Jiangling Motors Corporation, Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

After the Landwind Disaster, ADAC Will Also Crash the Brilliance Limousine BS6 No ESP, Just Two Airbags and a 2-Star Safety Rating Munich

+++ Exclusive +++ December 10, 2006 +++ Exclusive +++ published in issue 25/2006 on December 11, 2006 After the Landwind disaster, ADAC will also crash the Brilliance limousine BS6 No ESP, just two airbags and a 2-star safety rating Munich. German auto club ADAC will smash after the China-built SUV Landwind also the new Brilliance BS6 limousine, which will launched this month in Europe. "We will do a crash test for sure. But we will test a car that we purchase, not one that is given to us [by the carmaker]," an ADAC spokesman told Automotive News Europe (ANE). He said the test "may happen within days or weeks." The BS6 has no ESP, just two airbags and the car received only two out of 5 stars in Euro NCAP-style crash test carried out by the TÜV Nord German testing organization. Last year the Chinese automaker Jiangling Motors Company stopped sale of the China-built Landwind SUV after it badly failed an ADAC-run crash test. Hans-Ulrich Sachs, managing director HSO Motors Europe, Brilliance's importer for Europe, is confident that Brilliance's market launch will not be stalled because of safety concerns. "We have two small things that we have to correct," he told ANE. The BS6 sedan is due to arrive at European dealers this month. The car is built by Chinese automaker Brilliance Jinbei Automotive in a joint-venture factory with BMW in Shenyang, near China's border with North Korea. The plant also builds BMW's 3- and 5-series models for China. Mercedes: More components from eastern Europe Stuttgart. -

Groupe Renault and Jmcg Officially Establish a Joint Venture for Electric Vehicles in China

PRESS RELEASE 20190717 GROUPE RENAULT AND JMCG OFFICIALLY ESTABLISH A JOINT VENTURE FOR ELECTRIC VEHICLES IN CHINA • Groupe Renault will increase its share capital by RMB 1 billion to become a major shareholder of JMEV with a 50% stake. BoulogneBillancourt, July 17, 2019 – Groupe Renault and Jiangling Motors Corporation Group (JMCG) announced the official establishment of their joint venture to further promote the development of the EV industry in China, following a first agreement on December 20, 2018. Groupe Renault will increase its share capital by RMB 1 billion (about 128.5 million euros) to become a major shareholder of JMEV with a 50% stake. JMEV has already completed business license registration. This cooperation is part of the overall strategy of JMCG and Groupe Renault. Through this joint venture, Groupe Renault will be able to expand its influence in China’s electric vehicle market, while JMCG will be able to integrate and leverage more resources, which will promote its rapid growth in the future. China is a key market for Groupe Renault. This partnership in electric vehicle business with JMCG will support our growth plan in China and our EV capabilities. As a pioneer and leader in the European EV market for 10 years, we will capitalize on our experience in EV R&D, production, sales and services, said Mr. Francois Provost, Senior Vice President, Chairman of China Region, Groupe Renault. Adhering to the concept of openness and cooperation, JMCG is one of the first domestic enterprises to introduce international strategic partners. By partnering with Groupe Renault, JMEV will be able to elevate its comprehensive competitiveness to a new level and penetrate into China’s electric vehicle market, said Mr. -

State of Automotive Technology in PR China - 2014

Lanza, G. (Editor) Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Shanghai Lanza, G. (Editor); Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Institute of Production Science (wbk) Karlsruhe Institute of Technology (KIT) Global Advanced Manufacturing Institute (GAMI) Leading Edge Cluster Electric Mobility South-West Contents Foreword 4 Core Findings and Implications 5 1. Initial Situation and Ambition 6 Map of China 2. Current State of the Chinese Automotive Industry 8 2.1 Current State of the Chinese Automotive Market 8 2.2 Differences between Global and Local Players 14 2.3 An Overview of the Current Status of Joint Ventures 24 2.4 Production Methods 32 3. Research Capacities in China 40 4. Development Focus Areas of the Automotive Sector 50 4.1 Comfort and Safety 50 4.1.1 Advanced Driver Assistance Systems 53 4.1.2 Connectivity and Intermodality 57 4.2 Sustainability 60 4.2.1 Development of Alternative Drives 61 4.2.2 Development of New Lightweight Materials 64 5. Geographical Structure 68 5.1 Industrial Cluster 68 5.2 Geographical Development 73 6. Summary 76 List of References 78 List of Figures 93 List of Abbreviations 94 Edition Notice 96 2 3 Foreword Core Findings and Implications . China’s market plays a decisive role in the . A Chinese lean culture is still in the initial future of the automotive industry. China rose to stage; therefore further extensive training and become the largest automobile manufacturer education opportunities are indispensable. -

2009-Mmrc-269

MMRC DISCUSSION PAPER SERIES No. 269 The Role of International Technology Transfer in the Chinese Automotive Industry Zejian Li, Ph.D. Project Research Associate Manufacturing Management Research Center (MMRC) Faculty of Economics, THE UNIVERSITY OF TOKYO July 2009 東京大学ものづくり経営研究センター Manufacturing Management Research Center (MMRC) Discussion papers are in draft form distributed for purposes of comment and discussion. Contact the author for permission when reproducing or citing any part of this paper. Copyright is held by the author. http://merc.e.u-tokyo.ac.jp/mmrc/dp/index.html The Role of International Technology Transfer in the Chinese Automotive Industry Zejian Li, Ph.D. (E-mail: [email protected]) Project Research Associate Manufacturing Management Research Center (MMRC) Faculty of Economics, THE UNIVERSITY OF TOKYO May 2009 Abstract The so called Independent Chinese Automobile Manufacturers (ICAMs), such as CHERY, Geely and BYD, emerged at the end of 1990's as new entrants to Chinese passenger vehicle market and have achieved remarkable growth. The phenomenon of these autonomous Chinese Automakers is drawing increasing attention not only from academia but also from business and government circles. This paper attempts to clarify the relationship between emergence of ICAMs and International Technology Transfer. Many scholars indicate the use of outside supplies (of engines and other key-parts), as a sole reason for high-speed growth of ICAMs. However, the internal approach, at a level of how companies act, is also necessary to outline all the reasons and factors that might contribute to the process. This paper, based on organizational view, starts from historical perspective and clarifies the internal dynamics of the ICAMs. -

MAGNA REACHES Edrive GEARBOX PRODUCTION MILESTONE and WINS ADDITIONAL BUSINESS in CHINA

NEWS RELEASE MAGNA REACHES eDRIVE GEARBOX PRODUCTION MILESTONE AND WINS ADDITIONAL BUSINESS IN CHINA • 100,000 eDrive gearboxes produced for Chinese electric vehicle manufacturers • New eDrive gearbox business won, further supporting Chinese startups • Technology helps power pure electric vehicles, from sedans to SUVs HGHLIGHT SHANGHAI, China, April 19, 2021 – On the heels of reaching a production milestone for its eDrive gearboxes, Magna has won additional business to further support Chinese electric vehicle (EV) start-ups. Supporting the fast-growing EV market in China, Magna’s joint venture with Jiangling Motors Co., Ltd. celebrated a major milestone, achieving its 100,000th eDrive gearbox produced. 100,000 Magna eDrive gearboxes produced for Chinese EV manufacturers Magna’s plant in Jiangxi began production of eDrive gearboxes in 2018 that featured: high efficiency; best-in-class power density; excellent noise, vibration and harshness performance; and a complete torque range from 200Nm to 530Nm. Today, they are found in various car models from sedans to SUVs for several Chinese automakers including NIO and Xpeng. With the success of these programs, Magna continues to win new business for eDrive technologies with EV start-ups. “As powertrain electrification accelerates, especially in the Chinese market, we are positioned well to continue supporting automakers in their continued efforts to bring electrified vehicles to market quickly,” said Tom Rucker, President of Magna Powertrain. “Magna’s competitive advantage is attributed to our flexible approach to this growing market by offering both complete systems as well as e-components to our customers.” Magna continues to deliver comprehensive electrification solutions from mild hybrid to battery electric vehicles as the industry progresses toward a cleaner future. -

Ford-1Q2021 Earnings- Presentation

Q1 2021 Earnings Review April 28, 2021 Note: See slide A15 for related notes Information Regarding This Presentation FORWARD-LOOKING STATEMENTS This presentation includes forward-looking statements. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated. For a discussion of these risks, uncertainties, and other factors, please see the “Cautionary Note on Forward-Looking Statements” at the end of this presentation and “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, as updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. GAAP AND NON-GAAP FINANCIAL MEASURES This presentation includes financial measures calculated in accordance with Generally Accepted Accounting Principles (“GAAP”) and non-GAAP financial measures. The non-GAAP financial measures are intended to be considered supplemental information to their comparable GAAP financial measures. The non-GAAP financial measures are defined and reconciled to the most comparable GAAP financial measures in the Appendix to this presentation. ADDITIONAL INFORMATION Calculated results may not sum due to rounding. N / M denotes “Not Meaningful.” All variances are year-over-year unless otherwise noted. REPORTING CHANGES Effective with 2021 reporting, certain costs for the benefit of the global enterprise previously reported in Automotive are now reported in Corporate Other, and costs and benefits related to connectivity previously reported in Mobility are now reported in Automotive. Prior period results have been updated to be consistent with 2021 reporting. -

Jiangling Motors Corporation, Ltd. Extracts from 2003 Annual Report

Jiangling Motors Corporation, Ltd. Extracts From 2003 Annual Report §1 Important Note 1.1 The Board of Directors is collectively and individually liable for the truthfulness, accuracy and completeness of the information disclosed in the report and undertakes that no major events have been omitted, and that there are no misstatements and material misleading information in this report. These extracts are extracted from the original of Annual Report. Investors should read the original for details. 1.2 PwC Zhong Tian CPAs issued unqualified auditor’s reports for JMC’s year 2003 financial report. 1.3 Chairman Jiang Linsheng, President Lu Shuifang, CFO Manto Wong and Head of Finance Department, Wu Kai, ensure that the Financial Report in the Annual Report is truthful and complete. 1.4 Except that the Financial Report (Section 9) of the English version is drawn up according to the Auditors’ Report prepared in accordance with International Accounting Standards (‘IAS’), all financial data are based on Chinese Accounting Standards (‘CAS’). §2 Brief Introduction 2.1 Brief introduction Share’s name Jiangling Motors Jiangling B Share’s code 000550 200550 Place of listing Shenzhen Stock Exchange Company registered address No. 509, Northern Yingbin Avenue, Nanchang City, & headquarters address Jiangxi Province, P.R.C Post code 330001 Company’s website http://www.jmc.com.cn E-mail [email protected] 2.2 Contact persons and contact details Board Secretary Person for financial Securities Affair information disclosure Representative Name Xiong Zhongping Manto Wong Quan Shi Telephone 86-791-5235675 86-791-5232888-6503 86-791-5232888-6178 Fax 86-791-5232839 E-mail [email protected] Contact address No. -

Ford Motor Company Posts Record Annual Sales in China; Sales Rise 14% to 1.27 Million; Lincoln Demand Surges 180%

2017-1-6 | Shanghai Ford Motor Company Posts Record Annual Sales in China; Sales Rise 14% to 1.27 Million; Lincoln Demand Surges 180% • Ford Motor Company sold a record 1.27 million vehicles in 2016 in China, up 14 percent • Changan Ford JV sold 957,495 vehicles in 2016; December sales total 115,654 vehicles • Jiangling Motor Corp. sold 265,056 vehicles in 2016; December sales total 32,193 vehicles • Lincoln sold 32,558 vehicles in 2016, nearly three-fold increase over 2015 SHANGHAI,Jan. 4, 2017-- Ford Motor Company sales surged 23 percent in China in December, capping a record year for the automaker in the world’s largest new vehicle market. For all of 2016, Ford Motor Company sales totaled a best-ever 1.27 million vehicles, 14 percent higher than 2015. That total includes sales by joint ventures Changan Ford Automobile and Jiangling Motors Corporation, sales of Ford models imported to China and Lincoln, which has become the fastest growing luxury brand in China. In December alone, Ford and its joint ventures sold nearly 150,000 vehicles in China, up 21 percent over 2015. The growth was driven by strong demand for Ford’s expanded lineup of SUVs such as the Ford Edge and Explorer, the Ford Taurus large car, and performance vehicles such as the Ford Mustang. “We have built some great sales momentum in China, particularly in the second half of 2016, on the strength of our expanded vehicle lineup,” said Peter Fleet, vice president of Marketing, Sales and Service, Asia Pacific. “Record numbers of customers are choosing our 3-row Edge crossover, elegant Taurus sedan, Explorer premium SUV and Lincoln luxury vehicles.” Changan Ford Automobile, Ford's passenger car joint venture, broke both annual and December sales records. -

HAVAS CHINA Monthly Market Update

COVID-19 EDITION #5 Havas Group China 1 April 28th 2020 In this edition 1. COVID-19 situation update 2. Immediate consumption impact 3. Media consumption impact 4. Economic outlook 5. Outlook for key categories 6. Media market implications 7. POV & recommendation 2 More daily life positive picture, this one would have been for the peak not for now COVID-19 situation update 3 Everyday step by step Chinese are discovering and shaping the new normality, different than expected 50%+ 900M Top 1 43% traffic in 77% of Chinese are planning for concern of Chinese is: are optimistic in the recovered stores May 1 holiday traveling not knowing how long it will last China’s economic fast recovery Week of Apr 6th, 2020 Apr 22nd , 2020 Mar 30th, 2020 Mar 30th, 2020 Sources: CHINA COMMERCE ASSOCIATION FOR GENERAL MERCHANDISE , Tencent news, McKinsey 4 Chinese are discovering and shaping the new normality • With continuing imported cases, local infections slightly go up again, but within small scale and certain areas (Beijing, Heilongjiang, Guangzhou, etc.). Until Apr 26st , the national existing infected cases dropped to 801 from the peak ~60,000 in Mid-February, 15 provinces have reported 0 cases. • Chinese are getting used to a new normality. Less worrying about the virus, start to enjoy daily life again but in the meantime doing everything they can for protection. Wearing masks, washing hands, and keeping social distance have become the daily must. • Until mid Apr, China was to 90%-95% back to work - supermarket 96%, farmer’s market 97%, shopping malls 90%. 77% of stores recovered 50%+ traffic in the week of Apr 6, 16% increase vs. -

EVS34 Program Brochure.Pdf

The 34th International Electric Vehicle Symposium & Exhibition Hosted by: China Electrotechnical Society Program Brochure World Electric Vehicle Association Electric Vehicle Association of Asia-Pacific The People’s Government of Nanjing Municipality Partners: The European Association for Electromobility Electric Drive Transportation Association Contents Messege From EVS34 Chairmen 2 Organization 3 EVS34 Committees 4 Program 12 Detailed Program & Venue Layout 13 Opening&Closing Ceremony 16 Special Session 20 Roundtable 52 Tutorial 62 Lecture Session 64 Dialogue Session 118 Technical Tour 166 Ride&Drive 168 Gala Dinner 170 Venue 172 Accommodation 176 Shuttle Bus 178 Food Service 180 Travel Around Nanjing 182 The 34th International Electric Vehicle Symposium & Exhibition Messege From EVS34 Chairmen Organization Co-hosts C.C.CHAN Qingxin YANG China Council for the Promotion of International Trade Machinery Sub-Council EVS34 General Chair EVS34 General Chair China Association of Automobile Manufacturers President of WEVA and EVAAP President of CES Lishui District People’s Government of NanJing Municipality Chinese Society for Science and Technology Journalism Electric Vehicles are playing important role in the fourth industrial revolution Nanjing Airport Exhibition Investment Management Co., LTD and digital economy. The core of fourth industrial revolution is the artificial intelligence, while the core of digital economy is to achieve high quality economic development through digitized knowledge and information. The In collaboration with Intelligent connected vehicles are not only means of transportation, but also nodes of the Internet of Things, sources of big data, intelligent terminals for China Society of Automotive Engineers mobile broadband, promoters of 5G communication, while intelligent connected China Electric Vehicle100 vehicles themselves are computers and mobile distributed energy. -

Electric Vehicles | CHINA

Electric vehicles | CHINA INDUSTRIALS / AUTOS & AUTO PARTS NOMURA INTERNATIONAL (HK) LIMITED NEW Yankun Hou +852 2252 6234 [email protected] THEME Action Stocks in focus We believe that various electric vehicles (xEV) are the ultimate solution for the We believe the EV theme will sustainability of the global auto industry. We think current EV technology is not support BYD’s share price, although sophisticated enough to compete with the internal combustion engine, but can be we find it difficult to see upside from applied to niche markets. Penetration in niche markets will probably depend on here without clearer milestones; CSR government policy. We are cutting our rating for BYD to NEUTRAL (from Buy) on could benefit due to its strong R&D possible slower sales of EV products in 2011 and a demanding valuation. We think ability in EV buses. WATG, Tianneng Power, A123, Ningbo Yunsheng and CSR (NEUTRAL) have exposure to the EV theme. Price Catalysts Stock Rating Price target BYD (1211 HK) NEUTRAL 42.75 40.00 Government policies on EV; auto sales volume. CSR (1766 HK) NEUTRAL 10.78 11.20 Anchor themes Downgrading from Buy. Cutting PT. We think the niche auto market, including buses, taxis, and LSEVs, provides the Closing prices as of 12 January 2011; local currency first entry point for EV producers. So near and yet so far Analysts Yankun Hou +852 2252 6234 Technology ready to take off as a niche product [email protected] We believe the current EV technology cannot compete with the conventional internal combustion engine (ICE) on driving experience, but that it is ready to be Ming Xu applied to niche markets, though the speed of penetration depends on government +852 2252 1569 commitment. -

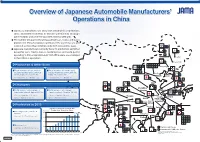

Overview of Japanese Automobile Manufactures' Operations in China

● Japanese manufacturers carry out automobile production, sales, andrelated activities in China in partnership (through joint ventures and other tie-ups) with Chinese affiliates. ● The number of Japanese-brand passenger cars, trucks and buses produced in China has grown rapidly over the past 10 years, and recorded as more than 3 million units for 5 consecutive years. 11 13 ● Japanese manufacturers currently have 95 production and other bases(for cars, trucks, buses, motorcycles, and auto parts) 39 43 operating in China.Approximately 181,100180,800 people are employed 77 Harbin in their Chinese operations. 42 Changchun Production & Other Bases 48 52 54 56 57 65 9 12 14 66 69 70 71 72 Shenyang 15 16 26 ■Total number of car, truck & ■Total number of motorcycle 55 59 60 bus production bases/Invest production bases/Investment, Beijing ment, R&D, etc. bases: 79 R&D, etc. bases: 16 29 Tianjin Dalian Production: 47; Other: 32 Production: 10; Other: 6 25 80 81 91 30 23 Jinan Employees 10 28 86 40 22 Zhengzhou 41 87 75 ■Total number of employees ■Total number of employees Taizhou 27 34 Xiangyang 19 20 58 (cars, trucks & buses): Approx 166,000 (motorcycles): Approx 14,800 Changshu 21 64 8 Plants: Approx 158,900; Plants: Approx 14,200; Nanjing Chengdu Shanghai Other: Approx 7,100 Other: Approx 600 Changzhou Wuhan Hangzhou Jiujiang Jingdezhen Chongqing 45 Changsha 1 2 3 Nanchang Production in 2013 Zhuzhou 46 6 Fuzhou 17 18 47 4 32 ■Passenger cars, trucks & 85 88 84 89 5 400 Approx 3.67million units 24 buses: Guangzhou 7 82 51 Huizhou Approx 3.67 million units 300 31 Foshan 49 50 53 61 44 62 68 76 78 200 33 35 38 79 90 92 93 94 95 ■Motorcycles: 83 100 Production Bases Approx 2.87 million units 63 67 73 Investment, R&D, etc.