Case No COMP/M.2275 - PEPSICO / QUAKER

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case 23 Pepsico's

BFV GROUP : Beatrice Teresa Colantoni, Francesco Morgia, Valentina Palmerio. PepsiCo’s Business Case – CASE 23 PEPSICO’S HISTORY. PepsiCo, Inc., was established in 1965 when PepsiCola and Frito-Lay shareholders agreed to a merger between the salty-snack icon and soft-drink giant. The new company was founded with annual revenues of $510 million and such well-known brands as Pepsi-Cola, Mountain Dew, Fritos, Lay’s, Cheetos, Ruffles, and Rold Gold. By 1971, PepsiCo had more than doubled its revenues to reach $1 billion. The company began to pursue growth through acquisitions outside snacks and beverages as early as 1968, but its 1977 acquisition of Pizza Hut significantly shaped the strategic direction of PepsiCo for the next 20 years. The acquisitions of Taco Bell in 1978 and Kentucky Fried Chicken in 1986 created a business portfolio described by Wayne Calloway (PepsiCo’s CEO between 1986 and 1996) as a balanced three-legged stool. Calloway believed the combination of snack foods, soft drinks, and fast food offered considerable cost sharing and skill transfer opportunities. PepsiCo strengthened its portfolio of snack foods and beverages during the 1980s and 1990s, adding also quick-service restaurant. By 1996 it had become clear to PepsiCo management that the potential strategic-fit benefits existing between restaurants and PepsiCo’s core beverage and snack businesses were difficult to capture. In 1997, CEO Roger Enrico spun off the company’s restaurants as an independent, publicly traded company to focus PepsiCo on food and beverages. Soon after the spinoff of PepsiCo’s fast-food restaurants was completed, Enrico acquired Cracker Jack, Tropicana, Smith’s Snackfood Company in Australia, SoBe teas and alternative beverages, Tasali Snack Foods (the leader in the Saudi Arabian salty-snack market), and the Quaker Oats Company. -

Quaker Sees an ROI of Over 6X by Reaching Amazon Shoppers on Amazon and Across the Web1

Case Study Amazon.com | Amazon Advertising Platform (AAP) Quaker sees an ROI of over 6X by reaching Amazon shoppers on Amazon and across the web1 The Quaker Oats company, a leading manufacturer of packaged grocery The AMG Solution foods and subsidiary of PepsiCo, Inc., worked with Amazon Media Quaker and AMG launched a campaign using custom Group (AMG) to drive purchase considerations and sales of Quaker coupon ads that ran on Amazon.com and amplified Oatmeal Squares Cereal. They assumed the AMG campaign would campaign reach with the Amazon Advertising Platform deliver on their objectives on Amazon, but they were also interested (AAP). The AMG campaign also revealed exact groups in learning what effect the campaign would have on offline sales in of Amazon customers who were who were most likely traditional brick and mortar stores. Through a mix of standard AMG to take action after exposure to their ads such as those post-campaign measurements and AMG’s partnership with Nielsen who were in-market for other grocery products. With HomeScan, Quaker was able to better understand the effect of their carefully targeted ads served across Amazon and campaign on key success metrics – both on and offline. AAP, Quaker maximized exposure among groups that mattered most, yielding a strong ROI. Online Success Metrics Total Campaign ROI For every $1 spent on advertising with Amazon, Quaker recognized over $6 in incremental sales Offline Sales Boost ¡ 26% lift in offline sales as a result of the on-Amazon portion of the campaign ¡ 29% lift in offline sales as a result of the AAP portion of the campaign On-Amazon Success Metrics On average, users who were exposed to Quaker ads were: ¡ 5x more likely to consider Quaker Oatmeal Squares versus those who weren’t ¡ Almost 2x more likely to purchase Quaker Oatmeal Squares versus those who weren’t About The Quaker Oats Company: The Quaker Oats Company, headquartered in Chicago, is a Methodology unit of PepsiCo, Inc., one of the world’s largest consumer packaged goods companies. -

TROPICANA PRODUCTS, INC., ) ) a Corporation

042 3154 UNITED STATES OF AMERICA FEDERAL TRADE COMMISSION COMMISSIONERS: Deborah Platt Majoras, Chairman Thomas B. Leary Pamela Jones Harbour Jon Leibowitz ) In the Matter of ) ) DOCKET NO. C-4145 TROPICANA PRODUCTS, INC., ) ) a corporation. ) ) COMPLAINT The Federal Trade Commission, having reason to believe that Tropicana Products, Inc., a corporation, (“respondent”), has violated the provisions of the Federal Trade Commission Act, and it appearing to the Commission that this proceeding is in the public interest, alleges: 1. Respondent is a Delaware corporation with its principal office or place of business at 555 Monroe Street, Chicago, Illinois 60661. 2. Respondent has advertised, labeled, offered for sale, sold, and distributed food products to the public, including orange juice sold under the “Tropicana” name. 3. Orange juice is a “food” within the meaning of Sections 12 and 15 of the Federal Trade Commission Act. 4. The acts and practices of respondent alleged in this complaint have been in or affecting commerce, as “commerce” is defined in Section 4 of the Federal Trade Commission Act. 5. Respondent has disseminated or has caused to be disseminated national advertising and promotional materials for its orange juice, including but not limited to the television and print advertisements attached as Exhibits A-C. The advertisements contain the following statements and depictions: Page 1 of 5 A. VISUAL: Carton of Tropicana orange juice with blood pressure gauge attached. TEXT: Lowering your blood pressure never tasted so good. VISUAL: Two small glasses of orange juice. TEXT: A new clinical study shows enjoying two glasses of Tropicana Pure Premium every day can lower your blood pressure an average of ten points. -

Pepsico Q2 2019 10-Q

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q (Mark One) X QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 15, 2019 (24 weeks) OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-1183 PepsiCo, Inc. (Exact Name of Registrant as Specified in its Charter) North Carolina 13-1584302 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.) 700 Anderson Hill Road, Purchase, New York 10577 (Address of Principal Executive Offices) (Zip Code) 914-253-2000 (Registrant’s Telephone Number, Including Area Code) N/A (Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report) Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: Title of each class Trading Symbols Name of each exchange on which registered Common Stock, par value 1-2/3 cents per share PEP The Nasdaq Stock Market LLC 2.500% Senior Notes Due 2022 PEP22a The Nasdaq Stock Market LLC 1.750% Senior Notes Due 2021 PEP21a The Nasdaq Stock Market LLC 2.625% Senior Notes Due 2026 PEP26 The Nasdaq Stock Market LLC 0.875% Senior Notes Due 2028 PEP28 The Nasdaq Stock Market LLC 0.750% Senior Notes Due 2027 PEP27 The Nasdaq Stock Market LLC 1.125% Senior Notes Due 2031 PEP31 The Nasdaq Stock Market LLC Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Pepsico, Inc. (Exact Name of Registrant As Specified in Its Charter)

FORM 10-K PEPSICO INC - PEP Exhibit: � Filed: February 20, 2007 (period: December 30, 2006) Annual report which provides a comprehensive overview of the company for the past year Table of Contents PART I Item 1. Business 1 PART I Item 1. Business Item 1A. Risk Factors Item 1B. Unresolved Staff Comments Item 2. Properties Item 3. Legal Proceedings Item 4. Submission of Matters to a Vote of Security Holders PART II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of E Item 6. Selected Financial Data Item 7. Management s Discussion and Analysis Item 7A. Quantitative and Qualitative Disclosures About Market Risk Item 8. Financial Statements and Supplementary Data Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information PART III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matt Item 13. Certain Relationships and Related Transactions, and Director Independence Item 14. Principal Accountant Fees and Services PART IV Item 15. Exhibits and Financial Statement Schedules SIGNATURES ITEM 15(a)(3) EX-3.2 (BY-LAWS OF PEPSICO) EX-10.31 (AMENDMENTS TO THE PEPSICO) EX-10.34 (AMENDMENTS TO THE PEPSICO EXECUTIVE INCOME DEFERRAL PROGRAM) EX-10.41 (AMENDMENT TO THE PEPSICO) EX-12 (COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES.) EX-21 (SUBSIDAIRIES OF PEPSICO INC) EX-23 (CONSENT OF KPMG LLP.) EX-24 (POWER OF ATTORNEY) EX-31 (CERTIFICATION OF OUR CEO AND OUR CFO PURSUANT TO SECTION 302) EX-32 (CERTIFICATION OF OUR CEO AND OUR CFO PURSUANT TO SECTION 906) Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. -

GATORADE FLOOR: Quenching Thirst, Joints, Cracks and Curl

ARTICLE REPRINT ACI January 2002 GATORADE FLOOR: Quenching Thirst, Joints, Cracks and Curl “Gatorade and Metric Constructors agreed to use the most advanced, state-of- the-art techniques and materials Fig. 1 – SCC floor panel almost ready for concrete placement. Note: 125 by 100 ft. (38 by 30 m) panel size with no intermediate joints; square dowels in adjacent panels with special clips (red) having cushioning side pads to allow differential horizontal movements but transfer vertical loads. possible When selected by the Quaker Oats Company, the feature that set this project apart from makers of Gatorade, to provide engineering other facilities of this type was the unique services for the new Gatorade Southwest shrinkage-compensating concrete floor with Facility in Atlanta, Georgia, the design-build joints as far as 125 ft (38 m) apart with no partnership of Metric Constructors and significant cracking. Lockwood Green Engineers and Architects The focus of this article is on some of the opted for a state-of-the-art design that unique features of the Gatorade facility’s would use cutting-edge technology where floors, which are significantly different possible. This decision would ensure a design from typical bottling or warehouse facility that accommodated the many specialized floors and even far from many previously functions of the bottling/warehouse constructed high-quality floors. The facility and would eliminate or minimize final design of the floors specified over the problems that occur in most typical 415,000 ft. (38,000 m2), most of which industrial floor construction. Gatorade and were of shrinkage-compensating concrete, Metric Constructors agreed to use the most the design and construction of which advanced, state-of-the-art techniques and incorporated the most advanced techniques materials possible; furthermore, Gatorade were combined in ways never previously and Metrick fostered a spirit of teamwork used to create floors of this type. -

Evaluating Sugary Drink Nutrition and Marketing to Youth Methods

Evaluating Sugary Drink Nutrition and Marketing to Youth Methods Sugary Drink FACTS: Evaluating Sugary Drink Nutrition and Marketing to Youth Authors: Jennifer L. Harris, PhD, MBA Marlene B. Schwartz, PhD Kelly D. Brownell, PhD Johanna Javadizadeh, MBA Megan Weinberg, MA Vishnudas Sarda, MBBS, MPH Christina Munsell, MS, RD Carol Shin, MBA Fran Fleming Milici, PhD Amy Ustjanauskas Renee Gross Sarah Speers Andrew Cheyne, CPhil Lori Dorfman, DrPH Priscilla Gonzalez, MPH Pamela Mejia, MS, MPH Rudd Center for Food Policy and Obesity October, 2011 Acknowledgements We would like to thank the following people for their valuable assistance in collecting data: Susannah Albert-Chandhok Ryan Gebhard Darina Nghiem Josh Baker Eliza Gombert Eunie Park Kate Barnett Jay Imus Angel Reese Kelly Barrett Heather Kaplan Hannah Sheehy Casey Carden Carly Litzenberger Jennifer Shin Robert Dowding Benjamin Lovell Ashita Soni Ashley Firth, MA Lisa Martinez, MPH Kate Stearns We would also like to thank our steering committee and other advisors: Doug Blanke, JD Dale Kunkel, PhD Mary Story, PhD, RD Frank Chaloupka, PhD Tim Lobstein, PhD Stephen Teret, JD, MPH Thomas Farley, MD, MPH Susan T. Mayne, PhD Ellen Wartella, PhD Sonya A Grier, PhD, MBA C. Tracy Orleans, PhD James G. Webster, PhD Corinna Hawkes, PhD Lisa M. Powell, PhD Walter Willett, MD, DrPH Shiriki Kumanyika, PhD, MPH Amelie Ramirez, DrPH Jerome D. Williams, PhD Thank you to our colleagues at the Rudd Center, especially Andrea Wilson, Megan Orciari, and Tricia Wynne We thank Cavich Creative, LLC, and Chris Lenz for their assistance in preparing the manuscript and website. Finally, we thank the leadership and staff at the Robert Wood Johnson Foundation, with special thanks to the Childhood Obesity Team. -

Decisions of the United States Court of International Trade

Decisions of the United States Court of International Trade ᭜ SLIP OP. 07–55 TROPICANA PRODUCTS,INC., Plaintiff, and LOUIS DREYFUS CITRUS, INC., and FISCHER S/A AGROINDUSTRIA, Plaintiff-Intervenors, v. UNITED STATES, Defendant, and A. DUDA &SONS,INC., CITRUS WORLD,INC., FLORIDA CITRUS MUTUAL,SOUTHERN GARDEN CITRUS PROCESSING CORP., and THE COCA-COLA COMPANY, Defendant-Intervenors. Before: Jane A. Restani, Chief Judge Court No. 06–00109 Public Version OPINION [The International Trade Commission’s affirmative determination of material in- jury by reason of imports of certain orange juice from Brazil REMANDED.] Dated: April 12, 2007 Neville Peterson, LLP (John M. Peterson, Catherine C. Chen, and George W. Th- ompson for the plaintiff. Vinson & Elkins, LLP (Christopher A. Dunn and Valerie S. Ellis) for the plaintiff- intervenor Louis Dreyfus Citrus, Inc. Kalik Lewin (Robert G. Kalik and Brenna S. Lenchak) for the plaintiff-intervenor Fischer S/A Agroindustria. Peter D. Keisler, Assistant Attorney General; Jeanne Davidson, Director, Commer- cial Litigation Branch, Civil Division, U.S. Department of Justice (Michael J. Dierberg), for the defendant. James M. Lyons, General Counsel, U.S. International Trade Commission (David A.J. Goldfine and Andrea C. Casson) for the defendant. Barnes, Richardson & Colburn (Stephen W. Brophy) for defendant-intervenor A. Duda & Sons, Inc., Citrus World, Inc., Florida Citrus Mutual, and Southern Gardens Citrus Processing Corp. Crowell & Moring, LLP (Jeffrey L. Snyder and Alexander H. Schaefer) for the defendant-intervenor the Coca-Cola Company. Restani, Chief Judge: This matter is before the court on Plaintiff Tropicana Products Inc.’s (‘‘Tropicana’’) motion for judgment on the agency record pursuant to USCIT Rule 56.2. -

Example Entries from the Guide to MBA Recruitment In

Guide to MBA Recruitment in the Top 100 Marketing, Media, Advertising, PR and FMCG Companies EXAMPLE ENTRIES September 2018 Workmaze Limited 3 William House Rayne Road Braintree Essex CM7 2AA UK. Registered in England: Company Registration No. 4100091 VAT No. 766 486 087 A-Z Index of companies by type Click on the company Advertising Media PR Agencies FMCG Companies FMCG Companies name to be taken to the individual company entry. (continued) AMS Media Group Ascential plc Citigate Dewe Rogerson 2 Sisters Food Group For a list of companies in Arena Media BBC Edelman Adidas LVMH alphabetical order, please Dentsu Aegis Network Bertelsmann Freuds ADM Marston’s see the next page. Please Havas Group Bloomberg FTI Consulting Alfred Dunhill Mars note: all information was Interpublic Group BMG Grayling Anheuser-Busch InBev Mitchells & Butlers correct at time of John Ayling & Associates BMJ Group Hill & Knowlton Strategies Apple Inc Mondelēz publication. Digitas Sky Instinctif Arcadia Nestlé UK M & C Saatchi Channel 4 Ketchum Body Shop International Nike Media Campaign Daily Mail Kindred British American Tobacco PepsiCo MediaCom FremantleMedia Lansons Communications Britvic Premier Foods Omnicom Guardian Media Group The Red Consultancy Coca-Cola Proctor & Gamble Publicis UK Hibu Group Teneo Blue Rubicon Colgate-Palmolive Reckitt Benckiser Blue 449 ITV Finsbury COTY Roche Products UK WPP Macmillan Education Weber Shandwick Dairy Crest Sony Pearson Diageo Tate & Lyle Marketing/Consulting Reach plc Dyson Unilever Routledge Games Workshop Vion Greencore Group ADLER Europe Sony Music Entertainment Whitbread plc Greene King FutureBrand Thomson Reuters Heineken Interbrand Times Newspapers Limited KraftHeinz Landor Associates United Business Media Imperial Tobacco SuperUnion (UBM) Johnson & Johnson Wolff Olins Kellogg’s ZS Associates L’Oreal UK Workmaze Limited 3 William House Rayne Road Braintree Essex CM7 2AA UK. -

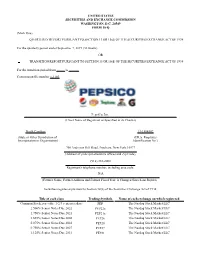

Pepsico Q3 2019 10-Q

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q (Mark One) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 7, 2019 (36 weeks) OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-1183 PepsiCo, Inc. (Exact Name of Registrant as Specified in its Charter) North Carolina 13-1584302 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.) 700 Anderson Hill Road, Purchase, New York 10577 (Address of principal executive offices and Zip Code) (914) 253-2000 Registrant's telephone number, including area code N/A (Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report) Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: Title of each class Trading Symbols Name of each exchange on which registered Common Stock, par value 1-2/3 cents per share PEP The Nasdaq Stock Market LLC 2.500% Senior Notes Due 2022 PEP22a The Nasdaq Stock Market LLC 1.750% Senior Notes Due 2021 PEP21a The Nasdaq Stock Market LLC 2.625% Senior Notes Due 2026 PEP26 The Nasdaq Stock Market LLC 0.875% Senior Notes Due 2028 PEP28 The Nasdaq Stock Market LLC 0.750% Senior Notes Due 2027 PEP27 The Nasdaq Stock Market LLC 1.125% Senior Notes Due 2031 PEP31 The Nasdaq Stock Market LLC Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Use These Links to Rapidly Review the Document TABLE of CONTENTS TABLE of CONTENTS 2

5 Use these links to rapidly review the document TABLE OF CONTENTS TABLE OF CONTENTS 2 CALCULATION OF REGISTRATION FEE Title of Each Class Maximum Aggregate Amount of of Securities Offered Offering Price Registration Fee(1) 2.625% Senior Notes due 2029 $1,000,000,000 $121,200 3.375% Senior Notes due 2049 $1,000,000,000 $121,200 Total $2,000,000,000 $242,400 (1) Calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended. Table of Contents 5 Filed Pursuant to Rule 424(b)(2) File No. 333-216082 PROSPECTUS SUPPLEMENT (To Prospectus Dated February 15, 2017) $2,000,000,000 PepsiCo, Inc. $1,000,000,000 2.625% Senior Notes due 2029 $1,000,000,000 3.375% Senior Notes due 2049 We are offering $1,000,000,000 of our 2.625% senior notes due 2029 (the "2029 notes") and $1,000,000,000 of our 3.375% senior notes due 2049 (the "2049 notes," and together with the 2029 notes, the "notes"). The 2029 notes will bear interest at a fixed rate of 2.625% per annum and will mature on July 29, 2029. The 2049 notes will bear interest at a fixed rate of 3.375% per annum and will mature on July 29, 2049. We will pay interest on the notes on January 29 and July 29 of each year until maturity, beginning on January 29, 2020. We may redeem some or all of either series of notes at any time and from time to time at the applicable redemption price for that series described in this prospectus supplement. -

A Project Report on At

A Project Report On “Channel Satisfaction” At Lumbini Beverages Pvt. Ltd. Hajipur Under The Guidance of Mr.Rakesh Ranjan [(Head-Marketing & Training), PEPSI, Patna (Bihar)] In Partial Fulfillment of the Requirements For the award of “Post Graduate Diploma In Management” (PGDM) Academic Session 2012-2014 Internal Guide Submitted By Dr.Monika Suri Abhishek Kumar Singh (Associate Prof.:-Marketing) Enrollment No.:-0122PGM031 Doon Business School, Dehradun Doon Business School-Global Behind Pharma City, Mi-122 Selaqui,Dehradun Tel:-0135-2699085 i Channel Satisfaction DECLARATION I, ‘Abhishek Kumar Singh’ declaring that all the information given in this project report is true and correct as far as I know. I am also declaring that all the work in this project is done by me and not copied from anywhere. Abhishek Kumar Singh Enrollment No-0122PGM031 Session- 2012-14 ii Channel Satisfaction iii Channel Satisfaction PREFACE There is a famous saying “The theory without practical is lame and practical without theory is blind.” This modern era is era of consumers. Consumers satisfy themselves according to their needs and desires, so they choose that commodity from where they extract maximum satisfaction. It has been identified that in the beginning of 21st century the market was observed a drastic change. The successful brand presents itself in such a way that buyers buy them in special values which match their needs. Marketing is an important part of any business and advertisement is the most important part of marketing. Summer training is an integral part of the PGDM and student of Management have to undergo training session in a business organization for 2 months to gain some practical knowledge in their specialization and to gain some working experience.