FTSE Publications

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1332 Nippon Suisan Kaisha, Ltd. 50 1333 Maruha Nichiro Corp. 500 1605 Inpex Corp

Nikkei Stock Average - Par Value (Update:August/1, 2017) Code Company Name Par Value(Yen) 1332 Nippon Suisan Kaisha, Ltd. 50 1333 Maruha Nichiro Corp. 500 1605 Inpex Corp. 125 1721 Comsys Holdings Corp. 50 1801 Taisei Corp. 50 1802 Obayashi Corp. 50 1803 Shimizu Corp. 50 1808 Haseko Corp. 250 1812 Kajima Corp. 50 1925 Daiwa House Industry Co., Ltd. 50 1928 Sekisui House, Ltd. 50 1963 JGC Corp. 50 2002 Nisshin Seifun Group Inc. 50 2269 Meiji Holdings Co., Ltd. 250 2282 Nh Foods Ltd. 50 2432 DeNA Co., Ltd. 500/3 2501 Sapporo Holdings Ltd. 250 2502 Asahi Group Holdings, Ltd. 50 2503 Kirin Holdings Co., Ltd. 50 2531 Takara Holdings Inc. 50 2768 Sojitz Corp. 500 2801 Kikkoman Corp. 50 2802 Ajinomoto Co., Inc. 50 2871 Nichirei Corp. 100 2914 Japan Tobacco Inc. 50 3086 J.Front Retailing Co., Ltd. 100 3099 Isetan Mitsukoshi Holdings Ltd. 50 3101 Toyobo Co., Ltd. 50 3103 Unitika Ltd. 50 3105 Nisshinbo Holdings Inc. 50 3289 Tokyu Fudosan Holdings Corp. 50 3382 Seven & i Holdings Co., Ltd. 50 3401 Teijin Ltd. 250 3402 Toray Industries, Inc. 50 3405 Kuraray Co., Ltd. 50 3407 Asahi Kasei Corp. 50 3436 SUMCO Corp. 500 3861 Oji Holdings Corp. 50 3863 Nippon Paper Industries Co., Ltd. 500 3865 Hokuetsu Kishu Paper Co., Ltd. 50 4004 Showa Denko K.K. 500 4005 Sumitomo Chemical Co., Ltd. 50 4021 Nissan Chemical Industries, Ltd. 50 4042 Tosoh Corp. 50 4043 Tokuyama Corp. 50 WF-101-E-20170803 Copyright © Nikkei Inc. All rights reserved. 1/5 Nikkei Stock Average - Par Value (Update:August/1, 2017) Code Company Name Par Value(Yen) 4061 Denka Co., Ltd. -

Published on 7 October 2016 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2016) Published on 7 October 2016 1. Constituents Change Addition( 70 ) Deletion( 60 ) Code Issue Code Issue 1810 MATSUI CONSTRUCTION CO.,LTD. 1868 Mitsui Home Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2196 ESCRIT INC. 2117 Nissin Sugar Co.,Ltd. 2198 IKK Inc. 2124 JAC Recruitment Co.,Ltd. 2418 TSUKADA GLOBAL HOLDINGS Inc. 2170 Link and Motivation Inc. 3079 DVx Inc. 2337 Ichigo Inc. 3093 Treasure Factory Co.,LTD. 2359 CORE CORPORATION 3194 KIRINDO HOLDINGS CO.,LTD. 2429 WORLD HOLDINGS CO.,LTD. 3205 DAIDOH LIMITED 2462 J-COM Holdings Co.,Ltd. 3667 enish,inc. 2485 TEAR Corporation 3834 ASAHI Net,Inc. 2492 Infomart Corporation 3946 TOMOKU CO.,LTD. 2915 KENKO Mayonnaise Co.,Ltd. 4221 Okura Industrial Co.,Ltd. 3179 Syuppin Co.,Ltd. 4238 Miraial Co.,Ltd. 3193 Torikizoku co.,ltd. 4331 TAKE AND GIVE. NEEDS Co.,Ltd. 3196 HOTLAND Co.,Ltd. 4406 New Japan Chemical Co.,Ltd. 3199 Watahan & Co.,Ltd. 4538 Fuso Pharmaceutical Industries,Ltd. 3244 Samty Co.,Ltd. 4550 Nissui Pharmaceutical Co.,Ltd. 3250 A.D.Works Co.,Ltd. 4636 T&K TOKA CO.,LTD. 3543 KOMEDA Holdings Co.,Ltd. 4651 SANIX INCORPORATED 3636 Mitsubishi Research Institute,Inc. 4809 Paraca Inc. 3654 HITO-Communications,Inc. 5204 ISHIZUKA GLASS CO.,LTD. 3666 TECNOS JAPAN INCORPORATED 5998 Advanex Inc. 3678 MEDIA DO Co.,Ltd. 6203 Howa Machinery,Ltd. 3688 VOYAGE GROUP,INC. 6319 SNT CORPORATION 3694 OPTiM CORPORATION 6362 Ishii Iron Works Co.,Ltd. 3724 VeriServe Corporation 6373 DAIDO KOGYO CO.,LTD. 3765 GungHo Online Entertainment,Inc. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

Company Response Status and Score Company Response Status and Score

2017 Company response status and score Company response status and score Key to response status: AQ Answered questionnaire AQ (NP) Answered questionnaire but response not made public AQ (SA) Company is either a subsidiary or has merged during the reporting process; see Company in parenthesis for further information AQ (L) Answered questionnaire after submission deadline DP Declined to participate NR No response RV Responded voluntarily 1 Score levels: The levels build consecutively from Disclosure to Leadership. A threshold of 75% in a lower level has to be passed before a company is scored for the next level. For more information, please see our Introduction to Scoring. A Leadership A- B Management B- C Awareness C- D Disclosure D- F: Failure to provide sufficient information to CDP to be evaluated for this purpose 2 Company Response Status Ticker Country HQ CDP Band and Score Consumer Discretionary ABC-Mart, Inc. NR 2670 JP Japan Failure to disclose (F) AccorHotels DP AC FP France Failure to disclose (F) Adastria Co., Ltd. NR 2685 JP Japan Failure to disclose (F) adidas AG AQ ADS GR Germany Leadership (A-) Advance Auto Parts Inc NR AAP US USA Failure to disclose (F) Aisin Seiki Co., Ltd. AQ (NP) 7259 JP Japan Awareness (C) AKSA AKRILIK KIMYA SANAYII A.S. DP AKSA TI Turkey Failure to disclose (F) Anta Sports Products Ltd NR 2020 HK Hong Kong Failure to disclose (F) Aoyama Trading Co., Ltd. NR 8219 JP Japan Failure to disclose (F) 1 Companies that respond voluntarily to CDP are not scored unless they request this service. -

Annual Report 2017 Nippon Paper Industries Co., Ltd. Annual Report 2017 5 to Our Stakeholders

NIPPON PAPER INDUSTRIES CO., LTD. CO., INDUSTRIES PAPER NIPPON ANNUAL REPORT 2017 Nippon Paper Industries Co., Ltd. 4-6, Kanda-Surugadai, Chiyoda-ku, Tokyo 101-0062, Japan TEL +81-3-6665-1111 http://www.nipponpapergroup.com/english/ ANNUAL REPORT 2017 For the Fiscal Year Ended March 31, 2017 Securities Code: 3863 Nippon Paper Industries Co., Ltd. (Securities Code: 3863) To shape the future with trees The identity of the Nippon Paper Group is “with trees.” At the heart of our Group Mission is our belief in the possibilities of paper and the consistent contribution we have made to people’s lives and culture throughout our history. By applying our technology and expertise to maximize the value of renewable forest resources, we will continue to contribute to better living and cultural progress around the world. Mission The Nippon Paper Group aims to contribute to better living and cultural progress everywhere it does business. Vision 1. Drive social sustainability through our business 2. Delight our customers 3. Instill pride in employees 4. Give back to society Values Challenge: Embrace new challenges Fairness: Be fair Teamwork: Champion teamwork Slogan Shaping the future with trees KKitayama,itayama, a NNipponippon PPaper-ownedaper-owned FForestorest NNipponippon PPaperaper IIndustriesndustries CCo.,o., LLtd.td. AAnnualnnual RReporteport 20172017 1 as a comprehensive biomass company, Wood is a renewable resource that is characterized by its diverse applications, and makes possible the creation of some of the leading materials of our generation. As a comprehensive biomass company, Nippon Paper operates a broad range of businesses, from products using wood fi ber as the raw material such as paper, packaging and healthcare goods through to businesses that take full advantage of wood components, such as creating chemical products, producing lumber and construction materials and providing energy services. -

ACZH Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value Fund May 28, 2021 Avantis International Small Cap Value Fund - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 98.5% Australia — 8.0% Adairs Ltd. 10,087 36,395 Adbri Ltd. 41,613 106,901 Aeris Resources Ltd.(1) 194,638 25,413 Alkane Resources Ltd.(1)(2) 23,444 15,852 Alliance Aviation Services Ltd.(1) 9,551 32,478 Asaleo Care Ltd. 55,544 60,172 Aurelia Metals Ltd. 117,534 40,228 Austal Ltd. 40,665 74,694 Australian Finance Group Ltd. 27,184 58,450 Australian Pharmaceutical Industries Ltd. 57,039 50,799 Bank of Queensland Ltd. 50,470 351,413 Beach Energy Ltd. 256,312 252,041 Bega Cheese Ltd. 10,686 47,626 Bendigo & Adelaide Bank Ltd. 28,090 227,274 Boral Ltd.(1) 23,590 124,899 Brickworks Ltd. 3,303 53,477 Byron Energy Ltd.(1) 7,834 635 Calix Ltd.(1) 13,271 28,120 Champion Iron Ltd.(1) 59,052 300,176 Class Ltd. 1,392 1,856 Coronado Global Resources, Inc.(1) 116,275 62,270 CSR Ltd. 61,819 265,781 Dacian Gold Ltd.(1) 57,096 12,508 Eclipx Group Ltd.(1) 40,478 66,477 Emeco Holdings Ltd.(1) 64,744 45,199 EML Payments Ltd.(1) 32,108 84,701 Fleetwood Ltd. 1,403 2,649 Galaxy Resources Ltd.(1) 50,126 148,165 Genworth Mortgage Insurance Australia Ltd.(1) 23,355 49,881 Gold Road Resources Ltd. 119,473 138,134 GrainCorp Ltd., A Shares 46,105 178,302 Grange Resources Ltd. -

2019 Investment Stewardship Annual Report

2019 Investment Stewardship Annual Report August 2019 Annual Report Navigating long-term change – 3 Active the year in review 2018-2019 Investment Stewardship 4 stewardship: highlights creating long- Our achievements 5 Our principles, guidelines, priorities, 7 term value and commentaries The Investment Stewardship Engagement and voting case studies 10-22 Annual Report provides an • Board quality and effectiveness remain overview of BlackRock’s approach our primary focus • Corporate strategy and capital allocation to corporate governance and • Executive compensation stewardship in support of long- • Environmental risk and opportunities term value creation for our clients. • Human capital management as an In this report we provide practical investment issue examples of the BlackRock Spotlight on activism 23 Investment Stewardship (BIS) Engagement and voting statistics 24 team’s work over the year, Investor perspective and public policy 25 distilling some of the trends and Industry affiliations and memberships 28 company-specific situations reported in our regional quarterly Appendix reports. We emphasize the List of companies engaged 31 outcome of our engagements with BlackRock’s 2019 PRI assessment 38 companies, including some which report and score have spanned several years. We also provide examples of where we have contributed to the public discourse on corporate Our Annual Report reporting period is July 1, 2018 to June 30, 2019, representing the Securities and Exchange governance and investment Commission’s (SEC) 12-month reporting period for US mutual funds, including iShares. stewardship. Navigating long-term change – the year in review The adage “change is the only constant” has never been more true than in the past year. -

CDP Japan Water Security Report 2019

CDP Japan Water Security Report 2019 On behalf of 525 institutional investors with assets of USD 96 trillion CDP Japan Water Security Report 2019 | 2020 March Report writer Contents CDP Foreword 3 Report Writer Foreword 4 Water Security A List 2019 6 Scoring 7 Stories of Change 8 - Kao Corporation - Japan Tobacco Inc. Executive Summary 12 Response to CDP’s Water Security Questionnaire 14 Appendix 22 - CDP Water Security 2019 Japanese companies Please note that the names of companies in the text do not indicate their corporate status. Important Notice The contents of this report may be used by anyone providing acknowledgment is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2019 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327 -

Grid Export Data

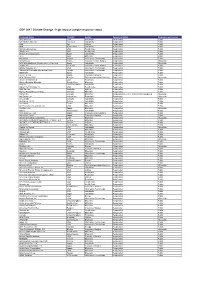

CDP 2017 Climate Change - high-impact sample response status Company Name Country Sector Response Status Response permission 3M Company USA Industrials Responded Public A.P. Moller - Maersk Denmark Industrials Responded Public A2A Italy Utilities Responded Public ABB Switzerland Industrials Responded Public Abbott Laboratories USA Health Care Responded Public AbbVie Inc USA Health Care Responded Public Abertis Infraestructuras Spain Industrials Responded Public ACC India Materials Responded Public Accenture Ireland Information Technology Responded Public AccorHotels France Consumer Discretionary Responded Not public ACS Actividades de Construccion y Servicios Spain Industrials Responded Not public adidas AG Germany Consumer Discretionary Responded Public Adobe Systems, Inc. USA Information Technology Responded Public Advanced Semiconductor Engineering Taiwan Information Technology Responded Public AENA SA Spain Industrials Responded Public Aeon Co., Ltd. Japan Consumer Staples Responded Public AFK Sistema JFSC Russia Telecommunication Services Responded Not public AFLAC Incorporated USA Financials Responded Public African Rainbow Minerals South Africa Materials Responded Public Aggreko United Kingdom Industrials Responded Public Agilent Technologies Inc. USA Health Care Responded Public AGL Energy Australia Utilities Responded Public Agnico-Eagle Mines Limited Canada Materials Responded Public Agrium Inc. Canada Materials Responded late, after analysis was completed Not public AIA Group Ltd. Hong Kong Financials Responded Not public Air Canada Canada Industrials Responded Public Air France - KLM France Industrials Responded Public Air Liquide France Materials Responded Public Air Products & Chemicals, Inc. USA Materials Responded Public Air Water Inc. Japan Materials Responded Not public Airbus Netherlands Industrials Responded Public Aisin Seiki Co., Ltd. Japan Consumer Discretionary Responded Public Ajinomoto Co.Inc. Japan Consumer Staples Responded Public AK Steel Holding Corporation USA Materials Responded Not public AKÇANSA ÇİMENTO SANAYİ VE TİCARET A.Ş. -

List of the Expected Price Adjustment Factor As on May 10, 2021

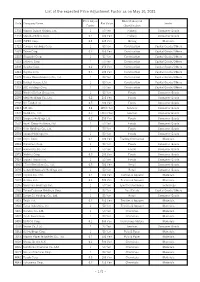

List of the expected Price Adjustment Factor as on May 10, 2021 Price Adjust Nikkei Industrial Code Company Name Par Value Sector Factor Classification 1332 Nippon Suisan Kaisha, Ltd. 1 50 Yen Fishery Consumer Goods 1333 Maruha Nichiro Corp. 0.1 500 Yen Fishery Consumer Goods 1605 INPEX Corp. 0.4 125 Yen Mining Materials 1721 Comsys Holdings Corp. 1 50 Yen Construction Capital Goods/Others 1801 Taisei Corp. 0.2 250 Yen Construction Capital Goods/Others 1802 Obayashi Corp. 1 50 Yen Construction Capital Goods/Others 1803 Shimizu Corp. 1 50 Yen Construction Capital Goods/Others 1808 Haseko Corp. 0.2 250 Yen Construction Capital Goods/Others 1812 Kajima Corp. 0.5 100 Yen Construction Capital Goods/Others 1925 Daiwa House Industry Co., Ltd. 1 50 Yen Construction Capital Goods/Others 1928 Sekisui House, Ltd. 1 50 Yen Construction Capital Goods/Others 1963 JGC Holdings Corp. 1 50 Yen Construction Capital Goods/Others 2002 Nisshin Seifun Group Inc. 1 50 Yen Foods Consumer Goods 2269 Meiji Holdings Co., Ltd. 0.2 250 Yen Foods Consumer Goods 2282 NH Foods Ltd. 0.5 100 Yen Foods Consumer Goods 2413 M3, Inc. 2.4 125/6 Yen Services Consumer Goods 2432 DeNA Co., Ltd. 0.3 500/3 Yen Services Consumer Goods 2501 Sapporo Holdings Ltd. 0.2 250 Yen Foods Consumer Goods 2502 Asahi Group Holdings, Ltd. 1 50 Yen Foods Consumer Goods 2503 Kirin Holdings Co., Ltd. 1 50 Yen Foods Consumer Goods 2531 Takara Holdings Inc. 1 50 Yen Foods Consumer Goods 2768 Sojitz Corp. 0.1 500 Yen Trading Companies Materials 2801 Kikkoman Corp. -

Sustainability Report 2012

Sustainability Report 2012 Sustainability Report NIPPON PAPER GROUP Sustainability Report 2012 Detailed Edition NIPPON PAPER GROUP, INC. Editorial Policy The Nippon Paper Group has this year published an English-language detailed edition sustainability report to provide both in-house and external stakeholders an in-depth account of the Group’s corporate social responsibility (CSR) activities. In addition, the Group has published an annual report covering the economic and financial aspects of the Group’s activities. Sustainability Report 2012 (Highlight Edition, Japanese only) Most Material In order to enhance communication, the Nippon Paper Group has drawn attention of stakeholders Issues Matters holding the from its wide-ranging CSR activities to provide an easy-to-read highlight Sustainability Report edition that focuses on matters of particular interest to stakeholders as (Highlight Edition, well as activities that the Company considers are of major importance. Japanese only) Major Efforts Sustainability Report 2012 (Detailed Edition) This Report Regarding CSR The Nippon Paper Group has endeavored to provide a full and Sustainability Report (Detailed Edition) comprehensive account of its major CSR activities in an effort to promote in-depth information disclosure and to ensure accountability. Referring to the ISO 26000 standard, which provides voluntary guidance on social responsibility, this Sustainability Report 2012 also outlines the connection Matters the Company between seven core subjects and disclosure items. (Please refer to the considers important bottom of page 3.) The Selection of Reporting Items The selection of reporting items was made taking into consideration matters holding the attention of stakeholders and items that the Company considers are of major importance.