Download Commentary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

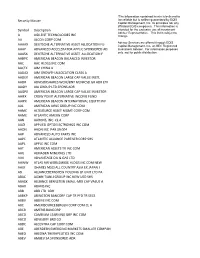

Security Master Symbol Description a AGILENT TECHNOLOGIES INC AA

*The information contained herein is believed to Security Master be reliable but is neither guaranteed by EQIS Capital Management, Inc. its principles nor any affiliated EQIS companies. This information is Symbol Description intended for the exclusive use of investment Adviser Representative. This list is subject to A AGILENT TECHNOLOGIES INC change. AA ALCOA CORP COM Advisor Services are offered through EQIS AAAAX DEUTSCHE ALTERNATIVE ASSET ALLOCATION FU Capital Management, Inc. an SEC Registered AAAP ADVANCED ACCELERATOR APPLIC SPONSORED AD Investment Adviser. For information purposes AAASX DEUTSCHE ALTERNATIVE ASSET ALLOCATION F only, not for public distribution. AABPX AMERICAN BEACON BALANCED INVESTOR AAC AAC HLDGS INC COM AACFX AIM CHINA A AADAX AIM GROWTH ALLOCATION CLASS A AADEX AMERICAN BEACON LARGE CAP VALUE INSTL AADR ADVISORSHARES WCM/BNY MLNFCSD GR ADR ETF AAGIY AIA GROUP LTD SPONS ADR AAGPX AMERICAN BEACON LARGE CAP VALUE INVESTOR AAIFX CROW POINT ALTERNATIVE INCOME FUND AAIPX AMERICAN BEACON INTERNATIONAL EQUITY INV AAL AMERICAN AIRLS GROUP INC COM AAMC ALTISOURCE ASSET MGMT CORP COM AAME ATLANTIC AMERN CORP AAN AARONS, INC. CL A AAOI APPLIED OPTOELECTRONICS INC COM AAON AAON INC PAR $0.004 AAP ADVANCED AUTO PARTS INC AAPC ATLANTIC ALLIANCE PARTNER CORP SHS AAPL APPLE INC COM AAT AMERICAN ASSETS TR INC COM AAU ALMADEN MINERALS LTD AAV ADVANTAGE OIL & GAS LTD AAWW ATLAS AIR WORLDWIDE HLDGS INC COM NEW AAXJ ISHARES MSCI ALL COUNTRY ASIA EX JAPAN I AB ALLIANCEBERNSTEIN HOLDING LP UNIT LTD PA ABAC AOXIN TIANLI GROUP INC NEW -

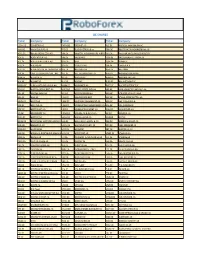

R Trader Instruments Cfds and Stocks

DE SHARES Ticker Company Ticker Company Ticker Company 1COV.DE COVESTRO AG FNTN.DE FREENET AG P1Z.DE PATRIZIA IMMOBILIEN AG AAD.DE AMADEUS FIRE AG FPE.DE FUCHS PETROLUB vz PBB.DE DEUTSCHE PFANDBRIEFBANK AG ACX1.DE BET-AT-HOME.COM AG FRA.DE FRAPORT AG FRANKFURT AIRPORTPFV.DE PFEIFFER VACUUM TECHNOLOGY ADJ.DE ADO PROPERTIES FRE.DE FRESENIUS PSM.DE PROSIEBENSAT.1 MEDIA SE ADL.DE ADLER REAL ESTATE AG G1A.DE GEA PUM.DE PUMA SE ADS.DE ADIDAS AG G24.DE SCOUT24 AG QIA.DE QIAGEN N.V. ADV.DE ADVA OPTICAL NETWORKING SE GBF.DE BILFINGER SE RAA.DE RATIONAL AFX.DE CARL ZEISS MEDITEC AG - BR GFT.DE GFT TECHNOLOGIES SE RHK.DE RHOEN-KLINIKUM AG AIXA.DE AIXTRON SE GIL.DE DMG MORI RHM.DE RHEINMETALL AG ALV.DE ALLIANZ SE GLJ.DE GRENKE RIB1.DE RIB SOFTWARE SE AM3D.DE SLM SOLUTIONS GROUP AG GMM.DE GRAMMER AG RKET.DE ROCKET INTERNET SE AOX.DE ALSTRIA OFFICE REIT-AG GWI1.DE GERRY WEBER INTL AG S92.DE SMA SOLAR TECHNOLOGY AG ARL.DE AAREAL BANK AG GXI.DE GERRESHEIMER AG SAX.DE STROEER SE & CO KGAA BAS.DE BASF SE HAB.DE HAMBORNER REIT SAZ.DE STADA ARZNEIMITTEL AG BAYN.DE BAYER AG HBM.DE HORNBACH BAUMARKT AG SFQ.DE SAF HOLLAND S.A. BC8.DE BECHTLE AG HDD.DE HEIDELBERGER DRUCKMASCHINENSGL.DE SGL CARBON SE BDT.DE BERTRANDT AG HEI.DE HEIDELBERGCEMENT AG SHA.DE SCHAEFFLER AG BEI.DE BEIERSDORF AG HEN3.DE HENKEL AG & CO KGAA SIE.DE SIEMENS AG BIO4.DE BIOTEST AG HLAG.DE HAPAG-LLOYD AG SIX2.DE SIXT SE BMW.DE BAYERISCHE MOTOREN WERKE AGHLE.DE HELLA KGAA HUECK & CO SKB.DE KOENIG & BAUER AG BNR.DE BRENNTAG AG HNR1.DE HANNOVER RUECK SE SPR.DE AXEL SPRINGER SE BOSS.DE HUGO BOSS -

Sigma Planning Corp Form 13F-HR Filed 2021-08-13

SECURITIES AND EXCHANGE COMMISSION FORM 13F-HR Initial quarterly Form 13F holdings report filed by institutional managers Filing Date: 2021-08-13 | Period of Report: 2021-06-30 SEC Accession No. 0001420506-21-001133 (HTML Version on secdatabase.com) FILER Sigma Planning Corp Mailing Address Business Address 300 PARKLAND PLAZA 300 PARKLAND PLAZA CIK:1449126| IRS No.: 382472558 | State of Incorp.:MI | Fiscal Year End: 0131 ANN ARBOR MI 48103 ANN ARBOR MI 48103 Type: 13F-HR | Act: 34 | File No.: 028-16541 | Film No.: 211171451 734-663-1611 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document OMB APPROVAL UNITED STATES SECURITIES AND EXCHANGE OMB Number: 3235-0006 COMMISSION Expires: July 31, 2015 Washington, D.C. 20549 Estimated average burden hours per response: 23.8 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: 06-30-2021 Check here if Amendment: ☐ Amendment Number: This Amendment (Check only one.): ☐ is a restatement. ☐ adds new holdings entries. Institutional Investment Manager Filing this Report: Name: Sigma Planning Corp Address: 300 Parkland Plaza ANN ARBOR, MI 48103 Form 13F File Number: 028-16541 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Randolph Pistor Title: Chief Compliance Officer Phone: 734-663-1611 Signature, Place, and Date of Signing: Randolph Pistor, Chief Compliance Officer ANN ARBOR, MICHIGAN 08-13-2021 [Signature] [City, State] [Date] Report Type (Check only one.): ☒ 13F HOLDINGS REPORT. -

Quantitative Review of U.S. Equities 2Q 2021

Brandywine Global Investment Management, LLC Topical Insight | June 30, 2021 Quantitative Review of U.S. Equities 2Q 2021 • U.S. equity markets continued to rally through the second quarter, with the S&P up 8.6% for the quarter and 15.3% YTD. Remarkably, the S&P 500 is now up 96.1% since its low on March 23, 2020, and 29.9% from its February 2020 pre-pandemic highs. • Value factors led the markets higher, as they have since the fourth quarter 2020, until faltering in mid-May and June. As a result, these factors had mixed performance for the quarter but were still quite strong for the year to date. • Growth stocks initially lagged as value stocks dominated but then in mid-May again began to A NOTE FROM BRANDYWINE outperform. Their results are therefore mixed for the quarter but still trailing versus the market GLOBAL’S DIVERSIFIED EQUITY TEAM in the first half of 2021. This paper is the quarterly report • With the stock market continuing to rally higher, more defensive factors generally performed poorly, as they have since March 2020, with most high quality and lower volatility factors by Brandywine Global’s Diversified producing negative returns. Large-cap stocks were an exception as they outperformed smaller Equity team on quantitative factors caps within most market segments. impacting the U.S. equity markets. In each publication, we will provide a • With the shift in market leadership, at least temporarily, back to growth from value this quarter, the higher price momentum factor was mixed across the Russell domestic equity indices. -

RBC Equity Funds Annual Report

Annual Report For the year ended September 30, 2020 RBC SMID Cap Growth Fund RBC Enterprise Fund RBC Small Cap Core Fund RBC MicrocapValue Fund RBC Small CapValue Fund Beginning on January 1, 2021, as permittedby regulations adoptedbythe U.S. Securities and Exchange commission,paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a reportisposted and provided with awebsite link to access thereport. If you already elected to receive shareholder reports electronically,you will not be affected by this changeand you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800-422-2766. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Ifyou invest directly with a Fund, you can call 800-422-2766 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will applytoall Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with a Fund. -

Exhibit 3 Page 17 of 25

SR-NSX-2010-08 Exhibit 3 Page 17 of 25 Exhibit 3 Symbol Name AAXJ iShares MSCI All Country Asia ex Japan Index Fund ACWI iShares MSCI ACWI Index Fund ACWX iShares MSCI ACWI ex US Index Fund ADRE BLDRS Emerging Markets 50 ADR Index Fund AGG iShares Barclays Aggregate Bond Fund AGZ iShares Barclays Agency Bond Fund AMJ JPMorgan Alerian MLP Index ETN BAB PowerShares Build America Bond Portfolio BBH Biotech HOLDRs Trust BDG PowerShares DB Base Metals Long ETN BIK SPDR S&P BRIC 40 ETF BIL SPDR Barclays Capital 1-3 Month T-Bill ETF BIV Vanguard Intermediate-Term Bond ETF BKF iShares MSCI BRIC Index Fund BLV Vanguard Long-Term Bond ETF BND Vanguard Total Bond Market ETF BOS PowerShares DB Base Metals Short ETN BRF Market Vectors Brazil Small-Cap ETF BSV Vanguard Short-Term Bond ETF BWX SPDR Barclays Capital International Treasury Bond ETF CEW WisdomTree Dreyfus Emerging Currency Fund CFT iShares Barclays Credit Bond Fund CIU iShares Barclays Intermediate Credit Bond Fund CSJ iShares Barclays 1-3 Year Credit Bond Fund CUT Claymore/Beacon Global Timber Index ETF CVY Claymore/Zacks Multi-Asset Income Index ETF CWB SPDR Barclays Capital Convertible Securities ETF CYB WisdomTree Dreyfus Chinese Yuan Fund DBA PowerShares DB Agriculture Fund DBB PowerShares DB Base Metals Fund DBC PowerShares DB Commodity Index Tracking Fund DBO PowerShares DB Oil Fund DBP PowerShares DB Precious Metals Fund DBV PowerShares DB G10 Currency Harvest Fund DDG ProShares Short Oil & Gas DEM WisdomTree Emerging Markets Equity Income Fund DFJ WisdomTree Japan SmallCap Dividend -

Download Commentary

3Q17 Manager Commentary THIS ISSUE? SEPTEMBER 2017 "THIRD QUARTER REVIEW" SMALLCAPS DISTRIBUTION UPDATE PERFORMANCE UPDATE Perritt MicroCap Opportunities-PRCGX Perritt Ultra MicroCap-PREOX Perritt Low Priced Stock Fund-PLOWX SMALL-CAPS LEAD IN SEPTEMBER and THIRD QUARTER The small- and micro-cap markets started the third quarter with a modest correction, but finished the quarter with a monster gain in September. All equity markets produced posi- tive results in the third quarter, but the real stars were smaller stocks. As you can see from the table below, the Russell 2000 Index outperformed the large-cap Russell 1000 Index in both September and the third quarter. The Russell Microcap Index was the strongest performer with a 8.15% gain in September and a 6.65% gain for the quarter. The renewed promise of lower taxes from the Trump Administration was certainly a big catalyst for the rally. However, the strengthening economy and improved corporate profits were also reasons for the gains. Index Results Michael Corbett, September 3rd Quarter YTD Chief Investment Officer Portfolio Manager Russell 1000 2.13% 4.48% 14.17% Russell 2000 6.24 5.67 10.94 Source: FTSE Russell Russell Microcap 8.15 6.65 11.16 Source: FTSE Russell LEADERSHIP A deeper look at the recent performance of value and growth stocks show that leadership may be changing. While value related stocks performed well in 2016, the real leader this year has been growth stocks. As the table below shows, growth has been the place to be year-to-date, as well as for the third quarter, but value stocks outperformed growth in September. -

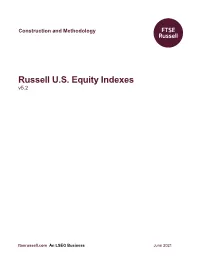

Russell U.S. Equity Indexes Construction and Methodology, V5.2, June 2021 2

Construction and Methodology Russell U.S. Equity Indexes v5.2 ftserussell.com An LSEG Business June 2021 Construction and Methodology Contents 1.0 Introduction .......................................................................... 5 1.2 FTSE Russell ............................................................................................ 5 1.3 Available indexes ..................................................................................... 6 2.0 Management Responsibilities ............................................ 8 2.1 FTSE International Limited (FTSE) ........................................................ 8 2.2 Amendments to the Construction and Methodology ........................... 8 3.1 Queries, Complaints and Appeals ......................................................... 9 3.2 Index Policy for Trading Halts and Market Closures ........................... 9 3.3 Index Policy in the Event Clients are Unable to Trade a Market ......... 9 3.4 Recalculation Policy and Guidelines ................................................... 10 3.5 Policy for Benchmark Methodology Changes .................................... 10 4.0 Basic Methodology ............................................................ 11 4.2 Annual reconstitution............................................................................ 11 4.3 Quarterly initial public offerings .......................................................... 11 5.0 Defining Eligible Securities ............................................... 13 5.2 Determining U.S. Companies -

AGGRESSIVE INVESTORS 1 BRAGX ULTRA-SMALL COMPANY BRUSX (Open to Existing Investors — Direct Only)

A no-load mutual fund family of domestic funds Semi-Annual Report December 31, 2014 (Unaudited) AGGRESSIVE INVESTORS 1 BRAGX ULTRA-SMALL COMPANY BRUSX (Open to Existing Investors — Direct Only) ULTRA-SMALL COMPANY MARKET BRSIX SMALL-CAP MOMENTUM BRSMX SMALL-CAP GROWTH BRSGX SMALL-CAP VALUE BRSVX LARGE-CAP GROWTH BRLGX BLUE CHIP 35 INDEX BRLIX MANAGED VOLATILITY BRBPX www.bridgeway.com TABLE OF CONTENTS Letter from the Investment Management Team 1 AGGRESSIVE INVESTORS 1 FUND Manager’s Commentary 7 Schedule of Investments 11 ULTRA-SMALL COMPANY FUND Manager’s Commentary 14 Schedule of Investments 18 ULTRA-SMALL COMPANY MARKET FUND Manager’s Commentary 23 Schedule of Investments 27 SMALL-CAP MOMENTUM FUND Manager’s Commentary 39 Schedule of Investments 42 SMALL-CAP GROWTH FUND Manager’s Commentary 50 Schedule of Investments 53 SMALL-CAP VALUE FUND Manager’s Commentary 56 Schedule of Investments 59 LARGE-CAP GROWTH FUND Manager’s Commentary 62 Schedule of Investments 65 BLUE CHIP 35 INDEX FUND Manager’s Commentary 68 Schedule of Investments 72 MANAGED VOLATILITY FUND Manager’s Commentary 74 Schedule of Investments 78 Schedule of Options Written 82 STATEMENTS OF ASSETS AND LIABILITIES 87 STATEMENTS OF OPERATIONS 89 STATEMENTS OF CHANGES IN NET ASSETS 91 FINANCIAL HIGHLIGHTS 95 Notes to Financial Statements 104 Other Information 117 Disclosure of Fund Expenses 118 Bridgeway Funds Standardized Returns as of December 31, 2014* (Unaudited) Annualized Gross Net Inception Inception Expense Expense Fund Quarter Six Months 1 Year 5 Years 10 Years to