Humana Board Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Execution Venues List

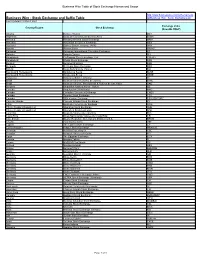

Execution Venues List This list should be read in conjunction with the Best Execution policy for Credit Suisse AG (excluding branches and subsidiaries), Credit Suisse (Switzerland) Ltd, Credit Suisse (Luxembourg) S.A, Credit Suisse (Luxembourg) S.A. Zweigniederlassung Österreichand, Neue Aargauer Bank AG published at www.credit-suisse.com/MiFID and https://www.credit-suisse.com/lu/en/private-banking/best-execution.html The Execution Venues1) shown enable the in scope legal entities to obtain on a consistent basis the best possible result for the execution of client orders. Accordingly, where the in scope legal entities may place significant reliance on these Execution Venues. Equity Cash & Exchange Traded Funds Country/Liquidity Pool Execution Venue1) Name MIC Code2) Regulated Markets & 3rd party exchanges Europe Austria Wiener Börse – Official Market WBAH Austria Wiener Börse – Securities Exchange XVIE Austria Wiener Börse XWBO Austria Wiener Börse Dritter Markt WBDM Belgium Euronext Brussels XBRU Belgium Euronext Growth Brussels ALXB Czech Republic Prague Stock Exchange XPRA Cyprus Cyprus Stock Exchange XCYS Denmark NASDAQ Copenhagen XCSE Estonia NASDAQ Tallinn XTAL Finland NASDAQ Helsinki XHEL France EURONEXT Paris XPAR France EURONEXT Growth Paris ALXP Germany Börse Berlin XBER Germany Börse Berlin – Equiduct Trading XEQT Germany Deutsche Börse XFRA Germany Börse Frankfurt Warrants XSCO Germany Börse Hamburg XHAM Germany Börse Düsseldorf XDUS Germany Börse München XMUN Germany Börse Stuttgart XSTU Germany Hannover Stock Exchange XHAN -

Surveillance Stockholm

Surveillance Stockholm Exchange Notice Stockholm 2020-05-18 News for listed companies 8/20 Information from the Surveillance function at Nasdaq Stockholm with regards to amendments to the Act on Temporary Exemptions Following up on the Surveillance update on March 31, 2020, regarding Corona related topics relevant for issuers on Nasdaq Stockholm and Nasdaq First North Growth Market Stockholm, Nasdaq now informs about amendments to the Act (2020:198) on temporary exemptions to facilitate the implementation of corporate and association meetings (the Act on Temporary Exemptions) that came into force today, May 18, 2020. Summary As of today, Swedish companies are temporarily allowed to hold general meetings without any physical participation. According to amendments to the Act on Temporary Exemptions general meetings can be held either by electronic connection in combination with postal voting, or by the shareholders only participating by postal vote. If the general meeting is held by postal vote only, shareholders must also be able to exercise their other rights by post. To apply these temporary exemptions, it must be stated in the notice to the general meeting, entailing that the option to hold the meeting completely without physical participation can be applied by companies that have not yet convene the general meeting, or companies that decide to postpone the general meeting within the time limits set out in applicable law. You can find the Act on Temporary Exemptions (available in Swedish only) – https://www.riksdagen.se/sv/dokument-lagar/dokument/svensk-forfattningssamling/lag-2020198- om-tillfalliga-undantag-for-att_sfs-2020-198 Please be advised that we are available for discussions regarding regulatory and disclosure-related matters. -

Representation Letter from Nasdaq Stockholm

Katten Paternoster House 65 St Paul's Churchyard London, EC4M SAB +44 (0) 20 7776 7620 tel +44 (0) 20 7776 7621 fax www.katten.co.uk [email protected] +44 (0) 20 7776 7625 direct January 15, 2020 Ref No. 385248 00020 CHJ:sh VIA E-MAIL AND FEDERAL EXPRESS Mr. Brett Redfeam Director U.S. Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549-7010 United States of America Re: Intent of Nasdaq Stockholm AB to Rely on No-Action Relief for Foreign Options Markets and Their Members That Engage in Familiarization Activities Dear Mr. Redfeam: At the request of our client, Nasdaq Stockholm AB ("Nasdaq"), we are writing to provide you with a notification of Nasdaq's intent to rely on the class no-action relief issued by the Securities and Exchange Commission's ("SEC" or "Commission") Division of Trading and Markets ("Division") for foreign options markets and their members that engage in familiarization activities with certain U.S.-based persons.1 BACKGROUND In the Class Relief, the Division took a no-action position under which a Foreign Options Market2, its Representatives3 and the Foreign Options Market's members, could engage in 1 See LIFFE A&M and Class Relief, SEC No-Action Letter (Jul. 1, 2013) ("Class Relief'). Capitalized terms used herein and not otherwise defined have the meanings given in the Class Relief. Pursuant to the Class Relief, a Foreign Options Market is not required to apply de novo for similar no-action or other relief; it can file with the Division a notice of intent to rely on the Class Relief. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

May 2010 Statistics Report from the NASDAQ OMX Nordic Exchanges

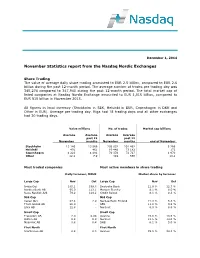

December 1, 2014 November Statistics report from the Nasdaq Nordic Exchanges Share Trading The value of average daily share trading amounted to EUR 2.5 billion, compared to EUR 2.6 billion during the past 12-month period. The average number of trades per trading day was 345,274 compared to 347,940 during the past 12-month period. The total market cap of listed companies at Nasdaq Nordic Exchange amounted to EUR 1,015 billion, compared to EUR 915 billion in November 2013. All figures in local currency (Stockholm in SEK, Helsinki in EUR, Copenhagen in DKK and Other in EUR). Average per trading day. Riga had 18 trading days and all other exchanges had 20 trading days. Value millions No. of trades Market cap billions Average Average Average Average past 12 past 12 November months November months end of November Stockholm 13 140 13 566 205 032 201 462 5 266 Helsinki 491 461 69 448 73 182 172 Copenhagen 4 223 4 481 70 376 72 727 1 970 Other 12.1 7.9 419 568 10.1 Most traded companies Most active members in share trading Daily turnover, MEUR Market share by turnover Large Cap Nov Oct Large Cap Nov Oct Nokia Oyj 145.1 189.4 Deutsche Bank 12.9 % 12.7 % Nordea Bank AB 95.0 113.1 Morgan Stanley 8.1 % 8.0 % Novo Nordisk A/S 79.2 129.2 Credit Suisse 8.1 % 8.3 % Mid Cap Mid Cap Vacon Oyj 47.4 2.9 Nordea Bank Finland 21.3 % 5.3 % Thule Group AB 20.0 - SEB 11.8 % 9.8 % Lifco AB 12.8 - Nordnet 6.0 % 8.6 % Small Cap Small Cap Transcom AB 2.0 0.08 Avanza 15.8 % 13.5 % Bulten AB 0.8 0.9 Nordnet 13.5 % 13.0 % Mycronic AB 0.8 0.4 SHB 6.1 % 5.0 % First North -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Arise Ab (Publ)

ARISE AB (PUBL) Prospectus for the admission to trading on Nasdaq Stockholm of SEK 650,000,000 SENIOR SECURED GREEN FLOATING RATE NOTES 2018/2021 ISIN: SE0010920900 Lead Manager SW37716777/13 Page 2 of 81 IMPORTANT INFORMATION In this prospectus, “Arise”, the “Company” or the “Group”, depending on the context, refers to Arise AB (publ), the group in which Arise AB (publ) is the parent company, a subsidiary of the group in which Arise AB (publ) is the parent company or including the associ- ated company Sirocco Wind Holding AB as relevant. The “Issuer” means Arise AB (publ). The “Sole Manager” means DNB Markets, DNB Bank ASA, Sverige filial. “Euroclear” refers to Euroclear Sweden AB and “Nasdaq Stockholm” refers to Nasdaq Stockholm AB. “SEK” refers to Swedish kronor. Words and expressions defined in the terms and conditions of the Notes (as defined below) (the “Terms and Conditions”) beginning on page 39 have the same meaning when used in this Prospectus, unless expressly stated or the context requires otherwise. Notice to investors On 16 March 2018 (the “Issue Date”) the Issuer issued a note loan in the amount of SEK 650,000,000. The initial nominal amount of each note is SEK 2,000,000 (the “Nominal Amount”) (the “Notes”). The maximum nominal amount of the Notes may not exceed SEK 650,000,000 unless a consent from the Noteholders is obtained pursuant to the Terms and Conditions. This prospectus (the “Pro- spectus”) has been prepared for the listing of the loan constituted by the Notes on a Regulated Market. This Prospectus does not con- tain and does not constitute an offer or a solicitation to buy or sell Notes. -

Over 100 Exchanges Worldwide 'Ring the Bell for Gender Equality in 2021' with Women in Etfs and Five Partner Organizations

OVER 100 EXCHANGES WORLDWIDE 'RING THE BELL FOR GENDER EQUALITY IN 2021’ WITH WOMEN IN ETFS AND FIVE PARTNER ORGANIZATIONS Wednesday March 3, 2021, London – For the seventh consecutive year, a global collaboration across over 100 exchanges around the world plan to hold a bell ringing event to celebrate International Women’s Day 2021 (8 March 2020). The events - which start on Monday 1 March, and will last for two weeks - are a partnership between IFC, Sustainable Stock Exchanges (SSE) Initiative, UN Global Compact, UN Women, the World Federation of Exchanges and Women in ETFs, The UN Women’s theme for International Women’s Day 2021 - “Women in leadership: Achieving an equal future in a COVID-19 world ” celebrates the tremendous efforts by women and girls around the world in shaping a more equal future and recovery from the COVID-19 pandemic. Women leaders and women’s organizations have demonstrated their skills, knowledge and networks to effectively lead in COVID-19 response and recovery efforts. Today there is more recognition than ever before that women bring different experiences, perspectives and skills to the table, and make irreplaceable contributions to decisions, policies and laws that work better for all. Women in ETFs leadership globally are united in the view that “There is a natural synergy for Women in ETFs to celebrate International Women’s Day with bell ringings. Gender equality is central to driving the global economy and the private sector has an important role to play. Our mission is to create opportunities for professional development and advancement of women by expanding connections among women and men in the financial industry.” The list of exchanges and organisations that have registered to hold an in person or virtual bell ringing event are shown on the following pages. -

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia -

VA Lieux Exécution

VENUE NAME VENUE SHORTNAME MIC COUNTRY ZONE ASSET CLASS TYPE * WIENER BOERSE WB XWBO AUSTRIA EUROPE SECURITIES RM NYSE EURONEXT BRUSSELS ENXBE XBRU BELGIUM EUROPE ETD & SECURITIES RM PRUE STOCK EXCHANGE PSE XPRA CZECH REPUBLIC EUROPE ETD RM NASDAQ COPENHEN OMX DK XCSE DENMARK EUROPE ETD & SECURITIES RM NASDAQ HELSINKI OMX FI XHEL FINLAND EUROPE SECURITIES RM NYSE EURONEXT PARIS ENXFR XPAR FRANCE EUROPE ETD & SECURITIES RM DEUTSCHE BOERSE DEUTSCHE BOERSE XFRA GERMANY EUROPE SECURITIES RM BOERSE BERLIN BERLIN XBER GERMANY EUROPE SECURITIES RM BOERSE DUESSELDORF DUSSELDORF XDUS GERMANY EUROPE SECURITIES RM DEUTSCHE BOERSE AG FRANCFORT XFRA GERMANY EUROPE SECURITIES RM HANSEATISCHE WERTPAPIERBOERSE HAMBURG HAMBOURG XHAM GERMANY EUROPE SECURITIES RM NIEDERSAECHSISCHE BOERSE ZU HANNOVER HANOVRE XHAN GERMANY EUROPE SECURITIES RM BOERSE MUENCHEN MUNICH XMUN GERMANY EUROPE SECURITIES RM BOERSE STUTTGART STUTTGART XSTU GERMANY EUROPE SECURITIES RM EQUIDUCT EQUIDUCT XBER GERMANY EUROPE SECURITIES MTF EUREX DEUTSCHLAND EUREX XEUR GERMANY EUROPE ETD RM ATHENS EXCHANGE ATHEX XATH GREECE EUROPE SECURITIES RM NASDAQ OMX ICELAND OMX IC XICE ICELAND EUROPE SECURITIES RM IRISH STOCK EXCHANGE ISE XDUB IRELAND EUROPE SECURITIES RM BORSA ITALIANA BORSA ITALIANA XMIL ITALY EUROPE ETD & SECURITIES RM LONDON METAL EXCHANGE LME XLME LONDON EUROPE ETD RM FISH POOL FISH FISH NORWAY EUROPE ETD RM NASDAQ OMX COMMODITIES OMX CO NORX NORWAY EUROPE ETD RM OSLO BORS OSLO BORS XOSL NORWAY EUROPE ETD & SECURITIES RM WARSAW STOCK EXCHANGE WSE XWAR POLAND EUROPE SECURITIES -

Northern Trust Emea Order Execution Policy

NORTHERN TRUST EMEA ORDER EXECUTION POLICY For Professional Clients of the following Northern Trust entities: • Northern Trust Global Services SE, and its branches • Northern Trust Securities LLP, and its branches • The Northern Trust Company, London branch Publication date: 1 January 2021 Contents INTRODUCTION .................................................................................................................................................................... 3 A. Purpose of this policy .................................................................................................................................................................................... 3 B. What is Best Execution? ............................................................................................................................................................................... 3 POLICY SCOPE ..................................................................................................................................................................... 4 A. Northern Trust entities subject to this Policy ................................................................................................................................................. 4 B. Types of Clients ............................................................................................................................................................................................. 4 C. Activities ....................................................................................................................................................................................................... -

FIX for Genium INET for NASDAQ Nordic 2.0

FIX for Genium INET for NASDAQ Nordic 2.0 Revision 2.08 2017-10-31 Confidentiality/Disclaimer This specification is being forwarded to you strictly for informational purposes and solely for the purpose of developing or operating systems for your use that interact with systems of NASDAQ and its affiliates (collectively, NASDAQ ). This specification is proprietary to NASDAQ. NASDAQ reserves the right to withdraw, modify, or replace this specification at any time, without prior notice. No obligation is made by NASDAQ regarding the level, scope or timing of NASDAQ’s implementation of the functions or features discussed in this specification. The specification is provided “AS IS,” “WITH ALL FAULTS”. NASDAQ makes no warranties to this specification or its accuracy, and disclaims all warranties, whether express, implied, or statutory related to the specification or its accuracy. This document is not intended to represent an offer of any terms by NASDAQ. Whilst all reasonable care has been taken to ensure that the details contained herein are true and not misleading at the time of publication, no liability whatsoever is assumed by NASDAQ for any incompleteness or inaccuracies. By using this specification you agree that you will not, without prior written permission from NASDAQ, copy or reproduce the information in this specification except for the purposes noted above. You further agree that you will not, without prior written permission from NASDAQ, store the information contained in this specification in a retrieval system, or transmit it in any form or by any means, whether electronic, mechanical, or otherwise except for the purposes noted above.