February 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

SF Airlines, China's Leading Freight Airline, Retrofits Their Aircraft With

PRESS RELEASE 19 May 2020 Beijing SF Airlines, China’s leading freight airline, retrofits their aircraft with Thales/ACSS avionics to improve air traffic efficiency and capacity SF Airlines has selected Thales and ACSS as the exclusive equipment supplier for airborne ADS-B (Automatic Dependent Surveillance-Broadcast) equipment for its fleet to improve air traffic efficiency and capacity, in an active response to CAAC’s (Civil Aviation Administration of China) call for implementation of ADS-B technology. Thales and ACSS will provide ADS-B-compliant solutions for SF Airlines’ existing 59 aircraft and future optional aircraft, notably including replacement TCAS (Traffic Collision Avoidance System), TCAS directional antenna, and ATC (Air Traffic Control) transponders. SF Airlines © SF Airlines SF Airlines, which operates China’s largest cargo fleet, has chosen Thales and ACSS, an L3Harris Technologies and Thales joint venture, as the exclusive avionics suppliers to retrofit its fleet with ADS-B Out-compliant airborne equipment. This selection is an active response to CAAC’s (Civil Aviation Administration of China) promotion of ADS-B technology. ADS-B (Automatic Dependent Surveillance Broadcast) technology is aiming at vastly improving air traffic efficiency and capacity. It enables air traffic controllers to get much improved situational awareness thanks to the real-time aircraft information provided by their internal GPS, with more accuracy than with the usual radar. In view of these benefits, CAAC has listed ADS-B as one of the new technologies to be promoted for improving flight safety and operational efficiency as well as on- GROUP COMMUNICATIONS – Thales - Tour Carpe Diem - 31 Place des Corolles - 92098 Paris La Défense Cedex - France – Tel.: +33(0)1 57 77 86 26 - www.thalesgroup.com PRESS RELEASE 19 May 2020 Beijing time performance. -

Airline Name & Code Tên & Mã Các Hãng Hàng Không

HANLOG LOGISTICS TRADING CO.,LTD No. 4B, Lane 49, Group 21, Tran Cung Street Nghia Tan Ward, Cau Giay Dist, Hanoi, Vietnam Tel: +84 24 2244 6555 Hotline: + 84 913 004 899 Email: [email protected] Website: www.hanlog.vn AIRLINE NAME & CODE TÊN & MÃ CÁC HÃNG HÀNG KHÔNG SCAC CODE Tên hãng hàng không/ Airline Name SU AEROFLOT RUSSIAN AIRLINES AM AEROMEXICO VV AEROSVIT AIRLINES LD AHK AIR HONG KONG AK AIR ASIA D7 AIR ASIA X BX AIR BUSAN SB AIR CALEDONIE INTERNATIONAL AC AIR CANADA CA AIR CHINA INTERNATIONAL CORPORATION AF AIR FRANCE KJ AIR INCHEON AI AIR INDIA NQ AIR JAPAN NX AIR MACAU COMPANY LIMITED NZ AIR NEW ZEALAND EL AIR NIPPON CO.,LTD. PX AIR NIUGINI FJ AIR PACIFIC LIMITED AD AIR PARADISE TN AIR TAHITI NUI JW AIRASIA JAPAN CO.,LTD. RU AIRBRIDGE CARGO AIRLINES LLC AZ ALITALIA NH ALL NIPPON AIRWAYS CO.,LTD. HP AMERICA WEST AIRLINES AA AMERICAN AIRLINES,INC. 9N ANA & JP EXPRESS 8G ANGEL AIR AN ANSETT AUSTRALIA OZ ASIANA AIRLINES INC. 5Y ATLAS AIR INC. AO AUSTRALIAN AIRLINES OS AUSTRIAN AIRLINES AG PG BANGKOK AIRWAYS CO.,LTD. BG BIMAN BANGLADESH AIRLINES BA BRITISH AIRWAYS P.L.C. 8B BUSINESS AIR K6 CAMBODIA ANGKOR AIR 2G CARGOITALIA CV CARGOLUX AIRLINES INT'L S.A. C8 CARGOLUX ITALIA S.P.A. CX CATHAY PACIFIC AIRWAYS 5J CEBU PACIFIC AIR CI CHINA AIRLINES CK CHINA CARGO AIRLINES LTD. MU CHINA EASTERN AIRLINES WH CHINA NORTHWEST AIRLINES 8Y CHINA POSTAL AIRLINES LTD. CZ CHINA SOUTHERN AIRLINES SZ CHINA SOUTHWEST AIRLINES. CO CONTINENTAL AIRLINES,INC. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

World Air Transport Statistics, Media Kit Edition 2021

Since 1949 + WATSWorld Air Transport Statistics 2021 NOTICE DISCLAIMER. The information contained in this publication is subject to constant review in the light of changing government requirements and regulations. No subscriber or other reader should act on the basis of any such information without referring to applicable laws and regulations and/ or without taking appropriate professional advice. Although every effort has been made to ensure accuracy, the International Air Transport Associ- ation shall not be held responsible for any loss or damage caused by errors, omissions, misprints or misinterpretation of the contents hereof. Fur- thermore, the International Air Transport Asso- ciation expressly disclaims any and all liability to any person or entity, whether a purchaser of this publication or not, in respect of anything done or omitted, and the consequences of anything done or omitted, by any such person or entity in reliance on the contents of this publication. Opinions expressed in advertisements ap- pearing in this publication are the advertiser’s opinions and do not necessarily reflect those of IATA. The mention of specific companies or products in advertisement does not im- ply that they are endorsed or recommended by IATA in preference to others of a similar na- ture which are not mentioned or advertised. © International Air Transport Association. All Rights Reserved. No part of this publication may be reproduced, recast, reformatted or trans- mitted in any form by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval sys- tem, without the prior written permission from: Deputy Director General International Air Transport Association 33, Route de l’Aéroport 1215 Geneva 15 Airport Switzerland World Air Transport Statistics, Plus Edition 2021 ISBN 978-92-9264-350-8 © 2021 International Air Transport Association. -

Soaring to New Heights in the Greater Bay Area: Opportunities and Market Potentials for the Aviation Industry Content 1

Soaring to new heights in the Greater Bay Area: Opportunities and market potentials for the aviation industry Content 1. Strengths of the aviation industry in the Greater Bay Area 3 from a macro perspective 2. Optimise airport infrastructures to scale the development of the industry 5 3. Cultivate growth of related industries through marketisation of airlines 9 4. Achieve efficient allocation of aviation resources through a comprehensive 12 transportation system 5. Logistics capacity as a growth enabler for aviation leasing 14 Conclusion 17 Contact us 18 Soaring to new heights in the Greater Bay Area: Opportunities and market potentials for the aviation industry 2 1. Strengths of the aviation industry in the Greater Bay Area from a macro perspective Soaring to new heights in the Greater Bay Area: Opportunities and market potentials for the aviation industry 3 1. Strengths of the aviation industry in the GBA from a macro perspective In February 2019, the Central Committee of the The Greater Bay Area is a hub that integrates Communist Party of China and the State Council manufacturing, technology and financial services – officially published the “Outline Development Plan for incorporating the strategic positioning of the other three the Guangdong-Hong Kong-Macao Greater Bay Area”. global Bay Areas. The Guangdong province has been a It stated clearly the national-level strategic plan for major manufacturing cluster since China’s economic developing the Guangdong-Hong Kong-Macao Greater reform and opening-up, with Dongguan and Foshan Bay Area (hereinafter referred to as Greater Bay Area renowned for being the centre of world-class or GBA for short), with the aim to position it as one of manufacturing “world’s factory” in particular. -

EU Ramp Inspection Programme Annual Report 2018 - 2019

Ref. Ares(2021)636251 - 26/01/2021 Flight Standards Directorate Air Operations Department EU Ramp Inspection Programme Annual Report 2018 - 2019 Aggregated Information Report (01 January 2018 to 31 December 2019) Air Operations Department TE.GEN.00400-006 © European Union Aviation Safety Agency. All rights reserved. ISO9001 Certified. Proprietary document. Copies are not controlled. Confirm revision status through the EASA-Internet/Intranet. An agency of the European Union Page 1 of 119 EU Ramp Inspection Programme Annual Report 2018 - 2019 EU Ramp Inspection Programme Annual Report 2018 - 2019 Aggregated Information Report (01 January 2018 to 31 December 2019) Document ref. Status Date Contact name and address for enquiries: European Union Aviation Safety Agency Flight Standards Directorate Postfach 10 12 53 50452 Köln Germany [email protected] Information on EASA is available at: www.easa.europa.eu Report Distribution List: 1 European Commission, DG MOVE, E.4 2 EU Ramp Inspection Programme Participating States 3 EASA website Air Operations Department TE.GEN.00400-006 © European Union Aviation Safety Agency. All rights reserved. ISO9001 Certified. Proprietary document. Copies are not controlled. Confirm revision status through the EASA-Internet/Intranet. An agency of the European Union Page 2 of 119 EU Ramp Inspection Programme Annual Report 2018 - 2019 Table of Contents Executive summary ........................................................................................................................................... 5 1 Introduction -

CONNECT 2014 DA Solutions and Value

Flight Operations Today John Kinsman Director, Jeppesen Sales and Service Copyright © 2014 Jeppesen. All rights reserved. Reduce Optimize Increase Leverage Minimize Improve fuel crew airplane real-time disruption operator consumption utilization availability information impact efficiency Delivering Operational Efficiency Copyright © 2014 Jeppesen. All rights reserved. Reduce fuel Consumption ENROUTE DEPARTURE DESCENT PRE-FLIGHT POST- FLIGHT Copyright © 2014 Jeppesen. All rights reserved. Challenge: In 5 years, Fuel costs projected to increase 100% (hedge wind-down) Requested Boeing to identify fuel efficiency opportunities Majority savings in flight planning and flight operations: APU Policy Single engine taxi Airplane weight Arrival Fuels Cost Index Airplane loading CASE STUDY: Flight Planning – Airplanes Mixed (3 types) 100+airplanes Fuel Efficiency Assessment–Flight Planning Copyright © 2014 Jeppesen. All rights reserved. CASE STUDY: Flight Planning – Airplanes Mixed (3 types) 100+airplanes Fuel Efficiency Assessment–Flight Planning Copyright © 2014 Jeppesen. All rights reserved. Challenge: Internal fuel conservation effort Request to identify additional savings Solution: Found weight savings Modified pilot procedures & flight planning QANTAS CASE STUDY Fuel Efficiency Assessment Copyright © 2014 Jeppesen. All rights reserved. QANTAS CASE STUDY Fuel Efficiency Assessment Copyright © 2014 Jeppesen. All rights reserved. Copyright © 2014 Jeppesen. All rights reserved. Current Fuel Dashboard Results Current Customer Results (August 2014) 7.0% Max Identified 4.5% Average Savings 3.5% to 5.5% with Potential 95% confidence (% of Fuel) 2.8% Min Customer Results • 11 airlines • ~600 aircraft • ~485,000 flights Fleet Size • ~$7.7B fuel spend Significant potential identified; Customers typically achieve 1% to 3% Copyright © 2014 Jeppesen. All rights reserved. Savings Identified: CASE STUDY: Fleet size: Extra Large– Region: EMEA Wind Updates Copyright © 2014 Jeppesen. -

Company Profile ✈

2 CHINA SOUTHERN AIRLINES COMPANY LIMITED 2005 ANNUAL REPORT Company Profile ✈ China Southern Airlines Company Limited (the “Company”), together with its subsidiaries (collectively, the “Group”), is one of the largest airlines in the People’s Republic of China (“China” or “the PRC”). In 2005, the Group continued to rank first among all Chinese airlines in terms of volume of passenger traffic, number of scheduled flights per week, number of hours flown, number of routes and size of aircraft fleet. As of the year end of 2005, the Group operated 559 routes, of which 452 were domestic, 78 were international and 29 were Hong Kong and Macau. The Group operates the most extensive domestic route network among all Chinese airlines. In 2005, the Group operated an average of 8,436 landings and take-offs per week, serving 142 destinations. Its route network covers commercial centres or rapidly developing economic regions in Mainland China. The Group’s headquarters is located in Guangzhou, one of the gateway cities of China. Located in the rapidly developing Pearl River Delta region, Guangzhou is the transportation hub of southern China. In addition to its main route base in Guangzhou, the Group maintains certain regional route bases in Beijing, Zhengzhou, Wuhan, Changsha, Shenzhen, Shenyang, Changchun, Dalian, Harbin, Urumqi, Haikou, Zhuhai, Xiamen, Fuzhou, Guilin, Shantou, Guiyang, Sanya and Beihai. Most of its regional route bases are located in provincial capitals or major commercial centres in the PRC. The Group operates a portion of its air transportation business through its subsidiaries, namely Xiamen Airlines Company Limited (“Xiamen Airlines”), Southern Airlines (Group) Shantou Airlines Company Limited, Guangxi Airlines Company Limited (“Guangxi Airlines”), Zhuhai Airlines Company Limited and Guizhou Airlines Company Limited (collectively, the “Airline Subsidiaries”). -

December, 2006

CoverINT 11/22/06 3:08 PM Page 1 WWW.AIRCARGOWORLD.COM DECEMBER 2006 INTERNATIONAL EDITION Review/Outlook Staged for Expansion 2006/2007 Latin America • Security • Air France-KLM Project1 10/10/06 11:54 AM Page 1 ALITALIA WITH A NEW DEDICATED FLEET AND 30 WEEKLY DIRECT FLIGHTS TO CHINA, CARGO. INDIA, NORTH AMERICA AND AFRICA WE TAKE CARE OF YOUR AIR SHIPMENTS: THE WORLD THEY WILL ARRIVE AT DESTINATION MOVES FASTER AND MORE EFFICIENTLY. WITH US. LET YOUR CARGO MOVE WITH US. OUR NEW SCHEDULE OF DIRECT FLIGHTS WILL IMPROVE THE TIMING OF YOUR AIR SHIPMENTS. FOR FURTHER INFORMATION: LOCAL CUSTOMER SERVICE, WWW.ALITALIACARGO.COM 01TOCINT 11/22/06 2:52 PM Page 1 INTERNATIONAL EDITION December 2006 CONTENTS Volume 9, Number 10 COLUMNS 10 North America 2006 In The TSA extended its com- pliance deadlines for portions of Review the cargo security rule and the The air cargo industry industry is grateful, if still con- had a far better year in 2006 fused on what’s expected of it than it did the previous year and 2007 is expected to be even better. 14 Europe The Air France-KLM partner- ship is on track, but the cargo- carrying couple continues to fret over market share 16 Pacific Airlines are looking for joint ventures to tap into China’s lu- crative cargo market but finding 22 the right partner is not easy Slowing the Fleet Latin America may not be the next great air cargo DEPARTMENTS market, but air carriers’ slow growth approach seems to 2 Edit Note work for now. -

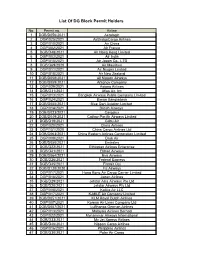

List of DG Block Permit Holders

List Of DG Block Permit Holders No. Permit no. Airline 1 DGB/D056/2021 Aerologic 2 DGP/025/2021 AirBridgeCargo Airlines 3 DGP/010/2021 Air China 4 DGP/002/2021 Air France 5 DGB/D48/2021 Air Hong Kong Limited 6 DGP/003/2021 Air India 7 DGP/015/2021 Air Japan Co., LTD 8 DGB/D69/2020 Air Mauritius 9 DGP/011/2021 Air Niugini Limited 10 DGP/018/2021 Air New Zealand 11 DGB/D058/2021 All Nippon Airways 12 DGB/D059/2021 Antonov Company 13 DGP/029/2021 Asiana Airlines 14 DGB/D31/2021 Atlas Air, Inc 15 DGP/013/2021 Bangkok Airways Public Company Limited 16 DGP/024/2021 Biman Bangladesh 17 DGB/D055/2021 Blue Dart Aviation Limited 18 DGP/014/2021 British Airways 19 DGB/D023/2021 Cargolux 20 DGB/D049/2021 Cathay Pacific Airways Limited 21 DGB/D19/2021 Cebu Air 22 DGP/020/2021 China Airlines 23 DGP/151/2020 China Cargo Airlines Ltd 24 DGB/D063/2021 China Eastern Airlines Corporation Limited 25 DGP/009/2021 Druk Air 26 DGB/D050/2021 Emirates 27 DGB/D22/2021 Ethiopian Airlines Enterprise 28 DGB/D41/2021 Etihad Airways 29 DGB/D064/2021 Eva Airways 30 DGB/D26/2021 Federal Express 31 DGB/D45/2021 Finnair Oyj 32 DGB/D120/2020 Fiji Airways 33 DGP/017/2021 Hong Kong Air Cargo Carrier Limited 34 DGP/016/2021 Japan Airlines 35 DGB/D29/2021 Jetstar Asia Airways Pte Ltd 36 DGB/D20/2021 Jetstar Airways Pty Ltd 37 DGP/008/2021 Kalitta Air LLC 38 DGP/017/2021 K-MILE Air Company Limited 39 DGB/D051/2021 KLM Royal Dutch Airlines 40 DGP/007/2021 Korean Air Lines Company Ltd 41 DGB/D057/2021 Lufthansa German Airlines 42 DGP/013/2021 Malaysia Airlines Berhad 43 DGP/022/2021 Mynammar Airways International 44 DGB/D33/2021 My Jet Xpress Airlines 45 DGB/D46/2021 Nippon Cargo Airlines 46 DGP/016/2021 Philippine Airlines 47 DGB/D30/2021 Polar Air Cargo No. -

Western-Built Jet and Turboprop Airliners

WORLD AIRLINER CENSUS Data compiled from Flightglobal ACAS database flightglobal.com/acas EXPLANATORY NOTES The data in this census covers all commercial jet- and requirements, put into storage, and so on, and when airliners that have been temporarily removed from an turboprop-powered transport aircraft in service or on flying hours for three consecutive months are reported airline’s fleet and returned to the state may not be firm order with the world’s airlines, excluding aircraft as zero. shown as being with the airline for which they operate. that carry fewer than 14 passengers, or the equivalent The exception is where the aircraft is undergoing Russian aircraft tend to spend a long time parked in cargo. maintenance, where it will remain classified as active. before being permanently retired – much longer than The tables are in two sections, both of which have Aircraft awaiting a conversion will be shown as parked. equivalent Western aircraft – so it can be difficult to been compiled by Flightglobal ACAS research officer The region is dictated by operator base and does not establish the exact status of the “available fleet” John Wilding using Flightglobal’s ACAS database. necessarily indicate the area of operation. Options and (parked aircraft that could be returned to operation). Section one records the fleets of the Western-built letters of intent (where a firm contract has not been For more information on airliner types see our two- airliners, and the second section records the fleets of signed) are not included. Orders by, and aircraft with, part World Airliners Directory (Flight International, 27 Russian/CIS-built types.