View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Serialization List Year Produced MODEL 18 D18S A-1 Thru A-37 1945 37

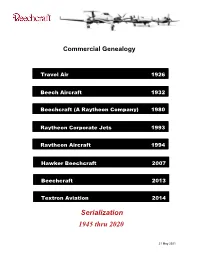

Commercial Genealogy Travel Air 1926 Beech Aircraft 1932 Beechcraft (A Raytheon Company) 1980 Raytheon Corporate Jets 1993 Raytheon Aircraft 1994 Hawker Beechcraft 2007 Beechcraft 2013 Textron Aviation 2014 Serialization 1945 thru 2020 21 May 2021 HAWKER 4000 BRITISH AEROSPACE AIRCRAFT HAWKER 1000 HAWKER 900XP HAWKER SIDDELEY 125-400 BEECHCRAFT HAWKER 125-400 U125A HAWKER 800 • HAWKER SIDDELEY 125 HAWKER 800XP HAWKER 800XPi HAWKER 850 HAWKER 800XPR SERIES 1 HAWKER 125-700 HAWKER 750 HAWKER 125-600 MODEL 400 BEECHJET • HAWKER SIDDELEY 125 400A BEECHJET 400A HAWKER 400XP HAWKER 400XPR SERIES 3 S18A T1A XA-38 GRIZZLY MODEL 2000 STARSHIP PREMIER I PREMIER IA S18 AT-10 KING AIR 350ER F2 KING AIR 350 • • • UC-45 U-21J SUPER KING AIR 300 KING AIR 350i KING AIR 350i D18S C45H SUPER E18 • • KING AIR B200 MODEL 18 SUPER H18 • • TWIN BEECH SUPER KING AIR 200 KING AIR B200GT KING AIR 250 KING AIR 250 C-12 AIR FORCE C-12 NAVY JRB-1 C-12 ARMY 1300 AIRLINER • • • • RC-12K C-12K JRB-2 • JRB-6 C-12 AIR FORCE U21F AT-11 • C-12 NAVY/MARINES KING AIR 100 • • • AT-7 KING AIR A100 B100 C-12 ARMY VC-6A B90 KING AIR B100 Legendary Innovation— • • • C90 SNB-1 MODEL 90 KING AIR T-44A E90 F90 KING AIR C90A Yesterday, Today and Tomorrow. SNB-2 • SNB-5P • • KING AIR C90B KING AIR C90GT KING AIR C90GTx KING AIR C90GTx U-21 RU-21 KING AIR F90-1 With a rich history dating back more than 80 years, Beechcraft Corporation continues to design, build NU-8F MODEL 99 AIRLINER B99 • and support a versatile and globally renowned fl eet of aircraft. -

LCD ISSUER REPORT Hawker Beechcraft Fourth-Quarter Earnings Review

February 22, 2010 LCD ISSUER REPORT Hawker Beechcraft Fourth-quarter earnings review Aircraft manufacturer Hawker Beechcraft recently company also provides parts, maintenance and fl ight- announced that 2009 adjusted EBITDA would be support services through a network of service centers in $127 million, versus a previous estimate for $95-110 27 countries to an estimated installed fl eet of more than million. The company has been severely impacted 37,000 aircraft. by the recession and the cancellation of orders over the past year, so any positive news at this point is Strengths encouraging. However, one relatively solid quarter • Solid market share in the segments in which it does not necessarily mean that the company has moved competes. beyond its recent struggles. Therefore, the following report will discuss the company’s adjusted EBITDA and • Strong liquidity. its strengths and weaknesses going forward, and will present an enterprise value/recovery analysis given the • Backlog does not have material concentrations after turmoil in the business and the general aviation markets. the U.S. government (approximately one third). Note that this analysis is not affi liated in any way with • Aircraft for military training purposes is a stable S&P’s ratings group and does not include any non-public source revenue. information, as LCD is not privy to that information. • Installed base of aircraft ensures relatively predictable Key financial data revenue from parts and maintenance, which represents $ thousand 12/31/2009 12/31/2008 Change approximately 14% of total revenue. Sales: 4Q 1,086,900 1,158,000 -6.1% LCD EBITDA: 4Q 57,200 101,800 -43.8% • Signifi cant barriers to entry in terms of capital, EBITDA margin 5.3% 8.8% technology, distribution, parts/service and brand LCD LTM EBITDA 102,900 308,000 -66.6% names limit new competitors. -

Aeromech, Incorporated; Hawker Beechcraft Corporation, Model

50850 Federal Register / Vol. 75, No. 159 / Wednesday, August 18, 2010 / Rules and Regulations Signed in Washington, DC, on August 11, associated with installation of the Mid- application of Li-ion batteries in 2010. Continent Instruments MD835 Lithium airborne applications. AeroMech, Jonathan W. Coppess, Ion (Li-ion) battery. The applicable Incorporated plans to replace an Executive Vice President, Commodity Credit airworthiness regulations do not contain existing L–3 Communications PS–835 Corporation. adequate or appropriate safety standards lead-acid emergency battery with a Mid- [FR Doc. 2010–20352 Filed 8–17–10; 8:45 am] for this design feature. These special Continent Instruments MD835 Li-ion BILLING CODE 3410–05–P conditions contain the additional safety battery on part 23 aircraft currently standards that the Administrator equipped with the PS–835 battery. This considers necessary to establish a level type of battery possesses certain failure, DEPARTMENT OF TRANSPORTATION of safety equivalent to that established operational, and maintenance by the existing airworthiness standards. characteristics that differ significantly Federal Aviation Administration DATES: Effective Date: August 9, 2010. from that of the nickel cadmium (Ni-Cd) FOR FURTHER INFORMATION CONTACT: and lead-acid rechargeable batteries 14 CFR Part 23 James Brady, Regulations and Policy currently approved in other normal, Branch, ACE–111, Federal Aviation [Docket No. CE307; Special Condition No. utility, acrobatic, and commuter 23–247–SC] Administration, Small Airplane category airplanes. Directorate, Aircraft Certification Special Conditions: AeroMech, Service, 901 Locust, Kansas City, MO Type Certification Basis 64106; telephone (816) 329–4132; Incorporated; Hawker Beechcraft Under the provisions of § 21.101, facsimile (816) 329–4090. -

Part 2 — Aircraft Type Designators (Decode) Partie 2 — Indicatifs De Types D'aéronef (Décodage) Parte 2 — Designadores De Tipos De Aeronave (Descifrado) Часть 2

2-1 PART 2 — AIRCRAFT TYPE DESIGNATORS (DECODE) PARTIE 2 — INDICATIFS DE TYPES D'AÉRONEF (DÉCODAGE) PARTE 2 — DESIGNADORES DE TIPOS DE AERONAVE (DESCIFRADO) ЧАСТЬ 2. УСЛОВНЫЕ ОБОЗНАЧЕНИЯ ТИПОВ ВОЗДУШНЫХ СУДОВ ( ДЕКОДИРОВАНИЕ ) DESIGNATOR MANUFACTURER, MODEL DESCRIPTION WTC DESIGNATOR MANUFACTURER, MODEL DESCRIPTION WTC INDICATIF CONSTRUCTEUR, MODÈLE DESCRIPTION WTC INDICATIF CONSTRUCTEUR, MODÈLE DESCRIPTION WTC DESIGNADOR FABRICANTE, MODELO DESCRIPCIÓN WTC DESIGNADOR FABRICANTE, MODELO DESCRIPCIÓN WTC УСЛ . ИЗГОТОВИТЕЛЬ , МОДЕЛЬ ВОЗДУШНОГО WTC УСЛ . ИЗГОТОВИТЕЛЬ , МОДЕЛЬ ВОЗДУШНОГО WTC ОБОЗНАЧЕНИЕ ОБОЗНАЧЕНИЕ A1 DOUGLAS, Skyraider L1P M NORTH AMERICAN ROCKWELL, Quail CommanderL1P L DOUGLAS, AD Skyraider L1P M NORTH AMERICAN ROCKWELL, A-9 Sparrow L1P L DOUGLAS, EA-1 Skyraider L1P M Commander NORTH AMERICAN ROCKWELL, A-9 Quail CommanderL1P L A2RT KAZAN, Ansat 2RT H2T L NORTH AMERICAN ROCKWELL, Sparrow CommanderL1P L A3 DOUGLAS, TA-3 Skywarrior L2J M DOUGLAS, NRA-3 SkywarriorL2J M A10 FAIRCHILD (1), OA-10 Thunderbolt 2 L2J M DOUGLAS, A-3 Skywarrior L2J M FAIRCHILD (1), A-10 Thunderbolt 2L2J M FAIRCHILD (1), Thunderbolt 2L2J M DOUGLAS, ERA-3 SkywarriorL2J M AVIADESIGN, A-16 Sport Falcon L1P L DOUGLAS, Skywarrior L2J M A16 AEROPRACT, A-19 L1P L A3ST AIRBUS, Super Transporter L2J H A19 AIRBUS, Beluga L2J H A20 DOUGLAS, Havoc L2P M DOUGLAS, A-20 Havoc L2P M AIRBUS, A-300ST Super TransporterL2J H AEROPRACT, Solo L1P L AIRBUS, A-300ST Beluga L2J H A21 SATIC, Beluga L2J H AEROPRACT, A-21 Solo L1P L SATIC, Super Transporter L2J H A22 SADLER, Piranha -

Engine Vibration and Health Monitoring Systems Engine Vibration Monitoring Systems

Engine vibration and health monitoring systems Engine Vibration Monitoring Systems EVM System benefits Engine Vibration Monitoring (EVM) Systems measure rotor out of balance with high indication reliability, and they also provide further functionality that brings large operational and commercial advantages: • Significant reduction of engine balancing costs through the storage of in-flight data for “multi-plane cold trim balance”. • Lower ownership costs via the introduction of digital algorithms to dramatically improve indication reliability. • Use of vibration trending techniques (outside the EVM) to allow condition based maintenance. • Reduction in spares holding costs to airlines with Vibro-Meter’s “universal” EVM. Total system responsibility: Sensing – Signal transmission – Processing Vibro-Meter is in a unique position to provide the total system capability from one source and thus ensure that the complete system is well integrated and functions correctly and reliably. Sensing: Signal transmission: Processing: Vibration sensors capable of operating Range of high performance, low noise EVMs provide vibration indication, up to 650°C with MTBFs upward of engine- and airframe- mounted cable allow airlines to trend vibration data 250’000 flight hours. Vibro-Meter is assemblies. We work closely with and perform condition based one of the few companies worldwide engine and aircraft manufacturers to maintenance decision making. that has the know how to develop and optimise architecture decisions They also record data continuously manufacture such technology. The involving parameters such as: weight, during normal flights, allowing to issue of “where and how to integrate” routing and signal quality. balance engines in a matter of the sensors on the engine is a minutes. -

Premier IA Certification

News Release Press Contact: Mike Turner 316.676.8674 www.hawkerbeechcraft.com Hawker Beechcraft Corporation Appoints Chief Pilots WICHITA, Kan. (April 23, 2007) – Hawker Beechcraft Corporation (HBC) is pleased to announce the appointment of Dan Weatherford to chief pilot, Hawker sales demonstration and Peter Kennedy to chief pilot, Beechcraft sales demonstration. “Both Dan and Peter are experienced and highly talented pilots, fully committed to the success of the new Hawker Beechcraft Corporation, their demonstration pilot teams and our customers,” said Jim Schuster, Chairman and CEO. “They lead the best pilots in the industry and will do a great job for the company.” “The chief pilots are the subject matter experts for the complete Hawker and Beechcraft product lineup and accountable for all aspects of flight operations,” said Marc Manella, director flight operations. Their role is a critical element in the sales process, not only in terms of daily oversight, management and training of demonstration pilots, but also in assuring that our customers understand the full capabilities and benefits of our aircraft.” He added, “They also work to ensure the success of each mission and manage all aspects of safety for the pilot teams at HBC as well as assisting our customers and their pilots. Dan Weatherford moves into the Hawker chief pilot role after extensive involvement in Hawker 4000 flight test activities and serving as training captain in the Hawker 800 series and 4000. He joined the demonstration department in1997 and has been flying worldwide demos in the Hawker 400XP, 800 series, 1000 and 4000. He was demo pilot of the year in 2004. -

Hawker HS-125 Series 700/750/800XP/850XP/900XP Professional Pilot and Technician Training Programs

Contact Pilot Maintenance Us Fact Sheet Fact Sheets Share Next Hawker HS-125 Series 700/750/800XP/850XP/900XP Professional Pilot and Technician Training Programs Updated 09/15 Contact Pilot Maintenance Us Fact Sheet Fact Sheets Share Prev Next FlightSafety offers comprehensive, professional pilot and maintenance technician training for the Hawker HS-125 Series aircraft, including the Hawker 700, Hawker 750, Hawker 800XP, Hawker 850XP and Hawker 900XP. Our highly qualified and experienced instructors, advanced- technology flight simulators and integrated training systems help ensure proficiency and safety. Hawker HS-125 Series training is available at FlightSafety Learning Centers in Columbus, Ohio; Houston, Texas; London Farnborough, United Kingdom; Wichita, Kansas; and Wilmington, Delaware. We also offer a full range of maintenance training at our Wichita Hawker Beechcraft Maintenance Learning Center. Innovation With One Purpose: Training Corporate Aviation Professionals for Safety and Proficiency FlightSafety International is the world’s leading aviation training organization. The leader in experience. The leader in technological innovation. The leader in global reach. FlightSafety serves the world’s aviation community providing total aviation training for pilots, maintenance technicians and other aviation professionals. We serve business, commercial, general and military aviation with training for virtually Experienced all fixed-wing aircraft and helicopters. We live, breathe and ThinkSafety. Instructors, FlightSafety enjoys a strong -

Hawker Beechcraft Accelerates 400XPR Certification Program with Second Test Aircraft

⏲ 14 April 2011, 03:00 (CDT) Hawker Beechcraft Accelerates 400XPR Certification Program with Second Test Aircraft Hawker Beechcraft Global Customer Support (GCS) today announced it is accelerating the Hawker 400XPR development program by adding a second aircraft to the test program. This aircraft will be used primarily to develop and certify various avionics upgrade options. “This additional aircraft allows us to engineer the program’s optional avionics upgrade concurrently with the Williams International FJ44-4A engine integration,” said Christi Tannahill, Hawker Beechcraft vice president, GCS. “This will keep the momentum going on the certification in order to meet the growing demand from our customers.” A number of variations of Rockwell Collins Pro Line 21 avionics are planned for the Hawker 400XPR. Customers can choose a baseline three-display system or a more advanced four-display system, along with other enhancements to meet their operational needs. The Hawker 400XPR three-display avionics system is expected to certify this summer at which time it will be available to all Beechjet 400A and Hawker 400XP aircraft as a stand alone upgrade. Additional 400XPR avionics variations and options will follow. As a Hawker Beechcraft factory product, all aspects of 400XPR aerodynamics, avionics and propulsion will be incorporated into the company’s interactive maintenance library and will be fully supported by its 1,000-employee-strong GCS organization. The Hawker 400XPR, which is expected to receive certification in 2012, offers greatly improved range and airfield performance, while reducing noise footprint and emissions by replacing the existing engines with new, more fuel-efficient Williams International FJ44-4A-32 dual FADEC high-bypass turbofans. -

Jets: 1 Dassault, 2 Embraer, 3 Gulfstream, 4 Textron, 5 Bombardier. Turboprops: 1 Pilatus, 2 Daher TBM, 3 Textron

2019 CORPORATE AIRCRAFT PRODUCT SUPPORT SURVEY Jets: 1 Dassault, 2 Embraer, 3 Gulfstream, 4 Textron, 5 Bombardier. Turboprops: 1 Pilatus, 2 Daher TBM, 3 Textron. Pro Pilot staff report the crown for the first time ever. It suc- this year down from 8.55 in 2018. Em- Data compiled by Conklin & de Decker ceeded with an overall score of 8.26 braer ranked 1st in cost of parts, tech this year up from 8.13 in 2018. It takes manuals and tech reps. Embraer’s Tech- ftersale product support is a 1st place in spares availability and ser- Care Center team are ready to assist op- vital activity among aircraft vice satisfaction and 2nd in company erators 24/7/365. Aowners and operators. Once response time, cost of parts, speed in aircraft have been selected and ac- AOG service, tech manuals and tech Gulfstream takes 3rd spot this year quired by flight departments and own- reps. Dassault’s biggest increase was after being 2nd in 2018 and 1st in ers based on their missions it is up in tech manuals with 8.42 in 2019 2017. Its overall score is 8.14 down the OEMs to keep satisfied users. It’s up from 8.18 in 2018, a difference from 8.36 in 2018. Big G is 1st in com- essential that operators receive the as- of 0.24. DJF and its FalconResponse pany response time and speed in AOG sistance needed to continue flying and program, together with Falcon Spares, service categories and 2nd in spares accomplish their missions. -

Hawker Beechcraft Corporation (District II)

Agenda Item No. IV-3 City of Wichita City Council Meeting May 17, 2011 TO: Mayor and City Council SUBJECT: City-County Economic Development Grant Agreement with Hawker Beechcraft Corporation (District II) INITIATED BY: Office of Urban Development AGENDA: New Business Recommendation: Approve the economic development grant agreement and place the Home Rule Ordinance on first reading. Background: In 2010, Hawker Beechcraft Corporation (“HBC”) announced it was considering moving a significant amount of production work from its Wichita plant to an undisclosed location in the southeast United States. In separate meetings with State of Kansas officials and City officials, the potential scope of the possible relocation project was discussed, along with the opportunity for state and local financial assistance to significantly reduce the downsizing. On October 5, 2010, Governor Mark Parkinson announced a tentative agreement to provide state assistance to retain HBC jobs in Wichita, subject to a new labor agreement being approved by both HBC and the International Association of Machinists. The union vote to approve the negotiated labor contract was defeated on October 16, 2010. Discussions between HBC and state and local officials resumed and on December 21, 2010 Governor Parkinson, Mayor Brewer and County Chair Peterjohn joined CEO Bill Boisture to announce an agreement that will guarantee that HBC will continue to be a major Wichita employer in exchange for state and local economic development incentives, the local incentives being subject to governing body approvals. Analysis: The incentive package offered HBC includes grants totaling $40,000,000 from the State of Kansas and $5,000,000 combined from the City of Wichita and Sedgwick County ($2,500,000 each). -

The New BEECHCRAFT® King Air 350I the World’S Most Legendary Turboprop Is Now the World’S Most Advanced

The world’s most legendary turboprop is now the world’s most advanced. The new BEECHCRAFT® King Air 350i The world’s most legendary turboprop is now the world’s most advanced. It’s good to be the King. Meet the icon of business aviation. The Beechcraft® King Air has always done what others could CATEGORY-BUSTING CABIN A NEW STANDARD OF QUIET not. Since the very first King Air was introduced in 1964, it has Luxuriously appointed and technologically Thanks to combined technologies, the been the class leader in capabilities and sales. Its unmatched Compare the King Air 350i’s performance, amenities advanced, passengers will think they’ve King Air 350i effectively eliminates sound versatility, reliability and safety are the reasons that individuals, and operating costs with those of its nearest stepped onto an aircraft costing and vibration — making it more quiet companies and governments in 105 countries around the world competitor, and the choice is clear. millions more. than many competitive jets. have purchased more than 6,000 of the aircraft. KING AIR CESSNA UNEQuaLED CABIN, PAYLOAD AND EFFICIENCY 350i CItatION CJ2+ The new-generation King Air 350i continues its undisputed reign. MORE PASSENGERS With a host of design enhancements and upgrades, the best LARGER CABIN INFOTAINMENT LEADER PIONEER OF THE GREEN MOVEMENT large turboprop is now better than ever. Its cabin size and load- Introducing Venue™ Cabin Management Social responsibility achieved. Fill the seats carrying capabilities are unequaled in any competitive turboprop. HIGHER MAX. PAYLOAD System (CMS). Connect laptops and and take nine passengers at a lower collaborate. -

Order 7340.1Z, Contractions

U.S. DEPARTMENT OF TRANSPORTATION CHANGE FEDERAL AVIATION ADMINISTRATION 7340.1Z CHG 2 SUBJ: CONTRACTIONS 1. PURPOSE. This change transmits revised pages to change 2 of Order 7340.1Z, Contractions. 2. DISTRIBUTION. This change is distributed to select offices in Washington and regional headquarters, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; all air traffic field offices and field facilities; all airway facilities field offices; all international aviation field offices, airport district offices, and flight standards district offices; and the interested aviation public. 3. EFFECTIVE DATE. October 25, 2007. 4. EXPLANATION OF CHANGES. Cancellations, additions, and modifications are listed in the CAM section of this change. Changes within sections are indicated by a vertical bar. 5. DISPOSITION OF TRANSMITTAL. Retain this transmittal until superseded by a new basic order. 6. PAGE CONTROL CHART. See the Page Control Chart attachment. Michael A. Cirillo Vice President, System Operations Services Air Traffic Organization Date: __________________ Distribution: ZAT-734, ZAT-464 Initiated by: AJR-0 Vice President, System Operations Services 10/25/07 7340.1Z CHG 2 PAGE CONTROL CHART REMOVE PAGES DATED INSERT PAGES DATED CAM-1-1 and CAM-1-10 07/05/07 CAM-1-1 and CAM-1-10 10/25/07 1-1-1 03/15/07 1-1-1 10/25/07 3-1-11 03/15/07 3-1-11 03/15/07 3-1-12 03/15/07 3-1-12 10/25/07 3-1-23 03/15/07 3-1-23 03/15/07 3-1-24 03/15/07 3-1-24 10/25/07 3-1-31 03/15/07 3-1-31 03/15/07 3-1-32 through 3-1-34 03/15/07 3-1-32 through