UNECE WPG LNG Chapter 1 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GECF Annual Statistical Bulletin 2019 3Rd Edition

1 2 GECF Annual Statistical Bulletin 2019 3rd edition Authors and Contributors Namely in Alphabetical Order Amira Remadna Data Analysis and Research Diana Cueto ICT and Software Support Katrien Hermans Public Relations and Marketing Maria Arteaga Graphic Design & Administrative Support Mohamed Arafat Data Engineering and Curation Mona Shokripour, PhD Data Modelling and Integration Rixio Morales, PhD ICT Solutions Architect and Maintenance Roberto Arenas Lara, PhD Team Leader 3 Disclaimer The GECF Annual Statistical Bulletin (ASB) 2019 is the result of the data gathering collection and processing obtained directly from GECF Member and Observer Countries through the GECF Data Exchange Mechanism and in part using processed data from secondary sources examined and analysed by GECF Secretariat. The data contained in the GECF ASB 2019 are for information purposes only and do not necessary reflect the views of GECF Member and Observer Countries. Neither GECF Secretariat nor any of GECF Member and Observer Countries nor any of their agents or their employees are liable for any errors in or omissions from such information and materials and does not assume any liability or responsibility for the accuracy completeness or reasonableness of data. Unless copyrighted by a third party, the information presented in the GECF ASB 2019 may be used and/or reproduced for research educational and other non-commercial purposes without GECF Secretariat’s prior written permission provided, fully acknowledging GECF as the copyright holder. Written permission from GECF Secretariat is required for any commercial use. The GECF ASB 2019 contains references to materials from third parties. GECF Secretariat will not be responsible for any unauthorized use of third party materials. -

Page 01 Jan 01NEW.Indd

Home | 2 Business | 14 Sport | 24 Qatar makes major Qatar stock index World No. 1 Djokovic strides in all areas gains 170.64 points all set to begin in 2015 past week season in Qatar The Peninsula Newspaper @PeninsulaQatar @peninsula_qatar FRIDAY 1 JANUARY 2016 • 21 Rabia I 1437 • Volume 20 Number 6662 www.thepeninsulaqatar.com [email protected] | [email protected] Editorial: 4455 7741 | Advertising: 4455 7837 / 4455 7780 New contracts Fire engulfs high-rise for rail projects hotel in Dubai DUBAI: A huge fire ripped through a luxury hotel yesterday, as people gathered to watch New Year’s Eve celebrations, injuring at least by mid-year 16 people, authorities said. The 63-storey building close to Burj Kha- lifa, the world’s tallest tower, was engulfed in flames across many floors as sirens wailed Qatar Rail to hold consultants’ meet and helicopters hovered overhead. Dubai Police Chief General Khamis Matar DOHA: Qatar Rail has started Qatar Rail is also studying ten- Al Mzeima said all the hotel’s residents had preparations to sign a slew of ders for additional services such been evacuated from the scene of the blaze. new contracts for the country’s as information technology and “Until the fire is put out, we will not have ambitious rail network compris- commercial services for use by information on what caused it,” he added. ing Doha Metro, Lusail Tram and passengers in the trains, at the “At least 14 people have been slightly the long-distance train. metro stations and in the light injured, along with one medium injury, and The first phase of the Doha trains in Lusail City. -

GIIGNL Annual Report Profile

The LNG industry GIIGNL Annual Report Profile Acknowledgements Profile We wish to thank all member companies for their contribution to the report and the GIIGNL is a non-profit organisation whose objective following international experts for their is to promote the development of activities related to comments and suggestions: LNG: purchasing, importing, processing, transportation, • Cybele Henriquez – Cheniere Energy handling, regasification and its various uses. • Najla Jamoussi – Cheniere Energy • Callum Bennett – Clarksons The Group constitutes a forum for exchange of • Laurent Hamou – Elengy information and experience among its 88 members in • Jacques Rottenberg – Elengy order to enhance the safety, reliability, efficiency and • María Ángeles de Vicente – Enagás sustainability of LNG import activities and in particular • Paul-Emmanuel Decroës – Engie the operation of LNG import terminals. • Oliver Simpson – Excelerate Energy • Andy Flower – Flower LNG • Magnus Koren – Höegh LNG • Mariana Ortiz – Naturgy Energy Group • Birthe van Vliet – Shell • Mika Iseki – Tokyo Gas • Yohei Hukins – Tokyo Gas • Donna DeWick – Total • Emmanuelle Viton – Total • Xinyi Zhang – Total © GIIGNL - International Group of Liquefied Natural Gas Importers All data and maps provided in this publication are for information purposes and shall be treated as indicative only. Under no circumstances shall they be regarded as data or maps intended for commercial use. Reproduction of the contents of this publication in any manner whatsoever is prohibited without prior -

Org20140714a5.Pdf

Make a difference by being the difference Discover how we turn local involvement into global impact GLOBAL CITIZEN FOUNDATION Global Citizen Foundation supports education research and empowers sustainable development around the world. To find out more about us or to join our cause, please visit www.global-citizen.org. DashwooD house, LeveL 17, 69 oLD BroaD street, LonDon eC2M 1Qs, uniteD KingDoM Involve. Evolve. Empower. t +44 207 256 4209 F +44 207 256 4122 WORLD HERITAGE No. 72 WHC cover 72_WHC 30/04/14 15:46 Page1 ach year, the special issue of World Heritage coinciding with the annual World Heritage editorial Committee session gives us the opportunity to focus on the heritage of a particular Ecountry or region. This year the 38th session of the Committee is hosted by the State of Qatar so we are taking a closer look at the cultural and natural heritage of this country, which Special Issue World Heritage deserves to be better known. in Qatar While Qatar adopted the World Heritage Convention in 1984, its first site was inscribed on the World Heritage List in 2013. Al Zubarah Archaeological Site is an excellent example US$9 £6 ¥850 € 7,50 of a fortified town linked to other settlements for the pearl trade, and was a key point in the June 2014 No. 72 • ISSN 1020-4202 development of urban centres in the 18th and 19th centuries in the Gulf region. Several articles 3 059630 101721 World Heritage present the history of this remarkable site and the archaeological works undertaken to shed Cover: Al Zubarah Archaeological Site, Qatar light on its development and significance to the region. -

Page 01 Nov 11.Indd

Home | 4 Business | 17 Sport | 28 HMC opens clinic Qatar accounts SC to launch in Sealine ahead of for 20pc of GCC roadshow on 2022 camping season chemicals export programmes The Peninsula Newspaper @PeninsulaQatar @peninsula_qatar WEDNESDAY 11 NOVEMBER 2015 • 28 Muharram 1437 • Volume 20 Number 6611 www.thepeninsulaqatar.com [email protected] | [email protected] Editorial: 4455 7741 | Advertising: 4455 7837 / 4455 7780 Emir participates in Arab-South American Summit Emir sends Deputy PM greetings to Cambodia King DOHA: Emir H H Sheikh Tamim opens farm bin Hamad Al Thani sent yester- day a cable of congratulations to the King of Cambodia, Norodom Sihamoni, on his country’s Inde- exhibition pendence Day. 180 local, international participants Suicide attack at Emir H H Sheikh Tamim bin Hamad Al Thani with other leaders participating in the Fourth Summit of Arab and South American countries that kicked off in Riyadh yesterday. See also page 2 By Sidi Mohamed production, in line with the Qatar Yemen varsity National Vision 2030. DOHA: Deputy Prime Minister “Qatar’s food security plans SANA’A: A suicide bomber blew and Minister of State for Cabinet have begun to materialise, and the himself up yesterday inside a Affairs, H E Ahmed bin Abdul- contribution of domestic produc- Yemeni university in the Houthi- lah bin Zaid Al Mahmoud, inau- tion to self-sufficiency is increas- Israeli forces shoot dead two controlled province of Ibb. gurated yesterday the 4th Qatar ing through many agricultural Security sources in the prov- International Agricultural Exhi- projects and animal production ince said that an unidentified sui- bition. -

Keeping History Alive – Guide to Heritage Sites in Qatar Taking Qm Beyond the Walls Taking Qm Beyond the Walls – – Introduction Content

KEEPING HISTORY ALIVE – GUIDE TO HERITAGE SITES IN QATAR TAKING QM BEYOND THE WALLS TAKING QM BEYOND THE WALLS – – INTRODUCTION CONTENT From Bronze age settlements to medieval palaces, 19th century forts, villages, Heritage SITES Location MAP 7 towers and mosques, the Qatar Museums team excavates, restores, protects and promotes heritage sites of Qatar that flourished long ago. We put local communities, Archaeological Heritage 9 young and old, in touch with their past, reminding them of the skills, wisdom and the AL ZubaRAH ARCHAEOLOGICAL SITE 10 struggles of their ancestors. FREIHA 16 RuwaYda 18 Our goals are to dig into the past and discover its traces, to protect heritage sites and safeguard them for future generations, and to develop them in order to attract MURwab 20 visitors and educate them about Qatar’s rich culture and history. Architectural Heritage 23 BARZAN TowERS 24 AL KHOR TowERS 28 THE WELL OF AIN HLEEtaN 30 OLD PALacE IN DOHA 32 AL REKAYat FORT 36 AL THAGHAB FORT 38 AL JUMAIL VILLAGE 40 Cultural AND natural heritage 43 AL JassasIYA Rock CARVING SITE 44 JAZIRat BIN GHANNAM 48 RAS ABROUQ, ZEKREET FORT AND 50 East-WEst/WEst-East BY RICHARD SERRA For general inquiries please contact QM Cultural Tourism Unit: OTHER Information 55 THINGS to havE IN MIND WHEN VISITING 56 Division of Cultural Heritage Cultural Tourism Unit [email protected] +974 4402 8305 School visit to Al Zubarah Fort OTHER INFORMATION – LOCATION MAP 4 5 TAKING QM BEYOND THE WALLS HERITAGE SITES LOCATION – – LEGEND LOCATION MAP AL RUWAIS PARKING Road -

Giignl Annual Report 2017 the Lng Industry in 2016

The LNG industry GIIGNL ANNUAL REPORT 2017 THE LNG INDUSTRY IN 2016 Editorial Dear Colleagues, In 2016, global LNG trade recorded a growth rate Looking at future years, with Australian projects of around 7.5% compared to 2015, returning to a ramping-up and new trains from the United States robust pace experienced before 2011. progressively coming online, the global LNG market could become oversupplied until the mid Primarily driven by new Australian volumes, 2020’s. Nevertheless, surplus capacity could be additional supply was not as abundant as expected progressively absorbed by additional imports and/ due to production delays, slower ramp-ups and or by shut-ins, both as a consequence of low price lower exports from historical suppliers. As a result, levels, resulting in a market rebalancing in the first the expected “wave” of LNG has not materialized part of the decade. Given the scarce number of FIDs yet, and some signs of market tightness have even taken in recent months (only 1 in Indonesia and 1 in been observed towards year-end due to colder the US) a tightening of supplies in the long run can weather than usual in Europe and North East Asia. be expected, perhaps slowing down the emergence of a more flexible and liquid traded LNG market. On the import side the year was marked by soaring In this context more than ever, cooperation along the deliveries to the Middle East, confirming the region’s value chain will be needed in order to reduce costs status of rising star amongst importers. After a and develop new projects in due time. -

2020 World Lng Report

2020 WORLD LNG REPORT Sponsored by RE Advertorial_International Gas Union - LNG Report_Print_FA.pdf 1 4/8/2020 11:16:51 PM IGU World LNG report - 2020 Edition 4 C M Y CM MY CY CMY K 2 3 IGU World LNG report - 2020 Edition Message from the Chapter 1: State of the Table Of Contents President of the LNG Industry International Gas Union 7 8 Chapter 2 : LNG Trade Chapter 3 : LNG and Gas Chapter 4 : Liquefaction Chapter 5 : Shipping Pricing Plants 2.1 Overview 4.1 Overview 5.1 Overview 2.2 LNG Exports by Market 4.2 Global Liquefaction Capacity and Utilisation 5.2 LNG Carriers 2.3 LNG Imports by Market 4.3 Liquefaction Capacity by Market 5 . 3 F l o a t i n g S t o r a g e a n d R e g a s i fi c a t i o n U n i t 2.4 LNG Interregional Trade 4.4 Liquefaction Technologies Ownership (FSRUs) 4.5 Floating Liquefaction 5.4 2020 LNG Orderbook Map: Global LNG Liquefaction Terminals 5.5 Vessel Costs and Delivery Schedule 4.6 Risks to Project Development 5.6 Charter Market 4.7 Update on New Liquefaction Plays 5.7 Fleet Voyages and Vessel Utilisation 4.8 Refrigeration Compressor Driver Map: Major LNG Shipping Routes Developments 5.8 Near Term Shipping Developments 10 22 28 52 Chapter 6 : LNG Receiving Chapter 7 : The LNG Chapter 8 : References Appendices Terminals Industry in Years Ahead 6.1 Overview 8.1 Data Collection for Chapters 3, 4, 5 and 6 1. -

World LNG Carrier Fleet

p24-30_LNG 3 11/07/2019 10:46 Page 2 CARRIER FLEET World LNG Carrier Fleet LNG Capacity Owned or Builder Delivery Flag Power Cargo No. of Ship built for carrier m3 Ordered by Date Plant System tanks Export plant Aamira 266,000 QGTC Samsung Dec-10 Liberia DRL GTT 5 Qatargas IV Abadi 135,000 Brunei Gas Carriers Mitsubishi Nagasaki Jun-02 Brunei S Moss 5 Brunei LNG Abalamabie 174,900 Bonny Gas Samsung June-16 Bermuda DFDE GTT 4 Nigeria LNG Adam LNG 162,000 Oman LNG Hyundai Dec-14 Marshall Is. DFDE GTT 4 Oman LNG Al Aamriya 210,100 J5 Consortium Daewoo Feb-08 Marshall Is. DRL GTT 4 Qatargas Al Areesh 151,700 Teekay LNG Daewoo Jan-07 Qatar S GTT 4 Ras Gas II Al Bahiya 210,185 QGTC Samsung Oct-09 Liberia DRL GTT 5 Qatar-Atlantic Al Biddah 135,275 J4 Consortium Kawasaki Sakaide Nov-99 Japan S Moss 5 Qatargas Al Daayen 151,700 Teekay LNG Daewoo Apr-07 Qatar S GTT 4 RasGas II Al Dafna 266,000 QGTC Samsung Oct-09 Marshall Is. LR DRL GTT 4 Qatar-Atlantic Al Deebel 145,000 Peninsular LNG Samsung Dec-05 Bahamas S GTT 4 Qatargas Al Gattara 216,200 OSG/Nakilat Hyundai Oct-07 Marshall Is. DRL GTT 4 Qatargas II Al Ghariya 210,100 ProNav Daewoo Feb-08 Bahamas DRL GTT 4 Qatargas Al Gharaffa 216,200 OSG/Nakilat Hyundai Jan-08 Marshall Is. DRL GTT 4 Various Al Ghashamiya 216,000 QGTC Samsung Mar-09 Liberia DRL GTT 4 Qatar-Atlantic Basin Al Ghuwairiya 261,700 QGTC Daewoo Aug-08 Marshall Is. -

GIIGNL Annual Report

The LNG industry GIIGNL Annual Report 2021 Profile Acknowledgements Profile We wish to thank all member companies for their contribution to the report and the GIIGNL is a non-profit organisation whose objective following international experts for their is to promote the development of activities related to comments and suggestions: LNG: purchasing, importing, processing, transportation, handling, re-gasification and its various uses. • Cybele Henriquez – Cheniere Energy • Najla Jamoussi – Cheniere Energy The Group constitutes a forum for exchange of • Callum Bennett – Clarksons information and experience among its 86 members in • Oliver Stavrinidis – Clarksons order to enhance the safety, reliability, efficiency and • Laurent Hamou – Elengy sustainability of LNG import activities and in particular, • Jacques Rottenberg – Elengy the operation of LNG import terminals. • María Ángeles de Vicente – Enagás • Paul-Emmanuel Decroës – Engie • Oliver Simpson – Excelerate Energy • Andy Flower – Flower LNG • Magnus Koren – Höegh LNG • Gavin Stevens – MOL • Mariana Ortiz – Naturgy Energy Group • Birthe van Vliet – Shell • Mayumi Ikeda – Tokyo Gas • Donna DeWick – Total © GIIGNL - International Group of Liquefied Natural Gas Importers • Xinyi Zhang – Total All data and maps provided in this publication are for information purposes and shall be treated as indicative only. Under no circumstances shall they be regarded as data or maps intended for commercial use. Reproduction of the contents of this publication in any manner whatsoever is prohibited without prior consent of the copyright owners. Editorial The LNG industry in 2020 Jean Abiteboul President Dear Colleagues, 2020 can be characterized as a year of market Towards the end of the year, the market recorded price investment in infrastructure and access to low-cost volatility. -

Relación De Buques Metaneros Compatibles Con Las Terminales De Regasificación

RELACIÓN DE BUQUES METANEROS COMPATIBLES CON LAS TERMINALES DE REGASIFICACIÓN X = Compatible Planta Planta Planta Planta Planta Planta Identificación Buque metanero BARCELONA CARTAGENA HUELVA BILBAO SAGUNTO MUGARDOS AAMIRA (QMAX) X X X ABUJA II X ADAM LNG X AKWA IBOM X X AL AAMRIYA (QFLEX) X X X AL AREESH X X X X X AL BAHIYA X X AL BIDDA X AL DAAYEN X X X AL DAFNA (QFLEX) X X X AL DEEBEL X X X AL GATTARA (QFLEX) X X X X AL GHARAFFA (QFLEX) X X X X AL GHARIYA (QFLEX) X X X AL GHASHAMIYA X X X AL GHUWAIRIYA (QMAX) X X X AL HAMLA (QFLEX) X X X AL HUWAILA (QFLEX) X X X X AL JASRA X AL JASSASIYA X X X X AL KHARAANA (QFLEX) X X X X AL KHARAITIYAT (QFLEX) X X X AL KHARSAAH (QFLEX) X X X AL KHATTIYA X X AL KHAZNAH X AL KHOR X AL KHUWAIR (QFLEX) X X AL MAFYAR (QFLEX) X X X X AL MARROUNA X X X X X AL MAYEDA (QMAX) X X X X AL NUAMAN X X X AL ORAIQ X AL RAYYAN X AL REKAYYAT (QFLEX) X X X X AL RUWAIS (QFLEX) X X X X X AL SADD X X X AL SAFLIYA (QFLEX) X X X X AL SAHLA (QFLEX) X X X X AL SAMRIYA (QMAX) X X X AL SHAMAL (QFLEX) X X X AL SHEEHANIYA X X X AL THAKHIRA X X X AL THUMAMA X X X X AL UTOURIYA (QFLEX) X X AL WAJBAH X AL WAKRAH X AL ZUBARAH X ANNABELLA X X X X ARCTIC AURORA X X ARCTIC DISCOVERER X X X X X ARCTIC LADY X X X X X ARCTIC PRINCESS X X X X X X ARCTIC SPIRIT X X X X ARCTIC VOYAGER X X X X X ARWA SPIRIT (EX - MAERSK ARWA) X X X X X ASIA VISION X X X X BACHIR CHIHANI X X X BARCELONA KNUTSEN X X X X X X BEKULAN X X BEN BADIS X X X X BEN BOULAID X BERGE ARZEW X X X X X BILBAO KNUTSEN X X X X X X BLUE SKY X BP GEM CLASS X BRITISH DIAMOND X -

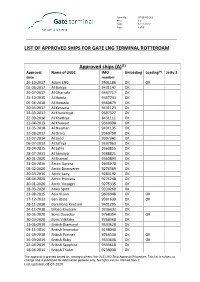

List of Approved Ships for Gate Lng Terminal Rotterdam

Form No.: GT-SE-FO-023 Rev: 1.0 Date: 12-12-2017 Page: 1 of 8 LIST OF APPROVED SHIPS FOR GATE LNG TERMINAL ROTTERDAM Approved ships (A)(1) Approval Name of LNGC IMO Unloading Loading(4) Jetty 3 date number 26-10-2017 Adam LNG 9501186 OK OK 02-06-2017 Al Bahiya 9431147 OK 29-07-2017 Al Gharrafa 9337717 OK 23-10-2015 Al Hamla 9337743 OK 05-06-2018 Al Huwaila 9360879 OK 20-05-2017 Al Karaana 9431123 OK 24-03-2017 Al Kharaitiyat 9397327 OK 22-09-2018 Al Khattiya 8431111 OK 22-04-2013 Al Khuwair 9360908 OK 11-05-2018 Al Nuaman 9431135 OK 13-08-2013 Al Oraiq 9360790 OK 31-07-2014 Al Sadd 9397341 OK 06-07-2013 Al Safliya 9337963 OK 28-04-2015 Al Sahla 9360855 OK 28-07-2011 Al Samriya 9388821 OK 30-01-2020 Al Shamal 9360893 OK 23-04-2016 Arctic Aurora 9645970 OK 08-02-2020 Arctic Discoverer 9276389 OK 20-03-2014 Arctic Lady 9284192 OK 08-04-2020 Arctic Princess 9271248 OK 20-01-2020 Arctic Voyager 9275335 OK 18-03-2020 Arwa Spirit 9339260 OK 21-08-2015 Asia Vision 9606948 OK OK 17-12-2013 Ben Badis 9361639 OK OK 28-11-2018 Barcelona Knutsen 9401295 OK 24-11-2018 Bilbao Knutsen 9236432 OK 10-06-2020 Boris Davydov 9768394 OK OK 30-03-2020 Boris Vilkitsky 9768368 OK 13-06-2019 British Diamond 9333620 OK 03-11-2014 British Innovator 9238040 OK 01-09-2018 British Partner 9766530 OK OK 26-09-2019 British Ruby 9333606 OK OK 24-04-2019 British Sapphire 9333618 OK 18-04-2014 British Trader 9238038 OK The approval is granted based on, amongst others, the GLE LNG Ship Approval Procedure.