An Empirical Analysis of the Turkish Private Airline Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Athe TURKISH CIVIL Register TC-.Pdf

TURKISH CIVIL REGISTER TC- This register is un-official introduction to the register click on address below http://www.ole-nikolajsen.com/TURKISH%20FORCES%202004/civil%20reg%20intro.pdf Interested in seing the pictures of all those aircraft? click below: http://www.ole-nikolajsen.com/TURKISH%20FORCES%202004/civil%20acft%20fotos.htm * Indicate that a picture of the aircraft is available in the PICTURE ALBUM (frame above) BOLD PRINT = indicate that aircraft was believed to be current at the update date *Yellow highlight = new green highlight = update REGISTER updated 1.SEPTEMBER 2021 The Turkish civil aviation LAW ON 26. June 2016 prescribes the following rules for the register. MADDE 4- (Değişik: 26/06/2016 - 52217814-010.07.01/E.389) Türk sivil hava araçları için tescil işareti harf kombinasyonlarından oluşur. Tescil işareti ulusal işaretten sonra hava aracı sınıflarına göre, ; b) Çok Hafif Hava Aracı (Sabit Kanat): Motor teçhizatına sahip, azami kalkış ağırlığı 750 kg ve altında olan sabit kanatlı hava araçlarını,sabit kanatlı çok hafif hava araçları için U, döner kanatlı hava araçları ve döner kanatlı çok hafif hava araçları azami kalkış ağırlığı 600 kg için U. Döner kanatlı hava araçları H, zirai amaçlı hava araçları için Z ve planörler için P harfi ile başlayan üçlü harf kombinasyonları seçilmelidir. (4) (amended: 26/6/2016-52217814-010.07.01/E. 389) Turkish registered civil aircraft carry letter combinations containing a 5 letter combination: After the national mark TC- a category letter according to the class; Balloons B-. Very light Aircraft (Fixed Wing) with an engine and maximum takeoff weight of less than 750kg and very light Rotary wing aircraft of MTOW of less than 600kg U-. -

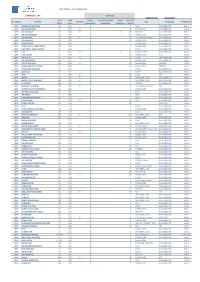

UPDATED ON: 18-03-2019 STATION AIRLINE IATA CODE AWB Prefix ON-LINE CARGO HANDLING FREIGHTER RAMP HANDLING RAMP LINEHAUL IMPORT

WFS CARGO - CUSTOMERS LIST DENMARK - CPH SERVICES UPDATED ON: 18-03-2019 IATA AWB CARGO FREIGHTER RAMP RAMP IMPORT STATION AIRLINE ON-LINE GSA TRUCKING TERMINAL CODE Prefix HANDLING HANDLING LINEHAUL EXPORT CPH AMERICAN AIRLINES AA 001 X E NAL WALLENBORN HAL 1 CPH DELTA AIRLINES DL 006 X X I/E PROACTIVE WALLENBORN HAL1 CPH AIR CANADA AC 014 X X X I/E HWF DK WALLENBORN HAL 1 CPH UNITED AIRLINES UA 016 X I/E NORDIC GSA WALLENBORN HAL1 CPH LUFTHANSA LH 020 X X I/E LUFTHANSA CARGO WALLENBORN HAL1 CPH US AIRWAYS US 037 X I/E NORDIC GSA WALLENBORN HAL1 CPH DRAGON AIR XH 043 X I NORDIC GSA WALLENBORN HAL1 CPH AEROLINEAS ARGENTINAS AR 044 X E CARGOCARE WALLENBORN HAL1 CPH LAN CHILE - LINEA AEREA LA 045 X E KALES WALLENBORN HAL1 CPH TAP TP 047 X X x I/E SCANPARTNER WALLENBORN HAL1 CPH AER LINGUS EI 053 X I/E NORDIC GSA N/A HAL1 CPH AIR France AF 057 X X I/E KL/AF KIM JOHANSEN HAL2 CPH AIR SEYCHELLES HM 061 X E NORDIC GSA WALLENBORN HAL1 CPH CZECH AIRLINES OK 064 X X I/E AviationPlus VARIOUS HAL1 CPH SAUDI AIRLINES CARGO SV 065 X I/E AviationPlus VARIOUS HAL1 CPH ETHIOPIAN AIRLINES ET 071 X E KALES WALLENBORN HAL1 CPH GULF AIR GF 072 X E KALES WALLENBORN HAL1 CPH KLM KL 074 X X I/E KL/AF JDR HAL2 CPH IBERIA IB 075 X X I/E UNIVERSAL GSA WALLENBORN HAL1 CPH MIDDLE EAST AIRLINES ME 076 X X E UNIVERSAL GSA WALLENBORN HAL1 CPH EGYPTAIR MS 077 X E HWF DK WALLENBORN HAL1 CPH BRUSSELS AIRLINES SN 020 X X I/E LUFTHANSA CARGO JDR HAL1 CPH SOUTH AFRICAN AIRWAYS SA 083 X E CARGOCARE WALLENBORN HAL1 CPH AIR NEW ZEALAND NZ 086 X E KALES WALLENBORN HAL1 CPH AIR -

Turkey Business Guide

Turkey Business Guide Compiled by: Swiss Business Hub Turkey Istanbul, August 2018 ARRIVAL AND DEPARTURE Ordinary and official passport holders are exempted from visa for their travels up to 90 days. Visa is only valid when the purpose of travel is tourism or commerce. For other purposes, such as work and study, visas are given by Turkish Embassies or Consulates. To learn more about visa procedures, please visit www.mfa.gov.tr and contact the nearest Turkish Embassy or Consulate. For information about the customs’ regulations on entry and exit, please visit www.gtb.gov.tr. You can also refer to the Embassy web page to get information on various topics (www.eda.admin.ch/ankara). LANGUAGES USED FOR BUSINESS The official language is Turkish. In business, English is the preferred language for communication. In tourism, German and Russian are most commonly spoken foreign languages which are followed by French, Italian and Arabic. Translators are available at a cost from business service provider companies. Switzerland Global Enterprise – Business Guide 1/11 PUBLIC HOLIDAYS January 1 New Year holiday April 23 National Sovereignty and Children's Day May 19 Commemoration of Atatürk and Youth & Sports Day July 15 Democracy and National Unity Day August 30 Victory Day October 29 Republic Day Religious Holidays The dates of the religious festivals change according to the Muslim lunar calendar and thus occur 10 days earlier each year. − Ramadan or Seker Bayrami (the Festival of Fast-Breaking): 3-day festival. − Kurban Bayrami (the Festival of Sacrifice): 4-day festival. HEALTH AND INOCULATIONS Turkey does not pose any unusual health risks. -

Official Monthly Bulletin of AACO

Issue 90 - Sep 2014 Official Monthly Bulletin of AACO Arab world marks a decrease of 6% AVIATION WITHIN THE ARAB WORLD GLOBAL ARAB AVIATION in July 2014 in international passenger numbers - p. 6 GROWTH p: 10 SPREADING OUT p: 22 PARTNER AIRLINES p: 42 - 53 INDUSTRY PARTNERS p: 54 - 79 AACO members put into service 20 ARAB AIRLINES ECONOMICS p: 11 COLLABORATION p: 30 new aircraft in July 2014 copared to AACO & RTC CALENDARS p: 80 - 83 April 2014 - p. 14 EXPANSION p: 12 ENVIRONMENT p: 30 LAURELS p: 15 REGULATORY TONE p: 31 AACO MEMBERS & PARTNERS p: 84 - 87 IATA World Air Transport Statistics re- TECHNOLOGY & E-COMMERCE p: 15 AN AVIATION MARKET leased - p. 36 IN FOCUS: TURKEY p: 34 MRO p: 16 WORLD NEWS p: 36 ARAB AIRPORTS p: 16 ATM p: 19 Daily news on www.aaco.org Issue 90 - Sep 2014 AACO airlines have put into ser- announced plans for expansion with world regions (more details on vice 20 new aircraft between page 23). April and July 2014 and parked 40 old ones during the same period. Airports in the region have shown positive results in July; Queen Alia Recently, Emirates has agreed on International Airport registered a 5.6% increase in passenger num- a USD 425 million loan for 2 A380 bers, Muscat International Airport witnessed an increase of 7.5% dur- jets, Iraqi Airways DG announced ing the first half of 2014, noting that a world first air traffic monitoring that the airline is expecting to system, developed by Spanish firm Indra, has been installed in Oman receive 16 Boeing aircraft in 2015, to oversee aircraft in the skies above Muscat and Salalah. -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

Export Clients +358 10 323 3351

Open 24/7 Rahtitie 1 01530 Vantaa [email protected] Export Clients +358 10 323 3351 Air Canada AC 014- Air Astana KC 465- United Airlines UA 016- Astral Aviation 8V 485- Juneyao Airlines HO 018- Silk Way West Airlines ZP 501- LH Lufthansa LH 020- Royal Jordanian RJ 512- Fedex FX 023- Ukraine International Airlines PS 566- Cathay Pacific XH 043- Air Moldova 9U 572- LAN Cargo LA 045- Allied Air 4W 574- Saudi Arabian Airlines SV 065- Sky Lease Cargo KYE 576- Ethiopean Airilnes ET 071- AirBridge Cargo Airlines RU 580- Middle East Airlines ME 076- Jet Airways 9W 589- Egypt Air MS 077- SriLankan Airlines UL 603- Brussels Airlines SN 082- Etihad Cargo EY 607- Air New Zeland NZ 086- Atlas Global KK 610- Tibet Airlines TV 088- Singapore Airlines SQ 618- Iran Air IR 096- Yemenia Cargo IY 635- Air India AI 098- Air Malta KM 643- Caribbean Airlines BW 106- Demavia EO 663- China Cargo Airlines CK 112- C.A.L Cargo Airlines 5C 700- TAAG Angola airlines DT 118- MNG Airlines MB 716- Air Algerie AH 124- Avianca AV 729- Garuda Indonasia Airlines GA 126- Xiamen Airlines MF 731- Aero Mexico AM 139- Vietnam Airlines VN 738- Royal Air Maroc AT 147- TNT Airways 3V 756- Qatar Airways QR 157- KF Cargo KW 758- Cathay Pacific XH 160- China Southern Airlines CZ 784- Adria Airways JP 165- Amerjet M6 810- Air Malawi QM 167- Croatia Airlines OU 831- Cargolux CV 172- Africa West FK 858- Air Namibia SW 186- Yangtze River Express Airlines Y8 871- Aero Charter Airlines DW 187- Hainan Airlines HU 880- All Nippon Airlines (ANA) NH 205- Compagnie Africaine d'Aviation -

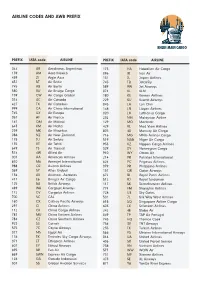

Airline Codes.Indd

AIRLINE CODES AND AWB PREFIX PREFIX IATA code AIRLINE PREFIX IATA code AIRLINE 044 AR Aerolineas Argentinas 173 HA Hawaiian Air Cargo 139 AM Aero Mexico 096 IR Iran Air 439 ZI Aigle Azur 131 JL Japan Airlines 657 BT Air Baltic 745 TB JetairFly 745 AB Air Berlin 589 9W Jet Airways 580 RU Air Bridge Cargo 074 KL KLM 159 CW Air Cargo Global 180 KE Korean Airlines 014 AC Air Canada 229 KU Kuwait Airways 427 TX Air Caraibes 045 LA Lan Chili 999 CA Air China International 148 LN Libyan Airlines 745 UX Air Europe 020 LH Lufthansa Cargo 057 AF Air France 232 MH Malaysian Airline 167 QM Air Malawi 129 MO Martinair 643 KM Air Malta 429 VL Med View Airlines 239 MK Air Mauritius 805 4X Mercury Air Cargo 086 NZ Air New Zealand 716 MG MNG Airlines Cargo 115 JU Air Serbia 519 NAB Niger Air Cargo 135 VT Air Tahiti 933 KZ Nippon Cargo Airlines 649 TS Air Transat 329 DY Norwegian Cargo 574 4W Allied Air 910 WY Oman Air 001 AA American Airlines 214 PR Pakistan International 810 M6 Amerijet International 624 PC Pegasus Airlines 988 OZ Asiana Airlines 079 PR Philippine Airlines 369 5Y Atlas Global 157 QR Qatar Airways 134 AV Avianca - Aerovias 672 BI Royal Runei Airlines 417 E6 Bringer Air Cargo 512 RJ Royal Jordanian 125 BA British Airways 117 SK Scandinavian Airlines 489 W8 Cargojet Airways 774 FM Shanghai Airlines 172 CV Cargolux Airlines 728 U3 Sky Gates 700 5C CAL 501 7L Silk Way West Airlines 160 CX Cathay Pacific Airways 618 SQ Singapore Airline Cargo 297 CI China Airlines 603 LX Srilankan Airlines 112 CK China Cargo Airlines 242 4E Stabo Air 781 MU -

6–17–08 Vol. 73 No. 117 Tuesday June 17, 2008 Pages 34175–34604

6–17–08 Tuesday Vol. 73 No. 117 June 17, 2008 Pages 34175–34604 VerDate Aug 31 2005 19:57 Jun 16, 2008 Jkt 021001 PO 00000 Frm 00001 Fmt 4710 Sfmt 4710 E:\FR\FM\17JNWS.LOC 17JNWS pwalker on PROD1PC71 with PROPOSALS2 II Federal Register / Vol. 73, No. 117 / Tuesday, June 17, 2008 The FEDERAL REGISTER (ISSN 0097–6326) is published daily, SUBSCRIPTIONS AND COPIES Monday through Friday, except official holidays, by the Office PUBLIC of the Federal Register, National Archives and Records Administration, Washington, DC 20408, under the Federal Register Subscriptions: Act (44 U.S.C. Ch. 15) and the regulations of the Administrative Paper or fiche 202–512–1800 Committee of the Federal Register (1 CFR Ch. I). The Assistance with public subscriptions 202–512–1806 Superintendent of Documents, U.S. Government Printing Office, Washington, DC 20402 is the exclusive distributor of the official General online information 202–512–1530; 1–888–293–6498 edition. Periodicals postage is paid at Washington, DC. Single copies/back copies: The FEDERAL REGISTER provides a uniform system for making Paper or fiche 202–512–1800 available to the public regulations and legal notices issued by Assistance with public single copies 1–866–512–1800 Federal agencies. These include Presidential proclamations and (Toll-Free) Executive Orders, Federal agency documents having general FEDERAL AGENCIES applicability and legal effect, documents required to be published Subscriptions: by act of Congress, and other Federal agency documents of public interest. Paper or fiche 202–741–6005 Documents are on file for public inspection in the Office of the Assistance with Federal agency subscriptions 202–741–6005 Federal Register the day before they are published, unless the issuing agency requests earlier filing. -

C RSIA Carbon Offsetting and Reduction Scheme for International Aviation

INTERNATIONAL CIVIL AVIATION ORGANIZATION ICAO document CORSIA Aeroplane Operator to State Attributions December 2020 C RSIA Carbon Offsetting and Reduction Scheme for International Aviation This ICAO document is referenced in Annex 16 — Environmental Protection, Volume IV — Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). This ICAO document is material approved by the ICAO Council for publication by ICAO to support Annex 16, Volume IV and is essential for the implementation of the CORSIA. This ICAO document is available on the ICAO CORSIA website and may only be amended by the Council. Disclaimer: The designations employed and the presentation of the material presented in this ICAO document do not imply the expression of any opinion whatsoever on the part of ICAO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. The table below shows the amendments to this ICAO document over time, together with the dates on which the amendments were approved by the Council. Amendments to the ICAO document “CORSIA Aeroplane Operator to State Attributions” Edition Amendment Approved Information on 670 aeroplane operators from 117 States. Belarus, Belize, Iceland, Iran (Islamic Republic of), Maldives, Mozambique, Solomon Islands, South Africa, and Turkmenistan 2nd Edition 20 Sep 2019 provided information for the first time. Comoros, Egypt, Lebanon, Mongolia, Philippines, San Marino, Saudi Arabia and Turkey updated the information previously submitted. Information on 690 aeroplane operators from 122 States. Cambodia, Guatemala, Nicaragua, Republic of Korea, and United 3rd Edition 24 Dec 2019 Republic of Tanzania provided information for the first time. -

Globaler Airline-Newsletter Von Berlinspotter.De Sehr Geehrte Leser

Globaler Airline-Newsletter von Berlinspotter.de Sehr geehrte Leser, Hiermit erhalten Sie als PDF die europäischen und globalen Airline-News aus dem Bearbeitungszeitraum 6. Juli bis 20. Juli – unterteilt in die drei letzten Update-Blöcke der Premium-Version (ein Wechsel ist jederzeit möglich). Ich danke Ihnen für die Unterstützung des einzigen deutschsprachigen Luftfahrt- Newsletter. Mit freundlichen Grüßen Oliver Pritzkow Webmaster Berlinspotter.de --- Update 10.7. --- EUROPA Aegean Airlines kündigte eine Erhöhung des Kerosinzuschlags von 3 Euro auf Inlands- und internationalen Flügen an. Im 1. Quartal flog man einen Verlust von 4,4 Mio. Euro nach Hause, da die Energiekosten um 57 % gestiegen waren. Verglichen mit dem Vorjahreszeitraum lagen die Kosten für Kerosin sogar um 110 % höher. Sie machen mittlerweile 35 % aller Ausgaben aus. Die Modernisierung der Flotte auf A320/321 wird fortgesetzt, um mit diesen ökonomischeren Flugzeugen auf die steigenden Preise zu reagieren. Die Nachfrage ist da, denn im 1. Quartal wurden mit 1,1 Mio. Passagieren gut 10 % mehr Fluggäste an Bord begrüßt. Aerofan , bisher eine Flugschule in Madrid mit Leichtflugzeugen, stellte eine erste MD-87 in Dienst (EC-KSF, msn 53207). Air Atlanta Icelandic übernahm eine 747-200F(SCD) (TF-AAA, msn 22442). Die von Cargo Aircraft Llc geleaste Maschine flog zuletzt bei der gescheiterten Focus Air. Eine weitere soll folgen (msn 22304). Eine andere, bereits abgestellte 747-300 (TF- ARS, msn 22996) wurde ausgeschlachtet. Air Berlin baut ihr innerspanisches Netz zum Winterflugplan 2008/09 aus. Seit 8. Juli sind 70 Inlandsverbindungen buchbar – das sind fast 400 % mehr als im Vorjahr. Über das Drehkreuz Palma werden 11 spanische Städte sowie Faro miteinander verbunden. -

Evidence from the Turkish Airline Industry

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Çetin, Tamer; Eryiğit, Kadir Y. Working Paper Estimating the economic effects of deregulation: Evidence from the Turkish airline industry Working Paper, No. 1525 Provided in Cooperation with: Koç University - TÜSİAD Economic Research Forum, Istanbul Suggested Citation: Çetin, Tamer; Eryiğit, Kadir Y. (2015) : Estimating the economic effects of deregulation: Evidence from the Turkish airline industry, Working Paper, No. 1525, Koç University-TÜSİAD Economic Research Forum (ERF), Istanbul This Version is available at: http://hdl.handle.net/10419/129346 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu KOÇ UNIVERSITY-TÜSİAD ECONOMIC RESEARCH FORUM WORKING PAPER SERIES ESTIMATING THE ECONOMIC EFFECTS OF DEREGULATION: EVIDENCE FROM THE TURKISH AIRLINE INDUSTRY Tamer Çetin Kadir Y.