Open Alexandra Cohen Thesis.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2008 Economic and Social Report

Welcome to our factory BRINGING HEALTH THROUGH FOOD TO AS MANY PEOPLE AS POSSIBLE Economic and Social Report DANONE 08 economic and social report Interview with Franck Riboud A BUSINESS FOCUSED 100% ON HEALTH, WITH CLEAR PRIORITIES Special report: Nature NATURE, OUR PATH TO THE FUTURE Strategy DANONE FOR ALL? DANONE 2008 To our readers 2008 Annual reports often focus attention on earnings and num- 23 au 26 bers. But a business is much more Juillet 2009 than that. It’s about people and Evian - France the way they go about things; www.evianmasters.com it’s about values and challenges, a shared culture and a common project. Which is why Danone 08 looks beyond the figures in the hope of sharing with you some of what makes our experience a special adventure. The editorial team Danone 08 is also on www.danone.com Selected texts, insider news, photos and films—meet the people who are the real subject of Danone 08. More information to carry on the adventure. Danone 2008 —— 03 Contents 2008 Introducing a delicious dessert 06 FRANCK RIBOUD 62 DANONE FOR ALL? BRINGING HEALTH THROUGH FOOD TO AS MANY PEOPLE AS POSSIBLE A business 100% focused on Nearly 2 billion people DANONEeconomic and social report with all the goodness of Activia. health, with clear priorities. around the world have 08 access to at least one Danone product. 16 HIGHLIGHTS Achieving organic growth of 8.4%, Danone confirmed 72 INTERVIEW its targets—a roundup of Bernard Hours talks about the initiatives and products the Danone business model that set their mark on and levers for growth. -

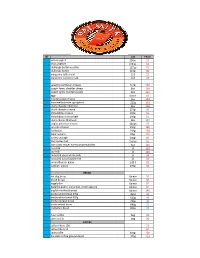

QT . SIZE PRICE Activia Yogurt 250Ml 15 Oikos Yoghurt 150 Gs 16 Challenge Butter Unsalted 113 Gs 72 Challenge Butter 113Gr 85 Ma

QT . SIZE PRICE activia yogurt 250ml 15 oikos yoghurt 150 gs 16 challenge butter unsalted 113 gs 72 challenge butter 113gr 85 margarine table maid 113 15 margarine country crock 113 23 sargento parmesan cheese 141gr 140 joseph farms cheddar cheese 8oz 109 joseph farms monterrey jack 8oz 116 eggs docen 50 monterey jack cheese 6oz 104 mozzarella cheese springfield 227g 103 sharp cheedar tillamook 8oz 150 shard cheedar cheese 227gr 96 philadelphia cheese 190gr 51 philadelphia cheese light 190gr 51 sharp cheese tillamook 8oz 104 singles american cheese 144 gs 97 san rafael bacon 250gr 140 fud bacon 250gr 104 italian salami 85gr 110 turkey sausage 500gr 95 ham turkey fud 250 gs 62 ham oscar mayer honey,smoked,boiled 6oz 116 rice milk 1lt 120 soy milk 1lt 120 caracol & yaqui whole milk 1lt 34 caracol & yaqui lowfat milk 1lt 34 caracol&yaqui galon 1.89 lt 62 yoghurt yoplait 170gr 35 BREAD hot dog bread 6piece 30 bread burger 6piece 30 bagel plain 6piece 92 bagel blueberri, cinnamon, onion,sesame 6piece 92 english muffins thomas 6piece 140 bimbo white bread 395g 395g 42 bimbo white bread 650g 650g 42 bimbo integral bread 720g 46 whole wheat bread 840g 72 multigrain bread 840g 72 flour tortilla bag 30 corn tortilla bag 25 COFFEE coffee filters 100 72 coffee filters 50 42 carey coffe 340gr 150 the cabo coffee ground decaff 375g 203 the cabo coffee medium ground 375g 203 the cabo coffee whole bean dark 375g 203 el marino traditional 369g 131 el marino espreess coffe 200g 102 el marino special roast 200g 110 el marino decaf 369g 159 sweet low sugar -

Danone Opens New Sustainable Nutricia Plant in the Netherlands to Meet Growing, Global Demand for Specialized Infant Formula

Press Release – Cuijk, the Netherlands, March 25, 2019 Danone opens new sustainable Nutricia plant in the Netherlands to meet growing, global demand for specialized infant formula • €240 million facility in Cuijk is among Danone’s largest investments in its European production network in the last ten years, building on the Netherland’s agricultural heritage and Nutricia’s scientific capabilities • Plant will produce highly specialized infant formula – including formula for specific health conditions, and will employ close to 500 employees once fully operational • State-of-the-art, sustainable, zero-waste facility powered with 100% renewable electricity Today, Danone proudly announces the official opening of its new Nutricia Cuijk production facility. The opening ceremony, taking place in the presence of a broad range of stakeholders, including the Minister of Agriculture, Nature and Food Quality, Carola Schouten, as well as industry and healthcare representatives, marks the completion of a three-year journey to build a state-of-the-art, energy-efficient, zero- waste plant. The facility will primarily produce specialized infant formula that meets the needs of infants diagnosed with specific medical conditions – such as cow’s milk protein allergy, as well as standard infant formula. The €240 million investment is among Danone’s largest in its European production network in the last ten years. “At Danone, we believe the health of people and the planet are interconnected, as expressed through our company vision ‘One Planet. One Health’. Our new Nutricia Cuijk facility is a significant investment towards achieving that vision. At this facility, we’ll be producing food for vulnerable babies; and we’re also doing everything we can to preserve a healthy and clean environment for future generations,” said Veronique Penchienati -Bosetta, Executive Vice President, Danone Specialized Nutrition. -

Danone to Acquire Whitewave, a USD 4 Bn Sales Global Leader in Organic Foods, Plant-Based Milks and Related Products

Danone to acquire WhiteWave, a USD 4 bn sales Global Leader in Organic Foods, Plant-based Milks and related products July 7, 2016 1 Cautionary note regarding forward-looking statements This document is presented by Danone. It contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify these forward-looking statements by forward-looking words, such as “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “believe,” “forecast,” “foresee,” “likely,” “may,” “should,” “goal,” “target,” “might,” “will,” “could,” “predict,” and “continue,” the negative or plural of these words and other comparable terminology. Forward-looking statements in this document include, but are not limited to, statements regarding the expected timing of the completion of the transactions described in this document, Danone’s operation of WhiteWave’s business following completion of the contemplated merger, and statements regarding the future operation, direction and success of WhiteWave’s businesses. These forward-looking statements are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those anticipated in these forward-looking statements. These risks and uncertainties include, but are not limited to, uncertainties as to the timing of the contemplated merger; uncertainties as to the approval of WhiteWave’s stockholders required in connection with the contemplated -

Registration Document DANONE Annual Financial Report 13 TABLE of CONTENTS

DANONERegistration Document 13 Annual Financial Report TABLE OF CONTENTS SELECTED FINANCIAL INFORMATION, SOCIAL, SOCIETAL 1 INFORMATION ABOUT THE ISSUER 5 AND ENVIRONMENTAL RESPONSIBILITY 160 AND INFORMATION ON THE 5.1 Danone social, societal and environmental approach 162 REGISTRATION DOCUMENT 4 5.2 Information concerning the Group’s social, societal and environmental performance in compliance with 1.1 Selected fi nancial information 6 the Grenelle II law 165 1.2 Information about the issuer 6 5.3 Funds sponsored by Danone 190 1.3 Information about the Registration Document 8 CORPORATE GOVERNANCE 196 OVERVIEW OF ACTIVITIES, RISK FACTORS 10 6 6.1 Governance bodies 198 2 6.2 Positions and responsibilities of the Directors and nominees to the Board of Directors 222 2.1 History 12 6.3 Compensation and benefi ts for executives 2.2 Presentation of the Group 13 and governance bodies 239 2.3 Strategic growth areas 14 6.4 Internal control and risk management 267 2.4 Description and strategy of the Divisions 16 6.5 Statutory auditors’ special report on related party 2.5 Other elements related to the Group’s activity agreements and commitments 275 and organization 18 2.6 Simplifi ed organizational chart of the Group as of December 31, 2013 23 SHARE CAPITAL AND SHARE OWNERSHIP 284 2.7 Risk factors 25 7 7.1 Company’s share capital 286 7.2 Treasury shares and DANONE call options held DANONE’S BUSINESS HIGHLIGHTS IN by the Company and its subsidiaries 287 2013 AND OUTLOOK FOR 2014 38 7.3 Authorization to issue securities that give access 3 to the share -

Culture Warsw To

Culture Warsw to How the Food Giants Turned Yogurt, a Health Food, into Junk Food Navigating the Dairy Case to Find Quality, Safety and Nutritional Value A Report by The Cornucopia Institute | November 2014 Table of Contents Executive Summary ....................................................... 5 Section I: Yogurt, Probiotics and the Microbiome ................................ 9 Section II: Benefits of Organic Yogurt ......................................... 17 Section III: Greek Yogurt ................................................... 23 Section IV: Ingredients in Yogurt ............................................. 27 Section V: Cost Comparison of Conventional vs. Organic Brands ................... 47 Conclusion ............................................................... 51 Appendix: The Yogurt Market ............................................... 53 References .............................................................. 55 The Cornucopia Institute wishes to sincerely thank the thousands of family farmers and their “urban allies” who fund our work with their generous donations. Special thanks to Olivia Shelton and Maggie Yount for their work on this report. The Cornucopia Institute is dedicated to the fight for economic justice for the family-scale farming community. Through research and education, our goal is to empower farmers and their customers in the good food movement, both politically and through marketplace initiatives. Cornucopia’s Organic Integrity Project acts as a corporate and governmental watchdog assuring that -

2.2.3. Danone

1 2.2.3. Danone without any clear sustainability criteria. The company currently reports having reached 6.4% recycled material in its total volume of Danone is a French multinational; its product ranges cover infant nutrition, water, and dairy- and plant-based products, and its well- plastic packaging; this has increased from 5.3% in 2017, which they attribute to the increase of rPET.15 known brands include Activia, Alpro, Aptamil, Nutricia, Evian and Volvic.1 The company has declared its plastic footprint as 820,000 metric tonnes, and has published a breakdown of its packaging portfolio by material and packaging type.2 It said that, in 2017, 86% of The company reports plans to eliminate single-use plastic straws and cutlery by 2025,16 and highlights a pilot scheme assessing alterna- its total packaging (and 77% of plastic packaging) was already reusable, recyclable or compostable.3 The company was identified as the tives to plastic straws with its Indonesian brand, Aqua.17 However, there is very little detail about how the single-use-plastic items will fourth-biggest global plastic polluter in the 2018 Break Free From Plastic Audit, but did not feature in the top ten in the 2019 audit.4 be eliminated, or whether they will be replaced with another single-use material. Danone has also committed to phasing out all PVC and Nevertheless, as a multinational, fast-moving consumer-goods (FMCG) company with a significant plastic footprint, we have chosen to PVDC from packaging by 2021. include Danone in this analysis. Danone appears to be one of very few companies that explicitly reference the need for effective collection systems and express support for DRS, which is commendable.5 Danone also says it will help to meet – or go beyond – mandatory-col- lection targets, as set by regulators worldwide. -

ANNUAL REPORT 2019 Danone

ANNUAL REPORT 2019 Danone Accelerating the FOOD revolution TOGETHER Celebrating ‘ONE PERSON, BUSiNESS-LED 100 YEARS ONE VOiCE, ONE SHARE’ COALITiONS of pioneering healthy 100,000 employees for inclusive growth innovation co-owning our future & biodiversity Contents #1 Danone in 2019 4 11 Danone Empowering employees at a gIance to co-own our vision 12 2019 Celebrating 100 years of pioneering Key milestones healthy innovation together 8 13 Interview with our Chairman and CEO, Collective action Emmanuel Faber, for greater impact by Danone employees & transformational change 10 Progressing towards our 2030 Goals #2 Performance Creating sustainable & profitable value for all 15 22 3 questions to Essential Dairy Cécile Cabanis, CFO & Plant-Based 1 24 #3 Health & Nutrition Waters performance 2 18 Specialized Nutrition Collaborative Environmental performance innovation 20 Building a healthier Social performance & sustainable food system together 29 34 Boosting Co-creating innovation the future of food 30 3 Growing with purpose A people-powered company 32 Biodiversity: from farm to fork For more information: danone.com/integrated- annual-report-2019 3 Danone at a glance OUR MISSION: ‘BRINGING HEALTH THROUGH FOOD A GLOBAL LEADER WITH A UNIQUE HEALTH-FOCUSED TO AS MANY PEOPLE AS POSSIBLE’ PORTFOLIO IN FOOD AND BEVERAGES LEADING POSITIONS (1) STRONG PROGRESS ON PROFITABLE GROWTH IN 2019 #1 #1 #2 €25.3 bn 15.21% €3.85 €2.10 Sales Recurring operating Recurring earnings Dividend per share WORLDWiDE EUROPE WORLDWiDE margin per share (EPS) payable in -

Poursuite De La Croissance Rentable Objectifs Confirmés

Résultats du 1er semestre 2019 Communiqué de presse – Paris, le 25 juillet 2019 Exécution réussie : poursuite de la croissance rentable Objectifs confirmés ▪ Chiffre d’affaires consolidé en hausse de +1,3% en données publiées au 2e trimestre, à 6 496 millions d’euros ▪ Rebond de la croissance des ventes au 2e trimestre comme attendu : +2,5% en données comparables, avec tous les pôles en croissance de plus de 2% ▪ Marge opérationnelle courante en hausse de 42 pb à 14,69%, en amélioration pour le 7ème semestre consécutif ▪ Forte croissance du BNPA courant : +6,3%, à 1,87€ ▪ BNPA publié : 1,58€, intégrant les effets de la vente d’Earthbound Farm et de coûts de restructuration non courants ▪ Objectifs 2019 confirmés : croissance du chiffre d’affaires autour de 3% en données comparables et marge opérationnelle courante supérieure à 15% Commentaire d’Emmanuel Faber, Président-Directeur Général « Notre performance du premier semestre reflète la priorité donnée à une exécution de qualité, et les progrès réalisés dans la transformation de Danone afin d’être plus agiles et résilients, et générer une croissance rentable durable. Je me réjouis de l’accélération des ventes au deuxième trimestre, avec une croissance dans tous les pôles. La dynamique d’innovation reste soutenue, et nous avons également redressé la plupart de nos activités moins performantes. L’amélioration de la marge brute, et les économies générées par notre programme d’efficacité ‘Protein’ ont permis une bonne progression de notre marge opérationnelle. Cette performance est portée par notre objectif de long- terme de création de valeur responsable et inclusive; nous sommes en bonne voie pour l’atteinte de nos objectifs 2020. -

Superfood : the Taste of Tomorrow RECIPES from MULTINATIONALS the Functional Food Boom the Success of Organic Products Investigating the Proteins Market

N°2 MAY 2016 WWW.SWISSQUOTE.COM CHF 8.- FOXCONN Rise of the robots 15 firms under the magnifying ANALYSIS Is the Swiss watch glass industry in crisis ? MATCH GROUP Getting to know the leader in DOSSIER online dating Superfood : the taste of tomorrow RECIPES FROM MULTINATIONALS The functional food boom The success of organic products Investigating the proteins market DANONE PEPSICO KELLOGG’S YAKULT GENERAL MILLS NESTLÉ CAMPBELL’S TO BREAK THE RULES, YOU MUST FIRST MASTER THEM. THE VALLÉE DE JOUX. FOR MILLENNIA A HARSH, UNYIELDING ENVIRONMENT; AND SINCE 1875 THE HOME OF AUDEMARS PIGUET, IN THE VILLAGE OF LE BRASSUS. THE EARLY WATCHMAKERS WERE SHAPED HERE, IN AWE OF THE FORCE OF NATURE YET DRIVEN TO MASTER ITS MYSTERIES THROUGH THE COMPLEX MECHANICS OF THEIR CRAFT. STILL TODAY THIS PIONEERING SPIRIT INSPIRES US TO CONSTANTLY CHALLENGE THE CONVENTIONS OF FINE WATCHMAKING. ROYAL OAK CHRONOGRAPH IN YELLOW GOLD GENEVA BOUTIQUE AUDEMARS PIGUET PLACE DE LA FUSTERIE 12, TEL: +41 22 319 06 80 MONTRES PRESTIGE GRAND HOTEL KEMPINSKI, TEL: +41 22 732 83 00 EDITORIAL SWISSQUOTE MAY 2016 Superfoods are becoming super popular Marc Bürki, CEO of Swissquote onsumers today are more At the Nestlé Institute of Health health-conscious, and Sciences on the EPFL campus, the they’re willing to pay more company is developing products to Cfor foods that are better for them – prevent diabetes, cardiovascular or advertised as such. Food industry disease and muscle loss. giants are adapting to the trend. In addition to being very promising, You can find functional foods the health food market presents (‘high-tech’ foods with added another important advantage for vitamins and supplements) at the businesses : it’s a great time to get supermarket next to the organic, into e-commerce. -

Bryan Hussey - Target Companies

BRYAN HUSSEY - TARGET COMPANIES FOODS LOCATION BRANDS ACH Foods Cordova, TN Argo, Karo, Mazola, Durkee, Spice Islands, Blue Buffalo Company, Ltd. Wilton, CT Blue Bufffalo Clif Bar & Company Emeryville, CA Clif Bar Diamond Foods Inc. (Snyder's Lance) Stockton, CA Diamond, Pop Secret, Emerald Hain Celestial Group Lake Success, NY Celestial Seasonings, Hain, Earth's Best, Garden of Eatin' Hormel Foods Austin, MN Hormel, Spam, Skippy, Justin's JM Smucker Company Orville, OH Smucker's, Jif, Crisco, Folgers McCormick & Company Sparks, MD McCormick, Lawry's, Old Bay Post Holdings St. Louis, MO Post, Malt-O-Meal, Better Oats, All Whites, Power Bar, Premier Protein Sunsweet Growers Yuba City, CA Sunsweet Whitewave Foods Denver, CO Silk, So Delicious, Alpro, Vega, International Delight, Horizon Organic, Earthbound Farm Organic OTC Clarion Brands Trevose, PA Lipo-Flavonoid, Certain Dri, Cystex, Abolene, Absorbine Jr. Majestic Drug Co. South Fallsburg, NY Dentemp, Refilit, Recapit, Repair-It, Reline-It, Clean-It, Proxi-Plus, SenzAway, Sword Floss Matrixx Initiatives, Inc. Scottsdale, AZ Zicam Moberg Pharma Cedar Knolls, NJ Nalox, Kerasal, Emtrix, Balmex, Domeboro Natren Inc. Westlake Village, CA Natren Prestige Brands Tarrytown, NY Dramamine, Gaviscon, Chloraseptic, Clear Eyes, Comet, Spic & Span, Massengill, Efferdent, Anacin, Nytol PERSONAL CARE Carma Labs Inc. Franklin, WI Carmex CB Fleet Company Lynchburg, VA Fleet, Pedia Lax, Summer's Eve, Norforms, Phazyme, Boudreaux's Church & Dwight Trenton, NJ Arm & Hammer, Orajel, Nair, OxiClean, First Response, Trojan, Vitafusion, Arrid, Close-up, Kaboom, Orange Glo ET Browne Drug Co., Inc. Englewood Cliffs, NJ Palmer's EO Products San Rafael, CA EO The Honest Company Santa Monica, CA Honest OTHER ACME United Corp. -

Danone Sells Earthbound Farm to Taylor Farms

Press Release – Paris, April 11, 2019 Danone sells Earthbound Farm to Taylor Farms Danone announces it has signed a definitive agreement for the sale of Earthbound Farm, the US organic salads business, to California-based Taylor Farms, a family-owned salads and fresh foods company. The transaction closed today. The sale of Earthbound Farm, which had annual sales of about USD400m in 2018, is part of Danone’s portfolio management and capital allocation optimization strategy. Earthbound Farm, founded in 1984 in California, is the largest producer of organic salads in the US. The company had been owned by WhiteWave Foods since 2013. Danone acquired WhiteWave in 2017, significantly expanding its global presence in plant-based and organic food products and creating a global leader uniquely positioned to capitalize on consumer trends towards healthier and more sustainable eating and drinking choices. About Danone (www.danone.com) Dedicated to bringing health through food to as many people as possible, Danone is a leading global food & beverage company building on health-focused and fast-growing categories in three businesses: Essential Dairy & Plant-based products, Waters and Specialized Nutrition. Danone aims to inspire healthier and more sustainable eating and drinking practices, in line with its ‘One Planet. One Health’ vision which reflects a strong belief that the health of people and that of the planet are interconnected. To bring this vision to life and create superior, sustainable, profitable value for all its stakeholders, Danone has defined its 2030 Goals: a set of nine integrated goals aligned with the Sustainable Development Goals (SDGs) of the United Nations.