Nottinghamshire Economic Development Capital Fund State Aid Reference No: SA 39381

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bringing Artists Into View Discover Art and Craft in Your Community

Open Studios Notts MAY-JUNE 2018 BRINGING ARTISTS INTO VIEW DISCOVER ART AND CRAFT IN YOUR COMMUNITY OVER 250 ARTISTS AND MAKERS INVITE YOU TO VISIT THEIR STUDIOS AND EVENTS IN NOTTINGHAMSHIRE, WITH EXHIBITIONS AT RETFORD LIBRARY, ARNOLD LIBRARY AND BEESTON LIBRARY EVENTS PROGRAMME DIRECTORY OF ARTISTS AND MAKERS www.osnotts.co.uk SCROOBY ARTISTS 2-4 CHRIS CAMPBELL 5 NORTH NOTTS DOVECOT GALLERY, 1A 26-27 May, 10-5 STYRRUP ANN ROBBINS SCULPTURE, 2 D WORK 12-13 May, 2 5-7 May (BH), 10-5 Grapevine Gallery, Grendon HILARY CARTMEL 1 26-28 May (BH), 11-5 CERAMICS Lodge, Main Street, Mattersey 12-13 May, Dovecot Gallery, Kirkby House, Scrooby DN10 5DZ 26-28 May (BH), 11-5 Poplars Farm, Main Street, DN10 6AD 01777 818884 SCULPTURE, PRINTMAKING, Styrrup DN11 8NB 07710 423108 www.campbelldesign.org PAINTING 01302 618095 [email protected] R FW Dovecot Gallery, Poplars Farm, www.dovecotgallery.co.uk Main Street, Styrrup DN11 8NB R NW R NW JOY GIBBS-PRICE 6 01302 618095 270 year-old Dovecot where JEAN RUSH 3 26-27 May (incl Raku on www.hilarycartmel.co.uk sculptors Hilary Cartmel & 5-7 May (BH), 10-5 27th), 10-4 R NW Michael Johnson have OIL & ACRYLIC PAINTING CERAMICS worked for over 25 years. Lyndhurst, Chapel Lane, Scrooby Grapevine Studios, Grendon The restored building is DN10 6AE Lodge, Main Street, Mattersey enjoying a new lease of life 01302 719573 DN10 5DZ as a gallery and during R PW 07842 114145 Open Studios will be showing www.joygibbsprice.co.uk work by locally based PENNY CAWLEY 4 R NW PAINTERS, PRINTMAKERS, 5-7 May (BH), On Sun 27 May there will be a POTTERS AND SCULPTORS 9-10 June, 10-4 Raku demonstration with a including Ann Robbins, OIL PAINTING & WATERCOLOUR chance to fire a piece of bisque Carol Eason, Emma See also our 4 Holmefield Croft, Scrooby, ware. -

Directory of Clubs and Secretaries

DIRECTORY OF CLUBS AND SECRETARIES ARNOLD PARK Hon. Sec. Chris Smith 19 Bentley Avenue, Nottingham NG3 7AX 0115 987 3407 E-mail [email protected] Captain Mick Leafe [email protected] 07748 628 402 Green Arnot Hill Park, Nottingham Road, Arnold, Nottingham NG5 6LU ATTENBOROUGH Hon. Sec. Barbara Stratford 24 Hurts Croft, Chilwell, Nottingham NG9 5DE 0115 925 0842 E-mail [email protected] Captain Colin Firbank [email protected] 0115 925 6632 Fixtures Stephen Ward [email protected] 07935 414 518 Green The Strand, Attenborough, Nottingham NG9 6AU BEESTON UNITY Hon. Sec. Malcolm Potter 8 Bishopdale Close, Long Eaton, Nottingham NG10 3PJ 0115 972 3624 E-mail [email protected] 07746 663 063 Green Recreation Ground, Broadgate, Beeston, Nottingham NG9 2DS BLIDWORTH Hon. Sec. Pete Richens 13 Bourne Drive, Ravenshead, Notts NG15 9FN 01623 796632 E-mail [email protected] 07810 555 800 Captain Brian Kay [email protected] 07855 881 046 Green Miners Welfare, Mansfield Road, Blidworth, Notts NG21 0LR BRIERLEY PARK Hon. Sec. Alan Ayre 53 Newcastle Street, Huthwaite, Notts NG17 2LT 01623 558334 E-Mail Danny McCrossan [email protected] Green Manor Park, Ley Lane, Mansfield Woodhouse, Notts NG19 8JU BULWELL FOREST Hon. Sec. Gerry Wilkinson 7 Rise Park Road, Rise Park, Nottingham NG5 5BJ 0115 927 9694 E-mail J Fernley [email protected] 0115 955 0466 Green Bulwell Forest, Hucknall Road, Bulwell, Nottingham NG6 9LQ CAVALIERS Hon. Sec. Frank Wallis 5 Falconers Walk, Arnold, Nottingham NG5 8NY 07971 992 189 E-mail [email protected] Captain David Baird [email protected] 07939 751 101 Green Nottingham University Sports Ground, Derby Road, Nottingham NG7 2RD CHILWELL Hon. -

The Secure Estate for Children and Young People

Youth Justice Board Bwrdd Cyawnder Ieuenctid The secure estate for children and young people Berwick-upon-Tweed Alnwick Amble Ashington Morpeth Newcastle Longtown upon Tynemouth Haltwhistle Corbridge Tyne South Shields Hexham Jarrow Brampton Gateshead Carlisle SundeSunderrland Alston Consett Chester-le-Street Durham Maryport Hartlepool Cockermouth Penrith Bishop Auckland Workington AyclieAyclie (18)(18) Keswick Staindrop Redcar Middlesbrough Whitehaven Appleby-in- Barnard Castle Westmorland Stockton-on-Tees Eston Egremont Brough Darlington Whitby Ambleside Richmond Windermere Catterick Kendal Sedbergh Leyburn Northallerton Hawes Scarborough Helmsley Thirsk Pickering Filey Kirkby Lonsdale Ripon Malton Barrow-in-Furness Boroughbridge Bridlington Morecambe Settle Lancaster Harrogate Skipton Driffield Ilkley York Wetherby (336) Fleetwood Otley Clitheroe Keighley Wetherby Market Weighton Nelson Colne Bingley Beverley Adel Beck (16) Blackpool Shipley Selby Burnley Bradford Leeds Hull Preston Blackburn Castleford Howden Halifax Dewsbury Bacup Brighouse Ponontefract Goole Barton-upon-Humber Southport Huddersfield Wakefield Bury Thorne Immingham Grimsby Formby Ormskirk Rochdale Wigan Bolton Barnsley Scunthorpe Brigg Oldham Cleethorpes Skelmersdale Prestwich Doncaster Barton Moss (24) St. Helens Ashton-under-Lyne Bootle Manchester Glossop Bawtry Rotherham Gainsborough Market Rasen Wallasey Liverpool Warrington Stockport Sheffield Louth Birkenhead Widnes Altrincham Aldine House (4) Holyhead Llandudno Rhyl Prestatyn Mablethorpe Runcorn Retford Llangefni -

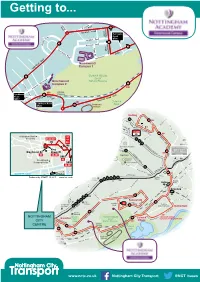

Getting To... E C D O 58 R C E R a S R Country Park WCASTLE M a and Lambley

t . n T d Brownlow Drive e S Bestwood 46 to Woodborough c a Oakwood Academy 68 s 17 t o H e n Getting to... e C d O 58 r c e R A s R Country Park WCASTLE M a and Lambley A C 16 E H 68 e n B RO e E VENSWORTH Bulwell r o F C a d A n I 87 C d E L D R 79 o B a R r L T o NLOW DRIVE L E 79 U n W E ROAD 69 A Hall o RO D TR f S o B w d H 79 C A Bulwell Hall g l n S d t S A C V n o O n s 16 79 e t R 69 B i i B . o 79 r C r e f 79 Park L e A 79 G B Rise Park B s lv E Killisick d 88 79 n a N 79 oa a R B A C A S 79 L 15 16 79 89 89 A AD L 25 ce P L . RO M N i 89 88 C Redhill S I pp A C D a Y Gleneagles o L A 53 C N 16 Bus Terminus E A RED e E I r H l L All services K F 89 R d I a dG Drive 46 O L d aR P J C R o a L k o a Golf Course I r U 43 m 79 U C A B a l R a RS H Q All services Morrisons U 88 e O P R o e C 58 Y 47 s A o 70 . -

Nottinghamshire. [Kelly•I " ...··

66,6 !'AB NOTTINGHAMSHIRE. [KELLY•I " ...·· . FARMERS con'inued. · Hollin.<J William, Lyndhurst, Mansfield Hutchinson W. Sth Collingham~ Newark Hemstock Mrs. S. Gedling, Nottingham Holloway Geo. Elmsley lodge, Mansfield Hutson Joseph; Treswell, Lincoln Henfrey George, Maplebeck, Newark Holloway James, Python hill, Blid- Ibbetson George, Ranskill, Bawtry Henshaw . Richard, Tithby grange, worth, Mansfield R.S.O. (Yorks). ; · ? · Tithby; Bingham .- Hollow~y Mrs. S. A. Laxton,- Newark Ibbotsou Frederick,, Boon hills, Nethet Henson Arthur, Bradmore, Nottingham Holloway W. E. Lowdham, Nottingham Langwith, Cuckney, Mansfield Henson John, Strelley, Nottingham Holloway Wm. Calverton, Nottingham lbbotson George, Hockel'ton, SouthweU Henton George, Newton, Nottingham Holmes John, Cotgrave, Nottingham lll.liP.gsworth W. Sturton-le-Steeple, Rtfrd Henton W. Norwell Woodhouse, Newark Holmes John, Scarrington, Nottingham rsaac William, H~veringham, Nottioghm 'Herbert James, Edwinstowe, Newark Holmes John, South Scarle, Newark Jacklin William, Teversal, Mansfield Herrick Thomas, Kinoulton, Nottingham Holmes Robt; Wm. Keyworth, Nttnghm Jackson Charles, Clifton-with-Glapto~ Herring Samuel, Sookholme, Mans::eld Holmes Thomas, Trowell, Nottingham Nottingham · ' · · · Herrod Francis, Kelham, Newark Holmes William, Owthorpe, Nottingham Jackson Charles, Newthorpe, Nottingbnt Herrod Frank Gee, Hawton, Newark Holmes William Gunn, Keyworth,Ntngm Jackson Mrs. Eliza, Bagnall road, Old Herrod Mrs. Hannab, Farndon, Newark Holt William, Bole, Gainsborough Basford, Nottingham Herrod W. Hucknall Huthwaite, Mansfld Hook William, Sookholme, Mansfield Jackson Frank, • Rectory road, West Hewerdine John, Laxton; Newark · Hopewell George, .Granby, Nottingham Bridgford, Nottingham Hewitt John, Haughton, Newark . Hopkin James, Oxton, Southwell Jackson G. Gringley-on-the-HiU, Dncstt Hewitt Thompson, Warsop, Mansfield · Hopkinson Ernest, Bonbusk, Holbeck, Jackson G. Kingston-on-Soar, Derby Hextall Gcorge, Balderton, New~k . · Welbeck, Worksop Jackson George, East Dray-fun,. -

Private Residents. (Notti:Ngb.Amsbii:E

:S.AN PRIVATE RESIDENTS. (NOTTI:NGB.AMSBII:E. Hanlon Mrs. Carlinford house, High Hart Mrs. 33 Castle gate, Newark Heazell E. H. 4 Oxford st. Nottingham street, Hucknall Torkard Hartas Thomas, 19 Bridge street, Mnsfld Hebblethwaite Joseph Louis, Chestnut Hannah Frederick, Beech Hurst, 14 Hartley Thomas Arthur, Lorne grove, gro. Radcliffe-on-Trent, Nottingham Hamilton road, Nottingham Radcliffe-on-Trt>nt, Nottingham Hedderly Hy. S. Church st. :Mansfield Hannah "\Villiam J. Glenfield, 12 Alex- Hartshorn Mrs. Dudley lodge, Pe,eril Heelis Robert M.D. 33 Church street, andra street, Nottingham drive, Nottingham Lenton, Nottingham Hannam Mrs. West Retford Hartshorn Stuart, Charmvood, Caven- Hemfrey Miss, Cotgrave, Nottingham Hanson Henry, Bingham road, Radcliffe- dish crescent north, Nottingham Heming Jame..~, The Park, Newark on-Trent, Nottingham Hartshorn William Edward, Ellesmere, Hemingway C. R. Lucknow dri. Nttnghm Hanson Henry, The Elms, Westhorpe, 22 Burn street, Nottingham Hemingway James, 19 Meadow road, Southwell Hartshorne Miss, 7 Grove st. Retford Beeston, Nottingham Hanson Jn. 71 West Hill drive, Mansfld Harvey Rev. Thomas, 12 Patrick street, Hemsley Henry, Shelton, Newark Hanson Miss, The Cottage, Kimberley, West Bridgford, Nottingham Hemsley William, 11 Rylands road, Nottingham Harvey Frederick, The Vicarage, Eg- Beeston, Nottingham Hanson Mrs. Clover lands, Kimberley, manton, Tuxford Hemsley William Sydney, Harlaxton ho. Nottingham Harvey Joseph, 17 Springgdns. Newark Harlaxton drive, Nottingham Hanson Robt. A. Kimberley, Nottinghm Harvey Mrs. Friary Field, Newark Hemstock Mrs. Gedling, Nottingham Hanson William Banner, Nuthall house, Harvey Mrs. Ivy ho. E. Markham, Nwrk Henderson Rev. Alexander R. M:.A. 72 N uthall, Nottingham Harvey Richard, 15 Spring gdns. N ewark Mapperley road, Nottingham Harcourt-Vernon Edward Evelyn D.L., Harwood Alfred, Harlaxton dri. -

N224 -Ravenshead- St Phillip Neri.Xlsx

CONTRACT REF: SCHOOL: St Philip Neri Academy BUS OPERATOR: BUS SERVICE NO: N224 CAPACITY: 16 VEHICLE SPEC AGE OF VEHICLE CONTRACT START: CONTRACT END: OPTION TO EXTEND: CONTRACT TYPE: ROUTE AM: Ravenshead, Longdale Lane (Quarry Road), Nottingham Road, Larch Farm, Main, Road,Fishpool Road, Main Street, Blidworth, Mansfield Road, Warsop Lane, Rainworth, B6020 Southwell Road East, A6191 Southwell Road West, Bellamy Road, Old Newark Road turning circle, Bellamy Road, Lindhurst Lane, Chatsworth Drive, Litchfield Lane, Berry Hill Lane, Southwell Road West, Windsor Road, Littleworth, Baums Lane, Nottingham Road, Portland Road, Belvedere St, Rosemary St, St Philip Neri - ROUTE PM: St Philip Neri, the reverse of the morning route. TIMETABLE MORNINGS Ravenshead, Longdale Lane, Quarry Road Depart 07:55 Longdale Lane, the Hollies 07:57 Larch Farm 08:03 Main Road, Chapel Lane 08:06 Blidworth, Mansfield Road 08:09 Rainworth, Robin Hood 08:13 Bellamy Road, Redruth Drive 08:19 Chatsworth Drive 08:21 St Phillip Neri School Arrive 08:40 AFTERNOONS St Phillip Neri School Arrive 15:40 Chatsworth Drive 15:54 Bellamy Road, Redruth Drive 15:56 Rainworth, Robin Hood 16:02 Blidworth, Mansfield Road 16:06 Main Road, Chapel Lane 16:09 Larch Farm 16:12 Longdale Lane, the Hollies 16:15 Ravenshead, Longdale Lane, Quarry Road Arrive 16:18 NOTES 1. The conditions of travel on this journey are as set out in the leaflet issued with the travel permit by the Authority 2. The bus will stop for pupils to board and alight at the places named and at intermediate service stops, where available, if signalled accordingly. -

Fire Cover Review Report Agenda Supplement for Nottinghamshire

TO FOLLOW AGENDA ITEM This is a supplement to the original agenda and includes a report that was marked ‘to follow’ on the original agenda. NOTTINGHAMSHIRE AND CITY OF NOTTINGHAM FIRE AND RESCUE AUTHORITY MEETING OF THE AUTHORITY Date: Friday, 25 September 2015 Time: 10.30 am Venue: Fire and Rescue Services HQ, Bestwood Lodge, Arnold Nottingham NG5 8PD Constitutional Services Officer: Catherine Ziane-Pryor Direct Dial: 0115 8764298 AGENDA Pages 12 FIRE COVER REVIEW 2015 3 - 102 To Follow Nottinghamshire and City of Nottingham Fire and Rescue Authority FIRE COVER REVIEW 2015 Report of the Chief Fire Officer Date: 25 September 2015 Purpose of Report: To present the Fire Authority with the findings of Fire Cover Review 2015 and to request that the Community Safety Committee consider its implications. CONTACT OFFICER John Buckley Name : Chief Fire Officer Tel : 0115 967 0880 Email : [email protected] Media Enquiries Bridget Aherne Contact : (0115) 967 0880 [email protected] 1. BACKGROUND 1.1 In 2004 a new Fire and Rescue Services Act was introduced. This Act served to reinforce the provisions of responsibility for Local Authorities and Fire and Rescue Authorities that were contained within the 1947 Act, but removed any central restrictions on decision making or requirement to adhere to national standards of fire cover. 1.2 The Act introduced the concept of integrated risk management planning (IRMP), where the Local Authority responsible for its fire and rescue service would deliver a plan as to how it was going to use its resources to reduce risk and best serve the needs of its community. -

Mansfield Local Plan Examination Hearing Papers Main Matter 1

Mansfield Local Plan Examination Hearing Papers Main Matter 1 Prepared on behalf of The Lindhurst Group | April 2019 MANSFIELD LOCAL PLAN EXAMINATION HEARING PAPERS MAIN MATTER 1 – Duty to Co-operate (DtC) and Other Legal Requirements Issue – Has the Council complied with the DtC in the preparation of the plan? 1.0 With regards to this Plan the relevant strategic matters under the Duty to Co-operate in relation to housing are the identification of an appropriate Housing Market Area (HMA), the meeting of objectively assessed housing needs (OAHN) in full and the distribution of housing. Issue - Has the Council maximised the effectiveness of the plan by engaging constructively, actively and on an ongoing basis with the prescribed bodies on relevant strategic matters during the preparation of the plan and what form has this taken? 2.0 In respect of this Plan the relevant prescribed bodies for engagement with on strategic housing matters are:- • Ashfield District Council and Newark & Sherwood District Council in the same HMA as Mansfield District Council; • Adjoining authorities of Bassetlaw District Council and Bolsover District Council; and • Nottinghamshire County Council. It is evident that The Council has engaged with these prescribed bodies during the preparation of the Plan via the preparation of joint evidence and regular meetings. Issue - What outcomes have resulted from the co-operation with the prescribed bodies on any relevant strategic matters and how have these informed the plan’s policies? 3.0 It is evident from the information supporting the Plan that the Authorities agree to work collaboratively to deliver the development requirements of the Nottingham Outer Area (as identified by the Local Plan for each District). -

Employment Bulletin EB 4/15

Employment Bulletin A Monthly Analysis of Employment, Unemployment and Jobs EB 4/15 March 2015 Key Facts Unemployment according to the Government’s preferred measure was 1.84 million in the * Claimant count in Nottinghamshire falls by 572 three months to February 2015, over the month. down 76,000 from the previous * Jobless total now 17,455. three months and down 416,000 from the same period a year ago. The unemployment * Claimant count rates in March (residence based); rate was 5.6%, down 0.2 from United Kingdom 2.0% the previous three months and East Midlands 1.9% down 1.3 from a year earlier. Nottinghamshire 2.4% The unemployment rate County 1.8% for 18-24 year olds was 14.3% in the three months to February City 3.9% 2015, down by 0.8% on the quarter and down 2.8% on the * LFS Unemployment in the United Kingdom year. There were 588,000 1,840,000 or 5.6% of the workforce. unemployed young people aged from 18 to 24 in the quarter to February 2015. This is down by 24,000 on the quarter and down population which excludes those unemployed. The long-term by 124,000 over the year. not seeking or available for work. increase in the proportion of Comparisons of youth Unemployment rates are not the young people going into full- unemployment over time are proportion of the total time education reduces the size complicated by the fact that population who are unemployed. of the economically active unemployment rates are They are the proportion of the population and therefore calculated as the number of economically active population increases the unemployment unemployed people divided by (those in work plus those seeking rate. -

CABINET Meeting to Be Held in the New Council Chamber, Town Hall, Beeston, Nottingham, NG9 1AB

CABINET Meeting to be held in the New Council Chamber, Town Hall, Beeston, Nottingham, NG9 1AB 27 January 2015 at 6.00pm 19 January 2015 Dear Councillor You are hereby requested to attend a meeting of the Cabinet to be held at the date/place and time mentioned above for the purpose of transacting the business of the agenda set out below. Decisions made at this meeting will be published as soon as is reasonably practicable. Urgent decisions which will be shown as asterisked agenda items or as may be determined by Cabinet will be effective immediately. Non-urgent decisions may be called in within 5 working days of this meeting in accordance with standing order X/30. This agenda gives notice of items to be considered in private as required by Regulations 5 (4) and (5) of The Local Authorities (Executive Arrangements) (Meetings and Access to Information) (England) Regulations 2012. Yours faithfully RUTH E HYDE Chief Executive To: Members of the Cabinet Other members of the Council (for information) A G E N D A 1. APOLOGIES FOR ABSENCE 2. DECLARATIONS OF INTEREST Members are requested to declare the existence and nature of any disclosable pecuniary interest and/or other interest in any item on the agenda. 3. MINUTES PAGES 1 - 6 Cabinet is asked to confirm as a correct record the minutes of the meeting held on 6 January 2015. 4. CABINET WORK PROGRAMME PAGES 7 - 8 Cabinet is asked to approve its Work Programme, including potential key decisions that will help to achieve the Council’s key priorities and associated objectives. -

Heritage Assessment

HERITAGE ASSESSMENT Gedling Borough Council Local Planning Document Assessment of Impact of LPD Development Sites on Scheduled Monuments Prepared by Stephen Bradwell, MA MRTPI IHBC Date: January 2017 (amended February 2017) Trigpoint Conservation & Planning Ltd 6 Guildford Way, Loughborough, Leics LE11 3SE t: 01509 828288 m: 07941 809921 www.trigpointcp.co.uk Heritage Assessment Gedling Borough Council Local Planning Document Assessment of Impact of LPD Development Sites on Scheduled Monuments 1.0 EXECUTIVE SUMMARY 1.1 This heritage assessment has been prepared on behalf of Gedling Borough Council by Stephen Bradwell MA MRTPI IHBC of Trigpoint Conservation & Planning Ltd. The purpose of this report is to assess the potential impact of the proposed development sites identified within Gedling’s Local Planning Document (LPD) on the Scheduled Monuments both within Gedling Borough and in the neighbouring authorities within 1km of the district boundary, having regard to the advice in the appropriate local and national planning policies. 1.2 The assessment has reviewed the setting of the nine Scheduled Monuments within Gedling as well as a further seven other Monuments that lie within adjoining districts and has concluded that the LPD development sites will not harm the setting of any of the Scheduled Monuments within the search area. In this context it is considered that the allocation of the residential and employment sites within the LPD is consistent with the objectives of the appropriate local and national planning policies in respect of development within the historic environment. 2.0 BACKGROUND INFORMATION 2.1 Gedling Borough lies to the north-east of Nottingham City and it is bounded on all sides by a number of other Council areas including Nottingham City and Ashfield to the west, Newark and Sherwood to the east and Rushcliffe to the south.