Dividend Distribution Policy Disclosure a Status Check

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Welspun Gujarat Crosses Coveted $ 1 Billion Mark

BUSINESS UPDATE Welspun Corp Limited - ‘1 mn Ton’ Pipe Order Book - Significant contribution by International Operations - Well poised to get new prestigious orders Sales up by 12% in FY 12 and 24% in Q4 FY 12 Operating EBITDA sustained despite difficult market conditions Mumbai, May 29 2012: Welspun Corp Ltd. (WCL) the flagship Company of the $3.5 billion Welspun Group today announced its financial results for the FY2012 & 4th Quarter FY 2012. Consolidated Financial Summary of Q4 FY12 and FY 2012 (Figures in Rs. Million) Particulars FY 2012 FY 2011 Change % Q4 FY12 Q4 FY11 Change % Sales 89,766 80,221 12% 26,998 21,744 24% Other Income 2,676 1,139 135% 1,061 410 159% EBITDA 11,246 13,784 -18% 3,673 2,852 29% Interest 3,999 2,240 79% 1,157 755 53% Depreciation 3,515 2,439 44% 918 632 45% PAT 2,385 6,330 -62% 1,186 1,181 0% Cash PAT 6,192 9,700 -36% 2,360 2,218 6% EPS (Rs./Share) 9.71 28.66 -66% 4.53 5.41 -16% Reported EBITDA Margin (%) 12.5% 16.22% 13.60% 13.12% PAT Margin (%) 2.66% 7.89% 4.39% 5.43% Operational Numbers after accounting for exceptional items*: Particulars FY 12 Q4 FY 12 Operational EBITDA 10,467 1,551 PAT 3,685 469 CASH PAT 7,492 1,644 * FY12 operational performance was impacted by foreign exchange provisions of Rs ,1244 million and provisions made towards amicable settlement with a customer of Rs 649 million. -

Large Diamater Welded Pipe India Countervailing Duty Final Determination

C-533-882 Investigation Public Document E&C/VIII: STL DATE: November 5, 2018 MEMORANDUM TO: Gary Taverman Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations, performing the non-exclusive functions and duties of the Assistant Secretary for Enforcement and Compliance FROM: James Maeder Associate Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations performing the duties of Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations SUBJECT: Issues and Decision Memorandum for the Final Affirmative Determination of the Countervailing Duty Investigation of Large Diameter Welded Pipe from India I. SUMMARY The Department of Commerce (Commerce) determines that countervailable subsidies are being provided to producers and exporters of large diameter welded pipe from India, as provided in section 705 of the Tariff Act of 1930, as amended (the Act). Below is the complete list of issues in this investigation for which we received comments from interested parties. Issues Comment 1: Whether Commerce Properly Applied Adverse Facts Available (AFA) in the Preliminary Determination. Comment 2: Whether Commerce Should Continue to Find the AAP, DDP, EPCG, and MEIS Programs Countervailable II. BACKGROUND A. Case History On June 29, 2018, Commerce published its Preliminary Determination for this investigation.1 The selected mandatory respondents in this investigation are Bhushan Steel (Bhushan) and Welspun Trading Limited (Welspun). In the Preliminary Determination, we aligned the final countervailing duty (CVD) determination with the final determination in the companion antidumping duty (AD) investigation, in accordance with section 705(a)(1) of the Act and 19 CFR 351.210(b)(4). As noted in the Preliminary Determination, Bhushan and Welspun did not respond to Commerce’s initial questionnaire. -

Welspun Corp.Xlsx

April 15, 2019 Pick of the Week Welspun Corp Limited Analyst: Jatin Damania (Email: [email protected]; Contact: +91 22 6218 6440) CMP (Rs) Target Price (Rs) Potential Upside (%) 52 Week H/L (Rs) Mkt Cap (Rs mn) 136.20161 18.21% 187 / 87 36124 Key Highlights: Welspun Corp (WCL) is a leading global manufacturer of large diameter pipes with an installed capacity of 2.4 Mn tonnes. Given its presence in USA, Saudi Arabia and India, we believe that, the company is better placed compared to its peers in terms of tapping the global market opportunity of over US$400 bn. The company has entered into agreement to divest its Plate and Coil Mill Division (PCMD) and its 43 MW Power Division at a consideration of Rs9.4bn. The transaction is likely to complete by end of Dec’19. Post the completion of the transaction, balance sheet will strengthen and it will improve profitability & RoCE, as PCMD contribution to EBITDA was nil. The Company has received additional pipe orders of 180 KT, of these 136 KT will be serviced from India, with a major portion to be executed from the new facility in Madhya Pradesh and balance mainly from Americas. After considering the above additions and the execution, the WCL order book at the start of financial year stands at 1.66 M, valued at Rs141 bn to be executed over the next 15-18 months, thereby providing strong revenue visibility. We expect WCL to register growth of ~11% CAGR in revenue during the FY18-FY21E period. The overseas order book not only provides good revenue visibility, but also comes with the stronger margin compared to the domestic market, as number of qualified bidders are less. -

Front Cover Page

SCHEME INFORMATION DOCUMENT Motilal Oswal Nifty Smallcap 250 Index Fund (MOFSMALLCAP) (An open ended scheme replicating / tracking Nifty Smallcap 250 Index) This product is suitable for investors who are seeking* Return that corresponds to the performance of Nifty Smallcap 250 Index subject to tracking error Equity and equity related securities covered by Nifty Smallcap 250 Index Long term capital growth *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Scheme re- Continuous Offer of Units at NAV based prices Name of Mutual Fund Motilal Oswal Mutual Fund Name of Asset Management Motilal Oswal Asset Management Company Limited (MOAMC) Company (AMC) Name of Trustee Company Motilal Oswal Trustee Company Limited Address Registered Office: 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opp. Parel ST Depot, Prabhadevi, Mumbai-400025 Website www.motilaloswalmf.com The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, (herein after referred to as SEBI (MF) Regulations) as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document (SID). The SID sets forth concisely the information about the Scheme that a prospective investor ought to know before investing. Before investing, investors should also ascertain about any further changes to this SID after the date of this Document from the Mutual Fund / Investor Service Centres / Website / Distributors or Brokers. -

WELSPUN CORP WCI/SE~F2o19 May 15, 2019 To, BSE Ltd. National

WELSPUN CORP PIPES AND PLATES WCI/SE~f2O19 May 15, 2019 To, BSE Ltd. National Stock Exchange of India Ltd. (Scrip Code-532144) (Symbol: WELCORP, Series EQ) Department of Listing, Exchange Plaza, Bandra-Kurla Complex, P. J. Towers, Dalal Street, Mumbai — 400 001. Bandra (E), Mumbai — 400 051. Dear Sirs/ Madam, Sub: Outcome of the meeting of the Board of Directors of Weispun Corp Limited (the Company) commenced on May 14, 2019 and concluded on May 15, 2019. Please take note that the Board of Directors of the Company at its meeting commenced on May 14, 2019 and concluded on May 15, 2019 has considered and approved the following businesses: (A) Audited Financial statements for the year ended March 31, 2019. Pursuant to Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find enclosed herewith standalone as well as consolidated Audited Financial Results for the year ended March 31, 2019 (“AFR”) along-with the ururtodified audit report as reviewed by the Audit Coniniittee and approved by the Board of Directors. A declaration pursuant to Regulation 33 (3)(d) of SEBI (LODR), 2015 is also enclosed herewith. (B) Recommendation of Dividend. The Board of Directors of the Company have recommended a dividend at the rate of 10% (i.e. Re. 0.50/- per share) on 265,226,109 Equity Shares of Rs.5/- each fully paid up, i.e. Rs. 132,613,054.50/-. The record date for determining the eligible shareholders for payment of dividend shall be intimated later. (C) Approval of Buy-Back. 1. Approved buyback proposal for purchase by the Company of its own fully paid equity shares of Rs. -

Annual Report FY 2011-12

Excellence in Engineering…. It is an art; it is a science It requires skill; it requires vision It needs flair; it needs innovation It involves execution …. …. With perfection We are WELSPUN FINANCIAL HIGHLIGHTS (Consolidated) Total Income (Rs. Mn) PAT (Rs. Mn) 92,442 8,000 105,000 6,104 6,330 73,822 81,360 6,000 57,582 40,052 3,408 55,000 4,000 2,135 2,385 2,000 5,000 - 2007-08 2008-09 2009-10 2010-11 2011-12 2007-08 2008-09 2009-10 2010-11 2011-12 Exports/Overseas Revenue (Rs. Mn) Basic EPS (Rs. / Share) 65,000 52,603 52,860 46,139 41.0 41,515 31.7 45,000 30.9 32,750 31.0 20.9 21.0 25,000 11.5 10.9 11.0 5,000 1.0 2007-08 2008-09 2009-10 2010-11 2011-12 2007-08 2008-09 2009-10 2010-11 2011-12 Reported EBITDA (Rs. Mn)@@ Networth (Rs. Mn) @ 49,139* 13,372 ## 14,500 13,784 ### 50,000 11,247 12,500 40,000 33,735 10,500 29,011 # 8,500 6,662 6,535 30,000 6,500 20,000 15,672 15,597 4,500 10,000 2,500 500 1,000 2007-08 2008-09 2009-10 2010-11 2011-12 2007-08 2008-09 2009-10 2010-11 2011-12 EBITDA Margin (%) Fixed Assets (Gross Block- Rs. Mn) 18.1% 20.0% 16.6% 16.9% 100,000 86,957* 12.2% 58,339* 15.0% 11.3% 75,000 10.0% 50,000 40,682 44,248 29,213 5.0% 25,000 0.0% - 2007-08 2008-09 2009-10 2010-11 2011-12 2007-08 2008-09 2009-10 2010-11 2011-12 @@: For FY11 and FY12, Other Income, a part of Reported EBITDA includes Interest Income for the respective years. -

DEPARTMENT of COMMERCE International

This document is scheduled to be published in the Federal Register on 12/19/2011 and available online at http://federalregister.gov/a/2011-32445, and on FDsys.gov (BILLING CODE: 3510-DS-P) DEPARTMENT OF COMMERCE International Trade Administration A-533-502 Certain Welded Carbon Steel Standard Pipes and Tubes from India: Rescission of Antidumping Duty Administrative Review AGENCY: Import Administration, International Trade Administration, Department of Commerce SUMMARY: In response to a request from an interested party, the Department of Commerce (the Department) initiated an administrative review of the antidumping duty order on certain welded carbon steel standard pipes and tubes from India. The period of review is May 1, 2010, through April 30, 2011. As a result of the withdrawal of the request for review, the Department is rescinding this review. EFFECTIVE DATE: (Insert date of publication in the Federal Register). FOR FURTHER INFORMATION CONTACT: Catherine Cartsos or Minoo Hatten, AD/CVD Operations, Office 5, Import Administration, International Trade Administration, U.S. Department of Commerce, 14th Street and Constitution Avenue, NW, Washington, DC 20230; telephone: (202) 482-1757 or (202) 482-1690, respectively. SUPPLEMENTARY INFORMATION: Background On June 28, 2011, and in accordance with 19 CFR 351.213(g) and 19 CFR 351.221(b)(1), the Department published a notice of initiation of an administrative review of the antidumping duty order on certain welded carbon steel standard pipes and tubes from India. See Initiation of Antidumping and Countervailing Duty Administrative Reviews and Request for Revocation in Part, 76 FR 37781 (June 28, 2011) (Notice of Initiation). Based on a request for review from United States Steel Corporation, we initiated reviews of Arihant Domestic Appliances Ltd., Good Luck Steel Tubes Ltd. -

Company Profile

COMPANY PROFILE 01 TABLE OF CONTENTS Section 1 Executive Summary 03 Section 2 Welspun Group 04 Section 3 Welspun One Logistics Parks (WOLP) 10 Section 4 Our Flagship Project - Bhiwandi 14 Section 5 People Behind Us 17 02 EXECUTIVE SUMMARY Welspun One Logistics Parks (“WOLP”) aspires to become the most preferred warehousing company in India WOLP is an institutional, industrial real estate platform, and the only one to be backed by a global conglomerate – the Welspun Group: • Welspun Group is a leading name in line pipes, home textiles, infrastructure, steel, advanced textiles & flooring solutions • The group has delivered manufacturing / industrial facilities across 4 states and 7 cities pan-India, spanning ~3,275 acres of land entailing an investment of ~USD 2BN • WOLP sources & develops feasible land parcels which suit institutional investors and get leased by valued occupiers • WOLP’s Buy + Build + Lease is an integrated approach to develop futuristic logistics parks that are in line with our customers’ needs & aspirations • We offer Development Management Programme (DMP) for select funds, clients & landowners who wish to continue owning their assets while enjoying all returns from a Grade A warehousing development. • The WOLP team has a cumulative development experience of ~90 years, having delivered over 115 MM SF of construction projects in India • We are developing our flagship 3MM sft Logistic park with a project cost of USD 110 MM in the heart of Mumbai’s consumption hub – Bhiwandi. • It is planned as a benchmark project combining the best that the industry has to offer in expertise and standards. 03 WELSPUN GROUP 04 AN OVERVIEW ON WELSPUN GROUP Welspun is a global conglomerate, driven by its core philosophies of constant innovation and social responsibility to create a better future. -

Investor Presentation

(/(&7521,&),/,1* -7/&+'6( 0D\ &RUSRUDWH5HODWLRQVKLS6HUYLFHV &RUSRUDWH5HODWLRQVKLS6HUYLFHV %6(/LPLWHG 0HWURSROLWDQ6WRFN([FKDQJHRI,QGLD/LPLWHG 7+)ORRU3-7RZHUV WK)ORRU9LEJ\RUWRZHU2SSRVLWH7ULGHQW 'DODO6WUHHW +RWHO%DQGUD.XUOD&RPSOH[ 0XPEDL 0XPEDL %6(6FULS&RGH 06(,6\PERO-7/,1)5$ 'HDU6LU0DGDP 3OHDVHILQGHQFORVHGKHUHZLWK,QYHVWRU3UHVHQWDWLRQIRU4 )< :HUHTXHVW\RXWRNLQGO\GLVVHPLQDWHWKHDERYHLQIRUPDWLRQWRWKHVKDUHKROGHUV 7KDQNLQJ<RX <RXUVWUXO\ )RU-7/,QIUD/LPLWHG Digitally signed by MOHINDER MOHINDER SINGH Date: 2021.05.06 SINGH 10:59:48 +05'30' 0RKLQGHU6LQJK &RPSDQ\6HFUHWDU\ $ JTL INFRA Limited May 2021 JTL Infra Limited Table of Contents Company Overview Industry Overview Business Overview Financial Highlights Way Ahead JTL Infra Limited 2 Safe Harbour This presentation has been prepared by JTL Infra Limited (the “Company”) solely for information purposes and does not constitute any offer, recommendation or invitation to purchase or subscribe for any securities, and shall not form the basis or be relied on in connection with any contract or binding commitment what so ever. No offering of securities of the Company will be made except by means of a statutory offering document containing detailed information about the Company. This Presentation has been prepared by the Company based on information and data which the Company considers reliable, but the Company makes no representation or warranty, express or implied, whatsoever, and no reliance shall be plakhed on, the truth, accuracy, completeness, fairness and reasonableness of the contents of this Presentation. This Presentation may not be all inclusive and may not contain all of the information that you may consider material. Any liability in respect of the contents of, or any omission from, this Presentation is expressly excluded. Certain matters discussed in this Presentation may contain statements regarding the Company’s market opportunity and business prospects that are individually and collectively forward-looking statements. -

Welspun Corp Ltd ______Issue of Commercial Paper (Cp)

WELSPUN CORP LTD __________________________________________________________________________________ ISSUE OF COMMERCIAL PAPER (CP): LETTER OF OFFER PART I • Proposed Date Of Issue : 07.09.2020 • Credit Rating For CP : CARE A1+ • Date of Rating : 20TH AUGUST 2020 • Validity for issuance : 90 Days • Validity period for rating : 60 Days • For Amount : 500 crore • Conditions (If Any) : NA • Purpose Of Issue of CP : Working Capital • Credit Support (If Any) : NIL • Description of Instrument : Commercial Paper • Amount : Rs.20 Crore • Issued By : Welspun Corp Ltd • Net Worth of the Guarantor Company : NA Names of Companies To Which Guarantor Has : NA Issued Similar Guarantee Extent of The Guarantee Offered By The : NA Guarantor Company Conditions Under Which The Guarantee Will Be : NA Invoked • Details of Current Tranche: : NA ISIN AMOUNT MATURITY CURRENT VALIDITY CRA DATE CREDIT PERIOD OF RATING RATING INE191B14408 200,000,000/- 04/12/2020 A1+ 12 Months CARE _________________________________________________________________________________________________________________ Corporate Office : Welspun House, 5th Floor, Kamala City, Senapati Bapat Marg, Lower parel (West), Mumbai - 400013| CIN : L27100GJ1995PLC025609 Telephone No : +91-22-66136000; Fax No :+91-22-24908020 Registered Office : Welspun City, Tal. Anjar, District Kutch, Gujrat 370110, INDIA WELSPUN CORP LTD __________________________________________________________________________________ : • Issuing and Paying Agent : INDUSIND BANK LTD, 1st Floor, IndusInd House 425, Dadasaheb Bhadkamkar -

Conference Agenda

PROGRAM AT A GLANCE Day - 1 | Friday 26th Apr 8:30 16:30 Onsite registration 9:00 9:10 ASME PSD Introduction 9:10 9:20 Conference Inauguration & Opening Address 9:20 9:35 Address by Chief Guest 9:35 10:05 Keynote Address 10:05 10:30 Expo Inauguration & Tea Break Track 1 Materials, Design and Construction Vanguard Chair: S Jayachandran 10:30 12:50 Technical Papers 12:50 13:50 Lunch Track 2 Quality Governance in Pipelines Vanguard Chair: A K Tewari 13:50 15:30 Technical Papers 15:30 16:00 Tea Break & Expo Visit Panel Discussion II Session Moderator: K B Singh 16:00 17:30 Competency & Efficiency 17:30 18:00 Sponsored Presentation End of Technical Sessions Day -1 18:30 Hrs Onwards: Conference Gala Dinner Day 2 | Saturday 27th Apr 8:30 15:00 Onsite registration Track 3 Integrity Management Vanguard Chair: Narendra Kumar 8:40 10:40 Technical Papers - Session 1 10:40 11:10 Tea Break/ Expo Visit & Networking 11:10 12:30 Technical Papers - Session 2 12:30 13:30 Lunch Track 4 City Gas Distribution Vanguard Chair: E S Ranganathan 13:30 15:10 Technical Papers 15:10 15:40 Tea Break/ Expo Visit & Networking Panel Discussion II Session Moderator: Ashish Khera 15:40 17:00 Challenges & New Practices in Managing Ageing Pipeline Assets End of Technical Sessions Day -2 17:00 17:10 Closing Address 17:10 17:30 Vote of Thanks DETAILS OF IOGPC 2019 PAPERS Paper Number Title Author Organisation Track 1 Materials, Design and Construction Vanguard Chair: S Jayachandran IOGPC2019-4506 Manufacturing Of Extremely Low D/t LSAW Jigar Patel Welspun Corp Ltd Welded Pipe -

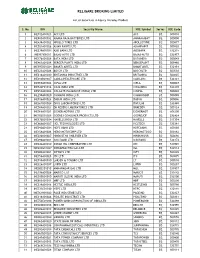

1.List of Scrips in Equity Intraday Product

RELIGARE BROKING LIMITED List of Securities in Equity Intraday Product S. No ISIN Security Name NSE Symbol Series BSE Code 1 INE012A01025 ACC LTD ACC EQ 500410 2 INE885A01032 AMARA RAJA BATTERIES LTD AMARAJABAT EQ 500008 3 INE438A01022 APOLLO TYRES LTD APOLLOTYRE EQ 500877 4 INE021A01026 ASIAN PAINTS LTD ASIANPAINT EQ 500820 5 INE238A01034 AXIS BANK LTD AXISBANK EQ 532215 6 INE917I01010 BAJAJ AUTO LTD BAJAJ-AUTO EQ 532977 7 INE176A01028 BATA INDIA LTD BATAINDIA EQ 500043 8 INE463A01038 BERGER PAINTS INDIA LTD BERGEPAINT EQ 509480 9 INE397D01024 BHARTI AIRTEL LTD BHARTIARTL EQ 532454 10 INE323A01026 BOSCH LTD BOSCHLTD EQ 500530 11 INE216A01030 BRITANNIA INDUSTRIES LTD BRITANNIA EQ 500825 12 INE010B01027 CADILA HEALTHCARE LTD CADILAHC EQ 532321 13 INE059A01026 CIPLA LTD CIPLA EQ 500087 14 INE522F01014 COAL INDIA LTD COALINDIA EQ 533278 15 INE259A01022 COLGATE-PALMOLIVE (INDIA) LTD COLPAL EQ 500830 16 INE298A01020 CUMMINS INDIA LTD CUMMINSIND EQ 500480 17 INE016A01026 DABUR INDIA LTD DABUR EQ 500096 18 INE361B01024 DIVIS LABORATORIES LTD DIVISLAB EQ 532488 19 INE089A01023 DR REDDYS LABORATORIES LTD DRREDDY EQ 500124 20 INE066A01021 EICHER MOTORS LTD EICHERMOT EQ 505200 21 INE102D01028 GODREJ CONSUMER PRODUCTS LTD GODREJCP EQ 532424 22 INE176B01034 HAVELLS INDIA LTD HAVELLS EQ 517354 23 INE860A01027 HCL TECHNOLOGIES LTD HCLTECH EQ 532281 24 INE040A01034 HDFC BANK LTD HDFCBANK EQ 500180 25 INE158A01026 HERO MOTOCORP LTD HEROMOTOCO EQ 500182 26 INE030A01027 HINDUSTAN UNILEVER LTD HINDUNILVR EQ 500696 27 INE090A01021 ICICI BANK LTD ICICIBANK