Banco Ambrosiano

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mandatory Data Retention by the Backdoor

statewatch monitoring the state and civil liberties in the UK and Europe vol 12 no 6 November-December 2002 Mandatory data retention by the backdoor EU: The majority of member states are adopting mandatory data retention and favour an EU-wide measure UK: Telecommunications surveillance has more than doubled under the Labour government A special analysis on the surveillance of telecommunications by states have, or are planning to, introduce mandatory data Statewatch shows that: i) the authorised surveillance in England, retention (only two member states appear to be resisting this Wales and Scotland has more than doubled since the Labour move). In due course it can be expected that a "harmonising" EU government came to power in 1997; ii) mandatory data retention measure will follow. is so far being introduced at national level in 9 out of 15 EU members states and 10 out of 15 favour a binding EU Framework Terrorism pretext for mandatory data retention Decision; iii) the introduction in the EU of the mandatory Mandatory data retention had been demanded by EU law retention of telecommunications data (ie: keeping details of all enforcement agencies and discussed in the EU working parties phone-calls, mobile phone calls and location, faxes, e-mails and and international fora for several years prior to 11 September internet usage of the whole population of Europe for at least 12 2000. On 20 September 2001 the EU Justice and Home Affairs months) is intended to combat crime in general. Council put it to the top of the agenda as one of the measures to combat terrorism. -

Excerpt from GOD's BANKERS by Gerald Posner 1 Murder in London

Excerpt from GOD’S BANKERS by Gerald Posner 1 Murder in London London, June 18, 1982, 7:30 a.m. Anthony Huntley, a young postal clerk at the Daily Express, was walking to work along the footpath under Blackfriars Bridge. His daily commute had become so routine that he paid little attention to the bridge’s distinctive pale blue and white wrought iron arches. But a yellowish orange rope tied to a pipe at the far end of the north arch caught his attention. Curious, he leaned over the parapet and froze. A body hung from the rope, a thick knot tied around its neck. The dead man’s eyes were partially open. The river lapped at his feet. Huntley rubbed his eyes in disbelief and then walked to a nearby terrace with an unobstructed view over the Thames: he wanted to confirm what he had seen. The shock of his grisly discovery sank in.1 By the time Huntley made his way to his newspaper office, he was pale and felt ill. He was so distressed that a colleague had to make the emergency call to Scotland Yard.2 In thirty minutes the Thames River Police anchored one of their boats beneath Blackfriars’ Number One arch. There they got a close-up of the dead man. He appeared to be about sixty, average height, slightly overweight, and his receding hair was dyed jet black. His expensive gray suit was lumpy and distorted. After cutting him down, they laid the body on the boat deck. It was then they discovered the reason his suit was so misshapen. -

La-Banda-Della-Magliana.Pdf

INDICE 1. La Banda della Magliana.................................................................................................................... 2. La struttura criminale della Banda della Magliana............................................................................. 3. Banda della Magliana......................................................................................................................... 4. Una Banda tra mafia, camorra e servizi segreti.................................................................................. 5. I rapporti tra la Banda della Magliana e Licio Gelli........................................................................... 6. I ricatti della Banda............................................................................................................................ 7. Gli intrecci pericolosi della Banda della Magliana............................................................................ 8. Dall’assassinio di Carmine Pecorelli alla fuga di Calvi..................................................................... 9. La mala romana e la Mafia................................................................................................................. 10. Vita e morte della gang romana........................................................................................................ 11. Banda della Magliana: i padroni di Roma........................................................................................ 12. Omicidio di Roberto Calvi.............................................................................................................. -

Public Plicy Brief 44

PPB No.44 2/18/99 2:50 PM Page a1 The Jerome Levy Economics Institute of Bard College Public Policy Brief The Asian Disease: Pl a u s i b l e Di a g n o s e s , Po s s i b l e Re m e d i e s Regulation of Cros s - B o r der Interbank Lending and Derivatives Tra d e Ma r tin Mayer No. 44, 1998 PPB No.44 2/18/99 2:50 PM Page 2 The Jerome Levy Economics Institute of Bard Co l l e g e , founded in 1986, is an autonomous, inde- pendently endowed re s e a rch organization. It is n o n p a rtisan, open to the examination of diverse points of view, and dedicated to public servi c e . The Jerome Levy Economics Institute is publish - ing this proposal with the conviction that it rep r e - sents a constructive and positive contribution to the discussions and debates on the relevant policy issues. Neither the Institute’s Board of Governo r s nor its Advisory Board necessarily endorses the pr oposal in this issue. The Levy Institute believes in the potential for the study of economics to improve the human condi- tion. Through scholarship and economic forecast- ing it generates viable, effective public policy responses to important economic problems that profoundly affect the quality of life in the United States and abroad. The present res e a r ch agenda includes such issues as financial instability, povert y, employment, pro b- lems associated with the distribution of income and wealth, and international trade and competitive- ness. -

Pope Faces Tense Korea Next Week Rights Opposition by Church, Crack-Down Have Caused Unrest •Alaska Stopover

/SSUES AND THE BISHOPS SEXPLOITATION' Taking stands on ERA, Moviemakers' golden rules immigration raids, for luring teens, dollars Reagan policies Entertainment, Page 19 - Pages 8-9 Opinion section. .P14-17 Entertainment .... P19 Know Your Faith P22-23 Vol. XXXI No. 61 Catholic Archdiocese of Miami Price 25* Friday, April 27, 1984 Pope faces tense Korea next week Rights opposition by Church, crack-down have caused unrest •Alaska stopover... Pg 4 The pope's itinerary also includes Kwangju, a southwestern city where By Father James Coiligan more recent deaths are also SEOUL, South Korea remembered. The stop indicates that (NC)—South Korea, where the small the human rights issue may surface Catholic Church and the government on the trip, and presents Pope John have often bitterly disagreed over Paul with a challenge. human rights conditions, is awaiting "Reconciliation" is the theme at the May 3-7 visit of Pope John Paul the Kwangju stop, where a citizens' II. He will also visit Papua New rebellion against the imposition of Guinea, the Solomon Islands and martial law was crushed by govern- Thailand. ment troops in May 1980. The The government of President Chun government later reported that 170 Doo Hwan recently restored the people died in the riots, but other rights of 202 blacklisted politicians. It estimates put the fatalities at ten freed many of the students jailed for times that number. anti-government activities and gave Archbishop Victorinus Youn of permission for them to return to cam- Kwangju told of looking helplessly pus in April, along with 1,200 others from the window of his residence at who had been expelled. -

Tuesday July 30, 1996

7±30±96 Tuesday Vol. 61 No. 147 July 30, 1996 Pages 39555±39838 federal register 1 II Federal Register / Vol. 61, No. 147 / Tuesday, July 30, 1996 SUBSCRIPTIONS AND COPIES PUBLIC Subscriptions: Paper or fiche 202±512±1800 FEDERAL REGISTER Published daily, Monday through Friday, Assistance with public subscriptions 512±1806 (not published on Saturdays, Sundays, or on official holidays), by General online information 202±512±1530 the Office of the Federal Register, National Archives and Records Administration, Washington, DC 20408, under the Federal Register Single copies/back copies: Act (49 Stat. 500, as amended; 44 U.S.C. Ch. 15) and the Paper or fiche 512±1800 regulations of the Administrative Committee of the Federal Register Assistance with public single copies 512±1803 (1 CFR Ch. I). Distribution is made only by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC FEDERAL AGENCIES 20402. Subscriptions: The Federal Register provides a uniform system for making Paper or fiche 523±5243 available to the public regulations and legal notices issued by Assistance with Federal agency subscriptions 523±5243 Federal agencies. These include Presidential proclamations and For other telephone numbers, see the Reader Aids section Executive Orders and Federal agency documents having general applicability and legal effect, documents required to be published at the end of this issue. by act of Congress and other Federal agency documents of public interest. Documents are on file for public inspection in the Office of the Federal Register the day before they are published, unless earlier filing is requested by the issuing agency. -

The Reason Given for the UK's Decision to Float Sterling Was the Weight of International Short-Term Capital

- Issue No. 181 No. 190, July 6, 1972 The Pound Afloat: The reason given for the U.K.'s decision to float sterling was the weight of international short-term capital movements which, despite concerted intervention from the Bank of England and European central banks, had necessitated massive sup port operations. The U.K. is anxious that the rate should quickly o.s move to a "realistic" level, at or around the old parity of %2. 40 - r,/, .• representing an effective 8% devaluation against the dollar. A w formal devaluation coupled with a wage freeze was urged by the :,I' Bank of England, but this would be politically embarrassing in the }t!IJ light of the U.K. Chancellor's repeated statements that the pound was "not at an unrealistic rate." The decision to float has been taken in spite of a danger that this may provoke an international or European monetary crisis. European markets tend to consider sterling as the dollar's first line of defense and, although the U.S. Treasury reaffirmed the Smithsonian Agreement, there are fears throughout Europe that pressure on the U.S. currency could disrupt the exchange rate re lationship established last December. On the Continent, the Dutch and Belgians have put forward a scheme for a joint float of Common Market currencies against the dollar. It will not easily be implemented, since speculation in the ex change markets has pushed the various EEC countries in different directions. The Germans have been under pressure to revalue, the Italians to devalue. Total opposition to a Community float is ex pected from France (this would sever the ties between the franc and gold), and the French also are adamant that Britain should re affirm its allegiance to the European monetary agreement and return to a fixed parity. -

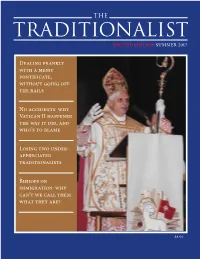

Why Vatican II Happened the Way It Did, and Who’S to Blame

SPECIAL EDITION SUMMER 2017 Dealing frankly with a messy pontificate, without going off the rails No accidents: why Vatican II happened the way it did, and who’s to blame Losing two under- appreciated traditionalists Bishops on immigration: why can’t we call them what they are? $8.00 Publisher’s Note The nasty personal remarks about Cardinal Burke in a new EDITORIAL OFFICE: book by a key papal advisor, Cardinal Maradiaga, follow a pattern PO Box 1209 of other taunts and putdowns of a sitting cardinal by significant Ridgefield, Connecticut 06877 cardinals like Wuerl and even Ouellette, who know that under [email protected] Pope Francis, foot-kissing is the norm. And everybody half- Your tax-deductible donations for the continu- alert knows that Burke is headed for Church oblivion—which ation of this magazine in print may be sent to is precisely what Wuerl threatened a couple of years ago when Catholic Media Apostolate at this address. he opined that “disloyal” cardinals can lose their red hats. This magazine exists to spotlight problems like this in the PUBLISHER/EDITOR: Church using the print medium of communication. We also Roger A. McCaffrey hope to present solutions, or at least cogent analysis, based upon traditional Catholic teaching and practice. Hence the stress in ASSOCIATE EDITORS: these pages on: Priscilla Smith McCaffrey • New papal blurtations, Church interference in politics, Steven Terenzio and novel practices unheard-of in Church history Original logo for The Traditionalist created by • Traditional Catholic life and beliefs, independent of AdServices of Hollywood, Florida. who is challenging these Can you help us with a donation? The magazine’s cover price SPECIAL THANKS TO: rorate-caeli.blogspot.com and lifesitenews.com is $8. -

EUROPEAN BANICING INTEGRATION, TEN YEARS AFTER by 95/92/FIN * Professor of Banking and Finance, at INSEAD, Boulevard De Constanc

EUROPEAN BANICING INTEGRATION, TEN YEARS AFTER by J. DERMINE 95/92/FIN * Professor of Banking and Finance, at INSEAD, Boulevard de Constance, 77305 Fontainebleau Codex, France. The author acknowledges financial support from INSEADs International Financial Services (IFS) programme. A working paper in the INSEAD Working Paper Series is intended as a means whereby a faculty researchers thoughts and findings may be communicated to interested readers. The paper should be considered preliminary in nature and may require revision. Printed at INSEAD, Fontainebleau, France EUROPEAN BANKING INTEGRATION, Ten Years After by Jean Dermine INSEAD F-77300 Fontainebleau, France October 1995 Revised and expanded version of a paper "Banking Industry in the ECs Internal Market" presented at a conference organized by the Sveriges Riksbank, Stockholm, November 1993. Forthcoming in European Financial Management. Abstract Ten year ago, the White Paper on the Completion of the Single Market announced the integration of European banking markets. The purpose of this essay is to identify four public issues that remain to be addressed. Home country control of international banks need to be complemented by host country control. The deposit guarantee schemes should be modified by rendering insured deposits "first order claim". A European authority is needed to ensure that banks do not exploit domestic rents to subsidize international activities. Finally, tax evasion is a fourth issue that remains to be addressed. At a meeting of the Council of Ministers held in Milan in 1985, the European Commission proposed a detailed timetable for the complete integration of European markets by January 1993. The aim was to dismantle the technological, regulatory and fiscal barriers which prevented the free flow of goods, capital and persons in the European Union. -

The Real Scandal on Spain's Economic Scene

Click here for Full Issue of EIR Volume 10, Number 10, March 15, 1983 ical environment of Spain today would appear to have other motivations than economic ones. A key to the apparent mystery may be the unusual serenity of the private banks. Indeed, it is now suspected that the entire operation against Rumasa was cooked up between the top private banks, in particular Banesto, Bilbao, Central, and Hispanoamericano, and Mariano Rubio, deputy governor of the Bank of Spain since 1965 and architect of the monetarist The real scandal on takeover of the country's finances. The profile of these top banks is highly interesting. Spain's economic scene Investments abroad-otherWise known as capital flight doubled in 1982 relative to 1981. Ninty-five percent of all overseas investment by banks was carried out by the top 10, by Katherine Kanter in Paris and after the United States-Miami, to be precise--Chile, Portugal, and Puerto Rico were the major recipients of Span When Spanish Finance Minister Miguel Boyer announced ish bankers' money. Investments increased most into Chile, Feb. 23, that due to non-cooperation on the part of the coun Puerto Rico, and Uruguary, and decreased in those countries try's largest private enterprise Rumasa S.A. (1.5 percent of struggling to industrialize in spite of their debt burden: Ar the GNP, 400 companies, 350,000 employees, 18 banks), gentina, Mexico, Brazil, and Peru. the government would probably have to send in auditors from Now, whatever one may think of the "ride' em cowboy" the central bank, the Bank of Spain, he provoked an imme entrepreneurial approach of Ruiz Mateus, the unescapable diate run on the Rumasa group's banks and a stir in the fact is that the Rumasa empire he controlled was the only :'1ternational financialpress demanding that Spain should be major economic and financial power in the country with some blacklisted on the credit markets. -

The Devil's Banker

THE DEVIL'S BANKER Screenplay by Gary Van Haas Based on the Novel by Gary Van Haas June 2017 Draft WGAw Registration #1346965 (c) 2014 by Gary Van Haas CINEMA ARTS GROUP [email protected] INSERT: "BASED ON ACTUAL EVENTS" FADE IN: EXT. DOCKSIDE WAREHOUSE - DAY A series of shipping containers stacked across from the front of a warehouse with the garage-style door open. Policeman SERGE PORTER (late 30’s) and his partner P.C. PAULA SANTOLI (29), hide belly down on top of a crate. They peer down at TWO THUGS leaning against a stack of palettes facing away from the cop's hiding spot. Porter moves ahead first, then Paula, getting the drop on the two men and... Porter pulls out his pistol and jumps down from the crate yelling as he RUNS for the THUGS with his pistol out. Paula follows as the THUGS whirl in surprise, hands shooting into the air. They drop to the ground, hands behind their heads as Porter covers them with his weapon. Just as they are about to cuff them...Paula smiles at Porter and takes THUG #1's hand as... A CAR revs up and tears out of the warehouse. A MAN jumps out... The MUZZLE flash of AN UZI lights up the darkness of the WAREHOUSE ENTRANCE as a car driven by THUG #3 roars toward them. ON PORTER: He sees the man then hears staccato GUN SHOTS - an UZI blazing away at them! He dives behind a palette...gets off a couple of rounds. Then, with a yell to Paula, as he dives behind the palettes. -

A Map of the Financial Powers That Control P-2 Operations

Click here for Full Issue of EIR Volume 8, Number 27, July 7, 1981 THE BANKING CONNECTIONS A map of the financial powers that control P-2 operations by David Goldman, Economics Editor Italian banking has been more international in character precedented opportunity to work through the Chinese than any other country's since the 14th century, and it is boxes of money-laundering fr om the inside outwards. not likely that a scandal implicating the board chairmen The most prominent financier of the Italian Socialist of every major Italian bank could fail to have worldwide Party, Calvi built the $6 billion Banco Ambrosiano as the ramifications. In fact, the publication of P-2 Grand core of a $20 billion international empire of merged and Master Licio Gelli's membership list sent shock waves associated companies. But Ambrosiano itself fits tightly out to Canada, Hong Kong, and the Caribbean. The into a larger series of boxes, a publicity-shy but powerful evidence now in the public domain comes very close to international syndicate known as "Inter-Alpha," among demonstrating the existence of a tightly coordinated the first. It includes West Germany's BHF-Bank, world network for dirty money transactions-a "Dope, France's Swiss-connected Credit Commercial, the Kre Inc.," as this publication first characterized it in an dietbank of Luxemburg, and the British combination of October 1978 feature. Williams and Glyns-Royal Bank of Scotland, the latter Not merely the major Italian banks, but Bank of about to merge with the Hongkong and Shanghai Bank. America and Chase Manhattan in the United States, the Ambrosiano is thoroughly Italian in character, but Hongkong and Shanghai Bank, and major institutions not in ownership.