Second Quarter 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Q4 2019 47Th St

Q4 2019 47TH ST GRAND CENTRAL TERMINAL 42ND ST AUTHORITYPORT BRYANT PUBLIC NY PARK LIBRARY EATERIES 66 6 3 15 6 1 AMERICAN WHISKEY 44 LOCAL CAFE & COCKTAILS 87 WICHCRAFT 7 THE SKYLARK 27 19 87 60 2 AYZA WINE & CHOCOLATE BAR 45 LUCY’S CANTINA ROYALE 88 WHOLE FOODS MARKET 8 SPYGLASS ROOFTOP BAR 11 7 70 23 6 31 3 BAKED BY MELISSA 46 LUKE’S LOBSTER 9 TOP OF THE STRAND 3 3 46 37 55 14 50 19 5 8 2 P FINE DINING 4 BARILLA 47 MACARON CAFÉ HOTELS 20 4 82 25 8 5 BLACK IRON BURGER 48 MADE NICE 1 A VOCE 72 69 5 35 68 9 16 27 11 6 BOI NOODLE HOUSE 49 MADMAN ESPRESSO 2 AI FIORI 1 ACE HOTEL 39 30 7 BOMBAY SANDWICH CO. 50 MAISON KAYSER 3 ARNO RISTORANTE 2 ARCHER HOTEL 32 16 17 9 15 8 BRGR 4 BIRICCHINO 3 BRYANT PARK HOTEL JACOB K. JAVITS 7 17 3 23 40 P 2 26 51 MARKET CRATES CONVENTION CENTER 9 BROTHER JIMMY’S BBQ 52 MAUI ONION POKE BAR 5 THE BRESLIN 4 COURTYARD CHELSEA 10 47 75 14 28 P 10 CAFÉ DEL SOL 53 MELT SHOP 6 COLBEH 5 COURTYARD HERALD SQUARE 6 21 6 57 67 5 4 12 14 43 11 CAFE GRUMPY 54 MEXICUE 7 DELMONICO’S KITCHEN 6 COURTYARD TIMES SQUARE 86 36 49 7 12 CAFÉ R 55 MIGHTY QUINN’S BBQ 8 ELEVEN MADISON PARK 7 EVENTI HOTEL 26 34TH ST 13 CAJUNSEA & OYSTER BAR FRANKIE & JOHNNIE’S P 56 MUSTANG HARRY’S 9 STEAKHOUSE 8 FAIRFIELD INN & SUITES 14 CHIPOTLE 38 15 24 81 83 57 MY BELLY’S PLAYLIST 10 GAONNURI 9 GANSEVOORT PARK AVENUE NYC 45 15 CHOP’T 58 NILES NEW YORK CITY 111 WEST 33RD ST. -

Tenants Partner with Us for the Best Solutions

PRE-BUILTS ON BROADWAY 1,975 .-12,988 Actual View PRE-BUILTS 1,975 – 12,988 Located on the Broadway pedestrian plaza, between Herald Square and Times Square Eats: Monarch Rooftop, Shake Shack, Tacombi, Broadway Bites, Maison Kayser STATE Grill and Bar, The Skylark, The Breslin, Wolfgang’s Steakhouse, Parker & Quinn, Refinery Rooftop and Reichenbach Hall Shop: Urban Outfitters, Macy’s, Target, Victoria’s Secret, Gap, H&M, Uniqlo and Zara 1350 Broadway: Tenants include Bob Woodruff Foundation, Captivate, Tarter Krinsky & Drogin, eBay and MobileEye 1359 Broadway: Tenants include Evite, IPREO, Sisense, Li and Fung and SLCE Architects 1333 Broadway: Tenants include Aetna Life Insurance Company, and Global Brands Group Steps to Penn Station, Port Authority, Grand Central Terminal, PATH and 16 subway lines 15' CEILING HEIGHT Entire 25th Floor - Penthouse MEETING MECHANICAL ROOM 8,586 PANTRY COAT • 15’ exposed ceilings with exposed columns IT FE • 2 offices, 4 conference/meeting rooms CONFERENCE ROOM COPY • Ideal layout for open-plan user PE PE PE PE EL-CL. • Metal and glass finishes throughout RECEPTION • 4 sides of windows with excellent light and views ELEVATOR LOBBY MECHANICAL • Full-floor penthouse opportunity WOMEN COAT OPEN WORK AREA OFFICE MEETING ROOM MEN STOR. MEETING ROOM OFFICE COPY OPEN WORK AREA 6 Suite 2400 Suite 1420 5,503 4,951 • 5 offices, 1 conference room • 9 offices, 1 conference room • Metal and glass finishes throughout • Wood and glass finishes throughout • High-end pantry with stainless steel appliances • Corner suite -

1350 Broadway

1350 Broadway AT HERALD SQUARE Highlights Facts & Figures Area Map 1350 Broadway PROVIDING A PLATFORM FOR YOUR BUSINESS' SUCCESS Superior Buildings: Every building upgraded with new amenities and 21st century technology. Responsive Management: 24/7 tenant-focused, on-site management. Outstanding Locations: Unsurpassed convenience with exceptional access to transportation. Superior Space Options: Boutique suites to multi-floor large blocks, and industry leading pre-builts. Broker-Friendly: No appointment necessary. Commissions paid 100% on lease signing. Sustainability: Leader in energy efficiency innovation. Thank you for the opportunity to compete for your business. 1350 BROADWAY Situated in the Broadway Office Corridor, across from Macy’s and Urban Outfitters flagship locations, 1350 Broadway contains 25 stories and 404,979 rentable square feet of modern, efficient office space for today’s most innovative firms. Tenants include eBay and Tarter Krinsky & Drogin. Overlooking the Broadway pedestrian plaza and Herald Square, the neighborhood surrounding 1350 Broadway offers every amenity including office services, shopping, dining, lodging and some of the best views of the Macy's Thanksgiving Day Parade! Amenities include: • Santander Bank, HSBC, Starbucks and Duane Reade in the building Building-wide upgrades include: • New lobby, renovated elevators, a new roof and façade • Renovated air-conditioned common corridors and restrooms • Upgraded building-wide systems, including state-of-the-art electrical, plumbing, HVAC and security Available -

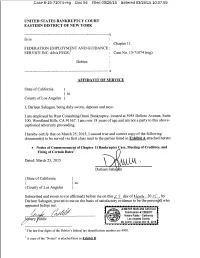

Case 8-15-71074-Reg Doc 953 Filed 10/09/17 Entered 10/09/17 18:11:49

Case 8-15-71074-reg Doc 953 Filed 10/09/17 Entered 10/09/17 18:11:49 UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF NEW YORK ----------------------------------------------------------------- x In re : : Chapter 11 FEDERATION EMPLOYMENT AND GUIDANCE : SERVICE INC. d/b/a FEGS,1 : Case No. 15-71074 (REG) : Debtor. : : ---------------------------------------------------------------- x AFFIDAVIT OF SERVICE State of California ) ) ss County of Los Angeles ) I, Darleen Sahagun, being duly sworn, depose and says: 1. I am employed by Rust Consulting/Omni Bankruptcy, located at 5955 DeSoto Avenue, Suite 100, Woodland Hills, CA 91367. I am over 18 years of age and am not a party to this above-captioned adversary proceeding. 2. On October 6, 2017, I caused to be served the: a. Plan of Liquidation Under Chapter 11 of the Bankruptcy Code of Federation Employment and Guidance Service, Inc. d/b/a/ FEGS [Docket No. 949], (the “Plan”), b. Disclosure Statement on Plan of Liquidation Under Chapter 11 of the Bankruptcy Code of Federation Employment and Guidance Service, Inc. d/b/a/ FEGS [Docket No. 950], (the “Disclosure Statement”), c. Motion for Entry of an Order, (I) Approving Disclosure Statement; (II) Scheduling Hearing on Confirmation of the Plan; and (III) Approving Related Procedures and Relief [Docket No. 951], (the “Motion”), d. Notice of Hearing on Motion for Entry of an Order, (Approving Disclosure Statement; (II) Scheduling Hearing on Confirmation of the Plan; and (III) Approving Related Procedures and Relief [Docket No. 952], (the “Notice”). By causing true and correct copies to be served (i) via email to the parties listed in Exhibit A, (ii) via first class mail to the parties listed in Exhibit B, and (iii) via overnight mail by placing the documents in a sealed envelope, affixing a pre-paid air bill, and delivering envelopes to an overnight courier location in Los Angeles, California to the parties listed on the Service List in Exhibit C attached hereto: I. -

Case 8-15-71074-Reg Doc 94 Filed 03/26/15

Case 8-15-71074-reg Doc 94 Filed 03/26/15 Entered 03/26/15 10:07:59 Case 8-15-71074-reg Doc 94 Filed 03/26/15 Entered 03/26/15 10:07:59 Case 8-15-71074-reg Doc 94 Filed 03/26/15 Entered 03/26/15 10:07:59 Federation Employment and Guidance Service , Inc. dba F.E.G.S. - U.S. Mail Served 3/25/2015 1036 REALTY LLC 1104 GAYATRI MATA LLC 118 WEST 137TH STREET LLC P.O. BOX 650 41 BAY AVENUE C/O PROSPECT MANAGEMENT CEDARHURST, NY 11516 EAST MORICHES, NY 11940 199 LEE AVENUE, #162 BROOKLYN, NY 11211 1199 NATIONAL BENEFIT FUND 1199 NATIONAL BENEFIT FUNDS FOR HEALTH 125 WEST 96TH ST. OWNERS CORP. 310 WEST 43RD STREET AND HUMAN SERVICE EMPLOYEES C/O CENTURY MANAGEMENT SERVICES, INC. NEW YORK, NY 10036 330 WEST 42ND STREET ATTN: A.J. REXHEPI NEW YORK, NY 10036 P.O. BOX 27984 NEWARK, NJ 07101-7984 1250 LLC 1256 CENTRAL LLC 14-26 BROADWAY TERRACE ASSOCIATES, LLC 7912 16TH AVENUE 1837 FLATBUSH AVENUE C/O BTH HOLDINGS LLC BROOKLYN, NY 11214 BROOKLYN, NY 11210 1324 LEXINGTON AVENUE, SUITE #245 NEW YORK, NY 10128 144TH STREET LLC 1460 CARROLL ASSOCIATES 147 CORP. 49 WEST 37TH STREET, 10TH FLOOR C/O MDAYS REALTY LLC C/O UNITED CAPITAL CORP NEW YORK, NY 10018 1437 CARROLL STREET, OFFICE ATTN: STEVE LAWRENCE, PROPERTY MGR. BROOKLYN, NY 11213 9 PARK PLACE, 4TH FLOOR GREAT NECK, NY 11021 147 CORP. 147 CORP. 1511 SHERIDAN LLC C/O UNITED CAPITAL CORP. -

1333 Broadway

1333 Broadway AT HERALD SQUARE Highlights Facts & Figures Area Map 1333 Broadway PROVIDING A PLATFORM FOR YOUR BUSINESS' SUCCESS Superior Buildings: Every building upgraded with new amenities and 21st century technology. Responsive Management: 24/7 tenant-focused, on-site management. Outstanding Locations: Unsurpassed convenience with exceptional access to transportation. Superior Space Options: Boutique suites to multi-floor large blocks, and industry leading pre-builts. Broker-Friendly: No appointment necessary. Commissions paid 100% on lease signing. Sustainability: Leader in energy efficiency innovation. Thank you for the opportunity to compete for your business. 1333 BROADWAY Situated in the Broadway Office Corridor, across from Macy’s flagship location, 1333 Broadway contains 12 stories and 359,630 rentable square feet of modern, efficient office space for tenants. Tenants include Aetna Life Insurance Company, Global Brands Group and New York Outdoor. Overlooking the Broadway pedestrian plaza and Herald Square, the neighborhood surrounding 1333 Broadway offers every amenity including office services, shopping, dining and lodging. Amenities include: • Urban Outfitters Lifestyle Center, Dr. Martens, Rituals and Shake Shack in the building Building-wide upgrades include: • New lobby, with a restored original ceiling • New and modernized elevators • New energy-efficient windows, renovated restrooms, air-conditioned common corridors • Upgraded building-wide systems, state-of-the-art electrical, plumbing, HVAC and security The building is convenient to Penn Station, Port Authority, Grand Central Terminal, PATH and 16 subway lines. A C E 1 2 3 7 B D F M N R Q W S 1333 Broadway FACTS & FIGURES LOCATION Northwest corner of 35th Street and Broadway COMPLETED 1915 ARCHITECT Clinton & Russell BUILDING SIZE 359,630 rentable square feet*, 12 floors FLOOR SIZES 20,733 - 30,000 rentable square feet AMENITIES Urban Outfitters Lifestyle Center, Dr. -

Empire State Building One Grand Central Place 111

WORLD’S MOST FAMOUS BUILDING 10 MILLION SQUARE FEET LEADER IN ENERGY EFFICIENCY AND SUSTAINABILITY 21ST CENTURY INFRASTRUCTURE 876 EMPLOYEES 2015 ANNUAL REPORT 1400 BROADWAY ONE GRAND CENTRAL PLACE FIRST STAMFORD PLACE MERRITTVIEW 501 SEVENTH AVENUE 10 UNION SQUARE EAST EMPIRE STATE BUILDING 1010 THIRD AVENUE 77 WEST 55TH STREET 1542 THIRD AVENUE 112 WEST 34TH STREET 111 WEST 33RD STREET 1333 BROADWAY 1350 BROADWAY 1359 BROADWAY 103-107 MAIN STREET 69-97 MAIN STREET 250 WEST 57TH STREET METRO CENTER 500 MAMARONECK AVENUE 10 BANK STREET 1 2 3 4 5 6 7 8 Performance for Today. Perspective for Tomorrow. 9 10 11 SUSTAINABILITY MATRIX Empire One Grand 1400 111 West 250 West State Central Broadway 33rd Street 57th Street Building Place Whole Building Energy Retrofit Analysis (Replicate ESB Model) Whole Building Energy Retrofit Implementation Low-e window retrofit High Performance Tenant Installation Required per Lease Submetering of All New Tenant Spaces Utilities Billed by Submetering (as installed) Building Management System (BMS) Status (I) BMS in place Hybrid/package (II) No BMS in place HVAC (III) Partial BMS in place No central HVAC No central HVAC Energy Star Certification Waste Management/Recycling (I) Construction Debris (II) Tenant Waste (III) Separate Electronic Recycling (IV) Single Stream Recycling Green Cleaning Products and Practices Green Pest Management Products and Practices Demand Response/Peak Load Shaving Sustainability Committee Annual & Long Term Sustainability Targets Leadership & Sharing To Our Fellow Stockholders: It is our pleasure to present Empire State Realty Trust’s 2015 annual report. In our second full year as a public company, we continued to deliver on our goals and promises. -

One Grand Central Place Electronic Tenant® Portal

One Grand Central Place Electronic Tenant® Portal Created on September 24, 2021 Construction & Other Policies: Construction Policies and Procedures Click here to download a copy of the Building Rules and Regulations. Construction & Other Policies: Insurance Requirements Click here to view the Insurance Requirements Questions regarding Insurance Certificates, please email Tenant Services Coordinator, Lisa Stalaj at [email protected] or Assistant Property Manager, David Taylor at [email protected] at the Building Management Office. Back to Top Construction & Other Policies: Moving & Delivery Guidelines; Use of Freight Elevator The following moving and delivery guidelines have been developed to ensure a safe and efficient move for you and your organization. Following these guidelines will expedite your move and protect the people handling the move as well as your property and the building itself. These guidelines are in no way meant to hamper or restrict your moving process, but rather to safeguard the elements involved in the process. Please let us know how we can best assist you with your move. We would be happy to answer any questions you may have. The Building's freight entrance is located at 53 East 41st Street. The freight elevators are available Monday through Friday from the hours of 8:00 a.m. to 6:00 p.m. free of charge for all non-moving related access. Tenant Move-in/ move-outs are to be scheduled after-hours and/or on weekends. Please note there is a minimum of four (4) hours for weekend/ holiday service. To reserve the freight elevator after normal working hours, you must notify the Building Office via the on-line work order system and request the day and time you require, at least 72 Hours in advance. -

Chapter 7: Urban Design and Visual Resources

Chapter 7: Urban Design and Visual Resources A. INTRODUCTION This chapter considers the potential of the proposed actions to impact urban design and visual resources. As defined in the 2014 City Environmental Quality Review (CEQR) Technical Manual, urban design is the totality of components that may affect a pedestrian’s experience of public space. A visual resource can include views of the waterfront, public parks, landmark structures or districts, or otherwise distinct buildings, and natural resources. The following analysis considers a 400-foot study area around the proposed Vanderbilt Corridor which includes the One Vanderbilt site. The study area considers where the proposed actions would be most likely to influence land use patterns and the built environment (see Figures 7-1 and 7-2).1 This analysis also considers longer views to the One Vanderbilt site, including views along West 42nd Street, from Bryant Park, and from Gantry Plaza State Park in Long Island City, Queens. This analysis addresses the urban design and visual resources of the study area for existing conditions, the future without the proposed actions (the No-Action Condition), and the future with the proposed actions (With-Action Condition) for the 2021 Build year, when the proposed One Vanderbilt development is expected to be completed and occupied. Based on the CEQR Technical Manual, a preliminary assessment of urban design and visual resources is appropriate when there is the potential for a pedestrian to observe, from the street level, a physical alteration beyond that allowed by existing zoning. Examples include projects that permit the modification of yard, height, and setback requirements, and projects that result in an increase in built floor area beyond what would be allowed “as‐of‐right” or in the No-Action condition. -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case 1:13-bk-15929-AA Doc 514 Filed 02/06/14 Entered 02/06/14 16:36:52 Desc Main Document Page 1 of 85 1 RICHARD M. PACHULSKI (SBN 90073) JEFFREY W. DULBERG (SBN 181200) 2 PACHULSKI STANG ZIEHL & JONES LLP 10100 Santa Monica Blvd.,13th Floor 3 Los Angeles, CA 90067 Telephone: 310/277-6910 4 Facsimile: 310/201-0760 E-mail: [email protected] 5 [email protected] 6 Proposed Counsel for David K. Gottlieb, Chapter 7 Trustee 7 8 UNITED STATES BANKRUPTCY COURT 9 CENTRAL DISTRICT OF CALIFORNIA 10 SAN FERNANDO VALLEY DIVISION 11 In re: Chapter 7 LLP LLP 12 ONES KSL MEDIA, INC., T.V. 10'S, LLC, and Case No.: 1:13-bk-15929-AA J & AW 13 FULCRUM 5, INC., L T ALIFORNIA A Jointly Administered with Case Nos.: C IEHL , Z 14 Debtors. 1:13-bk-15930-AA and 1:13-bk-15931-AA NGELES TTORNEYS TANG TANG A A S OS 15 NOTICE OF MOTION OF CHAPTER 7 L TRUSTEE FOR ORDER: (1) APPROVING 16 Affects KSL Media, Inc. THE EMPLOYMENT OF TIGER ACHULSKI P Affects T.V. 10’s, LLC REMARKETING SERVICES AS 17 AUCTIONEER FOR THE ESTATES Affects Fulcrum 5, Inc. PURSUANT TO 11 U.S.C. §§ 327 AND 328(a); 18 Affects All Debtors (2) AUTHORIZING THE SALE OF ESTATE PROPERTY AT PUBLIC AUCTION 19 OUTSIDE THE ORDINARY COURSE OF BUSINESS PURSUANT TO 11 U.S.C. §363(b) 20 (3) AUTHORIZING PAYMENT OF COSTS AND ALLOWING COMPENSATION; AND 21 (4) WAIVING 14-DAY STAY PERIOD; MEMORANDUM OF POINTS AND 22 AUTHORITIES AND DECLARATIONS OF DAVID K. -

Request for Evaluation

REQUEST FOR EVALUATION Address: 445 PARK AVENUE Location: Block 1311 Lot 1 Name: 445 Park Avenue Architect: Kahn & Jacobs Constructed: 1946-1947 Summary: The first post-war office building on Park Avenue – and the first fully air-conditioned commercial structure in New York City – 445 Park Avenue set the stage for future development along Park Avenue. The prominent architecture firm Kahn & Jacobs, architects of the Landmarked Municipal Asphalt Plant (1941-44), designed this building. The rectilinear glass and limestone structure, with its dark granite base, is composed of four setbacks, adhering to the 1916 zoning law. Continuous ribbon windows and limestone spandrel panels give the building a sleekness in stark contrast to its contemporary buildings. Lever Brothers Company, Schweppes, Ford Motor Company, Monsanto Chemical Company, and Universal Pictures Corporation all leased space in the structure in the 1940s. 1 REQUEST FOR EVALUATION Address: 450 PARK AVENUE Location: Block 1292 Lot 37 Name: former Franklin National Bank Building Architect: Emery Roth & Sons Constructed: 1968-1972 Summary: This 33-story skyscraper has been called “the handsomest black skyscraper in the city.” 450 Park Avenue served as the headquarters of the Franklin National Bank from 1972-74, and its sleek black façade and dark glass set it apart from other structures on Park Avenue, especially those designed by Emery Roth & Sons in the previous decades. The building has a smooth façade treatment composed of “black granite” (likely gabbro or diabase) and graceful elliptical window segments of gray-tinted glass. Following the 1961 zoning resolution, the architects designed a privately owned public space on the west side of the structure. -

Following This Cover Page Are Scanned Images of No-Opposition Summary Judgment Motions and Orders Filed on the Selected Date

Following this cover page are scanned images of no-opposition summary judgment motions and orders filed on the selected date. The documents are displayed in no particular order. However, all of these documents are searchable. To find a specific order, please use the Search/Find function within a PDF viewer. 1) Select Edit > Find in the main menu or press Ctrl-f (Command-f or Apple-f on a Mac); 2) Enter the index number, a word, or a phrase in the form field provided and press Enter or Return. In most applications, the first appearance of the index number, the word, or the phrase in the document will be highlighted. Tip: Ctrl-f opens the Find function in most applications, including browsers and PDF viewers. SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK ;©iii¥ED) INRE: NEW YORK CITY ASBESTOS LITIGATION MAY 0S 2015 -x This Document Relates To: PART 50 NYi SUPREME COURT - CIVIL WALLACE S. HANKIN and HELEN NYCAL HANKIN I.A.S. Part 30'Sh (Hon. Peter H. Moulton) Plaintiff(s), Index No.: 190054/2015 -against- NO-OPPOSITION SUMMARY JUDGMENT MOTIONAND ORDER A.O. SMITH WATER PRODUCTS CO., et al„ Defendants. WHEREFORE, defendant CRANE CO. hereby requests summary judgment in the above-entitled case, pursuant to Civil Practice Law and Rules Section 3212, dismissing plaintiffs' complaint against defendant CRANE CO. with prejudice, and there being no opposition thereto, ORDERED, that upon notice to all co-defendants, all claims and cross claims against defendant CRANE CO. be, and the same are hereby, dismissed with prejudice and without costs.