Cleary Gottlieb's German M&A Report 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Templeton Eafe Developed Markets Fund

TEMPLETON EAFE As at September 30, 2020 DEVELOPED MARKETS FUND Summary of Investment Portfolio REGIONAL WEIGHTINGS (%)* ASSET CLASS WEIGHTINGS (%) Europe 49.97 Common Stocks 91.84 Asia 41.87 Short-term securities and all other assets, net 8.16 INDUSTRY WEIGHTINGS (%)* TOP 25 HOLDINGS (%) Pharmaceuticals 10.94 Cash and cash equivalents** 5.79 Electronic Equipment, Instruments & Components 5.49 Deutsche Telekom AG 3.39 Multi-Utilities 5.30 Takeda Pharmaceutical Co. Ltd. 3.11 Real Estate Management & Development 5.05 E.ON SE 2.95 Chemicals 4.71 Hitachi Ltd. 2.93 Food & Staples Retailing 4.23 Fresenius Medical Care AG & Co. KGaA 2.83 Banks 4.18 BAE Systems PLC 2.80 Automobiles 4.09 AIA Group Ltd. 2.72 Semiconductors & Semiconductor Equipment 3.99 Bayer AG 2.63 Diversified Telecommunication Services 3.47 Kyocera Corp. 2.55 Oil, Gas & Consumable Fuels 2.96 Sumitomo Metal Mining Co. Ltd. 2.48 Health Care Providers & Services 2.83 Honda Motor Co. Ltd. 2.41 Aerospace & Defense 2.80 Sony Corp. 2.37 Textiles, Apparel & Luxury Goods 2.74 Covestro AG 2.36 Insurance 2.72 NXP Semiconductors NV 2.36 Machinery 2.60 Veolia Environnement SA 2.35 Metals & Mining 2.48 Matsumotokiyoshi Holdings Co. Ltd. 2.22 Wireless Telecommunication Services 2.44 Komatsu Ltd. 2.18 Industrial Conglomerates 2.38 Mitsui Fudosan Co. Ltd. 2.13 Household Durables 2.37 Roche Holding AG 2.08 Electrical Equipment 1.80 Sanofi 2.05 Construction & Engineering 1.59 Seven & i Holdings Co. Ltd. 2.01 Construction Materials 1.57 Sumitomo Mitsui Financial Group Inc. -

Eurozone 120, Euronext Vigeo US 50, Euronext Vigeo France 20, Euronext Vigeo United Kingdom 20 and Euronext Vigeo Benelux 20, Will Be Updated Every Six Months

Vigeo Eiris’ indices are composed of the highest-ranking listed companies as evaluated by the agency in terms of their performance in corporate responsibility. This range of indices: Euronext Vigeo World 120, Euronext Vigeo Europe 120, Euronext Vigeo Eurozone 120, Euronext Vigeo US 50, Euronext Vigeo France 20, Euronext Vigeo United Kingdom 20 and Euronext Vigeo Benelux 20, will be updated every six months. Constituent selection is based on data from the Equitics® methodology, developed by Vigeo. Selected companies have achieved the highest ratings in their reference universe. INDEX FEATURES Number of Constituents 120 Index Type Price Index Eligible Stock All the companies included in the related Vigeo Euronext Universe The weighting of each component at the review date reflects the Equitics® score of the Weighting company divided by the total sum of the scores of all components Review Semi-Annually ( June and December) New constituents – November 2016 Eurozone 120: the 4 most A2A Electric & Gas Utilities ABN-AMRO Hldg Diversified Banks represented sectors Carrefour Supermarkets Covestro AG Chemicals Enagas Electric & Gas Utilities 13% Fortum Electric & Gas Utilities Electric & Gas Utilities Groupe Casino Supermarkets 9% Chemicals HEIDELBERG CEMENT AG Building Materials Jerónimo Martins Supermarkets Diversified Publicis Groupe Broadcasting & Advertising 9% Banks Snam Electric & Gas Utilities Insurance 5% WARTSILA Industrial Goods & Services Other Information on performance Average overall score 55/100 Lowest global score 46/100 Highest -

Euro Stoxx® International Exposure Index

EURO STOXX® INTERNATIONAL EXPOSURE INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 6.02 LVMH MOET HENNESSY Consumer Products & Services France 4.99 LINDE Chemicals Germany 3.79 SAP Technology Germany 3.62 SANOFI Health Care France 3.20 IBERDROLA Utilities Spain 3.04 SIEMENS Industrial Goods & Services Germany 2.63 AIR LIQUIDE Chemicals France 2.17 SCHNEIDER ELECTRIC Industrial Goods & Services France 2.10 L'OREAL Consumer Products & Services France 2.05 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.99 BASF Chemicals Germany 1.89 ADIDAS Consumer Products & Services Germany 1.76 AIRBUS Industrial Goods & Services France 1.68 DAIMLER Automobiles & Parts Germany 1.65 BAYER Health Care Germany 1.61 PHILIPS Health Care Netherlands 1.51 ADYEN Industrial Goods & Services Netherlands 1.49 ESSILORLUXOTTICA Health Care France 1.40 DEUTSCHE TELEKOM Telecommunications Germany 1.36 INFINEON TECHNOLOGIES Technology Germany 1.35 Kering Retail France 1.35 BCO SANTANDER Banks Spain 1.29 SAFRAN Industrial Goods & Services France 1.26 HERMES INTERNATIONAL Consumer Products & Services France 1.10 PERNOD RICARD Food, Beverage & Tobacco France 1.09 CRH Construction & Materials Ireland 1.09 DEUTSCHE POST Industrial Goods & Services Germany 1.05 BCO BILBAO VIZCAYA ARGENTARIA Banks Spain 1.03 FLUTTER ENTERTAINMENT Travel & Leisure Ireland 1.02 DANONE Food, Beverage & Tobacco France 1.00 MUENCHENER RUECK Insurance Germany 0.99 VOLKSWAGEN PREF Automobiles & Parts Germany 0.82 BMW Automobiles & Parts Germany 0.80 -

Bayer AG Financial Statements 2015 2 Bayer AG Financial Statements 2015 Contents

Bayer AG Financial Statements 2015 2 Bayer AG Financial Statements 2015 Contents The management report of Bayer AG is combined with the management report of the Bayer Group. The Combined Management Report is published in Bayer’s Annual Report for 2015. The financial statements and the Combined Management Report of the Bayer Group and Bayer AG for fiscal 2015 have been submitted to the operator of the electronic Federal Gazette in Germany and are accessible via the Company Register website. Contents FINANCIAL STATEMENTS Income Statements 3 Statements of Financial Position 4 Notes to the Financial Statements 5 Accounting Policies 5 Recognition and Valuation Principles 5 Notes to the Income Statements 8 Notes to the Statements of Financial Position 13 Other Information 25 PROPOSAL FOR THE USE OF THE DISTRIBUTABLE PROFIT 47 RESPONSIBILITY STATEMENT 47 AUDITOR’S REPORT 48 FURTHER INFORMATION Governance Bodies 49 Financial Calendar, Masthead, Disclaimer 52 Bayer AG Financial Statements 2015 3 Income Statements Income Statements Note 2014 2015 € million € million Income from investments in affiliated companies – net [1] 3,213 2,444 Interest expense – net [2] (341) (484) Other financial income – net [3] 129 409 Other operating income [4] 128 99 General administration expenses (272) (324) Other operating expenses [5] (147) (177) Income before income taxes 2,710 1,967 Income taxes [6] (256) (606) Net income 2,454 1,361 Allocation to other retained earnings / Withdrawal from other retained earnings (593) 706 Distributable profit 1,861 2,067 4 Bayer -

2019 Spring Attendee List

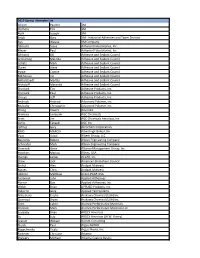

2019 Spring Attendee List Allison Pauline 3M Clemens Tim 3M Koch Joseph 3M Selph Gary 3M - Industrial Adhesives and Tapes Division Fan Wayne 3M Company Albrecht Steve Adherent Laboratories, Inc. Meyer Paul Adherent Laboratories, Inc. Allmond Bill Adhesive and Sealant Council Armstrong Malinda Adhesive and Sealant Council Collatz Mark Adhesive and Sealant Council Duren Steve Adhesive and Sealant Council Howe Connie Adhesive and Sealant Council Mikharava Val Adhesive and Sealant Council Mittelstaedt Martha Adhesive and Sealant Council Nickoloff Myranda Adhesive and Sealant Council Shattuck Tim Adhesive Products, Inc. Shattuck Paul Adhesive Products, Inc. Vinuya Jeff Adhesive Products, Inc. Andrade Andrew Advanced Polymer, Inc. Mulcahy Christopher Advanced Polymer, Inc. Zhang Xiawei AdvanSix Nomuva Sadayuki AGC Chemicals Scott Jim AGC Chemicals Americas, Inc. Ushio Takaaki AGC Inc. Jeffries Gary Akrochem Corporation KING MARCIA Alberdingk Boley USA Vyas Ujjval Alberti Group, LLC Reynolds Robert Albion Engineering Company Schneider Mark Albion Engineering Company Slowinski Gene Alliance Management Group, Inc. Hutchins Marcus Allnex, USA Owings Lamar ALVAR, Inc. Shaw Jack American Blockchain Council Erchul Alex Andpak Midwest Mayes Chris Andpak Midwest Jobbins Matthew Anton PAAR USA Feriancek John Applied Adhesives Horner Dan Applied Adhesives, Inc. Webb Brian APPLIED Products, Inc. Osborne Greg Applied Test Systems Natushara Eisuke Arakawa Chemical (USA) Inc. Quenaud Bryan Arakawa Chemical (USA) Inc. Shen Calvin Aramco Performance Materials Chesson Mark Aramco Performance Materials LLC Suddaby Brian ARDEX Americas Lu Lida ARDEX Americas (W.W. Henry) Arendt William Arendt Consulting Niznik Paul Argus DeWitt Rogachevsky Vitaly Argus Media, Inc. Fortener Christine Arkema Drewery Michael Arkema Coating Resins Dumain Eric Arkema Coating Resins Mattern David Arkema Coating Resins Miner Rick Arkema Coating Resins Shulack Pat Arkema Coating Resins Yocca Kevin Arkema Coating Resins Donnelly Zuzanna Arkema Inc. -

Supervisory Board of Siemens Energy AG

Supervisory Board of Siemens Energy AG siemens-energy.com Siemens Energy AG’s fiscal year 2020 was largely dominated by its spin-off from Siemens AG, which was completed with Siemens Energy AG’s listing. The company has thus achieved key milestones and is now independent. Siemens Energy’s first Annual Shareholders’ Meeting (AGM) will be held on February 10, 2021. We look forward to engaging with you at this Shareholders’ Meeting, which will be conducted as a virtual event due to the coronavirus pandemic. The meeting’s agenda contains important items that you are asked to vote on. Among other things, they include the appointment of the independent auditor, say-on-pay and in particular the election of the shareholder representatives on the Supervisory Board, who will represent your interests as part of their duties to oversee and advise the company. A lot of information on these subjects is already available, for example in the Annual Report or in the Notice of Annual Shareholders’ Meeting published in the German Federal Gazette (Bundesanzeiger) on December 15, 2020. For the first time, you have the opportunity to elect the Supervisory Board of the newly listed Siemens Energy. That is one of the core items on the agenda. We are, therefore, seeking dialogue with you in order to duly clarify key matters at the Annual Shareholders’ Meeting and, if necessary, deal with issues you feel to be important in greater depth. That is also important for us because interactive dialogue is restricted due to the fact that the Annual Shareholders’ Meeting is being held as a virtual event. -

180706 AR DAX 30 Event Presentation Engl FINAL

DAX 30 supervisory board study 2018 Selected results July 2018 Jens-Thomas Pietralla & Dr. Thomas Tomkos Board & CEO Practice Private and Confidential The following assessment and evaluation is based on publicly available biographical data *) on supervisory board members of DAX 30 and MDAX companies. Obviously, the effectiveness of supervisory boards also depends on the board culture, the personalities of their members and their constructive dialogue. *) Data sources: bioGraphies made available by companies, invitations to annual meetings, annual reports, voting results from annual meetings; additional externally available bioGraphical data where necessary Private and Confidential 2 Preview... § As expected, the ”super election year 2018” has resulted in siGnificant chanGes: 89 seats were up for election, of which 42 were filled by new candidates § EiGht new diGital directors add critical expertise to the DAX 30 boards. As of 2018 more than half of the companies can rely on this experience § For the first time the share of women amonG shareholder representatives in DAX 30 exceeds 30% § Equivalent representation of women in chairperson and committee positions is still laGGinG behind § While the number of foreiGn board members in DAX 30 declined sliGhtly, the companies are able to attract experienced female board members, especially from the anglophone world § The cross-linkage of “Germany Inc.” is shifting: there are less supervisory board members with more than one DAX 30 mandate; however, several current DAX 30 executive board members take on DAX 30 supervisory board sets for the first time § The average grade of all DAX 30 supervisory boards according to the German school grading system improves aGain: from 2.3 to 2.2 § Lufthansa, Daimler, Bayer and MunichRe lead the rankinG in 2018. -

Base Prospectus Dated May 12, 2021

Base Prospectus Dated May 12, 2021 This document constitutes three base prospectuses for the purpose of article 8(1) of Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017 (as amended, the Prospectus Regulation): (i) the base prospectus of Continental Aktiengesellschaft in respect of non-equity securities within the meaning of article 2(c) of the Prospectus Regulation (Non-Equity Securities), (ii) the base prospectus of Conti-Gummi Finance B.V. in respect of Non-Equity Securities and (iii) the base prospectus of Continental Rubber of America, Corp. in respect of Non-Equity Securities (together, the Prospectus). Continental Aktiengesellschaft (Hanover, Federal Republic of Germany) as Issuer and, in respect of Notes issued by Conti-Gummi Finance B.V. and Continental Rubber of America, Corp., as Guarantor Conti-Gummi Finance B.V. (Maastricht, The Netherlands) as Issuer Continental Rubber of America, Corp. (Wilmington, Delaware, United States of America) as Issuer EUR 7,500,000,000 Debt Issuance Programme (the Programme) This Prospectus has been approved by the Luxembourg Commission de Surveillance du Secteur Financier (the CSSF) as competent authority under the Prospectus Regulation. The CSSF only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of any of the Issuers or the Guarantor or of the quality of the notes issued under the Programme (the Notes) that are the subject of this Prospectus. Investors should make their own assessment as to the suitability of investing in the Notes. -

Press Release

Press Release Leverkusen, Bayer Pearl Polyurethane Systems LLC at the 8th Annual Fire Safety Forum in April 10, 2018 Dubai Covestro AG High performance polyurethane systems from Communications Covestro ensure energy-efficient and safe buildings 51365 Leverkusen Germany In recent years, some fires in Dubai’s prominent high-rise buildings were gaining Contact worldwide media attention and have resulted in local authorities tightening the Dr. Frank Rothbarth “United Arab Emirates (UAE) Fire and Life Safety Code” – not only for high-rise Telephone structures, but also for other types of buildings. +49 214 6009-2536 Email frank.rothbarth Bayer Pearl, Covestro’s polyurethane systems house Joint Venture in Dubai, is @covestro.com fully supporting the newly published UAE Fire and Life Safety Code and the regulations for sandwich panels in pre-engineered buildings like factories, warehouses and single- or double-story office buildings. The new regulation demands the use of products fulfilling highest fire safety standards. Raising awareness for a better protection of citizens was the aim of the 8th Annual Fire Safety Forum, held recently at Dubai, United Arab Emirates. Bayer Pearl attended the Forum and attracted much interest with their latest generation of polyisocyanurate (PIR) systems. Sandwich panels with superior fire safety These PIR systems are particularly suitable for use in sandwich panels for pre- engineered buildings, as their flame-retardant properties are superior to those of formerly used polyurethane systems. Thus it is with good reason that they achieve good fire ratings, such as the FM approval. “Our PIR systems contribute significantly to achieving the ambitious energy saving targets of the United Arab Emirates,” says Wissam Khaddaj, Head of Marketing at Bayer Pearl. -

M&A Telegram 2020

Frankfurt am Main, December 15, 2020 M&A Telegram 2020 — +++ Corona and a strong second half of the year. Following a brief Corona-related lull, the second half of the year was full of action. The first move was the agreed acquisition of the US cancer specialist Varian by Siemens Healthineers for approx. USD 16.4 billion. GlobalWafers plans to acquire its competitor Siltronic for approx. EUR 3.75 billion. K+S succeeds in transferring the salt business in the Americas to a consortium around Stone Canyon for approx. USD 3.2 billion. Bertelsmann acquires the US publisher Simon & Schuster from Viacom CBS for approx. USD 2.175 billion. Traton is also acquiring the rest of Navistar for a further approx. USD 3.7 billion. Deutsche Börse secures an 80% stake in ISS, the shareholder advisor valued at approx. USD 2.275 billion. Covestro acquires the RFM business from Royal DSM for approx. EUR 1.6 billion. For a reported purchase price of approx. EUR 1 billion, Oetker is supplementing its beverages division with the delivery service Flaschenpost, and Bayer is investing up to USD 4 billion in gene therapy with the acquisition of Asklepios BioPharmaceutical. +++ +++ Financial investors with high market share. The acquisition of the Thyssenkrupp elevator division by a consortium around Advent and Cinven represents one of the largest European PE deals in recent years with a transaction volume of approx. EUR 17.2 billion. Its financing was possible despite Corona. Prior to the outbreak of the pandemic, EQT and the Omers Pension Fund secured Deutsche Glasfaser from KKR and Reggeborgh for approx. -

Download Social Media Radar Here!

Social Media Radar Social Media Radar. Life-Science-Industry. Healthcare. Namics. A Merkle Company 1 Social Media Radar Social Media. Life Science. Healthcare Marketing. Success. Digital Communication. Ranking. Twitter. Facebook. Instagram. YouTube. Likes. Shares. Tweets. Assets. KPI. Tools. Analysis. Namics. A Merkle Company 2 Social Media Radar Table of Contents 4 Methodology – About the Social Media Radar 8 Management summary – The life-science-industry in the social web 10 In detail: Facebook – Emotions on Facebook are inevitable 11 Ranking Facebook 12 Lessons learned 14 In detail: Twitter – The most relevant channel of the life-science-industry 15 Ranking Twitter 16 Lessons learned 18 In detail: Instagram – Need for action on the blogger-platform 19 Ranking Instagram 20 Lessons learned 22 In detail: YouTube – No video, no social-media-strategy 23 Ranking YouTube 24 Lessons learned 26 Conclusion – Social media offers a big potential for life-science-brands 28 Glossary 29 References 32 Contact 3 Social Media Radar Methodology About the Social Media Radar The Social Medie Radar by Namics analyzes the top-selling companies in the pharmaceutical-, chemistry- and medical technology industry with head offices located in Germany. The channels Facebook, Twitter, Instagram and YouTube are the focus of the analysis. Their popularity and the use for a broad customer communication in a natural scientific environment were crucial factors for the choice of these mediums. In addition, the visibility of the individual companies on the social web between May 1st, 2017 and April 30th, 2018 was a deciding criterion for the inclusion into the study. Primarily german company profiles were considered; if those were not available, the international profile was accessed. -

Covestro Receives Sustainability Award from Henkel

Press Release Leverkusen, Third award since 2013 November 7, 2018 Covestro receives Sustainability Award from Covestro AG Henkel Communications 51365 Leverkusen Germany Continued commitment to more sustainable adhesive solutions Contact For the third time, Covestro received a Sustainability Award from Henkel Dr. Frank Rothbarth Adhesive Technologies. With this prize, the adhesive manufacturer Telephone +49 214 6009 2536 acknowledges its supplier's ongoing commitment to a sustainable product and E-mail process pipeline. Particular focus was placed on the cooperation in the frank.rothbarth development of biobased polyurethane raw materials and concepts to increase @covestro.com product safety, as well as the very good rating of Covestro's sustainability by the international rating agency EcoVadis. "We are happy to receive this award once again. This is a recognition of our efforts at Covestro in driving sustainability as one of our core strategic pillars," said Michael Hellemann, Senior Vice President, Commercial Operations EMEA/LATAM in the Coatings, Adhesives, Specialties segment at Covestro. "The award underscores our commitment as a company caring for the environment and for social responsibility." Covestro develops biobased adhesive and coating hardeners such as Desmodur® eco N, furthermore the new ultra series of curing agents with low content of free isocyanate monomers. Every year, Henkel Adhesive Technologies honors strategic partners who offer first-class service in terms of overall supplier performance, innovation and sustainability – for the sixth time this year. Close cooperation with strategic suppliers is an important success factor for this division in order to further expand its innovation and technology leadership. 01/02 covestro.com Press release About Covestro: With 2017 sales of EUR 14.1 billion, Covestro is among the world’s largest polymer companies.