SEC News Digest, 05-26-1983

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Reinsurance Company No One Wants Capital, GE Plans to Inject $1.8 Billion Into at ERC in 1999, the Company Sported Top GE’S Employers Re the Company

SM SCHIFFThe world’s most dangerous’ insuranceS publication November 22, 2002 Volume 14 • Number 17 INSURANCE OBSERVER The Reinsurance Company No One Wants capital, GE plans to inject $1.8 billion into at ERC in 1999, the company sported top GE’s Employers Re the company. (In the past five years ERC ratings from Best, S&P, and Moody’s. n early 1999 we placed a call to has upstreamed $2 billion in dividends to Those ratings are now history. As recently General Electric Capital—the parent its parent company.) GE also announced as July 10, Best affirmed ERC’s “A++” rat- of Employers Re (ERC), one of the a $4.5 billion infusion into GE Capital, ing, commenting on the company’s “ex- Iworld’s largest reinsurance organiza- whose balance sheet is stretched a bit cellent stand-alone capitalization; leading tions. We wanted to discuss a series of thin. (GE Capital has $260 billion of debt global market position, and prospective ERC ads that carried the famous GE logo outstanding.) long-term earnings capability.” On and that stated, in a variety of ways, that Until 2000, ERC had been reporting October 14, in light of the company’s ERC’s policies were “backed by” GE’s profits that did not upset Jack Welch’s gut. problems, Best revised its rating to “A+”, “resources” and “capital reserves.” Now it’s clear that ERC’s recent earn- expressing its “concerns regarding GE’s ERC’s ads were misleading and de- ings were an illusion resulting long-term commitment to GE Global ceptive because they gave the false im- from—we say this with all due re- [ERC’s direct parent] due to its pression that GE—as opposed to ERC— spect—honest mistakes made by bias against earnings volatility in- had financial responsibility for ERC’s GE stock-option holders trying to herent in GE Global’s non-life obligations. -

SEC News Digest, 07-09-1985

""~B~C new~.~~~lS~'~5t EXCHANGE COMMISt)ION CIVIL PROCEEDINGS SETTLEMENT REACHED BETWEEN SEC AND NEAL R. GROSS AND CO., INC. George G. Kundah1, Executive Director of the Commission, announced that on June 21 a settlement was reached between the Commission and Neal R. Gross and Co., Inc., the Commission's former stenographic reporting contractor. On June 13, 1982, the Commis- sion issued a default against Gross for late and poor quality transcripts. Gross sub- sequently appealed the default to the Armed Services Board of Contract Appeals, and claimed entitlement to excess performance costs in the amount of $706,691.66. Under the terms of the Settlement Agreement, Gross agrees to withdraw its claim for $706,691,661 the default is rescinded and the contract cancelled as of June 13, 19831 Gross agrees not to bid on any Commission contracts for reporting services for 15 years 1 and the Commission agrees to return $25,681 which it had drawn against Gross' performance bond, and $1,062.01 in incorrectly calculated discounts, plus interest on these amounts. (Appeals of Neal R. Gross and Co., Inc., ASBCA NOS. 28776 and 29982, filed October 26, 1983 and September 7, 1984, respectively). (LR-10810) CRIMINAL PROCEEDINGS . CHARLES J. ASCENZI INDICTED The washington Regional Office announced that on June 18 a grand jury in West Palm Beach, Florida named Charles J. Ascenzi of Silverdale, pennsylvania in a two-count indictment alleging wire fraud and the filing of false documents with a bank having deposits insured by the Federal Deposit Insurance Corporation. The indictment alleges that Ascenzi fraudulently obtained $625,000 from the proceeds of an industrial revenue bond issue by the City of West Memphis, Arkansas for the benefit of Maphis Chapman Corporation of Arkansas. -

Lehman Brothers

Lehman Brothers Lehman Brothers Holdings Inc. (Pink Sheets: LEHMQ, former NYSE ticker symbol LEH) (pronounced / ˈliːm ə n/ ) was a global financial services firm which, until declaring bankruptcy in 2008, participated in business in investment banking, equity and fixed-income sales, research and trading, investment management, private equity, and private banking. It was a primary dealer in the U.S. Treasury securities market. Its primary subsidiaries included Lehman Brothers Inc., Neuberger Berman Inc., Aurora Loan Services, Inc., SIB Mortgage Corporation, Lehman Brothers Bank, FSB, Eagle Energy Partners, and the Crossroads Group. The firm's worldwide headquarters were in New York City, with regional headquarters in London and Tokyo, as well as offices located throughout the world. On September 15, 2008, the firm filed for Chapter 11 bankruptcy protection following the massive exodus of most of its clients, drastic losses in its stock, and devaluation of its assets by credit rating agencies. The filing marked the largest bankruptcy in U.S. history.[2] The following day, the British bank Barclays announced its agreement to purchase, subject to regulatory approval, Lehman's North American investment-banking and trading divisions along with its New York headquarters building.[3][4] On September 20, 2008, a revised version of that agreement was approved by U.S. Bankruptcy Judge James M. Peck.[5] During the week of September 22, 2008, Nomura Holdings announced that it would acquire Lehman Brothers' franchise in the Asia Pacific region, including Japan, Hong Kong and Australia.[6] as well as, Lehman Brothers' investment banking and equities businesses in Europe and the Middle East. -

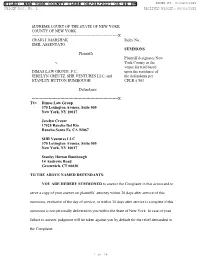

Filed: New York County Clerk 06/04/2021 06:46 Pm Index No

FILED: NEW YORK COUNTY CLERK 06/04/2021 06:46 PM INDEX NO. 653623/2021 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 06/04/2021 SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK ------------------------------------------------------------------X CRAIG J. MARSHAK, Index No.: EMIL ASSENTATO SUMMONS Plaintiffs Plaintiff designates New v. York County as the venue for trial based DIMAS LAW GROUP, P.C., upon the residence of JERELYN CREUTZ, SHR VENTURES LLC, and the defendants per STANLEY HUTTON RUMBOUGH CPLR § 503 Defendants ------------------------------------------------------------------X TO: Dimas Law Group 370 Lexington Avenue, Suite 505 New York, NY 10017 Jerelyn Creutz 17525 Rancho Del Rio Rancho Santa Fe, CA 92067 SHR Ventures LLC 370 Lexington Avenue, Suite 505 New York, NY 10017 Stanley Hutton Rumbough 14 Andrews Road Greenwich, CT 06830 TO THE ABOVE NAMED DEFENDANTS: YOU ARE HEREBY SUMMONED to answer the Complaint in this action and to serve a copy of your answer on plaintiffs’ attorney within 20 days after service of this summons, exclusive of the day of service, or within 30 days after service is complete if this summons is not personally delivered to you within the State of New York. In case of your failure to answer, judgment will be taken against you by default for the relief demanded in the Complaint. 1 of 18 FILED: NEW YORK COUNTY CLERK 06/04/2021 06:46 PM INDEX NO. 653623/2021 NYSCEF DOC. NO. 1 RECEIVED NYSCEF: 06/04/2021 Dated: New York, New York June 4, 2021 GUZOV, LLC By: _____________________ Debra J. Guzov, Esq. David J. Kaplan, Esq. -

Behavior Modification

Providing Global Opportunities for the Risk-Aware Investor Behavior Modification Author Michael Lewis must feel like Yogi Berra with déjà vu all over again. In 1989, as the country was looking in the rear view mirror at a major market crash preceded by a decade of overindulgence, he published “Liar’s Poker.” His personal account of working at Salomon Brothers in the 1980’s told the tale of testosterone-charged bond traders and their relentless pursuit of money and power. The book became an instant classic on Wall Street, and somewhat of a playbook for aspiring Gordon Gekkos. He labeled that era to be a “rare and amazing glitch” in the history of earning a living. Today, as we read the emails and listen to the stories of deals constructed during the earlier years of the 2000’s, it seems that the “rare” money-making opportunity of the 1980’s was not so rare after all. As our legislators craft the details of financial reform, we think it is important that they focus not just on how to extricate ourselves from the next crisis, but on how to best prevent one. The main goal of this paper is to illuminate the central points of financial reform legislation now being debated in Congress. In order to do that, we must first address the important question: “What led us to this point?” Twenty years after “Liar’s Poker” Michael Lewis has published another book, “The Big Short,” in which he chronicles the accounts of a handful of investors who bet on and profited from the collapse of the subprime mortgage market. -

Download (Pdf)

SM-85-5 c V E E o u "D C £ .2 > o» a: c v E la I« a a Q a> </) o* A Series of Occasional Papers in Draft Form Prepared by Members 'o FINANCIAL DARWINISM: NONBANKS—AND BANKS—ARE SURVIVING Christine Pavel and Harvey Rosenblum m O 73 > 70 m 73 < m 00 > Z * 0 Tl n x n > o 0 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Table of Contents Introduction ..................................................... 1 Overview and background ........................................ 4 Retailers ......................................................... 7 Industrial-based firms ...................................... 17 Diversified financial firms ........................................ 33 Insurance-based companies ................. 47 Conclusions 54 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Financial Darwinism: Nonbanks—and banks—are surviving Christine Pavel and Harvey Rosenblum* Introduction During the last decade, several trends have reshaped the financial services industry. M a n y specialized financial firms have sought to diversify them selves and have begun to offer a wider range of financial products than they had offered previously. For example, S & L s and mutual savings banks n o w offer commercial and consumer credit in addition to their mo r e tra ditional product, h o m e mortgages, and credit unions have begun to offer h o m e mortgages in addition to their traditional product, consumer credit. Commercial banks, which for m a n y years tended to restrict themselves to commercial lending, n o w serve a wide range of commercial, household, and government customers by intermediating across a wide range of financial products. Further, all three of these depository institutions have begun to offer a wider range of deposit instruments, particularly transaction ac counts, that were not offered previously. -

Copyrighted Material

Index Ackman, Bill, 127, 146, 150, 174, 200 Bailout, 187 Adidas-Salomon AG, 101 Bain Capital, 150 AIG, 6, 181, 187, 201 Balyasny, Dmitry, 93 AIG-FP, 187 Banc of America Securities Annual Ainslie, Lee, 33 Investment Conference, 74 Alpha, 90 Bank holding companies, 142 Al Quaeda, 78 Bank of America, 74, 142, 181 Amaranth, 14, 132–133 Banks, 141, 142, 187 Anderson, Dwight, 33, 85 Barakett, Tim, 93 Andor Capital, 85 Barber, Andrew, 169, 204 Andrew Carnegie (Nasaw), 149 Barclays Plc, 142 AOL Time Warner, 75 Basel Committee on Banking Apollo Advisors, 127, 129 Supervision, 128 Archipelago Holdings, 14 Basel II, 128 Arnold, John, 92, 133 Basis points, 88 Asia, 161 Baupost Group, 93 Asset AllocationCOPYRIGHTED Model Portfolio, 194 Bear market, MATERIAL 173 Asset-backed instruments, 119 Bears, 190 Asset-backed securities, 142 Bear Stearns, 85, 86, 128, 141, 142, Asset Management, 142 170, 173 AT&T, 75 Bear Stearns Asset Management A.W. Jones & Company, 132 (BSAM), 143, 151 Benton, Dan, 48, 58, 59, 64, 85 Babson, Roger, 149, 175 Bernanke, Ben, 181 Bailey, John, 14 “Bips,” 88 209 bbindex.inddindex.indd 220909 111/17/091/17/09 99:36:04:36:04 AAMM index Black, Leon, 127 Chess King, 32 BlackRock, 145 China, 86, 95, 109 Blackstone Group, 13, 127, 144, 145, 151 Chuck E. Cheese, 204 Black Week, 182, 188 Citadel Investment Group, 11, 92, Blake, Rich, 5 102, 119 Blogging, 159–164, 180, 181, 189–190 Clarium Capital Management, 92, 190 Blue Ridge Capital, 33 Clark, Tanya, 148 Blue Wave, 1, 144, 155, 177 Client letters, 202 Blum, Michael, 26, 76, 106, 111, -

Citigroup First Investment Management Americas LLC Form

SECURITIES AND EXCHANGE COMMISSION FORM 40-APP/A Application for exemption and other relief filed under the Investment Company Act of 1940 [amend] Filing Date: 2014-08-05 SEC Accession No. 0001144204-14-047144 (HTML Version on secdatabase.com) FILER Citigroup First Investment Management Americas LLC Mailing Address Business Address 388 GREENWICH STREET 390 GREENWICH STREET CIK:1554571| IRS No.: 451687238 | State of Incorp.:DE | Fiscal Year End: 1231 NEW YORK NY 10013 NEW YORK NY 10013 Type: 40-APP/A | Act: 40 | File No.: 812-13970-08 | Film No.: 141017232 2127239457 Citigroup Private Equity (Offshore) LLC Mailing Address Business Address 388 GREENWICH STREET 388 GREENWICH STREET CIK:1610813| IRS No.: 061497445 | State of Incorp.:DE | Fiscal Year End: 1231 NEW YORK NY 10013 NEW YORK NY 10013 Type: 40-APP/A | Act: 40 | File No.: 812-13970-09 | Film No.: 141017233 212-559-7941 Citigroup Capital Partners I GP l Corp. Mailing Address Business Address WILMERHALE WILMERHALE CIK:1452720 1875 PENNSYLVANIA AVE 1875 PENNSYLVANIA AVE Type: 40-APP/A | Act: 40 | File No.: 812-13970-02 | Film No.: 141017235 WASHINGTON DC 2006 WASHINGTON DC 2006 CITIGROUP ALTERNATIVE INVESTMENTS LLC Business Address 399 PARK AVE CIK:1229671| IRS No.: 000000000 7TH FLOOR Type: 40-APP/A | Act: 40 | File No.: 812-13970-04 | Film No.: 141017236 NEW YORK NY 10043 Citibank, N.A. Mailing Address Business Address C/O LEGAL AFFAIRS OFFICE 3900 PARADISE ROAD CIK:36684| IRS No.: 135266470 | Fiscal Year End: 1231 3900 PARADISE ROAD, SUITE 127 Type: 40-APP/A | Act: 40 | File No.: 812-13970-05 | Film No.: 141017237 SUITE 127 LAS VEGAS NV 89109 LAS VEGAS NV 89109 2125591000 CELFOF GP CORP Business Address 388 GREENWICH STREET CIK:1247233| IRS No.: 000000000 NEW YORK NY 10013 Type: 40-APP/A | Act: 40 | File No.: 812-13970-06 | Film No.: 141017238 CEFOF GP I CORP Mailing Address 388 GREENWICH STREET CIK:1247217| IRS No.: 000000000 NEW YORK NY 10013 Type: 40-APP/A | Act: 40 | File No.: 812-13970-07 | Film No.: 141017239 Copyright © 2014 www.secdatabase.com. -

Secondary Liability and “Selling Away” in Securities Cases

Secondary Liability and “Selling Away” in Securities Cases By Raymond W. Henney and Andrew J. Lievense Introduction theories of secondary liability. Under Michi- Based on media accounts, there appears to be gan law, when an investment is truly “sold an increase in the number of Ponzi schemes away” from the brokerage firm, the firm po- and other fraudulent investments. The rise of tentially can be held liable pursuant to claims these nefarious ventures may be explained, of vicarious liability, apparent authority, neg- in part, by an investment public that is weary ligence couched as a failure to supervise, and of the volatility of traditional markets and is “control person” liability under the Michigan susceptible to projects promising safety, sta- Uniform Securities Act. Moreover, liability bility, and reliable investment return. may arise in more uncommon circumstances. Generally, for a registered securities For example, a brokerage firm can be liable brokerage firm to market investments for for the broker’s conduct even after the bro- purchase directly from the issuer, the firm ker leaves a firm. This article discusses each is obligated to conduct an investigation or of these theories and when, under Michigan due diligence of the investment opportuni- law, a brokerage firm can be liable for such 3 ties.1 Consequently, perpetrators of these claims. ruses typically seek to avoid this scrutiny and do not sell their projects as approved Vicarious Liability and Apparent investments through brokerage firms. These Authority schemes instead are sold directly by the issu- The initial question in “selling away” cases er to the investor and not through a market or is the scope of the securities brokerage firm’s an exchange. -

Tone Enue 154 Com to Get the Economy Going Again…

The Blackstone Group Group The Blackstone The Blackstone To get the Group economy 345 Park Avenue 2 2 No. No. Volume Annual Report 2008, Volume Annual Report 2008, going again… New York, New York 10154 blackstone.com Annual Report 2008 290366_Cvr.indd 1 4/21/09 11:36:34 AM Contents/ Introduction 1/ Letter to Unitholders 10/ Blackstone At a Glance 17/ Providing Capital— Promoting Opportunity 18/ Corporate Private Equity 20/ Real Estate 24/ Marketable Alternative Asset Management 28/ Financial Advisory 32/ Core Beliefs 34/ Investing in the American Dream— Pete Peterson 35/ Leadership Directory 36/ Financials 37/ Unitholder Information 84 290366_Cvr.indd 2 4/21/09 11:36:35 AM will take strong institutions willing to invest capital long term. 1 290366_L01_NARR.indd 1 4/21/09 10:02:30 PM We have a deep pool of resources to invest in the future. 1 With $27 billion in uninvested capital in Blackstone’s private equity, real estate and credit oriented funds, we have a deep pool of resources to invest in the future.1 2 Our Limited Partner capital is committed to Blackstone funds for the long term — generally ten years — eliminating the possibility of redemptions. 3 In 2008 Blackstone’s GSO business provided $1.77 billion in loans. 4 We closed on $3.3 billion of new private equity investments in 2008, focusing on non‑cyclical businesses. 5 At $12.2 billion, we believe we have the largest pool of capital available for potential global real estate investments. 1 As of February 27, 2009. 2 The Blackstone Group Annual Report 2008 290366_L01_NARR.indd 2 4/21/09 10:02:30 PM 2$277 billion in uninvested capital1 3 290366_L01_NARR.indd 3 4/15/09 11:18:10 AM Our experience over the past 23 years indicates that the best investment opportunities often come at the bottom of an economic cycle. -

E. F. Hutton the Bank’S Total Assets

E E. F. Hutton the bank’s total assets. Internal auditors who were told to monitor the Hutton account wondered why ANYONE OLD enough to remember the heyday of the amounts were so large when Hutton’s local of- E. F. Hutton remembers their ad, “When E. F. Hut- fice employed only four people. ton speaks, people listen” in which entire city Within nine days of opening the Genesee ac- blocks fell silent to hear the pearls of financial ad- count, Hutton had deposited $26,427,507 in vice spoken by in whisper by a Hutton client. Chief checks. The 11 checks had all been written by Hut- Executive Officer Robert M. Foman was so enam- ton on its accounts at United Penn Bank in Wilkes- ored of Hutton’s image that he built a 29-story, Barre, Pennsylvania, and American Bank and Trust $100 million headquarters in Manhattan, New Company in Reading, Pennsylvania. Hutton was in- York City, that some people called a memorial to explicably moving funds among the three banks. corporate greed. Within that same nine-day period, Hutton had writ- People stopped listening to Hutton, however, ten numerous checks on the Genesee Bank totaling after discovering that the company had been en- $26,432,000, resulting in an overdraft of $4,493. gaged in a systematic effort to avoid paying interest After additional checks arrived at the Genesee on short-term bank loans through a complicated Bank, officials checked with United Penn Bank and scheme of check kiting. The scheme came to light in learned that Hutton had funds to cover one but not December 1981 when Hutton gave in to the pleas of both of two checks written on December 8 for the Batavia, New York, branch of the Genesee $6,000,000 and $8,000,000. -

Copyrighted Material

Index Abbey National, 139 Bank of America, 165, 191–192, 204, 207, 218 ABN Amro, 207 Barancik, Gary, 193, 195–197 Adams, James F., 26 Barbarians at the Gate (Burrough & Helyar), 15, Adams, Richard, 103 47, 58 Ahearn, Bill, 150 Barclays, 165, 192, 205 –206, 208 –211, Ainslie, Michael, 91 219–222, 232 Akers, John, 91 Bartiromo, Maria, 176 Altman, Roger, 15, 238 Bear Stearns, 12, 165, 173 –174, 190, 200, 201 Alvarez & Marsal, 232, 238 Becker, Holly, 139, 154 American Express. See also Shearson American Berger, Steve, 109 Express Berkenfeld, Steven, 14, 170, 204, 214 credit card business and, 39, 60 Berlind, Roger, 91 Golub and, 64 –70 Bernanke, Ben S., 2, 190, 200, 201 merger and, 2, 38, 40, 43, 57, 58 Bernstein, Brian J., 142 Robinson and, 38 – 40, 50, 60, 64 Beyman, Jonathan, 145 American International Group (AIG), 113, Bhattal, Jasjit “Jesse” 212–213, 223, 225 background of, 121–122 Antoncic, Madeleine,COPYRIGHTED 159, 171 following MATERIAL Lehman collapse, 238 Archstone-Smith, 165, 167, 170 Lehman Asia and, 151, 167 AT&T, 139 Binkley, Tracey, 183 Auletta, Ken, 1, 2, 14, 15, 37 Bioterrorism, 146 Ayres, Charlie, 153 Black, Fischer, 112 Black, Leon, 74 Bailey, Kathleen. See Fuld, Kathleen “Kathy” Black, Steve, 201 Bain and Hellman, 188, 214 Black-Scholes option pricing model, 112–113 Bain Capital, 202, 213 Blackstone Group, 12, 39, 43, 165, 188 Banchetti, Riccardo, 187 Blankfein, Lloyd, 178, 207, 226 263 bbindex.inddindex.indd 226363 22/22/10/22/10 11:44:58:44:58 PPMM 264 index Boshart, James S. “Jim,” III LCPI and, 49, 51 background of,