British Telecommunications Plc Annual Report and Form 20-F 2003 1 Business Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annex to the BT Response to Ofcom's Consultation on Promoting Competition and Investment in Fibre Networks – Wholesale Fixed

Annex to the BT response to Ofcom’s consultation on promoting competition and investment in fibre networks – Wholesale Fixed Telecoms Market Review 2021-26 29 May 2020 Non - confidential version Branding: only keep logos if the response is on behalf of more than one brand, i.e. BT/Openreach joint response or BT/EE/Plusnet joint response. Comments should be addressed to: Remove the other brands, or if it is purely a BT BT Group Regulatory Affairs, response remove all 4. BT Centre, London, EC1A 7AJ [email protected] BT RESPONSE TO OFCOM’S CONSULTATION ON COMPETITION AND INVESTMENT IN FIBRE NETWORKS 2 Contents CONTENTS .................................................................................................................................................. 2 A1. COMPASS LEXECON: REVIEW OF OFCOM'S APPROACH TO ASSESSING ULTRAFAST MARKET POWER 3 A2. ALTNET ULTRAFAST DEPLOYMENTS AND INVESTMENT FUNDING ...................................................... 4 A3. EXAMPLES OF INCREASING PRICE PRESSURE IN BUSINESS TENDERING MARKETS .............................. 6 A4. MARKET ANALYSIS AND REMEDIES RELATED TO PHYSICAL INFRASTRUCTURE ................................... 7 Our assessment of Ofcom’s market analysis ............................................................................................ 8 Our assessment of Ofcom’s remedies .................................................................................................... 12 A5. RISKS BORNE BY INVESTORS IN BT’S FIBRE INVESTMENT ................................................................ -

Annual Report & Accounts 1998

Annual report and accounts 1998 Chairman’s statement The 1998 financial year proved to be a very Turnover has grown by 4.7 per cent and we important chapter in the BT story, even if not have seen strong growth in demand. Customers quite in the way we anticipated 12 months ago. have benefited from sound quality of service, price cuts worth over £750 million in the year, This time last year, we expected that there was a and a range of new and exciting services. Our good chance that our prospective merger with MCI Internet-related business is growing fast and we Communications Corporation would be completed are seeing considerable demand for second lines by the end of the calendar year. In the event, of and ISDN connections. We have also announced course, this did not happen. WorldCom tabled a a major upgrade to our broadband network to considerably higher bid for MCI and we did not match the ever-increasing volumes of data we feel that it would be in shareholders’ best interests are required to carry. to match it. Earnings per share were 26.7 pence and I am In our view, the preferable course was to pleased to report a final dividend for the year of accept the offer WorldCom made for our 20 per 11.45 pence per share, which brings the total cent holding in MCI. On completion of the dividend for the year to 19 pence per share, MCI/WorldCom merger, BT will receive around which is as forecast. This represents an increase US$7 billion (more than £4 billion). -

BT Group Regulatory Affairs, Response Remove All 4

Annex to the BT response to Ofcom’s consultation on promoting competition and investment in fibre networks – Wholesale Fixed Telecoms Market Review 2021-26 29 May 2020 Non - confidential version Branding: only keep logos if the response is on behalf of more than one brand, i.e. BT/Openreach joint response or BT/EE/Plusnet joint response. Comments should be addressed to: Remove the other brands, or if it is purely a BT BT Group Regulatory Affairs, response remove all 4. BT Centre, London, EC1A 7AJ [email protected] BT RESPONSE TO OFCOM’S CONSULTATION ON COMPETITION AND INVESTMENT IN FIBRE NETWORKS 2 Contents CONTENTS .................................................................................................................................................. 2 A1. COMPASS LEXECON: REVIEW OF OFCOM'S APPROACH TO ASSESSING ULTRAFAST MARKET POWER 3 A2. ALTNET ULTRAFAST DEPLOYMENTS AND INVESTMENT FUNDING ...................................................... 4 A3. EXAMPLES OF INCREASING PRICE PRESSURE IN BUSINESS TENDERING MARKETS .............................. 6 A4. MARKET ANALYSIS AND REMEDIES RELATED TO PHYSICAL INFRASTRUCTURE ................................... 7 Our assessment of Ofcom’s market analysis ............................................................................................ 8 Our assessment of Ofcom’s remedies .................................................................................................... 12 A5. RISKS BORNE BY INVESTORS IN BT’S FIBRE INVESTMENT ................................................................ -

View Annual Report

BT Group plc Annual Report & Form 20-F 2017 Welcome to BT Group plc’s Annual Report and Form-20F for 2017 Where to find more information www.btplc.com www.bt.com/annualreport Delivering our Purpose Report We’re using the power of communications to make a better world. That’s our purpose. Read our annual update. www.btplc.com/purposefulbusiness Delivering our Purpose Report Update on our progress in 2016/17 THE STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS ADDITIONAL INFORMATION The strategic report 2 Contents Review of the year 3 How we’re organised 8 An introduction from our Chairman 10 A message from our Chief Executive 12 This is the BT Annual Report for the year ended Operating Committee 14 31 March 2017. It complies with UK regulations Our strategy Our strategy in a nutshell 16 and comprises part of the Annual Report and How we’re doing Form 20-F for the US Securities and Exchange – Delivering great customer experience 17 – Investing for growth 18 Commission to meet US regulations. – Transforming our costs 19 Key performance indicators 20 This is the third year that we’ve applied an Our business model Integrated Reporting (IR) approach to how Our business model 22 we structure and present our Annual Report. What we do 24 Resources, relationships and sustainability IR is an initiative led by the International Integrated Reporting – Financial strength 26 Council (IIRC). Its principles and aims are consistent with UK – Our people 26 regulatory developments in financial and corporate reporting. – Our networks and physical assets 30 We’ve reflected guiding principles and content elements from the – Properties 31 IIRC’s IR Framework in preparing our Annual Report. -

BT Strategic Report

BT Group plc Annual Report 2020 Strategic report 1 New BT Halo. ... of new products and services Contents Combining the We launched BT Halo, We’re best of 4G, 5G our best ever converged Strategic report connectivity package. and fibre. ... of flexible TV A message from our Chairman 2 A message from our Chief Executive 4 packages About BT 6 investing Our range of new flexible TV Executive Committee 8 packages aims to disrupt the Customers and markets 10 UK’s pay TV market and keep Regulatory update 12 pace with the rising tide of in the streamers. Our business model 14 Our strategy 16 Strategic progress 18 ... of next generation Our stakeholders 24 future... fibre broadband Culture and colleagues 30 We expect to invest around Introducing the Colleague Board 32 £12bn to connect 20m Section 172 statement 34 premises by mid-to-late-20s Non-financial information statement 35 if the conditions are right. Digital impact and sustainability 36 Our key performance indicators 40 Our performance as a sustainable and responsible business 42 ... of our Group performance 43 A letter from the Chair of Openreach 51 best-in-class How we manage risk 52 network ... to keep us all Our principal risks and uncertainties 53 5G makes a measurable connected Viability statement 64 difference to everyday During the pandemic, experiences and opens we’re helping those who up even more exciting need us the most. Corporate governance report 65 new experiences. Financial statements 117 ... to enable Additional information 204 a safer world This year, we used artificial intelligence (AI) Look out for these throughout the report: to anticipate emerging threats and help protect the nation from up to 4,000 cyberattacks a day. -

BT Plc Modern Slavery Act Statement 2016/17 We’Re Committed to the Principles of Ethical Behaviour and Respecting Human Rights

BT plc Modern Slavery Act Statement 2016/17 We’re committed to the principles of ethical behaviour and respecting human rights. We have a Contents long-standing policy that we don't use or accept forced, bonded or involuntary prison labour or child Our business and supply chain labour; nor do we demand deposits or hold onto our – who we are and what we do 04 workers' identity papers, or work with businesses that Our lines of business 04 do. We only work with people who choose to work Our supply chain – our suppliers and freely. We respect the right to equal opportunity, procurement process 05 freedom of association and collective bargaining. We're a signatory to the United Nations Global Value of BT supplier spend by region 05 Compact and we've committed to implementing the How we check our supply chain United Nations Guiding Principles on Business and sticks to our standards 06 Human Rights. Supplier assessments – when are they done? 06 In August 2016 we published our first Modern Slavery Act The assessment process 07 statement. This year’s statement provides an update on our progress over 2016/17 and our plans for further improvements Modern Slavery Act next year 2017/18. – mapping BT’s categories of spend 08 At a glance – what we’ve done this year: Our business operations – overview of our people and recruitment 09 Stronger governance • Our resourcing contracts now say that candidates must not be Things that matter to us 10 charged fees – the employer must pay How we make sure our people • We've doubled the number of assessors we use -

LTB 342.2019 Attachment 1

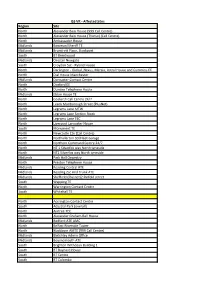

ISS VR - Affected Sites Region Site North Alexander Bain House (999 Call Centre) North Alexander Bain House (Thurso) (Call Centre) North Ambassador House Midlands Bowman/Sheriff TE Midlands Brundrett Place, Stockport South BT Brentwood Midlands Chester Newgate South Croydon Ssc - Ryland House North Darlington - Global ,Nexus, Mercia, Astral House and Cummins EE North Dial House Manchester Midlands Doncaster Contact Centre North Doxford EE North Dundee Telephone House Midlands Eldon House TE North Gosforth Call Centre 24/7 North Leeds Marlborough Street (PlusNet) North Legrams Lane MTW North Legrams Lane Section Stock North Legrams Lane TEC North Liverpool Lancaster House South Monument TE North Newcastle Cte (Call Centre) North Northallerton SD/Fleet Garage North Northern Command Centre 24/7 North NT 1 Silverfox way North tyneside North NT2 Silverfox way North tyneside Midlands Park Hall Oswestry North Preston Telephone House Midlands Reading Central ATE Midlands Reading Zsc And Trunk ATE Midlands Sheffield (Plusnet)2 Pinfold street South Wapping TE North Warrington Contact Centre South Whitehall TE North Accrington Contact Centre South Adastral Park (overall) North Aintree TEC North Alexander Graham Bell House Midlands Bedford ATE AMC North Belfast Riverside Tower North Blackburn AMTE (999 Call Centre) Midlands Bletchley Admin Office Midlands Bournemouth ATE South Brighton Withdean Building 1 South BT Baynard House South BT Centre South BT Colombo South BT Mill House South BT Tower South Canterbury Becket House South Crawley New TEC -

BT Group Regulatory Affairs, Response Remove All 4

BT response to Ofcom’s consultation on promoting competition and investment in fibre networks - Wholesale Fixed Telecoms Market Review 2021-26 13 May 2020 Non-confidential version Branding: only keep logos if the response is on behalf of more than one brand, i.e. BT/Openreach joint response or BT/EE/Plusnet joint response. Comments should be addressed to: Remove the other brands, or if it is purely a BT BT Group Regulatory Affairs, response remove all 4. BT Centre, London, EC1A 7AJ [email protected] BT RESPONSE TO OFCOM’S CONSULTATION ON COMPETITION AND INVESTMENT IN FIBRE NETWORKS 2 Contents1 CONTENTS ....................................................................................................................................................... 2 1. EXECUTIVE SUMMARY................................................................................................................................ 3 2. OFCOM'S MARKET ANALYSIS SHOULD BETTER REFLECT FORWARD-LOOKING COMPETITION .................. 10 OPENREACH FACES STRONG FORWARD-LOOKING WHOLESALE COMPETITION IN WLA MARKETS WHICH BENEFITS CONSUMERS .... 11 OFCOM SHOULD REVISIT ITS PROPOSED MARKET DEFINITION .......................................................................................... 19 OPENREACH DOES NOT HAVE SMP IN ULTRAFAST CAPABLE LINES NATIONALLY NOR FORWARD-LOOKING SMP AT ANY SPEEDS IN VIRGIN MEDIA AREAS ............................................................................................................................................. 22 LEASED LINES -

View Annual Report

BT ANNUAL REPORT AND FORM 20-F 2013 USER GUIDE Overview OVERVIEW Welcome to the BT Annual Report and Form 20– F 2013 . In this interactive pdf you can do many things to help you easily access the information that you want, whether that’s printing, searching for a section or website. These are explained below. Strategy 1. Document controls BUSINESS REVIEW Use the document controls located in the top right corner to help you navigate through this report. Search Print Go to Back/forward Fast link to contents one page previous page viewed Business 2. Links within this document Examples Throughout this report there are links to pages, other For further discussion of these items see pages 33 and 47 to 48. sections and web addresses for additional information. by line of business, and for the group, is provided in the table at the foot of pages 34 to 35. FINANCIAL REVIEW 3. Navigating with tabs Use the tabs to quickly go to the start of a Performance different section. Performance Governance Governance Financial statements Financial statements Additional information BT Group plc Annual Report & Form 20-F 2013 view VIEW BT Group plc Over Annual Report & OVER Form 20-F 2013 Strategy BUSINESS REVIEW Business FINANCIAL REVIEW Performance Governance BT Group plc Registered office: 81 Newgate Street, London EC1A 7AJ Registered in England and Wales No. 4190816 Produced by BT Group www.bt.com Financial statements PHME 67064 Printed in England by Pindar Scarborough Ltd Design by saslondon.com Typeset by RR Donnelley Printed on Amadeus 50 Silk which is made from 50% de-inked, post-consumer waste and 50% virgin fibre. -

(By Email) Our Ref: MGLA031218-9660 21 January

(By email) Our Ref: MGLA031218-9660 21 January 2019 Dear Thank you for your request for information which the GLA received on 3 December 2019. Your request has been dealt with under the Freedom of Information Act (2000) Our response to your request is as follows: I wish to see full copies of any and all meetings and emails with any of the following companies: InLink / LinkUK / Google / BT / Alphabet / Intersection / Primesight Regarding the InLink portals. Please find attached the information we have identified within scope of your request. Please note that some names of members of staff are exempt from disclosure under s.40 (Personal information) of the Freedom of Information Act. This information could potentially identify specific employees and as such constitutes as personal data which is defined by Article 4(1) of the General Data Protection Regulation (GDPR) to mean any information relating to an identified or identifiable living individual. It is considered that disclosure of this information would contravene the first data protection principle under Article 5(1) of GDPR which states that Personal data must be processed lawfully, fairly and in a transparent manner in relation to the data subject. A small amount of information contained within the email of 8 November 2018 (11:48) is exempt from disclosure under the exemption for Commercial Interests at section 43(2) of the FoIA. Section 43(2) provides that information can be withheld from release if its release would, or would be likely to, prejudice the commercial interests of any person. A commercial interest relates to a person’s ability to participate competitively in a commercial activity and in this instance, the information withheld from disclosure refers price estimates for advertisement space which is not publicly available, and disclosure would compromise inlinkuk’s competitiveness in the wider out of home market. -

D2.1 System Architecture

Directorate General for Communications Networks, Content and Technology Innovation Action ICT-687655 D2.1 System Architecture Due date of deliverable: 31 March 2016 Actual submission date: 10 May 2016 Resubmitted with minor changes: 28 April 2017 Start date of project: 1 December 2015 Duration: 36 months Lead contractor for this deliverable: Cisco Version: 28 April 2017 Confidentiality status: Public © 2-IMMERSE Consortium 2017 Page 1 of (128) Grant Agreement number: 687655 — 2-IMMERSE — H2020-ICT-2015 D2.1 System Architecture Abstract This document describes the system architecture being developed by the 2-IMMERSE project. This architecture is designed to enable the four multi-screen service prototypes that will be delivered through the project. The System Architecture is layered as a set of platform services, a client application architecture and production architecture. The system architecture is a work in progress; it will evolve both as we refine it and specify it in more detail, and as we deliver each of the multi-screen service prototypes through the project. Target audience This is a public deliverable and could be read by anyone with an interest in the system architecture being developed by the 2-IMMERSE project. As this is inherently technical in nature, we assume the audience is technically literate with a good grasp of television and Internet technologies in particular. We have included a Technology Overview section that summarises a range of technologies that are potentially applicable within the project. This document will be read by the Project Consortium as it defines the system architecture that will be adopted and evolved throughout the project. -

British Telecommunications Plc Annual Report 2019 Strategic Report Governance Financial Statements Extra Information

BRITISH TELECOMMUNICATIONS plc BRITISH TELECOMMUNI Annual Report CATIONS plc 2019 CATIONS 2019 1 British Telecommunications plc Annual Report 2019 Strategic report Governance Financial statements Extra information British Telecommunications plc (‘the group’ or ‘the company’) is the principal Contents operating subsidiary of BT Group plc. We’re a wholly-owned subsidiary of BT Group plc. The BT Group plc Board has ultimate responsibility for the management of the group while the Executive Committee of BT Group plc is out key management Strategic report committee. It monitors the group’s financial, operational and customer service About BT 2 performance and has cross-business oversight of BT’s customer-facing units. It Market context 4 also reviews the group’s key risks and considers potential threats and opportunities facing the business Our business model 8 Our strategy 10 British Telecommunications plc leverages the governance structure and processes of Strategic progress 12 BT Group plc, including: Our stakeholders 18 Our key performance indicators 26 – BT Group plc Board Group performance 30 – Executive Committee Our approach to risk management 36 – Audit & Risk Committee Our principal risks and uncertainties 38 Key management personnel comprise executive and non-executive directors of the BT Group plc Executive Committee, as well as the members of the BT plc Board. Governance 46 Financial statements 52 Additional information 156 Non-Financial Reporting Information Statement Our integrated approach to reporting means that the requirements of the Non-Financial Reporting Directive are addressed throughout the Strategic report. For ease of reference, information pertaining to each of the matters addressed by the new regulation can be found on the following pages: Human rights (page 21); Our people (page 18); Social (page 20); Environmental (page 22); Anti- corruption and bribery (page 28).