1 of 22 TROUTMAN PEPPER HAMILTON SANDERS LLP Brett D. Goodman 875 Third Avenue New York, NY 1002 Telephone: (212) 704.6170 Fax: (212) 704.6288 Email:[email protected] -and- Douglas D. Herrmann Marcy J. McLaughlin Smith (admitted pro hac vice) Hercules Plaza, Suite 5100 1313 N. Market Street Wilmington, Delaware 19801 Telephone: (302) 777.6500 Fax: (866) 422.3027 Email: [email protected] [email protected] – and – RIEMER & BRAUNSTEIN LLP Steven E. Fox, Esq. (admitted pro hac vice) Times Square Tower Seven Times Square, Suite 2506 New York, NY 10036 Telephone: (212) 789.3100 Email: [email protected] Counsel for Agent UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY ) In re: ) Chapter 11 ) CHRISTOPHER & BANKS CORPORATION, et al., ) Case No. 21-10269 (ABA) ) ) (Jointly Administered) Debtors. 1 ) _______________________________________________________________________ 1 The Debtors in these chapter 11 cases and the last four digits of each Debtor’s federal tax identification number, as applicable, are as follows: Christopher & Banks Corporation (5422), Christopher & Banks, Inc. (1237), and Christopher & Banks Company (2506). The Debtors’ corporate headquarters is located at 2400 Xenium Lane North, Plymouth, Minnesota 55441. Case 21-10269-ABA Doc 125 Filed 01/27/21 Entered 01/27/21 15:45:17 Desc Main Document Page 2 of 22 DECLARATION OF CINDI GIGLIO IN SUPPORT OF DEBTORS’ MOTION FOR INTERIM AND FINAL ORDERS (A)(1) CONFIRMING, ON AN INTERIM BASIS, THAT THE STORE CLOSING AGREEMENT IS OPERATIVE AND EFFECTIVE AND (2) AUTHORIZING, ON A FINAL BASIS, THE DEBTORS TO ASSUME THE STORE CLOSING AGREEMENT, (B) AUTHORIZING AND APPROVING STORE CLOSING SALES FREE AND CLEAR OF ALL LIENS, CLAIMS, AND ENCUMBRANCES, (C) APPROVING DISPUTE RESOLUTION PROCEDURES, AND (D) AUTHORIZING CUSTOMARY BONUSES TO EMPLOYEES OF STORES I, Cindi Giglio, make this declaration pursuant to 28 U.S.C. -

Michael Kors® Make Your Move at Sunglass Hut®

Michael Kors® Make Your Move at Sunglass Hut® Official Rules NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCES OF WINNING. VOID WHERE PROHIBITED BY LAW OR REGULATION and outside the fifty United States (and the District of ColuMbia). Subject to all federal, state, and local laws, regulations, and ordinances. This Gift ProMotion (“Gift Promotion”) is open only to residents of the fifty (50) United States and the District of ColuMbia ("U.S.") who are at least eighteen (18) years old at the tiMe of entry (each who enters, an “Entrant”). 1. GIFT PROMOTION TIMING: Michael Kors® Make Your Move at Sunglass Hut® Gift Promotion (the “Gift ProMotion”) begins on Friday, March 22, 2019 at 12:01 a.m. Eastern Time (“ET”) and ends at 11:59:59 p.m. ET on Wednesday, April 3, 2019 (the “Gift Period”). Participation in the Gift Promotion does not constitute entry into any other promotion, contest or game. By participating in the Gift Promotion, each Entrant unconditionally accepts and agrees to comply with and abide by these Official Rules and the decisions of Luxottica of America Inc., 4000 Luxottica Place, Mason, OH 45040 d/b/a Sunglass Hut (the “Sponsor”) and WYNG, 360 Park Avenue S., 20th Floor, NY, NY 10010 (the “AdMinistrator”), whose decisions shall be final and legally binding in all respects. 2. ELIGIBILITY: Employees, officers, and directors of Sponsor, Administrator, and each of their respective directors, officers, shareholders, and employees, affiliates, subsidiaries, distributors, -

Retail Market HOUSTON

HOUSTON RETAIL THIRD QUARTER 2009 Retail Market HOUSTON MARKET RESEARCH | THIRD QUARTER | 2009 Our Knowledge is your Property HOUSTON RETAIL THIRD QUARTER 2009 COLLIERS INTERNATIONAL | HOUSTON RilRetail MMkarket MARKET RESEARCH | THIRD QUARTER | 2009 Houston Retail Neighborhood Centers Lead Market Houston’s retail market continued to record weak fundamentals through the third quarter 2009 with net absorption, occupancy and rental rates falling below levels posted at this time last year. Certain retail categories, however, performed better than others under the current economic stress test. Neighborhood centers led the market with year-to-date positive net absorption of 875,062 sq. ft. through the third quarter, while all other retail categories posted less than 200,000 sq. ft. of net gains in occupied space. Among the most significant MARKET INDICATORS decreases in year-to-date negative net absorption were single-tenant retail properties with 328,422 sq. fft., fllfollowe dby community centers with 203,343 sq. fft.and malls with 160,815 Q3-08 Q3-09 sq. ft. With tough economic conditions pummeling consumers, neighborhood centers will likely continue to be counted among the most resilient retail categories through 2010. Quarterly Net Absorption 826,360 SF 447,965 SF As retailers continue to strategically position themselves to increase market share and win over increasingly value-conscious consumers, the local retail sector is experiencing an Overall NNN Rental Rate aggressive pricing war among key grocers led by Cincinnati-based Kroger and San Antonio- $16.00 psf $15.63 psf based H.E.B. Not to be left out, Randall’ s Food Markets (acquired by Pleasanton, California- basedSafewayin1999)hasannouncedplansthisyeartosignificantlyreducepricesasit attempts to rebrand itself from a high-end grocer to a more moderately priced store. -

UNITED STATES BANKRUPTCY COURT DISTRICT of NEW JERSEY Order Filed on April 1, 2021 Caption in Compliance with D.N.J

Case 21-10269-ABA Doc 357 Filed 04/01/21 Entered 04/01/21 11:13:02 Desc Main Document Page 1 of 120 UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW JERSEY Order Filed on April 1, 2021 Caption in Compliance with D.N.J. LBR 9004- by Clerk U.S. Bankruptcy Court 1(b) District of New Jersey COLE SCHOTZ P.C. Court Plaza North 25 Main Street P.O. Box 800 Hackensack, New Jersey 07602-0800 Michael D. Sirota ([email protected]) Felice R. Yudkin ([email protected]) Jacob S. Frumkin ([email protected]) Matteo Percontino ([email protected]) Rebecca W. Hollander ([email protected]) (201) 489-3000 (201) 489-1536 Facsimile Attorneys for Debtors and Debtors in Possession In re: Chapter 11 CHRISTOPHER & BANKS CORPORATION, Case No. 21-10269 (ABA) et al., Joint Administration Requested Debtors.1 Hearing Date and Time: ORDER APPROVING THE REJECTION OF CONTRACTS AND LEASES AND ABANDONMENT OF PROPER IN CONNECTION THEREWITH The relief set forth on the following pages, numbered two (2) through five (5), is hereby ORDERED. DATED: April 1, 2021 1 The Debtors in these chapter 11 cases and the last four digits of each Debtor’s federal tax identification number, as applicable, are as follows: Christopher & Banks Corporation (5422), Christopher & Banks, Inc. (1237), and Christopher & Banks Company (2506). The Debtors’ corporate headquarters is located at 2400 Xenium Lane North, Plymouth, Minnesota 55441. 61893/0001-40481014v1 Case 21-10269-ABA Doc 357 Filed 04/01/21 Entered 04/01/21 11:13:02 Desc Main Document Page 2 of 120 Page (2) Debtors: CHRISTOPHER & BANKS CORPORATION, et al.